The crypto hype in recent years made the space appealing not only to investors, but also to hackers with different agendas looking for a quick profit or looking to influence the markets in a certain way.

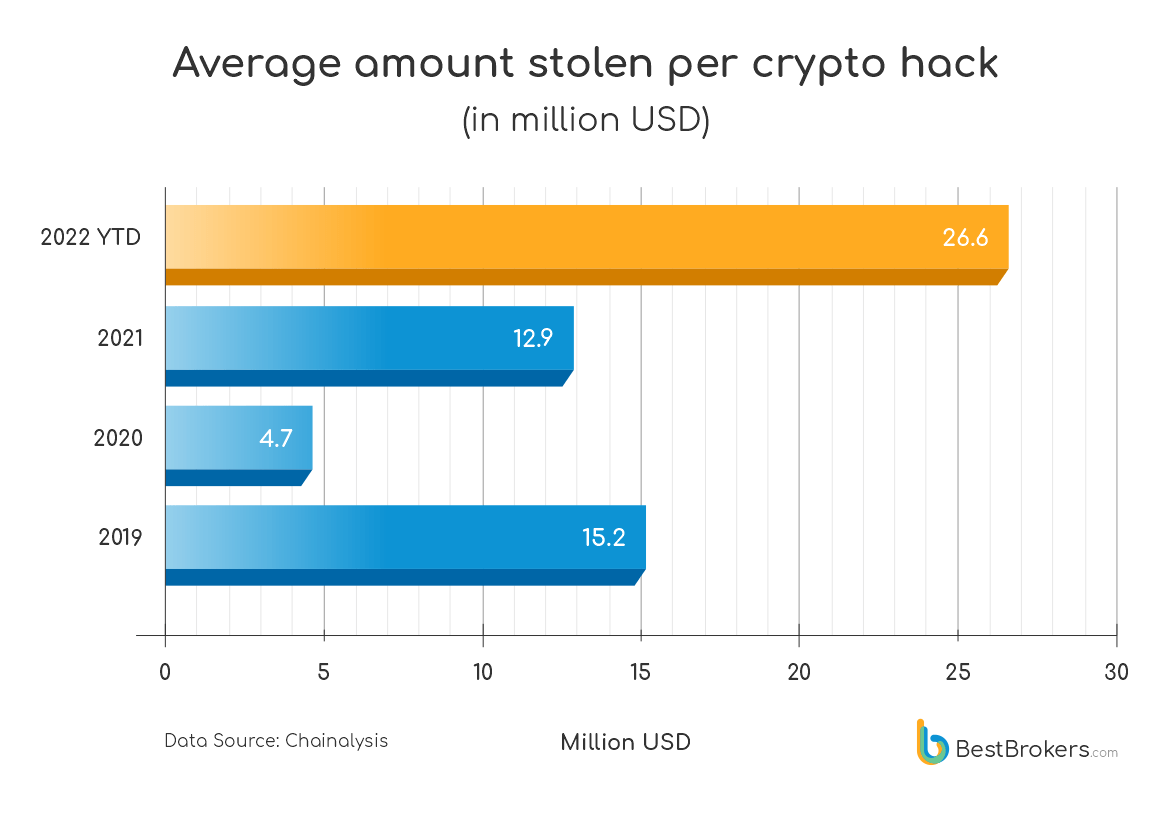

The research team at BestBrokers calculated the average amount stolen per hack and compared 2022 YTD to the last three years. As per the latest data published by Chainalysis, it turns out that the average amount stolen in a crypto hack in 2022 by far is $26.6 million in USD. That is an increase of 206% when compared to the 2021 average of $12.9 million.

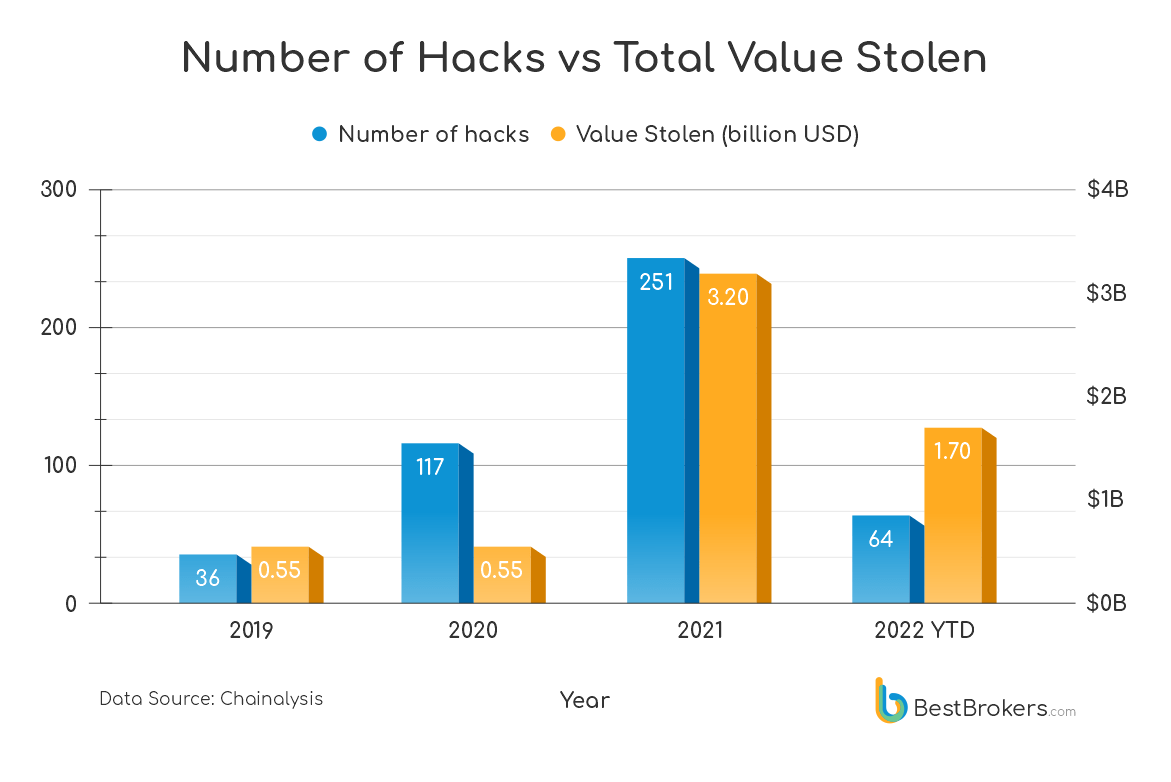

Last year 251 total hacks amounted to $3.2 billion USD in stolen crypto. This year as of mid June we have $1.7 billion USD stolen in 64 security breaches. Even though the number of crypto-related hacks is dropping sharply in 2022, this is not affecting the total dollar amounts stolen, in spite of the dropping crypto prices this year.

All this implies that black hats are aiming for and successfully hitting larger targets in 2022. The blooming DeFi market seems to be collecting the most hacker interest and black hats are currently making the largest returns on their invested time there.

In 2021 72% of all stolen crypto was attributed to DeFi protocols and services. In Q1 2022 this percentage increased to 97%, raising many eyebrows and ringing many alarm bells.

Decentralized Finance or DeFi is an umbrella term for peer-to-peer financial services, powered by the blockchain. The idea behind DeFi is to serve as a crypto alternative to banks with different services and protocols supporting standard banking services such as borrowing, lending and earning interest.

We turned to BestBrokers crypto expert Robert Hoffman for the reasons why DeFi is the hackers’ number 1 choice when it comes to crypto:

DeFi has been around since 2015, made possible by Ethereum’s Smart Contracts. However, it saw significant adoption only in 2020, when volumes of crypto held in DeFi Smart Contracts exceeded $1 billion in value. Over the next year it exploded, reaching $100 billion in 2021.

This explosive growth has to do with Big Venture Capital pouring the largest part of their money in Fintech startups ever since the start of the recent pandemic.

The race for building the digital financial system of the fourth industrial revolution is an extremely rapid one with many stakeholders competing for the first spot. Often when the time to market is too short it results in compromised aspects of the product, including security.

The flow of finances in a DeFi app is determined by the logic programmed into the Smart Contracts it utilizes. Once these contracts go live on the blockchain with the product launch, they are immutable and can never be changed. Since Smart Contracts are a relatively new concept and technology, there are still very few people in the world that can program such contracts at the professional level, required for a financial app. This may result in bugs in the Smart Contract code that remain hidden, but get found and exploited at a later stage.

All these make DeFi apps a preferred target for hackers, as with any new technology that gets mass adoption. With time it gets regulated and issues are taken care of. I expect this will also happen with DeFi, as long as it continues to see such high levels of adoption.