In times of extreme fear of a WWIII, inflation, recession and energy shortage most of the investment instruments suffer substantial losses. Stocks, gold and mostly cryptocurrencies are greatly affected by the troublesome atmosphere around the world.

With Ether down approximately 64% year-to-date, followed by Bitcoin down approximately 58% year-to-date, BestBrokers analyst team decided to look into blockchain transaction data and find out how this drop affects crypto users in actuality.

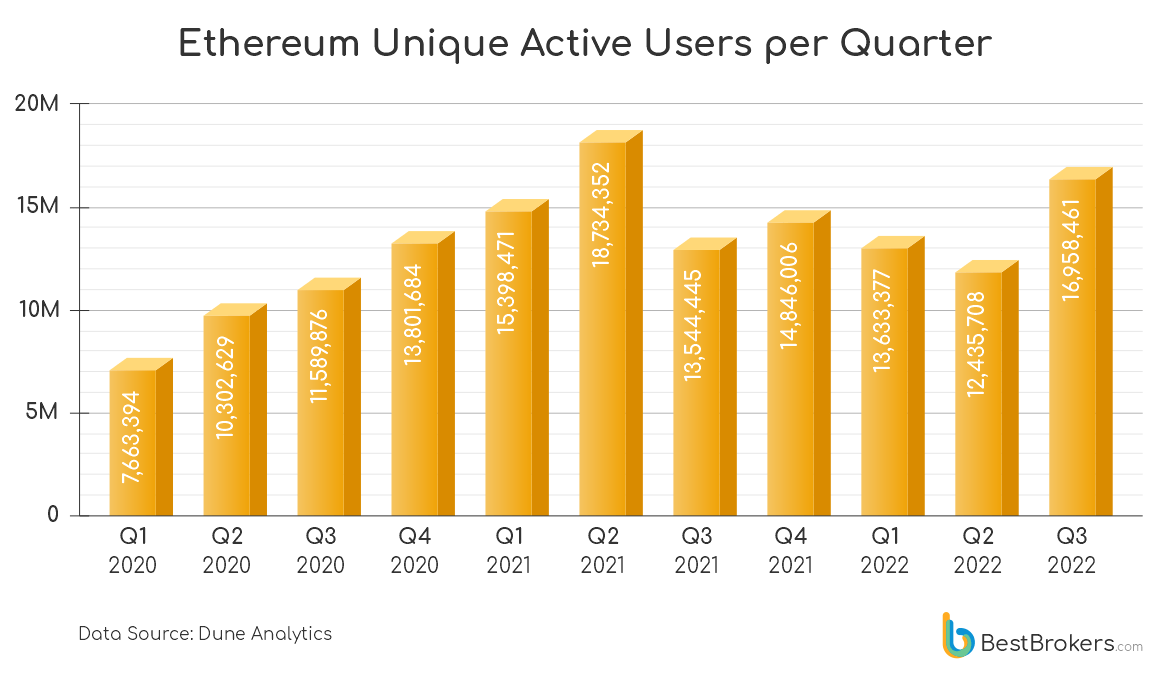

The raw data, queried from Dune Analytics clearly shows a great increase in interest in Ether as the number of active Ethereum users rose over 36% in Q3 2022, compared to Q2. Actually, this is the first positive quarter since Q4 2021 when Ether’s price rose to a record all time high of just over $4,890.

“The Ethereum 2.0 update went live just three weeks ago. It surely brought more interest in the Ethereum network but it cannot justify such a great rise. Other factors have to be taken into account, including the fact that people actually find cryptocurrencies as an investment option and the record lows of Q3 2022 seemed like a bargain to a lot of individual investors.”

– comments Alan Goldberg, analyst at BestBrokers.

The long-awaited Ethereum 2.0 update undeniably had a positive impact on Еthereum user count. However, it was completed so late in Q3 2022 that it is definitely not the only reason for the uptrend. The expectation and the news in mid July, confirming the final update date definitely contributed to the inreased trade, but we also have to take into account the fact that Ether price dropped below the $900 mark in late Q2 2022 and that low price must have looked like a bargain discount to optimistic investors. Since then the price went steady up with a few times touching the $1,000 resistance but made over 100% rise to just over $2,000 in August 2022.

Despite the current price sitting at around $1,360 or somehow around 33% lower than the August heights, Ether had great price swings, typical to most of the cryptocurrencies. After all, the price volatility and high volume are among the factors which drive investor interest into the crypto markets and that is exactly what Ethereum delivered in Q3, clearly showing that the markets have potential to get back on a positive trend.

“The 36% increase in the active users within just 3 months may be interpreted as a sign that the crypto markets are getting back on the positive trend. The fact that the number of active users is over 14% higher than Q4 2021, when both Bitcoin and Ether prices were at an all time high, only reinforces crypto analysts’ expectations that the markets have a great potential to rise again.”

– adds Alan.