Current market conditions can be easily described as disastrous. Inflation, recession, post-pandemic issues including lockdowns, war have major role in the current bear market.

In such hard times, the BestBrokers team decided to analyse the Gold investment levels across the major investment regions – namely United States, North America, China, India, and Europe.

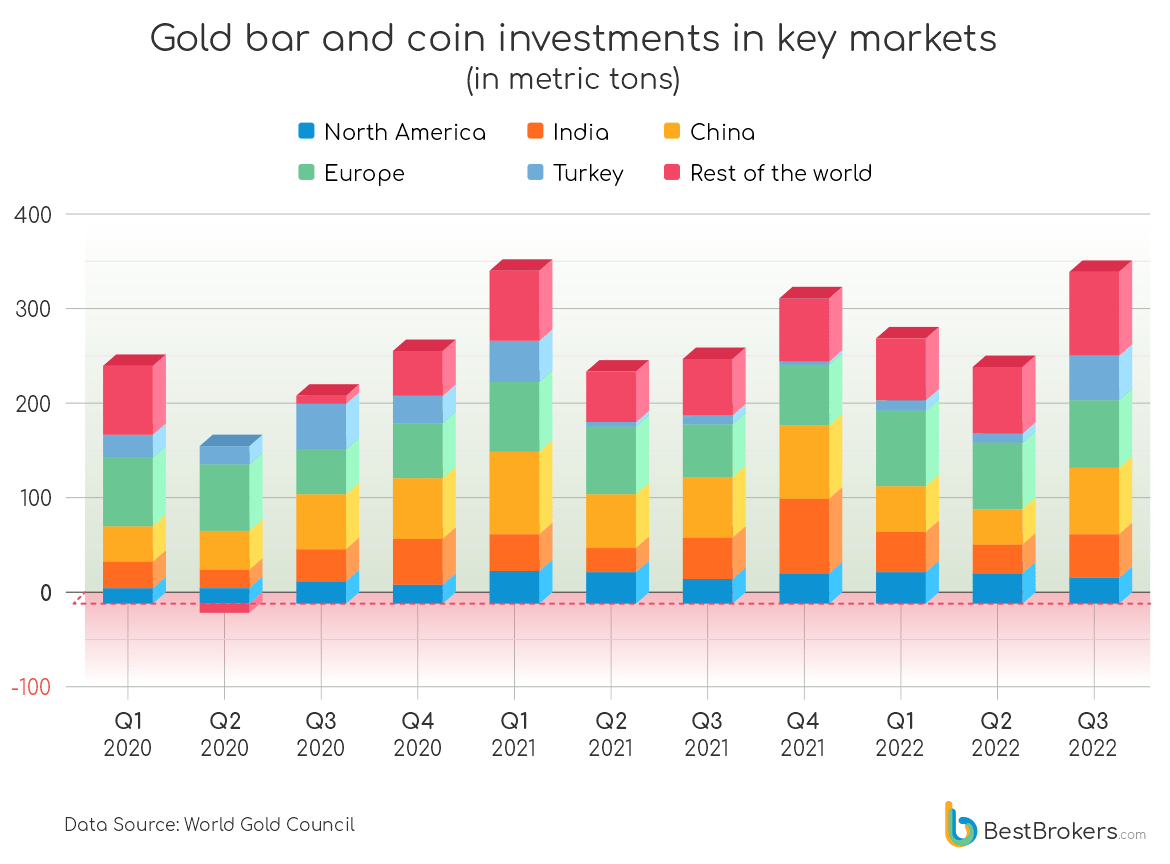

Globally, Q3 demand for investment grade Gold has been the highest since Q1 2021, at 351.1 tons, or a 36% increase over Q3 2021 and a 41% surge over Q2 2022.

“The Macroeconomic environment not only in the US but globally, has positioned Gold as a hedge against inflation and currency fluctuations in the foreground. US retail investors seem to have adhered to the idea that Gold bar and coin investments offer protection in periods of stubbornly high inflation and economic uncertainty. Others may consider investment grade Gold as a good portfolio diversification option.”

– comments Alan Goldberg, analyst at BestBrokers.

According to the latest data by the UK-based World Gold Council, year-to-date sales of US mint coins have reached their highest level since 1999 amid investor concerns over the state of the US economy and multi-decade high inflation.

Physical Gold investment demand in the United States was still elevated in the third quarter of 2022 in light of a complex macro environment of persistently high inflation, rising interest rates and decelerating economic growth.

US demand for investment grade Gold in the form of bars and coins increased 3% year-on-year in Q3 to 25 tons. That figure represented a near 11% drop compared to Q2 of 2022, but still remained above the average quarterly level of the past 5 years (15 tons).

In the North American region as a whole, physical Gold investment demand rose 5.2% year-on-year in Q3, to 27.9 tons, but decreased by 13.3% compared to the second quarter.

In China, Gold investment demand surged 87.4% to 70.1 tons in Q3 from Q2, when activity dropped as a result of COVID-19 related lockdowns. Compared to Q3 2021, demand in the country rose 8.3% last quarter. Local Gold prices plummeted substantially in July and encouraged bargain hunting. The latter was even bolstered by pent-up demand being released after stern pandemic-related restrictive measures in a number of major cities during the second quarter.

In India, another key market for physical Gold, investment demand rose 49.3% to 45.4 tons in Q3 compared to Q2, as investors took advantage of lower Gold prices locally, as well as a slump in local equities. That figure was 14% above the average quarterly level of the past 5 years. On a year-on-year basis, Gold coin and bar investment demand in the country rose 5.8% last quarter.

In continental Europe, physical Gold investment demand went up 28% year-on-year in Q3 to 71.8 tons. Gold investment flows were encouraged by various factors, including a slowdown in growth across much of the continent, continuing military conflict in Ukraine and an attempt by monetary authorities to raise interest rates sufficiently to rein in inflation without tipping the region’s economy into a sudden recession.

In Turkey, the Gold investment demand skyrocketed 509% year-on-year in Q3. When we compare this to the previous Q2 2022 the increase amounts to 493%. This is a clear sign that investors find the gold as a valid safe haven, especially when considering the volatile Turkish lira.