It has been exactly two weeks since the first 11 Bitcoin Spot Trading ETFs got approval by the SEC and started operating in the US.

There were some news stories, focused on the amount of BTC traded and the great interest the ETFs accumulated. This drove our team at BestBrokers to put things in perspective and compare the actual dollar volume liquidity of both the approved ETFs and BTC trading on popular crypto exchanges.

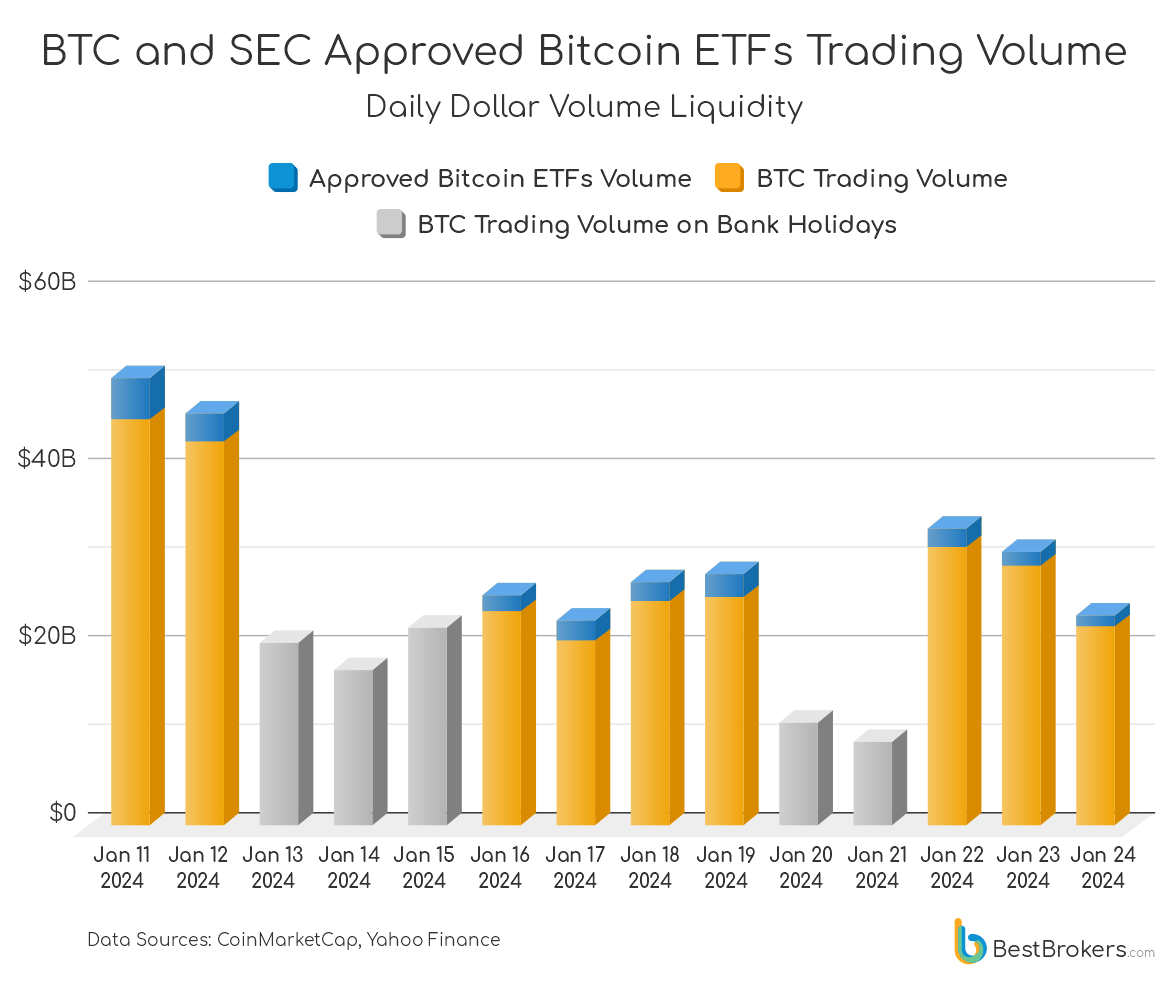

We used data from CoinMarketCap and Yahoo Finance to compare the Bitcoin trading activity and it turns out that for the 14-day period (since Jan 12 2024) 5.86% ($21,730,811,836) of the total dollar volume liquidity ($371,099,147,477) has been generated by trading the above-mentioned ETFs.

If we exclude the holidays, when ETFs cannot be traded, the dollar volume liquidity of the ETFs accounts for 6.96% ($21,730,811,836) of the $312,045,122,940 total.

“First of all we have to account for the fact that the SEC-approved Bitcoin ETFs are to be traded only by US traders and non-US traders who cover specific requirements. This makes it available to just a part of the investors, compared to the crypto exchanges, which are mostly accessible worldwide. Also, there are bank holidays and there was no activity during 5 days of the studied 14-day period.

Despite these unfavourable facts, the interest in BTC spot trading through ETFs seems enormous. Reaching 6% (even 7% if we discount bank holidays) of the total dollar volume liquidity in just 14 days is impressive. It would be hardly possible without institutional investments and just confirms the great interest of BTC by both retail and institutional investors. Although Bitcoin is the biggest crypto currency by far, it is just part of the entire crypto market. Approving ETFs for other crypto currencies will make both crypto trading activity and prices skyrocket even more”

– comments Alan Goldberg, market analyst at BestBrokers.

Methodology

Our team pulled historical volume data from Yahoo FInance for the eleven SEC approved Bitcoin ETFs, namely:

- ARK 21Shares Bitcoin ETF (NYSE:ARKB)

- Bitwise Bitcoin ETF (NYSE:BITB)

- Blackrock’s iShares Bitcoin Trust (NASDAQ:IBIT)

- Franklin Bitcoin ETF (NYSE:EZBC)

- Fidelity Wise Origin Bitcoin Trust (NYSE:FBTC)

- Grayscale Bitcoin Trust (NYSE:GBTC)

- Hashdex Bitcoin ETF (NYSEARCA:DEFI)

- Invesco Galaxy Bitcoin ETF (NYSE:BTCO)

- VanEck Bitcoin Trust (NYSE:HODL)

- Valkyrie Bitcoin Fund (NASDAQ:BRRR)

- WisdomTree Bitcoin Fund (NYSE:BTCW)

We calculated the total dollar volume liquidity for the Bitcoin ETFs by multiplying the number of traded shares by the average of open, close, low and high price during that specific date.

For the BTC volumes we pulled historical trading data from CoinMarketCap to get the total daily trading volume liquidity worldwide.

It is important to note that ETFs can be traded only during US business hours which means there is no activity on Jan 13 2024 – Jan 14 2024 (weekend), Jan 15 2024 (bank holiday), and Jan 20 2024 – Jan 21 2024 (weekend).

Raw Data

| Day | BTC Dollar Volume Liquidity | Approved Bitcoin ETFs Dollar Volume Liquidity | Bitcoin ETFs as % of total volume |

|---|---|---|---|

| Jan 11 2024 | $45,833,734,549 | $4,699,136,353 | 9.30% |

| Jan 12 2024 | $43,332,698,900 | $3,217,628,055 | 6.91% |

| Jan 13 2024 | $20,601,860,469 | 0 | 0.00% |

| Jan 14 2024 | $17,521,429,522 | 0 | 0.00% |

| Jan 15 2024 | $22,320,220,558 | 0 | 0.00% |

| Jan 16 2024 | $24,062,872,740 | $1,922,946,279 | 7.40% |

| Jan 17 2024 | $20,851,232,595 | $2,180,723,186 | 9.47% |

| Jan 18 2024 | $25,218,357,242 | $2,157,982,901 | 7.88% |

| Jan 19 2024 | $25,752,407,154 | $2,578,009,190 | 9.10% |

| Jan 20 2024 | $11,586,690,904 | 0 | 0.00% |

| Jan 21 2024 | $9,344,043,642 | 0 | 0.00% |

| Jan 22 2024 | $31,338,708,143 | $2,095,791,810 | 6.27% |

| Jan 23 2024 | $29,244,553,045 | $1,590,065,644 | 5.16% |

| Jan 24 2024 | $22,359,526,178 | $1,288,528,417 | 5.45% |