Americans have been losing billions of dollars to scams for decades but with the wider use of social media and technologies such as AI, schemes are now more sophisticated than ever. Impersonations, phishing scams, scam calls or deep fakes, fraudsters are becoming more and more creative in their ways to make unsuspecting victims believe anything and ultimately give away their money.

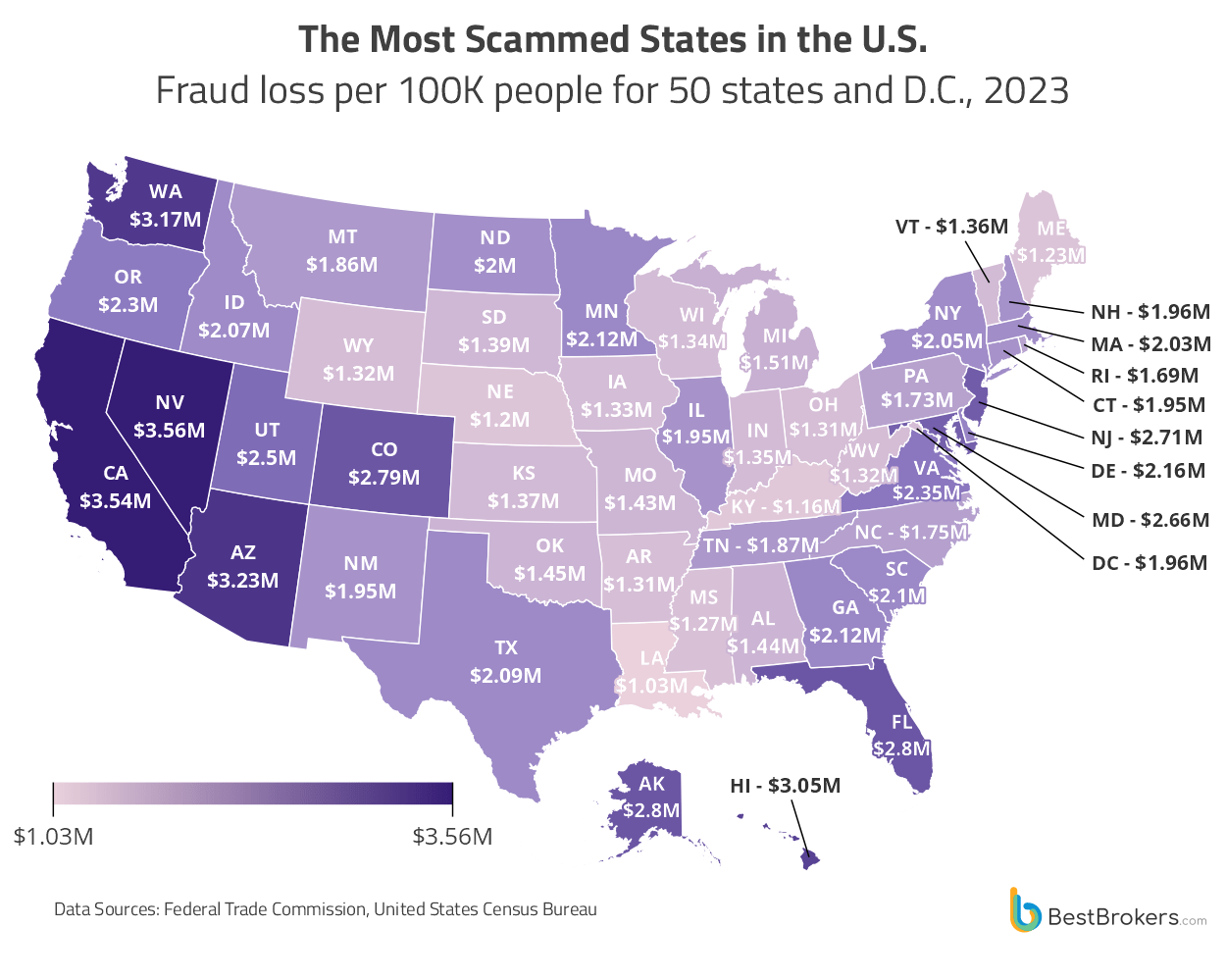

Recent data from the Federal Trade Commission shows that despite the similar number of scam reports in 2023 and 2022, the amount lost to fraud in 2023 was $10 billion, roughly $1 billion more than the previous year. And don’t forget that most scams go unreported. The team at BestBrokers looked at the latest statistics and found that fraudsters seem to be targeting people from some states more than others. We used the FTC data and created a map showing the most scammed states in America in terms of the amount lost to fraud per 100,000 residents in 2023.

Nevada and California are the most affected states when it comes to fraud. People in Nevada lost $3.56 million per 100 thousand residents to different types of scams last year, whereas Californians reported the largest amount of money lost to fraud, more than $1.38 billion. To put things in perspective, the second-largest amount, $636 million, was lost in Texas, and the third, $632 million, was reported in Florida.

Nevada, $3,556,473 Lost to Fraud per 100K People

In 2023, people in Nevada filed 46,840 fraud and other reports with the Federal Trade Commission (FTC) that led to a total loss of $113.6 million. That may not sound much but many of the reported scams did not include a financial loss. If we look at the number of reports per capita, Nevada is 3rd in the country after Georgia and Florida with 1,466 reports per 100,000 residents. But if we consider the amount lost, Nevadans lost the most to fraud, $3,556,473 per 100,000 people. The median loss of all reported cases is $649.

Identity theft is the most prevalent type of fraud in the state (21% of reports) and it is most commonly carried out by stealing credit card information. According to the FTC, this happens in 47% of the cases. In 19% of the identity theft reports, the fraudsters accessed personal information from loan and lease documents.

California, $3,544,702 Lost to Fraud per 100K People

In 2023, Californians lost a staggering $1.38 billion to fraud, roughly twice as much as Texans who lost $636.4 million and Florida residents who were robbed of $632.2 million. That the Golden State emerges as America’s fraud capital alongside Nevada won’t surprise anyone. Apart from the greatest fraud loss in the U.S., it has the largest number of fraud reports (405,354) and the third-largest median loss of $670.

The most common fraud reports in California are identity theft (23%), imposter scams (14%), online shopping and cases where consumers complained about negative reviews (6%).

Arizona, $3,226,873 Lost to Fraud per 100K People

At 86,066 fraud and other similar cases reported by consumers in 2023, the number of scams in Arizona was not that high (the state ranks sixth for reports per capita). The median fraud loss, however, was $700, the second-highest in the country. Moreover, the amount lost to fraud was significant considering Arizona’s population of just over 7.4 million. Last year, the reported loss was $239.8 million or $3.2 million per 100,000 residents.

Once again, identity theft (18% of reported cases) has the greatest prevalence, followed by imposter scams (16%), online shopping (6%), and scams related to banks and lenders (5%).

Washington, $3,167,846 Lost to Fraud per 100K People

The State of Washington ranks fourth in terms of the amount lost to fraud per capita last year. Residents here were robbed of $247.5 million, which is a little over $3.1 million per 100,000 people. The number of reports was 76,832 but the most common type of scam was imposter scams (22%), followed by identity theft (14%), as well as scams linked to online shopping (9%), and banks and lenders (5%).

Hawaii, $3,051,971 Lost to Fraud per 100K People

Interestingly, Hawaii ranks fifth on this list, with its $43.8 million in money lost to fraud and only 11,947 reports to the FTC. These figures are quite significant for a state with a population of less than 1.5 million. In 2023, the loss per 100 thousand residents was a little over $3 million, whereas the median loss calculated by the FTC was $600. Imposter scams take the greatest share of fraud reports (22%), followed by identity theft cases (13%), online shopping scams (8%), and fraud related to prizes, sweepstakes, and lotteries (5%).

Florida, $2,796,018 Lost to Fraud per 100K People

With $632.2 million in total fraud losses, Florida is one of the most severely affected states when it comes to scams. In 2023, residents filed 333,570 fraud and other reports, of which the median loss stood at $600. We calculate that this is almost $2.8 million lost to fraud per 100,000 people. Reports were most commonly filed by credit bureaus, information furnishers and report users (23%). Another 22% of reports were about identity theft, and 11% were about imposter scams.

Alaska, $2,795,177 Lost to Fraud per 100K People

As one of the least populated American states (and the most remote one), Alaska is an unusual entry in the top 10. It ranks 7th with nearly $2.8 million in losses per 100,000 people but if we look at the median loss from all reports, it is $750, the highest in the country. Only 6,456 fraud reports were filed in 2023 and the total money lost to fraud was $20.5 million. Imposter scams (24%), identity theft (12%), and online shopping scams (9%) were the most commonly reported types of fraud.

Colorado, $2,793,653 Lost to Fraud per 100K People

This year, Colorado was named the third most dangerous state by U.S. News and World Report. The Centennial State also makes it to the ten most scammed states, ranking 8th with losses of $2.79 million per 100,000 people in 2023, or 164.2 million in total. Consumers filed 61,433 fraud reports with a median loss amount of $500. The most commonly reported scams were imposter scams (19%), identity theft (17%), and schemes related to online shopping (8%).

New Jersey, $2,709,120 Lost to Fraud per 100K People

New Jersey is known as one of the safest states but it has plenty of scams, according to the data released by the FTC. Last year, 102,041 fraud reports were filed with a total loss of $251.7 million. This means that the Garden State now ranks 9th on our list with a fraud loss of $2.71 million per 100,000 people. Similarly to most states, identity theft is the most common scam (20% of all cases), followed by imposter scams (14%), and online shopping scams (7%).

Maryland, $2,658,467 Lost to Fraud per 100K People

In 2023, there were 84,353 fraud reports in Maryland and the total fraud loss reported to the FTC was $164.3 million. This places the state in top positions for both reports per capita (5th in the country) and loss per capita (10th). The money lost per 100,000 residents was roughly $2.66 million. The most common fraud reports were about identity theft (18%), imposter scams (15%), and various scams related to online shopping and negative reviews (6%).

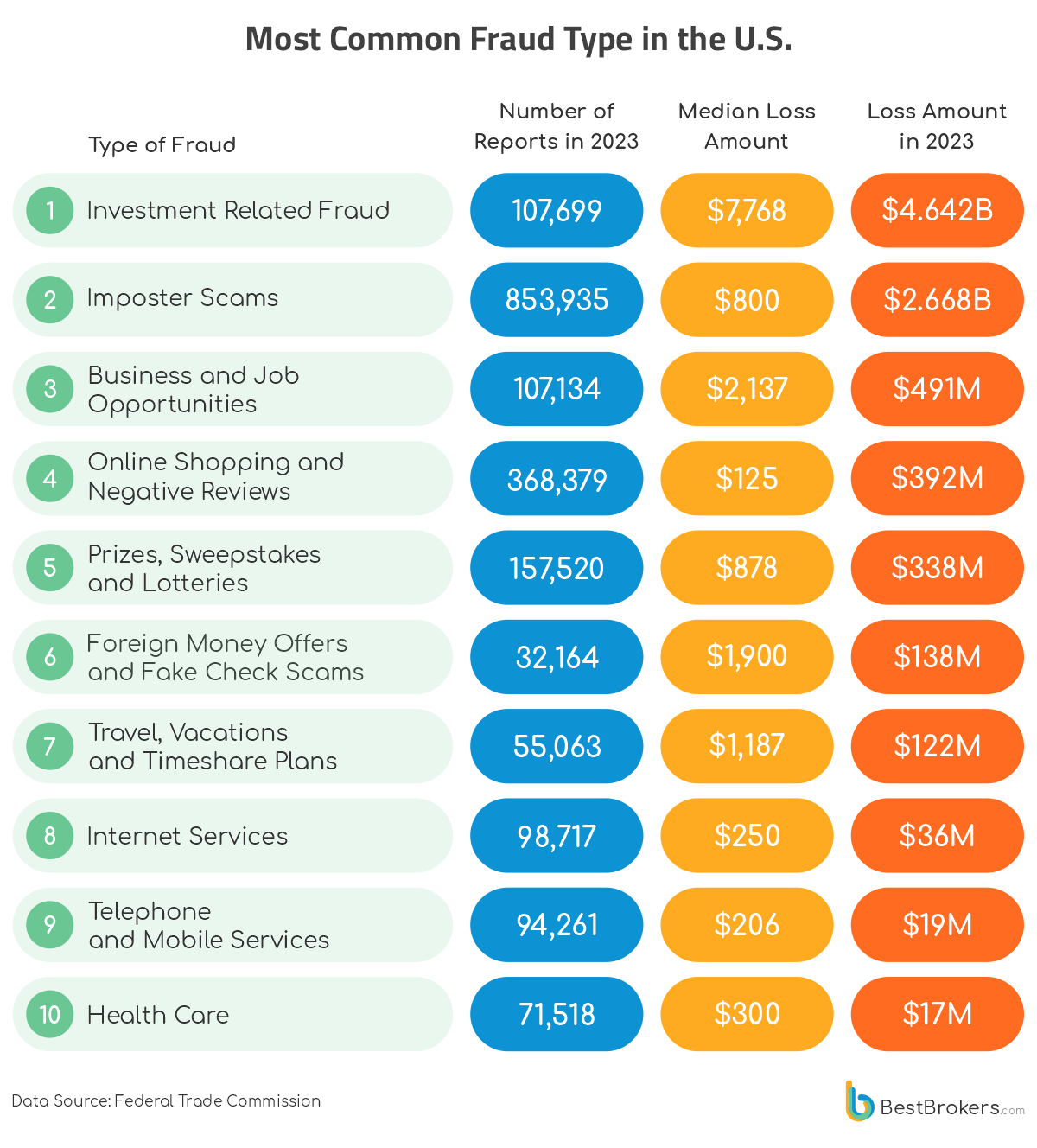

Types of Fraud: How Are Americans Losing Their Money?

Fraudsters always seem to find new ways of scamming people. But even though the particular schemes might change over time, as they adapt to new lifestyles and technologies, the concept remains the same. You look for a job, for a way to earn some money, or receive a service – and the scammer is there to provide. Or that is what they make you believe.

One of the scams proven time and time again is investment-related fraud. Schemes such as fake investment opportunities, Ponzi schemes, and cryptocurrency scams, promising high returns with little or no risk have been especially damaging and caused more than $4.64 billion in losses in 2023 alone. Americans also lost over $2.66 billion to imposter scams.

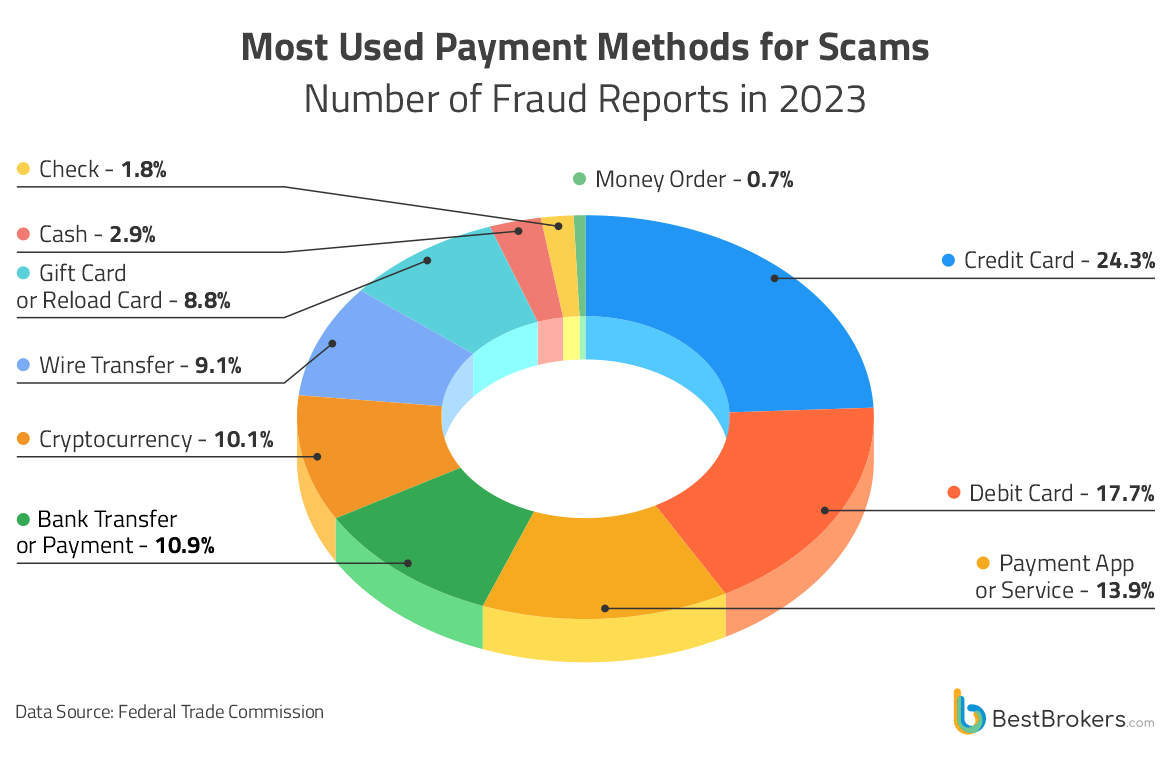

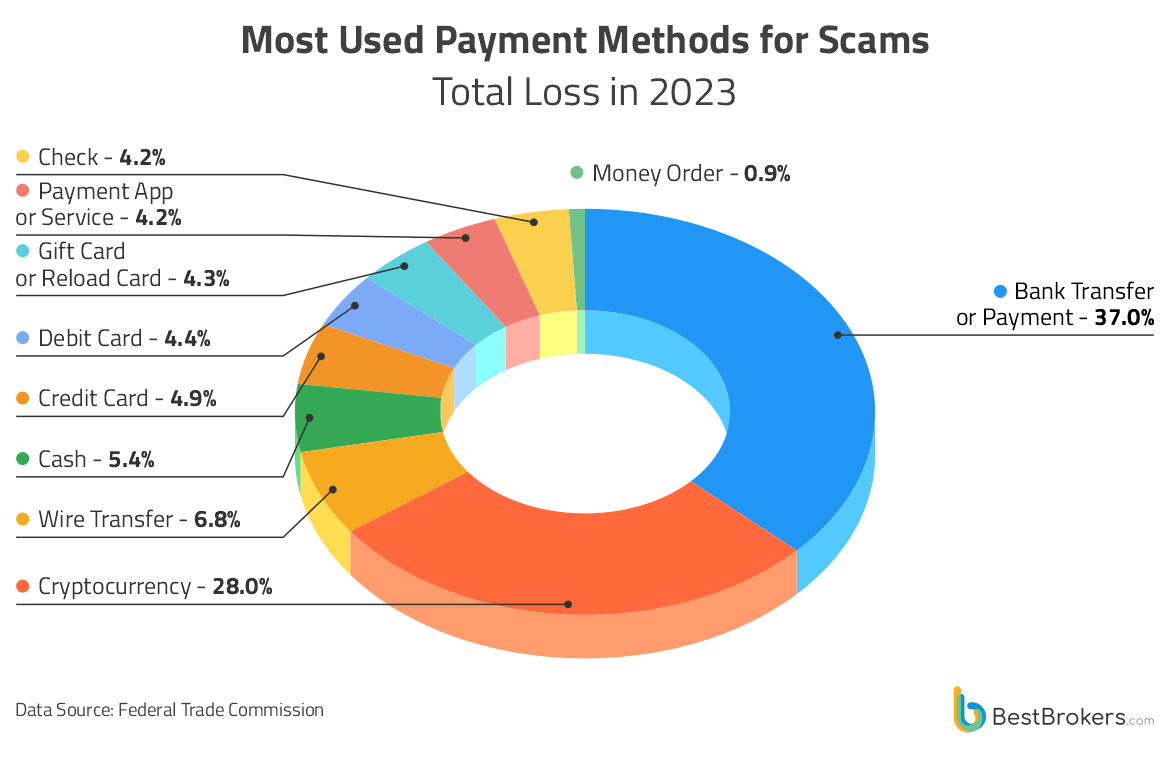

If we look at the payment methods most commonly used by fraudsters and in the largest scams (in terms of money lost), these are bank transfers, credit and debit cards, as well as cryptocurrencies. Roughly 42% of fraud reports, which included relevant information about the amount lost, the payment method, etc. (471,488 reports in total), had credit and debit cards used in the schemes. Another 13.85% of scams used payment apps or services, followed by bank transfers (10.86%) and cryptocurrencies (10.08%).

If we focus on the total amount lost in 2023 to scams, bank transfers were involved in schemes that led to the greatest losses, $1.86 billion. The second-largest loss ($1.41 billion) involved cryptocurrencies.

Another interesting insight from the 2023 fraud data is that the most common way for scammers to contact their victims is through email (24%). Phone calls remain popular among fraudsters, as well, with 20% of consumers being contacted via telephone. Other common methods for scammers to reach their victims are text messages (15%), websites or apps (13%), social media (12%), and social media (11%).

Who Is the Target?

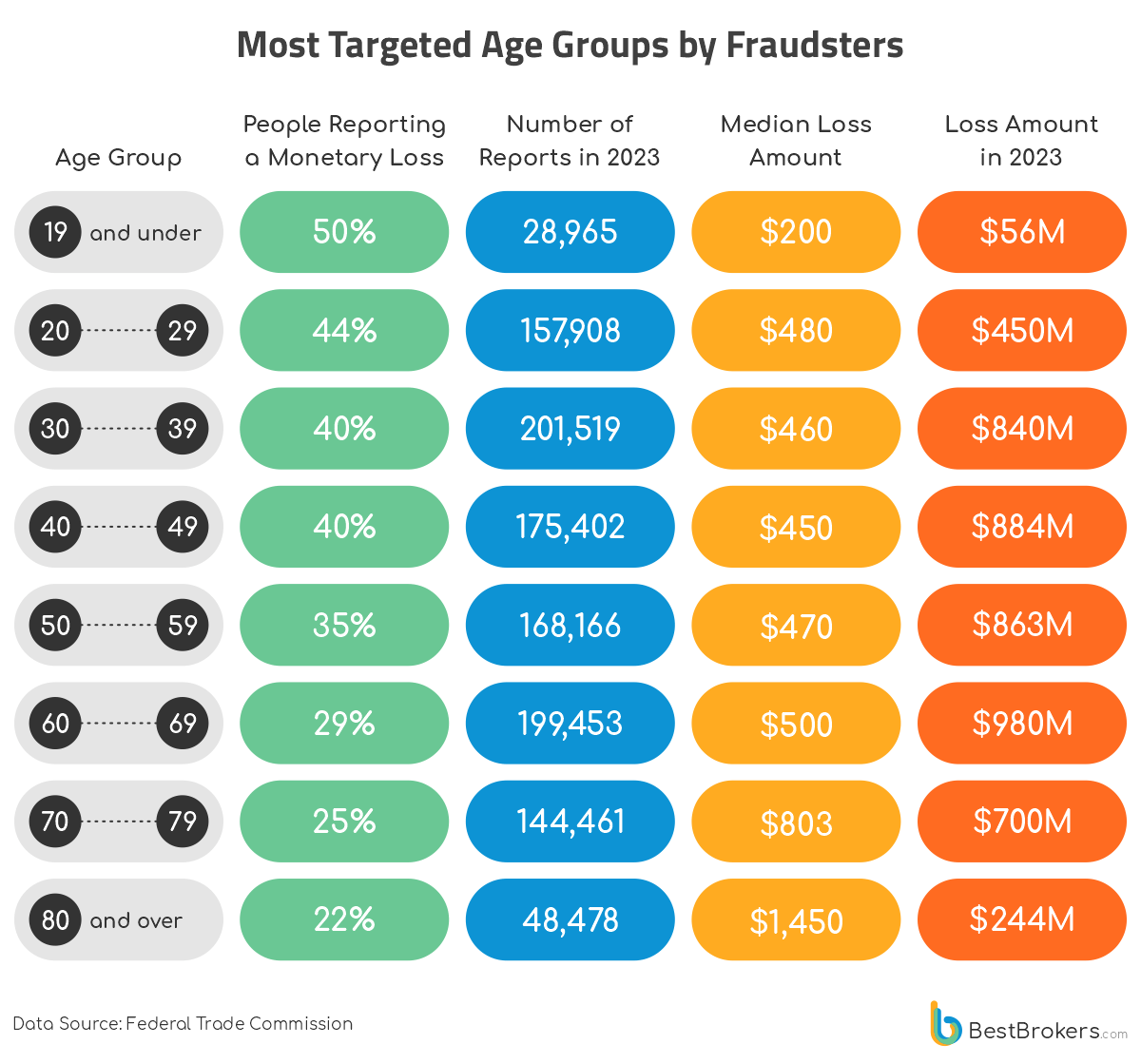

The elderly are often a target for all kinds of scams as they are perceived as over-trusting and vulnerable. Teenagers and young adults are also often easy to exploit and more likely to respond to fraudulent schemes. The 2023 fraud reports data shows a little more nuance, however. Eighteen-year-olds may be naive but aren’t particularly great prey since they have little to nothing to give, which explains why this is the age group with the fewest fraud reports filed in 2023, with 28,965 in total. Interestingly, roughly 50% of those aged 18 and younger also reported monetary losses. The median loss amount, however, is just $200.

The largest median loss related to fraud can be found in reports by those aged 80 and over. It is $1,450 or a total of $244 million from 48,478 reports for 2023. The age group that filed the most fraud reports is those aged 30 to 39 (201,519 reports), followed by the 60-69 age group (199,453 reports). The largest total loss to fraud was also for consumers aged 60 to 69.

The statistics reveal a couple of trends that are not entirely unexpected. The older people get, the less often they report being defrauded and robbed of money. Also, the older the victims, the more money they lose. This can be seen by the median loss amount per age group, but it’s the same correlation if we calculate the average loss from only those reports that included information about money being stolen.

- Victims aged 19 and Under – $56M in total loss, $3,866.74 on average

- Ages 20-29 – $450M in total loss, $6,476.73 on average

- Ages 30-39 – $840M, $10,420.85 on average

- Ages 40-49 – $884M, $12,599.63 on average

- Ages 50-59 – $863M, $14,662.38 on average

- Ages 60-69 – $980M, $16,942.89 on average

- Ages 70-79 – $700M, $19,382.39 on average

- Ages 80 and over – $244M, $22,878.23 on average

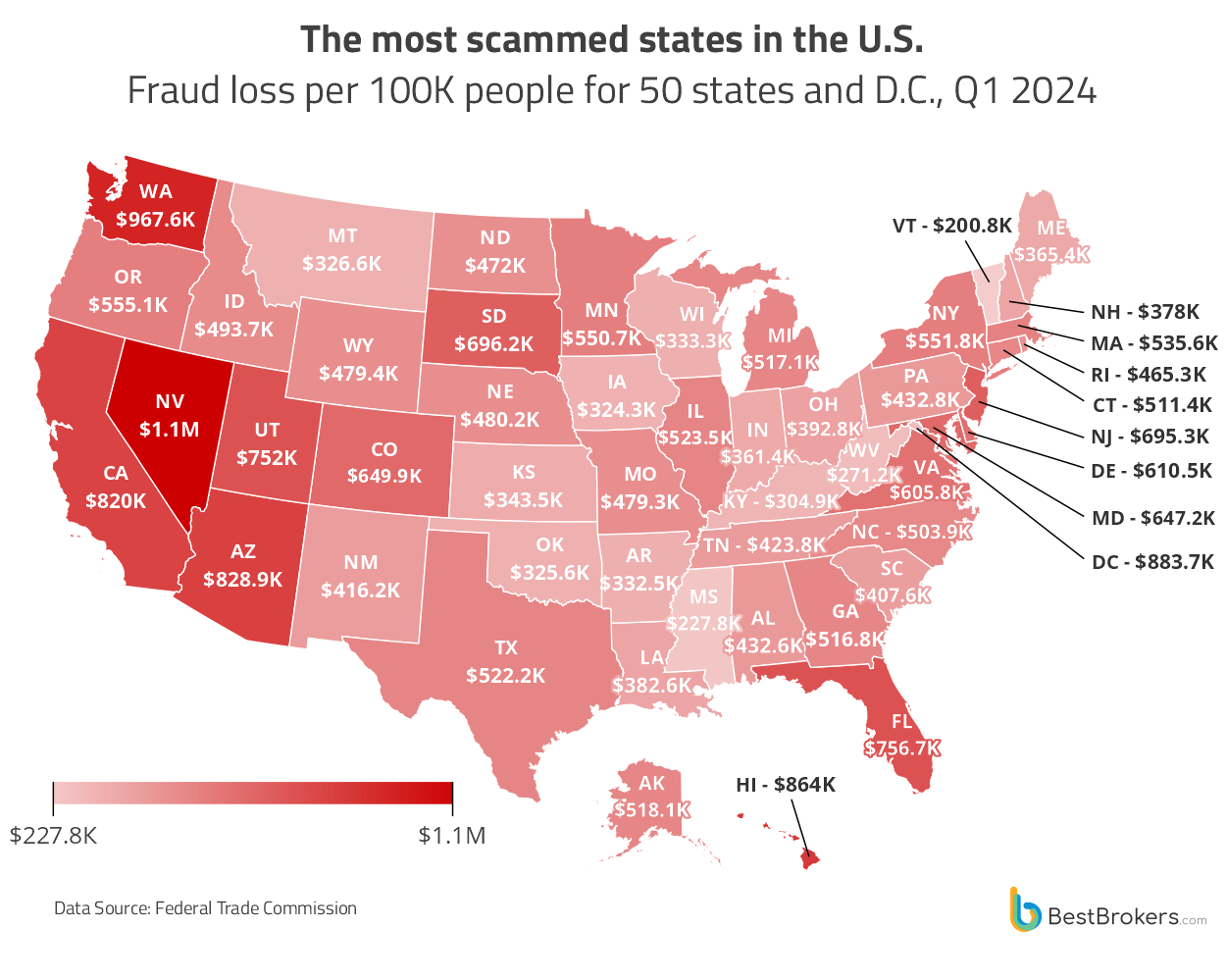

How Much Americans in Each State Lost to Fraud in the First Quarter of 2024

Between January and March of 2024, Americans were scammed out of a staggering $2.4 billion, according to the latest FTC scam data. This amount is $89.3 million more than the same period last year, even though the reported fraud cases dropped by 28% year-over-year, from 676,878 to 487,579.

Nevada was hit hardest, with losses of $1.1 million per 100,000 residents. Washington State and the District of Columbia were also heavily affected, losing $967.6 thousand and $883.7 thousand per 100,000 people, respectively. Notably, Washington D.C. reported the highest number of fraud cases per capita, with 228 incidents per 100,000 residents.

California, however, led the nation in total losses, with $319.5 million stolen. Following closely were Florida with $171.1 million, Texas with $159.9 million and New York with $108 million in reported losses. California also led in the number of fraud reports with 47,422 cases, with Texas (32,165), Florida (32,069), and New York (24,828) trailing behind. Meanwhile, Arizona, Florida, Utah, Delaware, and Wyoming had the highest median loss amounts at $500 each.

Imposter scams were the most common type of fraud in early 2024, accounting for 36.16% of all cases. Online shopping scams and negative reviews accounted for 16.38%, while business and job opportunity scams made up 5.62%. Internet services and investment-related scams were also prevalent, comprising 4.96% and 4.77% of reported incidents, respectively.

Methodology

Last year, the U.S. Federal Trade Commission (FTC) received 5.4 million consumer reports, while the financial injury totaled $10 billion. To create the map of the most scammed states, the team at BestBrokers used the latest data from the FTC. It includes information about financial fraud and impersonation scams reported by consumers to the FTC in 2023. To calculate the per capita loss to fraud for each state, we looked at 2023 population estimates from the U.S. Census Bureau.