Ever since the first Bitcoin block reward halving happened on 12 November 2012, these fundamental events, occurring approximately every 4 years, have marked the beginning of bull market cycles for the original cryptocurrency. This year the fourth halving happened in April, however now there was another huge factor into play – namely the spot Bitcoin ETFs, firstly approved in January 2024.

Seeing the tremendous price hike of Bitcoin since the approval of the spot ETFs, our team at BestBrokers decided to analyze how these financial instruments affected the Bitcoin cycle.

The approval of Bitcoin spot ETFs had a positive impact on Bitcoin’s price due to increased demand, accessibility for a broader range of investors, and institutional adoption. The enhanced legitimacy and reduced entry barriers provided by ETFs contributed to a more robust and mature Bitcoin market, driving the price up by over 50% in just 2 months time.

Price Volatility settles

The Bitcoin price reached its new ATH shortly before the halving in mid March and then, after the halving, started a downward trend, reaching its lowest point on 2 May. As discussed, such volatility is something we have already seen post previous halvings and was somewhat expected.

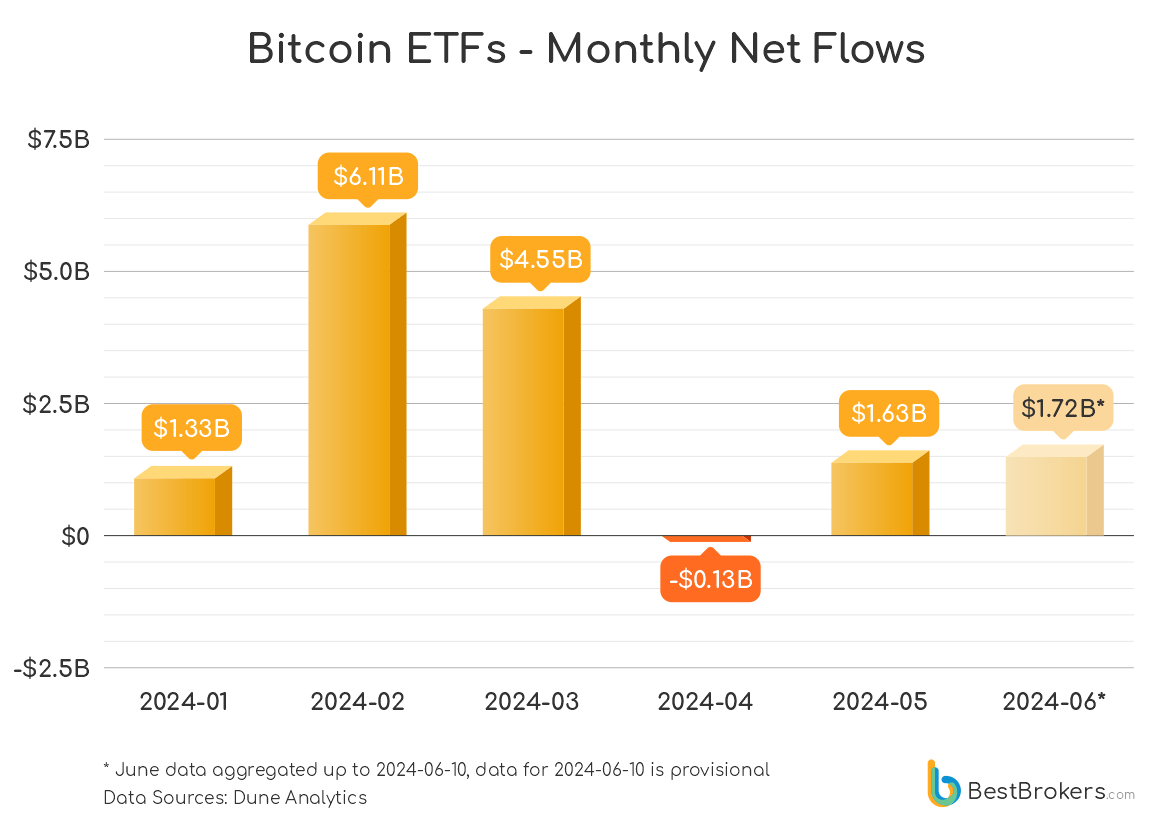

Following this low point throughout the month of May the price settled to the levels before the halving, which is also mirrored when we look at the ETF flows: May saw $1.63B positive net flows into Bitcoin ETFs.

What comes next

When we look at the net flows into Bitcoin ETFs in June, we can see that despite $65M net outflows this Monday, June has already surpassed May 2024 in terms of total net inflows at $1.72B compared to $1.61B in the entire month of May. This coincides with what our analyst Alan Goldberg had to say about that:

The approval of spot Bitcoin ETFs in January resulted in a 50% price increase for Bitcoin in the next few months. Thanks to the Spot ETFs pushing the crypto market so high prior to the halving, we saw a new All-Time-High reached before the block reward was cut in half, which happens for the first time in history. So far this has happened some time after the halving, because of the deflationary nature of Bitcoin and the market cycles.

What we are left with now is a very high starting point for the upcoming bull run, which historically has always come a few months after a halving event, spurred by the decreased daily supply that is mined globally. Thus, we will most likely see a strong bull run now that Bitcoin Spot ETFs come into play.”