Over the past few years, the inflated prices of everything from gas to food and housing have been taking a toll on Americans. As consumers are becoming increasingly price-sensitive and trying to optimize their budgets, hidden taxes slowly add to their expenses, often without their knowledge. While additional charges for certain services are easy to avoid, bank fees are almost inevitable for everyone with a legal income.

The banking industry is notorious for charging all kinds of hidden fees but some banks seem to have more of these so-called junk fees than others. Curious to see where banking services come with the most and least additional charges, the team at BestBrokers compared several banks and the different rates of fees they have. We looked at the ten largest banks in the United States by number of customers and focused our attention on eight fees that are more or less ubiquitous for the banking sector in the country.

What Are Junk Fees?

While most fees can be found in any bank’s tariff, charges for services such as wire transfers, overdrafts, and non-sufficient funds (NSF) fees can be labeled as surprise or predatory, since many clients find out about them after being charged with one. To put this in perspective, in 2022 credit card late payment fees and interest alone accounted for the record-breaking $130 billion of American card holders’ money.

Although the majority of fees are mandatory and there for a reason, they are almost always linked to lengthy descriptions as to why they are imposed, which let’s face it, no one reads. Junk fees, in particular, became widely discussed over the last few years, leading to President Joe Biden’s announcement of the ‘Junk Fee Prevention Act’ in March 2023. The suggested regulation gained him many supporters, who felt scammed by banks and other businesses that overcharged them wrongfully. The bill aims to lower and eliminate mandatory fees with little to no added value as well as undisclosed consumer charging.

The issue with junk fees escalated over the past few years, which prompted many Americans—aided by media coverage—to oppose those unfair practices. While most banks have started to lower or completely remove unnecessary fees, the topic is still relevant today, as low-income families struggle the most with the burden of being overcharged.

Most commonly imposed bank fees and their cost

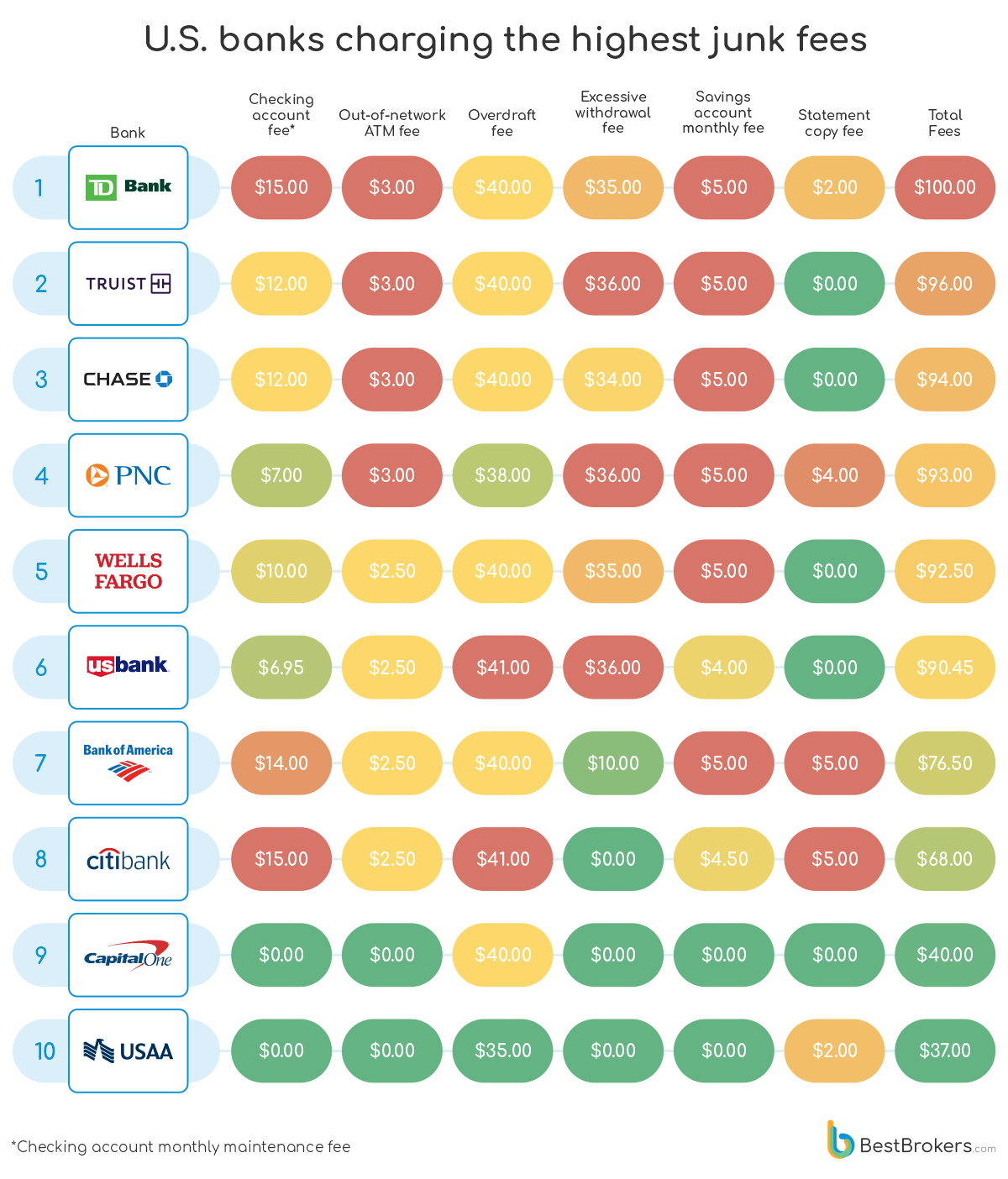

Looking at the websites of the ten U.S. banks with the most customers, our team compared the fees for some of the most popular banking products, as well as charges often neglected by consumers but could be quite costly. Our research shows that if banks imposed all eight fees we looked at, the client could be forced to pay between $37.00 and $103.00 for the given month. Note that some of these fees could be charged multiple times per month. Now let’s take a closer look at each fee and the banks charging them.

Checking account monthly maintenance fee

The monthly maintenance or service fee is a charge most financial institutions have in place just to keep your money stored every month. Although, on one hand, it might sound ironic that you have to pay to use your own money, most banks will waive that fee if you meet certain criteria such as having a minimum available balance at the end of each statement cycle. Banks are obliged by law to disclose this fee and any of the rest from our list upfront.

However, whether for promotion goals, attracting new customers, or bonuses, such fees are sometimes carefully concealed in the fine print, leaving some customers misled and having to pay money they were not informed of. While TD Bank and Citibank have the highest monthly fees at $15, Capital One and USAA Bank don’t impose this service fee.

Out-of-network ATM fee

The out-of-network ATM fee is levied if you withdraw money, check your balance, or deposit outside your bank provider ATM. The most popular banks are divided predominantly between $2.50 and $3 for each time you use an ATM of another bank though, again, Capital One and USAA Bank don’t apply it. Still, you might and in most cases will be charged some amount based on the rates of the ATM provider.

Credit card late fees

For over a decade, major credit card providers have raked in billions of dollars in junk fees, using inflation as a pretext to raise fees for borrowers and increase their profits. The Consumer Financial Protection Bureau’s (CFPB) ongoing war with credit card late fees struck a significant win earlier this year and accepted a rule, reducing the typical $32 fee for a late payment to only $8. After Bank of America and Citibank were slapped with $150 million and $29.5 million fines for credit card-related wrongdoings last year, the CFPB is tightening the control and misuse of such junk fees.

Although the rate varies, most banks declare a ceiling on the credit card late fee without clearly providing the minimum value. Instead, bank clients are left to fumble through pages of fine print. Currently, US Bank and Citibank levy the highest maximum fee of $41. You should expect to pay slightly less, up to $40, at six out of the ten banks. If you fail to make an on-time payment at PNC Bank it will cost up to $38, whilst the lowest maximum is $35 at USAA Bank.

Overdraft fees

An overdraft occurs when there are insufficient funds to meet a withdrawal amount, but the bank authorizes the account user to continue making transactions, covered by the overdraft. Essentially, the consumer can borrow a certain amount of money from the bank to cover their expenses despite their negative balance. The loan, of course, has interest attached to it, and each overdraft entails fees in case the amount is not paid back by the due date. Earlier this year, President Biden’s announcement against junk fees featured a section about reducing the average overdraft fee from $35 to $3, aiming to alleviate Americans from unfair money collections.

In April, a class action lawsuit from 2022 against Bank of America was revived, by customers who claimed the bank misled them. In 2020 the bank declared it would provide relief for clients facing hardships and waive overdraft or NSF fees. However, many customers insist it failed to do so. Some clients lost as much as $245 for two months, resulting in the astronomical $1.1 billion earnings for Bank of America from overdraft fees alone in 2020. According to a 2023 CFPB survey, roughly a quarter (26%) of Americans live in a household that incurred an overdraft or NSF fee at least once last year, while 43% did not anticipate the charge. At an average of $35 for the U.S., the highest overdraft fee from the top banks is $36, charged by PNC, US Bancorp, and Truist. Citibank, Capital One, and USAA Bank do not impose an overdraft fee.

Savings account monthly fee

Similarly to the monthly maintenance fee for checking accounts, most banks charge their clients for keeping their money in a savings account and earning interest. Again, some banks waive this fee if certain minimum conditions are met.

Nevertheless, it is of utmost importance that every customer familiarizes themselves with their bank’s tariff and is aware of all charges, even if they are as small as $4-$5 for a savings account service fee. US bank charges $4 per month, Citibank $4.50, and again Capital One and USAA Bank don’t impose it. With the rest of the banks, it is $5.

Paper statement copy

While a few decades ago, obtaining a bank statement was a bit of a hustle, nowadays, with digitalization so present in our day-to-day lives, receiving and printing statements is easier than ever. Most commonly, people find this fee misleading because they weren’t informed of its existence in advance. Many customers receive their monthly statements by post without realizing they are being billed for the service or that there is a fully free-of-charge electronic option.

Most banks try to go paperless and digitalize as many products as possible. Since the paper copy takes up resources, the fee is somewhat justifiable. Five banks don’t charge for the service (Truist, Chase, Wells Fargo, US Banks, and Capital Bank), while at the other five, it varies between $2 and $5.

Additional taxes to keep in mind

Of course, outside of the regular junk fees that are practically universal for most financial institutions, there are also additional taxes for different types of products. Wire transfer fees carry some of the heftiest charges ranging between $15 and $40 for incoming payments and up to a staggering $65 for an outgoing transfer at some banks.

Saving money with interest is one of the best available services banks can offer with a certificate of deposit (CD) account. However, just like with any other banking product, the most important information is the fine print of the contract. Since CDs have a maturity date, the account holder agrees not to withdraw any funds until the agreed-upon date with the bank. However, if that does occur an early withdrawal penalty is imposed. This charge is usually a few months’ worth of interest depending on the time left before the maturity date. One noteworthy point to highlight is that there is no upper limit on the penalty amount set by the federal government, which implies that the fine may reach thousands of dollars.

Another banking product with a variety of subtle fees is credit cards. In addition to the late payment fee, certain credit cards, advertised as having no maintenance fees sometimes trick people into getting one. Usually, banks don’t openly advertise one very important condition – that this applies for a fixed amount of time (three to twelve months) after you sign the contract, after which the bank imposes a credit card annual fee. Transaction fees are another part of using a credit card one should be aware of. Normally, they are either a set amount or a percentage of the total purchase ranging between 1% and 5% at most banks.

The excessive withdrawal fee is levied when the amount of withdrawals or transfers made over a given time frame—usually a month—exceeds a predetermined limit. It is only valid for certain accounts, meant to be used for longer-term deposits. Initially, this fee was mandatory, designated by the Federal Reserve’s Regulation D, limiting transfers and withdrawals from savings and deposit accounts to six per month.

However, the fee from this regulation was reduced to $0 in 2020, leaving it optional for financial institutions to impose it at their discretion. While many banks continued to charge it, it slowly became more uncommon over time. From what we could find on the websites and tariffs of America’s most popular banks, only TD Bank currently has an excessive withdrawal fee of $3.00

Junk fees: Banks raking in billions of dollars

Typically, retail banks have three main sources of revenue, namely interest, advisory services, and fees. Junk fees, in particular, could generate a significant amount of revenue; higher profits mean more money paid out to shareholders and executives to treat themselves fat bonuses at the end of the year.

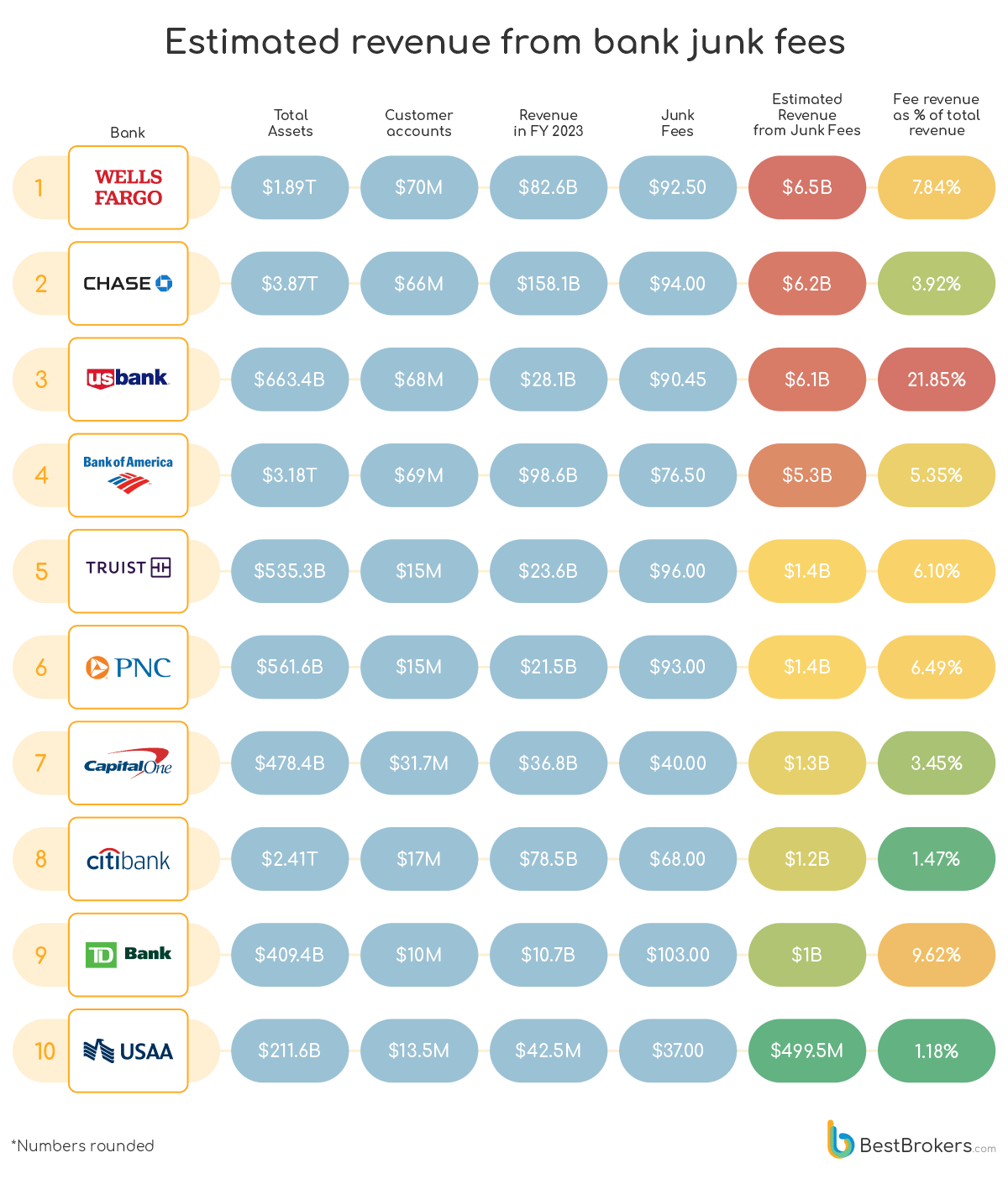

In 2022, revenue from overdraft/NSF fees reached an estimated $9.9 billion, according to the Financial Health Network. Looking at banks’ financial reports, we could see an increase in fee income. For instance, in its 2023 annual report, U.S. Bankcorp reveals it generated $1.306 billion in service charges over the fiscal year, up 0.6% from 2022 when the figure was $1.298 billion. Further income from junk fees is also included in the card revenue, which is $1.63 billion for the period.

If we look at the PNC 2023 annual report, we see the bank generated $1.323 billion in non-interest income from card and cash management and another $736 million from lending and deposit services last year. Don’t forget that this revenue does not include the income from interest.

It is easy to see that junk fees could account for a sizable portion of the total bank revenue. If we assume that the banks we looked at impose the 8 basic fees to all of their clients just once per year, we get 10-figure revenues from junk fees alone. Of course, these are just estimations that in no way aim at accurately predicting banks’ revenues from junk fees since this information isn’t available. These calculations were made just to show the sheer scale of junk fees in the banking sector, so make sure to take them with a grain of salt.

Methodology

For this analysis, the team at BestBrokers took data for the most popular U.S. banks, based on the number of accounts they had in May 2024 from DepositAccounts. Information was also sourced from the banks’ websites and financial statements.

We also searched through the websites and tariffs of each bank for the most commonly imposed junk, predatory, or hidden fees, that customers often find themselves paying unknowingly. This gave us a list of the eight most frequently encountered fees, although there are many, many more. Then, we ranked the banks in descending order based on the total of all fees. Furthermore, we estimated the possible income those junk fees could earn as a portion of each bank’s total revenue for 2023.

Additional information for the report was used from the Bureau of Labor Statistics, the CFPB, and the Federal Reserve websites.