Unicorns, defined as privately owned companies, valued at over $1 billion, are no longer such a rare sight. AI startups, in particular, are now quickly growing and reaching impressive success shortly after being created. OpenAI, the San Francisco-based company behind ChatGPT, recently closed a $6.6 billion funding round, nearly doubling its value from February to the current $157 billion. Meanwhile, Elon Musk’s SpaceX launched a tender offer in December that brought its valuation to $350 billion, overtaking Chinese tech giant ByteDance as the most valuable startup in the world.

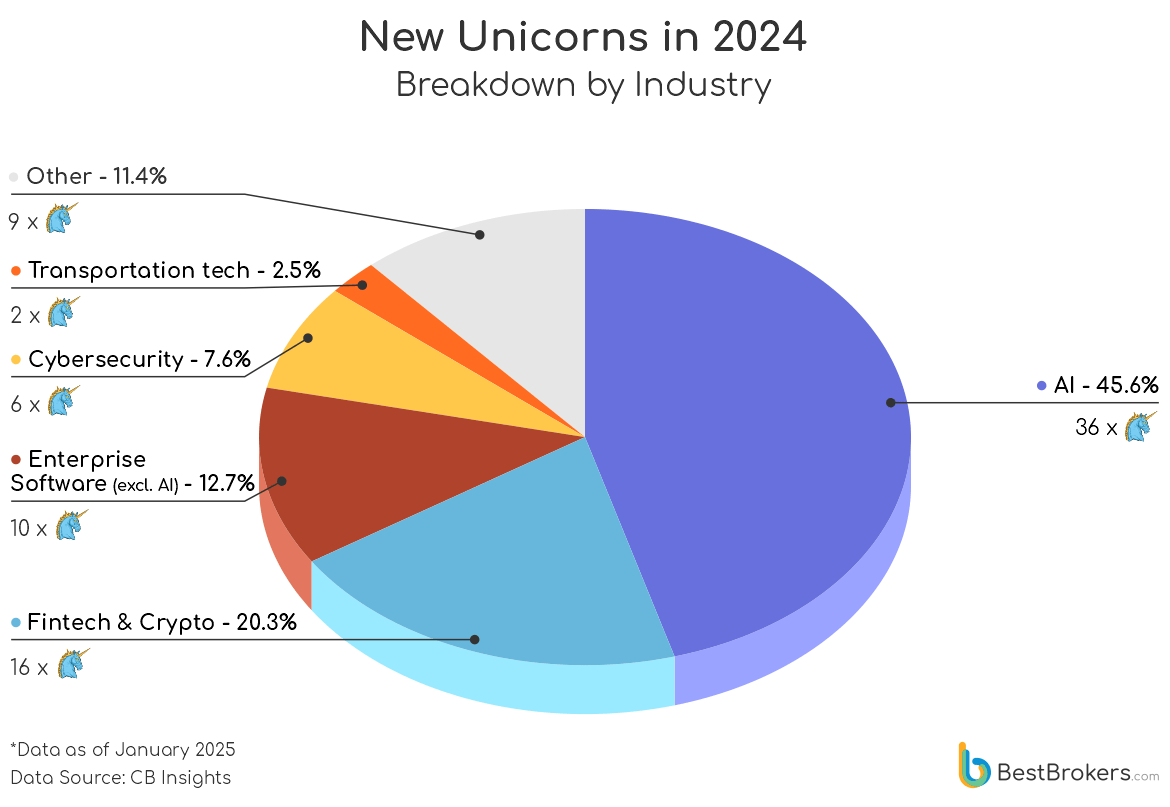

The extraordinary success of Musk’s companies this year, most notably SpaceX and xAI, along with OpenAI’s massive growth over the past few months our team at BestBrokers to analyse the most recent dataset on Unicorn startups from CB Insights. We wanted to see what kind of companies managed to enter this mythical group in 2024, and discovered that out of the 79 startups that have reached Unicorn status this year, 36 or nearly 46% are AI ones. Among them is Elon Musk’s own AI startup, which he founded last summer in a bid to compete with OpenAI following his exit from the company he helped create.

Artificial Intelligence Taking Over the Unicorn herd in 2024

Many of the private companies reaching unicorn status this year are, unsurprisingly, AI startups. Of the 79 companies that saw their market value surpass $1 billion by the end of December 2024, 36 are either developing artificial intelligence systems – generative AI, large language models, etc. or are at least heavily implementing them into their main products and services.

One of these is Sunnyvale-based Figure, developing general-purpose humanoid robots. The company was launched in 2022 and after raising $854 million in venture capital and angel investor funding from the likes of Intel Capital, OpenAI Startup Fund, Bezos Expeditions and the Amazon Industrial Innovation Fund, it is already worth $2.68 billion.

Another interesting AI unicorn is Cognition AI, a company from San Francisco, which focuses on creating AI software that functions as a software engineer. This is AI, which can code and potentially develop new AI on its own one day. The company was founded in 2023 and so far, it has raised $196 million, including a $175 million investment from Peter Thiel’s Founders Fund. Its market value is estimated at $2 billion.

AI-based search engine startup Perplexity.ai, which became a unicorn earlier this year, was recently valued at around $9 billion. In November, it closed a $500-million funding round that brought its valuation to $9 billion; the funding round was reportedly led by Institutional Venture Partners (IVP) and other investors included B Capital, NVentures (NVIDIA’s venture capital firm), New Enterprise Associates, and T. Rowe Price. The startup, threatening Google’s monopoly on internet search, was founded in August 2022 by several software engineers, who previously worked for companies such as OpenAI, Meta, Databricks, and Quora. In fact, these four engineers are among the many experts in machine learning and AI who have left their positions in leading tech companies to start working on their own startups.

Elon Musk is also an example of this; the billionaire-turned-Trump donor and appointed government efficiency department head in the new administration co-founded OpenAI in 2015 together with several others, including current CEO Sam Altman. While at first Altman and Musk were co-chairs, Tesla’s owner eventually stepped down from his position after his ambition to run the company on his own was rejected. The conflict turned into a bitter feud that escalated earlier this year, when Musk filed a lawsuit against OpenAI, dropped it soon after, and then filed another lawsuit against the company.

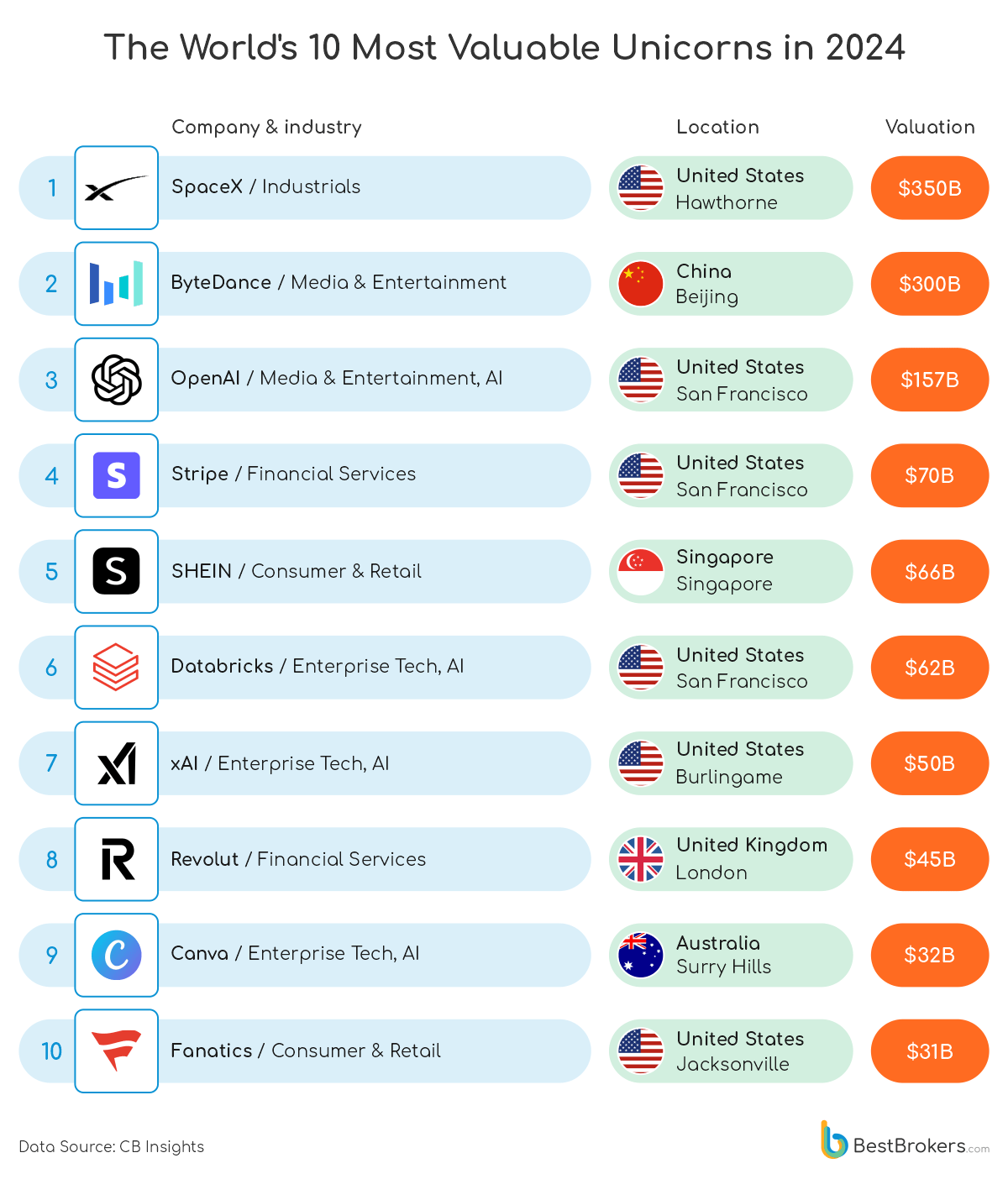

Now, his own artificial intelligence startup, xAI, which was founded in March 2023, quickly grew into one of the most promising and valuable unicorns in the world. In December, the company raised $6 billion during its latest funding round, which valued it at around $50 billion, double what it was worth in the summer. This swift success made xAI 2024’s most valuable startup and the seventh most valuable unicorn in the world, surpassing well-established businesses such as Revolut and Canva.

Another co-founder and former employee of OpenAI, Ilya Sutskever, is behind the second most-valuable unicorn that was born in 2024. This is Safe Superintelligence, a young company Sutskever founded in June 2024 alongside former Apple AI head Daniel Gross and AI researcher Daniel Levy. The company aims at creating “safe superintelligence” and was created following Ilya Sutskever’s exit from OpenAI. Sutskever was among the individuals responsible for the controversial but short-lived ousting of Sam Altman in November 2023.

Interestingly, the third-most valuable unicorn startup of 2024 is Sierra, an AI company founded by none other than OpenAI’s current chairman, Brett Taylor. Taylor, one of the most interesting tech entrepreneurs of the past decade, is well-known across Silicon Valley as one of the creators of Google Maps, former co-CEO of Salesforce, former CTO of Facebook, and also a current board member of Shopify. Sierra, one of the several companies he has started over the past few years, is now valued at $4.5 billion.

Among the startups that recently reached unicorn status is Physical Intelligence, a company developing artificial intelligence for robots. In early November, it raised $400 million in a funding round that brought its valuation to over $2 billion. CEO Karol Hausman, along with co-founder Brian Ichter, used to work for Google, while now their expertise in machine learning and large-scale models is behind one of the most interesting unicorns of 2024. This potential was apparently seen by investors, including Jeff Bezos and OpenAI, as well as venture capital veterans Sequoia Capital.

The largest privately held companies in the world

The number of privately held Unicorns reached 1,258 in December 2024, with Musk’s rocket company SpaceX beating Chinese social media giant ByteDance for the top spot this year. The company behind TikTok is valued at $300 billion, whereas the U.S.-based spacecraft maker now reached $350 billion. The startup that brought AI to the masses, OpenAI, ranks third with an estimated valuation of $157 billion. These are the other companies that make up the list of the 10 most valuable Unicorns as of December 16 2024:

Which countries are home to the most Unicorns?

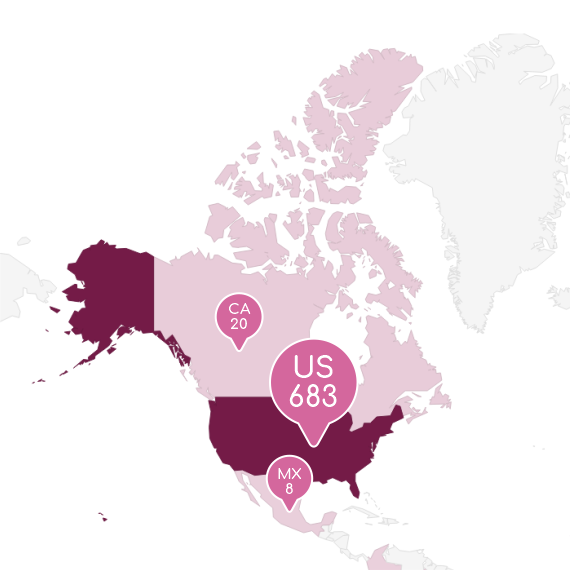

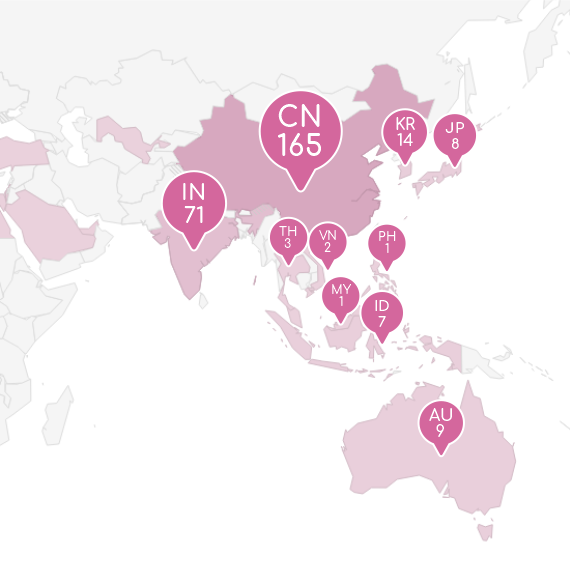

The United States has more unicorns than any other country and this has always been the case. In 2024, the U.S. is home to more than half of all unicorn startups, 683. Interestingly enough, many of these companies were actually started by immigrants or were started elsewhere but later relocated to the U.S. SpaceX, Databricks, and Stripe are just a few examples.

The U.S. is responsible for 683 unicorns with a combined worth of more than $2.541 trillion, followed by China with 165 unicorns valued at $638 billion, and India, which is home to 71 unicorns worth $186.03 billion.

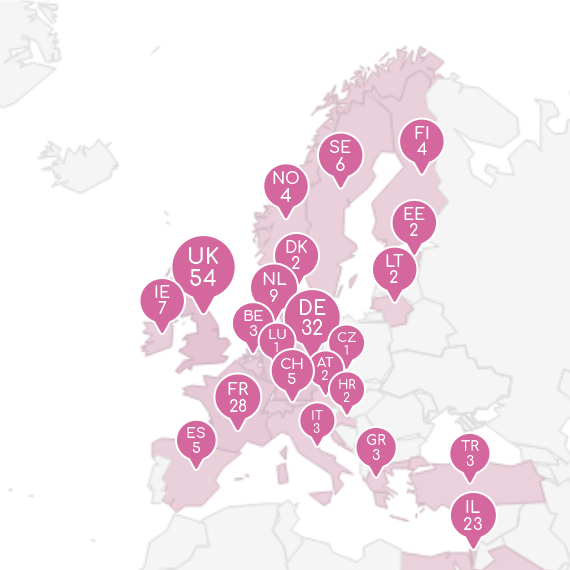

Across Europe, the UK has the largest number of unicorn startups, 54 in total, whose combined value stands at around $188 billion. Germany is home to 32 unicorn companies, followed by France with 28. Other places that have proved to be a thriving environment for private startups are Israel (23 unicorns worth $56 billion), Canada (20 unicorns worth $54 billion), Brazil (17 unicorns valued at $35.59), and Singapore (17 unicorns worth $94 billion).

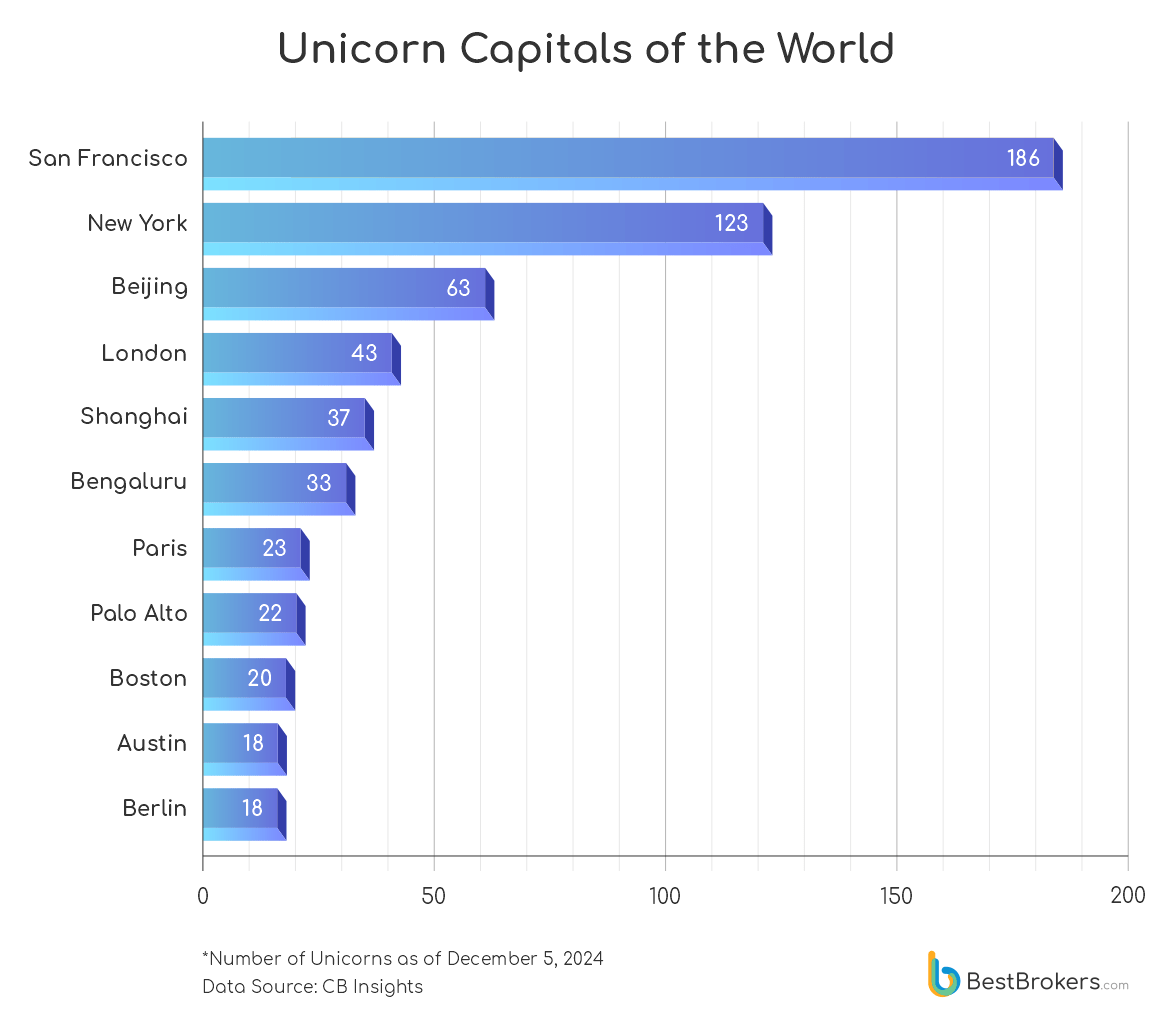

Silicon Valley, New York and Beijing – The Unicorn capitals in 2024

Location is one of the most important things to consider when starting a business; not only because of the potential customer base, local infrastructure and supply chains. According to recent research cited in the Wall Street Journal, startups’ odds of success increase in tech hubs. This is especially true for companies located or moving to Silicon Valley, which has an “entrepreneurial ecosystem” according to researchers.

So, it is hardly surprising that San Francisco is the world’s unicorn capital. It is home to 186 of these businesses, particularly those in the Enterprise Tech industry. Many of today’s hottest Fintech, crypto and AI startups have their quarters in or outside San Francisco. New York follows with 123 unicorns, Beijing ranks third with 63, London is in fourth place with 43 unicorns, and Shanghai is 5th with 37.

Why Do Companies Stay Private?

Not many companies manage to reach a valuation of $1 billion or more. Those that do will sometimes go public through an IPO or acquisition, but many company founders find staying private an enticing option for many reasons. On average, companies remain unicorns for eight years, according to a 2023 analysis by Ilya Strebulaev and the Venture Capital Initiative at Stanford.

It is a common misconception that companies’ founders prefer private to public companies so they can keep their finances private. While this is a valid reason that hardly needs an explanation, there are many other factors in play. Those who choose to remain private can exercise greater control over their business; they have more autonomy and answer to fewer shareholders. Of course, there are also fewer requirements for reporting whereas public companies in the United States, for instance, are subject to the rules of the Securities and Exchange Commission (SEC).

Until a couple of decades ago, IPOs or initial public offerings were the best way to raise capital. However, now many businesses are turning to venture capital funds and the private market. This allows them to choose their investors rather than sell shares to the public, which inevitably means having to meet shareholders’ high expectations.

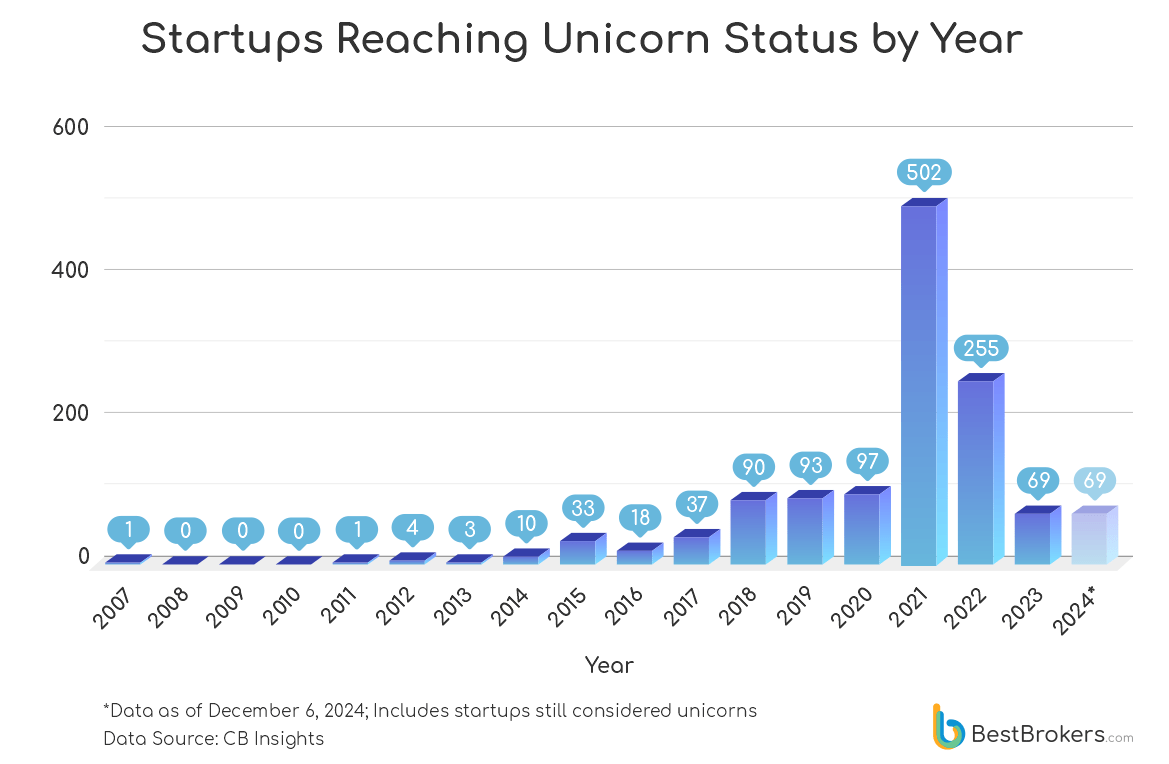

If we look at the specific years when companies reached a $1 billion value, it becomes clear that the past couple of years have not been the best for private companies. The year 2021 was when the most unicorns were born, 502 across various industries. Then, in 2022, another 255 private companies reached $1 billion value. Since then, the number of new unicorns has been falling – 69 startups joined and remained on the list in 2023, and by December 5, 2024, another 69 companies earned the prestigious status. In December 2024, we saw another 10 startups increasing their value to over $1 billion, bringing the number of 2024’s newly “born” unicorns to 79.

Bear in mind that these figures do not reflect the total number of unicorns around the world. They simply show how many privately held companies reached a market value of $1 billion or more.

Methodology

To visually represent the current state of unicorns, the team at BestBrokers analyzed raw company data from the business analytics platform CB Insights. We looked at figures as of December 5, 2024, and grouped the unicorns in the database by country, industry, and valuation. Note that the statistics are updated on a regular basis and changes might occur.

Companies that reached Unicorn status in 2024 – Raw Data

| Company | Valuation (billions of US$) | Date Joined | Country | City | Sector | Select Investors |

|---|---|---|---|---|---|---|

| xAI | $50 | 5/26/2024 | United States | Burlingame | AI | Sequoia Capital, Andreessen Horowitz, VY Capital |

| Perplexity AI | $9.00 | 4/23/2024 | United States | San Francisco | AI | New Enterprise Associates, Institutional Venture Partners, NVentures |

| SandboxAQ | $5.60 | 12/18/2024 | United States | Palo Alto | AI | Breyer Capital, Parkway VC, TIME Ventures |

| Safe Superintelligence | $5 | 9/4/2024 | United States | San Francisco | AI | Sequoia Capital, DST Global, Andreessen Horowitz |

| Sierra | $4.50 | 10/28/2024 | United States | San Francisco | AI | Benchmark, Sequoia Capital, Thrive Capital |

| Abba Platforms | $3.70 | 10/10/2024 | United States | New York | Fintech | Run4 Capital |

| Vultr | $3.50 | 12/18/2024 | United States | West Palm Beach | Enterprise software | AMD Ventures, LuminArx Capital Management |

| Moonshot AI | $3.30 | 2/19/2024 | China | Beijing | AI | HongShan, Jinfu Investment, ZhenFund |

| Cyera | $3.00 | 4/9/2024 | United States | New York | AI | Accel, CyberStarts, Sequoia Capital |

| Monad Labs | $3 | 4/9/2024 | United States | New York | Blockchain | HTX Ventures, Electric Capital, Coinbase Ventures |

| Poolside | $3 | 10/2/2024 | France | Paris | AI | Felicis, Redpoint Ventures, HSBC Venture Capital |

| Physical Intelligence | $2.80 | 11/4/2024 | United States | San Francisco | AI | Khosla Ventures, Sequoia Capital, Lux Capital |

| Figure | $2.68 | 2/23/2024 | United States | Sunnyvale | AI | Intel Capital, Parkway VC, Amazon Industrial Innovation Fund |

| Cursor | $2.60 | 12/20/2024 | United States | San Francisco | AI | Andreessen Horowitz, Thrive Capital, OpenAI Startup Fund |

| Bending Spoons | $2.55 | 2/15/2024 | Italy | Milan | AI | Durable Capital Partners, Adjacent, Creator Partners |

| Story Protocol | $2.25 | 8/21/2024 | United States | Bellevue | Blockchain | A16z Crypto, Andreessen Horowitz, Two Small Fish Ventures |

| Xaira Therapeutics | $2.15 | 4/23/2024 | United States | San Francisco | AI | ARCH Venture Partners, Foresite Capital, Two Sigma Ventures |

| Cognition AI | $2 | 4/24/2024 | United States | San Francisco | AI | Founders Fund, Khosla Ventures |

| Firefly Aerospace | $2 | 5/4/2024 | United States | Cedar Park | Aerospace & Defense Tech | Noosphere Ventures, RPM Ventures, SMS Capital Investment |

| Liquid AI | $2 | 12/13/2024 | United States | Cambridge | AI | OSS Capital, Duke Capital Partners, Samsung NEXT |

| SemiDrive | $1.93 | 7/14/2024 | China | Nanjing | AI | Vinno Capital, Shanghai STVC Group, Guozhong Venture Capital Management |

| NinjaOne | $1.90 | 2/6/2024 | United States | Austin | Enterprise software | Amit Agarwal, Frank Slootman, ICONIQ Growth, Ajmer Singh, Amar Desai |

| Writer | $1.90 | 11/25/2024 | United States | San Francisco | AI | Aspect Ventures, Upfront Ventures, Balderton Capital |

| Weka | $1.60 | 5/15/2024 | United States | Campbell | Enterprise software | Qualcomm Ventures, Hitachi Ventures, MoreTech Ventures |

| Huntress | $1.55 | 6/18/2024 | United States | Ellicott City | Cybersecurity | ForgePoint Capital, Sapphire Ventures, Gula Tech Adventures |

| Altruist | $1.50 | 4/16/2024 | United States | Culver City | Fintech | Venrock, Endeavor, Adams Street Partners |

| Harvey | $1.50 | 7/23/2024 | United States | San Francisco | AI | OpenAI Startup Fund, Kleiner Perkins, Sequoia Capital |

| Sigma Computing | $1.50 | 5/16/2024 | United States | San Francisco | Enterprise software | Sutter Hill Ventures, Snowflake Ventures, NewView Capital |

| Skild AI | $1.50 | 7/9/2024 | United States | Pittsburgh | AI | CRV, General Catalyst, Menlo Ventures |

| Agibank | $1.49 | 12/24/2024 | Brazil | Campinas | Fintech | |

| EON | $1.40 | 11/26/2024 | United States | New York | Enterprise software | Lightspeed Venture Partners, Sequoia Capital, Bond |

| Liquid Death | $1.40 | 3/11/2024 | United States | Santa Monica | Beverages | Science Media, Live Nation Labs, Velvet Sea Ventures |

| 24M Technology | $1.30 | 9/5/2024 | United States | Cambridge | Energy tech | North Bridge Venture Partners, CRV, Shumway Capital |

| Ather Energy | $1.30 | 08/13/2024 | India | Bengaluru | Auto tech & EV | 021 Capital |

| HashKeyHashKey | $1.30 | 01/16/2024 | Hong Kong | Hong Kong | Blockchain | OKX Ventures |

| Zum | $1.30 | 01/31/2024 | United States | Redwood City | AI | Sequoia Capital, BMW i Ventures, Spark Capital |

| Codeium | $1.25 | 8/29/2024 | United States | Sacramento | AI | General Catalyst, Kleiner Perkins, Founders Fund |

| Polyhedra Network | $1.25 | 03/14/2024 | United States | San Francisco | Blockchain | MH Ventures, Symbolic Capital, UOB Venture Management |

| Together AI | $1.25 | 3/13/2024 | United States | San Francisco | AI | Definition Capital, Long Journey Ventures, Lux Capital |

| Creatio | $1.20 | 6/25/2024 | United States | Boston | Enterprise software | Sapphire Ventures |

| EGYM | $1.20 | 9/24/2024 | Germany | Munich | Fitness tech | Bayern Kapital, NGP Capital, High-Tech Grunderfonds |

| Mews | $1.20 | 3/4/2024 | Netherlands | Amsterdam | Enterprise software | Notion Capital, Revaia, Battery Ventures |

| MoneyView | $1.20 | 9/12/2024 | India | Bengaluru | Fintech | Accel, Nexus Ventures, Nippon Life Global Investors America |

| Uzum | $1.16 | 3/26/2024 | Uzbekistan | Tashkent | Fintech | FinSight Ventures |

| DevRev | $1.15 | 7/25/2024 | United States | Palo Alto | AI | Khosla Ventures, Mayfield, Alumni Ventures |

| Chainguard | $1.12 | 7/25/2024 | United States | Kirkland | Cybersecurity | Amplify Partners, MANTIS Venture Capital, Sequoia Capital |

| ElevenLabs | $1.10 | 01/22/2024 | United States | New York | AI | Andreessen Horowitz, Credo Ventures, Sequoia Capital |

| Rapido | $1.10 | 7/29/2024 | India | Madhapur | Bike taxis | Nexus Venture Partners, Astarc Ventures, Shell Ventures |

| Altana AI | $1 | 7/29/2024 | United States | New York | AI | Google Ventures, Amadeus Capital Partners, Activate Capital |

| Aven | $1 | 7/17/2024 | United States | San Francisco | Fintech | Khosla Ventures, General Catalyst, Founders Fund |

| Ayar Labs | $1.00 | 12/11/2024 | United States | San Jose | AI | Intel Capital, Founders Fund, Playground Global |

| Cosm | $1 | 7/31/2024 | United States | Los Angeles | Enterprise software | Bolt Ventures |

| DataSnipper | $1 | 2/1/2024 | Netherlands | Amsterdam | AI | Index Ventures |

| EliseAI | $1 | 8/14/2024 | United States | New York | AI | Navitas Capital, Point72 Ventures, JLL Spark |

| EvenUp | $1 | 10/8/2024 | United States | San Francisco | AI | NFX, Lightspeed Venture Partners, Bessemer Venture Partners |

| Flo Health | $1 | 7/30/2024 | United Kingdom | London | Health tech | Flint Capital, Target Global, Vostok New Ventures |

| Halcyon | $1.00 | 11/25/2024 | United States | Austin | Cybersecurity | Bain Capital Ventures, SYN Ventures, Evolution Equity Partners |

| Huma | $1 | 07/16/2024 | United Kingdom | London | AI | Leaps by Bayer, Hitachi Ventures, Unilever Ventures |

| Humanity Protocol | $1 | 2/28/2024 | Hong Kong | Hong Kong | Blockchain | Shima Capital, CMCC Global, MH Ventures |

| IntraBio | $1 | 03/23/2024 | United Kingdom | Oxfordshire | Pharmaceutical | Biohealth Innovation, Oxford Science Enterprises |

| Kiteworks | $1 | 8/14/2024 | United States | Palo Alto | Cybersecurity | Insight Partners and Sixth Street |

| Krutrim | $1 | 01/26/2024 | India | Bengaluru | AI | Matrix Partners India |

| Lighthouse | $1 | 11/24/2024 | United Kingdom | London | Enterprise software | F-Prime Capital, Eight Roads Ventures |

| Merkle Manufactory | $1 | 03/30/2024 | United States | Los Angeles | Blockchain | Standard Crypto, Andreessen Horowitz, Union Square Ventures |

| Minute Media | $1 | 01/30/2024 | United States | New York | Digital media publisher | Dawn Capital, Battery Ventures, Gemini Israel Ventures |

| Moniepoint | $1 | 10/29/2024 | Nigeria | Lagos | Fintech | Lightrock, Novastar Ventures, QED Investors |

| Nimble | $1 | 10/23/2024 | United States | San Francisco | AI | GSR Ventures, Breyer Capital, Accel |

| Perfios | $1 | 03/13/2024 | India | Mumbai | Fintech | Bessemer Venture Partners, Teachers’ Venture Growth |

| Pigment | $1 | 04/03/2024 | France | Paris | Fintech | FirstMark Capital, Meritech Capital Partners, Institutional Venture Partners |

| Rentberry | $1 | 9/6/2024 | United States | San Francisco | Enterprise software | 369 Growth Partners, GTM Capital, Berkeley Hills Capital |

| Sakana AI | $1 | 06/26/2024 | Japan | Tokyo | AI | Lux Capital, Khosla Ventures, New Enterprise Associates |

| Saronic Technologies | $1 | 07/19/2024 | United States | Austin | AI | 8VC, Caffeinated Capital, Andreessen Horowitz |

| Semperis | $1 | 6/20/2024 | United States | Hoboken | Cybersecurity | Tech Pioneers Fund, Ten Eleven Ventures, Hudson Ventures |

| Silverfort | $1 | 01/23/2024 | Israel | Tel Aviv | Cybersecurity | SingTel Innov8, Citi Ventures, Maor Investments |

| Speak | $1.00 | 12/10/2024 | United States | San Francisco | AI | Khosla Ventures, OpenAI Startup Fund, Founders Fund |

| The Row | $1 | 9/12/2024 | United States | New York | Fashion | Wertheimer family (Chanel), L’Oréal heiress Françoise Bettencourt Meyers |

| The Sandbox | $1 | 6/6/2024 | Malta | St. Julians | Blockchain | LG Technology Ventures, True Global Ventures, 1kx |

| World Labs | $1 | 7/17/2024 | United States | Stanford | AI | Andreessen Horowitz, Radical Ventures, New Enterprise Associates |

| Xreal | $1 | 01/29/2024 | China | Beijing | AR glasses | Hongtai Capital Holdings, Shunwei Capital, GP Capital |

* Data as of December 5, 2024