Building on our recent work on the enormous electric power consumption for mining Bitcoin, this time our team at BestBrokers focused on the energy consumption footprint of Bitcoin transactions.

Calculating the exact amount of electric power consumed with every Bitcoin transaction is not a straightforward task. Technically speaking, the entire Blockchain is running solely for the purpose of recording and securing transactions. However, it is not a good approach to take the entire electric power consumption of all mining facilities globally and divide it by the number of transactions. Thus we will get a ridiculously high number and this will not be a very accurate representation.

It is clear that without the reward of currently 3.125 BTC for every block mined, there would not be enough incentive to pour so much electric power into mining just for the transaction fees. At least at the current price and current daily transaction volumes.

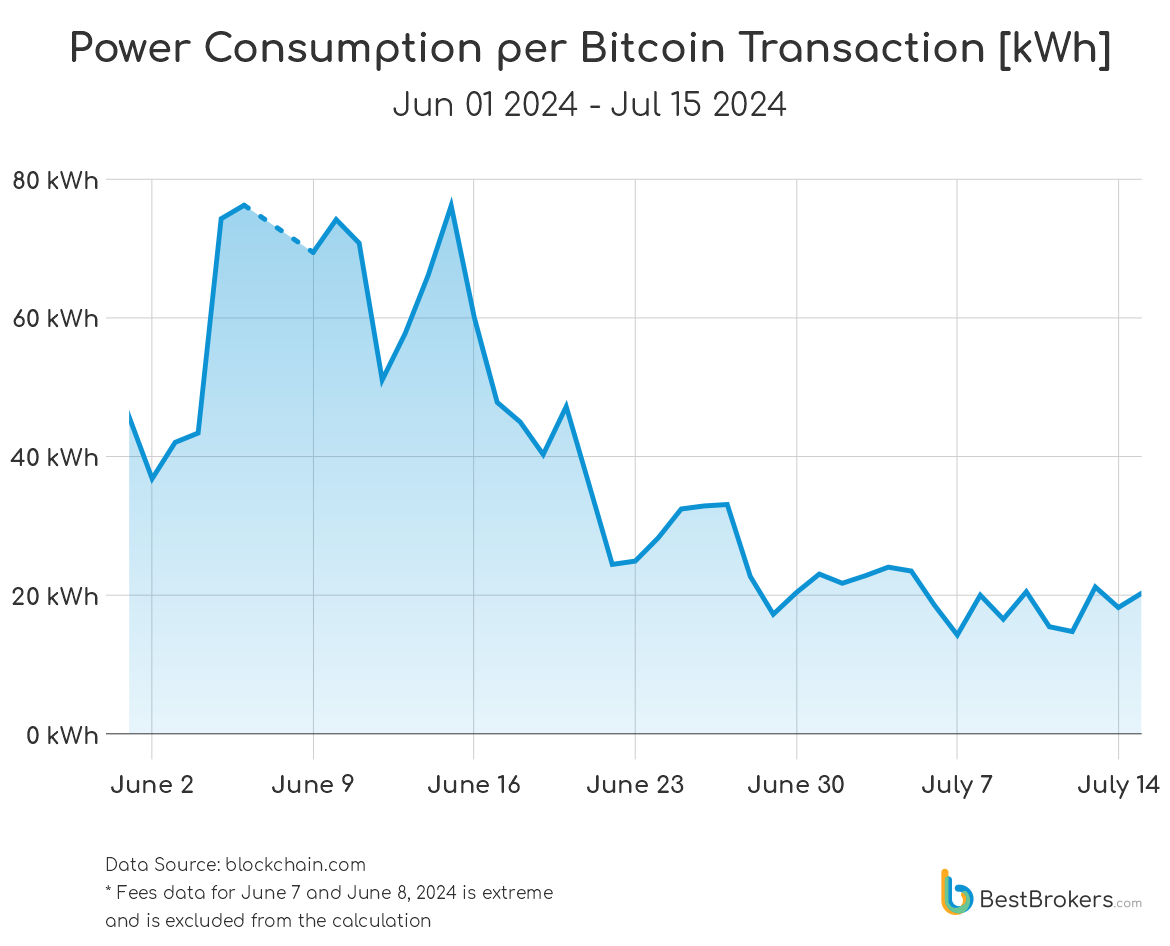

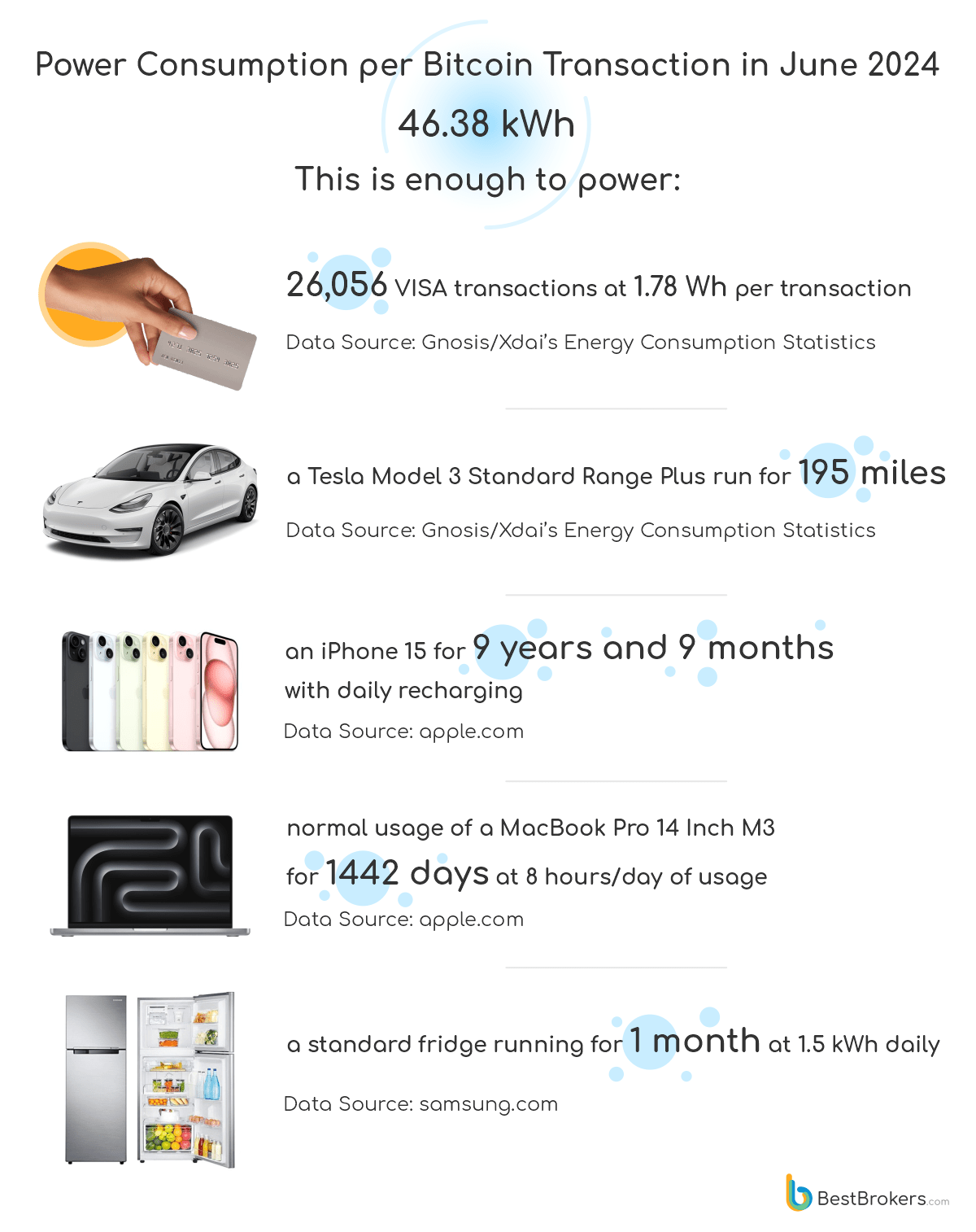

Therefore we came up with a methodology that accounts just for the portion of the total energy consumption, representing the fees. After running the numbers for June 2024, it turned out that 1 Bitcoin transaction consumed a whopping 46 kWh on average just in terms of the blockchain operation.

According to the U.S. Energy Information Administration (EIA) the average U.S. household’s daily power consumption is 29 kWh. Thus the power used for 1 Bitcoin transaction would power your home for a day and a half. To put this number in a better perspective we put up a table for you:

How can this be reduced

Bitcoin is the original cryptocurrency, the proof-of-concept gone live, and as such it had much more important problems to solve, than optimizing for transaction energy efficiency. Keeping this in mind, there are some factors that can affect the energy footprint of Bitcoin transactions in a positive way (reducing it):

Increase Mining Efficiency

Specialized mining hardware manufacturers constantly improve their ASIC miners for better efficiency. The current report’s calculations are based on an average efficiency of 26.41 Joules per Terahash. The newest mining hardware, which will be released in Q3 2024 is expected to have an efficiency of 15 J/TH, which is an improvement of 43%. However the network difficulty is constantly going up and these two even out.

Change of the consensus mechanism

Bitcoin can potentially adopt alternative consensus mechanisms such as Proof of Stake to reduce the energy footprint of transactions. However many analysts don’t think this is a viable solution, as it will change the core nature of Bitcoin and may have devastating results.

Transaction Layer Solutions

There can be Layer 2 solutions like the Lightning Network, which allows for faster and more energy-efficient off-chain transactions.

In short, there is not a simple way to reduce Bitcoin transactions’ energy footprint, as it is in direct relation to the network difficulty and total hashrate. Thus with the huge demand for Bitcoin these will tend to only go up, at least for the time being when there are still more unmined Bitcoins.

Methodology

- Miners mine blocks that facilitate the network operation. The blockchain difficulty is adjusted dynamically based on the total network hashrate, so that 1 block is mined every 10 minutes.

- Pending transactions are grouped together and confirmed when they get appended to a newly-mined block.

- The entire Bitcoin network consumed 369.77 GWh of electric power on a daily basis to mine 144 blocks for a total daily reward of 450 bitcoins in June 2024.

- On top of the block reward of 3.125 BTC for every block mined, miners get the cumulative fees for all transactions associated with that block. There were an average of 594,511 daily transactions in June 2024.

- Transaction fees are paid in Satoshis (the smallest fraction of the Bitcoin equal to one hundred-millionth part) and averaged 6135 satoshis per transaction in June 2024.

This lets us calculate the average electric power used for a transaction, based on the premise that miners run their power-hungry operations for monetary gain, consisting of block rewards plus fees. Thus they run their 369.77 GWh a day operations for the reward of 486.57 BTC (450 in block rewards and 36.57 in transaction fees).

When we divide the average daily fees of 36.57 BTC by the total daily reward for miners of 486.57 BTC (block rewards plus fees) we get that fees are 7.52% of the total remuneration miners get for their operation. Thus we can conclude that 27.57 GWh were used daily to cover for transaction fees (7.46% of the total 369.77 GWh spent on mining).

When we divide 27.57 GWh by the 594,511 daily transactions we come to 46.38 kWh of electric power spent on every bitcoin transaction.

Please refer to the full data for all daily numbers.