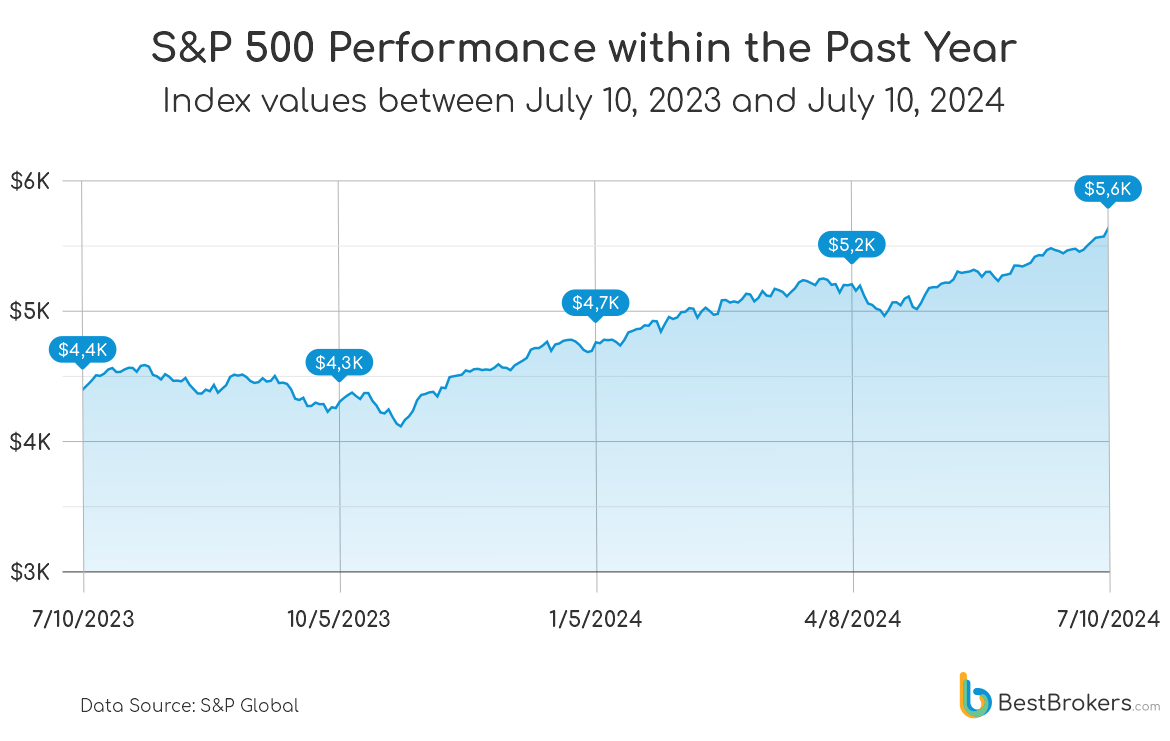

While investor enthusiasm for artificial intelligence has driven the performance of many stocks perceived to be linked to the “AI revolution”, some analysts have warned that AI is overhyped and a bubble about to burst – sooner than later. During the first six months of 2024, the S&P 500 index grew 14.5% from December 2023, jumping to record highs 31 times. AI stocks, however, outran the index, increasing more than 27% from the end of last year. So how long will the rally go? Boom or bubble, is the AI hype all that important to the broader stock market and the economy in the months to come?

Puzzled by the conflicting forecasts about AI, the team at BestBrokers examined the S&P 500 and its constituents, looking at the stock price changes over the past year. We also included the market capitalisation of AI companies as of July 2024 and estimated how it changed since July 2023. It turns out that companies developing or supplying software, materials and equipment to the AI sector have grown to nearly half of the entire market size of the index.

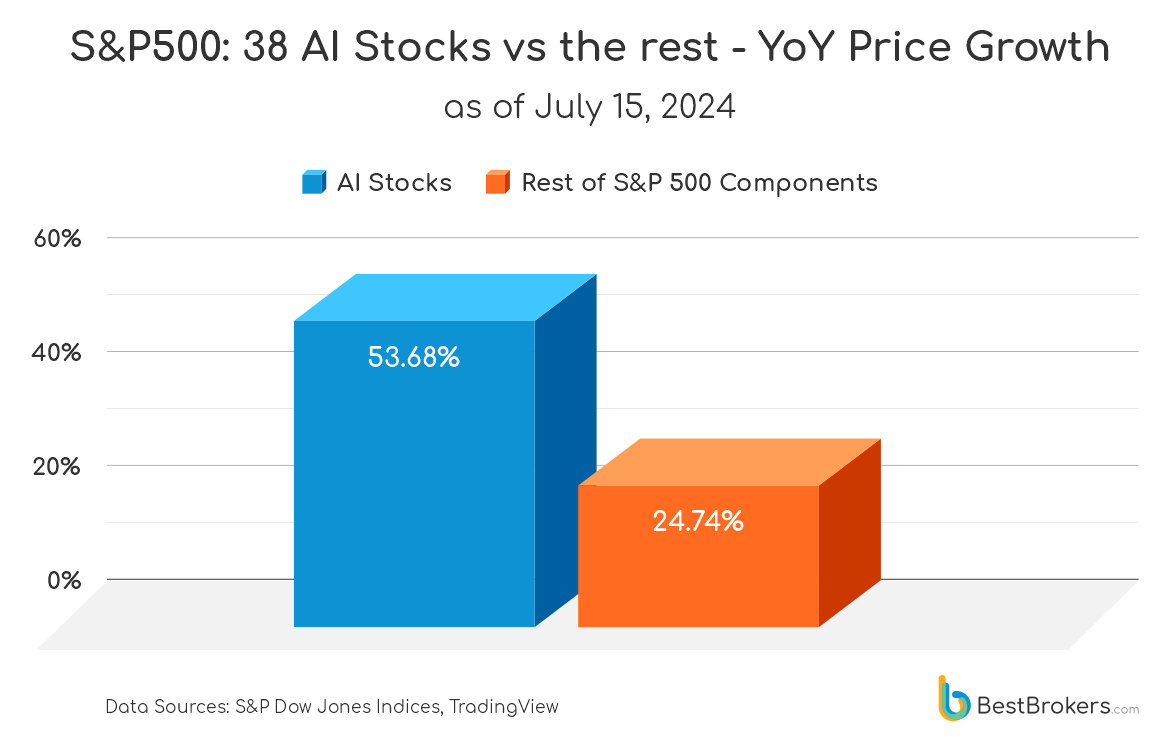

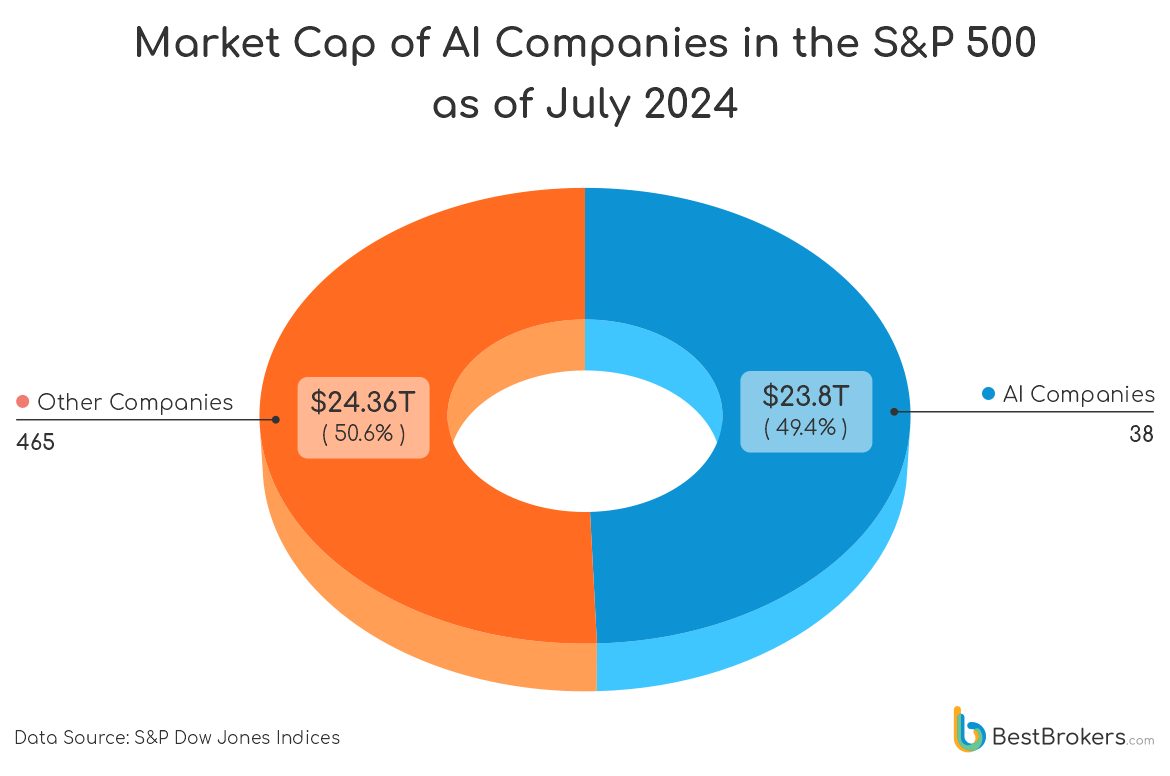

Now, the 38 companies we consider part of the AI industry are valued at $23.8 trillion, roughly 49.4% of the total market size of the S&P 500. Moreover, AI stocks saw a year-over-year rise of 53.68% in price as of July 15, compared to a 24.74% growth of non-AI index components. At the same time, the index rose 27.7% year-over-year driven by top-performing AI stocks.

Market Size of the Largest AI Companies

Including 500 leading companies (503 different stocks), the S&P 500 index covers roughly 80% of the total market capitalisation of U.S. public companies. As of July 15, its aggregate market cap was $48.168 trillion; in comparison, in January, the market cap stood at a little over $43 trillion. This means that in the first half of the year, the index increased by almost $5 trillion in market size.

Tech companies and AI companies, in particular, contributed to a lot of this growth. Businesses within the Information Technology sector have the most weight, roughly 32.4%, followed by Finance (12.4%), and Healthcare (11.7%) companies. When we take a closer look at the S&P 500 constituents, however, we see that there are currently 38 AI stocks, with the latest addition being CrowdStrike, which made it to the index on June 24, 2024.

These 38 companies make up just 7.55% of the S&P 500 but contribute an astounding $23.8 trillion or 49.4% to the aggregate capitalisation. The rest of the components, all 465 have a combined market cap of $24.36 trillion, which is 50.6% of the index total.

Most of the top 10 constituents by weight are also closely tied to AI, namely Apple ($3.51 trillion in market capitalisation), Microsoft Corporation ($3.296 trillion), NVIDIA Corporation ($2.903 trillion), Alphabet Inc. ($2.246 trillion), Amazon ($1.946 trillion), and Meta Platforms Inc. ($1.172 trillion).

AI Stocks Outrunning the S&P 500 Index

The rapid growth of artificial intelligence over the past couple of years has had a large impact on the broader economy. Rather than causing massive job loss, fake content overload, and infringement of privacy, which are still relevant concerns, of course, AI has been instrumental in the livening up of the stock market.

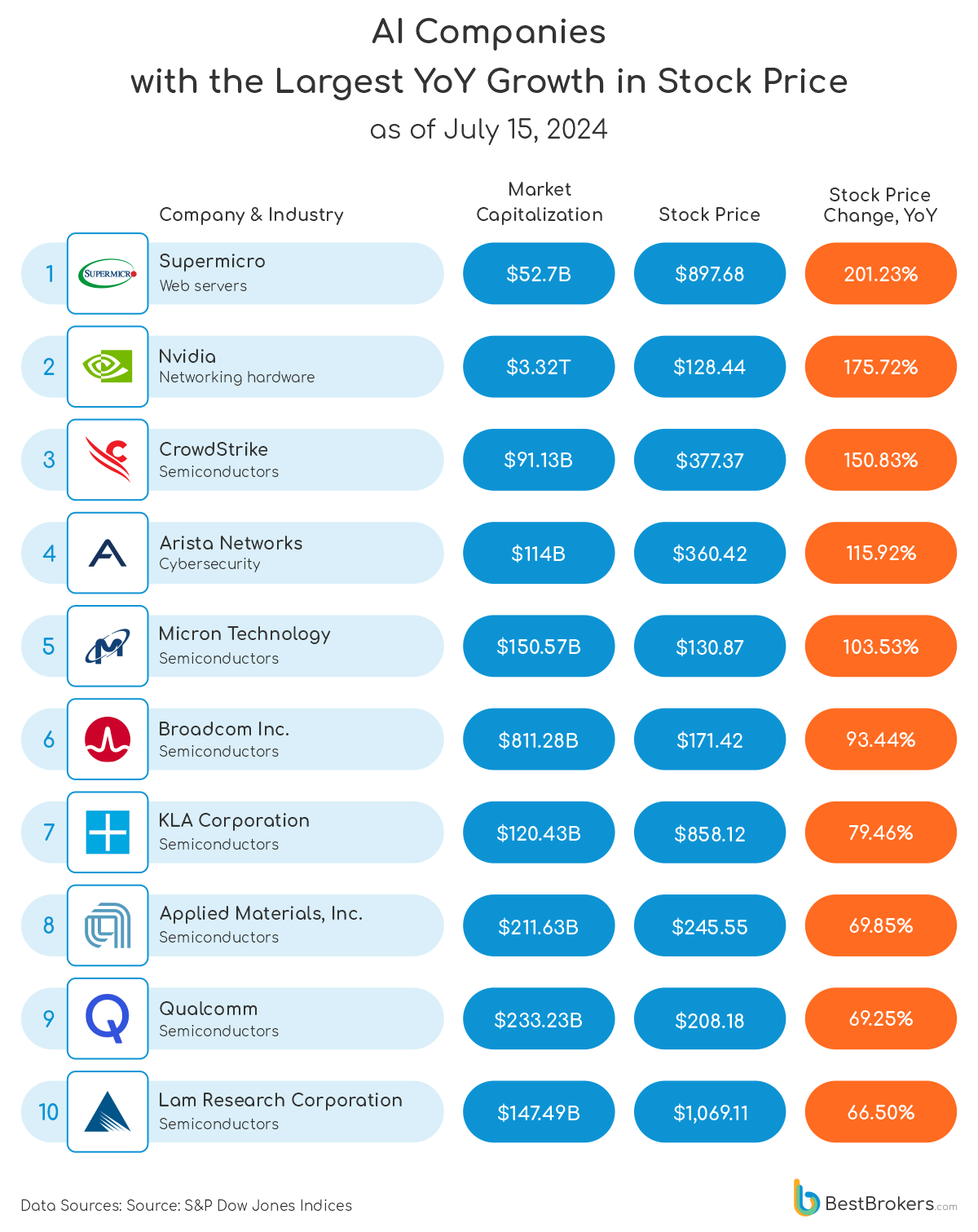

Nvidia, arguably the company driving the AI stock rally this year, has been the most talked about company. Between the end of 2023 and July 15, its stock gained 160.82% (and an even more impressive rally of more than 200% when comparing the share price from May last year to the same time in 2024).

The chip designer, however, was not the only one seeing huge gains. When looking at a snapshot of prices between July 15 2023 and July 15 2024, AI server manufacturer Supermicro has had the top-performing stock out of all 503 S&P 500 components, up 201.23% for the period. It reached $1,229 in March, roughly five times what it sold for last year.

The stock rose over 12% on June 13 following earning reports from AI-developing giants such as Oracle and Broadcom. Moreover, Supermicro reported a year-over-year increase of 200% in its revenue for the third quarter of the 2024 fiscal year to $3.85 billion with Non-GAAP diluted net income per common share of $6.65.

For the period between July 15 2023 and July 15 2024, Nvidia’s stock rose 175.72%; generative AI cybersecurity firm CrowdStrike gained 150.83%, while networking company Arista Networks saw a gain of 115.92%.

Methodology

Data for this report was sourced from S&P Dow Jones Indices with share prices and market capitalisation as of July 15, 2024. Note that since the S&P 500 includes two share classes of three of its constituent stocks, the total number of components is 503. The team at BestBrokers also looked at information from the Nasdaq and the New York Stock Exchange websites, Macrotrends and TradingView.