Apple has established itself as one of the most influential tech giants and is currently the most valuable company with a market cap of nearly $2.5 trillion and over 1.23 billion iPhone users worldwide in 2022. Being the most valuable company brings a lot of praise but, on the other hand, a lot of opposition too. That was the case recently when news broke that Apple officially announced it will allow apps on the App Store to sell NFTs. The catch was that the sales are to be done through in-app purchases in fiat currency, which means 15% sale fee (30% if you surpass $1 million yearly), no Web3 integration and no crypto accepted for NFT sales.

This provoked strong negative reactions in the industry with CEO of Fortnite developer Epic Games Tim Sweeney tweeting literally “Apple must be stopped”, complaining it is “killing all NFT app businesses it can’t tax”. With all the buzz surrounding the subject our team at BestBrokers decided to analyze what Apple actually offers and if it makes any sense to in fact sell your collection via an iOS app, having in mind that marketplaces like OpenSea take just 2.5% in sale fees.

A deal breaker for marketplaces

Apple’s In-App Purchase model is definitely prohibitive for NFT Marketplaces. Their fees typically do not surpass 5% and there is no margin to pay the 15% – 30% Apple fee. The only possible way would be to transfer the fees to the end customer. This would not make much sense as users would be able to buy the same NFT for a price that is 30% lower directly on the marketplace. This in essence means that marketplace apps would continue to just let users connect to their profile and browse collections. Transactions would have to remain outside of the App Store.

A new hope for independent NFT creators

NFTs have seen an unprecedented boom in the second half of 2021 with daily transaction volumes often surpassing $100 million. The number of daily transactions remains high in 2022, despite the dollar-value dropping due to the plunge in cryptocurrency prices. This hype has created a whole new submarket for NFT Marketing with many big players dumping large sums to promote their NFT collections and make quick turnovers. This has increased the entry costs to a point where it is simply prohibitive for independent artists to market their NFT items / collections.

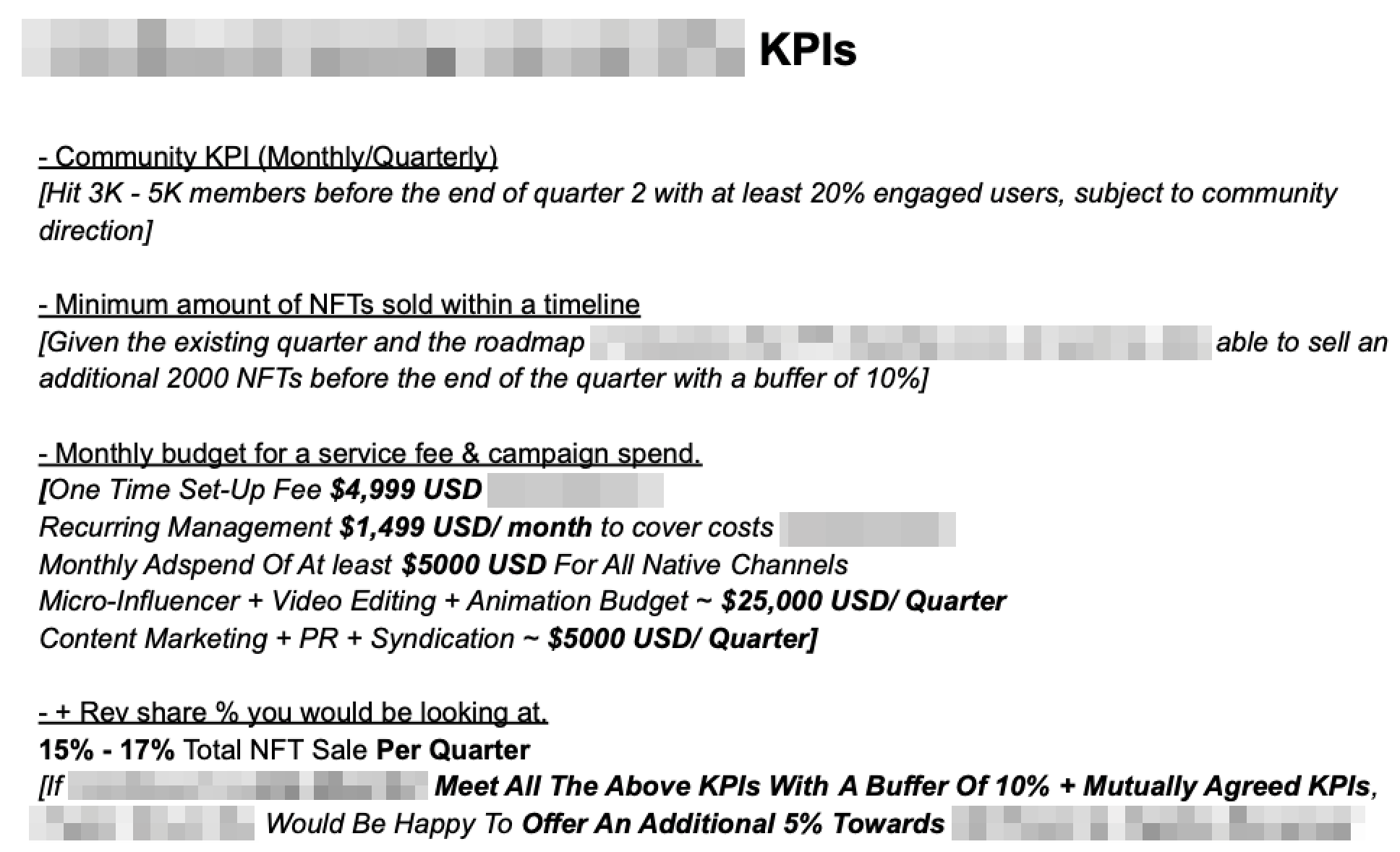

BestBrokers obtained an actual offer from a prominent NFT marketing agency to an NFT startup, to give you a perspective of the budgets involved in selling a limited NFT collection. Here are the proposed KPIs and amounts:

Let’s sum this up

For a six month campaign you are supposed to invest a minimum of $100,000 in ad spend, influencer marketing and management fees plus give out up to 20-22% in revenue share on all sales for a “guaranteed” 1800 sales and 3000-5000 new members on your socials. We put the guarantee in quotation marks because the only amount subject to refund is the management fees of $8994. With a price point around the $100 mark per item, this seems like a very risky investment for an independent creator or even a team of creators, who are trying to bootstrap a project and are not relying on major financial backing.

How Apple may turn this around

If you do a search for the highly-competitive “NFT” keyword on the App Store right now, you would get two kinds of results:

Apps of established marketplaces like OpenSea, where you are able to just browse collections on the secondary market and link your profile. Transactions are done outside the Apple infrastructure.

Apps that let you “design” NFTs, using libraries of stock graphics. These are pretty much freeriding on the NFT hype and moving away from the original NFT idea.

With their move to allow NFT sales on the platform Apple are in fact creating a blue ocean market for NFT creators, who are doing primary sales of their own NFT. With a relatively simple to build app, that Integrates In-App Purchases they will get access to Apple’s over 1.5 billion active devices. Many independent NFT creators will be more than happy to give up 15% of their proceeds after the fact for access to a practically unlimited market. With the low relevance of the current App Store search results, the first developers that manage to push their NFT selling apps live on the App Store might profit immensely.

We reached out to Miro Nikolov, marketing director at Pigletz NFT to get his take on the subject:

“In the past 9 months we have spent large budgets on Facebook, Google Ads, Twitter and Discord to build our community and we are seeing the cost per user acquisition increase constantly. When advertising through influencers, especially in crypto, you are not only spending thousands upfront, but you are also often asked for payments in crypto. This may result in problems with both accounting and accountability – we got scammed by ‘influencers’ with fake views and fake followers.

Our entire team is very excited about the news that Apple is finally allowing integrated NFT sales through In-App Purchases. This is something we expected and hoped for. We identify this as a great opportunity to do direct sales and we have already started development of our own iOS app with integrated In-App Purchases.”