Looming Fed rate hikes were the hottest topic in the beginning of 2022. Shortly after that global markets dove even deeper into the red with the start of the war between Russia and Ukraine. Not long after the LUNA crash followed and crypto markets plunged deeply.

Unfavorable events for the global economy continued and caused further damage to all crypto assets. Despite all the negativity surrounding crypto and multiple published analyses, concluding with the announcement of “crypto winter”, the NFT sector kept developing at a good pace and our team at BestBrokers decided to pull some raw data out of the Blockchain with Dune Analytics and give a visual representation.

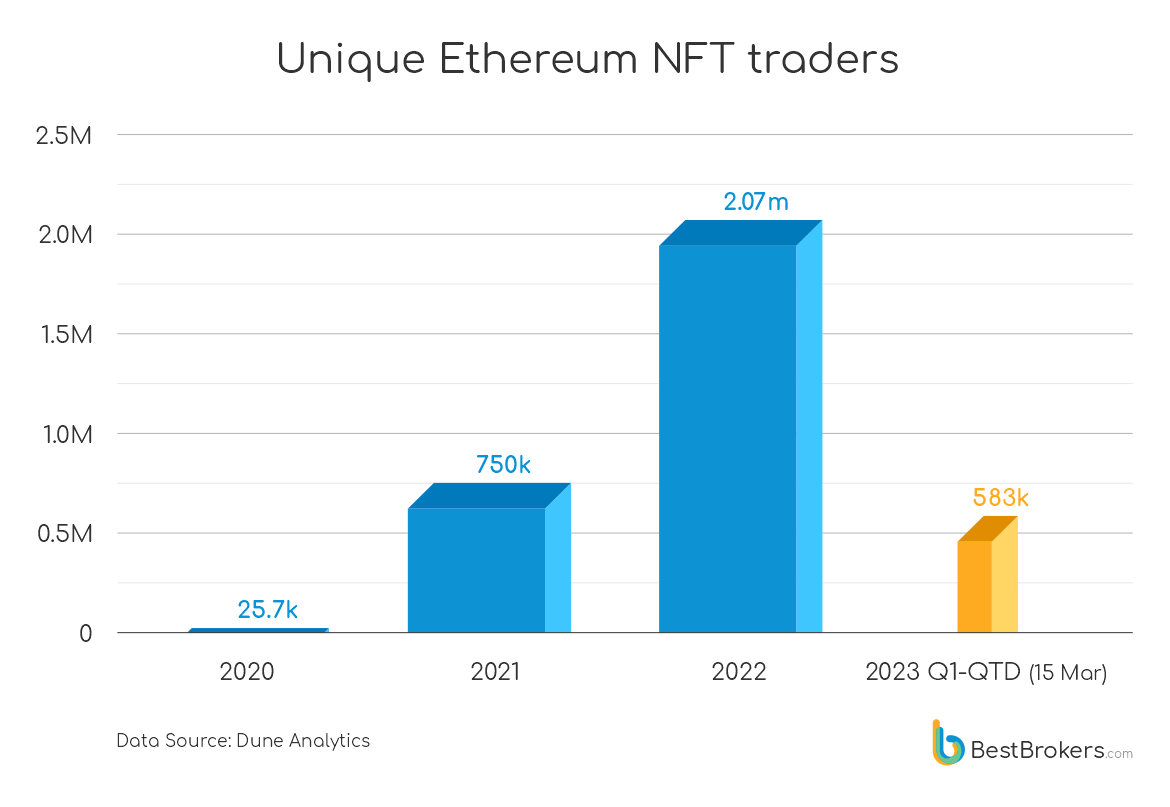

Despite the falling prices and the much lower trading volume for most of the cryptocurrencies, the number of the unique active NFT traders on the Ethereum blockchain rose to over 2.07 million in 2022 or 276% compared to 2021.

“The fact that NFTs kept traders’ attention during such tough times for the whole investing world means that there is something special about this asset. With the crypto prices expected to only rise from this point on, NFT will become even more mainstream and eventually will bring a lot of younger investors to the markets”

– comments Alan Goldberg, analyst at Best Brokers.

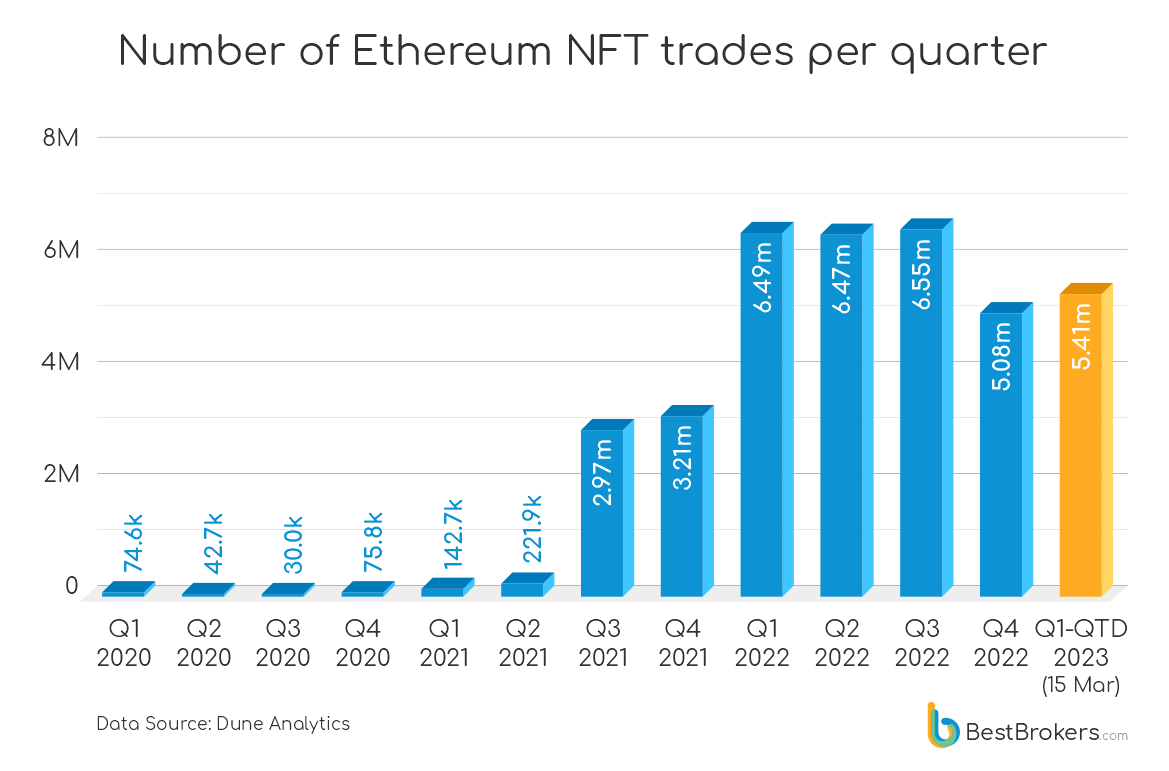

Stable overall trading activity

Ethereum NFT trading activity initially skyrocketed to almost 3 million trades for Q3 2021 with BTC and Ethereum reaching all time high. However, this trend remained stable despite the turbulent 2022, only dropping in Q4 2022 when the Fed rate reached (and exceeded) the 4% mark for the first time in 15 years.

Even after the number of trades plummeted 22.48% in Q4 2022 it still bounced back in Q1 2023 with the number of trades in this current first quarter already 6.65% higher as of 15 March 2023.

“Such stable activity, despite crypto and global markets having one of the most turbulent years in their history, only strengthens the expectations that NFTs will be one of the most popular trading instruments in the future. We have seen the power of retail investors in the so-called ‘meme stocks’ rallies in the past year, now we see it in the NFT trading.”

– adds Alan.