2024 has been an interesting year for gold, which reached historical highs backed by the growing demand for assets seen as a safe haven at a time of persistent inflation, economic crises, and international conflicts. Despite the dip gold experienced in early October, a troy ounce has been trading for over $2,650 over the past few weeks. The precious metal is expected to maintain its upward trajectory, with some analysts predicting even more record-breaking prices by the end of the year.

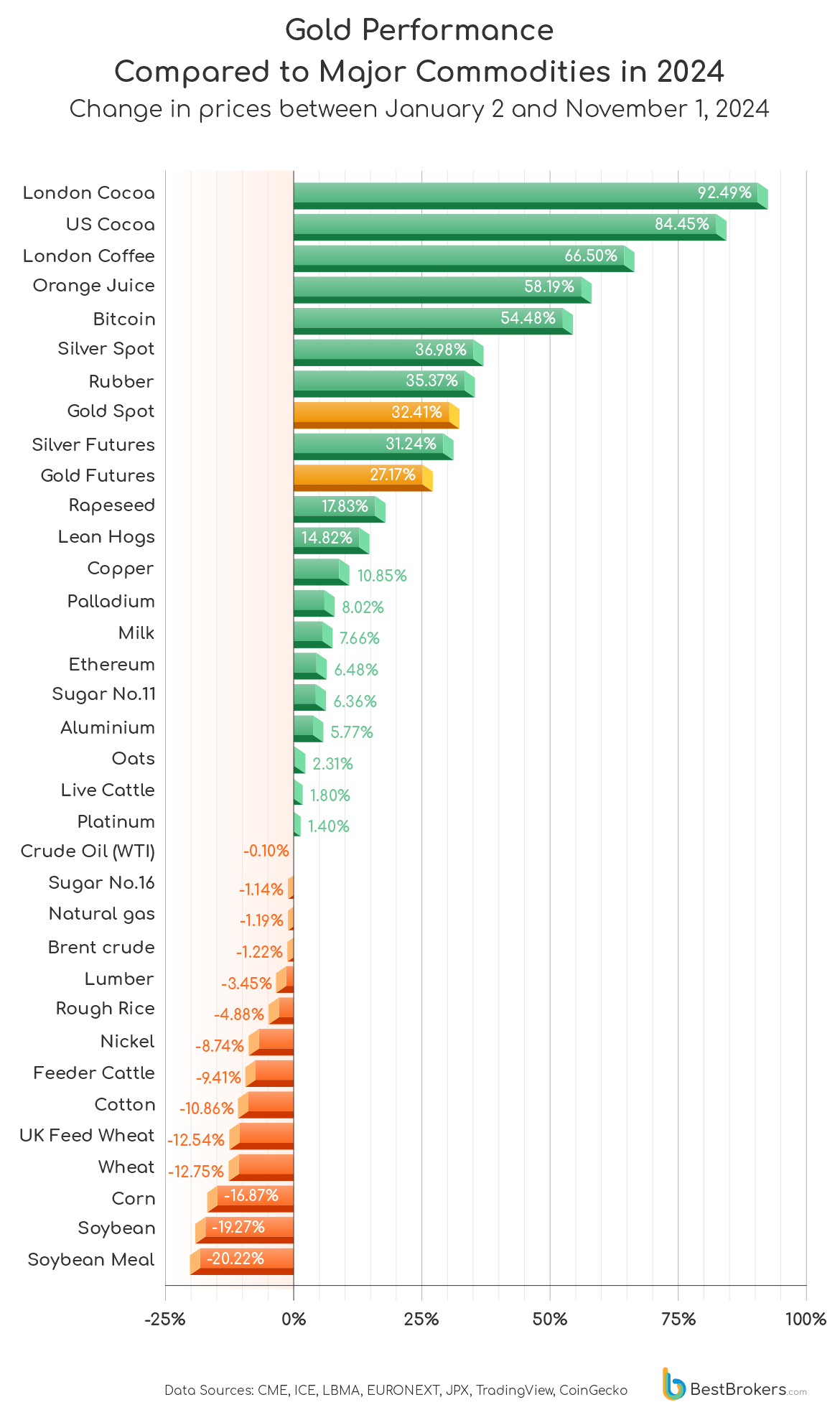

Gold is far from being the only commodity that saw an increase in value over the past ten months. Cocoa more than doubled in price since last year due to shortages and strong demand; coffee also increased in value due to poor harvests and adverse weather conditions. This made the team at BestBrokers curious to see whether gold’s performance this year is as exceptional as it seems, so we decided to compare it to other highly traded commodities.

We checked the prices of gold, silver, and several other assets on November 2 and compared them to those from January 2 since, for most markets, January 1 is not a trading day. Since cryptocurrencies are considered to be commodities by the Commodity Futures Trading Commission in the United States, we also decided to include Bitcoin and Ethereum in the comparison. Technically, they are also securities according to the U.S. Securities and Exchange Commission but weighing them up against physical commodities might be interesting.

Gold and Silver Prices in 2024

On its own, gold’s price growth is, indeed, impressive, with the international price at the London Bullion Market going over $2,783 on October 30. On Friday, November 1, a troy ounce of the precious metal traded for $2,747.35 (AM price) and compared to the beginning of the year, this is a growth rate of a little over 32% in 10 months. Meanwhile, gold futures on the U.S. Commodity Exchange (COMEX) rose almost 27.17% between January and November; the quote for December delivery on November 1 reached $2,772.40 intraday, eventually closing at $2,749.20.

Another precious metal on an upward trajectory this year due to investor demand for a safe haven is silver, with silver futures for December delivery up 31.24% year-to-date as of November 1. The international price for an ounce recorded by the London Bullion Market Association (LBMA) was $32.800, up 36.98% from the beginning of the year. Gold and silver may be a great option for investors right now but traders looking for the highest returns may want to look elsewhere.

Commodities That Gained the Most in 2024

When looking at performance since January, cocoa is beating all other commodities, indices, and even Bitcoin, which rose 54% from January. Due to supply shortages, cocoa prices are increasing even faster, with U.S. cocoa futures surging almost 84.5% since the beginning of the year and London cocoa increasing even faster in value. On November 1, London cocoa futures for December delivery traded for £5,871 per metric tonne, compared to only £3,050 in January. This is an increase of 92.49%. The deficit caused by crop issues in Ivory Coast and Ghana, which produce roughly 60% of the world’s cocoa, raised the price of the commodity in mid-April to over £8,200. The current price might be far from this peak but some analysts expect another surge by the end of the year due to persisting disease and the long-term impact of climate change.

Along with cocoa, coffee prices surged this year as a result of shortages paired with strong demand. Robusta coffee in particular, which is among the most traded agriculture commodities, started the year trading for $2,570 on the Intercontinental Exchange (ICE) in the U.S. January robusta futures sold for $4,279 per metric tonne on ICE on November 1, up 66.5% from the beginning of the year. Those interested in commodities know well that orange juice also saw huge growth on the global markets, with January futures going up by 58.19% between January 2 and November 1. ICE-listed frozen concentrated orange juice closed at $488.40 on Friday driven by severe weather and disease in Brazil, the world’s largest producer.

In February, the World Bank projected natural rubber prices to increase by 4% in 2024. However, increased global consumption raised the prices of the commodity even more. In January, the quote for ribbed smoked sheet (RSS) rubber futures with December delivery on the Osaka Securities Exchange was 255.6. On November 1, it reached 346.00, an increase of 35.37%.

Gold vs Crypto as an Investment

Cryptocurrencies rose in value with both Bitcoin and Ethereum peaking in March, while the total crypto market cap doubled from October of last year to around $2.47 trillion right now. As crypto exchange traded funds (ETFs) were approved earlier this year in the U.S., Bitcoin and Ethereum saw a huge boost due to massive interest by both retail and institutional investors.

Bitcoin, the largest cryptocurrency by both value and market capitalisation, has been volatile over the past year but surged as traders sensed a Trump victory in the U.S. elections. As of November 6, the total value of the market is estimated at $1.47 trillion, while the price soared to an all-time high of $75,086.55 according to the crypto trading platform Crypto.com. On November 1, one BTC reached $69,508 by midnight, up 54.48% from its value of $44,995 on January 2. The price of Ethereum also increased within this period; by a mere 6.48% despite the price hike to $4,070.6 in March. Currently, the value of the cryptocurrency is down to roughly $2,620.

Despite its volatility, Bitcoin is now seen by many as a good investment, especially against physical gold, which, like all commodities, comes with its complexities and limitations. The price swings of the cryptocurrency are expected to eventually cool down following the U.S. presidential election, with some projections eyeing a price of $80,000 in the coming days and weeks.

Is Gold the Best Asset to Invest in Right Now?

Looking at the record-high prices investment-grade gold currently trades for, buying the precious metal right now may not be the best strategy except for savvy investors who have dealt with gold before. Investing in a stock index such as the S&P 500 or Nasdaq Composite may come with lower returns but stocks have generally performed better than gold over the years. According to our comparison, an investment in Bitcoin would pay out even more; it is riskier, however, but may bring good returns even in the long term.

The current rally of the precious metal is, indeed, exceptional, yet, according to some analysts, central banks will continue buying it and the increased demand coupled with economic uncertainty, global conflicts, and inflation, will contribute to further price gains. The gold market will eventually cool down and whether gold is a good investment or not is very subjective, depending on personal investing goals, risk tolerance, and the other assets investors own. Another factor to consider is the time horizon of such an investment.

Why Is Gold So Expensive Right Now?

Inflation over the past several years coupled with economic instability played a role in the rising price of gold that started back in 2023 and picked up speed this year. Several things are currently keeping the price of gold high, one of which is the demand from central banks and their plans to increase their reserves.

While in 2022, this demand was driven by the central banks of Turkey, Uzbekistan, India, and Qatar, in 2023, the top buyers were China, Singapore, and the Czech Republic according to data from the World Gold Council. This year, the largest net buyers of gold so far have been Turkey with 51.5 tonnes purchased, India with 45.5 tonnes, and Poland, which has acquired 39.2 tonnes of the precious metal.

Industrial demand and more importantly, demand from the jewellery industry, have been on the rise. However, demand from large exchange-traded funds (ETFs) has also been a factor. The largest one, the SPDR Gold Trust ETF, currently holds 891.5 tonnes of gold; within the past month alone, it has acquired 28.5 tonnes.

The weaker U.S. dollar has also been instrumental in driving the price of gold higher this year. It has declined against several major currencies, including the Euro, the British pound, the Japanese yen, and the Canadian dollar since the beginning of the year. The dollar-denominated gold has therefore become more appealing for buyers using those currencies since this allowed them to buy more gold.

Raw Data

| Commodity | Details | Contract Delivery Date | Symbol | Exchange | Price Jan 2 2024 | Price Nov 1 2024 | Change % |

|---|---|---|---|---|---|---|---|

| London Cocoa | Cocoa futures | December 2024 | C | ICE | £3,050.00 | £5,871.00 | 92.49% |

| US Cocoa | Cocoa futures | December 2024 | CC | ICE | $3,980 | $7,341 | 84.45% |

| London Coffee | Robusta futures | January 2025 | RC | ICE | $2,570 | $4,279 | 66.50% |

| Orange Juice | FCOJ-A futures | January 2025 | OJ | ICE | $308.75 | $488.40 | 58.19% |

| Bitcoin | Cryptocurrency | BTC | Aggregated | $44,995 | $69,508 | 54.48% | |

| Silver Spot | International price for silver per ounce | – | LBMA | $23.945 | $32.800 | 36.98% | |

| Rubber | Ribbed smoked sheet rubber futures | December 2024 | RSS | OSE | 255.6 | 346 | 35.37% |

| Gold Spot | International price for gold per ounce | – | LBMA | $2,074.90 | $2,747.35 | 32.41% | |

| Silver Futures | CME Globex | December 2024 | SI | COMEX | $24.900 | $32.680 | 31.24% |

| Gold Futures | Gold futures | December 2024 | GC | COMEX | $2,161.80 | $2,749.20 | 27.17% |

| Rapeseed | Rapeseed futures | February 2025 | ECO | EURONEXT | €438.75 | €517.00 | 17.83% |

| Lean Hogs | Lean hog futures | December 2024 | HE | CME | $73.225 | $84.075 | 14.82% |

| Copper | Copper futures | December 2024 | HG | COMEX | $3.9435 | $4.3715 | 10.85% |

| Palladium | Palladium futures | December 2024 | PA | NYMEX | $1,026.50 | $1,108.80 | 8.02% |

| Milk | Class III milk futures | December 2024 | DC | CME | $18.28 | $19.68 | 7.66% |

| Ethereum | Cryptocurrency | ETH | Aggregated | $2,360.78 | $2,513.84 | 6.48% | |

| Sugar No.11 | Raw sugar futures | March 2025 | CB | ICE | $20.75 | $22.07 | 6.36% |

| Aluminium | Aluminium high grade futures | December 2024 | AH | LME | $2,446.26 | $2,587.29 | 5.77% |

| Oats | Oats futures | December 2024 | ZO | CBOT | $3.90 | $3.99 | 2.31% |

| Live Cattle | Live cattle futures | December 2024 | LE | CME | 182.025 | 185.295 | 1.80% |

| Platinum | Platinum futures | January 2025 | PL | NYMEX | $985.50 | $999.30 | 1.40% |

| Crude Oil (WTI) | WTI light sweet crude oil futures | January 2025 | WTI, T | ICE | $69.15 | $69.08 | -0.10% |

| Sugar No.16 | U.S.-grown raw sugar futures | March 2025 | SF | ICE | $38.45 | $38.01 | -1.14% |

| Natural gas | UK NBP natural gas futures | January 2025 | NBP, M | ICE | $101.94 | $100.73 | -1.19% |

| Brent crude | Brent futures | January 2025 | B | ICE | $74.00 | $73.10 | -1.22% |

| Lumber | Lumber futures | January 2025 | LBR | CME | $608.00 | $587.00 | -3.45% |

| Rough Rice | Rough rice futures | November 2024 | ZR | CBOT | $15.585 | $14.825 | -4.88% |

| Nickel | Nickel futures | December 2024 | NI | LME | $17,334.00 | $15,818.24 | -8.74% |

| Feeder Cattle | Feeder cattle futures | January 2025 | GF | CME | 268.475 | 243.2 | -9.41% |

| Cotton | Cotton No. 2 futures | December 2024 | CT | ICE | $78.72 | $70.17 | -10.86% |

| UK Feed Wheat | UK feed wheat futures | January 2025 | T | ICE | £210.15 | £183.80 | -12.54% |

| Wheat | Chicago SRW wheat futures | December 2024 | ZW | CBOT | $6.51 | $5.68 | -12.75% |

| Corn | Corn futures, electronic | December 2024 | ZC | CBOT | $4.98 | $4.14 | -16.87% |

| Soybean | Soybean futures | January 2025 | ZS | CBOT | $12.30 | $9.93 | -19.27% |

| Soybean Meal | Soybean meal futures | January 2025 | ZM | CBOT | $3.72 | $2.97 | -20.22% |

Sources: CME, ICE, LBMA, EURONEXT, JPX, TradingView, CoinGecko

Methodology

To compare the performance of gold and other major commodities this year, the team at BestBrokers pulled market prices from January 2, 2024 and November 1, 2024. Prices of gold and silver futures, along with other commodities were sourced from the website of the Chicago Mercantile Exchange (CME), while those of Bitcoin and Ethereum from independent crypto data aggregator CoinGecko.

We also looked at the Intercontinental Exchange (ICE) website for data regarding several commodities, including coffee, cocoa, orange juice, and crude oil (WTI). Other sources used for prices of commodities include EURONEXT, the London Bullion Market Association (LBMA), and the website of the Japan Exchange Group (JPX) and its subsidiary the Osaka Securities Exchange (OSE), where rubber is traded.