Admirals Account Types in Brief

Admirals provides a choice from two trading accounts for short-term price speculation – Trade MT4/MT5 and Zero MT4/MT5. Invest MT5 accounts are also available but are intended for long-term investing in stocks and exchange-traded funds (ETFs). Onboarding customers opting for either trading account can take advantage of maximum leverage of 1:30 for major pairs and 1:20 for minor pairs and gold.

Both account types give you access to five-digit pricing and offer market order execution with little to no requotes. Orders should be at least 0.01 lots, while the maximum is set at 100 standard lots. Clients can have up to 500 pending or open orders at a time. Both accounts protect you against balance deficits with negative balance protection.

Trade MT4/MT5 accounts can accommodate swap-free traders. Hedging, one-click trading, and Expert Advisors are supported. Trade MT4/MT5 accounts are suitable for traders looking to avoid commissions, but minimum spreads are higher at 0.5 pips. Zero MT4/MT5 accounts offer narrower spreads from zero pips but incur commissions from $1.8 to $3 per lot for forex and metals, $1 per lot for energies, and up to $3 per lot for indices.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

Admirals Minimum Deposit Requirements

Clients with Trade and Zero MT4/MT5 accounts must transfer at least $100 to their balance to start trading. Invest MT5 accounts have a lower barrier to entry of $1 but account holders cannot leverage their stock and ETF positions. The two types of trading accounts can be denominated in one of 10 base currencies (EUR, USD, GBP, BGN, CHF, RON, PLN, HUF, HRK, CZK). Invest accounts offer only two currency options, USD and EUR. Customers of the CySEC entity can deposit at no extra cost with Visa, Mastercard, Klarna, Skrill, and Bank Transfers.

What Can You Trade at Admirals?

Trade and Zero MT4/MT5 accounts facilitate trading in 80 forex pairs, 28 cryptocurrencies, 11 commodity futures, 15 commodity CFDs, 19 indices, 300 ETFs, and over 3,300 stocks. Bonds are also tradable through CFDs. Account holders will benefit from level II pricing, an economic calendar, and market analysis provided by Dow Jones. Professional traders are eligible for forex leverage of up to 1:500.

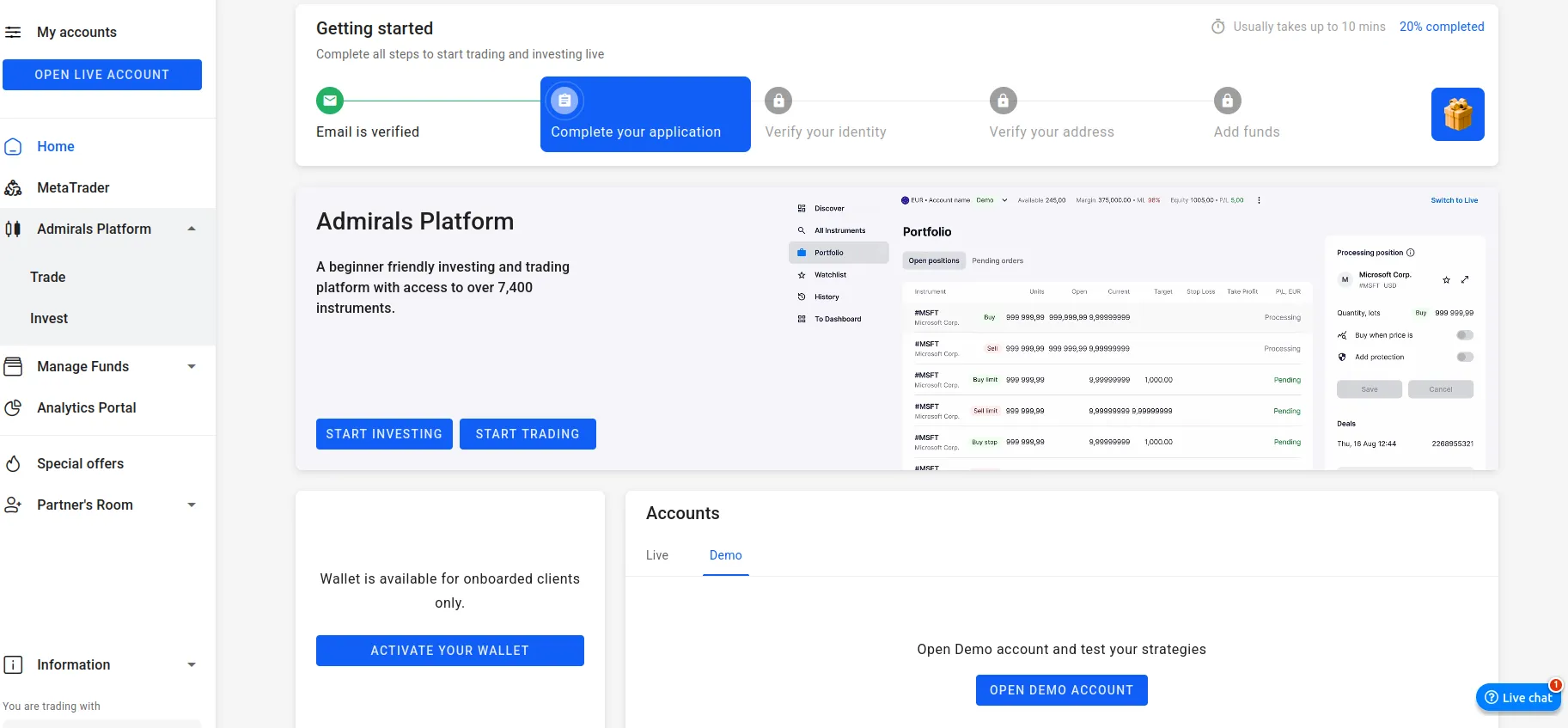

Step-by-Step Registration at Admirals (ASIC) – Approximately 20 to 25 Minutes in Total (including verification and fitness test)

-

Open the broker’s website (www.admiralmarkets.com) in your web browser and click the blue Register button in the upper right corner of the screen to initialize the registration process.

-

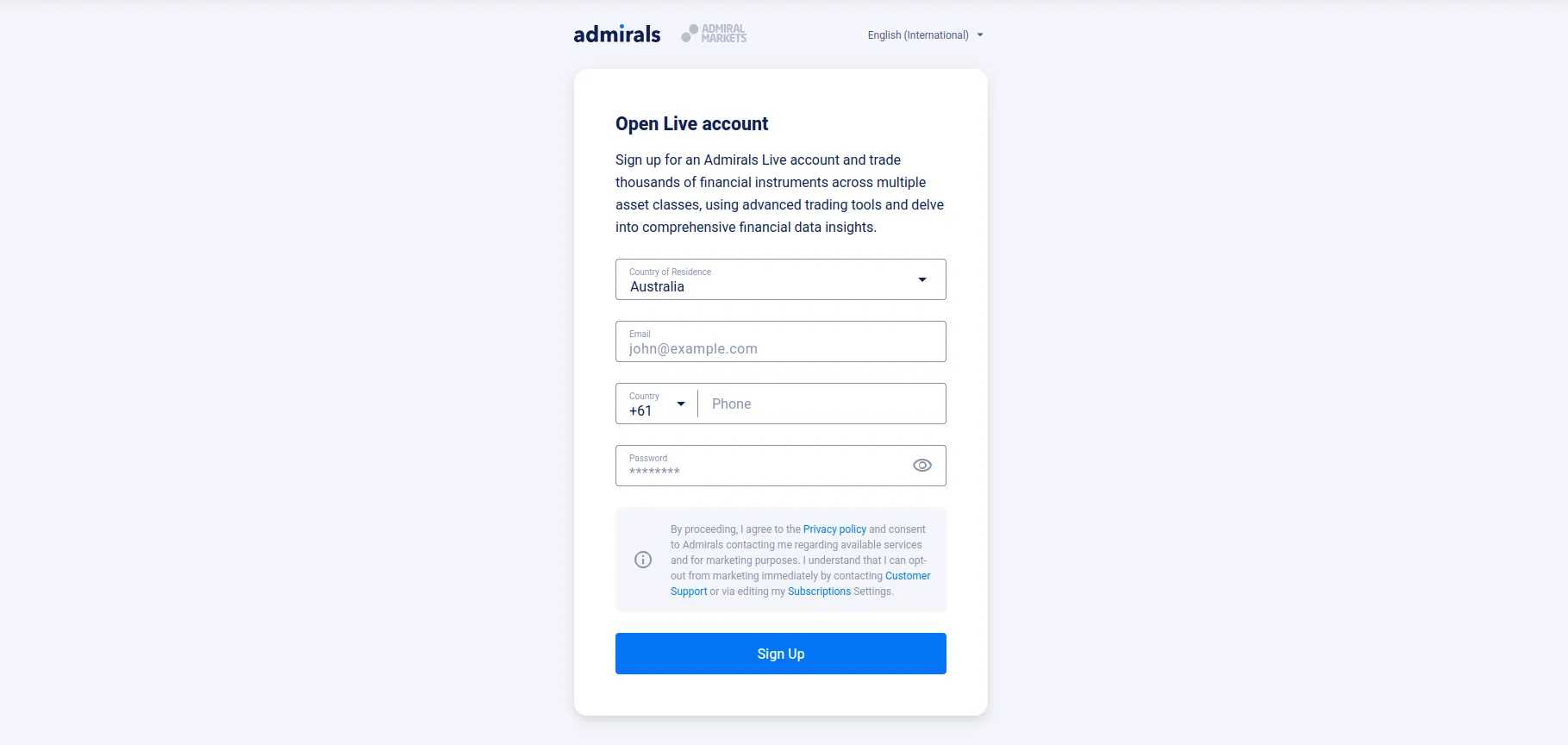

Select your country and enter your phone number, email address, and preferred password. They will email you a confirmation link so you can proceed to the next stage of the registration process.

-

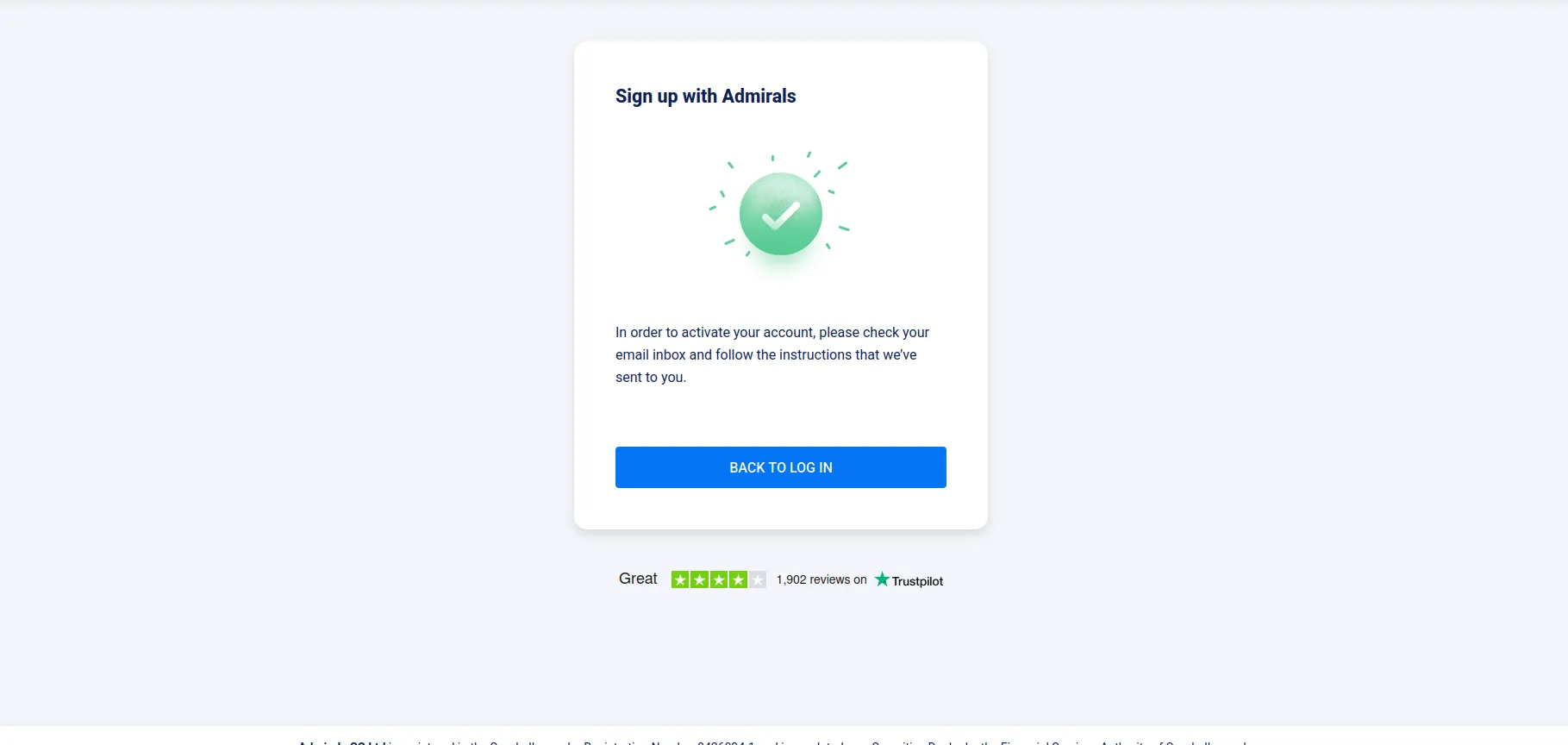

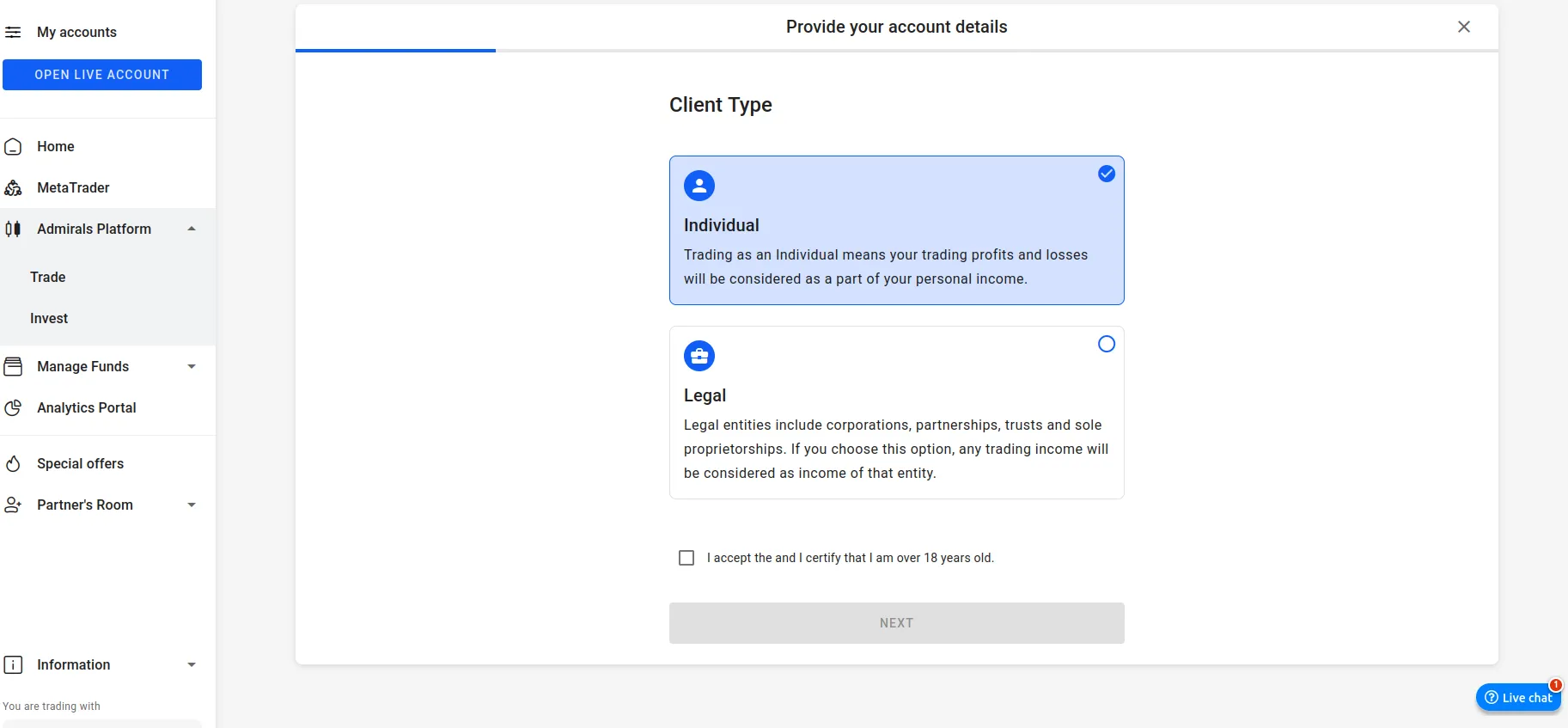

Once you verify your email, you must select the option of registering a live account and specify whether you wish to open an individual or corporate account.

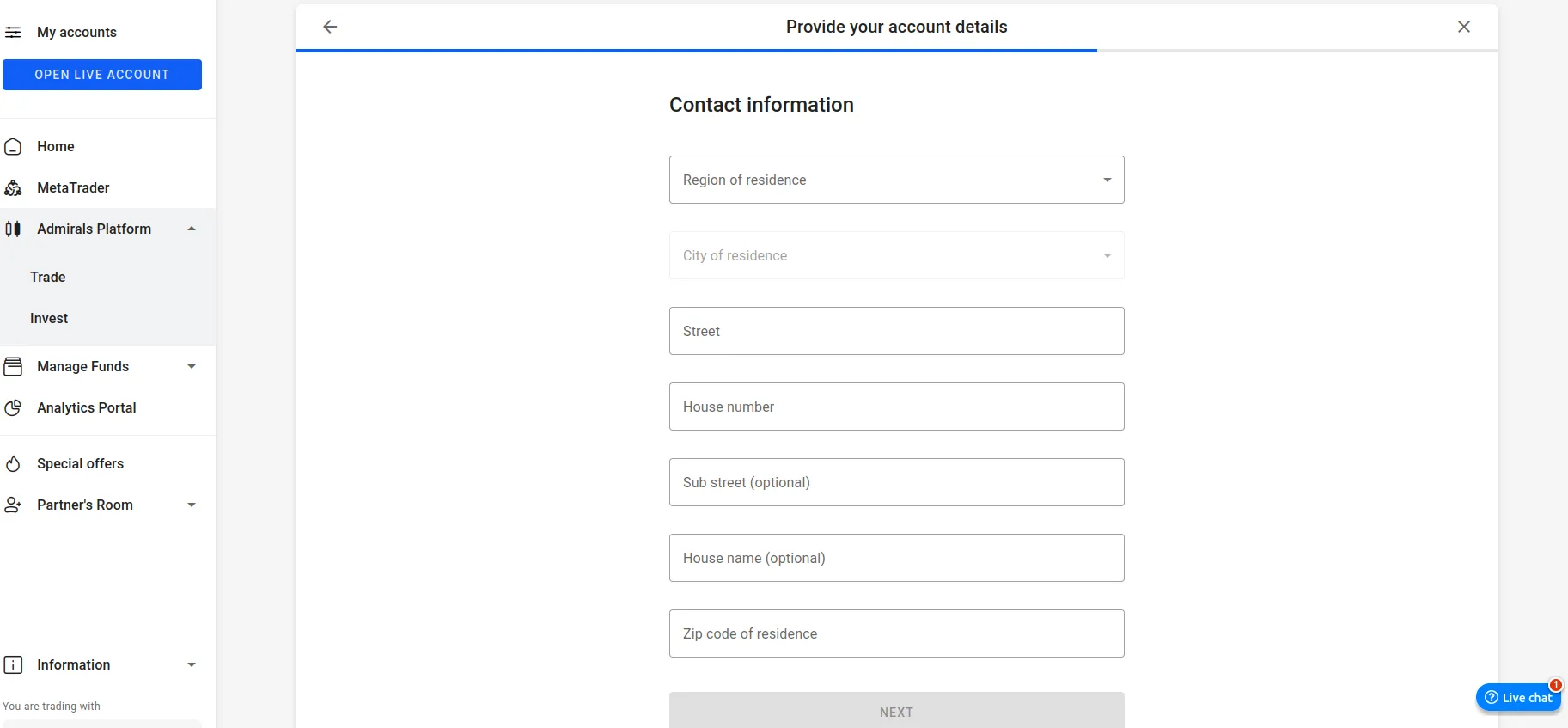

Fill in your personal information, including your state/province, city of residence, and current residential address.

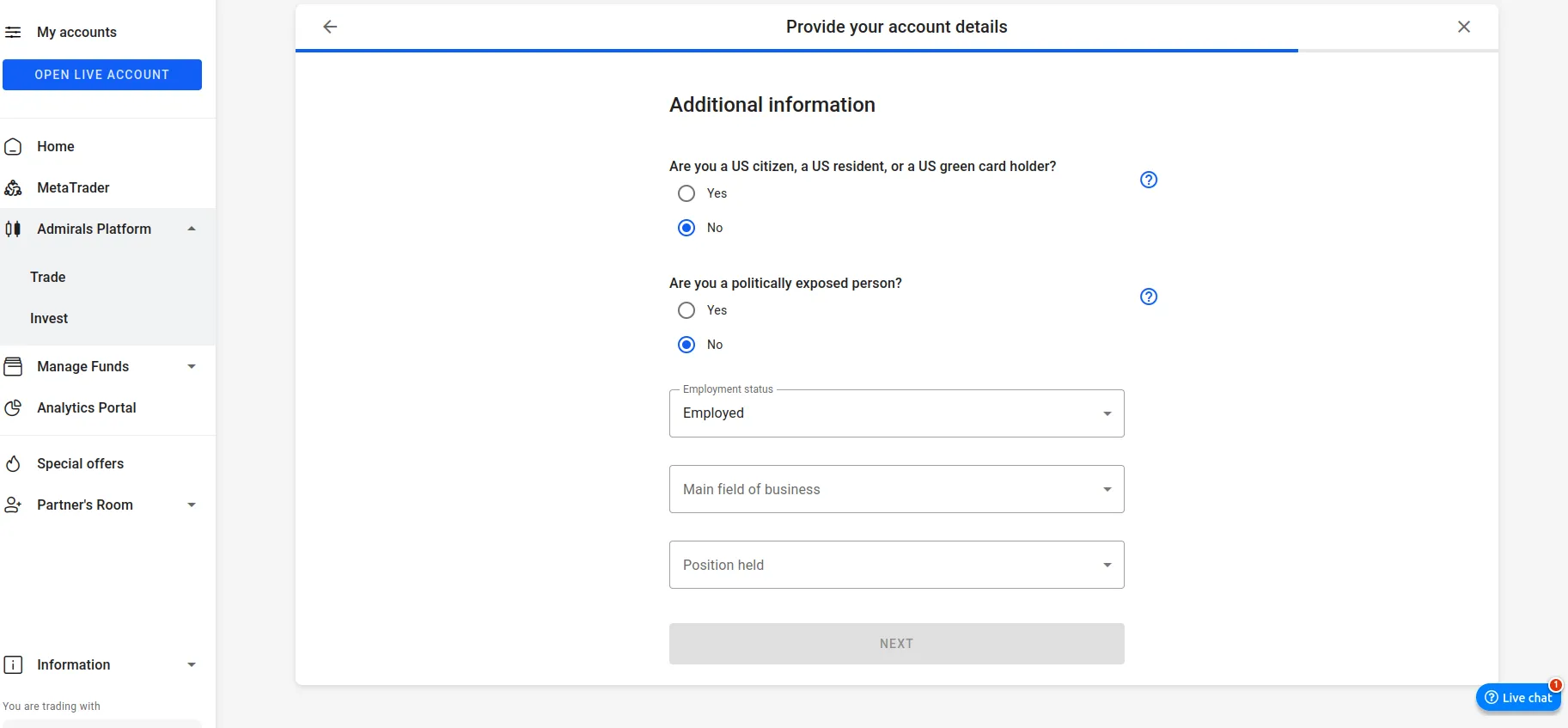

Provide additional information on your citizenship and employment status, including your business field and the position you currently hold. Accept the terms and conditions to advance to the identity verification stage.

-

KYC Verification and Fitness Test – Takes Approximately 10 Minutes

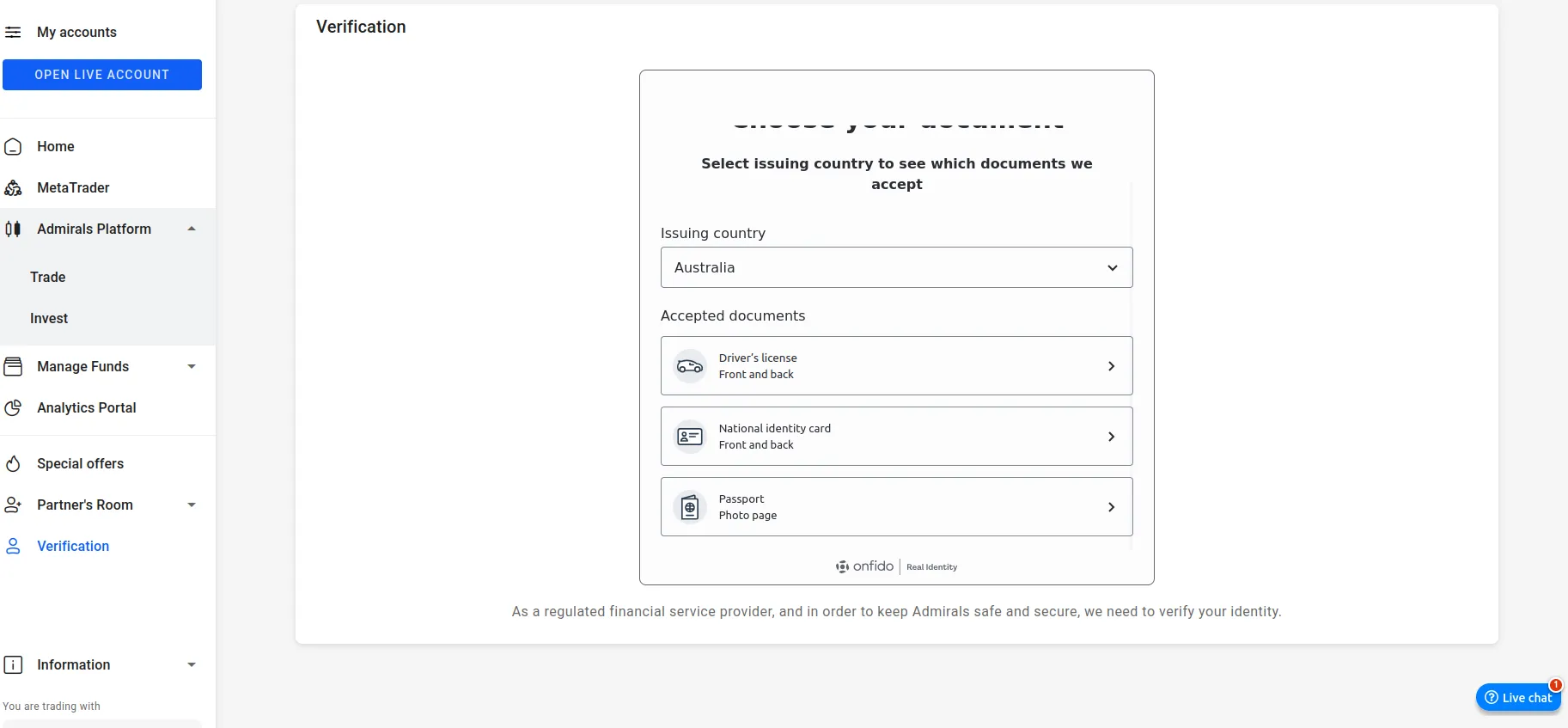

Onboarding customers from Australia can verify their identities by uploading colored photos of their driving licenses, government-issued ID cards, or passports.

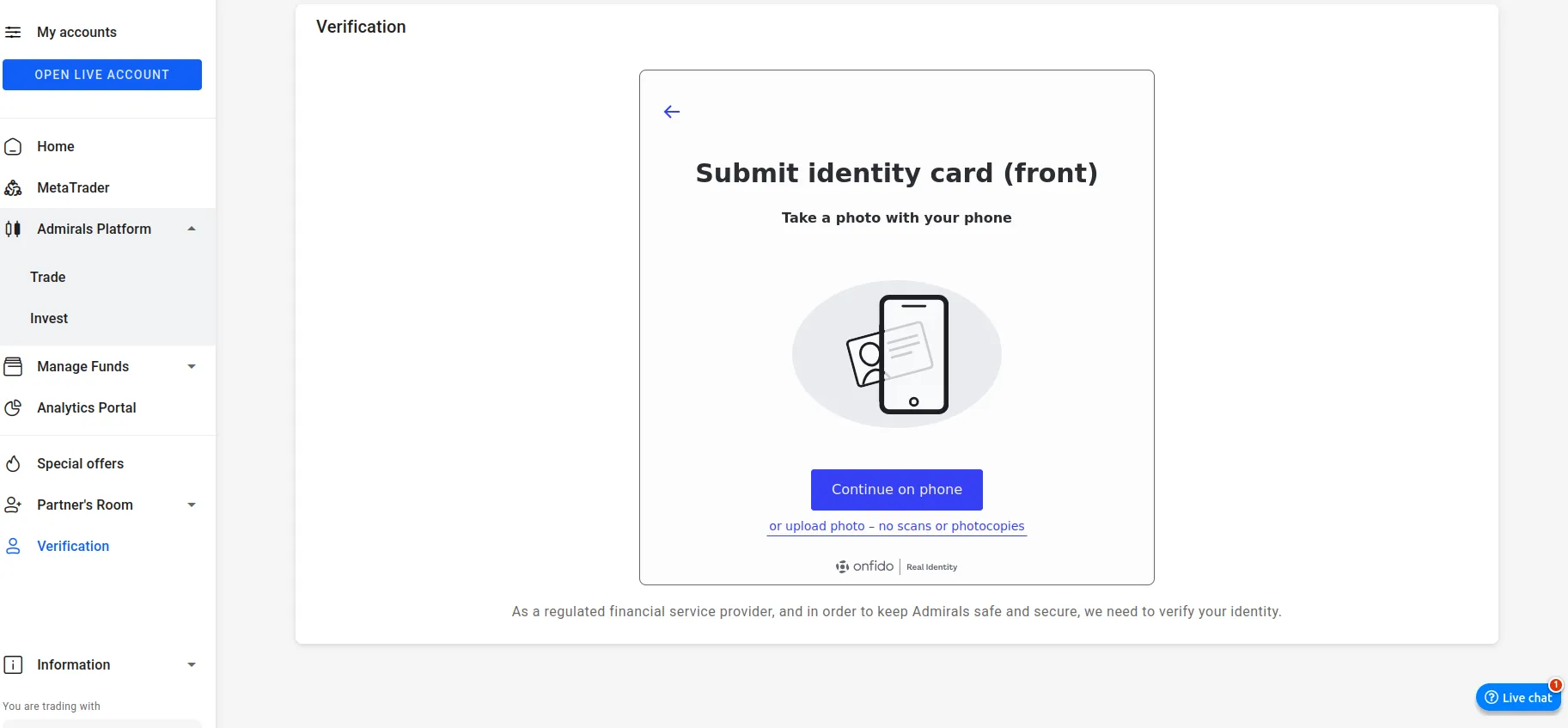

Select your preferred document and upload copies of the front and rear sides. Alternatively, you can take a photo on the spot using your smartphone camera.

-

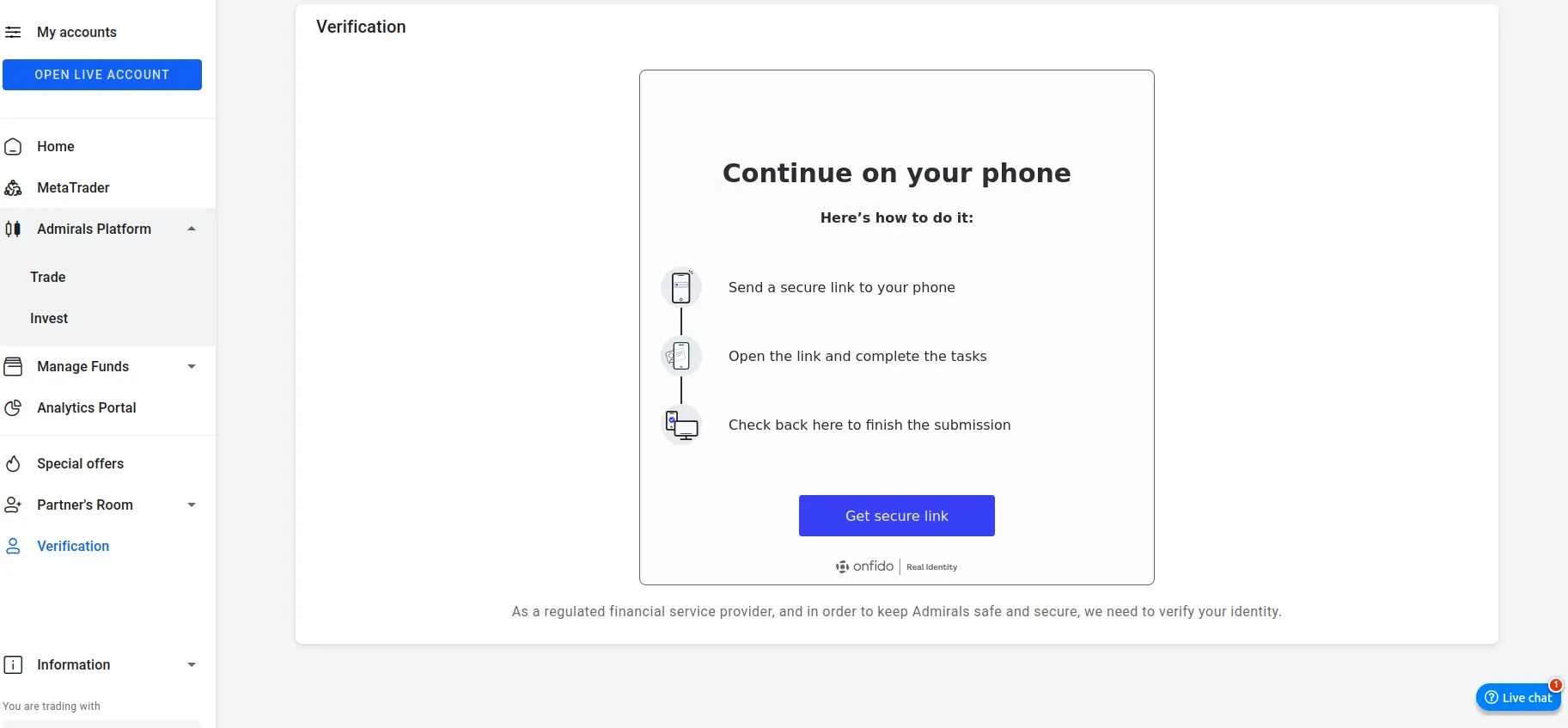

You must continue the identity verification on your smartphone by scanning a QR code or copying a unique link. Another option is requesting to receive the link as a text message. Do not close the desktop window you used to initiate the registration.

-

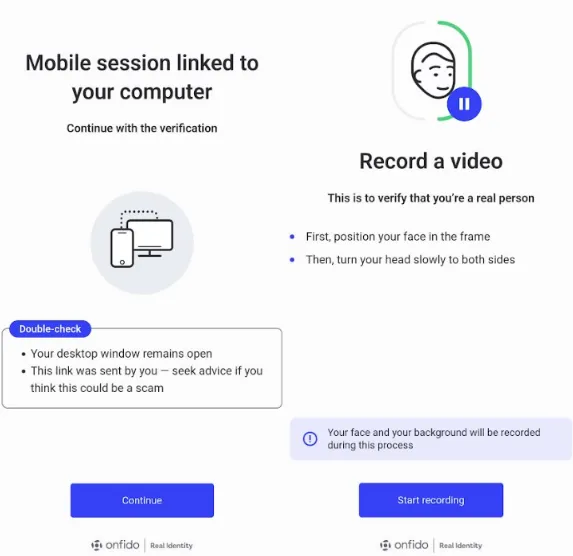

Next, you must complete several tasks, including recording a video of your face with your smartphone camera. It is a standard procedure at most ASIC brokers aiming to ensure onboarding customers are real persons. Slowly turn your face side to side so that both sides are visible.

- Once you upload the video and complete all tasks, you can return to your desktop and upload a proof of address, such as a recent utility bill or bank statement, to finalize your verification.

-

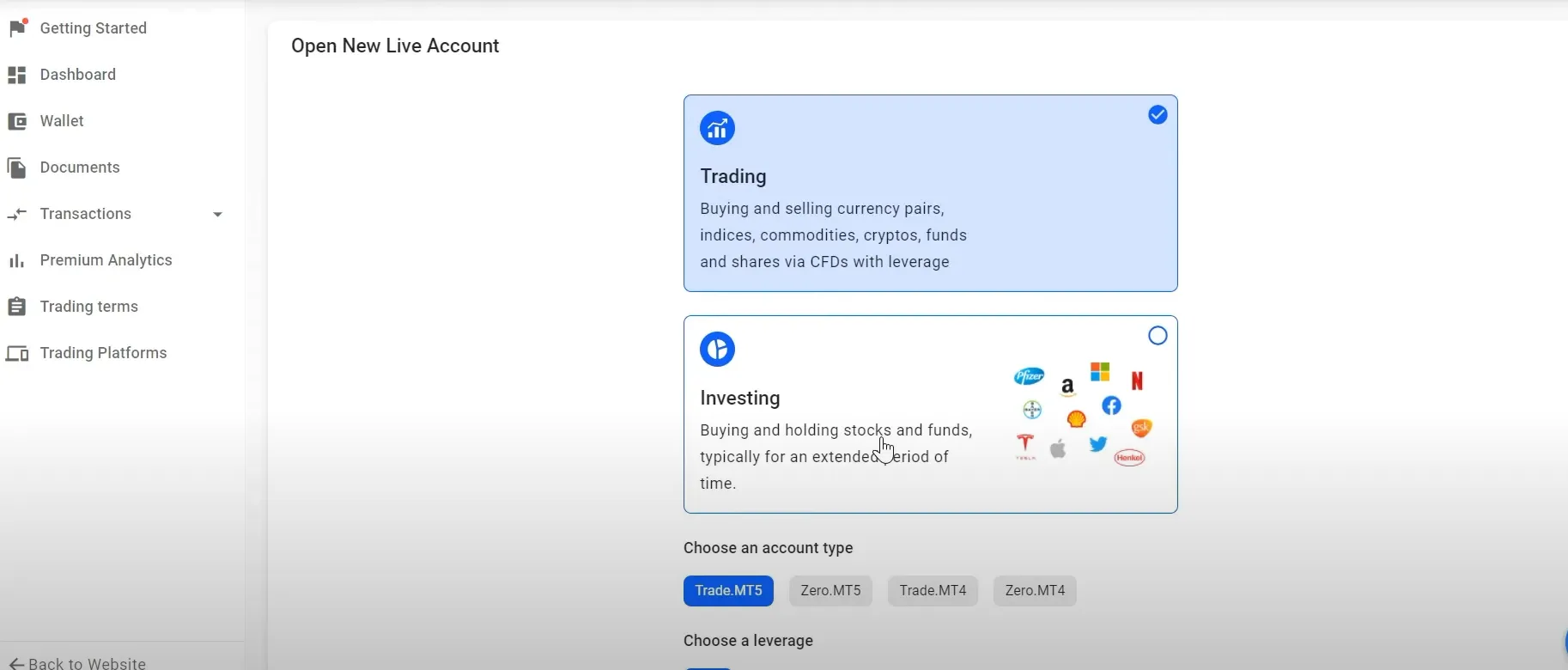

After verifying your identity and address, you will be able to configure your account. Select a Trading or Investing account, depending on your preferences and personal investment goals. You must also choose your account type (Trade MT4, Trade MT5, Zero MT4, Zero MT5, or Invest MT5) and select a base currency.

-

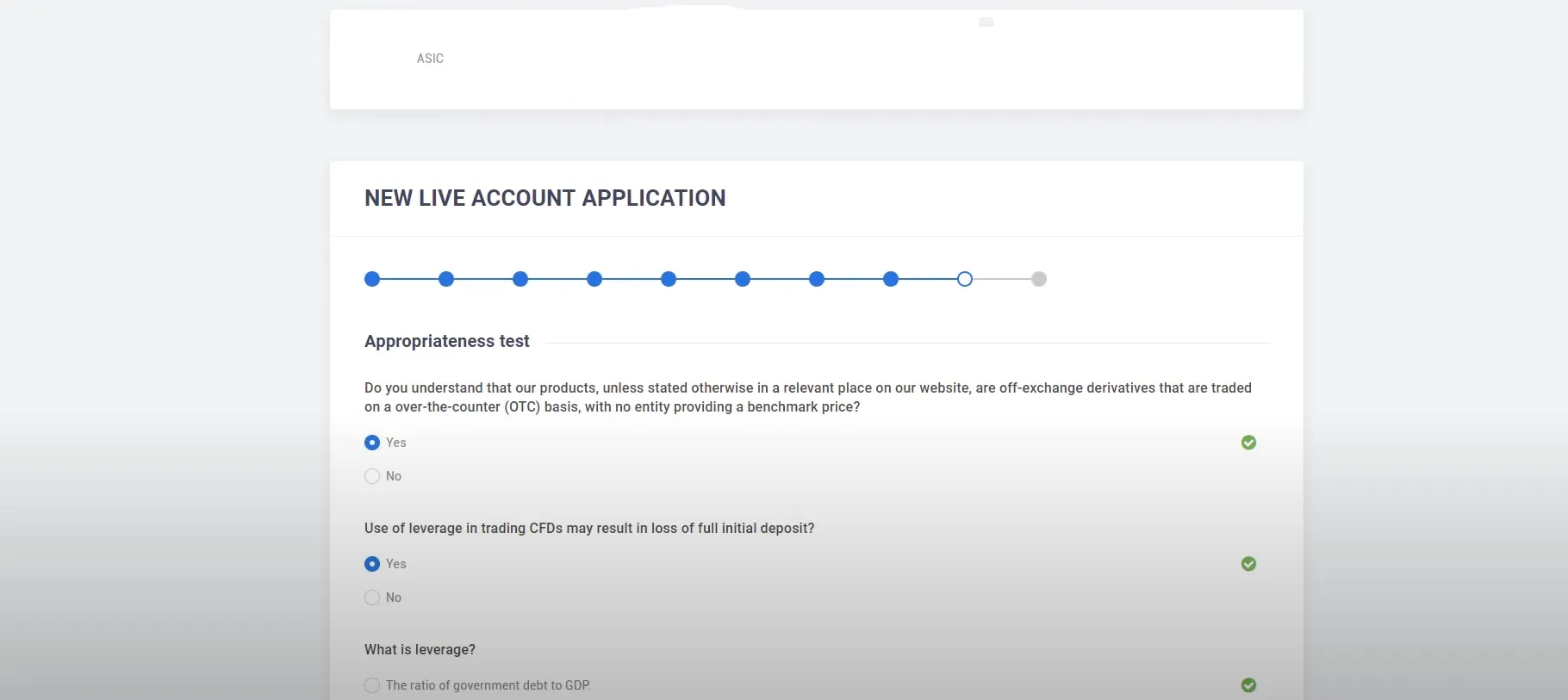

Since trading derivatives with leverage is a high-risk venture, Admirals will also prompt you to complete a brief suitability test to assess your fitness for CFD trading. Answering these questions should not take more than a couple of minutes if you are familiar with CFDs. Once you pass the quiz, you must simply wait for Admirals to confirm your account has been successfully verified before you can start trading.

Final Impressions

A Best Brokers reviewer took approximately 20 minutes to complete the account registration at Admirals. We prepared all documents required for verification in advance. If you don’t have your documents handy, this timeframe may extend to 30 or 40 minutes. Completing the fitness test also takes some time, especially if you have a limited knowledge of CFD trading. All steps in the process were clearly outlined and easy to follow, ensuring a relatively fuss-free registration for onboarding customers under the ASIC entity.