Vantage Account Types in Brief

Customers of the offshore entity can pick from four main account types. Standard STP accounts cater to novices seeking commission-free trading and direct market access. Spreads for this account type start from 1.1 pips. Onboarding clients insisting on raw pricing can open Raw ECN accounts with lower minimum spreads from 0.0 pips and fixed round-turn commissions of $6 per standard lot.

Pro ECN accounts are a viable option for experienced customers trading in professional capacity. This type of account also has spreads from 0.0 pips but round-turn commissions per standard lot are lower at $3. Vantage additionally accommodates Islamic customers with swap-free accounts. All available account types require minimum positions of 0.01 lots and support 10 fiat base currencies, including EUR, GBP, USD, AUD, JPY, CAD, and PLN.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

Vantage Minimum Deposit Requirements

The minimum investment entry for Standard STP, Raw ECN, and swap-free accounts is $50, which aligns with the industry average. High-volume traders using Pro ECN accounts must transfer at least $10,000 to their live balance. Vantage accepts an array of funding options, including bank transfers, cards, cryptocurrencies, and digital wallets like PayPal, Skrill, Neteller, and AstroPay.

There are no additional fees on deposits and withdrawals. Deposits are instant with most accepted methods except for bank and broker-to-broker transfers, which take up to 24 hours and 3 to 5 business days, respectively. Withdrawals require 1 to 5 business days, depending on the payment solution.

What Can You Trade with Vantage Live Accounts

Live account holders gain access to over 1,000 financial markets, including 40+ currency pairs, indices, commodities, and shares. Customers can connect their accounts to MT4 or MT5. TradingView and ProTrader are supported as well. Maximum leverage is capped at 1:30 for UK and Aussie customers. Clients registered through the offshore-licensed entity can access leverage of up to 1:500. Trade size ranges from 0.01 to 100 lots. Copy trading is available via the Vantage app.

Step-by-Step Registration at Vantage – Takes 15 to 20 Minutes in Total

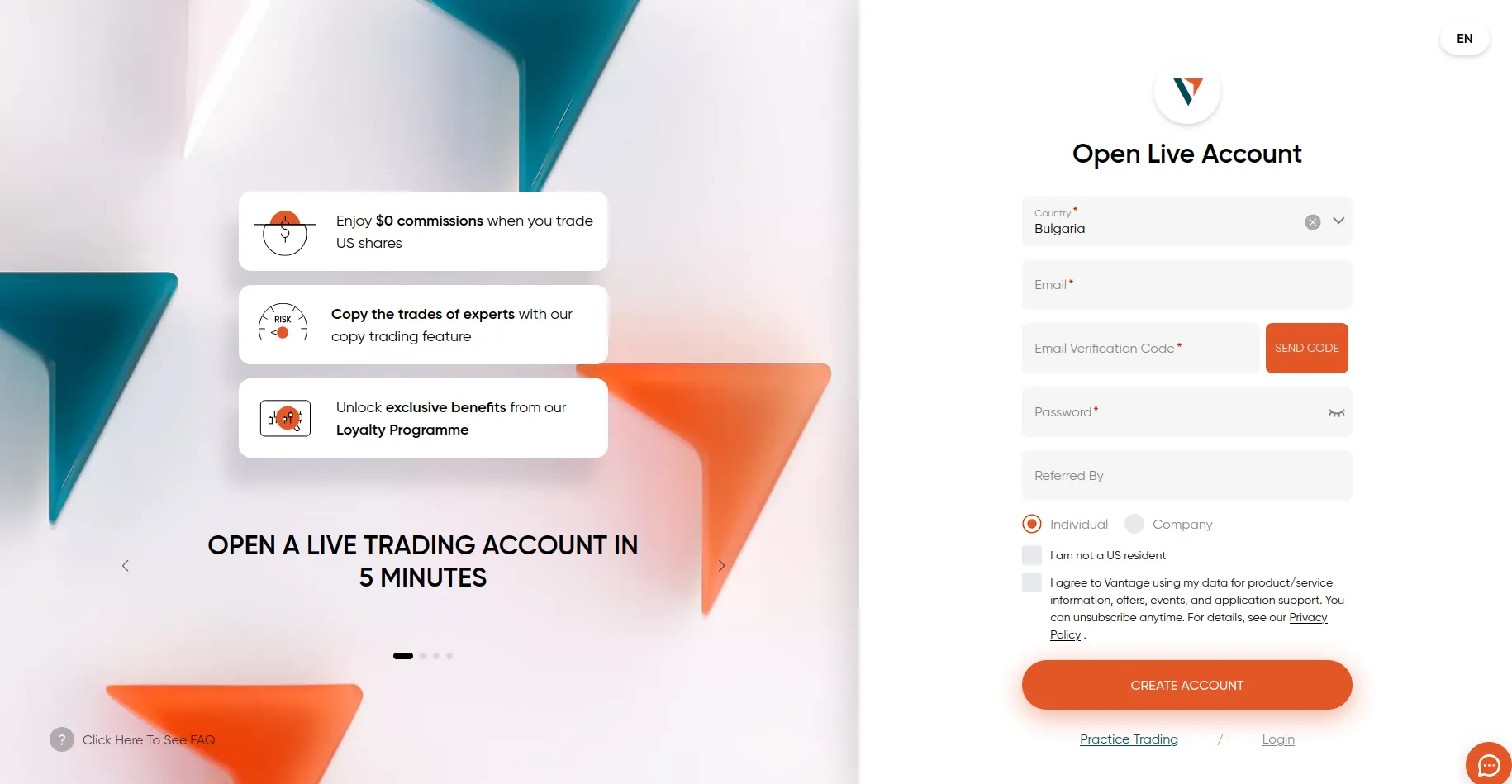

Go to the official Vantage website and click or tap the orange “Register” button in the top right corner of your desktop or mobile screen.

Initiate the registration process by entering your country, email, and password. Select whether you are opening a personal or corporate account. Vantage will send you a unique six-digit verification code to confirm your email address. Accept the terms of the privacy policy to proceed to the next step.

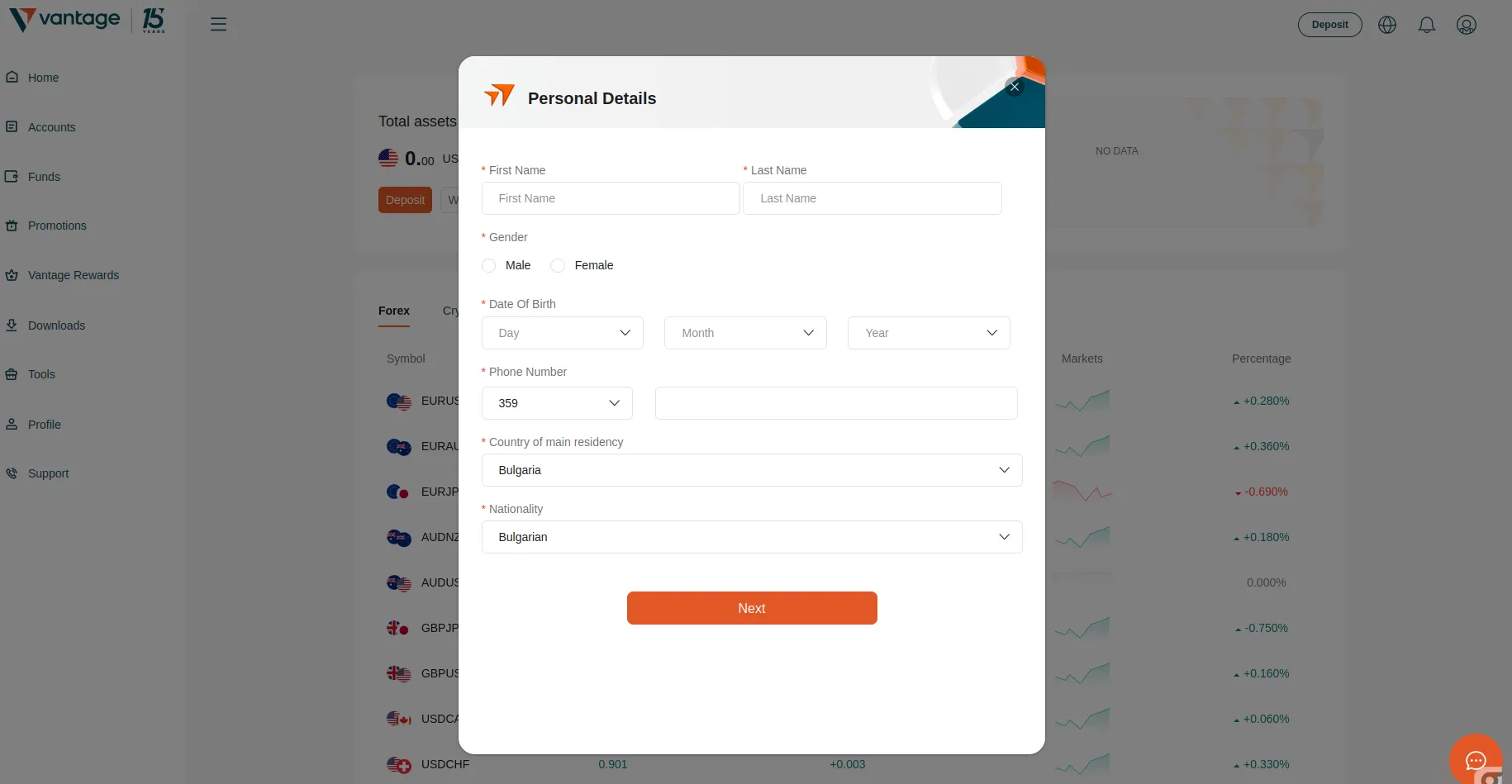

Fill in your personal details in the registration form, including your first and last name, gender, birth date, phone number, country, and nationality.

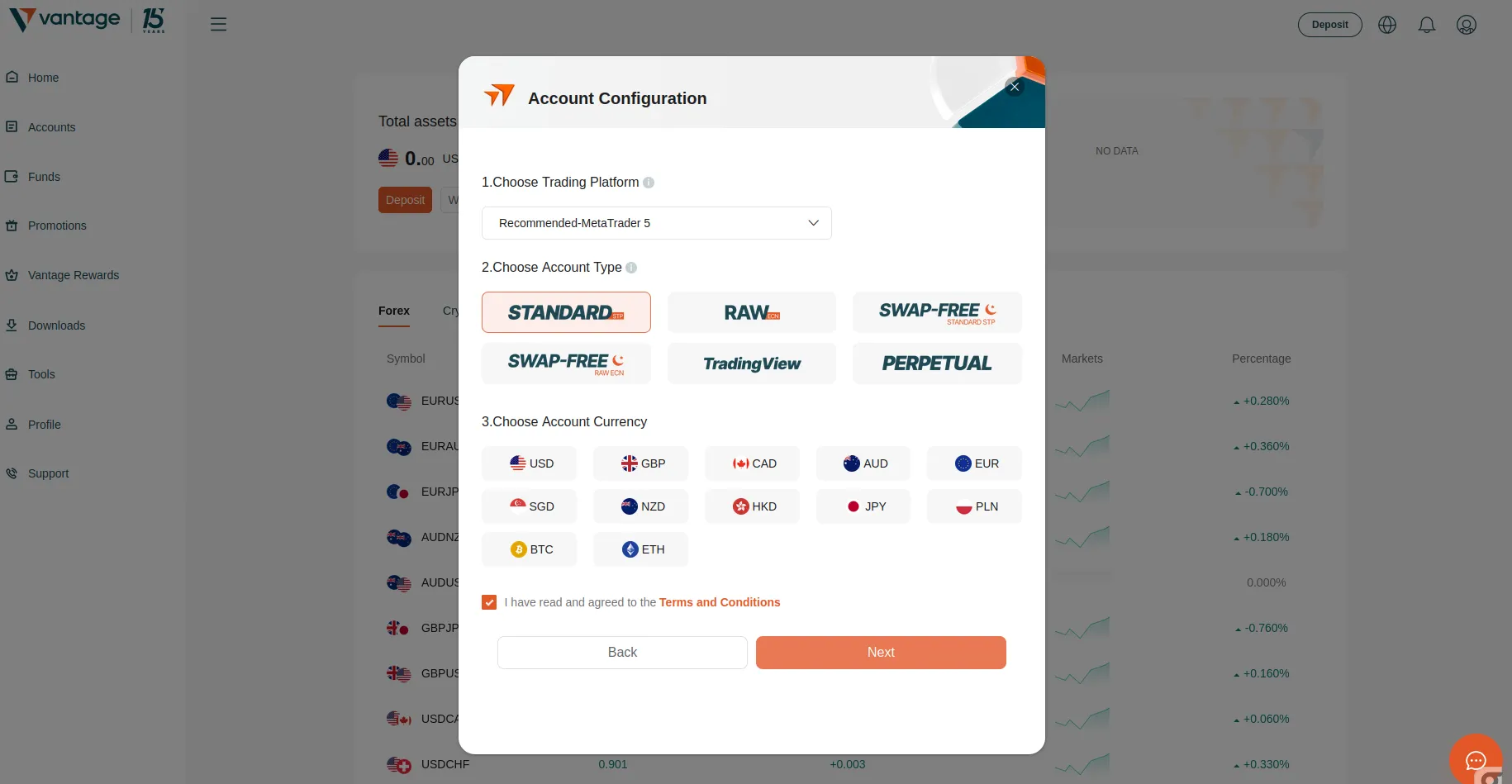

Continue with account configuration by selecting your preferred trading platform, account type, and base currency. Transacting in Bitcoin and Ethereum is an option. Tick off the box below to indicate you agree with the terms and conditions.

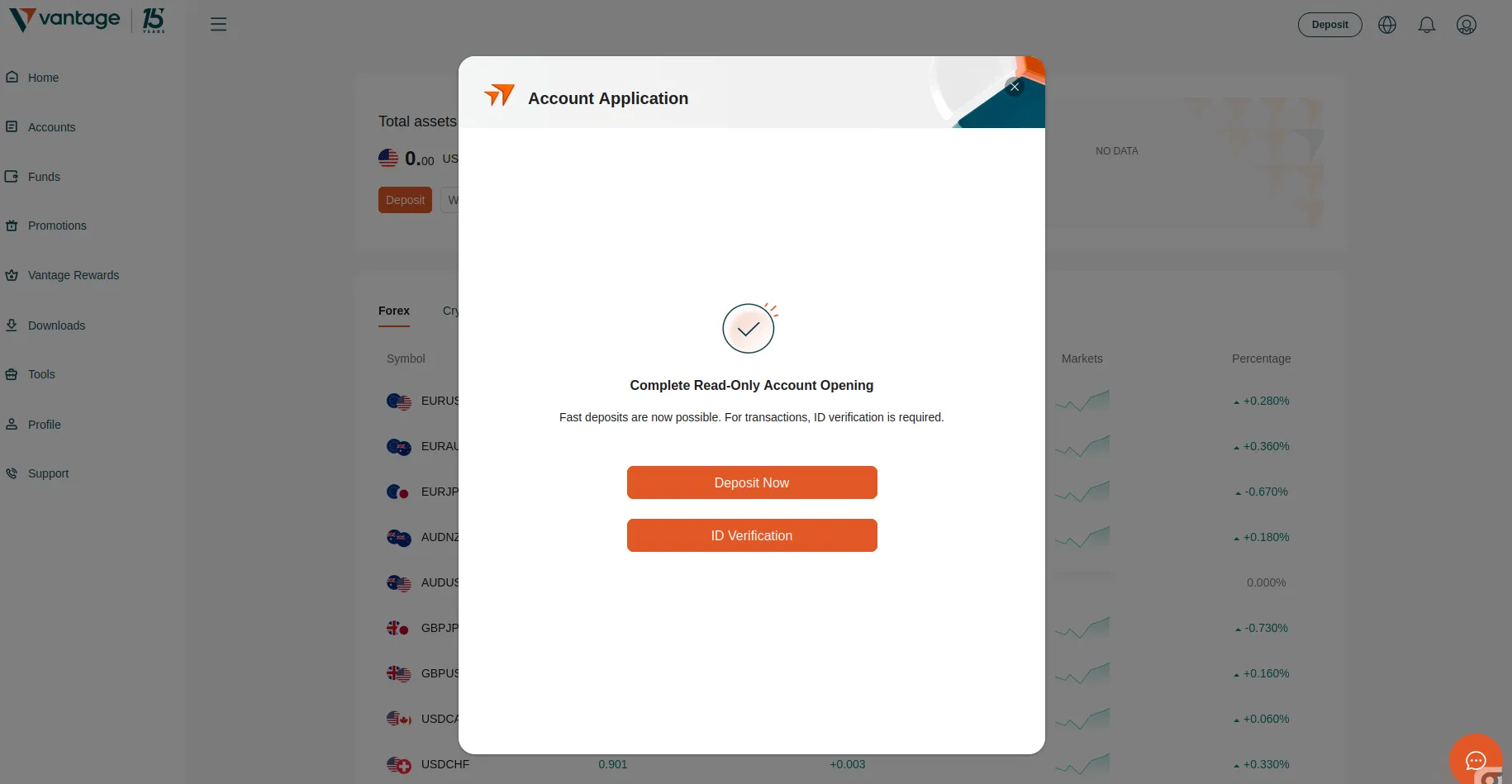

You have successfully completed your account application at this point and can now deposit funds to your live balance. We should highlight that onboarding customers must verify their identities before Vantage allows them to place real-money orders.

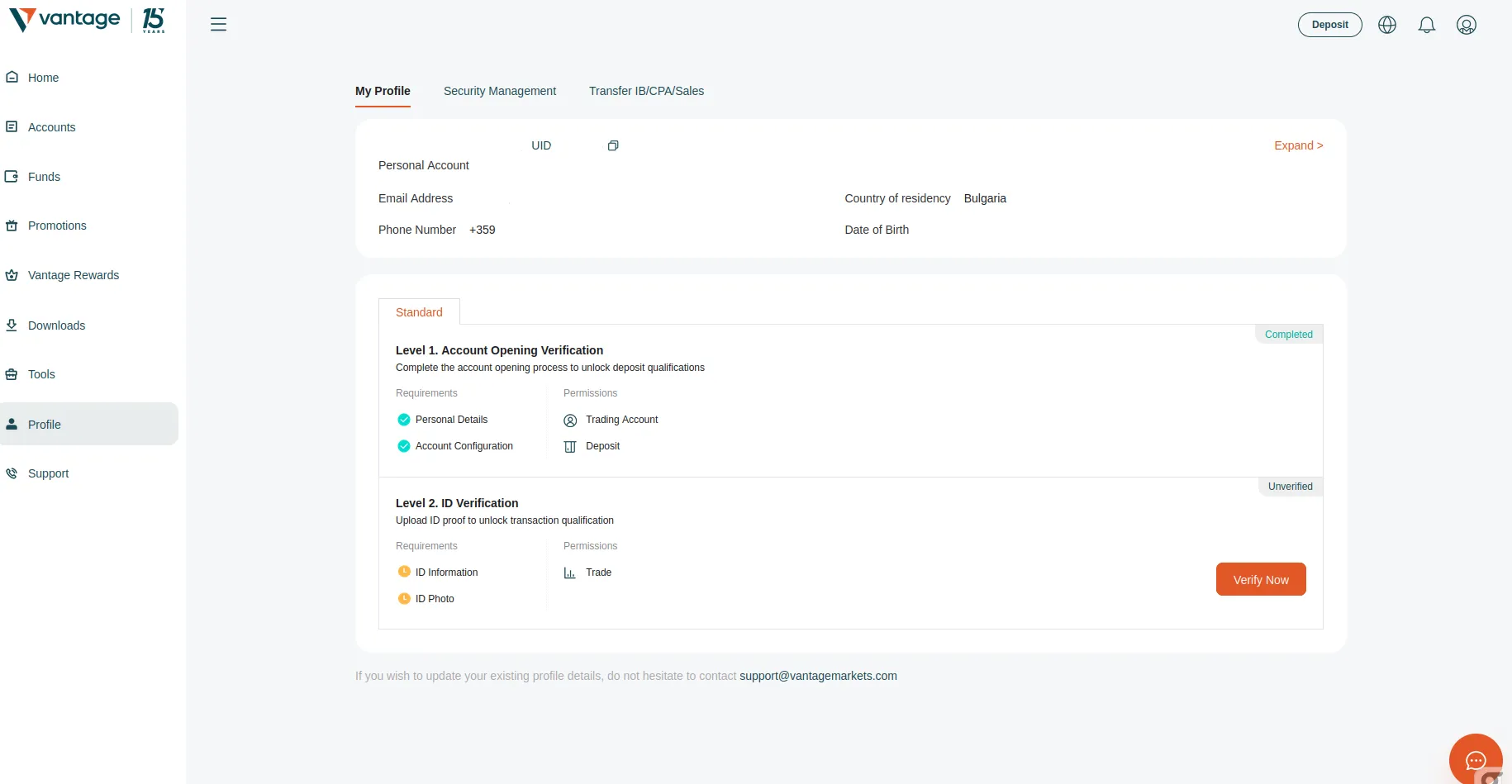

KYC Verification of Vantage Account – Takes 5 to 10 minutes

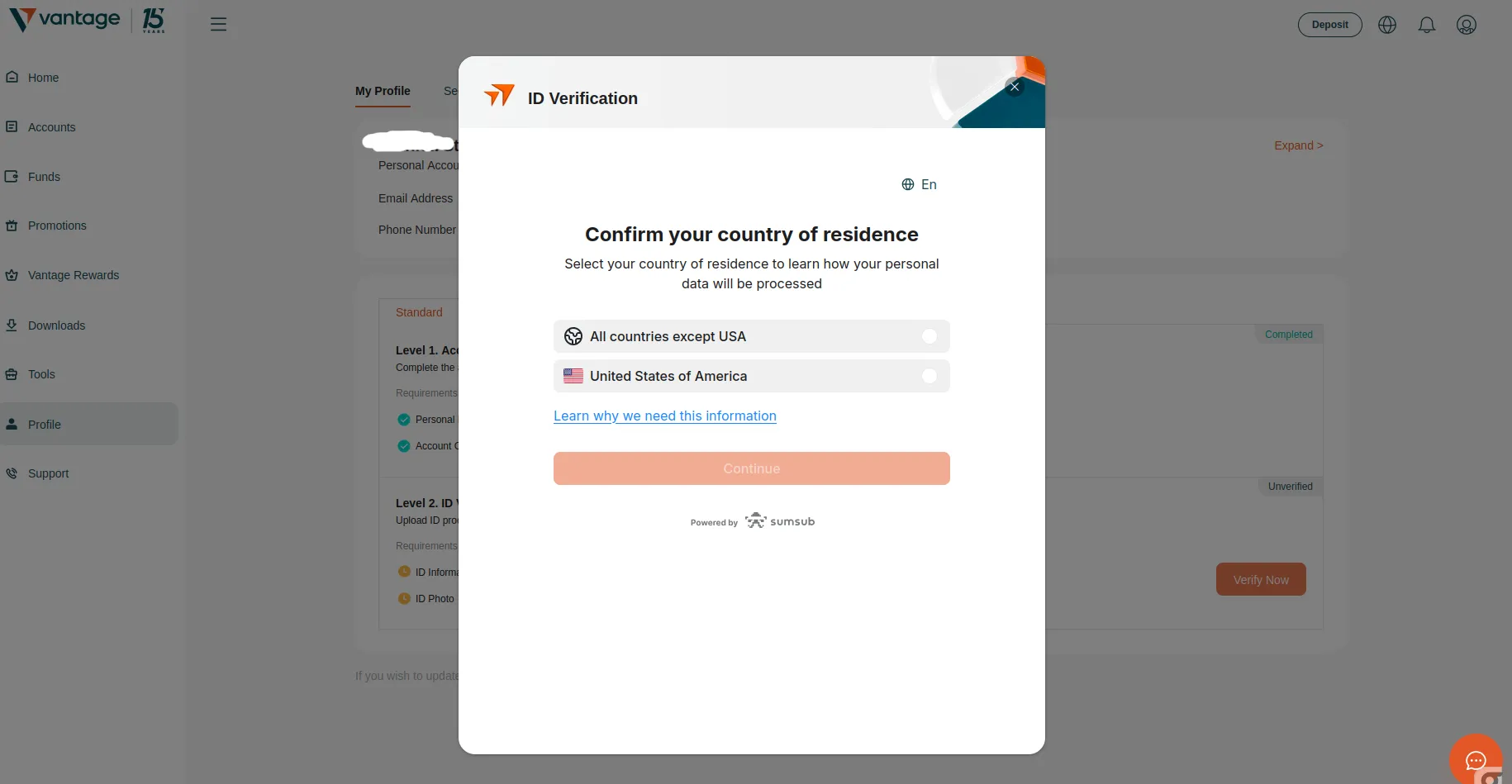

After you select ID verification, the broker will prompt you to upload photos of your identity documents to prove you are indeed the rightful owner of the account. Start by confirming your country of residence.

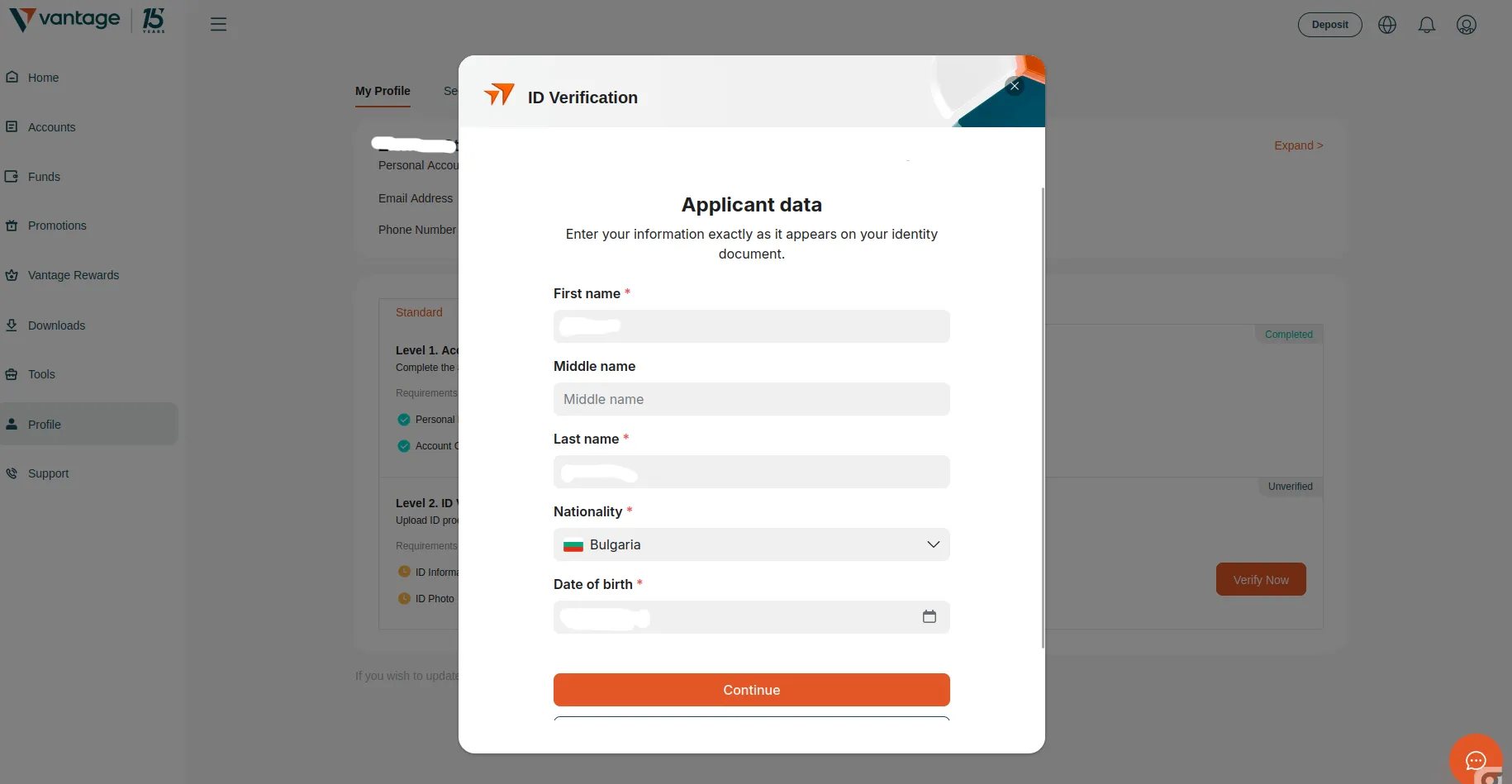

Fill in your personal information as it appears on your documents and click “Continue.”

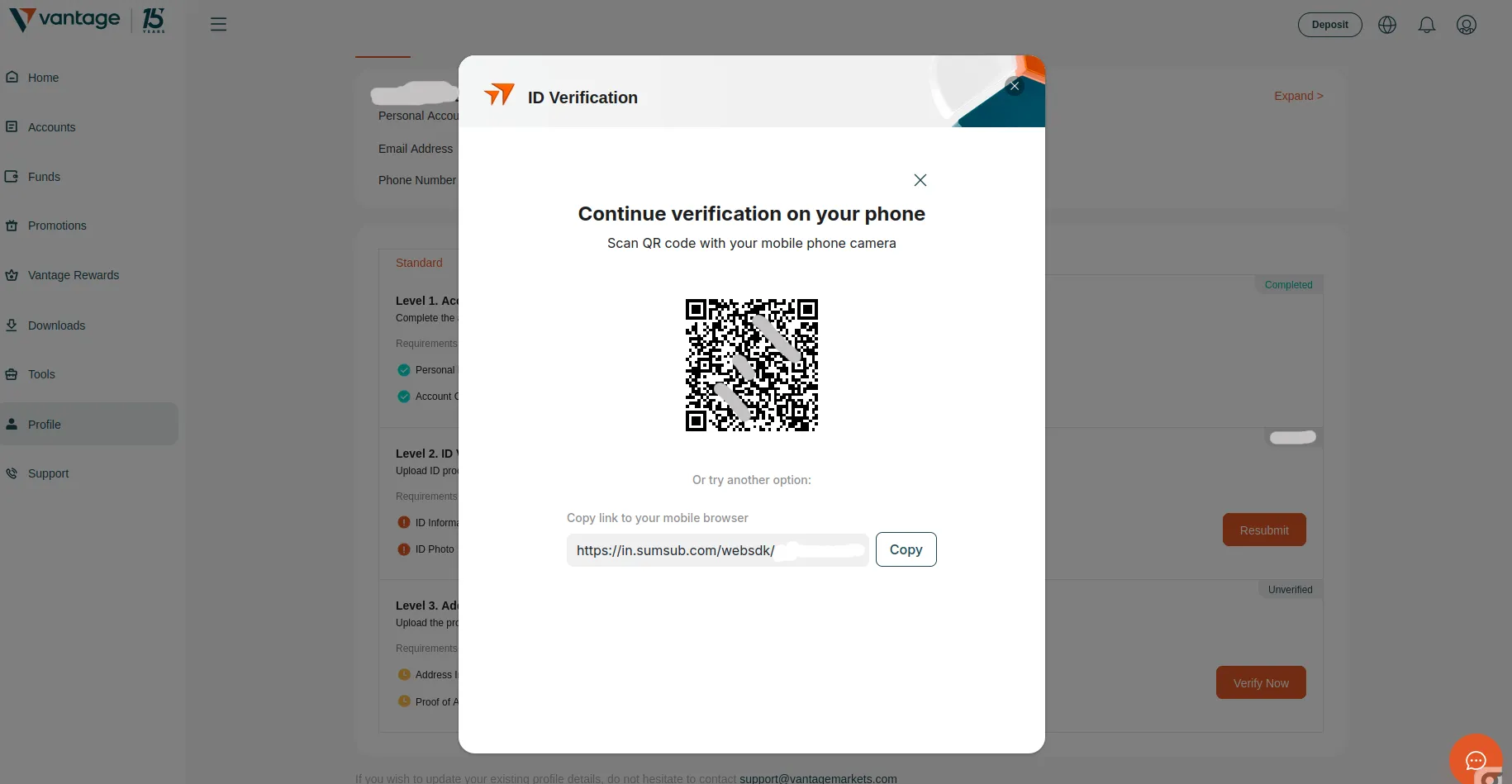

Side Note: You can continue your identity verification on your smartphone if you wish. Vantage will generate a unique QR code to scan with your phone camera, along with a verification link you can copy into your mobile browser.

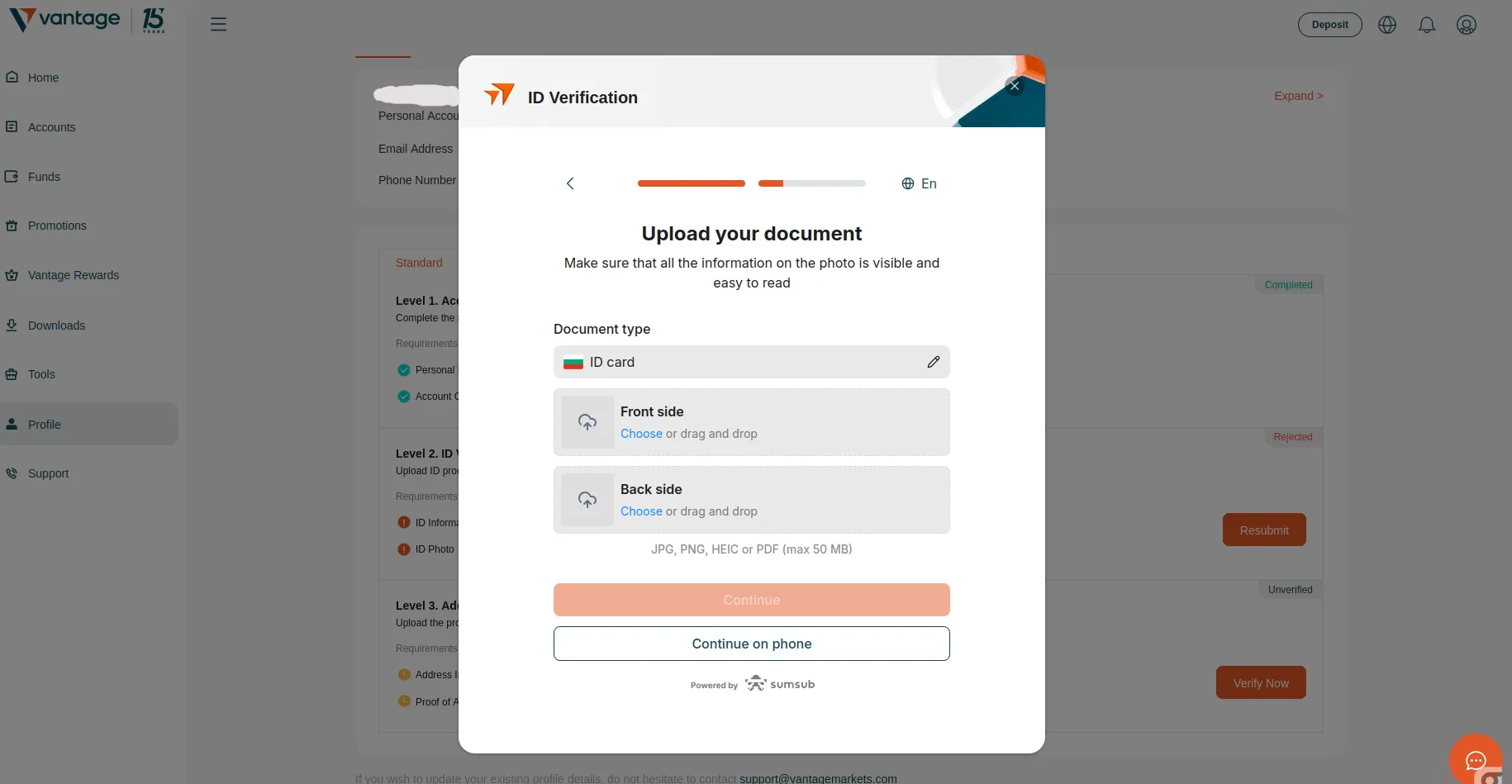

Click “Verify Now” to upload your identity documents. Feel free to use a government-issued ID card, passport, driving license, or residence permit.

Upload the front and back sides of your preferred identity document. Keep in mind the broker does not accept screenshots, blurry photos, or expired documents. Make sure your files are in a supported format (jpg, pdf, png, or heic). Their size should not exceed 50 MB.

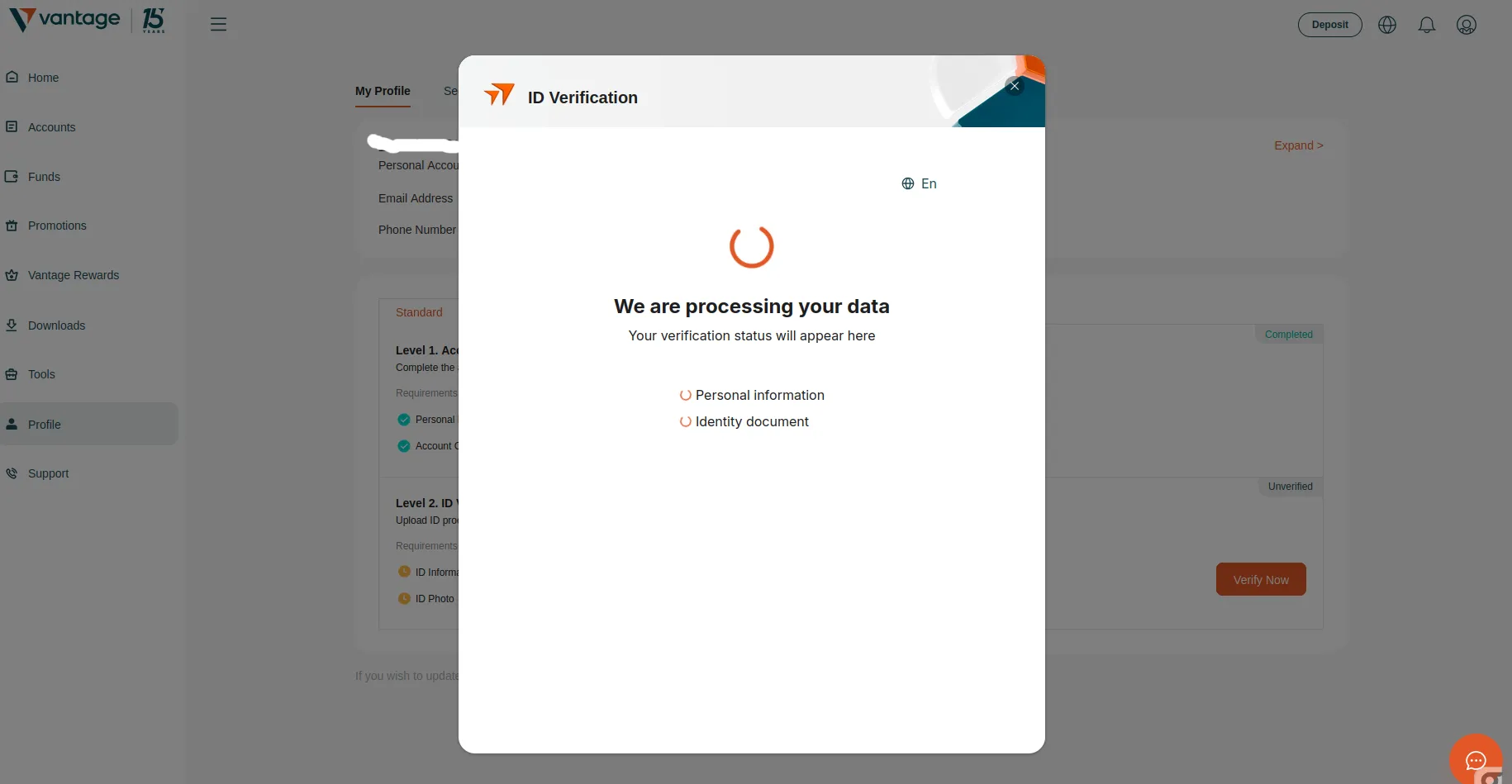

Wait for Vantage to process and accept your documents before you proceed to the next step.

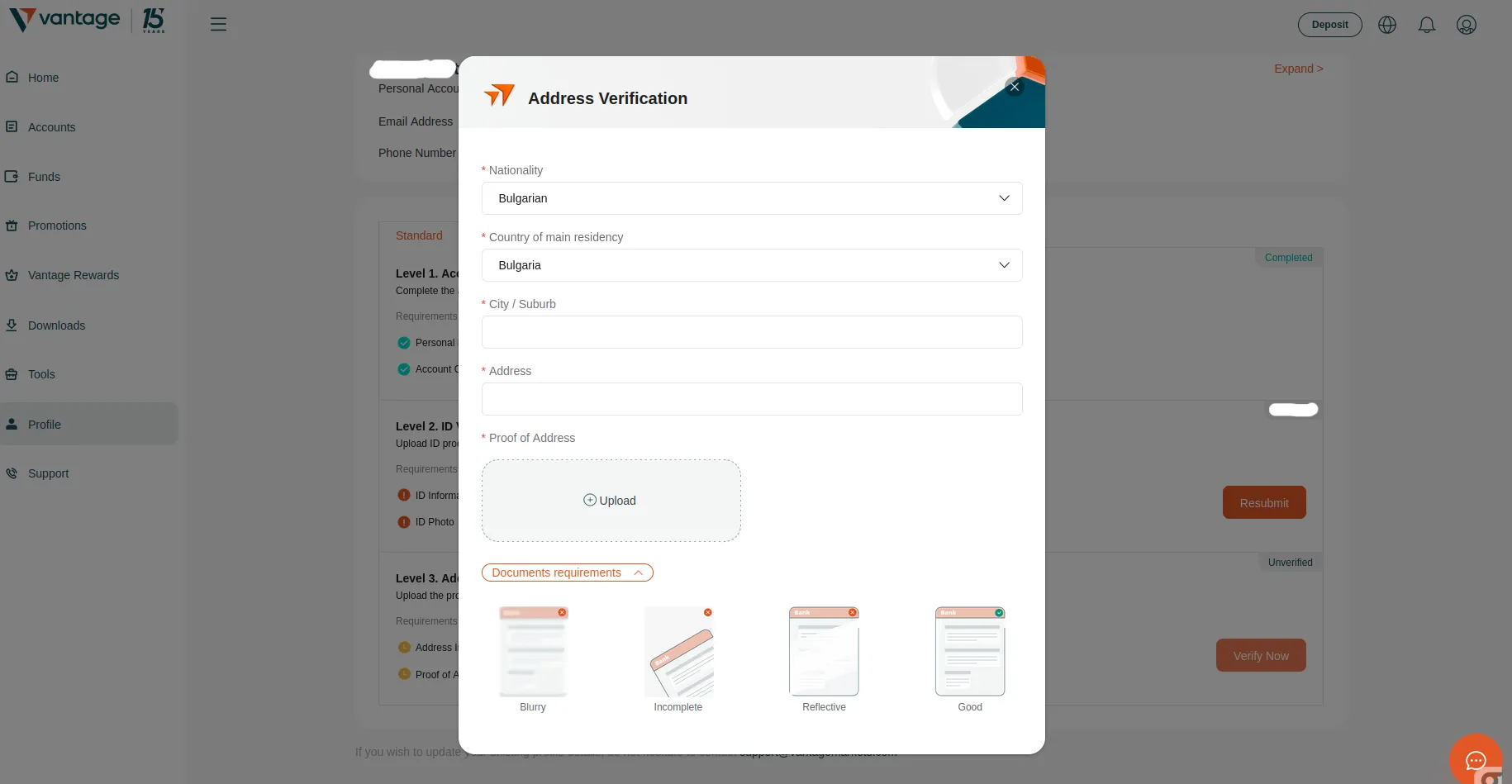

Complete your verification by uploading proof of address to confirm your current residential address. Vantage accepts several types of documents for this purpose, including utility bills for gas, water, or electricity, credit card statements, and bank statements.

File size must not exceed 5 MB in this case. The supported file types include jpg, jpeg, docx, doc, bmp, pdf, and png. It is worth highlighting that address verification will fail if your documents are older than 6 months.

Final Impressions

Completing all steps in the registration and verification process gives you absolute control over your account, allowing you to deposit, trade, and request withdrawals. In our experience, the process requires approximately 15 to 20 minutes if you upload legible files during verification. Customers registering through the offshore entity are not required to pass experience and knowledge tests during the registration process.

Verification is very intuitive and easy to complete, especially if your documents are in order and you have them within reach. Just make sure your country is not on the restricted jurisdictions list as Vantage does not accept customers from Canada, Singapore, Romania, China, and the US.