Account Types at BlackBull Markets

Depending on your experience, risk-level tolerance, and overall trading goals, you may create different accounts with BlackBull Markets. As soon as you open the registration form, you have the chance to create a Demo account, which will help you practice trading with virtual funds, eliminating the risk of losing real money while still learning how to trade.

Of course, live trading is the main focus here, which is why the broker is offering several account options to fit the trading styles of various traders. There are three types of live accounts one can open with BlackBull, with all of them offering ECN order executions. All three account variations support micro lots and offer the same maximum leverage. What is more, the ECN Standard and ECN Prime accounts support swap-free trading by Muslim traders. If you are wondering which account type is suitable for you, BlackBull Markets offers a simple and short quiz to help you make a decision.

The first account option is ECN Standard, which is extremely suitable for beginners as it has no minimum deposit requirement. That means traders can deposit as little as they feel comfortable with. Micro-lot trading is enabled with a minimum trade size of 0.01 lots. The spreads start at 0.8 pips and there is no commission charged per trade.

If you want to reduce the trading cost, you may opt for the ECN Prime, which offers tighter spreads starting at 0.1 pips. There is a small roundtrip commission of $6 applied to trades, but the overall trading cost is still lower. Those who prefer trading with larger volumes, expecting bigger returns, can resort to the ECN Institutional account. The spreads are reduced to as low as 0.0 pips and the roundtrip commission is only $4.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

Minimum Account Deposit Requirements

BlackBull Markets has modified its account offerings to fit the trading volume and deposit preferences of different traders. We suggest beginners choose the ECN Standard account as it has no minimum deposit requirement, allowing them to deposit as little as they feel comfortable with. That said, we would like to emphasize that the minimum contract requirement for this account is 0.01 lots, which is the equivalent of 1,000 units in the base currency of the account. That means traders must have at least $1,000 in their balance to be able to place a trade.

If you are more experienced and wish to reduce the trading cost, you can activate an ECN Prime account with BlackBull Markets, requiring a deposit of at least $2,000. Considering the minimum contract size being 0.01 lots, we think the minimum requirement of $2,000 is more than reasonable for this type of account.

As mentioned earlier, ECN Institutional is definitely most suitable for large-volume traders as it requires a minimum deposit of $20,000. That said, placing bigger trades can be very profitable as the trading cost is reduced significantly.

Tradable Instruments

No matter the account type, you will gain access to a wide range of trading platforms, which will offer the opportunity to trade 26,000 instruments. The markets available to BlackBull Markets clients include Forex, Equities, Commodities, Indices, Futures, and Crypto. The broker has partnered with popular third-party solutions like cTrader, MT4, MT5, and TradingView. In addition to said platforms, BlackBull Markets has launched its proprietary CopyTrader platform, suitable for tracking successful signal providers and replicating their trades.

If you are interested in trading currency pairs, the Forex section will offer you more than 70 tradable pairs, including major, minor, and exotic currency tickers. If you are specifically intrigued by the stock market, you can also try the broker’s BlackBull Invest platform, which grants access to more than 26,000 shares, bonds, ETFs, options, and other assets.

Registration Process at BlackBull Markets – Takes about 1-2 minutes

-

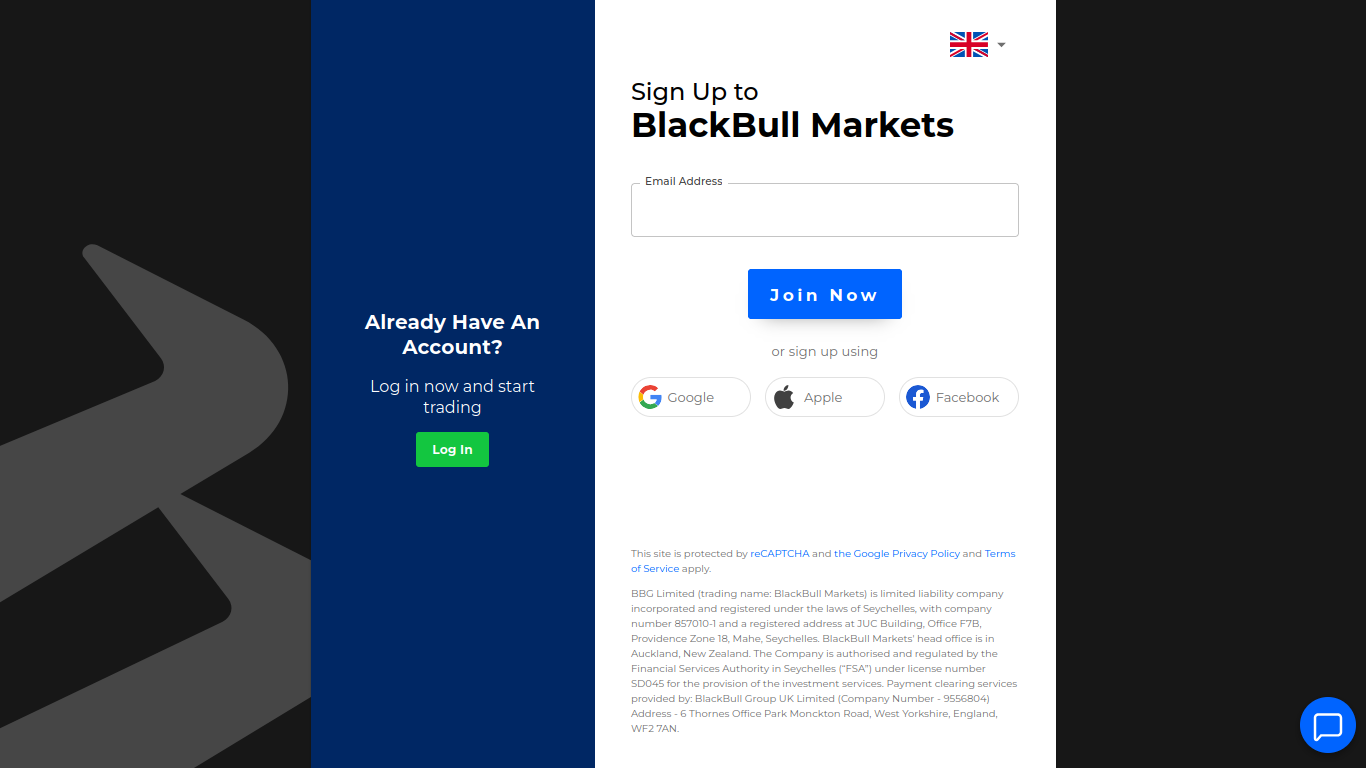

To join BlackBull Markets, click on the Join Now button on the home page of the broker’s website.

-

You will be redirected to the registration page where you will be asked to provide your email address to proceed. Alternatively, you can choose to sign up with your Google, Apple, or Facebook account.

-

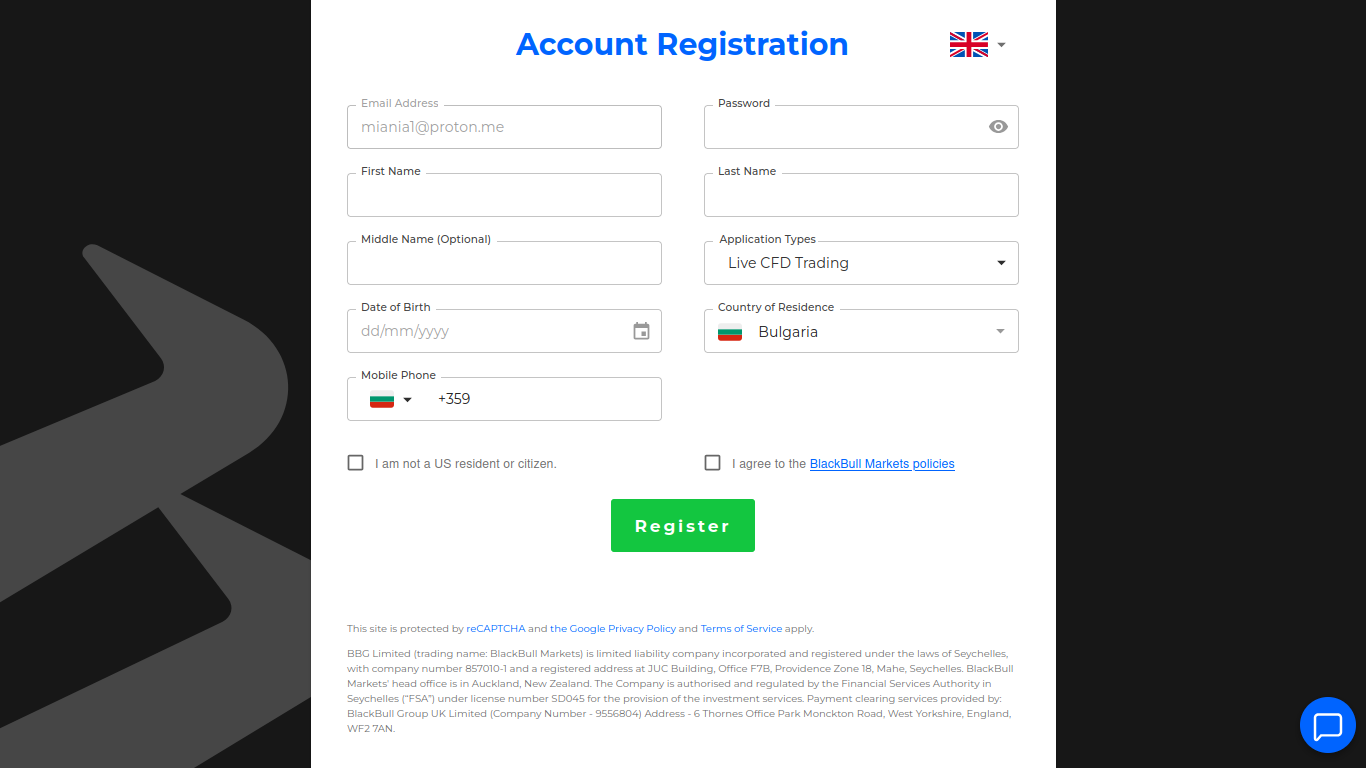

Provide the details required for the registration and choose whether you would like to open a Demo or Live Account. Confirm you are not a US resident and agree to the BlackBull Markets’ policies.

-

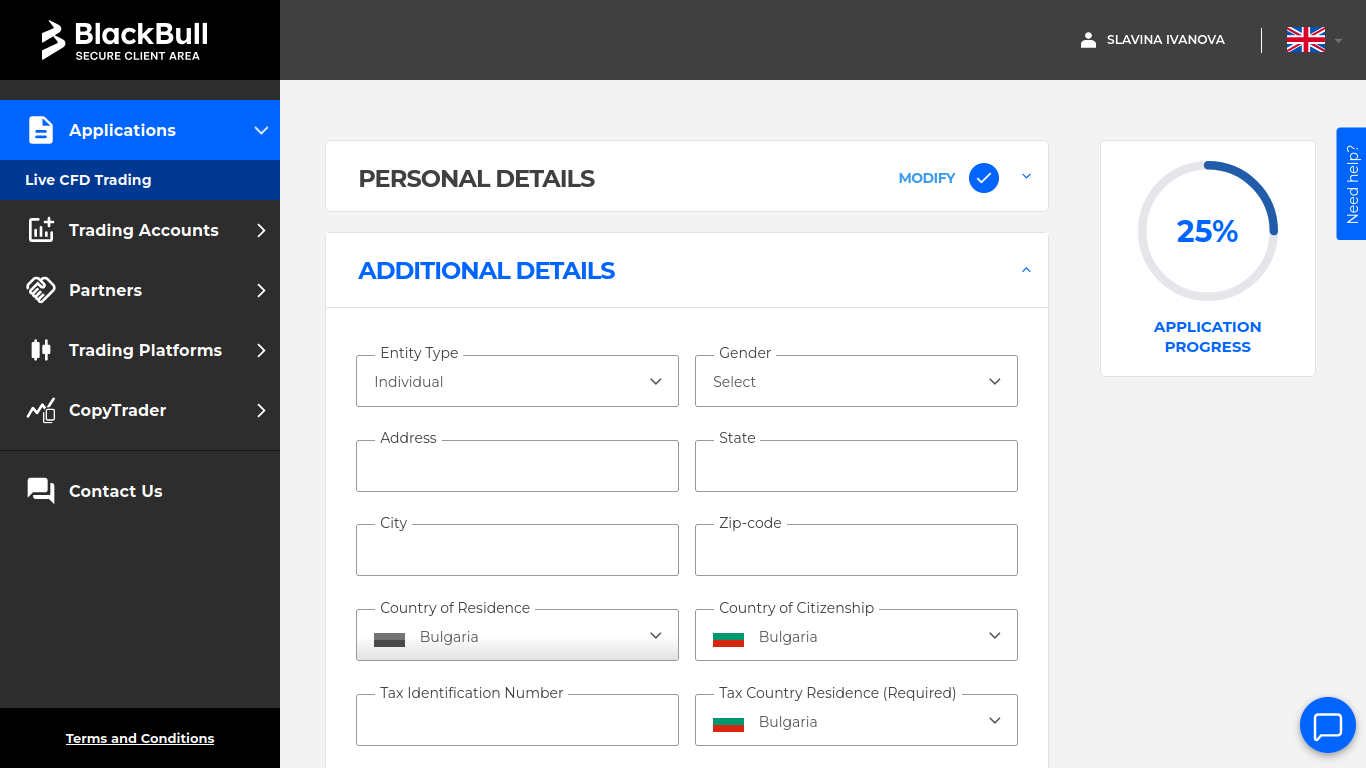

The next step is to enter additional details about your trading account, address, and some information used to identify you.

-

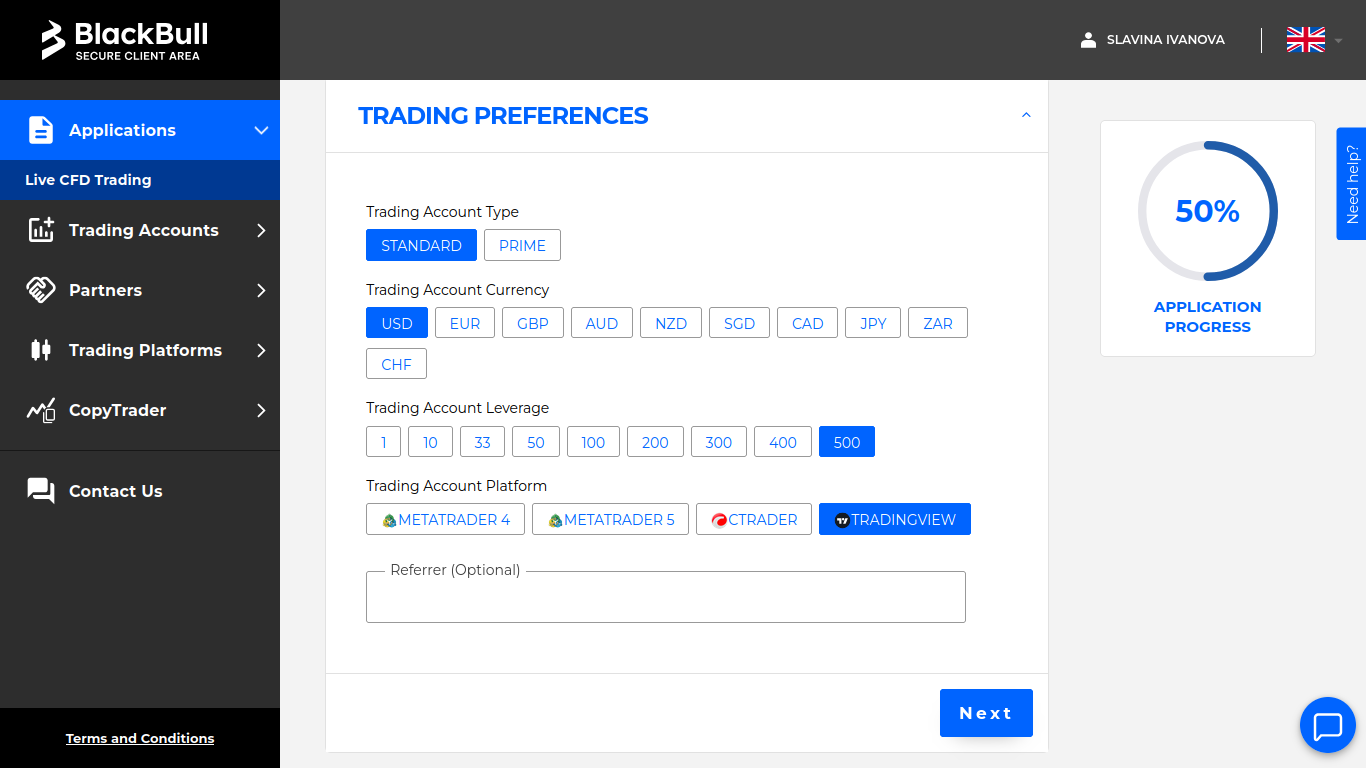

Once you have provided additional details, you can proceed to the next step, which requires choosing your trading preferences. These include account type, base currency, leverage, and trading platform.

-

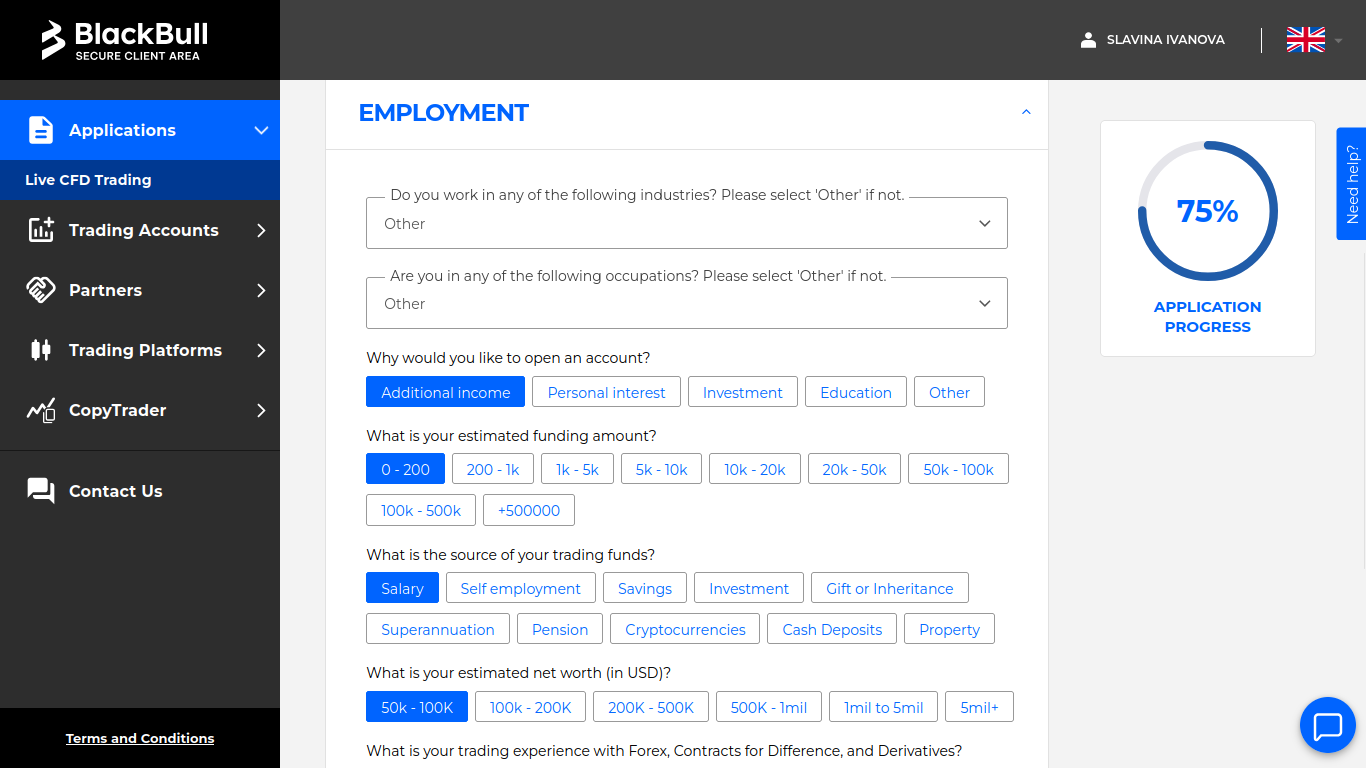

The next step is related to providing some information about your employment and funds. This step is required to help the broker assess your trading capabilities.

Identity Verification Process – Takes about 5 minutes

To create a Live trading account with BlackBull Markets, you also need to go through an identity and address verification. While this process may take a bit longer than the registration, we will explain all of the documents you will need, helping you go through this step as swiftly as possible.

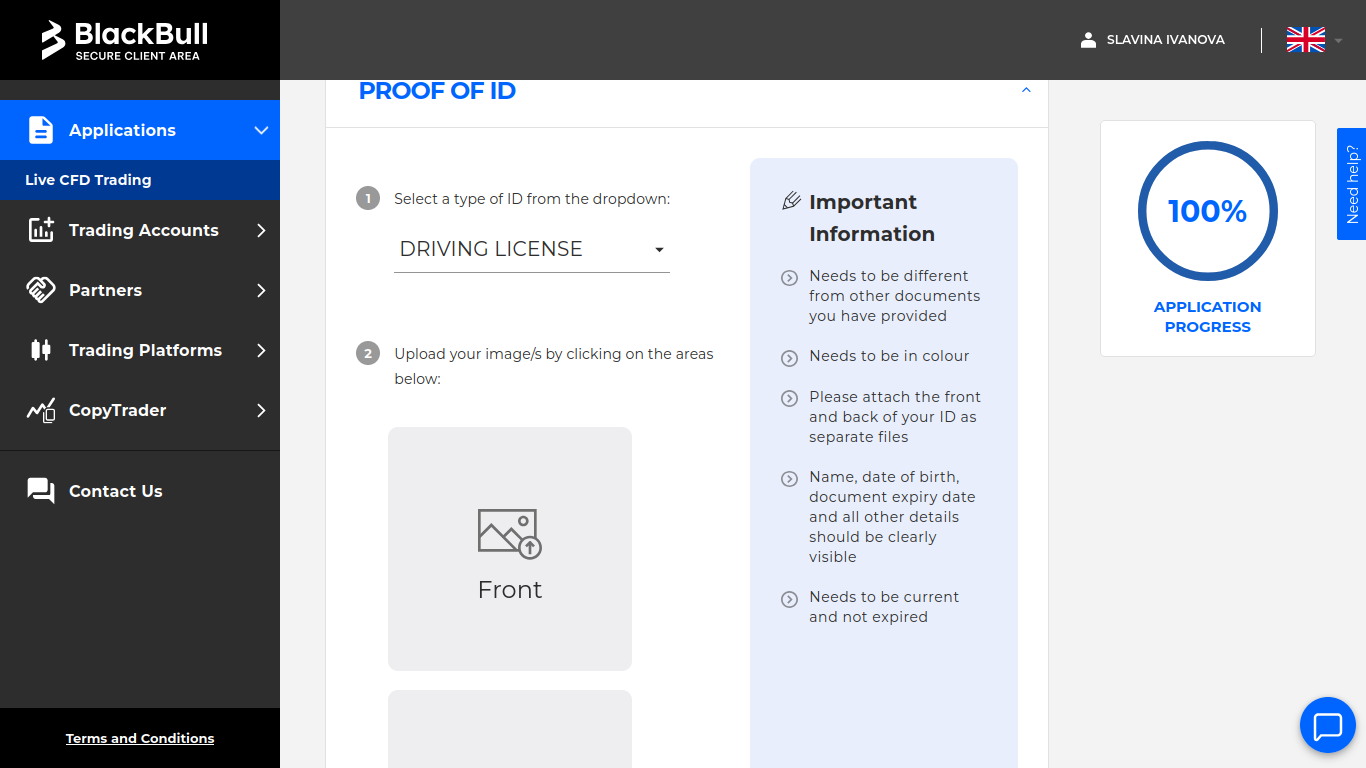

After you have completed the Employment questionnaire, you can proceed to the step requiring ID proof, which involves uploading pictures of a document such as a driver’s license or passport. Make sure to complete this step, following the instructions given in this section.

-

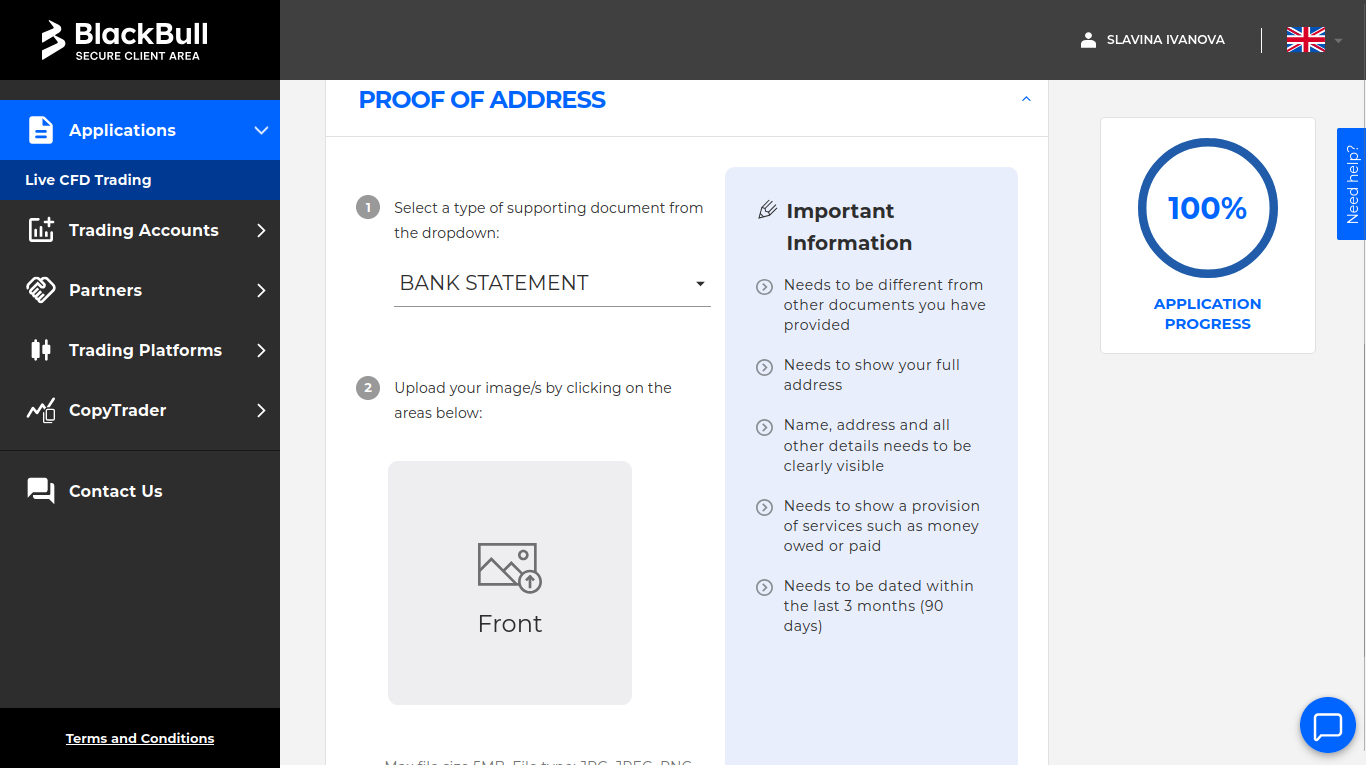

Traders must also provide proof of address, which requires uploading documents such as utility bills, bank statements, or other relavant documents. Make sure the document corresponds to the requirements listed in the Important Information section.

-

Once you provide the required documents, your Live trading account request is ready for approval from BlackBull Markets’ team. In the meantime, you can proceed with funding your trading account, choosing from several convenient payment options.

Overall Thoughts

We think that most traders would appreciate the simplicity of the registration process at BlackBull Markets as those who wish to open Demo accounts can start trading with virtual money in just a few minutes after they have started the sign-up process. Traders who are ready to start trading with real money can also open a live account in just a few steps, taking very few minutes to complete the whole process. Identity verification is also simple, and if you have prepared the required documents, you can complete this step within 5 minutes or maybe even less.