Account Types at OANDA

OANDA, a broker whose roots date to the 90s, has much to offer to forex enthusiasts. This includes an impressive range of trading instruments and excellent mobile compatibility. In an effort to accommodate traders of all experience levels, the broker features several account types.

Traders who are inexperienced and generally lack confidence in their trading skills can open an OANDA demo account. It allows beginners who wish to practice trading to do so without incurring any losses.

The next option is dubbed Basic, which is a live account that comes with OANDA’s average spreads of over 1 pip when it comes to pairs like EUR/USD and AUD/USD. Then we have Premium, an account that boasts discounted spreads (up to 30%) and grants the user a 1-year Essential Plan when it comes to Trading View. This account type, along with the highest retail account tier, also features a personal account manager. The aforementioned final tier is called Elite, and it serves as a viable option for experienced retail traders by featuring a 1-year subscription that grants access to Trading View’s Plus Plan.

We should note that all of the above-described live account types cater to retail traders and restrict leverage to a maximum of 1:30. Those looking to trade with higher leverage could consider applying for a professional client status at OANDA, as it raises the leverage cap to a far more flexible 1:200. You need to have experience as a professional in the field of finance, have substantial capital (€500,000+), or have made 10+ transactions (per quarter) in the previous four quarters.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

Minimum Account Deposit Requirements

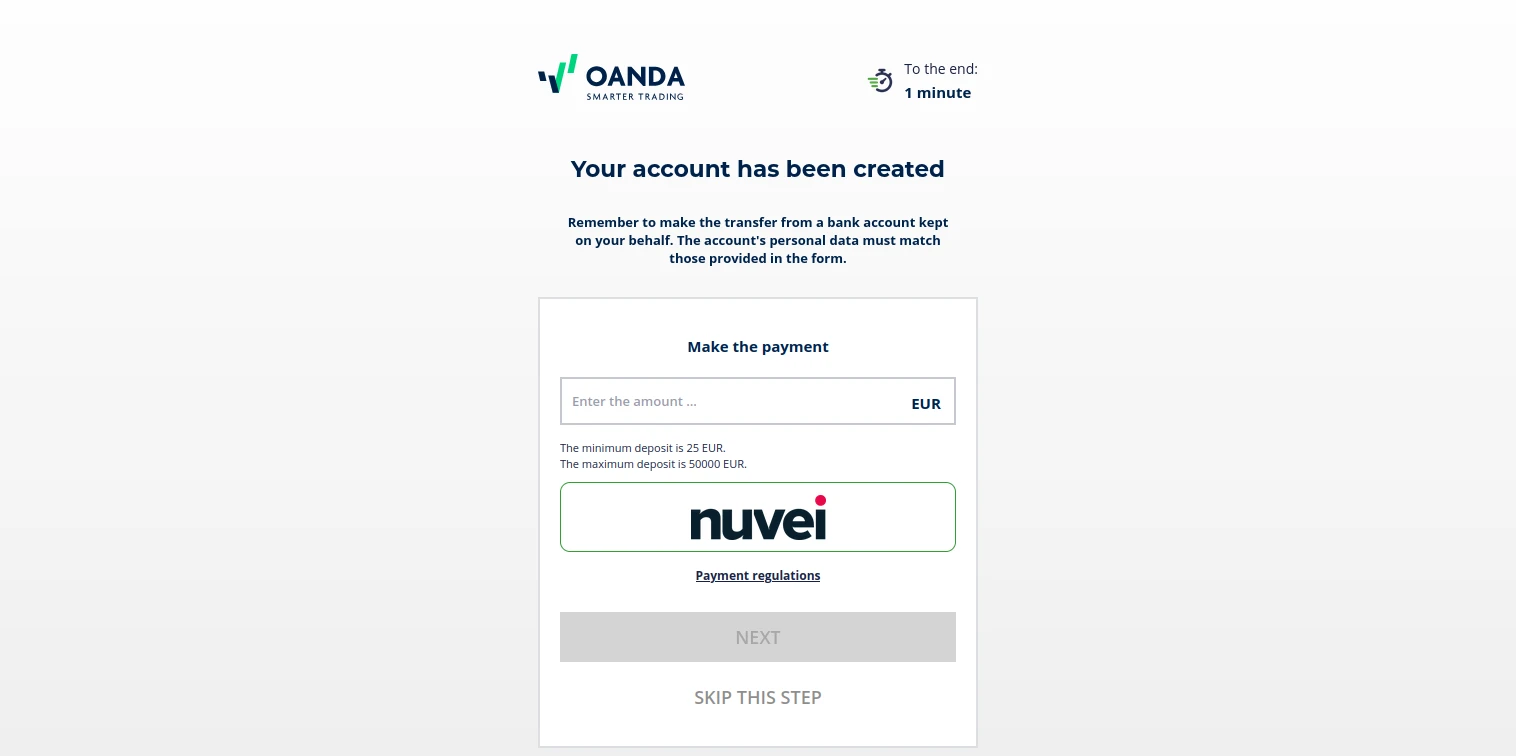

While OANDA does not impose a blanket transaction requirement, there are deposit minimums that are enforced when it comes to separate top-up solutions. If you wish to deposit via Visa or Mastercard, for instance, the amount cannot be lower than €/$25. We must stress that such an amount would not be anywhere near sufficient to trade currencies, however. For example, the minimum order value of EUR/USD at OANDA is 0.01 lots, i.e. €1,000.

Tradable Instruments

With a forex catalog that features CFDs on pairs like EUR/USD, EUR/JPY, USD/CHF, and dozens of other options, OANDA is an excellent broker for traders who are interested in the foreign exchange market. Those who value instrument variety or simply prefer other options will also find OANDA to be a suitable broker, as indices, shares, shares CFDs, indices CFDs, commodities CFDs, crypto CFDs, and ETF funds CFDs are all available.

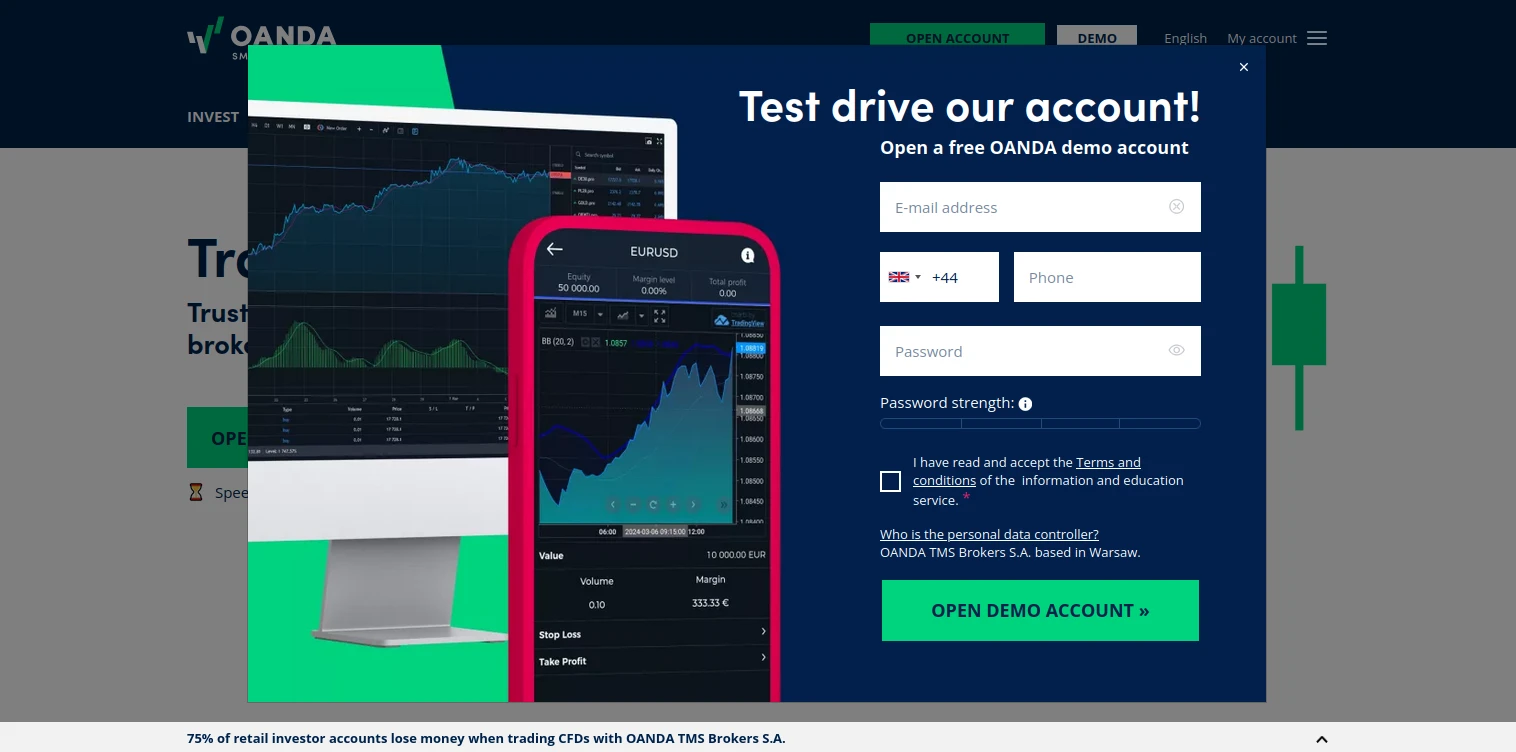

Account Registration at OANDA – Takes about 2 minutes (Demo account)

Firstly, we shall go over the process of creating a demo account. Unlike registering for live trading, making a demo account is exceptionally swift and simple, allowing novice traders to get a taste of what OANDA has to offer as soon as possible.

-

Pay a visit to OANDA’s homepage and click the Demo button next to the language options.

-

Provide your email and phone number, and create a strong password. When done, agree to OANDA’s terms and continue by clicking the Open Demo Account button.

-

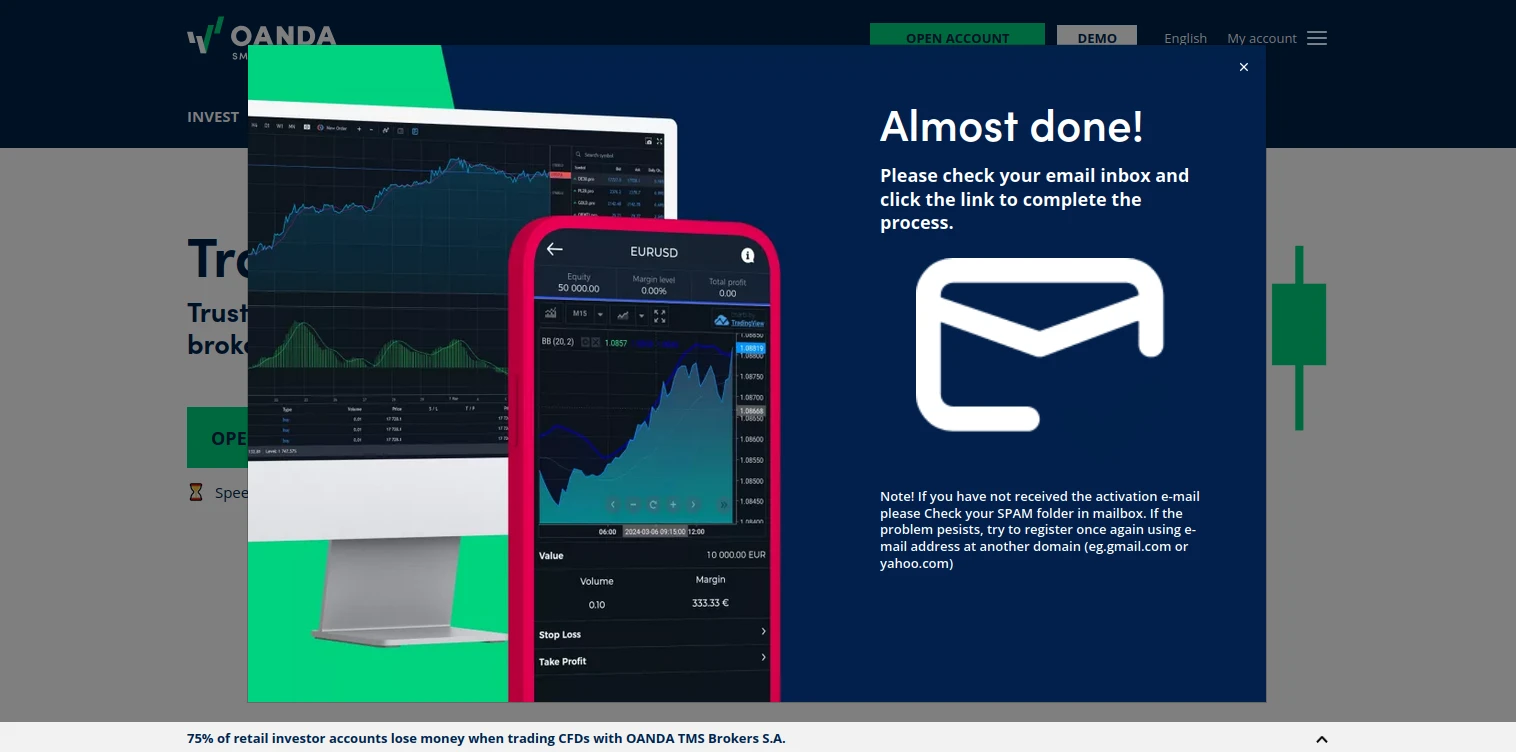

Now, OANDA will ask you to check your email and activate your account.

-

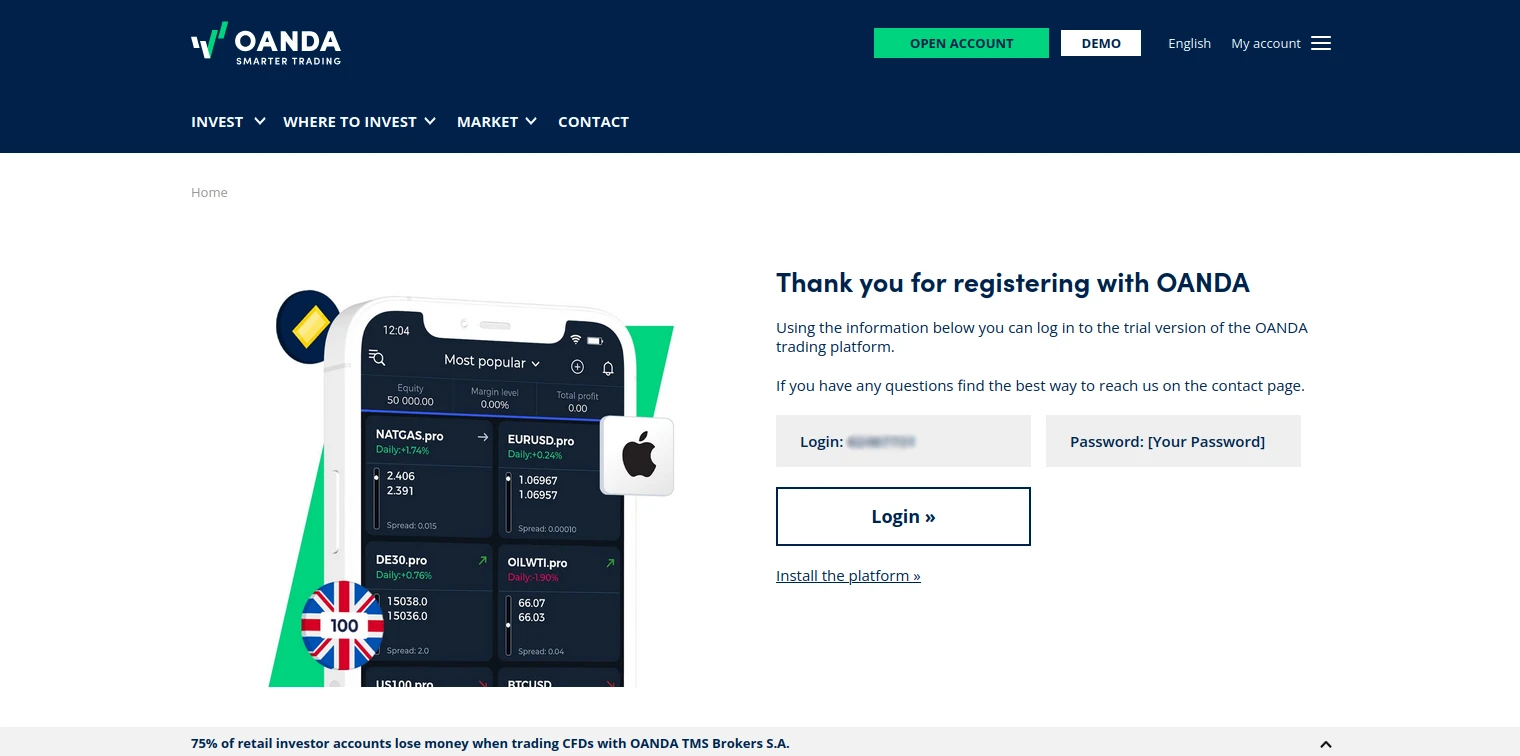

Following the activation link will lead to a page that has your login code. To continue, click the Login button.

-

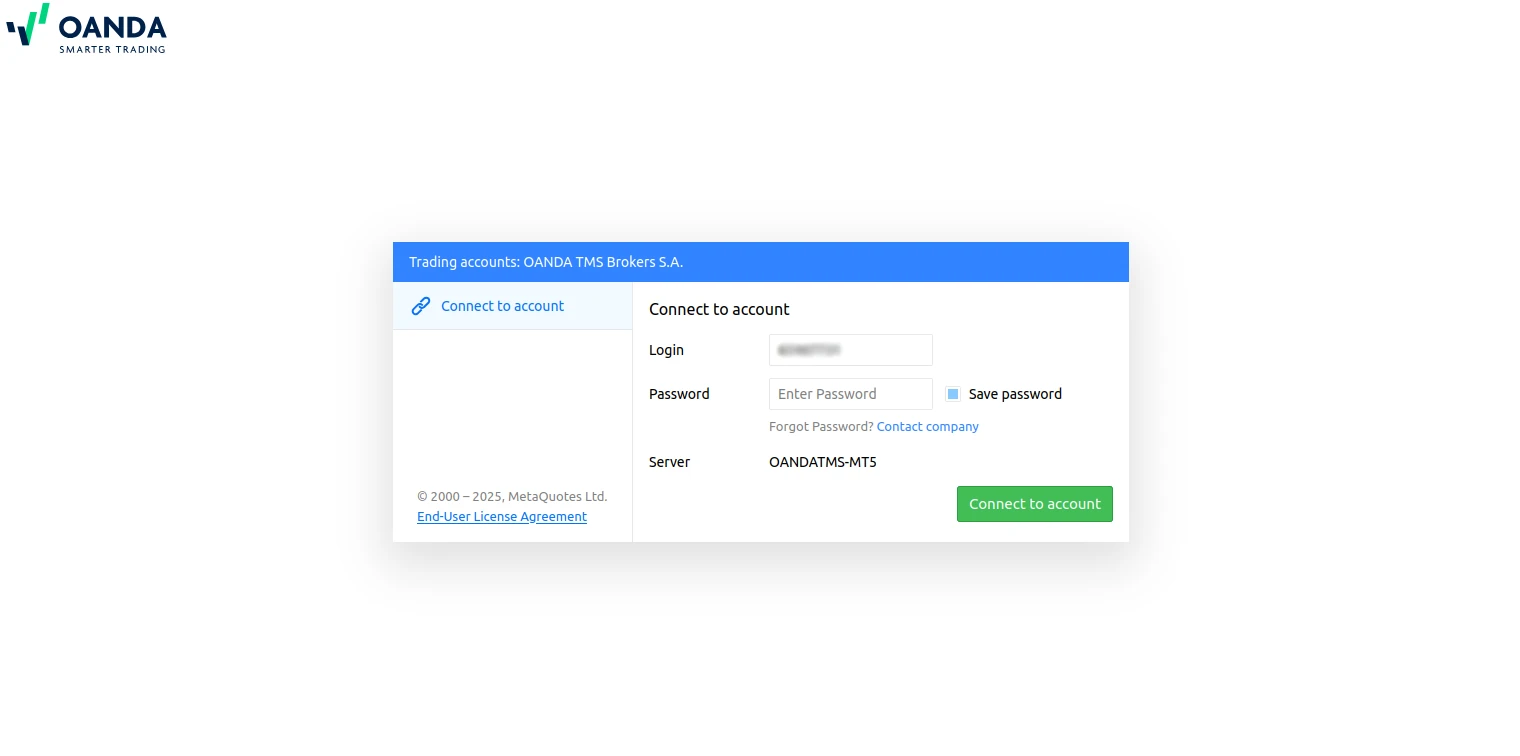

Login with the provided code and your password.

-

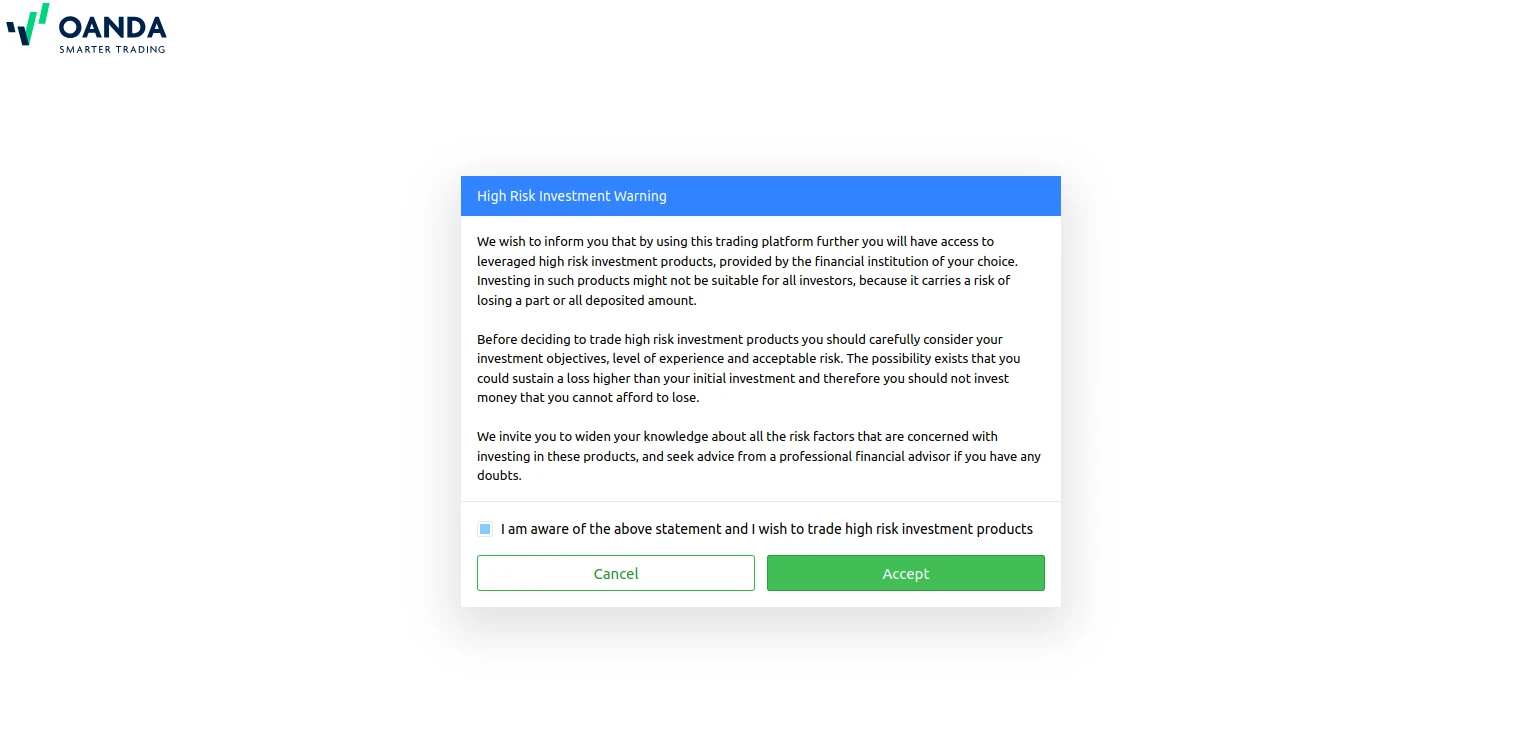

Read OANDA’s warning regarding the risks of leveraged products. If you understand the risks and wish to proceed, click Accept.

-

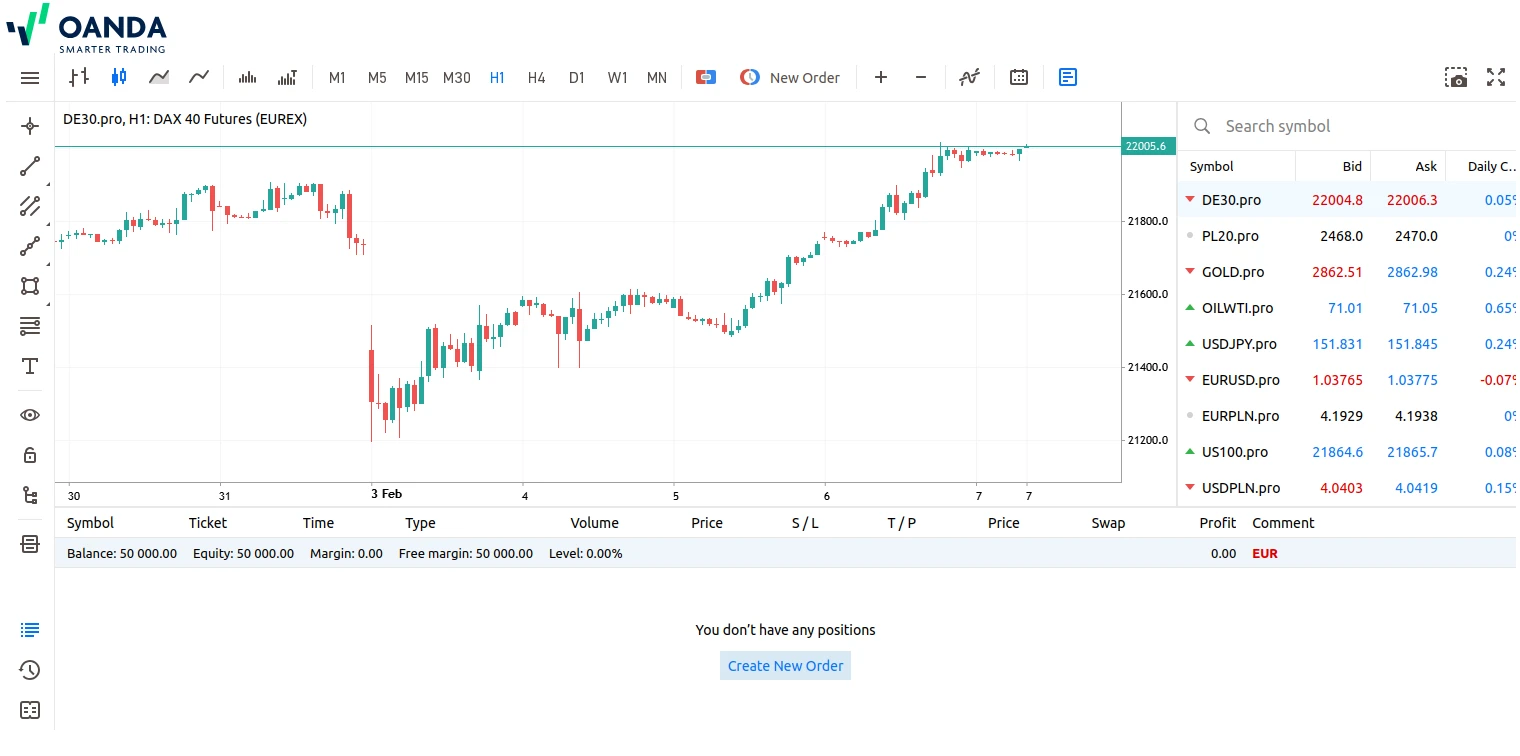

You are now ready to use your demo account.

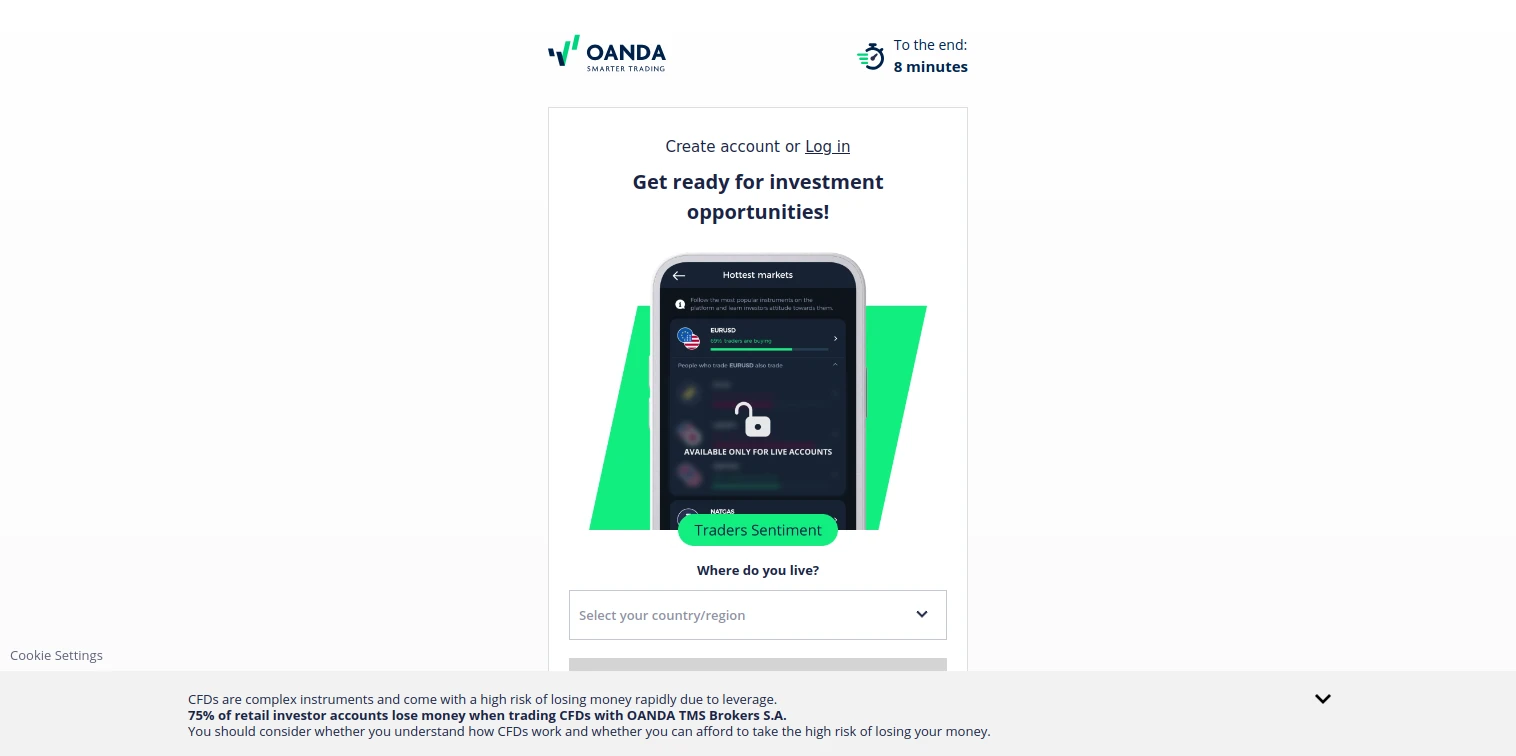

Account Registration and Verification at OANDA – Takes about 8 minutes (Live account)

Trading enthusiasts who plan on making OANDA their broker of choice and are ready to start trading with real funds are encouraged to register by following the steps below.

-

On OANDA’s homepage, click the Open Account button in order to begin the registration process.

-

Now, select your country of residence.

-

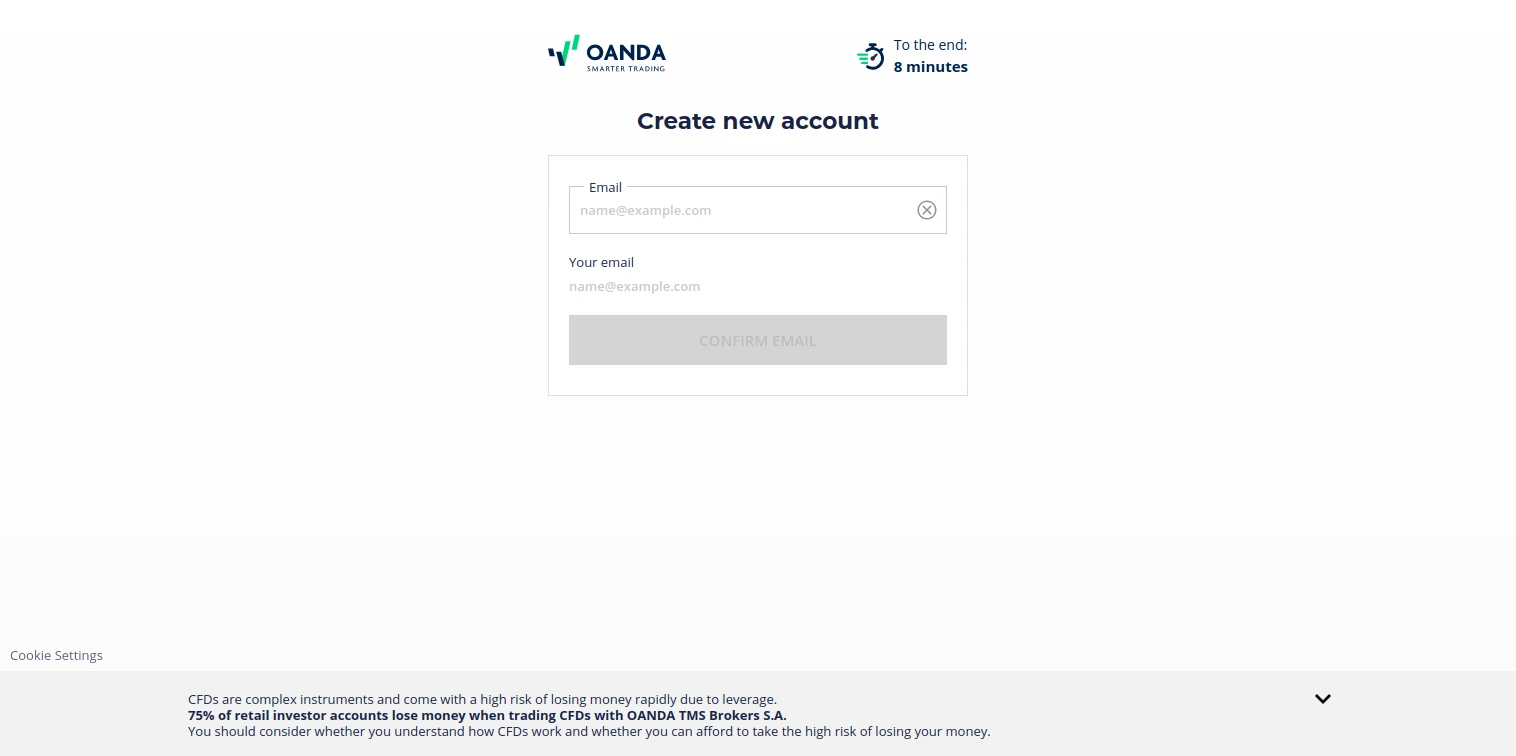

Input your email in the designated field and click Confirm Email.

-

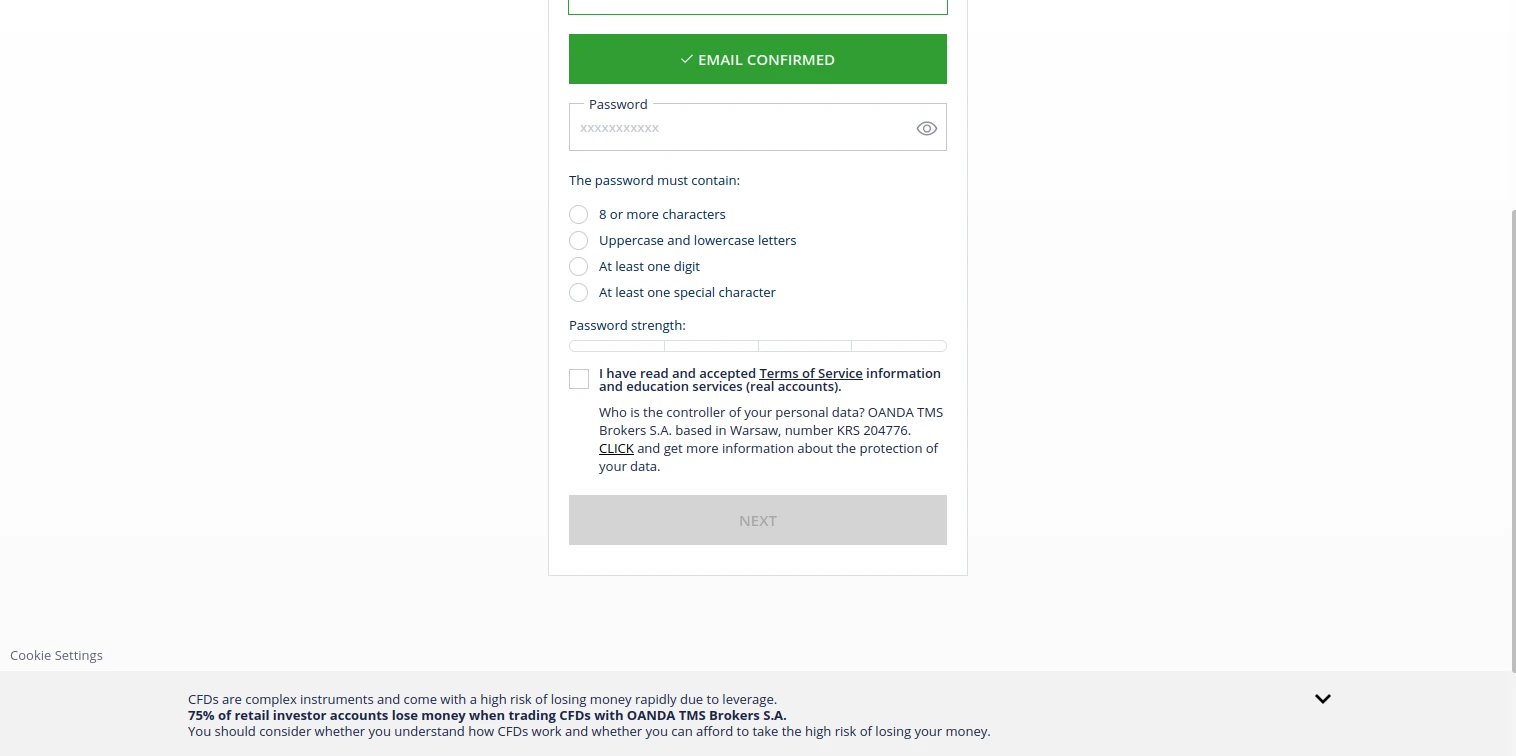

Create a secure password and accept OANDA’s Terms of Service.

-

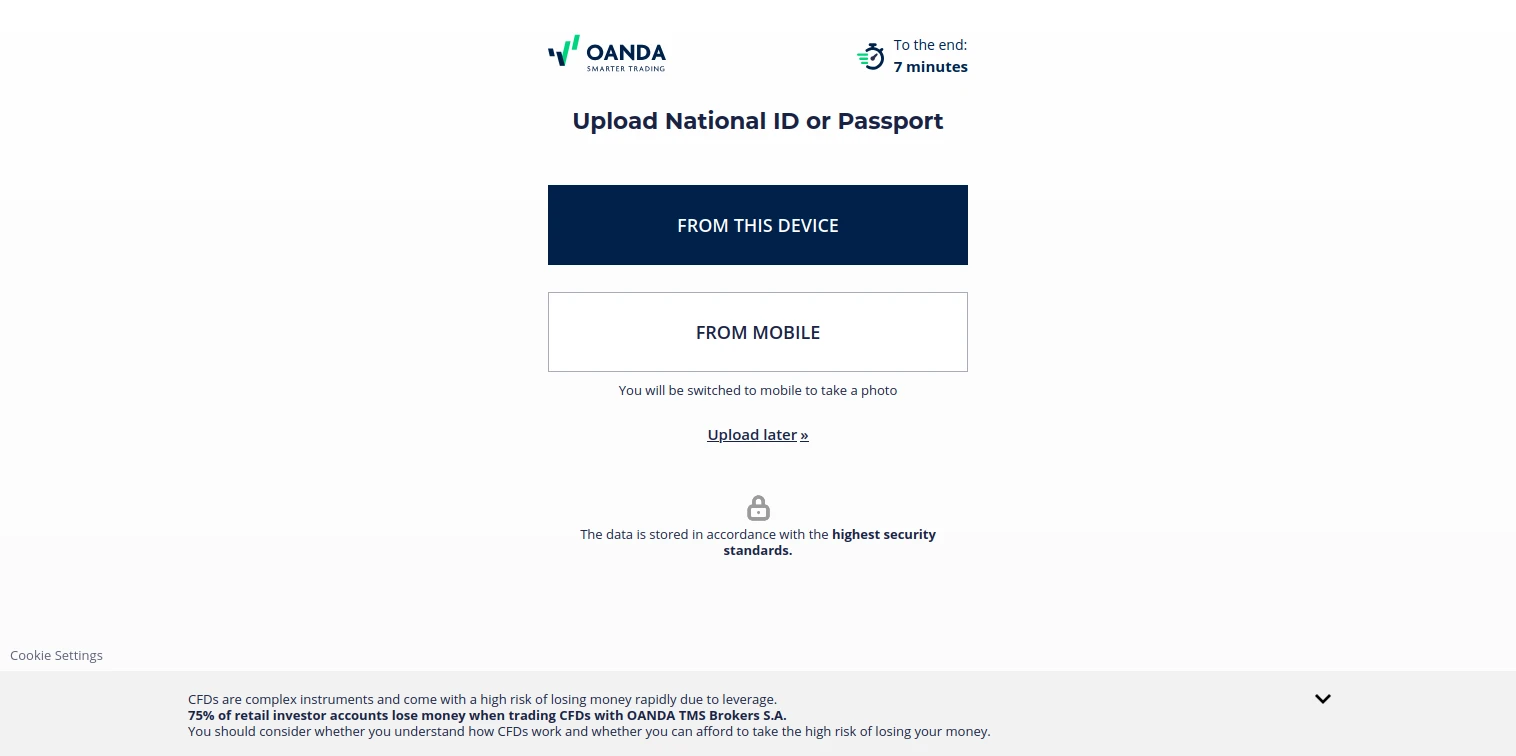

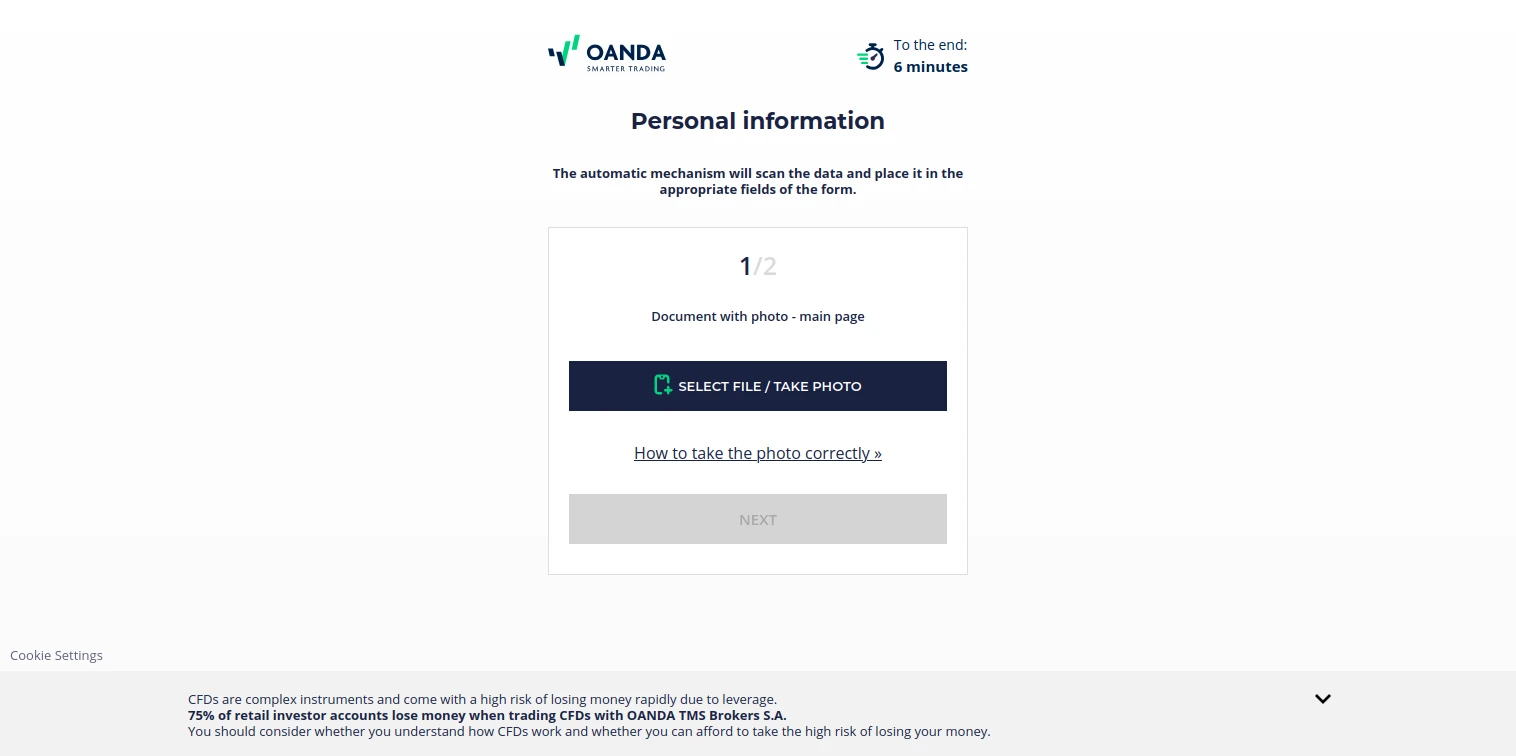

What follows is uploading your National ID or Passport. You can do so on your computer or on your mobile device.

-

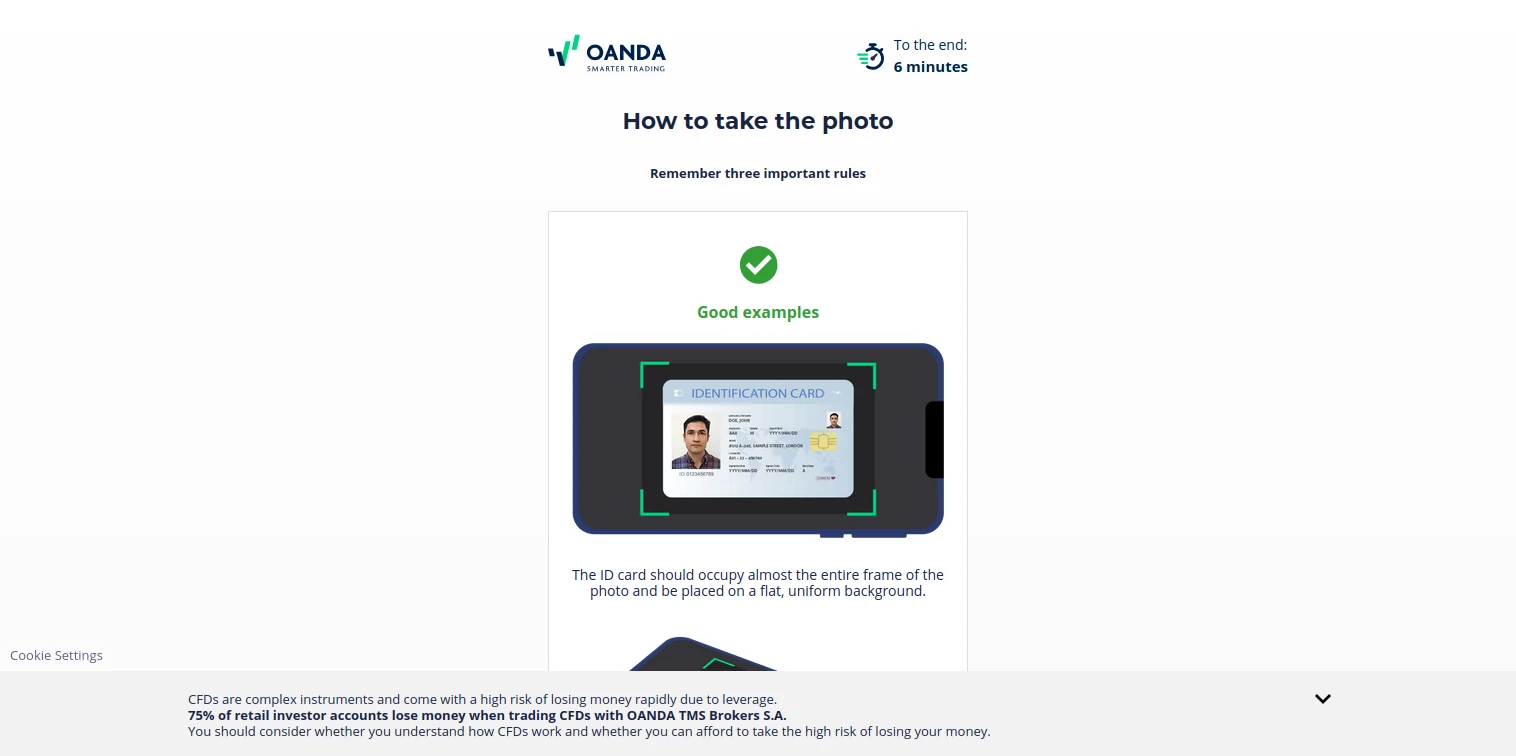

OANDA will provide instructions on how to upload a photo suitable for verification. In general, you will need to ensure that the information is visible and that nothing is obstructed by reflections or shadows.

-

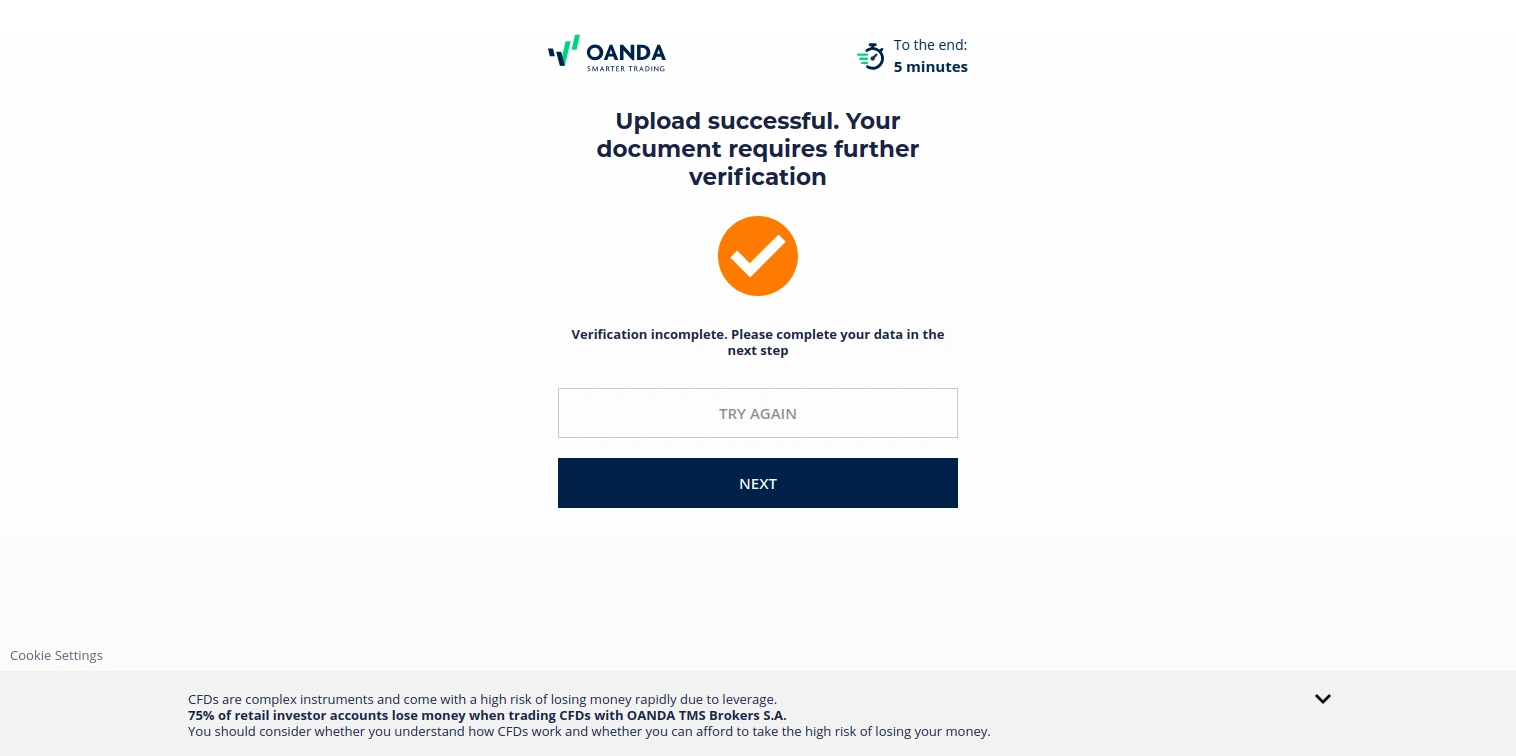

Now, either take the photo or select an already existing photo from your device’s storage. You will need to do this for the front and back of the document. If something goes wrong, OANDA will ask you to select another photo.

-

If your upload is successful, you can click the Next button and continue.

-

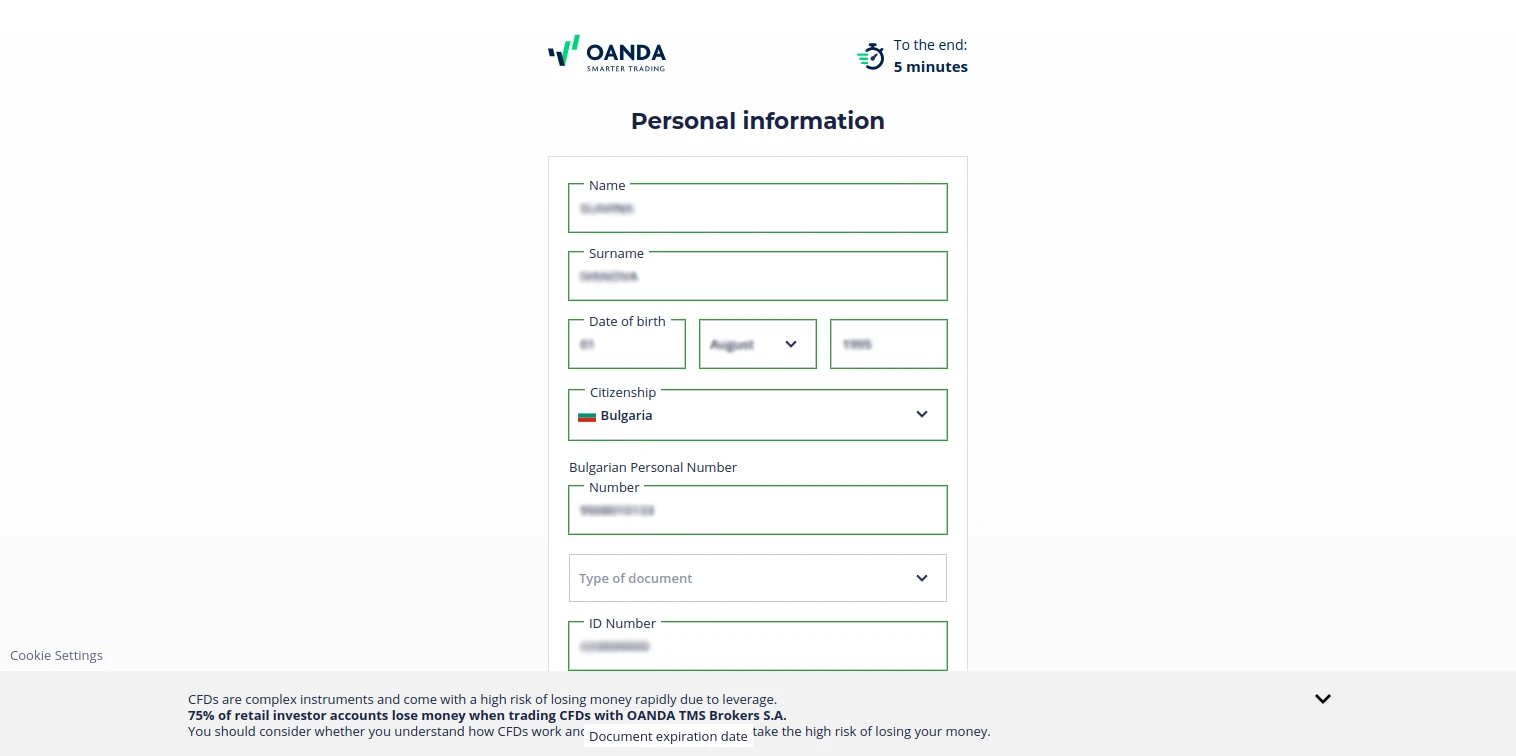

On the Personal Information page, you will find the information included in the document you uploaded previously. Check each field to ensure that everything is correct, and if nothing is amiss, click Next.

-

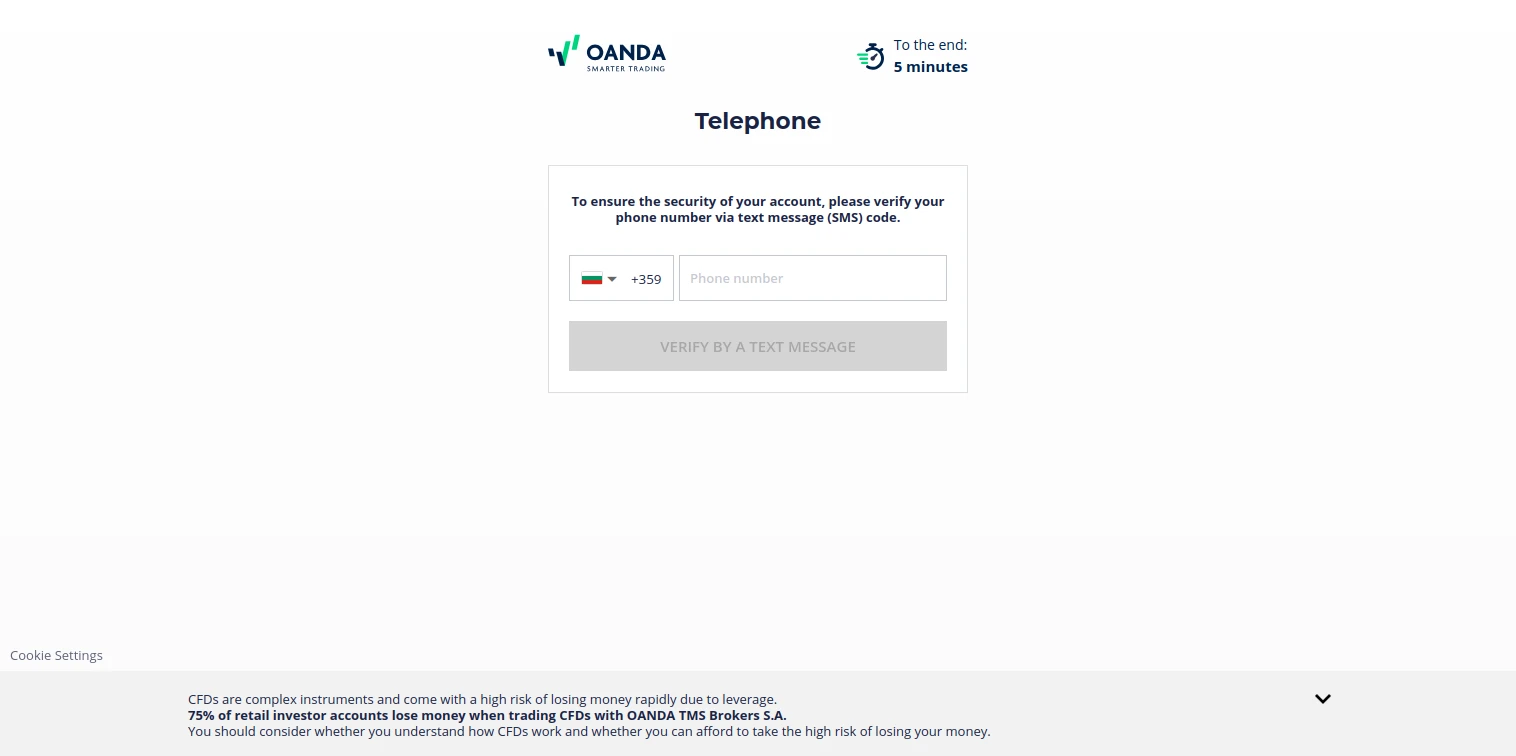

Now, you will need to verify your phone number.

-

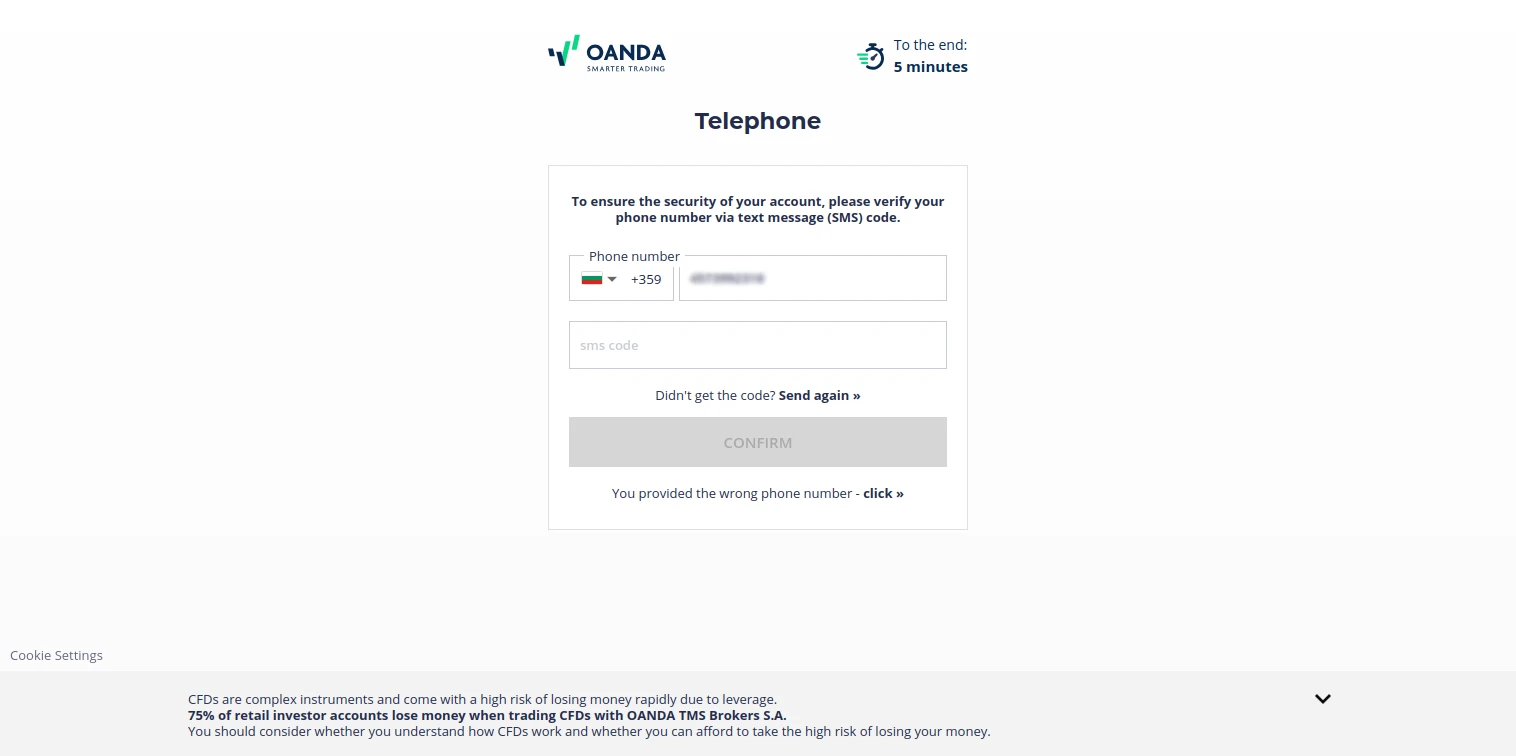

You should receive an SMS within several seconds. Then, input the code, and click Confirm.

-

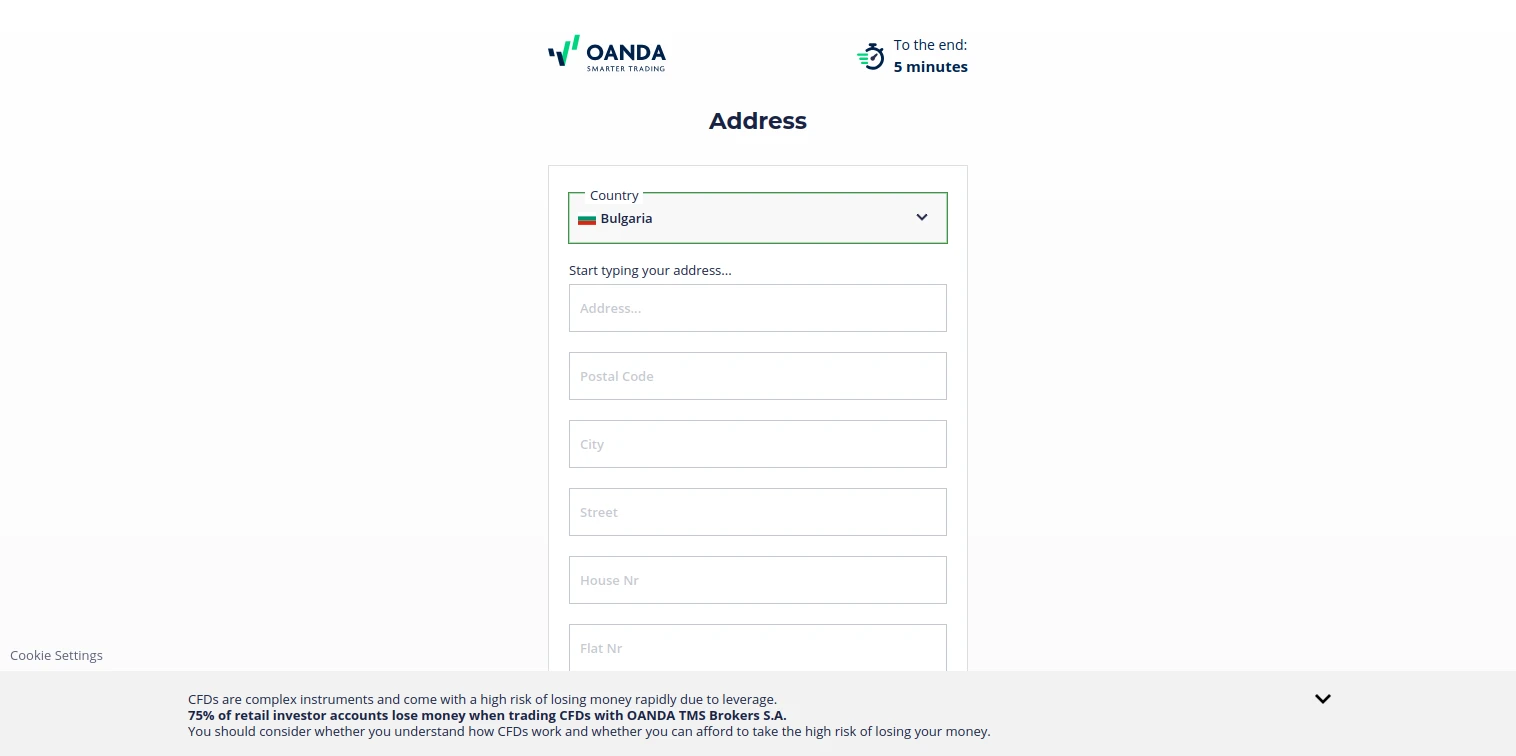

The next step involves providing your address.

-

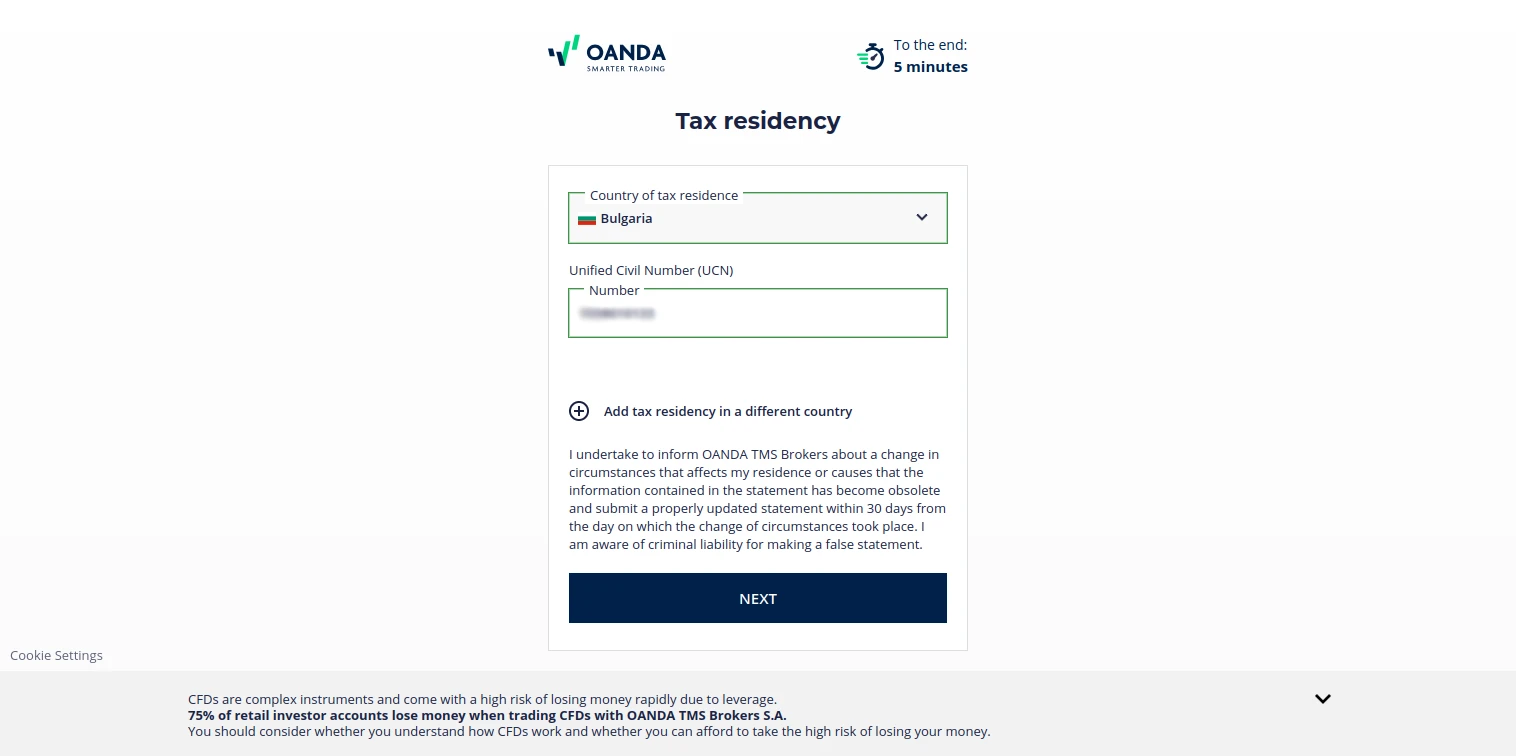

On this page, you will need to confirm your tax residency and input your Unified Civil Number or equivalent.

-

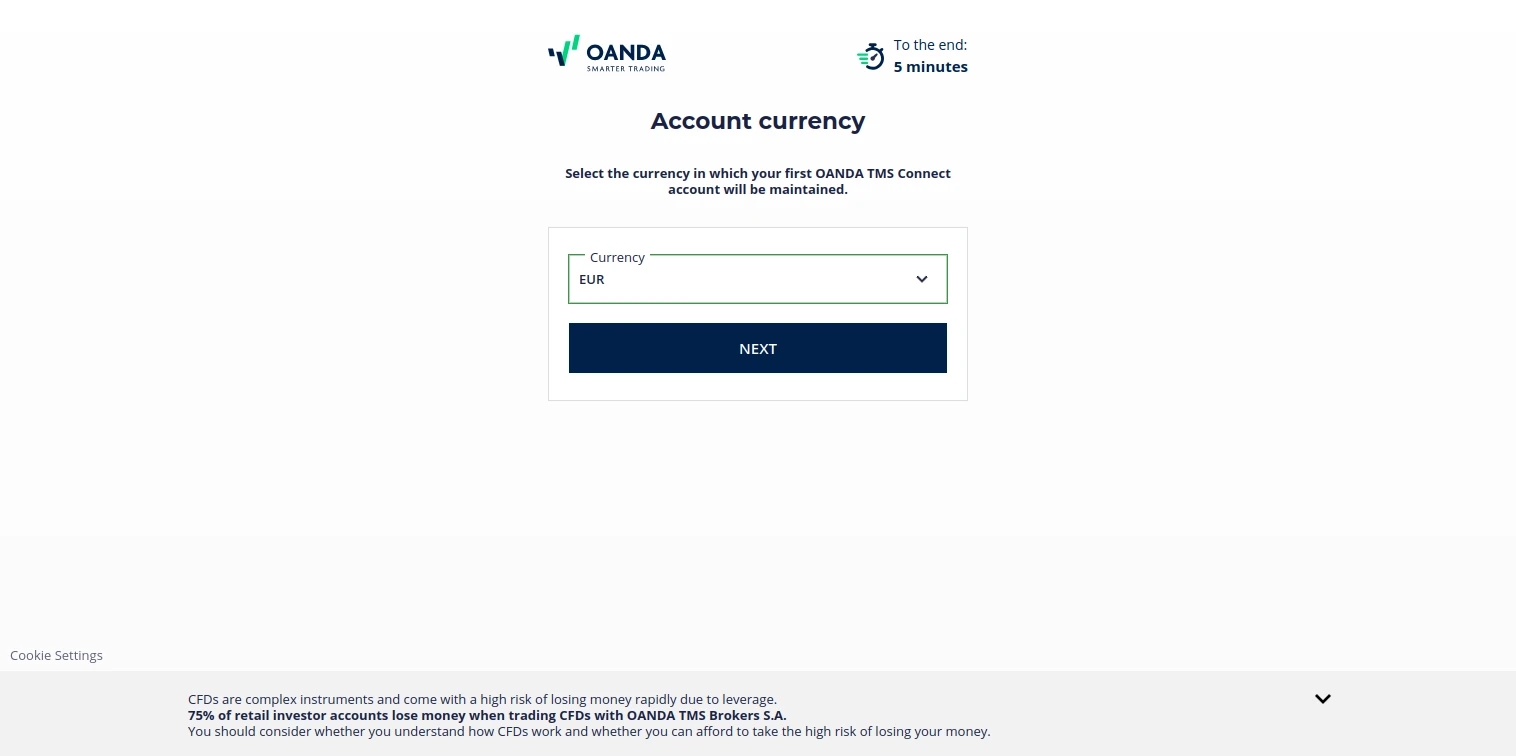

Next, pick your preferred currency. The options are EUR, PLN, USD, and CZK.

-

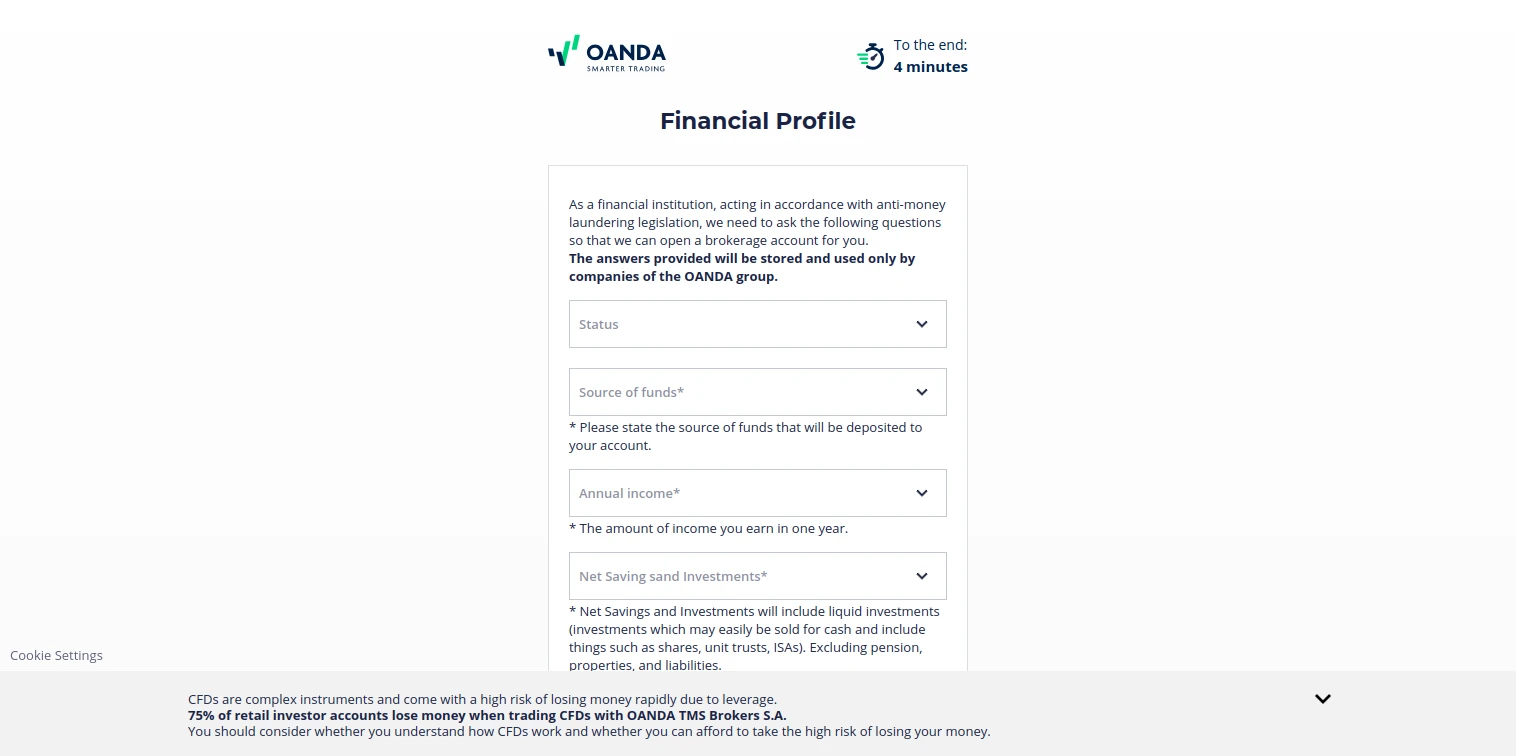

The page that follows is centered around your financial profile, and concerns your employment, income, and savings. When you are done, continue by clicking Next.

-

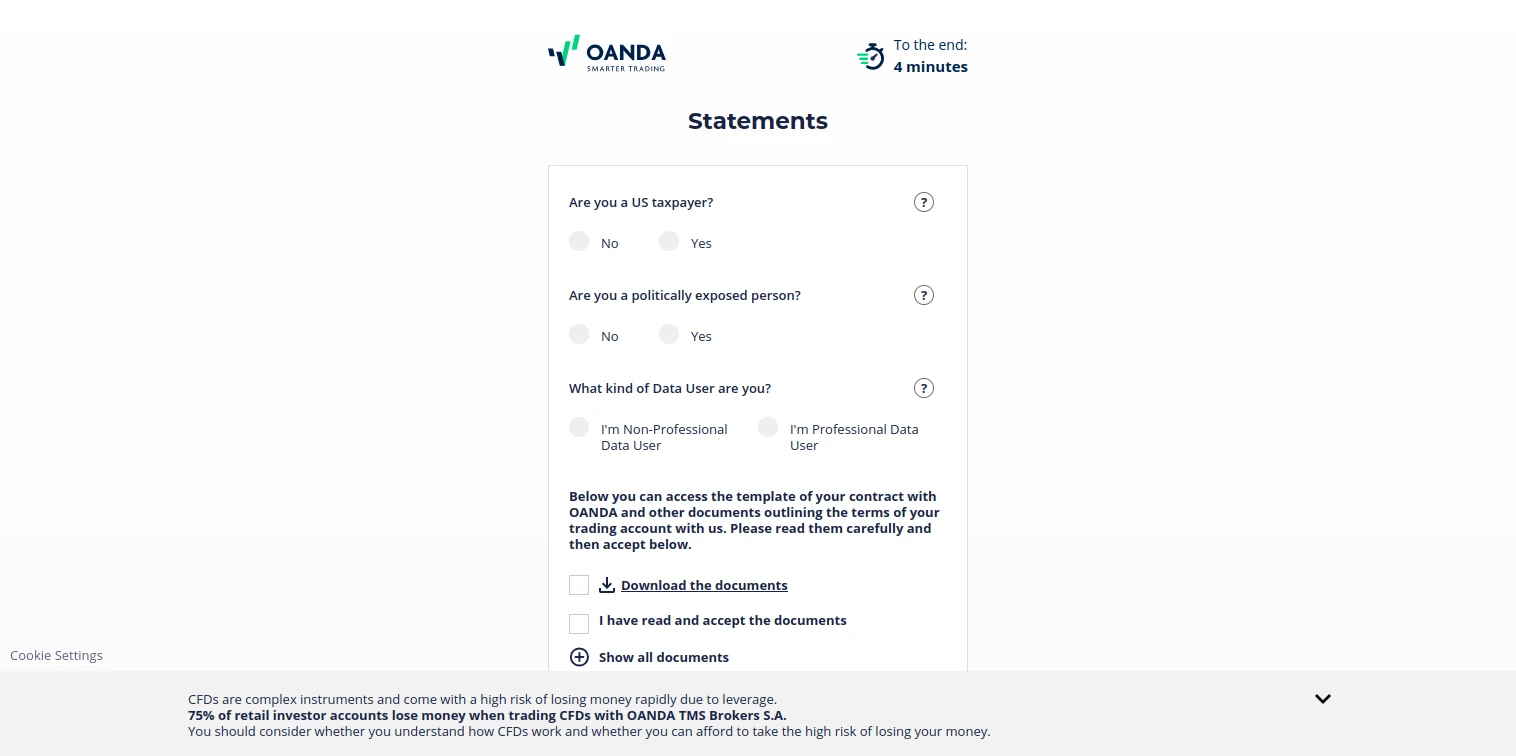

On the Statements page, OANDA will ask that you specify whether you are a US taxpayer or a politically exposed person. You will also need to clarify what kind of Data User you are. Then, read the documents regarding the trading account contract and confirm that you have read and accepted them. Then, proceed to the next stage.

-

Wait for OANDA to verify your information.

-

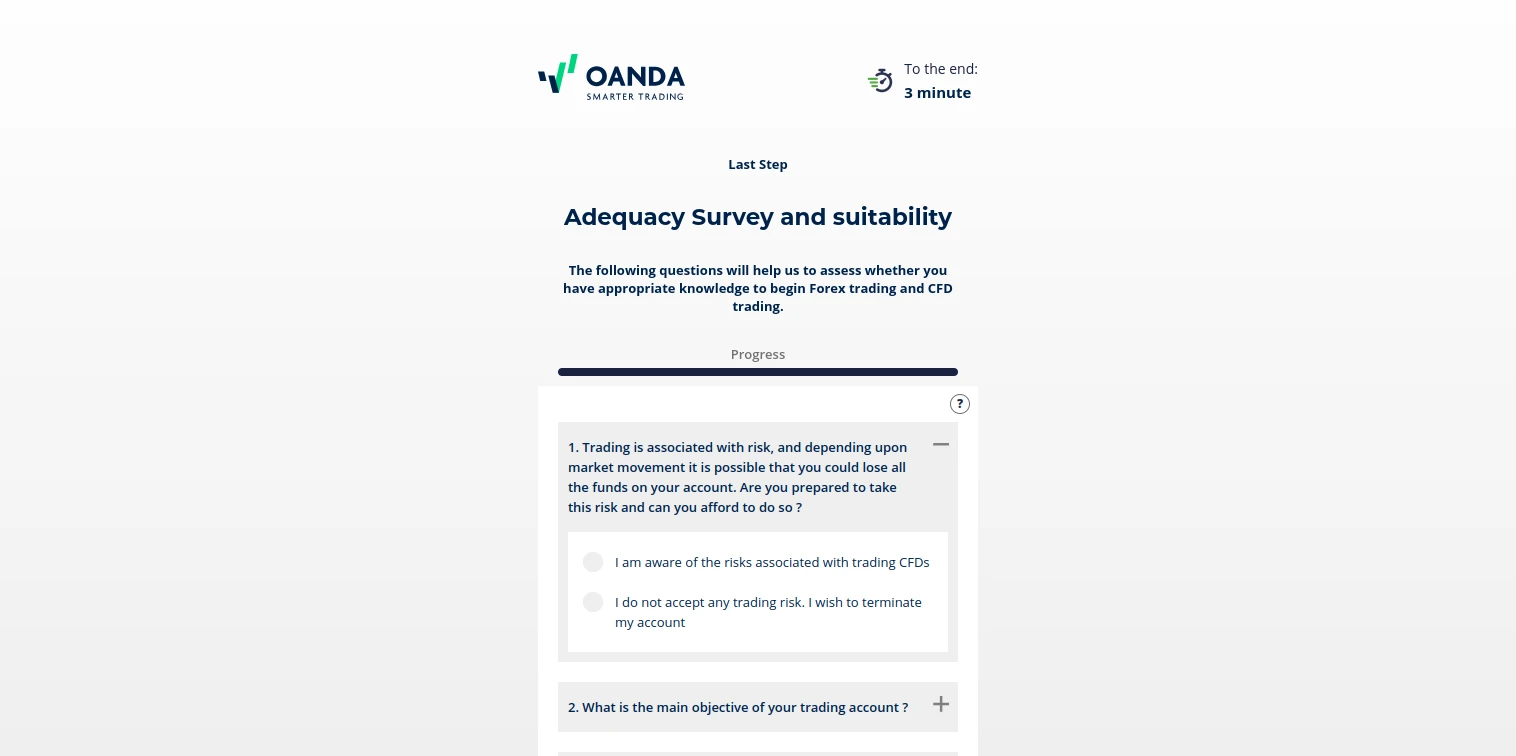

Complete the adequacy survey, which concerns your knowledge of forex trading and CFDs. Once done, confirm that your answers are true, and click Send.

-

If the questionnaire confirms that you are suitable for a live trading account, OANDA will allow you to proceed.

-

On the next page, you will be given the option to deposit money into your newly created account. You are free to skip this step for now.

-

The final registration page will provide you with a link to the Client Zone, which you can access by clicking Next.

-

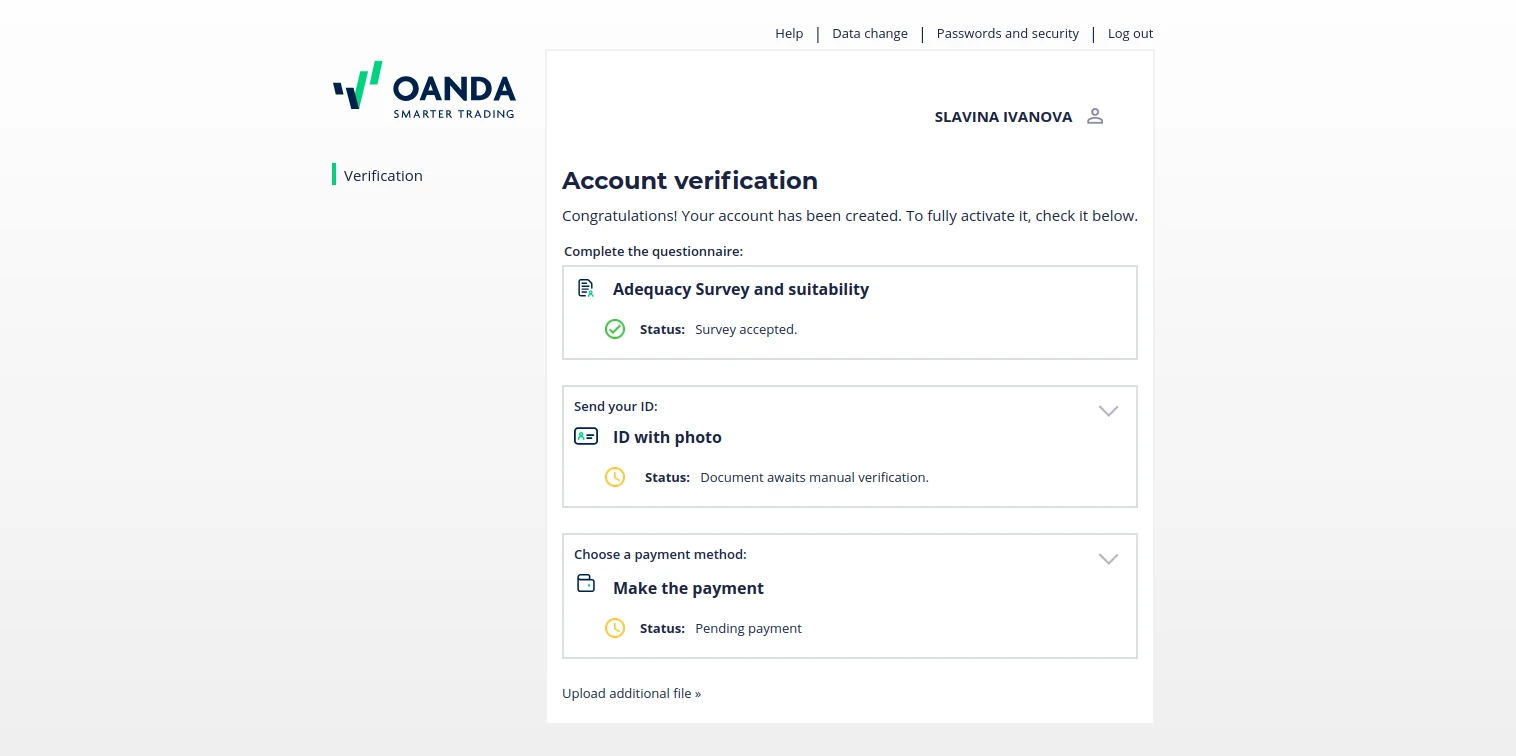

You have successfully undergone the registration process. What follows is waiting for OANDA’s team to verify your documents. OANDA will also send you an email specifying what other documentation is required. Keep in mind that if you deposit via your credit or debit card, OANDA will ask for photos of your driver’s license, passport, or the aforementioned credit/debit card. You will also be required to send a recent document (bank/credit card statement, utility bill, government document/council tax registration) to serve as proof of address.

Overall Thoughts

According to OANDA, the registration process will take around 8 minutes. In our experience, that estimate is mostly accurate, although it might take a bit longer if you need to re-upload your documents or face other minor issues. SMS verification was swift as well, as OANDA sent our team the verification code within seconds. As for the approval of users’ documents, this can be achieved within a day, or within several days.