The global Forex sector represents the biggest financial market in the world, being evaluated at $2.4 quadrillion in 2020. Unlike other markets, Forex has no physical location, being an over-the-counter (OTC) market that can be accessed online by different parts of the world. While numerous countries contribute to the rapid increase of the Forex industry, some actors have a more prominent influence on the growth of the market. The US is one of the biggest markets in the Forex sector, which is not that surprising as the US dollar is the most traded currency, being on either side of the most traded currency pairs worldwide.

In this report (updated November 2024), we will focus on the Forex market in the USA and the way it contributes to the way the global Forex industry scales up. We have resorted to several sources to access the most up-to-date data on the US Forex market, using surveys and reports by major authorities like the Bank for International Settlements (BIS), the New York Foreign Exchange Committee (FXC), and other key participants in the global Forex sector.

North America’s Place in the Global Forex Scene

As far as the number of active traders goes, North America is in third place among the regions with the highest number of active traders (1.5 million). The regions beating this market include Europe and Asia, with the number of active traders in the Asian parts of the world being around 3.2 million.

Number of Forex Traders by Region

Source: VT Markets

Despite Asia being the region with the highest cumulative number of active traders, when it comes to comparison between countries with the highest trading activity, the USA ranks in second place, with 335,000 active traders. The first place was taken by the UK, with a slightly higher number of 341,000 active traders.

Top 10 Countries with Most Forex Traders

Source: VT Markets

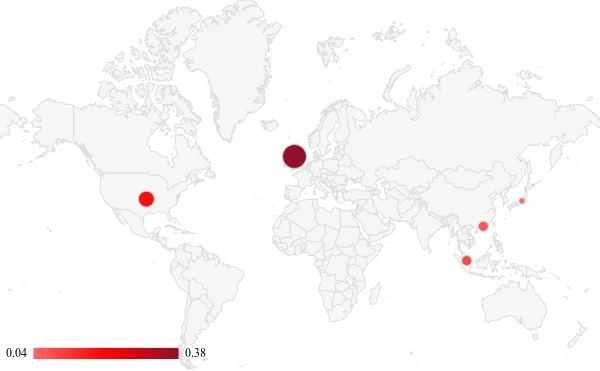

Data from 2022 revealed that the US is also in second place among the top 10 countries with the highest daily Forex turnover volume with an average of $1.9 trillion.

Average OTC Forex Daily Turnover in 2022 (in trillion USD)

The US, along with the UK, Hong Kong, Singapore, and Japan, is a part of the five major financial regions where 78% of the global Forex turnover takes place. The UK had the biggest Forex overturn in 2022, accounting for 38% of the global Forex overturn. Meanwhile, the US was second, contributing 19% to the global Forex overturn. Data for 2022 revealed that Hong Kong, Japan, and Singapore accounted for 7%, 4%, and 9% of the global Forex overturn, respectively. (Compare Forex Brokers)

Data shows that by 2019, the daily Forex turnover in the US had reached almost $1.4 trillion, reaching a growth of over $100 billion compared to results from 2016. While the UK’s daily Forex turnover for that period was still higher at $3.58 trillion, the US was still a strong second, with derivatives like spot transactions, swaps forwards, and options contributing to the surge in the trade volume in April 2019.

US Daily Forex Turnover 2001 – 2022 (in billion USD)

Source: Statista

Reasons Why US is a Major Forex Market

We can point out several reasons why the US has grown to be one of the leading markets in the worldwide Forex industry. We can start by pointing out that the US is currently the largest economy in the world, with a total GDP of $30.34 trillion and GDP per capita of $89.68 thousand as of February 2025. What is more, the biggest financial markets that boast the most liquidity are located in the US.

Largest Economies in the World by GDP in 2025 (in USD trillion)

Source: Forbes India

Without any doubt, the trading volume of the US dollar is also a major factor playing into the US Forex turnover growth. The US dollar is considered the reserve currency of the world and half of international loans as well as bonds are in USD. The currency is also used for a majority of cross-border orders as many commodities are priced in USD.

Forex Volume in the US

One of the easiest ways to track down the growth of the Forex industry in the US is to take a look at the increasing Forex volume recorded across the US. The most recent survey results published by the FXC revealed that the turnover recorded in October 2024 was up across several counterparties. Reporting Dealers marked a 7.5% increase, while Other Dealers saw a 7.4% decline, Other Financial Customers turnover went up by 7.9%, and Nonfinancial Customers saw a 7.0% drop compared to data from April 2024.

The total OTC average daily volume across all Forex instruments reported in October 2024 amounted to $1,196.4 billion. Compared to the results published in April 2024, this volume marked a 2.7% increase from $1,165.2 billion. Meanwhile, the volume recorded in October 2024 indicated a 17.2% year-over-year growth from $1,021.0 billion reported in October 2023.

The average daily volume in October 2024 saw an increase across spot and forward instruments, marking a six-month growth of 5.4% and 13.1%, respectively. Meanwhile, swaps and OTC options volumes were down 5.6% and 4.2%, respectively from April 2024 numbers. The year-over-year results show an increase across all instrumnets, with spot gaining 19.1%, forwards increasing 29.0%, swaps surging 10.8%, and OTC options increasing by 2.5%.

| Average Daily Forex Volume by Instruments (April 2024 – October 2024 in billion USD) | |||

|---|---|---|---|

| Instrument | October 2024 | April 2024 | Change % |

| Spot | 519,307 | 492,642 | 5.4 |

| Outright forwards | 248,553 | 219,818 | 13.1 |

| Forex swaps | 351,041 | 371,911 | -5.6 |

| OTC options | 77,473 | 80,872 | -4.2 |

| Total | 1,196,374 | 1,165,243 | 2.7 |

| Average Forex Volume by Instruments YoY Growth (in billion USD) | |||

|---|---|---|---|

| Instrument | October 2024 | October 2023 | Change % |

| Spot | 519,307 | 436,092 | 19.1 |

| Outright forwards | 248,553 | 192,631 | 29.0 |

| Forex swaps | 351,041 | 316,692 | 10.8 |

| OTC options | 77,473 | 75,594 | 2.5 |

| Total | 1,196,374 | 1,021,009 | 17.2 |

The monthly Forex volume also gained in October 2024, marking a 7.3% growth across all instruments compared to the April 2024 stats. As far as the year-over-year growth is concerned, spots surged 24.5% to a monthly volume of 11,944,052, forwards gained 34.9% to 5,716,724, swaps increased 15.8% to 8,073,946, and OTC options experienced 7.1% year-over-year growth, reaching 1,781,883 monthly volume in October 2024.

| Total Monthly Volume by Instrument (April 2024 – October 2024 in billion USD) | |||

|---|---|---|---|

| Instrument | October 2024 | April 2024 | Change % |

| Spot transactions | 11,944,052 | 10,838,126 | 10.2 |

| Outright forwards | 5,716,724 | 4,835,998 | 18.2 |

| Forex swaps | 8,073,946 | 8,182,054 | -1.3 |

| OTC options | 1,781,883 | 1,779,176 | 0.2 |

| Total | 27,516,604 | 25,635,353 | 7.3 |

| Total Monthly Volume by Instrument YoY Growth (in billion USD) | |||

|---|---|---|---|

| Instrument | October 2024 | October 2023 | Change % |

| Spot transactions | 11,944,052 | 9,594,014 | 24.5 |

| Outright forwards | 5,716,724 | 4,237,876 | 34.9 |

| Forex swaps | 8,073,946 | 6,967,224 | 15.9 |

| OTC options | 1,781,883 | 1,663,069 | 7.1 |

| Total | 27,516,604 | 22,462,182 | 22.5 |

The currency pairs that experienced the biggest volume increase across all instruments in October 2024 were EUR/USD and USD/CAD. Compared to the April 2024 data, the former had a $21.8 billion increase while the latter experienced a $26.0 billion surge. The year-over-year increase in volume for EUR/USD across all instruments was $89.3 billion, while the USD/CAR pair saw an year-over-year volume increase by $81.8 billion. Meanwhile, the currency pair that experienced the biggest drop in volume between April 2024 and October 2024 was USD/MXN, which declined by $22.9 billion and was followed by the second-worse performer, USD/JPY, which experienced a volume decline of $9.9 billion.

Trading Volume of the USD

While different factors play into the significant size of the Forex market in the US, the popularity of the USD as a tradable currency is definitely also a significant element influencing the market growth in the US. The latest triennial issued by BIS shows that USD was present on either side of 88% of the currencies traded in April 2022. It should be noted that since currencies are part of both sides of currency pair transactions, the total daily average for April 2022 amounts to 200% instead of 100%.

OTC Forex Daily Turnover by Currencies

Source: www.bis.org

*Currencies are part of both sides of currency pair transactions so the total daily turnover amounts to 200% instead of 100%

According to the International Monetary Fund (IMF), the USD was a part of 58.41% of allocated Forex reserves for Q4 2023.

Allocated Forex Reserves by Currencies (Q4 2023)

Source: International Monetary Fund

Like any of the currencies enjoying higher trading volume, the USD is easily affected by different factors, with the Federal Reserve Bank having a great impact on the value of the most-traded currency, ultimately impacting numerous key Forex markets across the globe. The Federal Reserve, often referred to as the Fed, is responsible for the stability of the financial market in the US, monitoring and regulating banks as well as influencing interest rates.

The way the Fed affects the Forex market is often related to changes in interest rates, which impacts the cost of hedging and forces traders to adjust their hedging strategies. Interest rate changes may also affect the cost of options and futures contracts, which will also lead to trading strategy adjustments.

The Fed introduced an interest rate cut of 0.25% on November 7th, 2024, which resulted in an interest rate range of 4.50%-4.75%. This decision followed a 0.50% cut that was implemented during the Federal Open Market Committee’s September meeting.

Between March 2022 and July 2023, the Fed raised interest rates 11 times, with the last increase introducing a rate of 5.25% to 5.5%. That level was the highest since January 2001, when the Fed introduced interest rates that skyrocketed to 6% when the dot-com stock market bubble burst.

Leading Retail Forex Brokers Operating in the US

The Commodity Futures Trading Commission (CFTC) is one of the authorities responsible for the monitoring of financial services provided by retail brokers operating in the US. Under CFTC regulations, each retail Forex dealer (RFED) and futures commission merchant (FCM) is required to submit monthly reports to the commission, providing data on their adjusted capital and customers’ assets.

RFEDs and FCMs are also obligated to report their total retail Forex obligations which reflect the total amount of funds obtained through money, securities, and property deposited by customers into their Forex accounts. The combined sum is adjusted to the company’s realized and unrealized net profit/loss.

The latest CFTC data from September 2024 shows that six of the 64 FCMs and RFEDs that have been registered to operate in the US have published their Forex obligations. Said entities include Charles Schwab, Gain Capital, TastyFX (IG US), Interactive Brokers, OANDA, and Trading.com. The broker that handled the largest deposit sum in September 2024 was Gain Capital, with its Forex obligations amounting to $204.62 million. OANDA recorded the second-highest Forex obligations amount for September 2024 ($175.74 million), followed by Charles Schwab ($65.27 million), TastyFX (IG US) ($50.83 million), Interactive Brokers ($28.52 million), and Trading.com ($1.76 million).

US Brokers’ Total Forex Obligations (September 2024)

Source: CFTC

US Forex Brokers Market Share Based on Forex Obligations (September 2024)

Source: CFTC

Forex Trends and Trading Demographics in the US

While the US currently ranks second in the world when it comes to average Forex trading volume, some forecasts predict that the region will continue to grow, probably becoming the country with the highest Forex trading turnover. In turn, that will help the overall expansion of the North American Forex market.

To understand the US Forex market better, we should inspect some of the trends among US traders as well as the typical demographics partaking in the growth of the Forex industry in the US.

Globally, Forex is an industry dominated by males, with data revealing that 87.6% of Forex traders worldwide are males while females represent only 12.4% of global Forex traders. Statistics about Forex trading in the US are quite similar, with 91.5% of US traders being males and only 8.5% of Forex investors in the US being females. If we take a look at the ratio between women and men in Forex trading throughout the years, we can see that not only does Forex continue to be a male-dominated industry, but the percentage of females in this sector has reduced in recent years.

Percentage of US Forex Traders by Gender 2010 – 2021

Source: Zippia

Data shows that about 29,521 US residents are employed in the Forex trading sector in the US. When speaking of professional Forex traders in the US, we can see that the predominant portion of employed Forex traders are above the age of 40. However, we should also mention that the percentage of millennials and Gen Z individuals participating in the US Forex market as retail traders is constantly increasing, with social media often used as the primary source of information on current Forex trends.

Age of Forex Traders in the US

As far as education is concerned, the majority of Forex traders in the US (61%) have a bachelor’s degree, while 20% have also obtained a master’s degree.

Education of US Forex Traders

Source: Zippia

The majority of reputable Forex brokers will warn their clients about the risk linked to currency pair trading. Typically, between 72% and 84.60% of online Forex traders end up losing their money while trading Forex pairs with some of the top retail brokers in the US. You can see the exact percentage on the official website of the online retail broker you have chosen to trade with. As far as successful Forex trading goes, about 29% of retail traders gain profit from their Forex trading sessions.

With online Forex trading gaining massive popularity across the globe, the regulation of the market has become an important issue. While there are numerous regulatory bodies responsible for monitoring Forex activities carried out across different jurisdictions, some authorities are stricter, offering higher levels of protection to Forex traders. The CFTC and the NFA, which are the two main authorities regulating Forex in the US, fall under the category of tier-1 regulators, meaning US traders can enjoy some of the best trading conditions online. Other tier-1 regulators include European bodies like the CySEC, BaFin, FINMA, the UK’s FCA, Australia’s ASIC, IIROC in Canada, and more.

In addition to having the CFTC regulate the Forex market in the US, the financial sector in the North American country has further tightened regulatory measures with the passing of the Dodd-Frank Act in 2010. With several respectful authorities overseeing the Forex industry in the US, 78% of US Forex traders have expressed higher confidence in the trading industry in the country.

Best Trading Hours in North America

While it is true that the Forex market never closes, there are certain hours when it is mostly recommended to place your orders. There are four trading sessions to keep in mind whenever you are trading Forex pairs – Sydney, Tokyo, London, and New York. With the four sessions opening and closing at a different time of the day due to differences in time zones, you can trade currency pairs 24 hours a day, five days a week. That said, the best time to trade Forex if you are a US trader is probably when the London and New York sessions overlap. You can find different Time Zone Converters online if you need to see the exact time in your country when a session is closing or opening. Below, we have provided a table with the four trading sessions and their opening and closing hours based on the New York time zone (GMT -4).

| Sydney | Tokyo | London | New York | |

|---|---|---|---|---|

| 12 am | ||||

| 1 am | ||||

| 2 am | ||||

| 3 am | ||||

| 4 am | ||||

| 5 am | ||||

| 6 am | ||||

| 7 am | ||||

| 8 am | ||||

| 9 am | ||||

| 10 am | ||||

| 11 am | ||||

| 12 pm | ||||

| 1 pm | ||||

| 2 pm | ||||

| 3 pm | ||||

| 4 pm | ||||

| 5 pm | ||||

| 6 pm | ||||

| 7 pm | ||||

| 8 pm | ||||

| 9 pm | ||||

| 10 pm | ||||

| 11 pm |

Trading Activity Throughout the Day (New York Time Zone GMT -4)

Source: Compare Forex Brokers

Predictions for the US and Global Forex Market

One of the main factors that plays a major role in the future of both the US and global Forex sectors is the stability of the USD. Even though inflation, geopolitical issues, and other economic factors have impacted the most traded currency, the USD has maintained its strength through somewhat stable inflation rates.

Experts of JPMorgan predict that the USD will keep its stable position, with December 2025 forecasts for major currency pairs like GBP/USD, EUR/USD, and USD/JPY predicting bullish levels, reaching 1.32, 1.08, and 148, respectively.

While no interest rate cuts were introduced by the summer of 2024, experts’ predictions that the Fed would start its easing cycle later that year were realized in September and November.

Commodities are also a key factor to pay attention to as they had gained almost 7% between February and the summer of 2024. JP Morgan experts predict a shift in the Brend crude oil market, reaching a large surplus in 2025 and and maintaining an average price of $73/bbl at the end of the year. That may further increase the USD value by the end of 2025 as it holds a long-term positive correlation with oil prices.

Correlation between USD and Brent Oil Prices

Source: Investing.com

Further interest rate cuts could have a huge role in the future of USD by the end of 2025. According to JPMorgan, we could see three to four further cuts be implemented by the middle of 2025. Experts believe the USD will maintain a somewhat bearish state in 2025, while currencies like the CNY and the SEK may stand 2% and 13% stronger against the USD, respectively.

Despite different speculations, the future of the US Forex market and the USD in particular depends on various factors that may often be unpredictable. One thing is sure, however, the global Forex industry is bound to continue expanding, with the US region being an important driver to an overall bigger Forex overturn in the upcoming years.