Days before President Joe Biden’s abrupt decision to abandon his bid for this year’s presidential elections, his administration announced it had approved another $1.2 billion in student loan debt forgiveness for 35,000 borrowers. The new round of relief brings the canceled student loan debt total to almost $169 billion, helping nearly 42.8 million Americans struggling to pay a debt they had accrued while seeking to improve their odds in life.

Many of them have not, however; while some have managed to graduate and thrive in the career they had dreamt about, others have ended up dropping out and taking up jobs just to get by. With or without a diploma, 42.8 million Americans are now in debt totaling $1.75 trillion as of the first quarter of 2024, according to data from the Federal Reserve. These are not just numbers; student debt puts a heavy burden on millions of families, many struggling to make monthly payments in the midst of a cost of living crisis. Interested in how people are managing to pay off this massive debt, the team at BestBrokers decided to ask the questions directly.

Since California has the highest number of college and university students, according to the National Student Clearinghouse Research Center, we surveyed 1,126 student loan borrowers from California who have not yet paid off their debt. These were people aged 22 to 27 who either graduated within the past five years or, for one reason or another, dropped out of college. What they had in common was their debt as a result of taking either federal or personal student loans while studying.

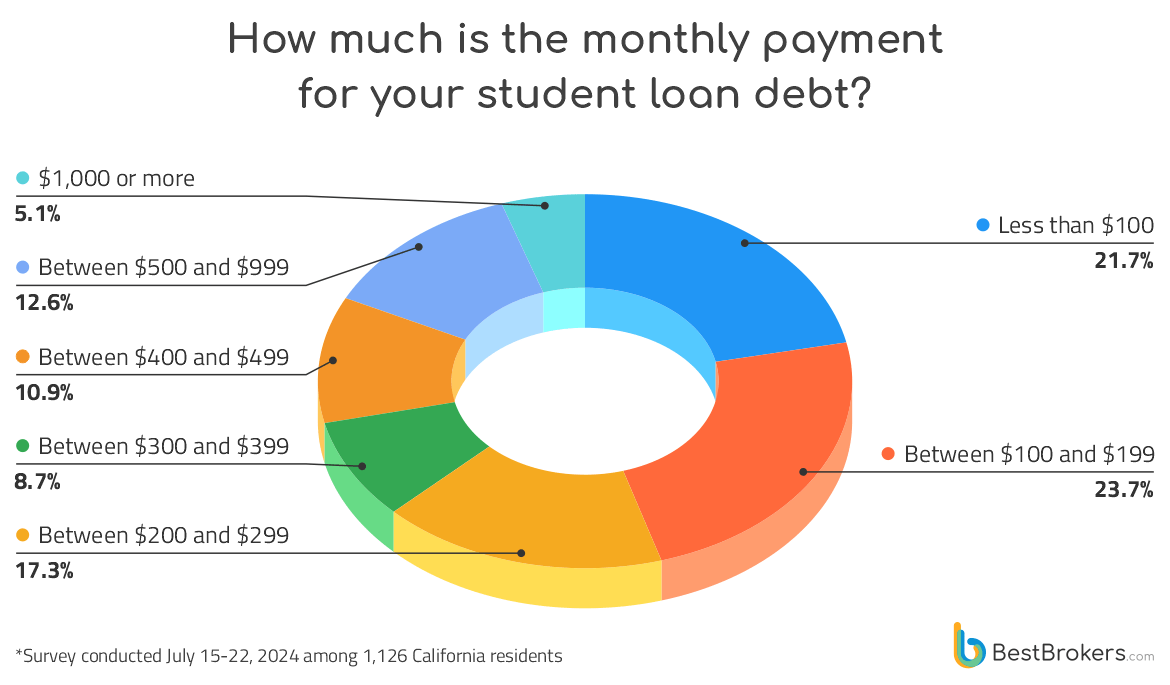

Roughly 82% of them pay less than $500 per month toward their student loan debts, while the share of those with monthly payments of less than $200 is 45.38%. This suggests that many people are trying to pay the minimum, which inevitably draws out the paying off the debt over time.

According to the latest statistics from the Federal Reserve, the total amount of student loan debt in the U.S. stands at $1.753.3 trillion as of the first quarter of 2024. This includes all Perkins loans, loans under the Federal Family Education Loan Program and the Direct Loan Program, as well as private student loans without government guarantees. However, more than 90% of all student loan debt is federal. Roughly 42.8 million people in the U.S. currently have outstanding student loan debt, with the average federal student loan debt balance around $37,853.

Remember that this is not the amount Americans owed when they took a student loan. Over time, interest and penalties add to the initial amount, especially when it comes to private loans.

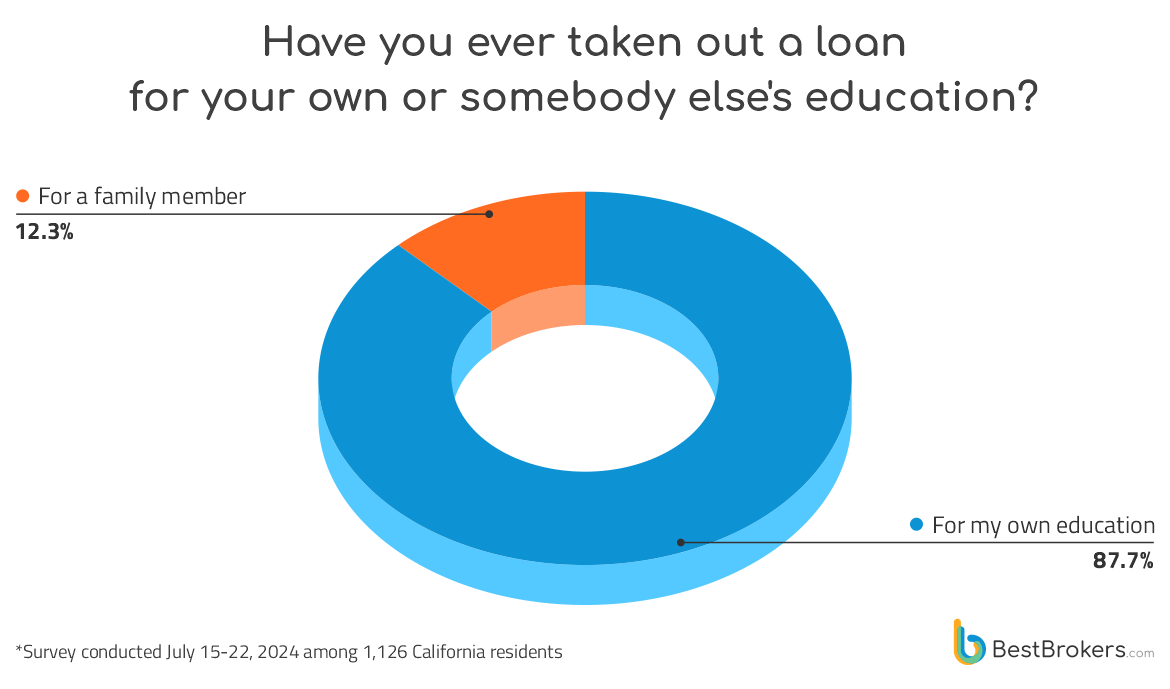

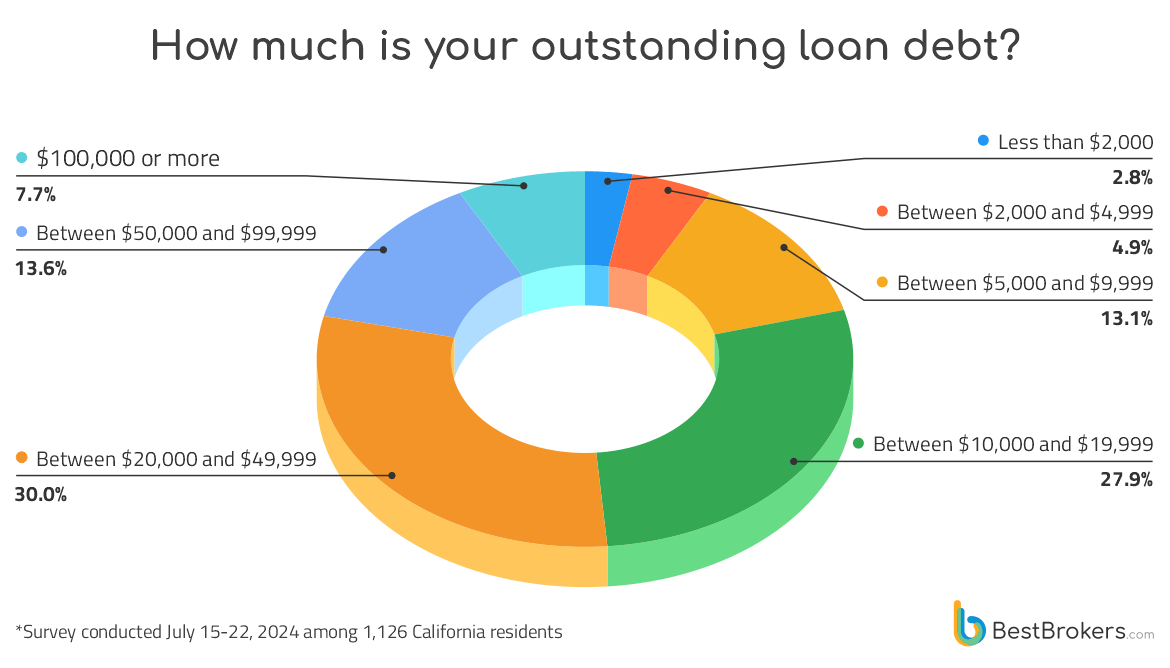

The answers from 1,126 Californians suggest that most people take loans for their own education and very few turn to this option when it comes to the school of their child or other family member. Most participants from our survey say they currently have a student loan debt balance of less than $50,000.

Approximately 30% owe between $20,000 and $50,000, whereas 20.78% say they owe less than $10,000. Another 7.73% have a student loan debt balance of $100,000 or more. Typically, such large amounts are accrued by those seeking a Master’s or Doctoral degree.

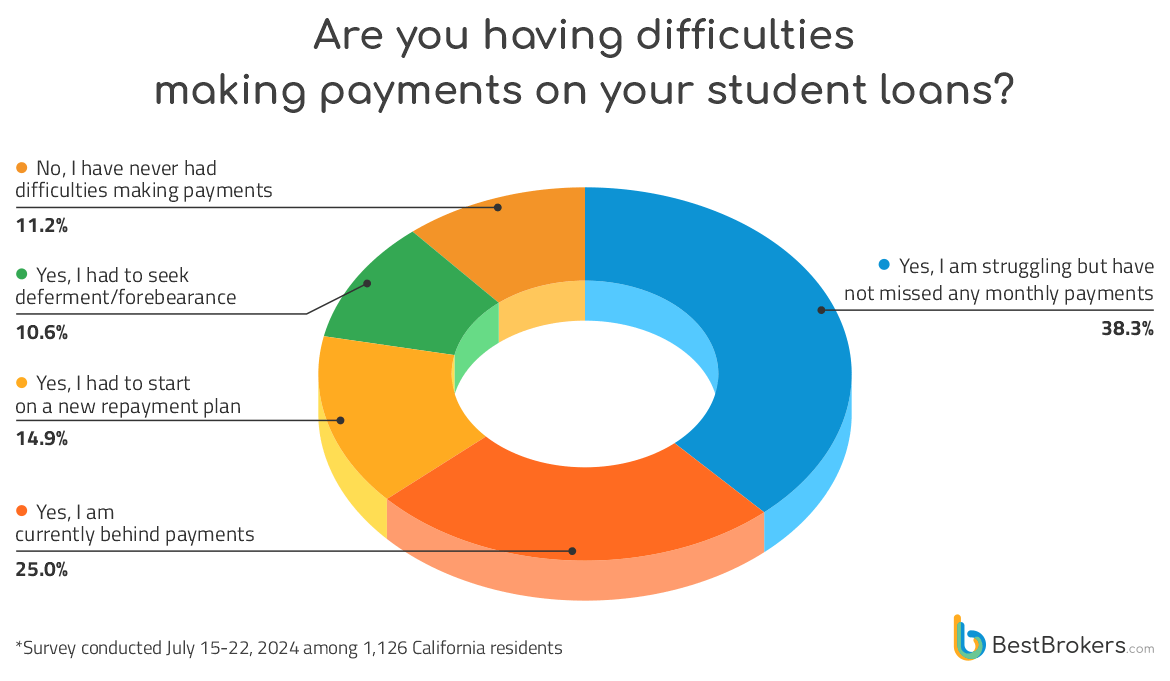

88.8% of People Struggling to Make Monthly Payments

Even average-sized student loan debt proves to be a heavy burden for many California residents. When asked whether they have had difficulties paying off their student loans, only 11.19% of survey participants say they have never had issues making the monthly payments. Another 38.28% say they are struggling but have never missed a monthly payment. A quarter of all respondents admit they are behind payments, while 14.9% had to start on a new payment plan.

Also, 10.57% of people say they had to seek forbearance, a temporary relief when the payment is suspended for a time. The other option available to those struggling to make regular payments is deferment and the difference between the two alternatives is that with forbearance, interest accrues on all direct loans. During a deferment, however, some loans remain unchanged as no interest is accrued.

Student Loan Debt Has Significantly Impacted Major Life Decisions

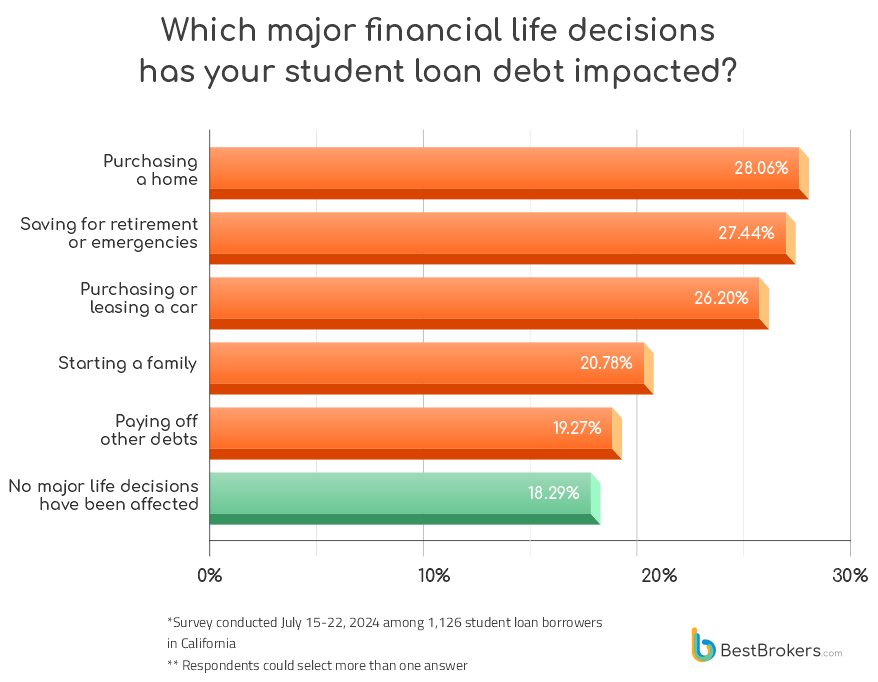

While for many, student loan debt is a difficult, yet possible obstacle to overcome, for some Americans, it has a huge impact on their financial well-being for years to come. We asked respondents how their student loan debt had affected their lives and finances and found that for a large part of survey participants, debt has delayed major life decisions such as starting a family (20.78%) and purchasing a home (28.06%).

More than a quarter of respondents (26.2%) say student debt has stopped them from buying a car, while 19.27% have, unfortunately, delayed paying off their other debts. This, of course, could cost them dearly, since student loans are among the few low-interest loans, whereas car leases, mortgages, and various types of consumer credit come with interest. For this question, respondents could choose multiple answers, as often, debt impacts more than one aspect of life. Out of all survey participants, only 18.29% say their student loan debt has had no impact on their life and finances.

More Than a Quarter of Respondents Had to Take Additional Loans

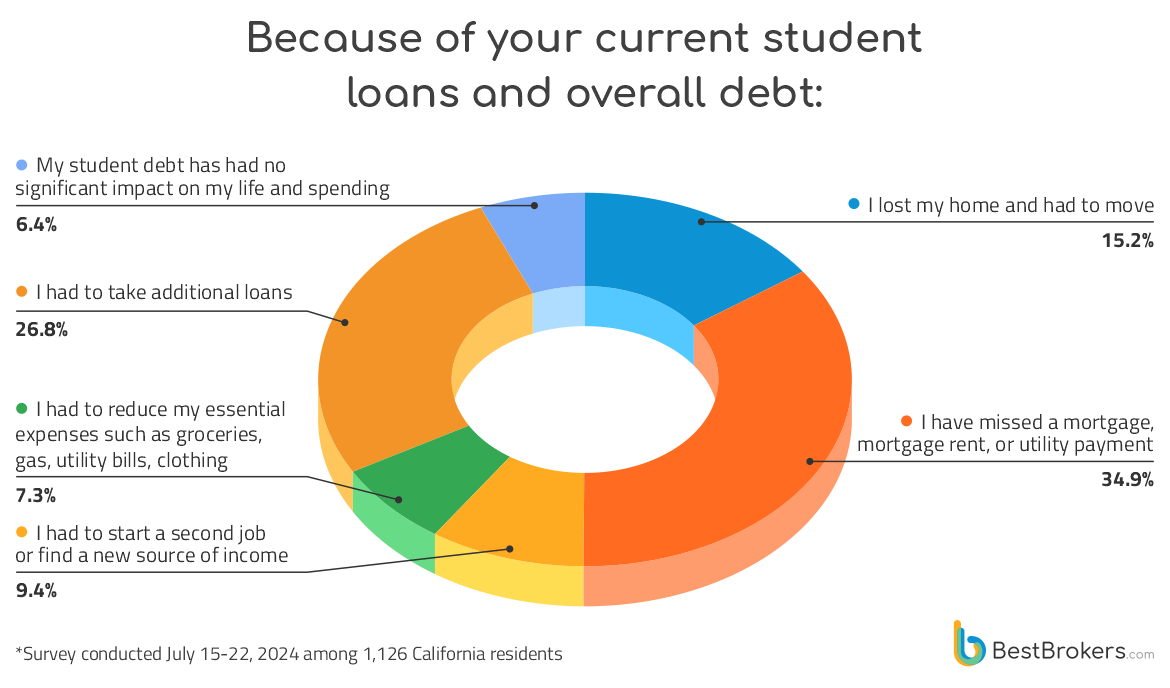

The increased cost of living in the past few years has affected many people in the U.S., mostly those from low and middle-income households. As one of the most expensive states, California has not been particularly welcoming for those with debt as student loan repayments take up a greater share of personal income. As a result of their student loan debt, 34.9% of participants in the survey say they have missed a mortgage, rent or utility payment.

An astounding 15.19% of respondents admit they have lost their home (due to missed mortgage and rent payments) and were forced to move. We could only imagine the profound impact not only on individuals but also on their entire families.

Around 9.4% of people say they had to start a second job or find another source of income in order to manage financially. Another 7.28% had to reduce essential expenses such as groceries, gas, clothing and even utility bills, while more than a quarter (26.82%) had to take additional loans to cover their expenses. Only 6.39% of people say that student loan debt has not affected their spending in any meaningful way.

Most People Stopped Paying Their Student Loan Debts during the Covid-19 Pandemic

There have been several instances when the federal government decided to provide relief to specific groups of borrowers such as public service workers. Since the first steps taken by the Biden administration, nearly $169 billion worth of student loan debt has been forgiven for millions of Americans.

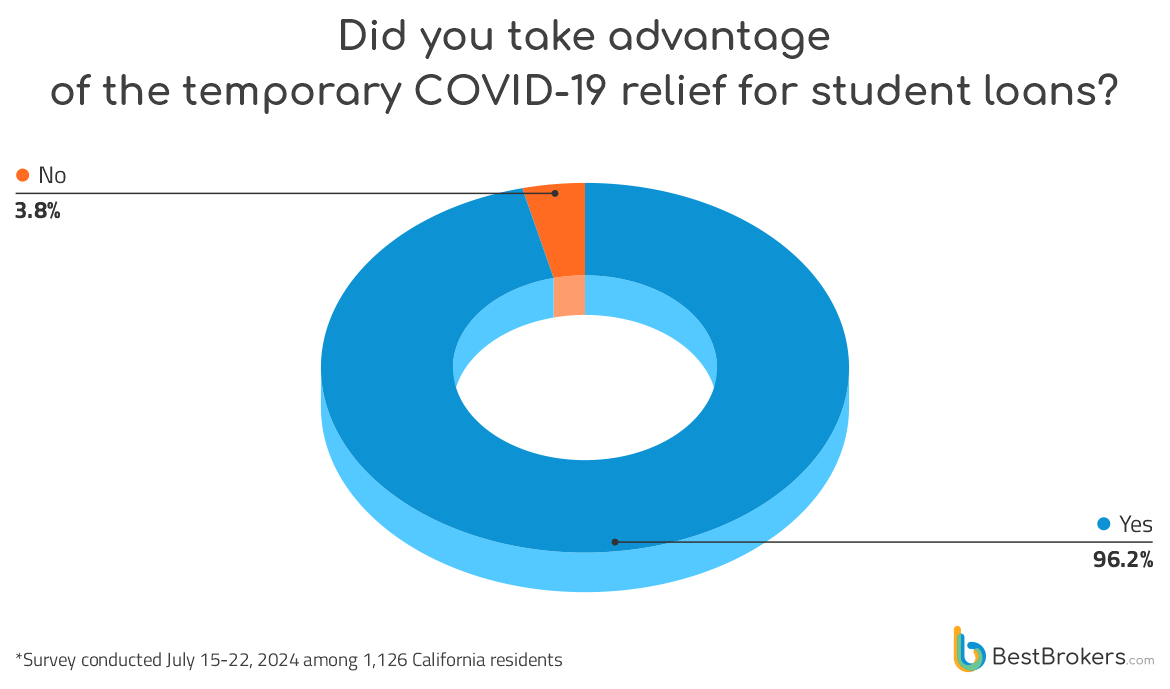

However, the temporary relief during the COVID-19 pandemic was probably the measure that reached the most people. It started in March 2020 and was extended several times, eventually coming to an end last fall. We asked survey respondents whether they took advantage of the temporary deferment and were quite surprised by the answers. An astonishing 96.18% of people turned to this option while only 3.82% continued to make monthly payments while the measure was in effect.

More Than Half of People Don’t Think Student Loans Are A Good Investment

Investing in yourself and your education has been important for previous generations and young people nowadays seem to agree as more and more Americans are taking student loans each year. However, those who are no longer in college seem to have a different opinion, with many maybe even regretting taking loans for their education.

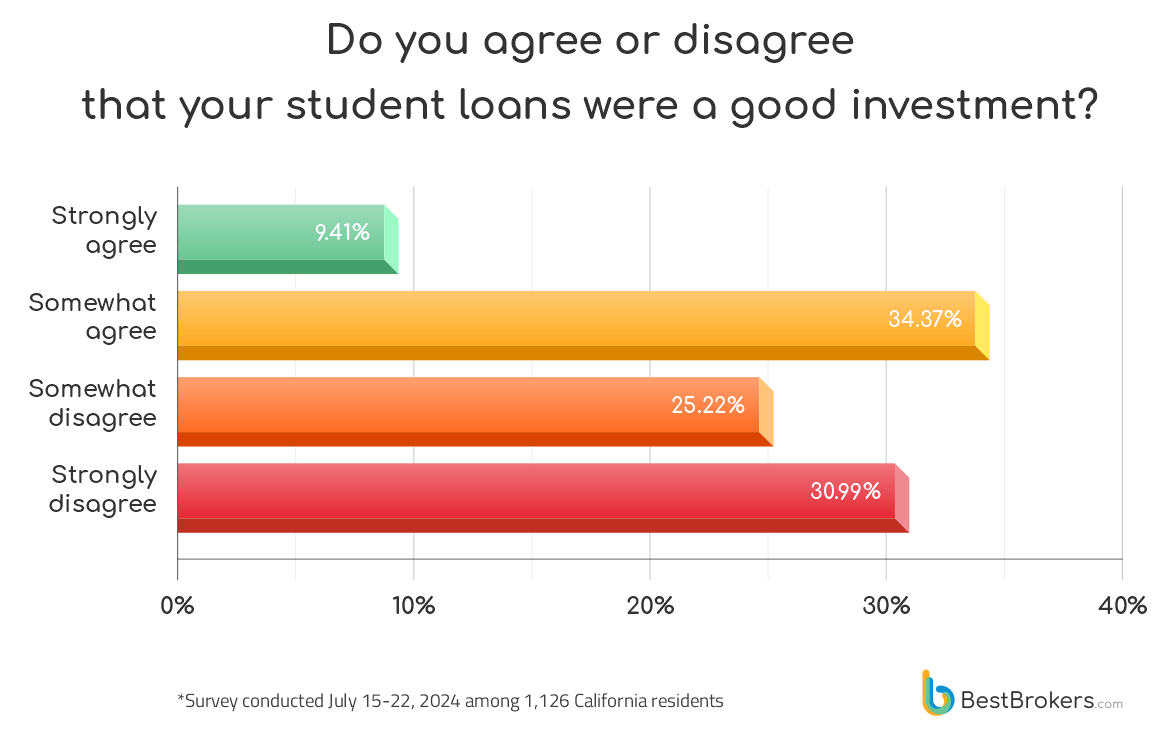

When asked whether they agreed or disagreed that their student loans were a good investment, only 9.41% of people said they “Strongly agreed” with the statement. More than 30% of survey participants, however, “strongly disagree” and believe they should not have put themselves into debt just to have a better education.

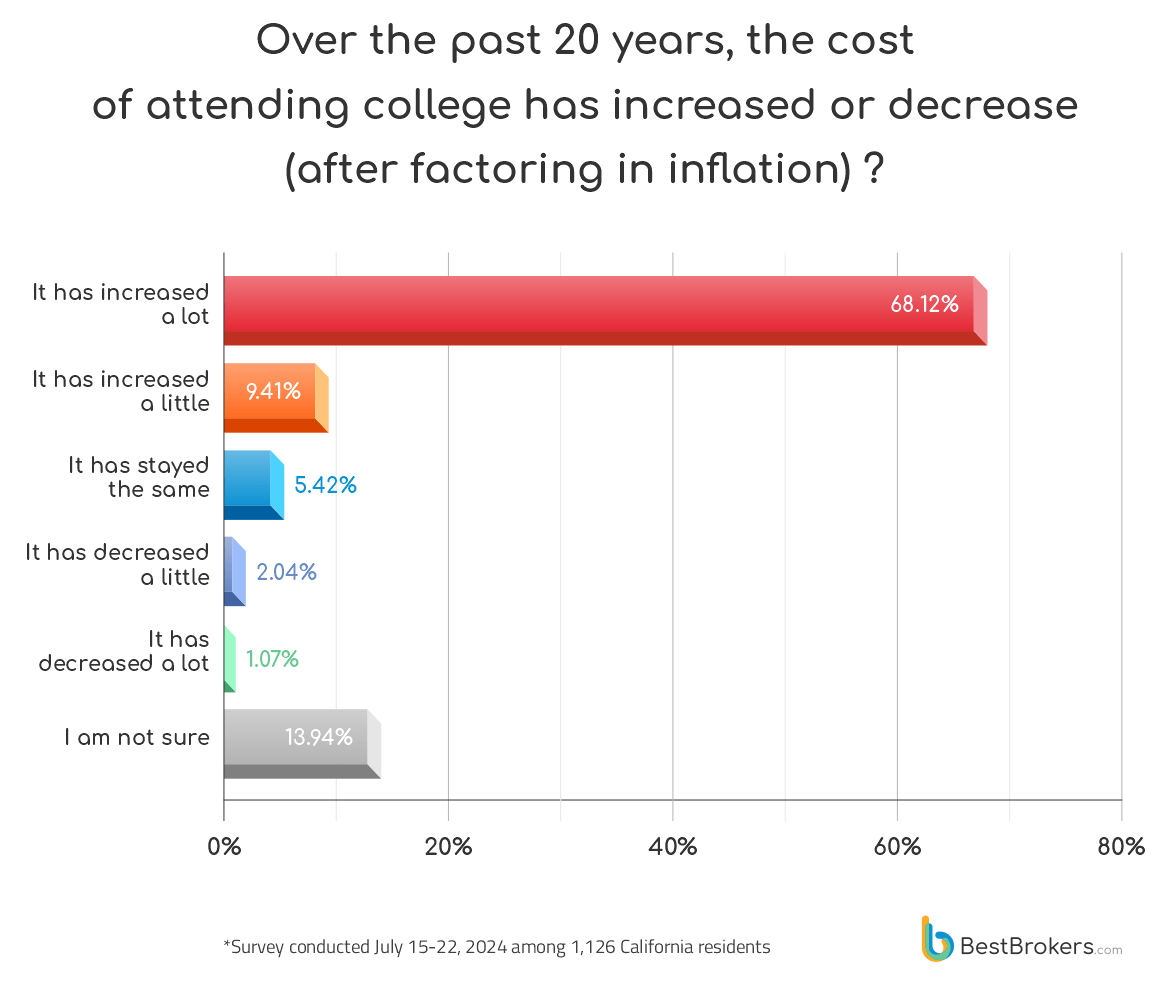

These regrets may also have something to do with the cost of education in the United States in recent decades. According to survey results, 68.12% of people think that over the past 20 years, the cost of attending college has increased significantly and another 9.41% believe it has gone up just slightly. A little over 3% of people think the cost of attending college, after factoring in inflation, has fallen down over the past couple of decades.

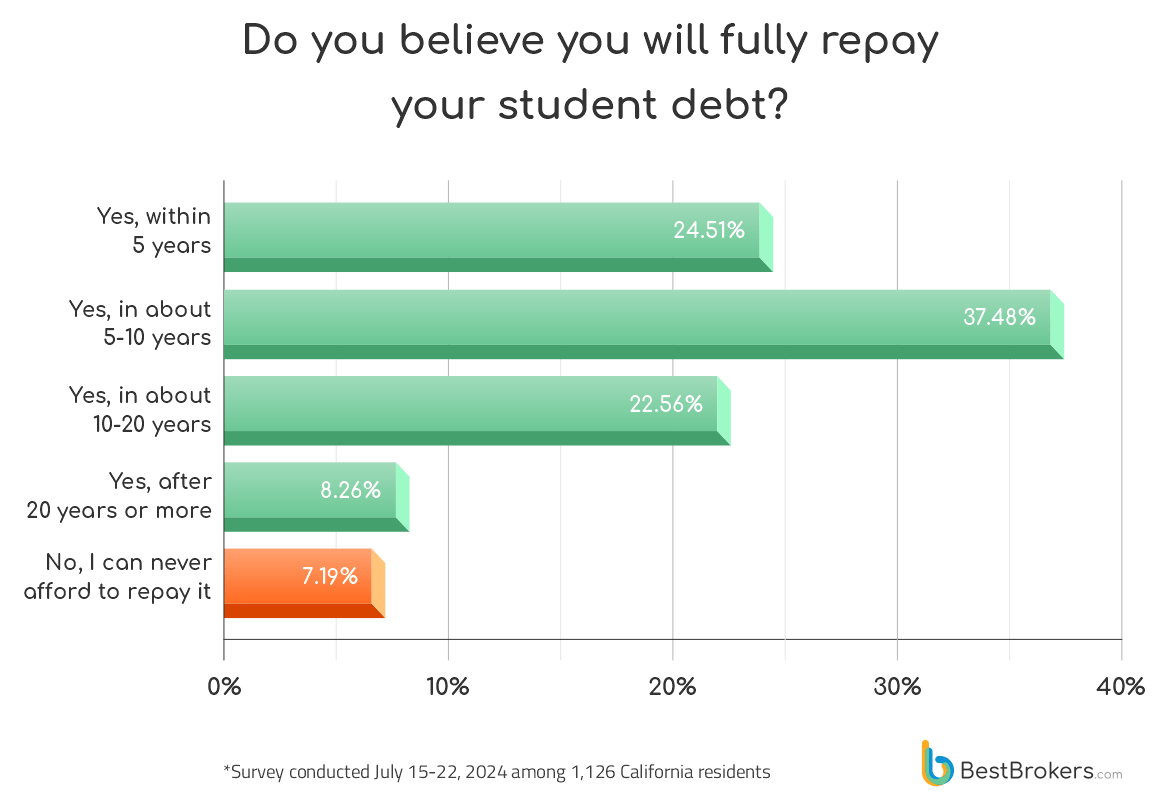

Despite the overall frustration with being in debt and the student loan system in the U.S. as a whole, many people are confident that they will be able to pay off the loans they took while studying. Approximately 24.5% of survey respondents believe they will be able to fully repay their student loan debt within 5 years. For another 37.48%, this period is between 5 and 10 years.

However, 22.56% of people say they will not be able to fully repay their education-related debts until after 10 or even 20 years from now. Some are even more pessimistic about their financial well-being in the future, saying they will pay off their student loan debt after 20 years or more. And for 7.19% of people, paying off their debt is simply impossible. They say they will never be able to afford that. Of course, this is just a snapshot of what American people think about the investment they have made into their education and is based on their current financial status and overall life situation.

Methodology

The survey was commissioned in early July by BestBrokers and was carried out by Marketschain between July 15 and July 22, 2024. It was conducted by phone among 1,126 respondents currently living in California. Survey participants are within the 22-27 age group and have taken student loans either for their own education or for the studies of a family member. All participants currently have outstanding student loan debt, deriving from either federal or private loans.

The survey included 10 questions, apart from those questions establishing whether the surveyed individuals met the criteria and wanted to participate. For each question, barring one, survey respondents had to select only one option – the answer that best described them or their situation. The only multiple-answer question (“Which major financial life decisions has your student loan debt impacted?”) allowed respondents to choose more than one option since many events and major decisions in life could be simultaneously affected by debt.