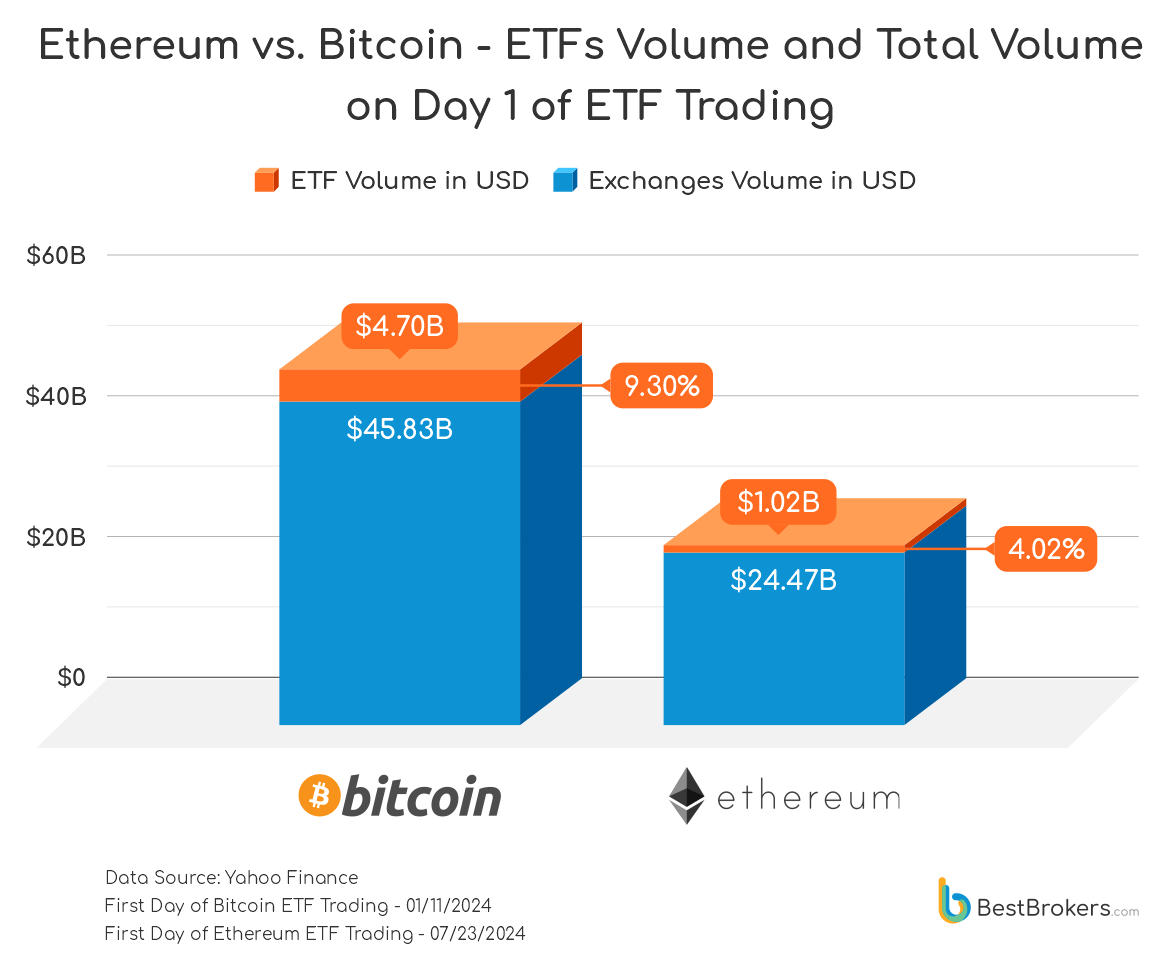

Yesterday we witnessed a historic debut of SEC-approved Ethereum ETFs and the total trading volume topped $1 billion. Although this is nowhere near the approximately $4.7B trading volume on Day 1 for Bitcoin ETFs, our team at BestBrokers decided to do further comparison between both crypto ETF debuts.

We compared the total traded amount of both ETH and BTC via ETFs and exchanges and it turns out while the launch was met with considerable interest, it didn’t quite match the fervor witnessed during Bitcoin’s ETF introduction earlier this year.

On its first day, the Ethereum ETF recorded a trading volume of $1.02 billion, making up 4.02% of Ethereum’s total trading volume of $25.49 billion across all exchanges and ETFs. In comparison, the Bitcoin ETF’s launch on January 11, 2024, saw a trading volume of $4.70 billion, representing a significant 9.30% of Bitcoin’s total trading volume of $50.53 billion.

The difference in performance indicates varying levels of market confidence and interest between the two leading cryptocurrencies. Bitcoin, the pioneer in the cryptocurrency space, continues to enjoy stronger institutional backing and market enthusiasm. Ethereum, while substantial, seems to be playing catch-up in the ETF market, possibly reflecting its evolving status among investors and ongoing developments within its ecosystem. We will have to collect more performance data for the Ethereum ETFs in the coming weeks and months to be able to see how Ethereum will match up against Bitcoin in the ETF space.

– commented Alan Goldberg, crypto analyst at BestBrokers.