With inflation slowing down in 2024, central banks in major economies have begun cutting interest rates, yet the cost of mortgages is still discouraging people from purchasing a home. However, home buyers in some countries benefit from low interest rates on house loans in combination with relatively high average income, whereas in struggling economies, purchasing a home is now nearly impossible for most.

Along with reducing the purchasing power of consumers, inflation affects the cost of both lending and borrowing, including mortgages. So, many analysts prefer tracking not only CPI (consumer price index, typically used to express inflation) but also the so-called “real” mortgage interest rates, i.e. mortgage interest rates when inflation is accounted for. Moreover, since prices and income vary significantly from one country to the next, the team at BestBrokers decided to compare property prices in different places but relative to the average earnings of local employees.

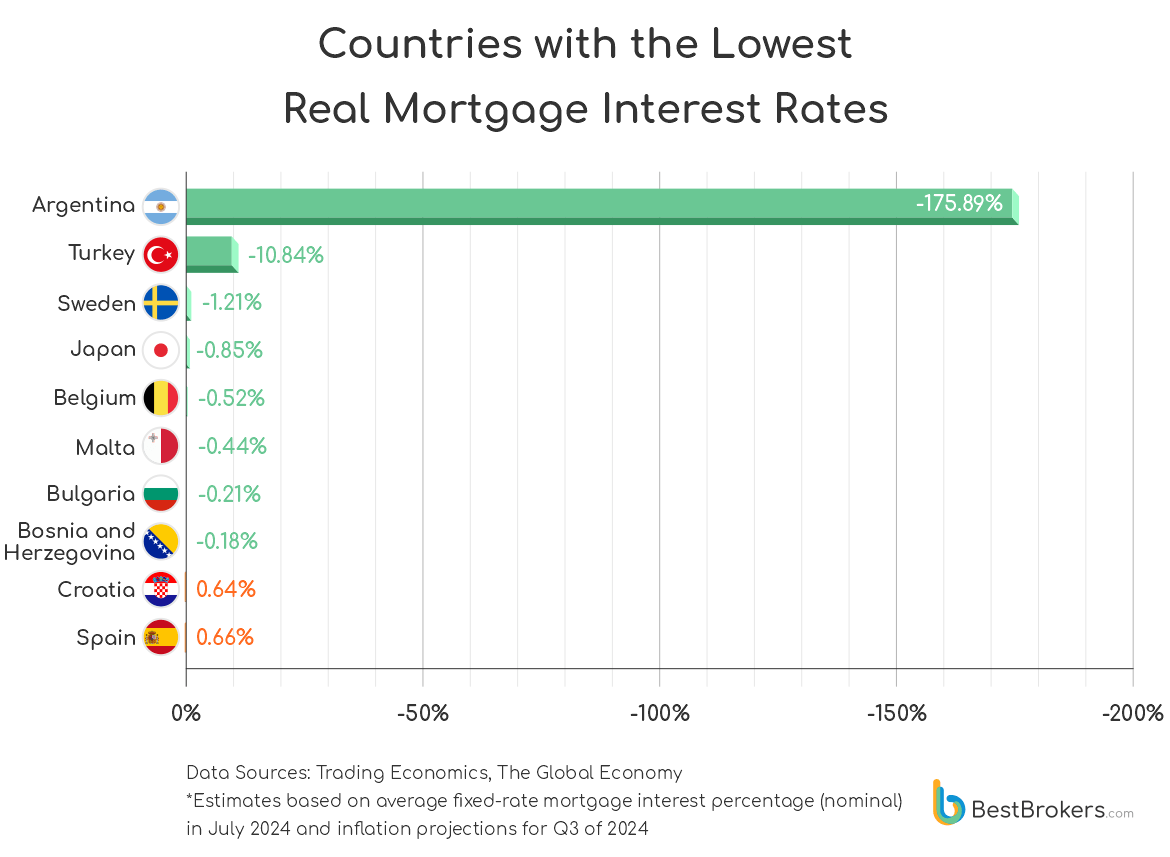

Using projected inflation rates for the third quarter of 2024, we calculated the ex-ante real interest rates of mortgage loans in 62 countries around the world. When the effect of inflation is removed, countries such as Sweden, Switzerland, and Spain end up with negative mortgage interest rates. Hyperinflation, however, leads to even more abnormal results, with Turkey now having a negative interest rate for mortgages of -10.84%, while the triple-digit annual inflation in Argentina has caused real mortgage interest of -175.89%.

What Are Real Mortgage Interest Rates?

The real interest rate for a mortgage is calculated as the difference between the nominal interest rate and the inflation rate. We subtract the inflation rate from the nominal mortgage rate, i.e. the interest rate set by the bank (either fixed or variable). The real mortgage interest rate reflects the true cost of funds for the borrower and the true yield for the lender.

In fact, eight out of the 62 countries we looked at have negative real rates. This does not suggest that homebuyers there would eventually pay no interest on their mortgage; rather, it shows that the true (versus nominal) cost of borrowing might have fallen.

Anomalies such as those seen in Argentina due to hyperinflation can have various long-term effects on the country’s broader economy. Although the South American nation entered a recession in January, it is now on the path of slow recovery under the new Milei government. In July, monthly inflation dropped to 4% from 4.6% in June, at least partially as a result of the reforms announced by economist-turned-president Javier Milei soon after he took office in December.

Why Ex-Ante?

The Latin phrase ex-ante translates as “before the event” and in finances and investing, it is used to describe future events based on forecasts as opposed to ex-post (“after the fact”). While ex-post analysis is factual and based on financial data and transactions, which have already been completed, ex-ante estimations are useful when making projections. In this report, we calculated the real interest rate for mortgages ex-ante based on the projected inflation rate for the current, third quarter of 2024 since the actual inflation rates for the period will not be published until the months of October or November for some countries.

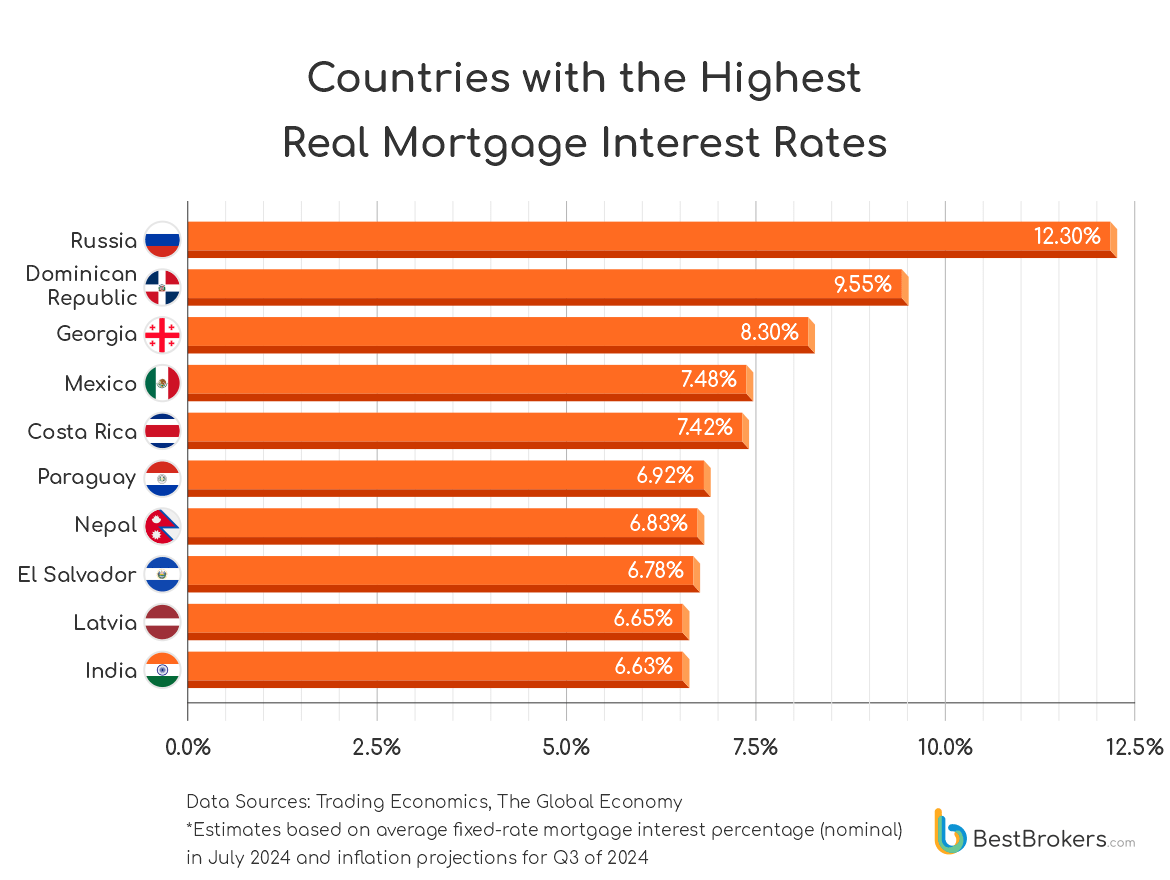

Real Mortgage Interest Rates in 2024 Are Higher in Developing Economies

Over the past couple of years, most home buyers around the world have been struggling with high interest on their mortgages on top of already sky-high home prices. Following the Covid-19 pandemic and the military conflict in Ukraine, real estate prices surged pushed by increased demand, supply shortages, and inflation. To tame record-high inflation, central banks increased basic rates, which had an almost universal cascading effect on lending, bringing mortgages to 30-year highs.

In the UK, the 2-year fixed rate reached 5.94% in September 2023; in the United States, the 30-year fixed-rate mortgage average peaked at 7.79% in October 2023. In South Africa, the average interest for mortgages is still very high; as of this June, it was 11.75%.

The nominal rate, however, does not always depict a realistic picture of the real estate market. When we look at the real mortgage interest, we see that the highest rates are in mostly developing countries such as the Dominican Republic where the average real rate is 9.55%, the highest among the countries we looked into. If we focus on the larger economies, however, we see Mexico in third place with a real mortgage rate of 7.48%, while South Africa ranks 9th with 6.55%. Indonesia is 11th on the list with a rate of 5.73%, followed by Brazil with a 5.55% real mortgage interest and Poland where it is 5.1%.

Meanwhile, with 3.98%, the United States is also among those with high real mortgage interest rates. The nominal rate for the 30-year fixed mortgage as of July 2024 is 6.78%, according to the latest Freddie Mac data.

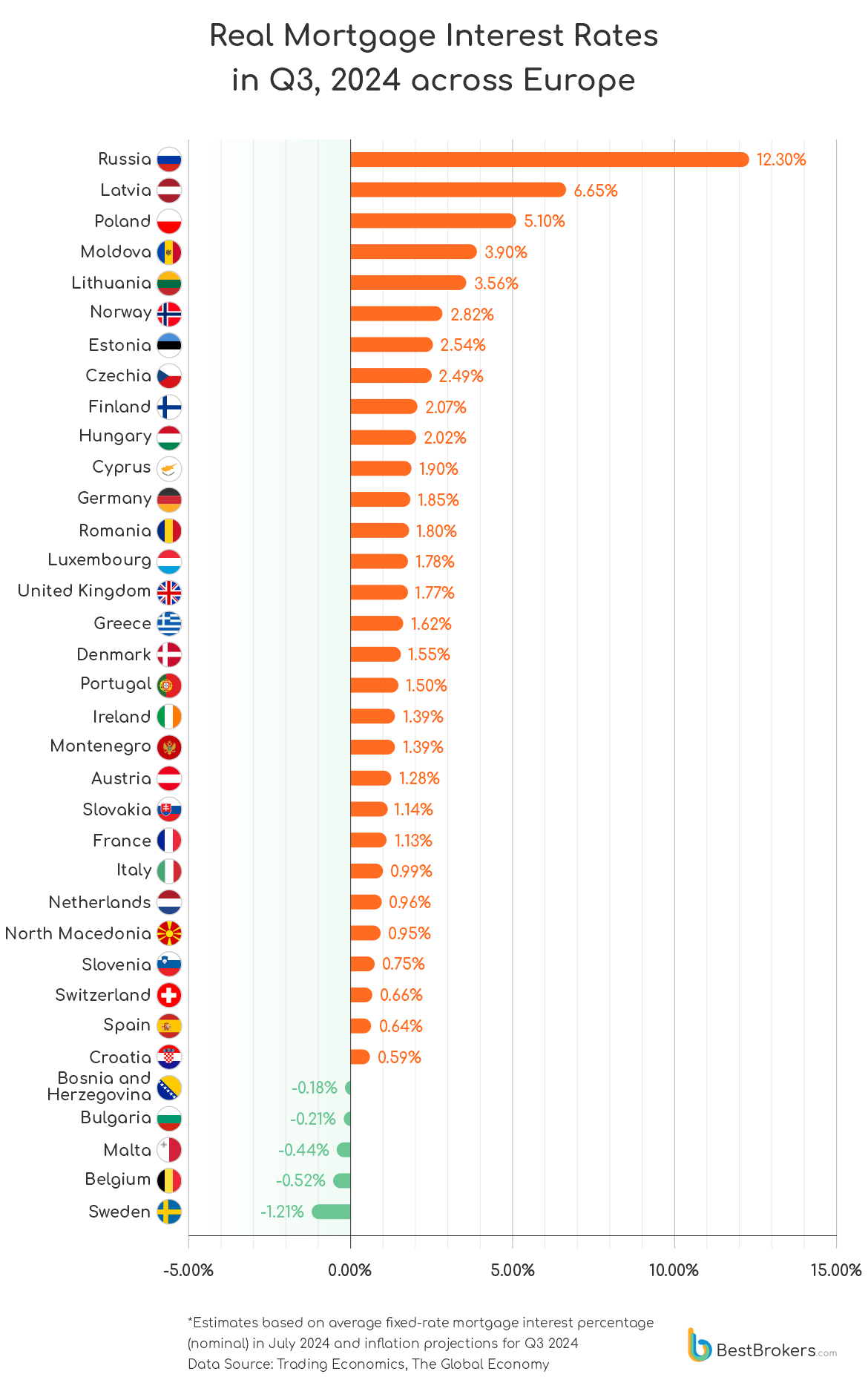

Huge Differences in Mortgage Rates Across Europe

Mortgages vary a lot from one country to another even if we take a look at European countries. Prompted by the Covid-19 pandemic, the Russian government introduced a preferential mortgage program with rates of up to 8% in 2020. The 1-year program not only supported the real estate market during the pandemic but also became popular among homebuyers and was extended until 2024. Following the invasion of Ukraine, the bank lending rate in Russia jumped to double-digit percentages, reaching 17.31% in May of 2024.

Meanwhile, on July 1, the state-backed mortgage program ended; in August, Sberbank, the largest bank in the country, announced its market mortgage rates would be raised. Borrowers can now expect minimum rates of 20%. For our comparison, we took a nominal mortgage rate of 20.3%, although the real rates offered by banks in September might already be much higher. At a projected inflation of 8% for the third quarter of 2024, the real mortgage rate now stands at 12.3%.

Other European countries with high real mortgage rates include Latvia at 6.65% and Poland at 5.1%, while the rate hovers around 1% in Austria (1.28%), Slovakia (1.14%), France (1.13%), Italy (0.99%), the Netherlands (0.96%), and North Macedonia (0.95%). Around the middle of the list, yet having reasonably low real mortgage rates, we see Luxembourg (1.78%), the United Kingdom (1.77%), Greece (1.62%), Denmark (1.55%), and Portugal (1.50%).

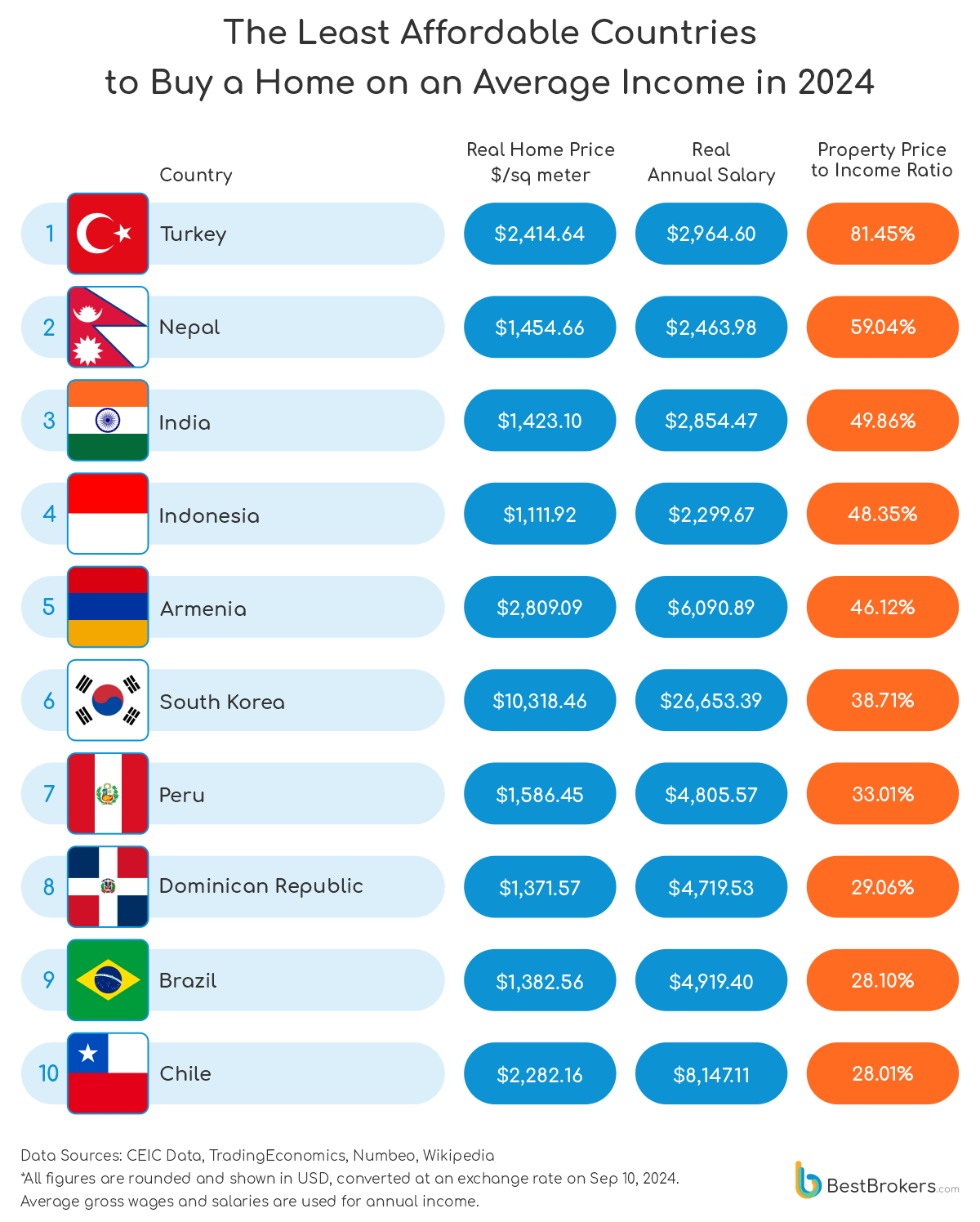

Home Affordability Around the World

Mortgages are just one of many concerns for those looking to purchase a home in 2024, with the actual price of the property being even more crucial when deciding whether to close on a deal or not. To compare home prices across different countries, we looked at the price per square metre (and per square foot) in U.S. dollars as of September 10 published by Numbeo. We also compiled income data from several sources in order to identify the countries with the least and most affordable homes relative to the average salary of employed people.

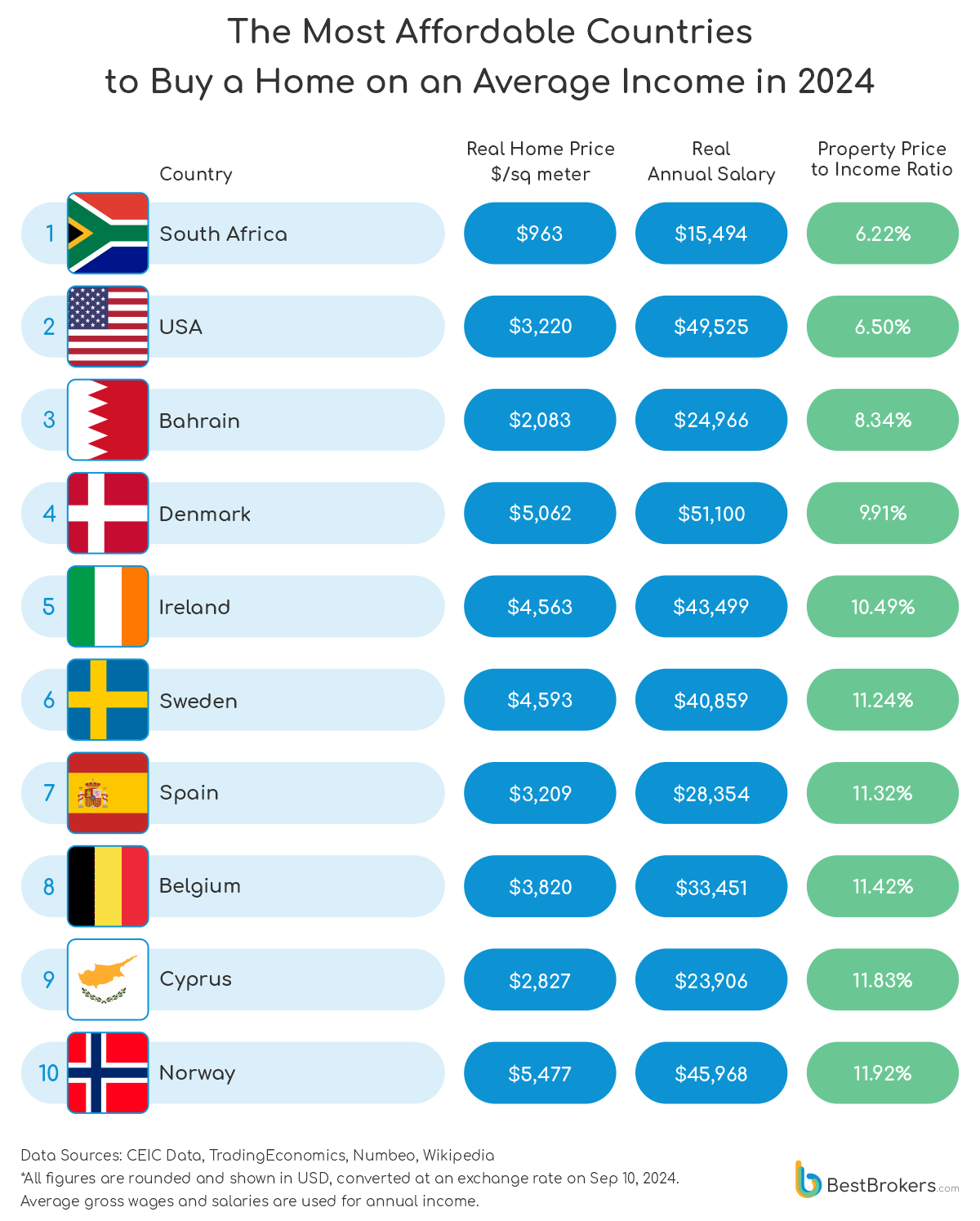

We calculated the real home price to real annual salary ratio and found that some of the most expensive residential properties are not in developed countries with high living standards but in smaller economies where the cost of homes might be low but so is the average income of residents. With a home price-to-income ratio of 81.45%, Turkey is the least affordable country to purchase a home in 2024.

Its top ranking is brought on mostly by its extremely high projected inflation rate of 55% year-over-year. This is not surprising considering that In June, annual inflation rose to 61.78%. The average monthly wage in the country is estimated at $549, which adds up to an annual salary of around $6,588. Due to the high expected inflation for the same period, however, the real salary drops to only $2,965.

Interestingly, South Korea appears among the countries where homes are the least affordable. It ranks 9th in this metric but not due to high inflation; the reason for its positioning is the extremely high real price of property ($10,318.46 per square metre) in comparison to the real income of residents, which is only $2,221 per month or $26,653 per year on average.

If we look at the most affordable countries, on the other hand, we see the United States surprisingly coming second after South Africa with a home price-to-income ratio of just 6.50%. Due to the high average annual salary of around $49,525 (in real terms), the fourth-highest on our list after only Switzerland, Denmark, and Australia, American home buyers have access to affordable housing compared to the rest of the world. Meanwhile, the U.S. ranks 29th in terms of real home prices, with an average of $3,220.11 per square metre, or $302.30 per square foot.

The rest of the countries on the list of affordable places for home buyers are mostly large economies or rich, high-GDP countries. South Africa tops the chart with a home price-to-income ratio of 6.22%, followed by the U.S. with 6.50%, Bahrain with 8.34%, and Denmark in with 9.91%.

We decided not to include Argentina in this ranking due to the hyperinflation. Because of it, the real monthly wage becomes negative (-$460) and the real property price-to-income ratio is anomalous -101%.

How Many Monthly Salaries Does a 100-sq-metre Home Cost Around the World?

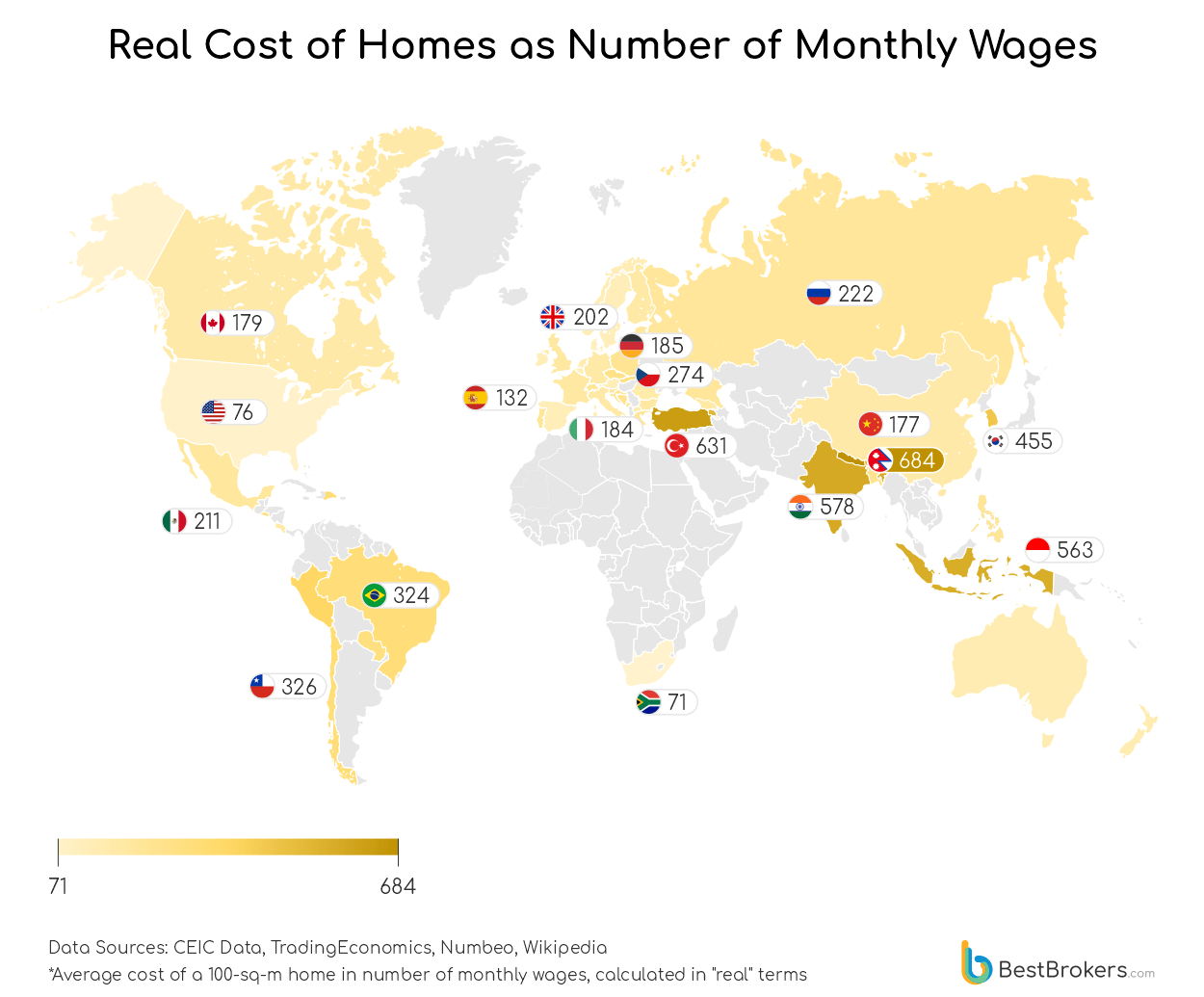

As shown above, South Africa and the United States emerge as the most affordable countries to buy a home out of the 62 nations analysed. Yet, with the current real estate prices, many Americans feel that they would never be able to afford a house and while this might be true in certain high-demand markets, it is not as universal when it comes to small towns. In reality, property prices vary a lot from one state to another; across cities, neighbourhoods, and counties.

So, if we look at home affordability in terms of monthly income, figures show that a 100-square-metre home (1,076 sq. ft.) in South Africa costs just 71 real monthly wages, while in the U.S. is around 76 average monthly wages. This is equivalent to roughly 6 years of annual salaries and is the best result out of all the countries we looked at.

The map shows that in other places, the same 100 square metres of residential property costs much more. Bahrain ranks third with homes costing 99 wages, followed by Denmark where residents would have to save their income for about 114 months in order to afford a home of this size.

At the other end of the spectrum, we see Nepal and Turkey where 100 sq. metres cost 684 and 631 real average salaries, respectively. This means that in Nepal, you would need 57 years’ worth of average income to buy a home of this size. In Turkey, it would require 52 years and six months of hard-earned wages. Let’s not forget, however, that these calculations are based on the real estimations for income and property prices (when inflation is accounted for). Also, huge variations may occur due to the use of average values.

Methodology

Comparing the mortgage rates around the world is really tricky. For this analysis, the team at BestBrokers decided to look at only interest rates for mortgages where the rates are fixed for a minimum of 5 years. Of course, for some countries, this means 10, 15, or even 30-year fixed rates. For Ireland, however, we found only an interest percentage for a rate fixed for over 3 years. For the majority of countries, official data from central banks or statistics agencies was available only as an average rate for all mortgages.

We also looked at the interest rates on new offers, rather than rates on outstanding loans (with a few exceptions, once again since different countries and banks use different statistics). Variable (floating) interest rates were not included in the calculations due to the variance in the conditions offered by banks. We sourced information from the following websites:

CEIC Data, IMF – Interest Rates, Inflation, Wages

TradingEconomics – Projected Inflation

Numbeo – Real Estate Prices

Talent.com – Tax Calculator

Wikipedia, Statista – Average Wages

As well as the official websites of multiple statistics agencies and governments.