The foreign exchange market, or forex for short, outpaces all other financial markets in terms of liquidity and achieved a record daily trading volume of over $7.508 trillion in April 2022, as data published by the Bank of International Settlements (BIS) revealed. Projections suggest the market will see further growth despite the negative impact of sociopolitical factors like the ongoing armed conflicts occurring in recent years.

There are currently 180 currencies in circulation across 195 countries. They combine to form around 2,500 currency pairs but a select few dominate the market in terms of demand, liquidity, and turnover. The EUR/USD pair reigns supreme, ranking first in daily trading volume (22.7% in April 2022) and market share, followed by other majors involving the US dollar.

The members of our team have crunched all key numbers on the forex pairs currently dominating the foreign exchange market and the currencies comprising them. We extracted data from trustworthy sources like BIS and IMF to deliver accurate and up-to-date information our readers can rely on. Here are several of the findings we uncovered during our exhaustive research.

Key Findings We Uncovered

- The average daily turnover of the forex market peaked at $7.508 trillion in the spring of 2022, marking a 14% increase from 2019.

- The EUR/USD snagged the title of the most traded currency pair in 2022, accounting for 22.7% of the average daily turnover of the market.

- The EUR/USD outstripped all currency pairs in terms of turnover, with a daily average of $1.71 trillion in 2022.

- The US dollar traded against the currencies of emerging economies (EME) like Brazil and South Africa accounted for 13.5% of average daily turnover in 2022.

- As many as 17 of the 20 most traded forex pairs involved the US dollar, which continues its dominance as the world’s most traded currency.

- The USD was on one side of 88.5% of all over-the-counter forex trades in April 2022.

- The Argentine peso is the least traded currency in the world, accounting for a 0% share of the global market with a meager average daily turnover of $1 billion.

- The USD/CNY experienced the greatest surge in daily trading volume as its average turnover per day rose by 83% in 2022.

- Foreign exchange swaps accounted for 50.7% of total daily turnover averages in 2022, followed by spot forex transactions.

- The UK has the highest daily forex turnover with a 38% share of the overall currency trading volume.

- Over 57% of the world’s foreign exchange reserves are held in US dollars.

- Global forex reserves in US dollars hit nearly $6.80 trillion in the third quarter of 2024.

- The Kuwaiti dinar is the currency with the highest value, whereas the Lebanese pound is the world’s weakest currency against the US dollar.

We derived the data featured in this article from the following sources:

- Bank for International Settlements (BIS)

- International Monetary Fund (IMF)

- Madison Trust Company

- Google Finance

- Central Bank Reports

FX Pairs Ranked by Turnover and Share of Overall Trading Volume

Data compiled for the triennial survey conducted by the Bank for International Settlements (BIS) reveals the EUR/USD secured the largest market share in terms of average daily forex trading volume in April 2022. The world’s most liquid currency pair outpaced other leading majors with a 22.7% share of the average daily turnover of the forex market. Then again, this is unsurprising as the pair involves the currencies of the two largest economies on a global scale, the United States and the European Union.

- USD/JPY Is Second Behind EUR/USD

The USD/JPY threaded on its heels with a 13.5% share, followed by the USD/GBP with a 9.5% share. The US dollar traded against the currencies of emerging market economies (EME) accounted for 13.8% of the market’s average turnover per day.

This was only to be expected as the US dollar consistently tops the list of the most traded currencies worldwide, as you shall see further on in this report. For clarification, the EME group comprises 26 emerging currencies, including BRL, PLN, RON, TRY, HUF, and CZK.

- Least Traded Currency Pairs in the Top 20

The EUR/CHF and USD/ZAR were the least traded pairs on the top-20 list during this period, each accounting for a meager 0.9% of the average daily turnover. The EUR/CHF, in particular, saw a nominal decrease of 0.2 percentage points compared to the previous BIS survey period in 2019 when its share amounted to 1.1%. By contrast, the volume share of USD/ZAR remained unchanged from 2019 to 2022 at 0.9%.

Leading FX Pairs Ranked by Share of Average Daily Trading Volume (April, 2022)

Source: Bank for International Settlements 2022 Survey

- EUR/USD Saw Nominal Decline in Average Daily Turnover

Despite its indisputable market dominance, the EUR/USD suffered a small decline as its average trading volume dropped by 1.3 percentage points in April 2022 compared to the previous survey period when the pair accounted for 24% of all daily forex transactions on average.

Increasing energy supply uncertainty and the rising energy prices as a result of the Russo-Ukrainian conflict are two possible explanations for this slight decline. In the meantime, the runner-up USD/JPY continued to perform solidly, witnessing an increase of 1.3 pp in average daily turnover, with its share rising from 12.2% in 2019 to 13.5% in 2022.

The share of the USD/GBP decreased negligibly by 0.1 pp, while that of the USD/CNY rose from 4.1% to 6.6% during this three-year period. This upturn extended to USD/CAD whose share increased from 4.4% to 5.5% for a 1.1-pp growth.

Leading FX Pairs Ranked by Share of Average Daily Trading Volume (April, 2019)

Source: Bank for International Settlements 2019 Survey

- Average Daily FX Turnover Rose by 14% in 2022

The average daily trading volume of the forex market peaked at a record $7.508 trillion in April 2022 across all currency pairs traded over the counter. While impressive in itself, this number corresponds to the lowest three-year growth rates in all but two triennial surveys conducted by BIS since 2004.

Total daily turnover increased by approximately 14% compared to the same period in 2019 when forex transaction volume stood at around $6.581 trillion. This somewhat underwhelming growth can be at least partially attributed to the pandemic-related constraints in China and its special administrative region Hong Kong, both of which classify as major players on the foreign exchange market.

- EUR/USD Daily Turnover Averaged $1.71 Trillion in 2022

FX Pairs Ranked by Average Amount Traded per Day (in bn USD)

Source: Bank for International Settlements 2019 and 2022 Triennial Surveys

As the graph above reveals, the relative ranking of the most traded currency pairs did not change significantly in 2022. As in previous years, the EUR/USD retained its dominance in the forex market, placing first in terms of average daily trading volume. Turnover in the EUR/USD reached an impressive $1.71 trillion per day in April 2022, up 7.6% from the previous survey period when it stood at around $1.58 trillion.

- USD/CNY Trading Volume Surged by 83%

Runner-up USD/JPY saw a 16.3% increase in average daily trading volume from 2019 with a turnover of $1.01 trillion. The USD/GBP placed third with $714 billion in turnover (↥13.3%), followed by the USD/CNY ($494 billion) and the USD/CAD ($410 billion). Out of the twenty most heavily traded currency pairs in 2022, the USD/CNY witnessed the most significant growth as its average daily turnover soared by 83% over this three-year period.

Other notable increases occurred in USD/SGD (↥53.6%), USD/CAD (↥42.9%), USD/CHF (↥29.1%), and USD/TWD (↥37.3%). Survey data indicates less traded pairs like USD/KRW and USD/MXN experienced a period of stagnation as their daily turnover only rose by 1.6% and 1%.

- USD/HKD Suffered the Steepest Decline

The most dramatic decline in trading volume was observed in USD/HKD whose average daily turnover sank by 15% between 2019 and 2022. Despite this downturn, the USD/HKD remained the 8th most traded currency pair globally, with an average daily turnover of $187 billion. Similar downswings in trading volume were observed in EUR/JPY (↧9.6%), USD/NZD (↧7.5%), EUR/CHF (↧6.8%), and USD/BRL (↧4.5%). All data considered, fifteen of the twenty most heavily traded pairs inhibited increases in average daily turnover in 2022.

Top 20 Most Traded Currencies by Market Share

The US dollar was officially crowned the world’s reserve currency in 1944 after the signing of the Brentwood Agreement in New Hampshire the same year. As a global reserve currency, the dollar is predominantly stable, stored in large quantities by central banks, and commonly used for international transactions.

- The USD – Undisputed King on the FX Scene

Considering its undisputed status as a global currency, it is hardly shocking the USD was involved in 17 of the 20 forex pairs with the highest average daily turnover in April 2022. The US dollar was on one side of 88.5% of forex trades during this period, seeing a trifling increase of 0.2 percentage points from the same month three years earlier.

- The EUR Suffers Decline in Market Share

The euro ranked as the second most traded individual currency regardless of pair, with a 30.5% share. However, its share of all forex trades declined by 1.8 pp from the previous BIS survey period. Third comes the yen as it participated in almost 17% of all forex trades, followed by the pound sterling with a 13% share and the yuan renminbi involved in 7% of all currency trades.

- The CNY Recorded Largest Market-Share Increase

While the sterling and the yen remained practically unchanged from the previous survey period, the CNY registered the most dramatic growth in terms of market share. The renminbi witnessed a 2.7 pp increase from April 2019 when it was on one side of 4.3% of all forex trades. It consequently climbed from the 8th place in the 2019 ranking to 5th place in 2022.

- CAD and SGD Global Turnover Also Rose Noticeably

The Canadian dollar (7th place in the top 20) and the Singaporean dollar (10th place) also witnessed noticeable increases from the previous survey period as their market shares rose by 0.6 pp and 1.2 pp, respectively. While securing the position of the 9th most traded currency, the Hong Kong dollar also suffered a considerable decline in global turnover, with its share falling by almost one whole percentage point in 2022. The Brazilian real and the Danish krone ranked as the two least traded currencies in the top 20, respectively participating in 0.9% and 0.7% of all trades in the global forex market.

| Most Traded Currencies Ranked by Share of Average Daily Volume | |||

|---|---|---|---|

| Currency | April 2022 | April 2019 | Triennial Change (in pp*) |

| US Dollar (USD) | 88.50% | 88.30% | ↥0.2 pp |

| Euro (EUR) | 30.50% | 32.30% | ↧1.8 pp |

| Japanese Yen (JPY) | 16.70% | 16.80% | ↧0.1 pp |

| Pound Sterling (GBP) | 12.90% | 12.80% | ↥0.1 pp |

| Chinese Yuan (CNY) | 7.00% | 4.30% | ↥2.7 pp |

| Australian Dollar (AUD) | 6.40% | 6.80% | ↧0.4 pp |

| Canadian Dollar (CAD) | 6.20% | 5.00% | ↥1.2 pp |

| Swiss Franc (CHF) | 5.20% | 4.90% | ↥0.3 pp |

| Hong Kong Dollar (HKD) | 2.60% | 3.50% | ↧0.9 pp |

| Singapore Dollar (SGD) | 2.40% | 1.80% | ↥0.6 pp |

| Swedish Krona (SEK) | 2.20% | 2.00% | ↥0.2 pp |

| South Korean Won (KRW) | 1.90% | 2.00% | ↧0.1 pp |

| Norwegian Krone (NOK) | 1.70% | 1.80% | ↧0.1 pp |

| New Zealand Dollar (NZD) | 1.70% | 2.10% | ↧0.4 pp |

| Indian Rupee (INR) | 1.60% | 1.70% | ↧0.1 pp |

| Mexican Peso (MXN) | 1.50% | 1.70% | ↧0.2 pp |

| New Taiwan Dollar (TWD) | 1.10% | 0.90% | ↥0.2 pp |

| South African Rand (ZAR) | 1.00% | 1.10% | ↧0.1 pp |

| Brazilian Real (BRL) | 0.90% | 1.10% | ↧0.2 pp |

| Danish Krone (DKK) | 0.70% | 0.60% | ↥0.1 pp |

*pp stands for percentage points. Source: Bank of International Settlements 2019 and 2022 Surveys

Top 20 Forex Currencies by Amount Traded

The US dollar reigns supreme over the OTC forex market as is to be expected from the world’s primary reserve currency. The USD outpaced all other currencies in terms of average daily turnover with a whopping $6.6 trillion ($6,639 billion) in April 2022. This number represents approximately a 14% increase from the same period three years earlier when the average amount of USD traded daily stood at the still-impressive $5.81 trillion.

The euro placed second with $2.29 trillion in daily turnover on average, followed by the yen with $1.25 trillion and the sterling with $968 billion. The yuan renminbi exhibited the biggest growth across this metric. The daily turnover of forex transactions involving the CNY increased by nearly 85%, jumping from $285 billion in 2019 to $526 billion in 2022.

As the currency of the second biggest economy on the planet, the yuan plays a vital role in the global financial markets. It is commonly traded against the currencies of other strong economies like the EU, the US, the UK, and Australia through majors and crosses like the EUR/CNY, USD/CNY, GBP/CNY, and AUD/CNY.

| Top 20 Currencies by Average Amount Traded per Day | |||

|---|---|---|---|

| Currency | April 2022 (in billion USD) | April 2019 (in billion USD) | Triennial Change (in %) |

| US Dollar (USD) | 6639 | 5811 | ↥14.2% |

| Euro (EUR) | 2292 | 2126 | ↥7.8% |

| Japanese Yen (JPY) | 1253 | 1108 | ↥13.1% |

| Pound Sterling (GBP) | 968 | 843 | ↥14.8% |

| Yuan Renminbi (CNY) | 526 | 285 | ↥84.6% |

| Australian Dollar (AUD) | 479 | 446 | ↥7.4% |

| Canadian Dollar (CAD) | 466 | 332 | ↥40.4% |

| Swiss Franc (CHF) | 390 | 326 | ↥19.6% |

| Hong Kong Dollar (HKD) | 194 | 233 | ↧16.7% |

| Singaporean Dollar (SGD) | 182 | 119 | ↥52.9% |

| Swedish Krona (SEK) | 168 | 134 | ↥25.4% |

| South Korean Won (KRW) | 142 | 132 | ↥7.6% |

| Norwegian Krone (NOK) | 125 | 119 | ↥5.0% |

| New Zealand Dollar (NZD) | 125 | 137 | ↧8.8% |

| Indian Rupee (INR) | 122 | 114 | ↥7.0% |

| Mexican Peso (MXN) | 114 | 111 | ↥2.7% |

| Taiwan New Dollar (TWD) | 83 | 60 | ↥38.3% |

| South African Rand (ZAR) | 73 | 72 | ↥1.4% |

| Brazilian Real (BRL) | 66 | 71 | ↧7.0% |

| Danish Krone (DKK) | 55 | 42 | ↥31% |

Source: Bank for International Settlements

As many as 17 of the 20 most traded currencies exhibited increases in average daily turnover, with the HKD, NZD, and BRL being the sole exceptions to the positive trend. Out of the three, the Hong Kong dollar had it the worst as its average trading volume per day sank by almost 17% over this three-year period, dropping from $233 billion to $194 billion in April 2022.

How Are the Most Popular Currency Pairs Traded?

Forex swaps accounted for the largest share of all over-the-counter forex transactions, attracting 50.7% of the average daily turnover in 2022. With forex swaps, the parties involved in transactions agree to borrow one currency and lend another at the same time. This is different from currency swaps where counterparties privately agree to exchange two currencies at a predetermined price at a later date, as opposed to spot trading where transactions are settled immediately, i.e. “on the spot”.

Share of Different Instruments in Average Daily FX Turnover

Source: BIS 2022 Survey

Spot transactions secured the second place with a 28% share of the global forex turnover, representing a decline of two percentage points from the previous three years. Outright forwards placed third with a 15.5% share, followed by forex options with 4.1% and currency swaps with 1.7%. Here is a more detailed breakdown of the turnover each instrument generated.

| Average Daily Turnover Breakdown by Forex Instrument (in bn USD) | |||

|---|---|---|---|

| Instrument | April 2019 | April 2022 | Change |

| Forex Swaps | 3203 | 3810 | ↥19% |

| Spot Trades | 1987 | 2104 | ↥5.9% |

| Outright Forwards | 999 | 1163 | ↥16.4% |

| Options | 298 | 304 | ↥2% |

| Currency Swaps | 108 | 124 | ↥14.8% |

Forex Swap Turnover of 10 Leading Currencies

Foreign exchange swaps accounted for nearly 51% (up 2 pp from 2019) of all over-the-counter currency transactions, with the ten most heavily traded currencies contributing around 92% of the overall average trading volume for this instrument. The top performer across this metric is no other than the world’s reserve currency, the US dollar, whose share of total forex swap turnover stood at 45.4% in 2022.

Important Note: Before we proceed further, we should specify that the figures featured in the chart below account for trading volume in both directions (long and short) as each forex trade involves two currencies (base and quote). Hence, the turnover of the ten leading currencies is twice the overall reported turnover.

The US dollar generated $3.46 trillion in daily swap turnover on average for a 45.4% share. Swaps with a seven-day maturity or less accounted for around $2.5 trillion of the overall trading volume for this instrument. This goes to show short-term swaps remain the most popular option among market participants looking to hedge their risk and increase their forex liquidity.

With this instrument, traders are left with a long position in one currency in a pair and a short position in the second currency. By contrast, USD swaps with a maturity exceeding half a year accounted for $89.4 billion of the instrument’s total average turnover per day. As much as $1.90 trillion of the USD swap turnover passed through local and cross-border dealers, followed by financial institutions like banks and hedge funds, whose trading volume for the USD against all other currencies amounted to $1.45 trillion.

Non-financial market participants like retail traders, for instance, generated around $115 billion of the total average swap turnover per day. The euro ranked second with $1.26 trillion and a 16.6% share of the overall amount. The pound sterling placed third with $560 billion, followed by the yen and the Canadian dollar with $557 billion and $252 billion, respectively.

Average Daily Turnover of FX Swaps in 2022, by Currency (in bn USD)

Source: BIS Triennial Survey Across 1,300 Banks Institutions from 52 jurisdictions (2022)

Spot Forex Transactions Turnover of 10 Leading Currencies

In April 2022, the ten most heavily traded currencies generated a combined average turnover of $3.741 trillion per day, accounting for approximately 88.9% of the overall trading volume from spot transactions on the forex market. For clarification, spot trading involves buying or selling currencies with immediate settlement and physical delivery in most cases.

One thing to keep in mind is that the data below corresponds to the volume of each individual currency when traded against all other currencies. As you can see, the US dollar snagged the largest share of the spot market with an average daily volume of $1.81 trillion. This impressive figure represents around 42.9% of the overall turnover of spot transactions involving the US dollar.

Another major reserve currency, the euro, secured the second place across this metric with a 14.6% share and $616 billion in average turnover per day as of April 2022. The yen, sterling, and yuan ranked third, fourth, and fifth, with $439 billion (10.4%), $231 billion (5.5%), and $175 billion (4.2%), respectively. The Singaporean dollar and Hong Kong dollar lagged behind as they generated an average of $56 billion and $45 billion in turnover per day for 1.3% and 1.1% shares of the overall trading volume of spot forex transactions.

Currencies’ Average Daily Turnover in Spot Transactions April 2022 (in bn USD)

Source: BIS Survey (2022)

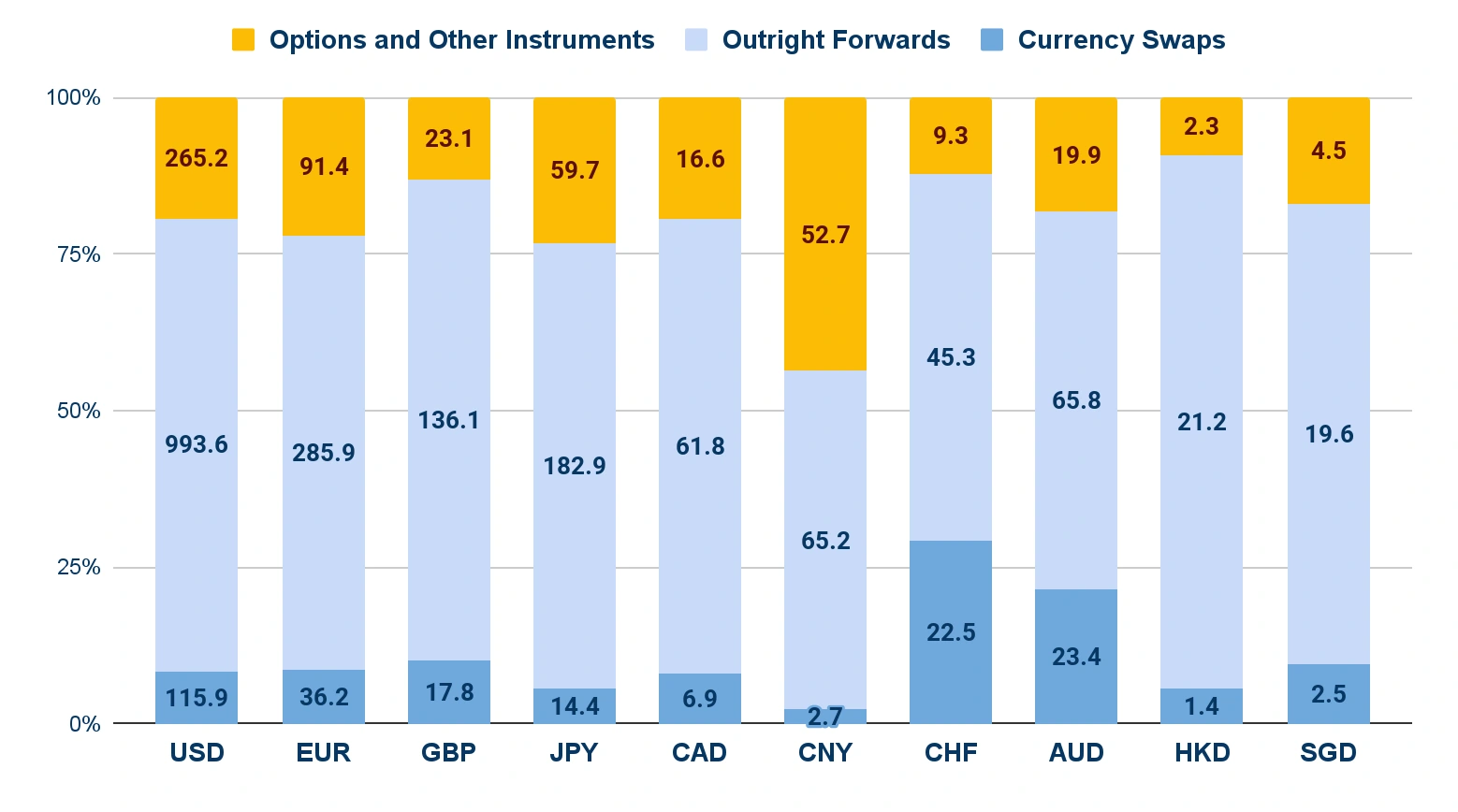

Leading Currencies Turnover for Other Financial Instruments

The ten most traded currencies recorded combined daily averages of $244 billion for currency swaps, $1.88 trillion for outright forwards, and $545 billion for options and other financial instruments. Currency swaps are characterized by their longer maturity period compared to forwards and foreign exchange swaps, resulting in a lower daily trading volume for this instrument. Again, we remind you that volumes in the chart below correspond to twice the reported turnover since all forex trades involve two currencies.

When traded against all other currencies, the USD once again outpaced all other top performers as it exhibited daily averages of $994 billion for outright forwards, $116 billion for currency swaps, and $265 billion for options. The euro and the yen recorded the second highest trading volumes across these instruments, boasting a combined daily turnover of $414 billion and $257 billion, respectively.

The Hong Kong dollar trailed behind all other currencies in the top 10 as it generated a turnover of $24.9 billion in total. As many as $21.2 billion of this total came from outright forwards, followed by HKD options with $2.3 billion and currency swaps with $1.4 billion in turnover.

Average Daily Turnover of Top 10 Currencies for Other Instruments (in bn USD)

Source: BIS Triennial Survey Results (2022)

Major Currency Pairs Turnover by Instrument

Turning our attention to individual forex majors, we see that the EUR/USD outperformed other key pairs both in terms of total daily averages and turnover from individual instruments. The pair, which pitches the euro against the US dollar, recorded roughly $1.71 trillion in average daily turnover, with foreign exchange swaps accounting for the largest share (58.8%) of the EUR/USD trading volume with $1 trillion.

This marks a 9.6% increase from the previous survey period when forex swaps for EUR/USD stood at $913.8 billion. Increases from 2019 occurred in all other instruments involving the EUR/USD pair, including spot transactions (↥0.6%), outright forwards (↥9.5%), currency swaps (↥52.1%), and options (↥5.7%). This impressive performance makes sense, considering the euro and the dollar represent the two most buoyant economies in the world.

The US dollar and the yen are among the most traded currencies globally, so understandably their pair recorded the second-highest turnover in four out of five instrument groups. Forex swaps in USD/JPY accounted for 47% of the pair’s overall daily turnover, rising by 10% from $432.6 billion in 2019 to $475.6 billion in 2022. The GBP/USD outpaced the USD/JPY in currency swap turnover but recorded lower daily averages for all other financial products.

The NZD/USD was the least traded among the seven major pairs, with daily averages of $49 billion for forex swaps (↥0.8% from 2019), $29.4 billion for spot transactions (↧23.3%), and $12.3 billion for outright forwards (↧5.1%). Options and currency swaps in the 14th most liquid pair accounted for a meager 8.6% of the NZD/USD daily turnover, with a combined volume of $8.5 billion.

| Daily Turnover Averages of Major Pairs in 2022 by Instrument (in bn USD) | ||||||

|---|---|---|---|---|---|---|

| Pair | Spot | Forwards | FX Swaps | Currency Swaps | Options | Total |

| EUR/USD | 418.8 | 192 | 1002 | 31.2 | 61.1 | 1705 |

| USD/JPY | 349.7 | 122.1 | 475.6 | 13.4 | 52.6 | 1013 |

| GBP/USD | 158.7 | 86.7 | 438.6 | 15.3 | 14.2 | 714 |

| USD/CHF | 59.2 | 31.9 | 193.5 | 2 | 6.3 | 293 |

| AUD/USD | 110 | 47.7 | 185.3 | 23.2 | 14.5 | 381 |

| USD/CAD | 109.4 | 43.5 | 237.5 | 6.2 | 13.5 | 410 |

| NZD/USD | 29.4 | 12.3 | 49 | 5 | 3.5 | 99 |

Source: BIS Triennial Survey 2022

Countries with Highest Currency Trading Volumes

Survey data from BIS indicates that most of the average daily turnover in currency trading comes from major financial hubs with busy forex markets. Financial centers like the UK, USA, Hong Kong, Singapore, and Japan accounted for approximately 78% of all forex trades in 2022. The UK snagged the largest share of the forex market as it generated 38.1% of the total daily average turnover.

The country witnessed a decline of 5 percentage points from the previous survey period when its share stood at 43%. The US ranked second with a 19.4% share of the overall daily averages (up 17% from 2019), followed by Singapore (9.4%), Hong Kong (7.1%), and Japan (4.4%). Greece, Portugal, Argentina, Bulgaria, Romania, and Peru were the countries with the smallest contribution to the total average turnover per day, with shares of less than 0.1%. The average daily trading volume of these underperformers range from $1 billion to $3 billion.

Countries with Largest Shares of Average Daily Forex Turnover (April 2022)

Source: BIS Triennial Survey (2022)

Daily turnover averages in the countries with the largest shares remained relatively unchanged from the previous survey period. In 2022, the United Kingdom generated an impressive amount of $3.76 trillion in average trading volume per day, securing the first place in the ranking. This figure marks a 5% increase from 2019 when the country’s turnover stood at $3.58 trillion. The latest data published by the Bank of England reveals the UK recorded average daily forex turnover of $3.35 trillion in April 2024. While this marks a 14% increase from October 2023, it also corresponds to daily turnover decreases of 6.4% and 10.9% from 2019 and 2022, respectively.

The United States placed second in terms of daily turnover with an average of $1.91 trillion, up 39.6% from $1.37 trillion in 2019. Looking at the latest results of the semi-annual survey of the New York Foreign Exchange Committee (FXC), we see that the US experienced a considerable decline in daily forex turnover, which dropped by around 39% from $1.91 trillion in April 2022 to $1.165 trillion in April 2024. Singapore, Hong Kong, and Japan ranked third, fourth, and fifth with $929 billion, $694 billion, and $433 billion, respectively. Check the graphic below for the full list of countries that made it to the top 10.

Top 10 Countries with Highest Daily Average for Currency Trading (in bn USD)

Source: BIS Triennial Surveys (2019 and 2022)

In 2022, the UK was also the country with the biggest turnover for the EUR/USD as its trading volume for this pair averaged $1.02 trillion per day, representing an increase of 1% from three years earlier. For comparison, EUR/USD generated an average daily turnover of $795 billion in April 2024 (down 22% from April 2022). The United States secured the second spot with $435 billion in average daily turnover for this pair, followed by France with $110 billion, Singapore with $109 billion, and Switzerland with $101 billion.

Nine countries in the top 10 exhibited increases in trading volume for the world’s most liquid currency pair. Japan was the sole exception as its average daily turnover for the EUR/USD declined by 20.2% from $34.6 billion in 2019 to $27.7 billion in 2022. The Netherlands witnessed the largest spike in EUR/USD turnover during this three-year period, with daily averages rising by 86.3% from $24 billion to $44.7 billion.

EUR/USD Daily Turnover Averages by Country (in bn USD)

Source: BIS Triennial Surveys (2019 and 2022)

Least Traded Forex Pairs and Currencies

After examining the top performers in the forex market, we figured it would be interesting to turn our gaze to the other side of the spectrum and have a quick look at some of the least traded currencies in the forex market. These are typically the national currencies of countries with emerging or underdeveloped economies like Bulgaria, Argentina, and Peru, as you can see in the chart below. Russia is one exception as it is often grouped either among developed or developing countries, depending on the classification parameters used.

Least Traded Currencies by Averages Daily Trading Volume in 2022 (in bn USD)

Source: Bank of International Settlements 2022 Survey

Each of these currencies accounts for zero percent in terms of total market share, hence the absence of this parameter in the chart above. Another thing worth noting is that BIS has grouped currencies with an even smaller average daily turnover in a separate category dubbed ‘other currencies’. As you can see, the Argentine peso (ARS) tops the list with a paltry OTC turnover of $1 billion, followed by the Bulgarian Lev (BGN) with $2 billion, and the Bahraini Dinar (BHD) with $3 billion.

The ruble, ringgit, and Colombian peso share the same average turnover of $14 billion per day, according to the BIS survey. The ruble is a special case, however, as it suffered the most dramatic triennial decline out of all ten currencies featured above as a result of the armed conflict between Russia and Ukraine.

The average daily turnover of the ruble dipped by 80.6%, plummeting from $72 billion in 2019 to a negligible $14 billion for the last BIS survey period. Of course, this was to be expected considering the overarching sanctions imposed by NATO member states on the world’s largest country.

BIS stopped receiving data from Russian authorities at the end of February 2022, which also significantly impacted results for the ruble. By contrast, the ringgit and the Colombian peso saw increases in average daily turnover of 40% and 16.7% compared to 2019. The Philippine peso and the Saudi riyal ranked as the 9th and 10th least traded currencies, each with a turnover of $18 billion.

Least Traded Forex Pairs by Average Daily Turnover (in bn USD)

Source: Bank for International Settlements 2019 and 2022 Triennial Surveys

Turning our gaze to specific currency pairs, we see that crosses like EUR/CZK, JPY/CHF, JPY/ZAR, JPY/NZD, and EUR/HUF were the five least traded pairs based on average daily turnover. All of them combined accounted for a meager 1.3% of the total trading volume in 2022. The euro against the koruna had it worse as it not only stagnated during this three-year period but also attracted the lowest turnover ($2 billion) of the five. The euro against the forint suffered the most dramatic decline as its average daily turnover plummeted by 27.3% over this triennial period.

Currencies with Largest Foreign Exchange Reserves

Now that we discussed the world’s leading currency pairs, we shall examine how different currencies measure against each other in terms of foreign exchange reserves. Forex reserves consist of foreign currencies and other financial assets like gold owned by central banks and national monetary authorities. Countries use them to maintain their financial stability and engage in international trade, among other things.

- Over 57% of Global Forex Reserves Are Held in USD

Most countries worldwide hold their reserves in USD due to its enormous liquidity, although other strong currencies like the pound sterling, the euro, the yuan, and the yen are also used. Unsurprisingly, over 57% of the global forex reserves are held in the US dollar, followed by the euro with around 20.02%, the yen with 5.82%, and the sterling with 4.97%.

Leading Currencies by Share of Global Forex Reserves (Q3 2024)

Source: International Monetary Fund

- Global USD FX Reserves Amounted to $6.80 Trillion in Q3 2024

Diving deeper into IMF data, we see that foreign exchange reserves in the US dollar increased from around $6.67 trillion in Q2 of 2024 to $6.80 trillion in Q3 of the same year, representing nominal 1.8% quarter-on-quarter growth. Despite remaining the world’s dominant foreign exchange currency, the greenback has been experiencing a gradual downturn as its share in global forex reserves declined by more than 10 percentage points over the last two decades.

Most of the leading currencies saw increases in reserve claims, with the Canadian dollar exhibiting the most significant hike of 5.8% during this period. The Swiss franc saw a notable quarter-on-quarter decrease of 11.6%. The franc remains the currency with the smallest share of allocated foreign exchange reserves ($19.82 billion in claims). The euro secured the second spot across this metric with $2.37 trillion in claims, followed by the yen with $689 billion and the pound sterling with $589 billion.

Allocated Foreign Exchange Reserves by Currency Q2/Q3 2024 (in bn USD)

Source: International Monetary Fund

Strongest Currencies against the US Dollar

The US dollar dominates the forex market in terms of trading volume but this by no means makes it the world’s strongest currency where value is concerned. You will perhaps find it surprising but certain fiat currencies outshine the greenback in value. Often pegged to the dollar, such currencies are in high demand and have strong exchange rates relative to the dollar. In other words, one needs several US dollars to purchase a single unit of such currencies.

The Kuwaiti dinar (KWD) serves as a great example, ranking as the highest-value currency in the world. At the time of publication, a single Kuwaiti dinar is valued at 3.24 US dollars. To put it another way, a single dollar can buy you 0.31 Kuwaiti dinars.

Four of the highest-value currencies are used in countries located within the Middle East, characterized by stable economies driven by oil production and export. Kuwait and Bahrain, in particular, have earned the status of major financial hubs in the Middle East. Here are all ten currencies outstripping the USD in terms of value.

| Currency | Exchange Rates* | Pegged to USD | |

|---|---|---|---|

| Kuwaiti Dinar (KWD) | 1 KWD = 3.24 USD | 1 USD = 0.31 KWD | Yes** |

| Bahraini Dinar (BHD) | 1 BHD = 2.65 USD | 1 USD = 0.38 BHD | Yes (since 1980) |

| Omani Rial (OMR) | 1 OMR = 2.60 USD | 1 USD = 0.38 OMR | Yes (since 1973) |

| Jordanian Dinar (JOD) | 1 JOD = 1.41 USD | 1 USD = 0.71 JOD | Yes (since 1995) |

| Pound Sterling (GBP) | 1 GBP = 1.29 USD | 1 USD = 0.77 GBP | No |

| Gibraltar Pound (GIP) | 1 GIP = 1.29 USD | 1 USD = 0.77 GIP | Yes (to GBP) |

| St. Helena Pound (SHP) | 1 SHP = 1.29 USD | 1 USD = 0.77 SHP | Yes (to GBP) |

| Cayman Dollar (KYD) | 1 KYD = 1.20 USD | 1 USD = 0.84 KYD | Yes (since 1974) |

| Swiss Franc (CHF) | 1 CHF = 1.13 USD | 1 USD = 0.88 CHF | No |

| Euro (EUR) | 1 EUR = 1.08 USD | 1 USD = 0.92 EUR | No |

*The exchange rates are accurate as of the time of writing. Minor fluctuations are possible over time.

**KWD is pegged to a basket of several currencies. Sources: Google Finance, Madison Trust Company

Weakest Currencies against the US Dollar

Now that we examined the world’s strongest currencies, let’s take a gander at the currencies on the other side of the spectrum. These are the national currencies of countries plagued by economic stagnation, budget deficits, soaring debt, and hyperinflation. Some have experienced periods of prolonged armed conflicts and civil unrest, resulting in currency devaluation and financial distress. Looking at their currencies’ exchange rates against the dollar really makes one feel rich.

Iran is a prime example, ranking as the country with the second weakest currency on a global scale. The depreciation of the Iranian rial is so monstrous that the currency virtually has no value. A single US dollar is equal to 42,100 Iranian rials and historical data suggest this has been the case for at least five years back.

Only the Lebanese pound eclipses the rial in terms of depreciation, with one US dollar equaling a whopping 89,561 LBP, as you can see in the table below. According to Reuters, Lebanon’s currency has lost approximately 98% of its value since the country experienced a crippling financial crisis in 2019.

Another factor that contributed to the Lebanese pound’s depreciation was the country’s piling debt following a civil war that lasted for over twenty years. The Lebanese government’s unwillingness to adequately address the issue and work toward recovery only made matters worse. Other weak currencies that made this unenviable ranking include the Vietnamese dong, the Sierra Leonean Leone, and the Laotian Kip.

| Currency | Exchange Rates* | Inflation Rates (November 2024) | |

|---|---|---|---|

| Lebanese Pound (LBP) | 1 LBP = 0.000011 USD | 1 USD = 89,561 LBP | Data unavailable |

| Iranian Rial (IRR) | 1 IRR = 0.000024 USD | 1 USD = 42,100 IRR | 29.50% |

| Vietnamese Dong (VND) | 1 VND = 0.000039 USD | 1 USD = 25,620 VND | 3.50% |

| Sierra Leonean Leone (SLL) | 1 SSL = 0.000044 USD | 1 USD = 20,970 SLL | 18.00% |

| Laotian Kip (LAK) | 1 LAK = 0.000046 USD | 1 USD = 21,715 LAK | 23.70% |

| Indonesian Rupiah (IDR) | 1 IDR = 0.000063 USD | 1 USD = 15,906 IDR | 2.50% |

| Syrian Pound (SYP) | 1 SYP = 0.000080 USD | 1 USD = 13,002 SYP | Data unavailable |

| Uzbekistan Som (UZS) | 1 UZS = 0.000077 USD | 1 USD = 12,983 UZS | 9.40% |

| Guinean Franc (GNF) | 1 GNF = 0.00012 USD | 1 USD = 8,672 GNF | 10.20% |

*Exchange rates are listed for illustrative purposes and are subject to change. Sources: Google Finance, Madison Trust, International Monetary Fund (Inflation Rates)