AvaTrade Account Types in Brief

European customers under the CySEC entity benefit from a standard retail account enabling commission-free forex trading with CFDs. Minimum spread costs for this account type range from 0.9 to 350 pips, depending on the currency pairs you trade. The minimum trade size is 0.01 lots or 1000 currency units. Onboarding clients can connect their newly registered retail accounts to MT4 or MT5.

Setting up a professional account is another option for CySEC customers provided they meet the eligibility criteria. These include sufficient trading activity within the past year, relevant experience in finance, and a financial portfolio exceeding €500,000.

Professional accounts offer lower spreads from 0.6 pips for major pairs and maximum leverage of 1:400. This account type is restricted to customers residing in specific countries, including Sweden, Germany, Spain, Bulgaria, France, Italy, Portugal, Poland, Denmark, and the UK.

Alternatively, clients who cannot pay or receive interest due to their religious beliefs can apply for Islamic accounts that enable swap-free trading in forex, gold, silver, and indices. Leveraged positions can remain open for up to five days without incurring overnight charges (swaps). The accounts are available in a demo format and offer negative balance protection.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

AvaTrade Minimum Deposit Requirements

The minimum deposit at AvaTrade is €100 or the equivalent in another supported base currency like GBP, USD, or AUD. With this in mind, the broker recommends onboarding customers to deposit at least €1,000 for effective trading. New traders can top up their live balance with credit/debit cards and wire transfers.

E-wallets like Neteller, WebMoney, and Skrill are available to customers from select countries. AvaTrade charges a €50 inactivity fee after three uninterrupted months of non-use. Clients with dormant accounts incur additional administrative charges of €100 after 12 successive months of inactivity.

What Can You Trade with AvaTrade Live Accounts

AvaTrade clients can trade over 1,200 financial markets, including 50+ currency pairs, indices, commodities, stocks, cryptocurrencies, and options. All trading costs are built into the spreads, which start from 0.9 pips for retail customers. The range of supported trading platforms includes MetaTrader 4, MetaTrader 5, DupliTrade, WebTrader, and AvaOptions. The last two are proprietary. AvaSocial, also proprietary, enables copy trading.

Step-by-Step Registration at AvaTrade – Takes Approximately 20 Minutes in Total

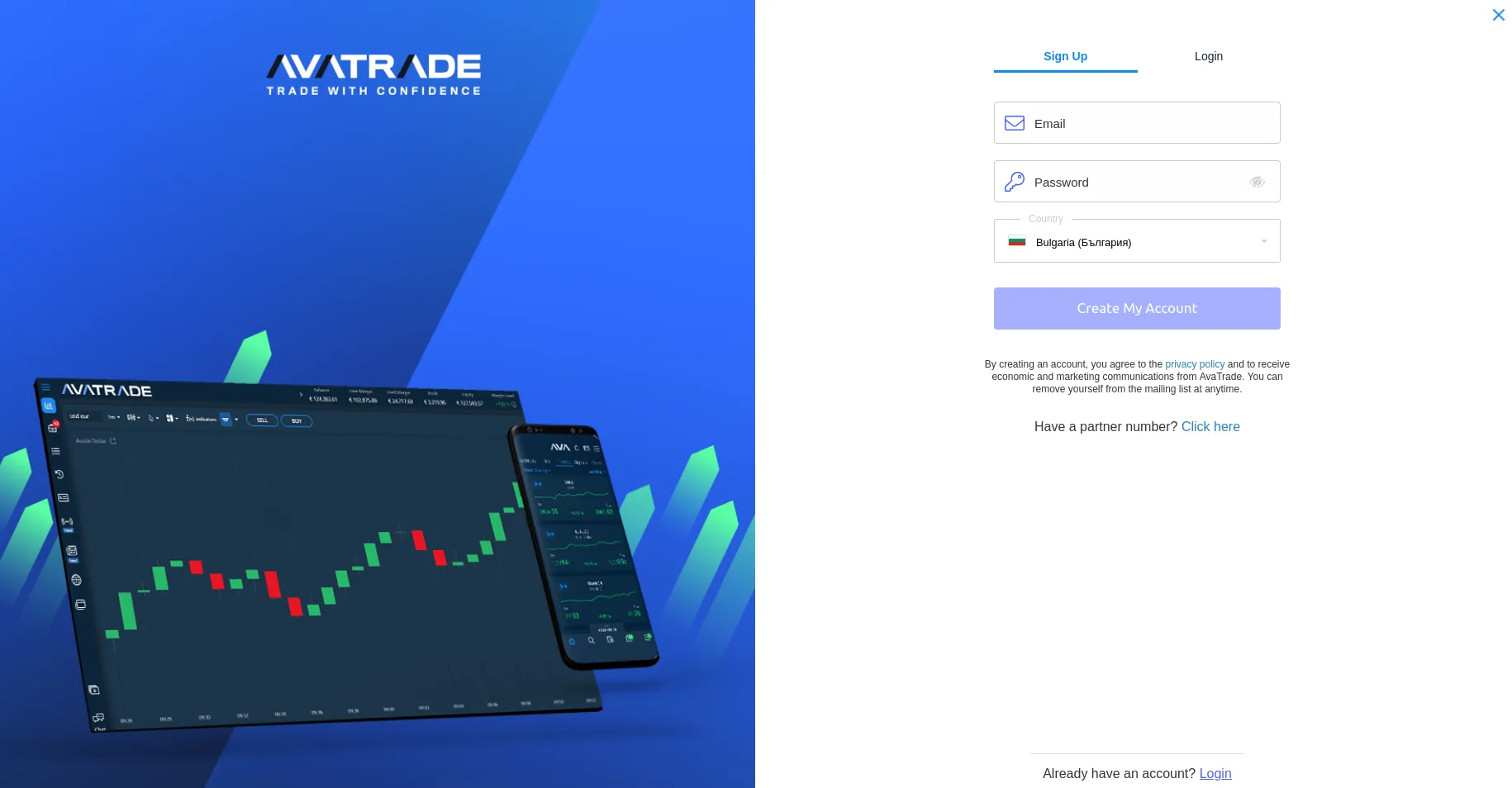

Navigate to www.avatrade.com and click or tap the orange Register Now button in the top right corner of your screen.

-

Provide a valid email address registered in your name, select a strong password, and pick your country from the dropdown menu.

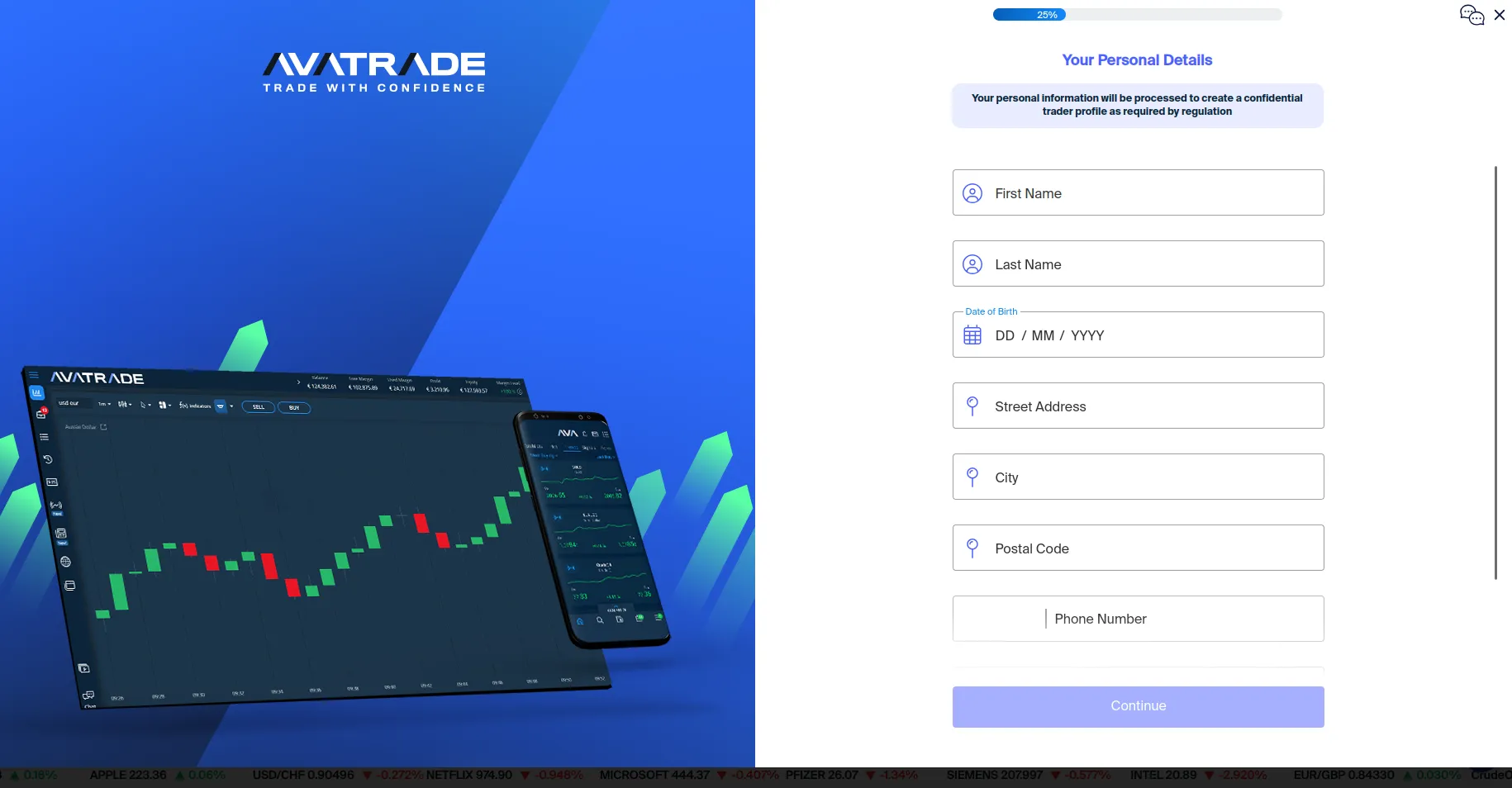

- Type your personal details in the registration form, including your first and last name, birth date, street address, city, and postal code. Provide a valid mobile number and continue to the next step.

-

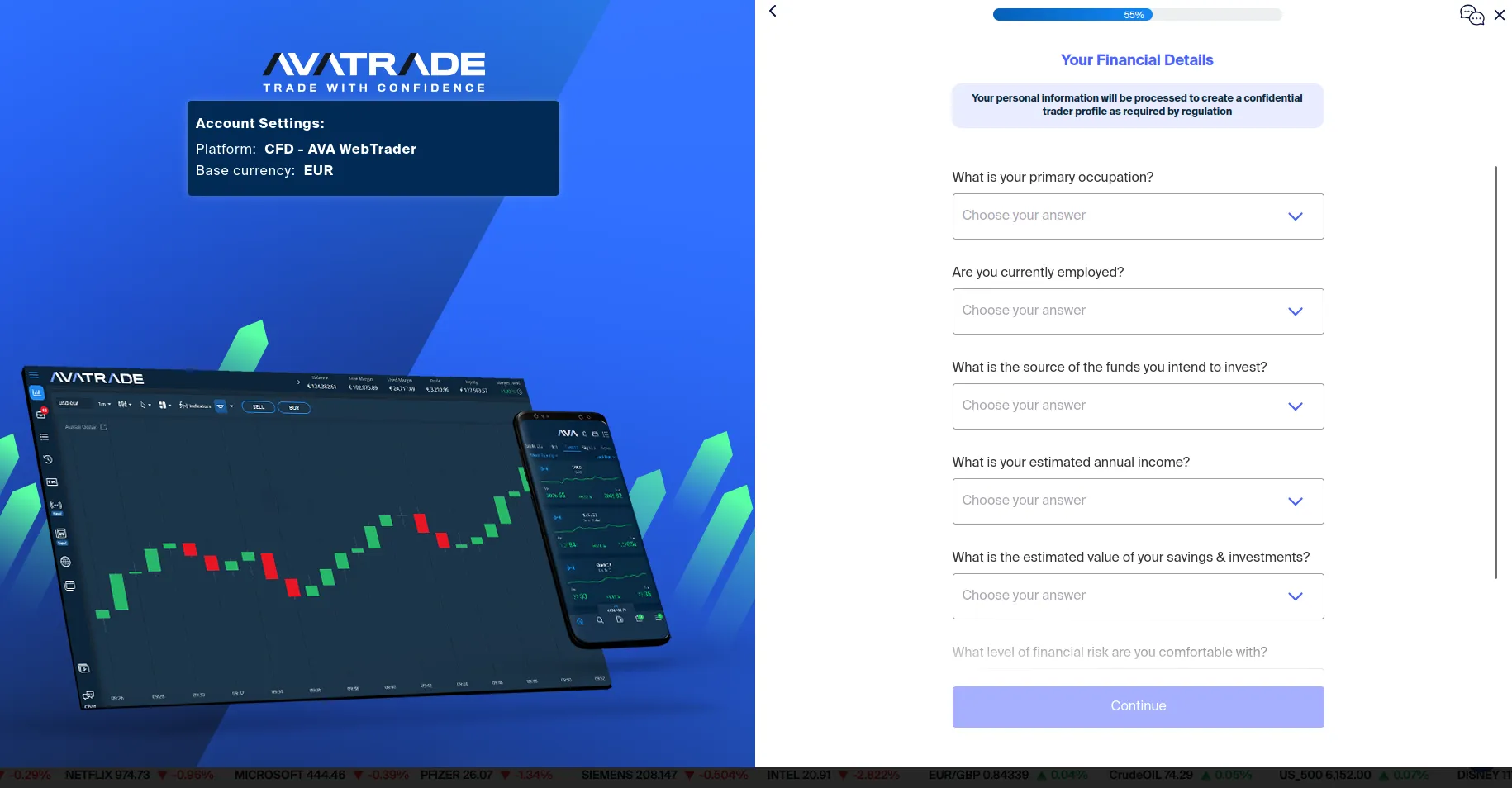

During this step, you must provide financial information like your main professional occupation, employment status, source of funds, average annual income, investments, and savings. Specify what level of risk you can tolerate. This information helps AvaTrade determine whether you are suitable for derivative trading.

-

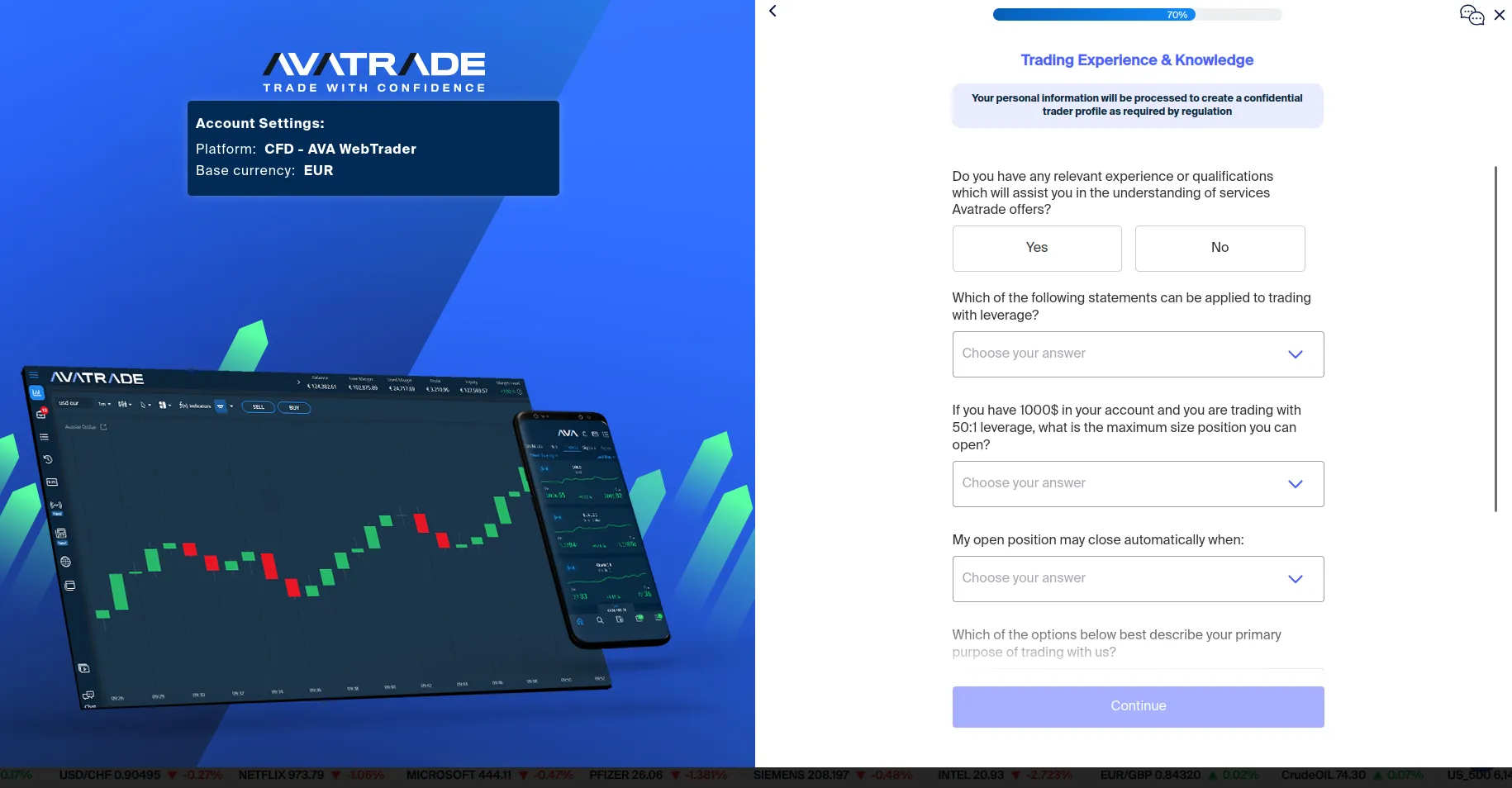

AvaTrade will also evaluate your experience and expertise by prompting you to complete a short quiz on leverage trading.

-

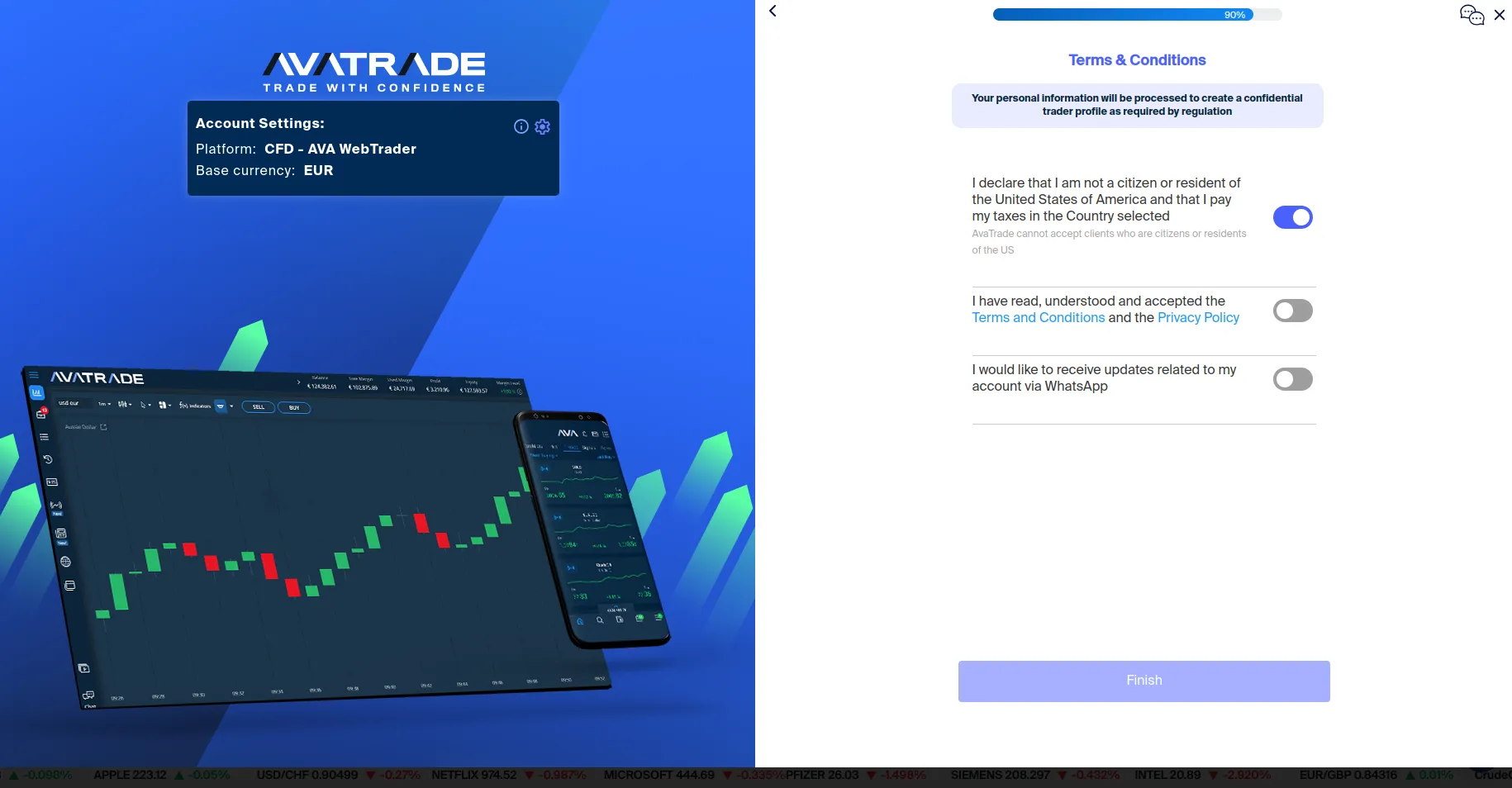

Accept the terms and conditions and confirm you are not a tax resident of the United States. You can also opt in to receive account-related updates via WhatsApp.

-

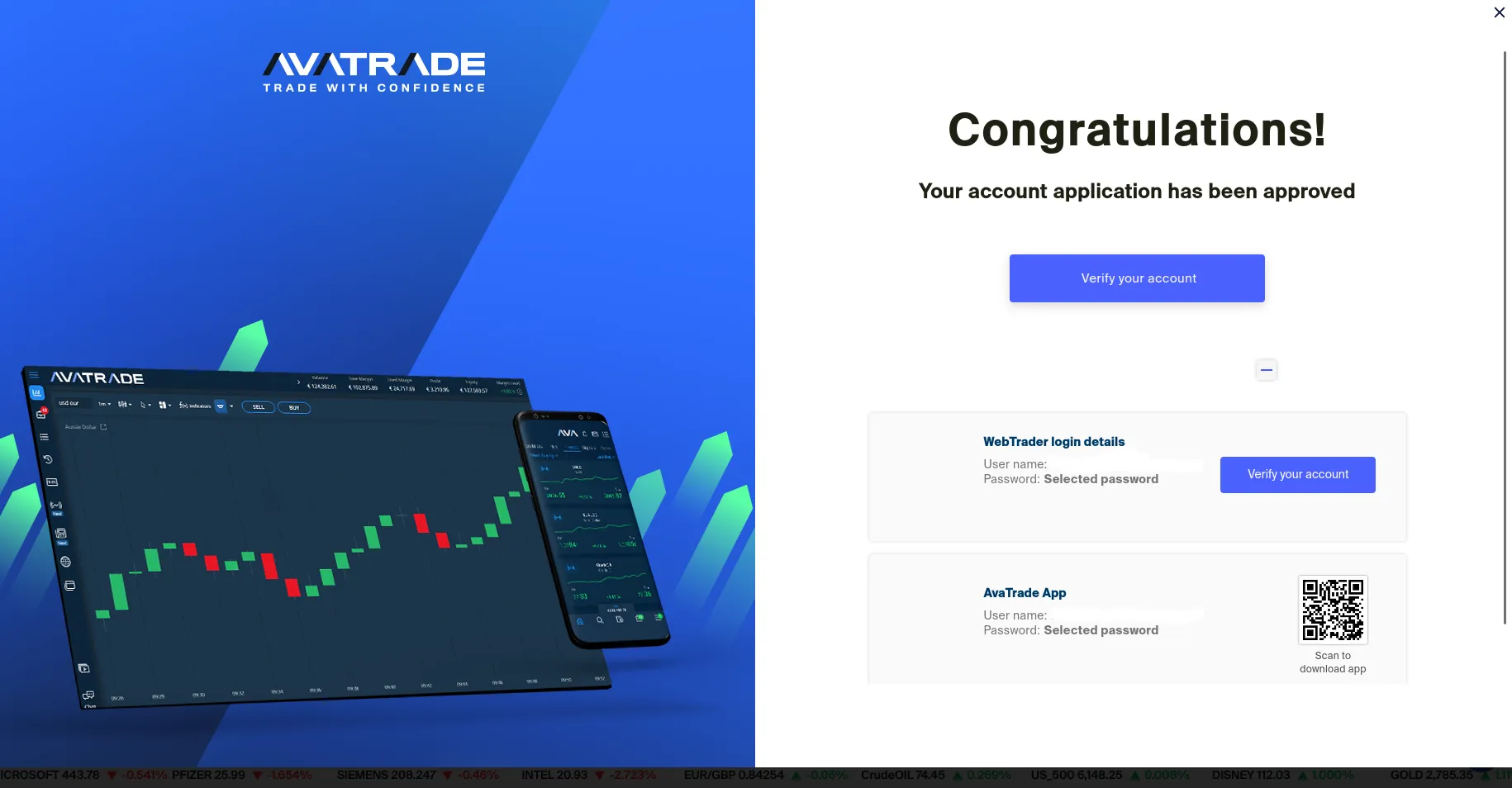

AvaTrade will assess your application based on your financial details and quiz results. Approved customers can now log into their newly created accounts to verify their identity and residential address.

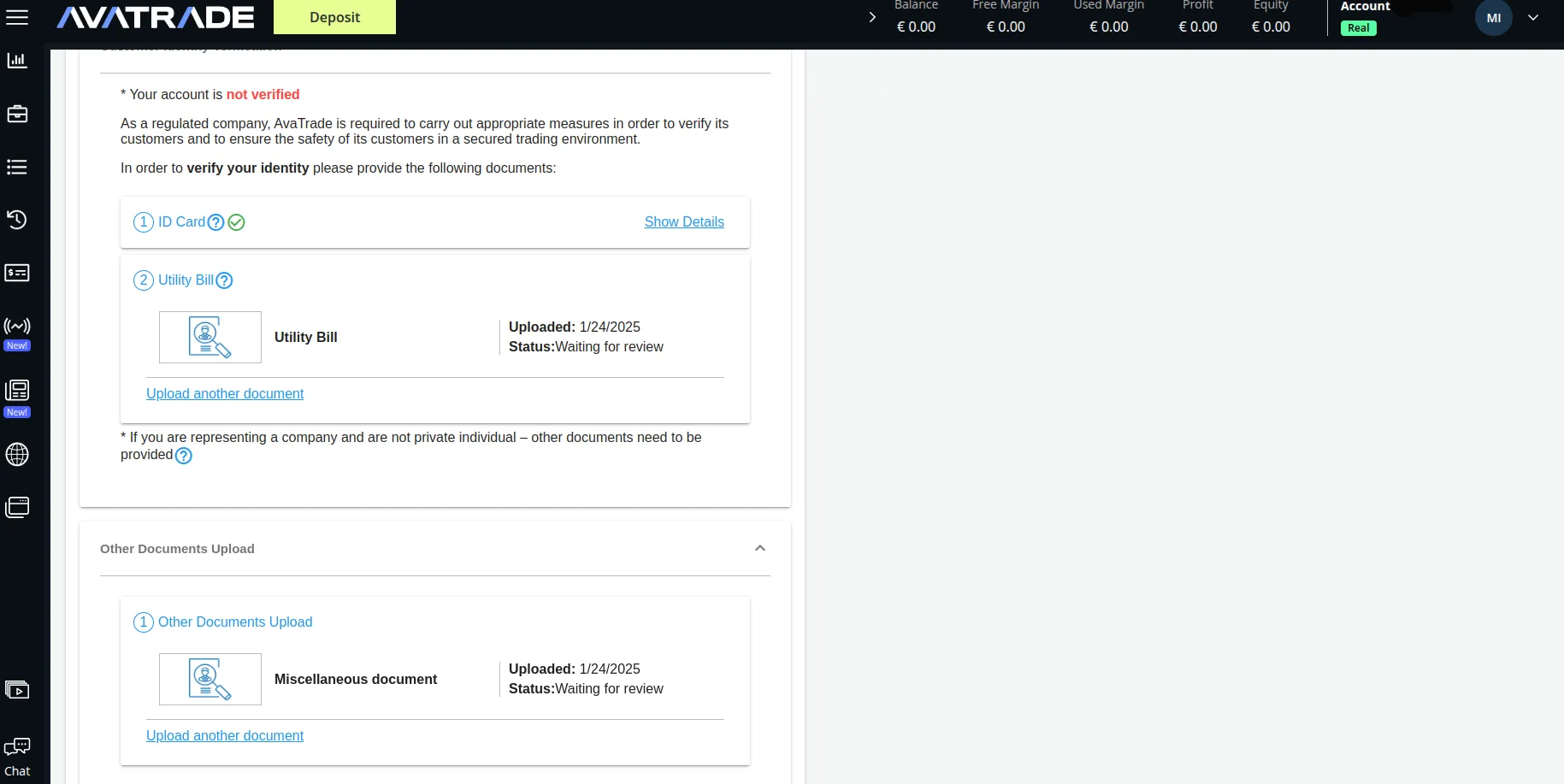

- KYC Verification of AvaTrade Accounts – Approximately 5 to 10 Minutes

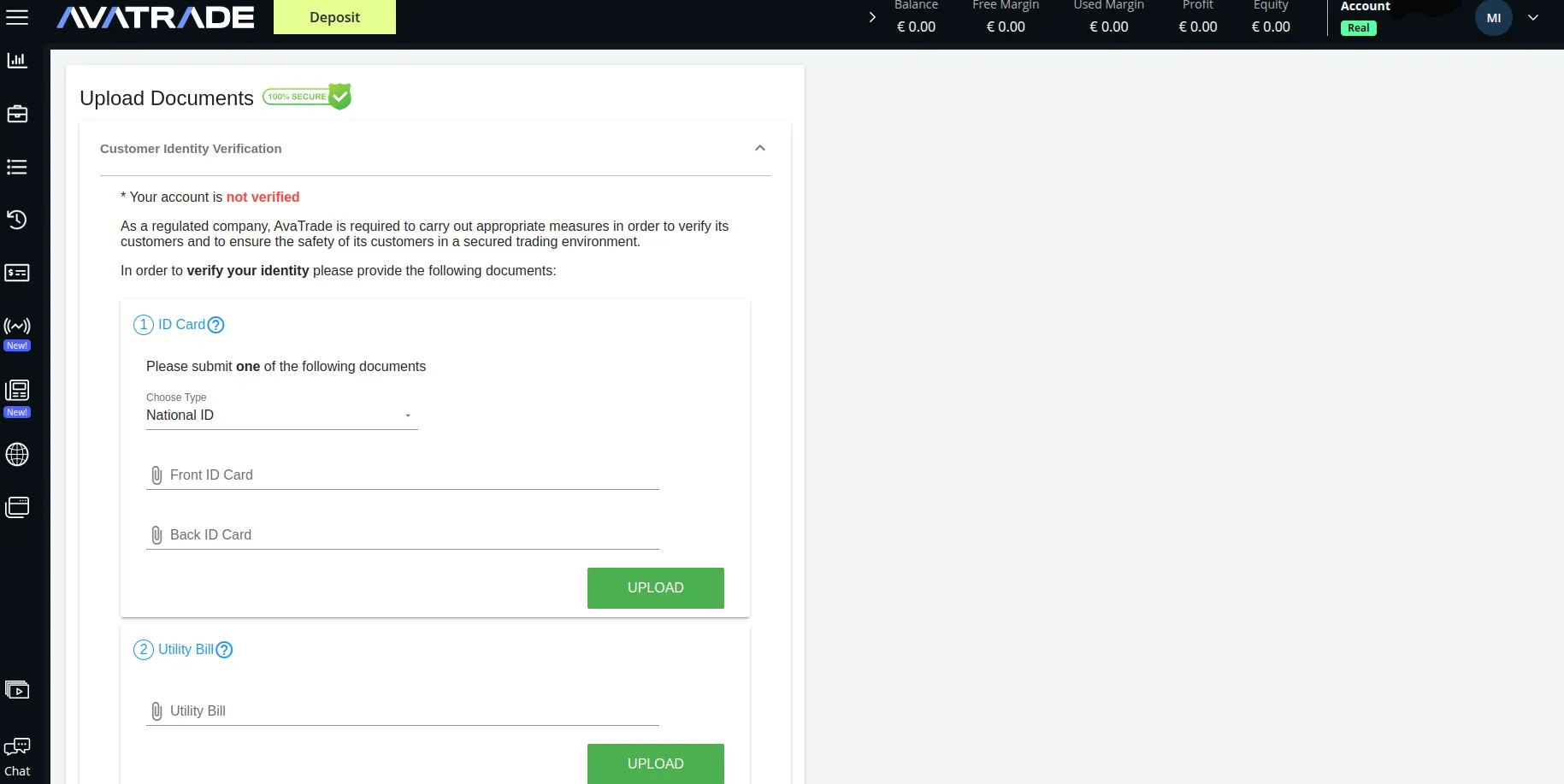

You must upload the requested documents before you can deposit and place orders.

Start with uploading your identity documents. This can be your national identification card, passport, or driver’s license. Whichever document you choose, make sure you upload legible copies of the front and rear sides.

-

Provide a copy of a recent utility bill so that AvaTrade can confirm that your current residential address coincides with the one you entered in the registration form.

-

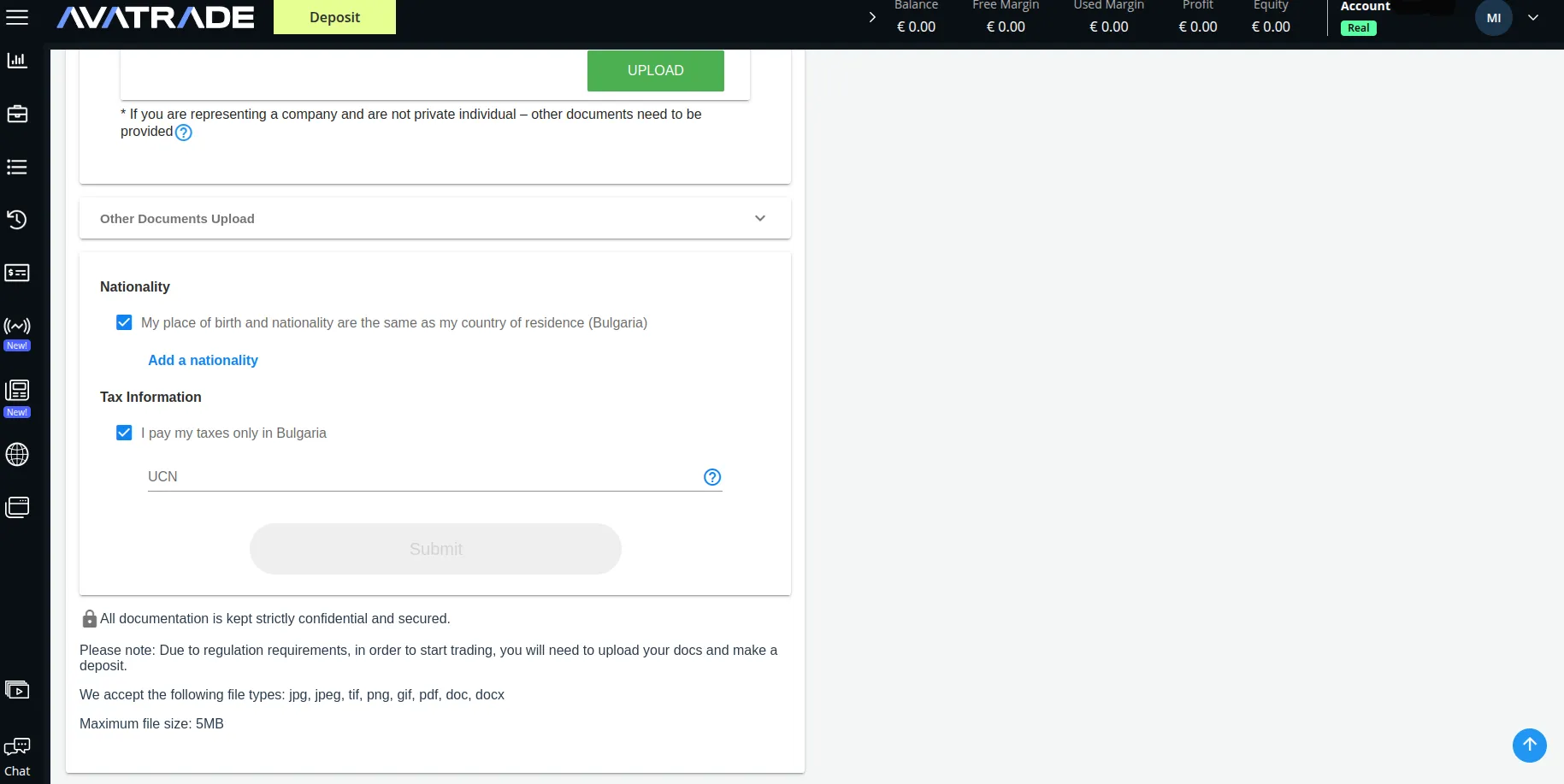

Tick the box to confirm your nationality coincides with your country of residence. If not, add another nationality. Last but not least, you must specify whether you pay your taxes in the country of residence and provide your unique tax identification number (TIN). In some EU countries like Bulgaria, this would be the unified civil number (UCN) included in your identity documents. Click Submit and wait for AvaTrade to assess your verification.

Final Impression

The entire registration process at AvaTrade requires no more than 20 minutes provided you have all relevant documents within reach. The quiz collecting financial and knowledge information should be easy to pass if you have any prior experience in derivative trading. Keep in mind the broker may take up to one business day to evaluate your application and documents when dealing with a heavy workload. It is important to highlight that AvaTrade does not accept registrations from jurisdictions like the US, Russia, New Zealand, Lebanon, and Cuba.