Axi Account Types in Brief

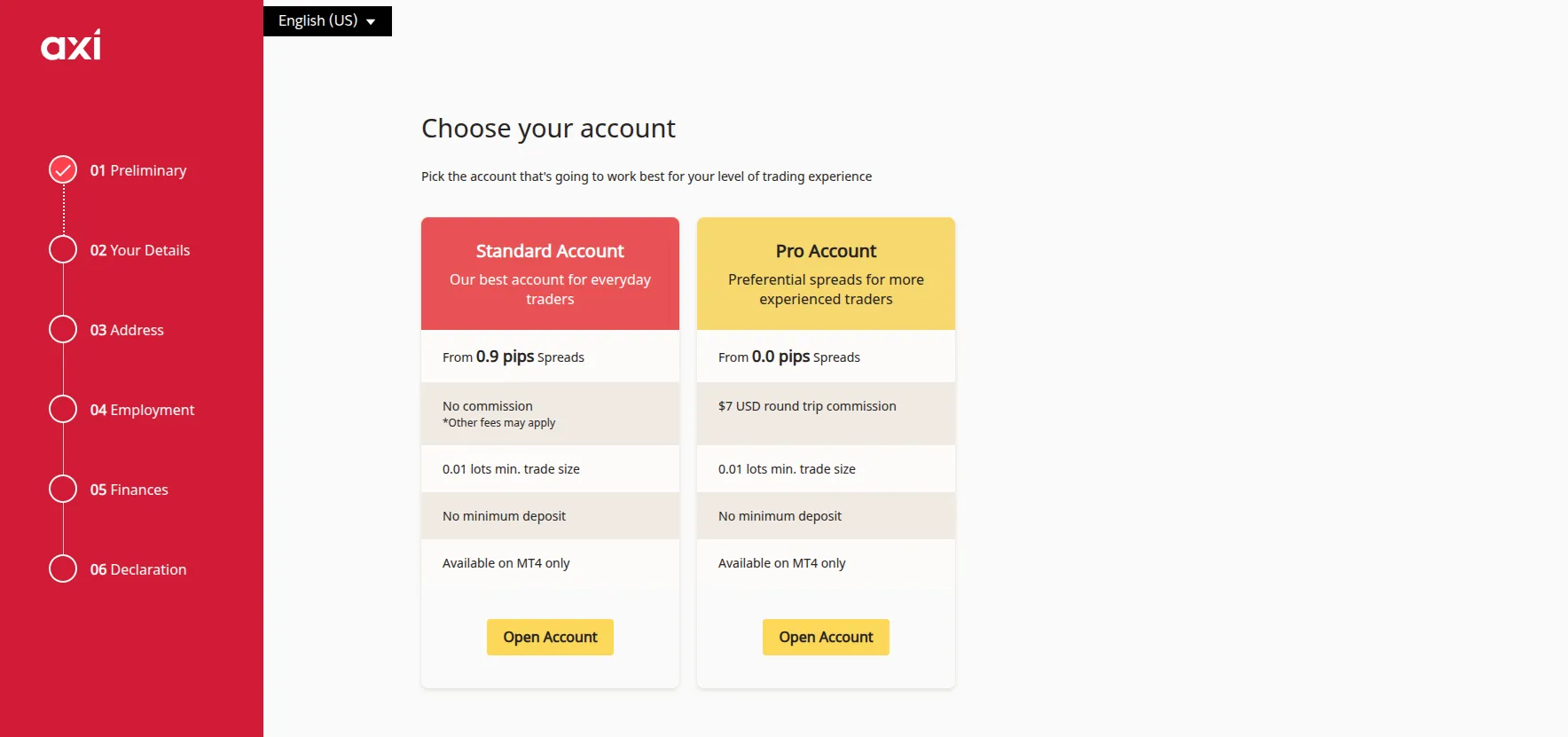

The available account types vary based on the country of the onboarding customer. European clients registering through the CySEC entity can choose from Standard and Pro retail accounts. Clients signing up through the offshore-licensed version of the website also have access to Elite accounts. All three account types require minimum trades of 0.01 lots and offer 5-digit pricing.

Spreads for Standard accounts are as low as 0.9 pips, with no commissions upon opening and closing leveraged positions. Pro accounts offer tighter spreads from zero pips at the expense of a round-trip commission of $7, or $3.50 each way. All account types have access to automated trading via Expert Advisors (EAs) and VPS hosting but the latter service requires a subscription. Clients with a portfolio of $500,000, among other criteria, can apply for professional accounts.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

Axi Minimum Deposit Requirements

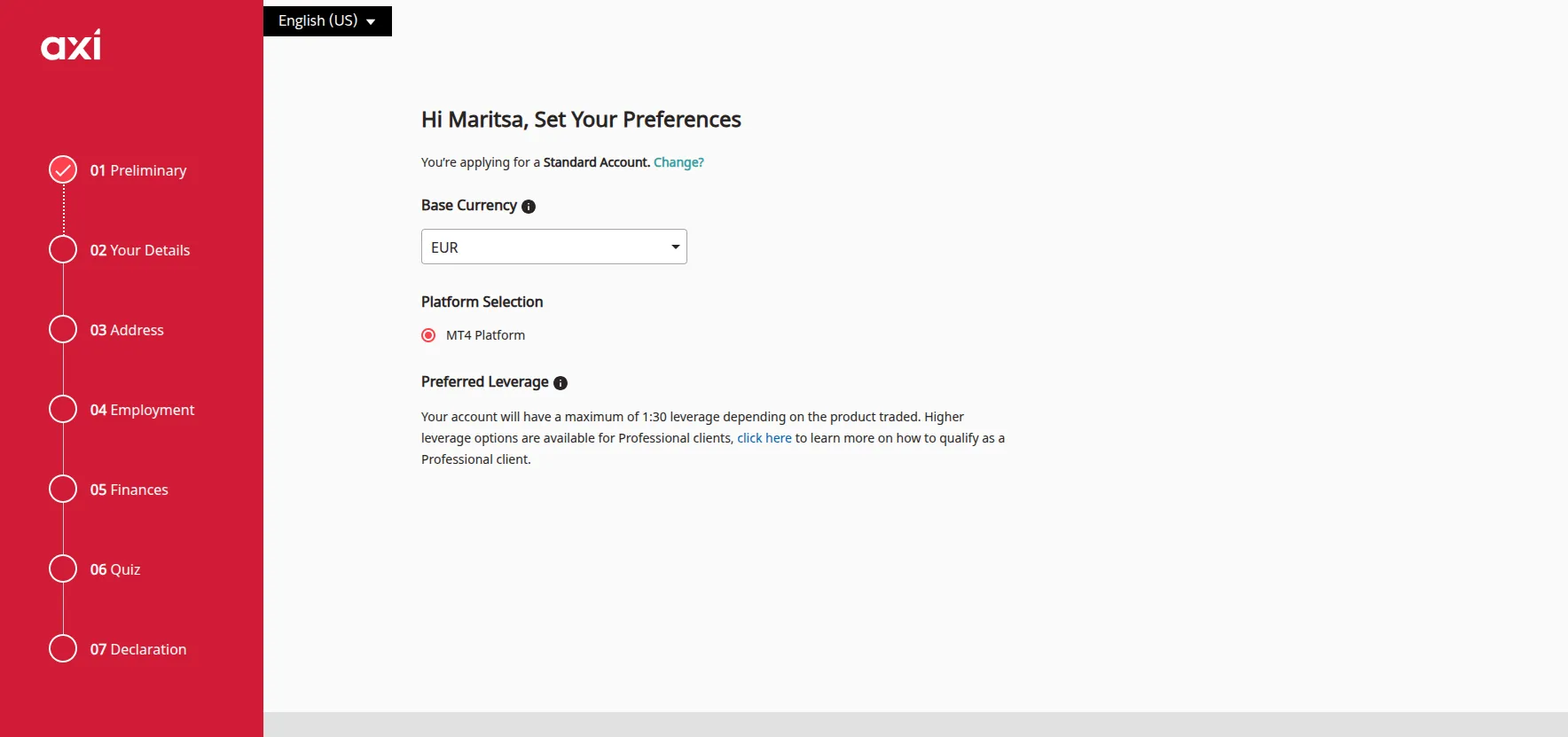

Standard and Pro accounts have minimum deposit requirements of $5 or $0, depending on where you register from. The minimum deposit threshold for Elite accounts is significantly higher at $25,000. CySEC customers can choose from three base currencies – EUR, PLN, or USD. Clients can fund their live balance with credit or debit cards ($5 – $100,000) or bank transfers ($10 – $1 million). Card deposits are instant but bank transfers require 1 to 3 business days.

What Can You Trade at Axi?

Registered EU traders can speculate on the price fluctuations of over 220 financial markets, ranging from 70 currency pairs and 30 popular cryptocurrencies to stocks, commodities, and indices. MetaTrader 4 is the only supported third-party platform at the moment. Novices unfamiliar with the platform will benefit from detailed guides on how to use it.

Step-by-Step Registration at Axi (CySEC) – Requires Approximately 10 Minutes

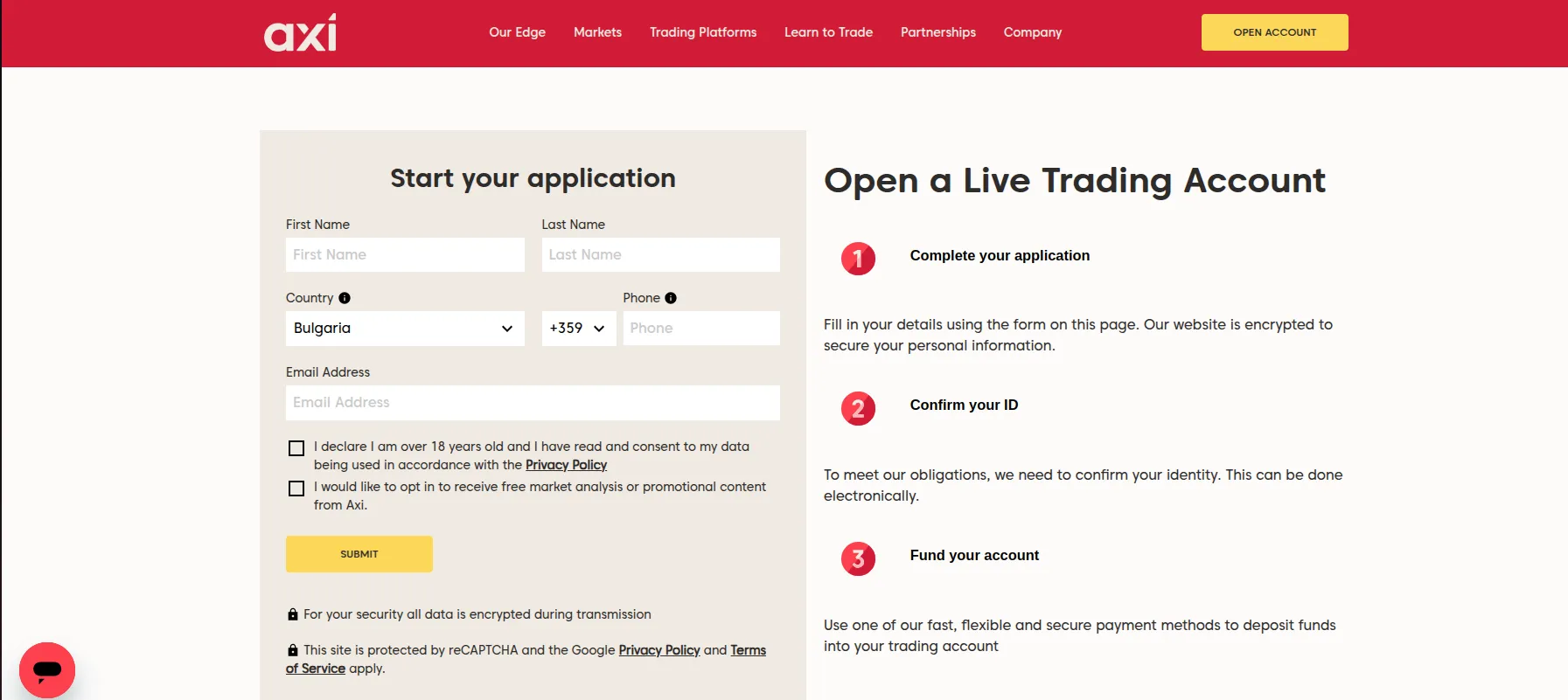

Load Axi (www.axi.com/eu) in your desktop or mobile browser and click or tap the yellow Open Account button in the top right corner.

Initiate your application by filling in your name, telephone number, country, and email address. Then select your preferred account type.

You must pick a base account currency and platform during the preliminary stage of registration.

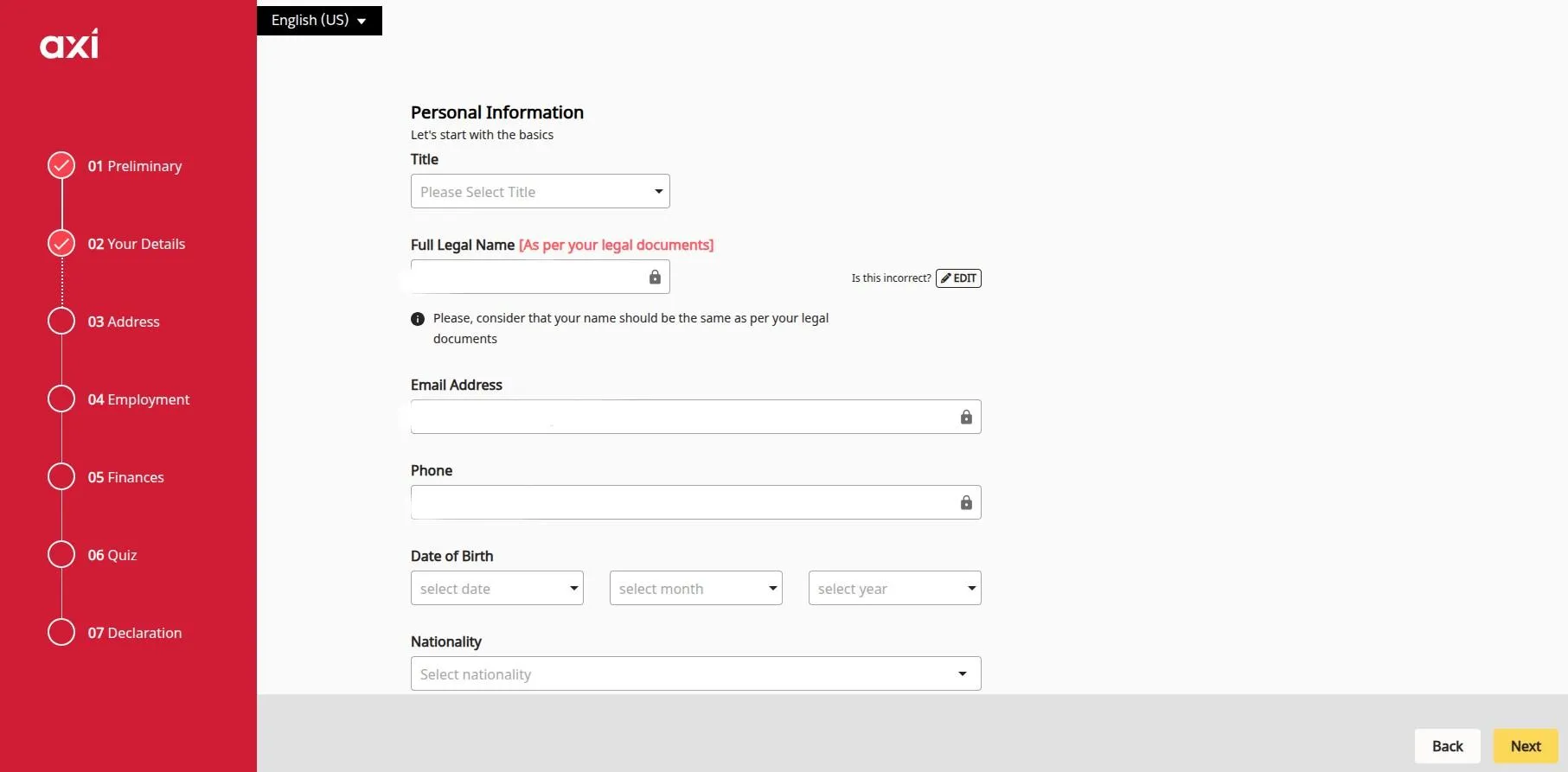

Enter your personal details in the registration form, including your full legal name, email address, birth date, and telephone number. Choose your nationality from the dropdown menu.

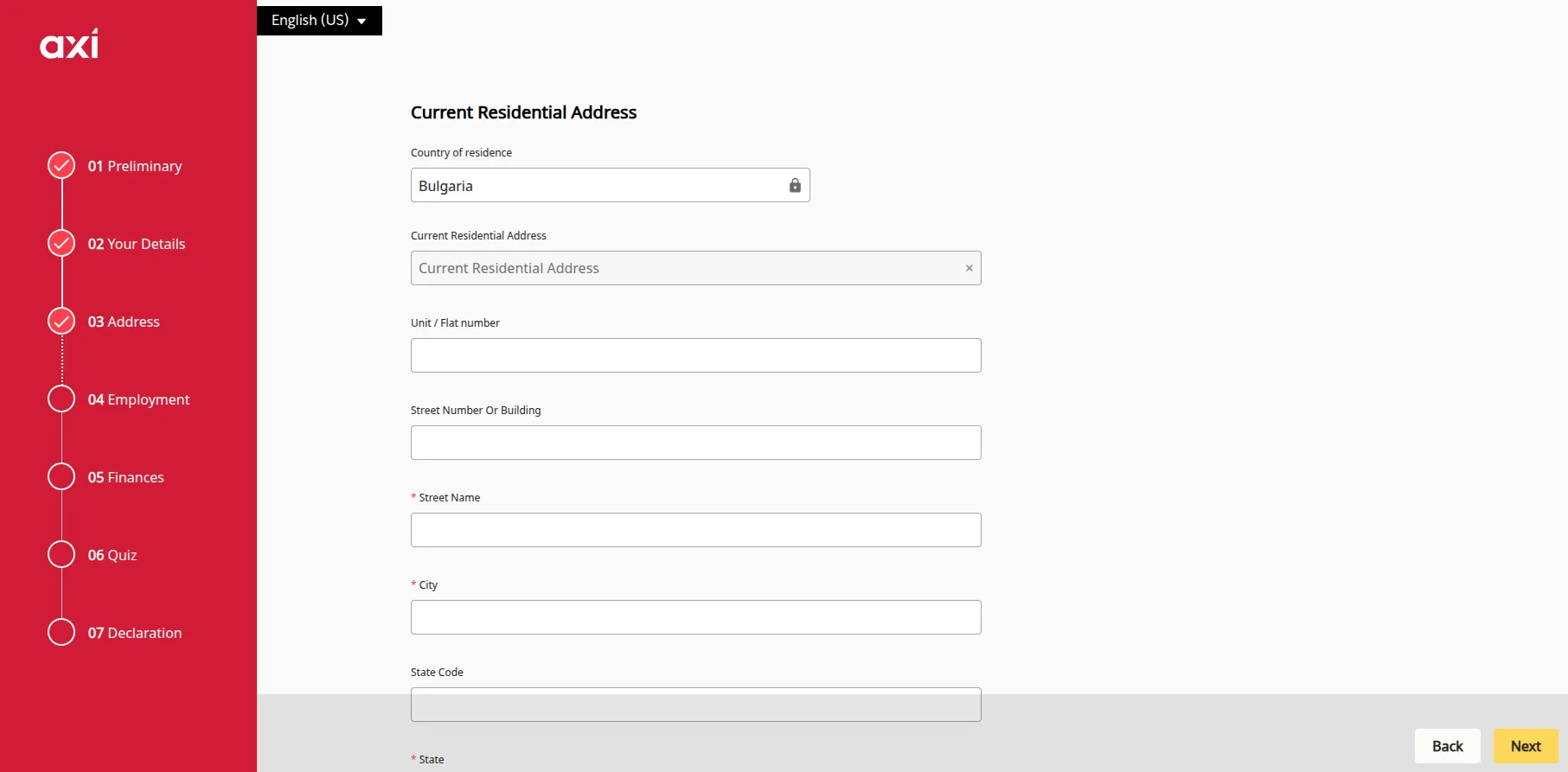

Enter your country and current residential address, including street name, house or flat number, and city.

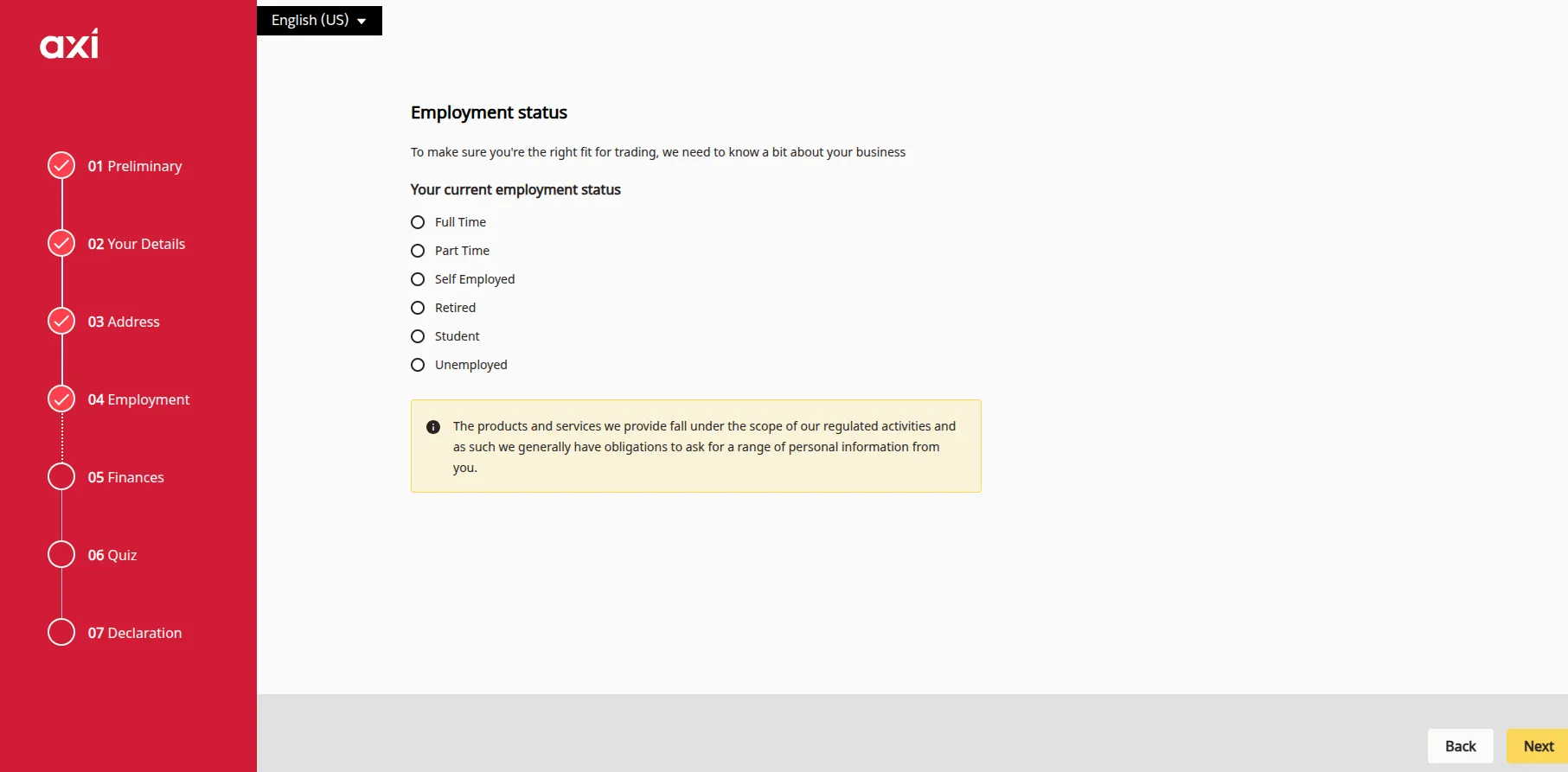

Specify your current employment status.

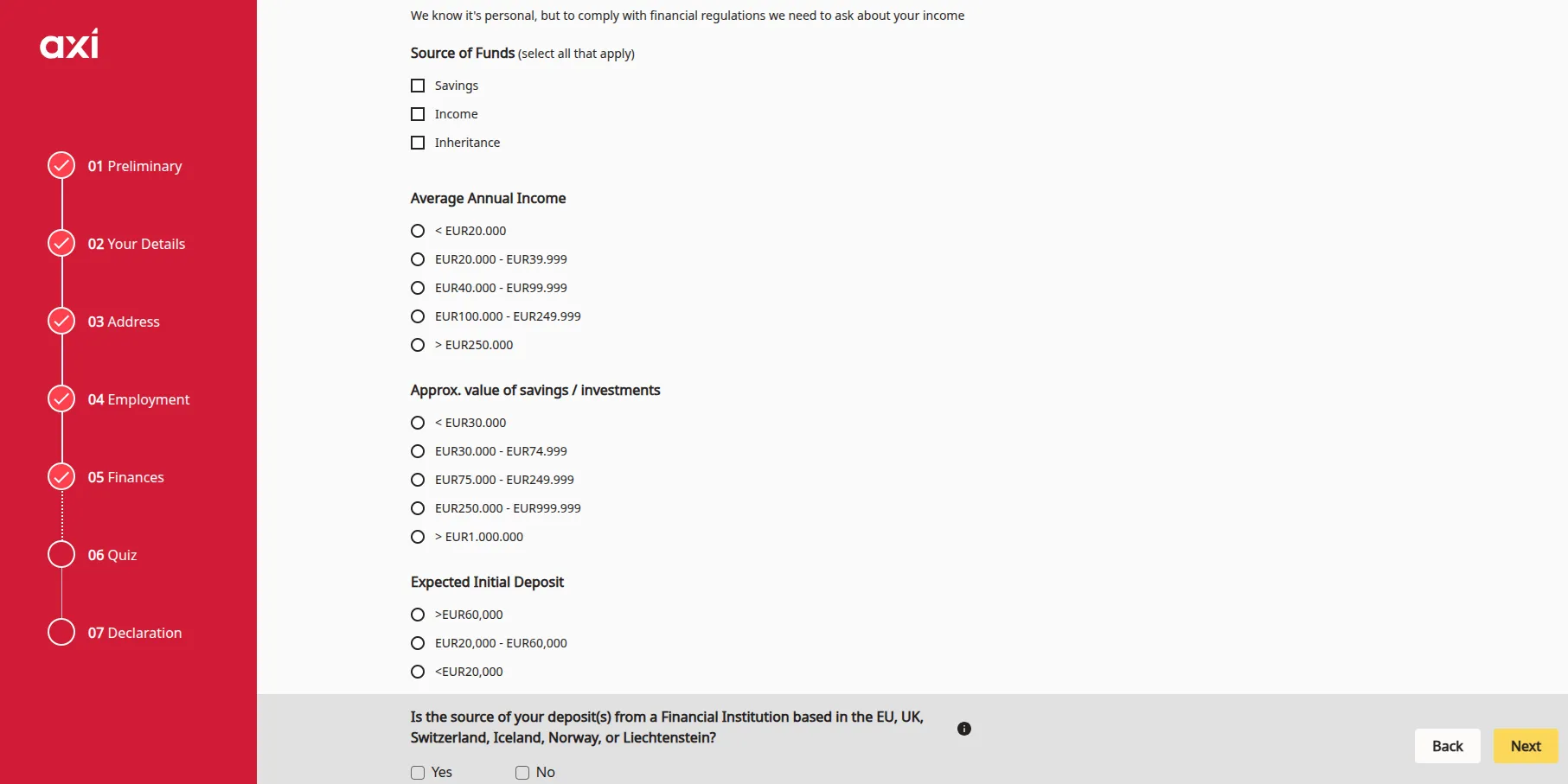

Provide information about your source of funds, annual income, savings, and expected first-time deposit. You must also specify whether the source of your deposits comes from a financial institution based in Europe.

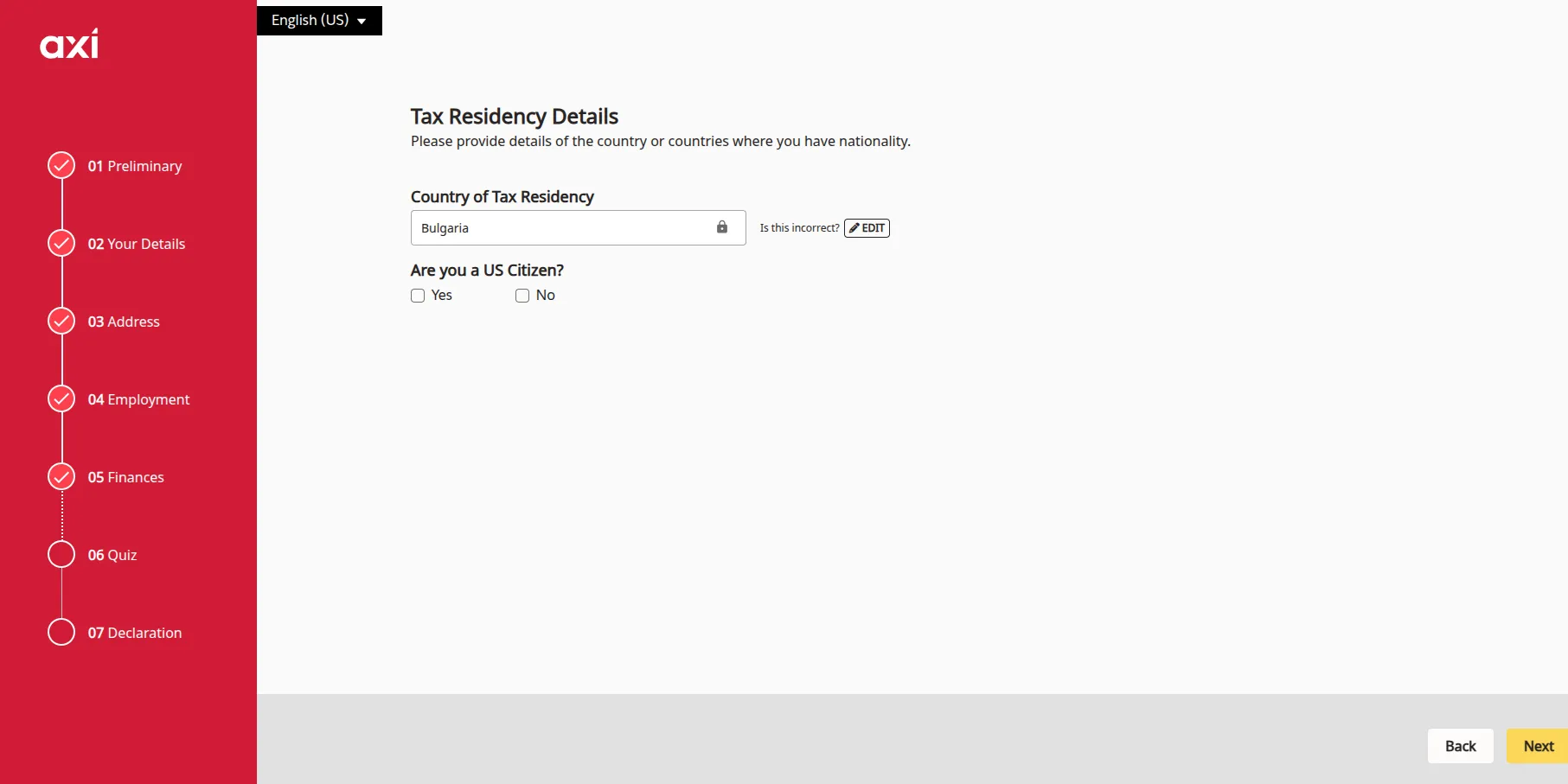

Additionally, you should specify your country of tax residency and whether you are a US citizen or not.

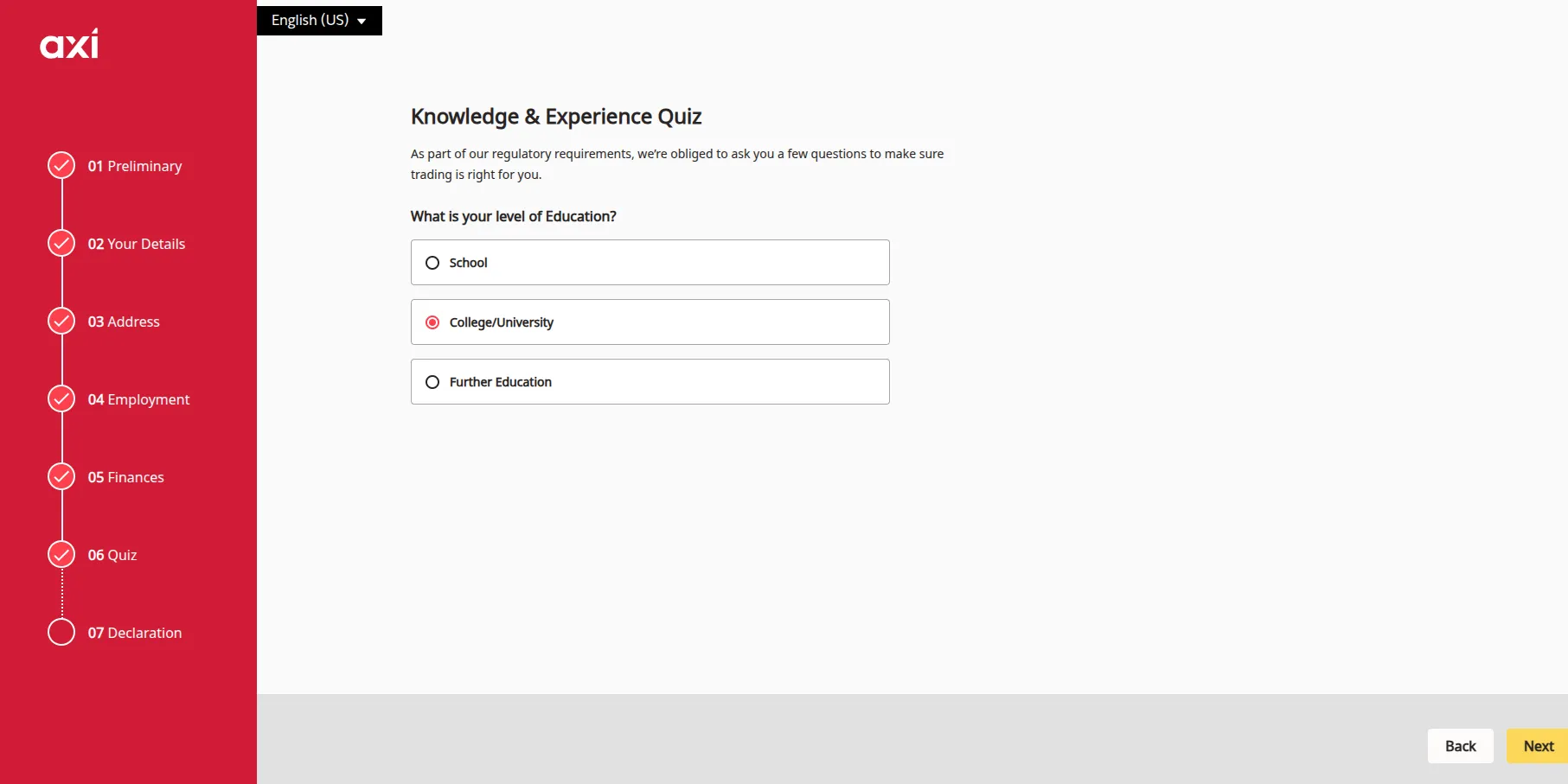

Axi will then prompt you to take a short quiz to evaluate your knowledge and experience in derivative trading. This helps the broker determine whether onboarding clients meet the suitability criteria for trading high-risk leveraged instruments like the CFD. You start by specifying your education level.

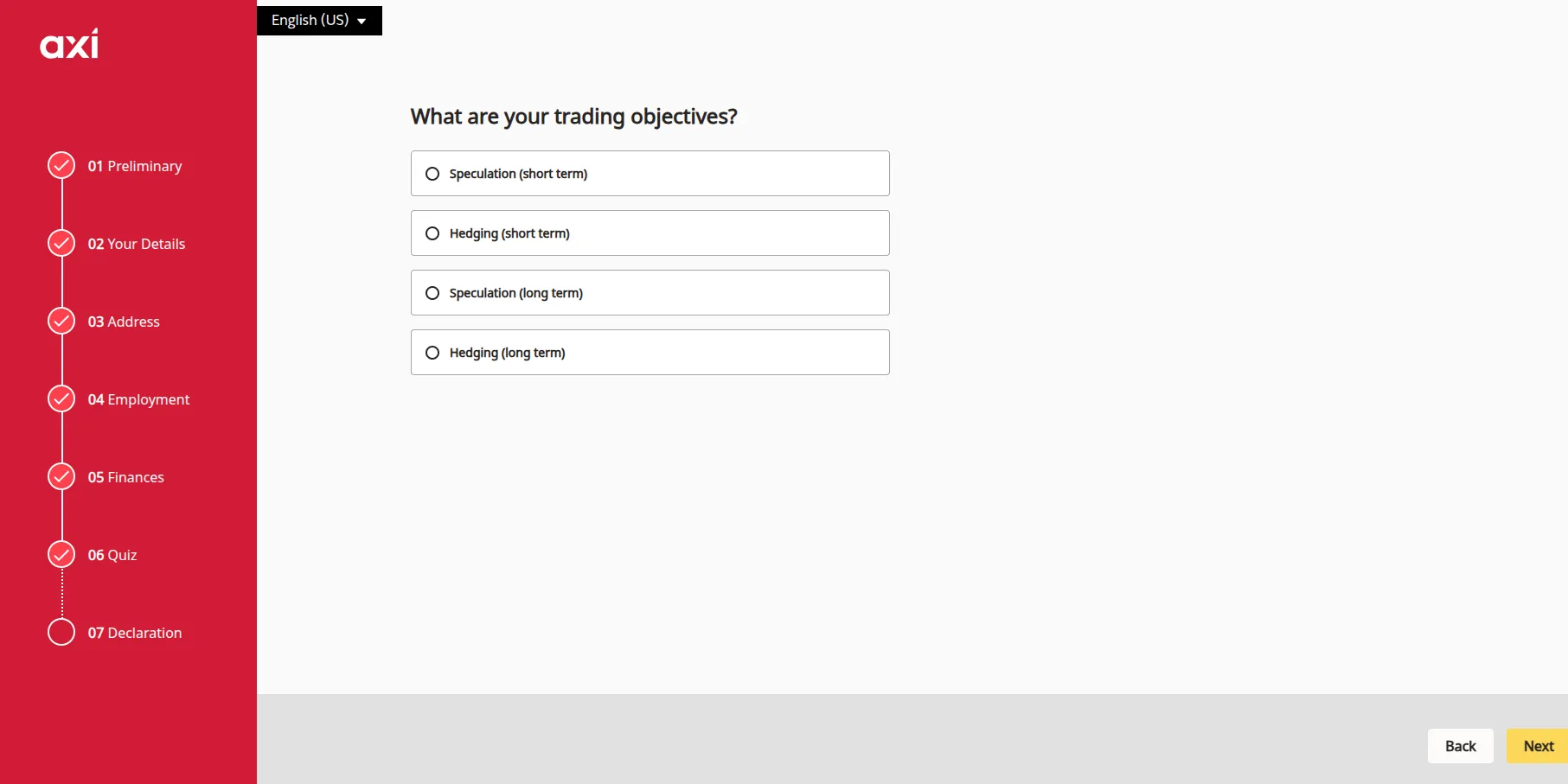

The broker will also inquire about your trading objectives, i.e. whether you intend to engage in long-term or short-term price speculation or hedging.

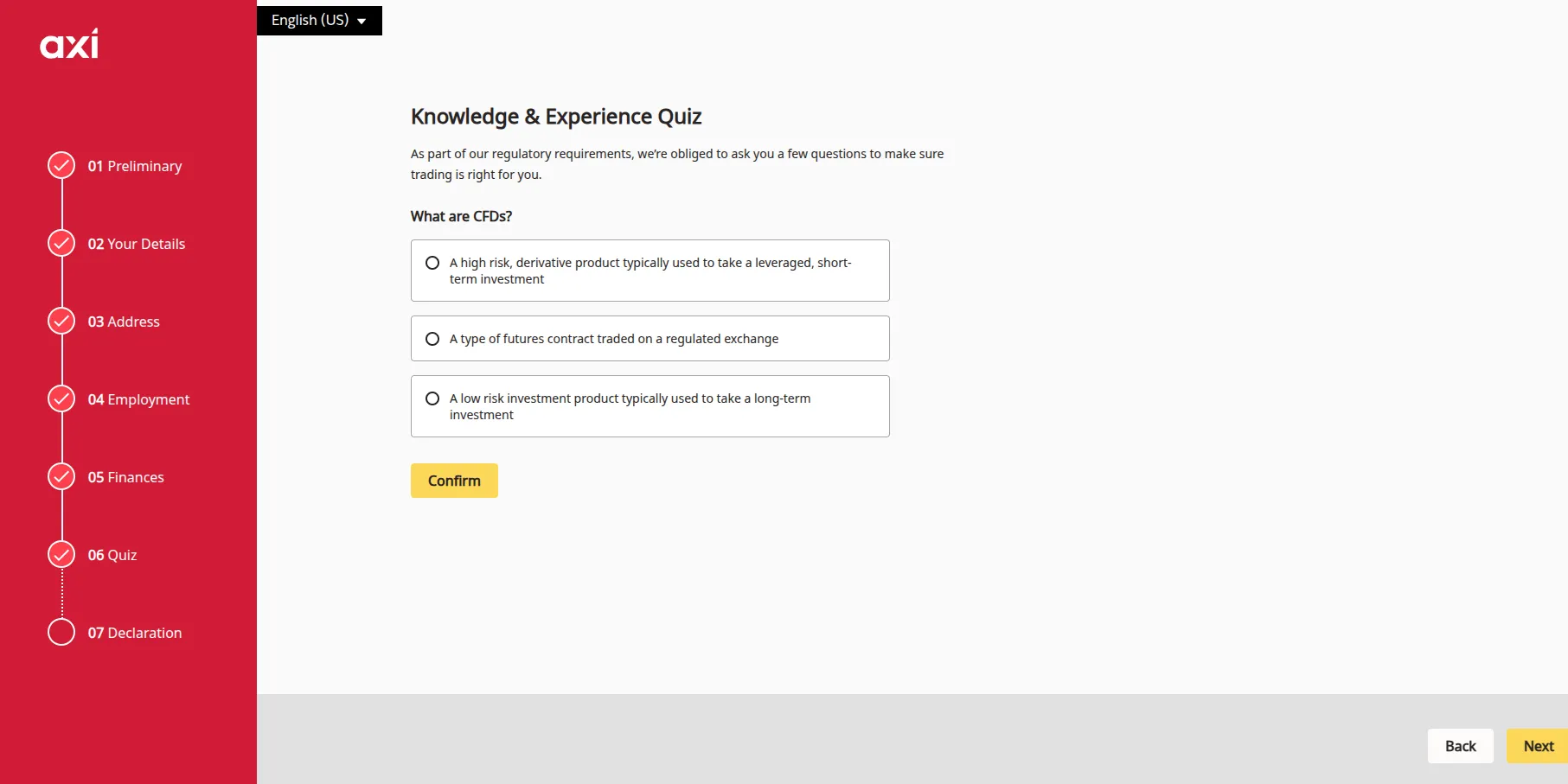

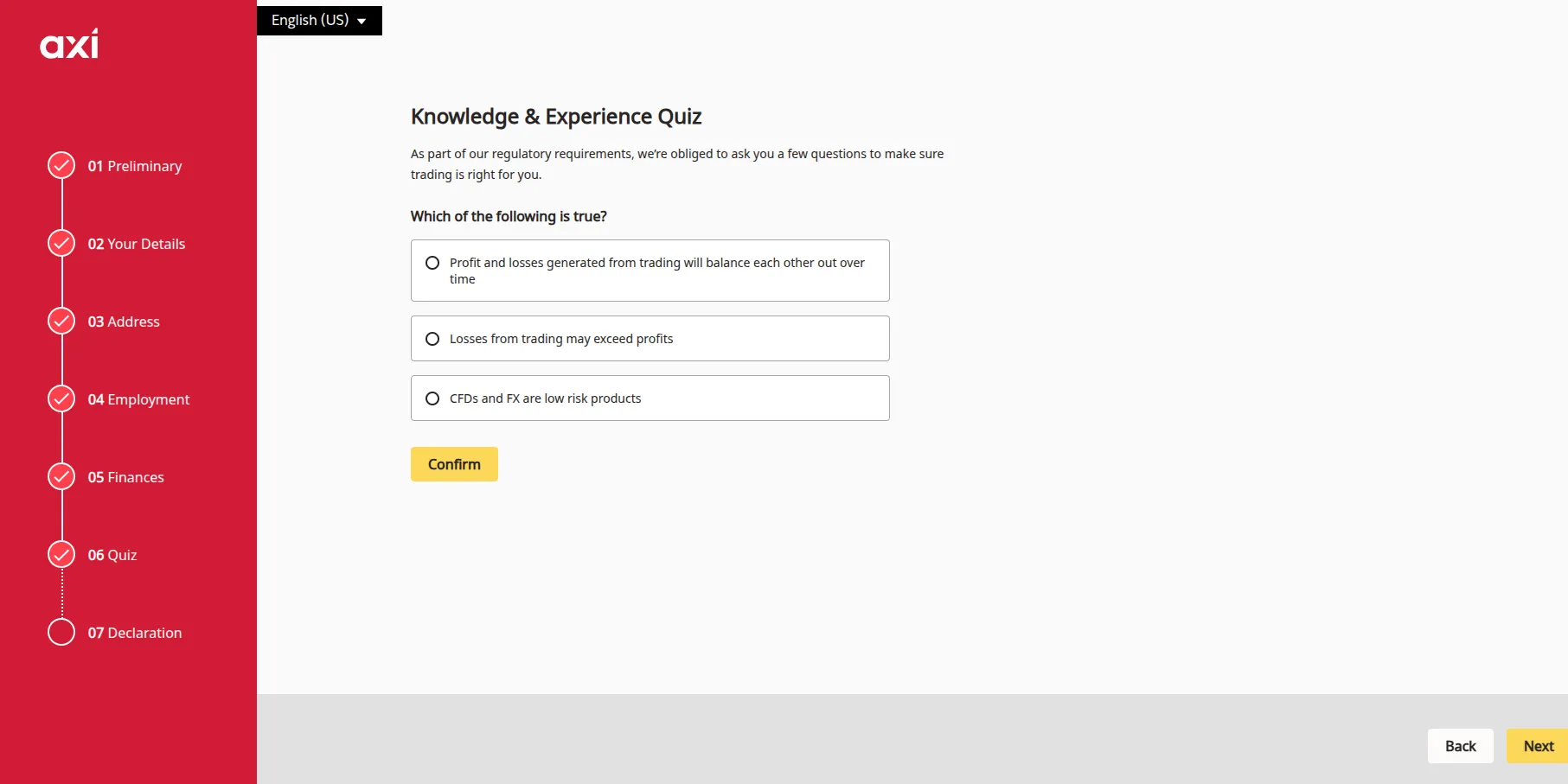

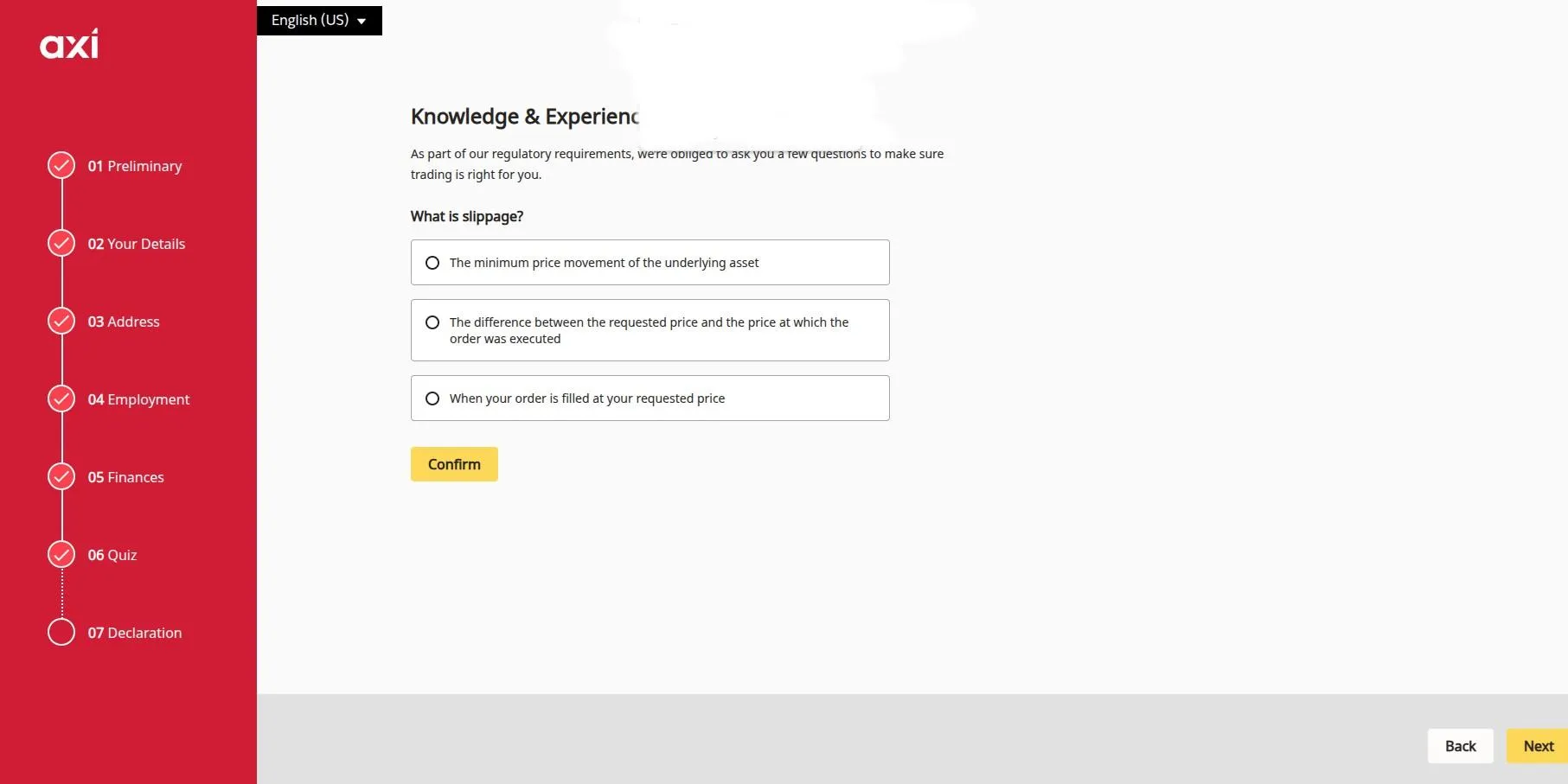

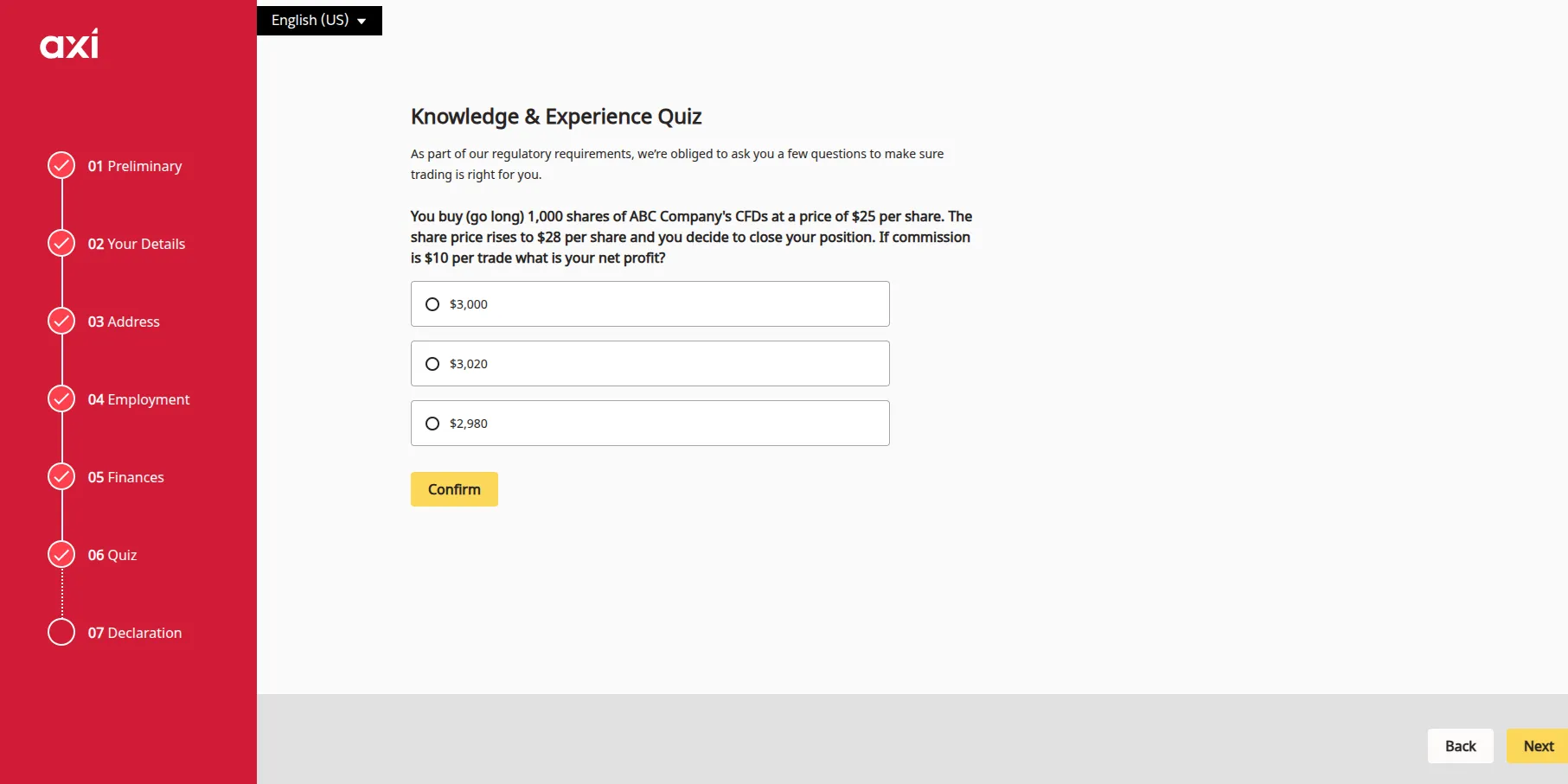

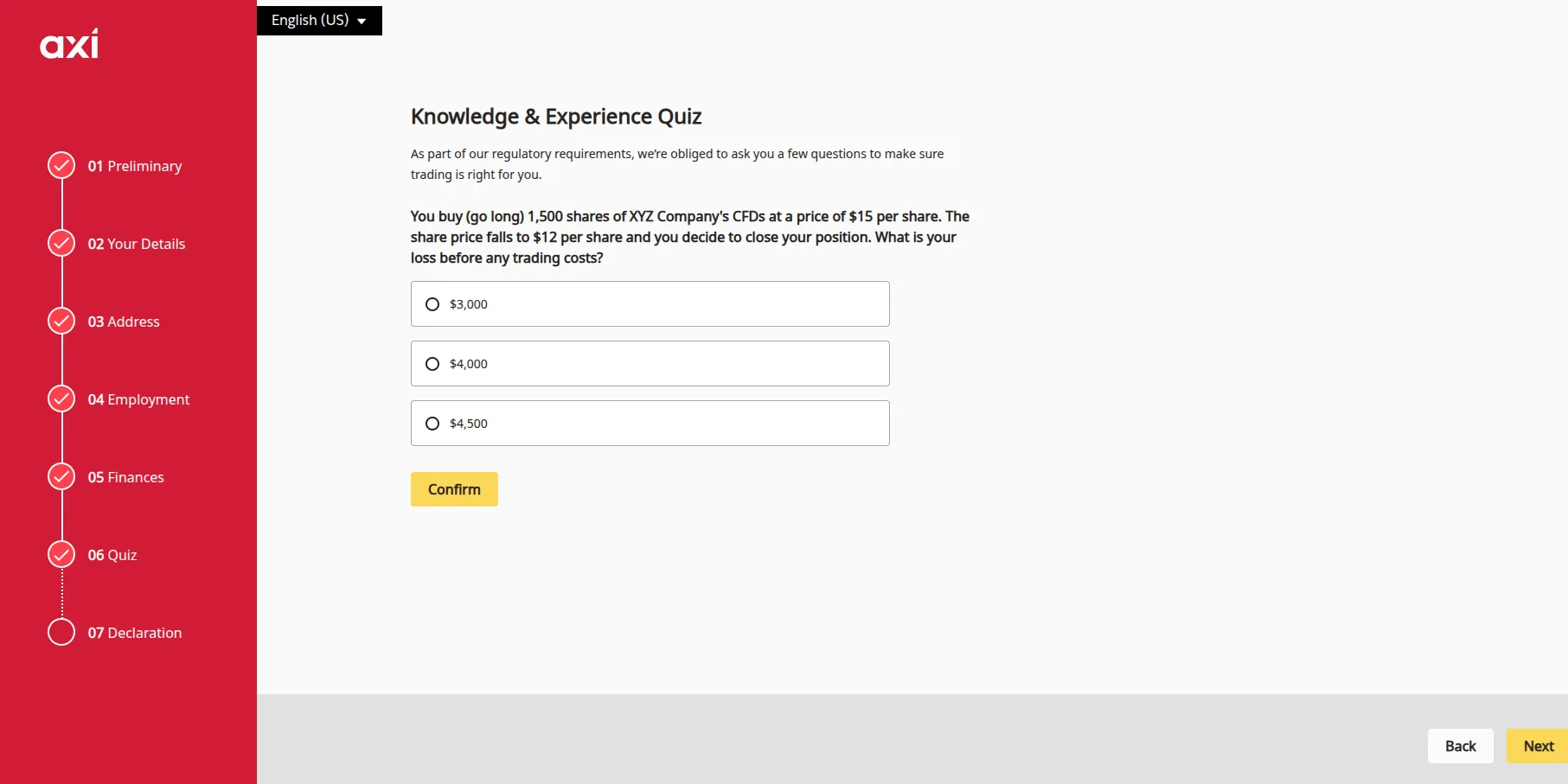

Next, you should answer some basic questions regarding CFD trading.

Quiz Question 1

Quiz Question 2

Quiz Question 3

Quiz Question 4

Quiz Question 5

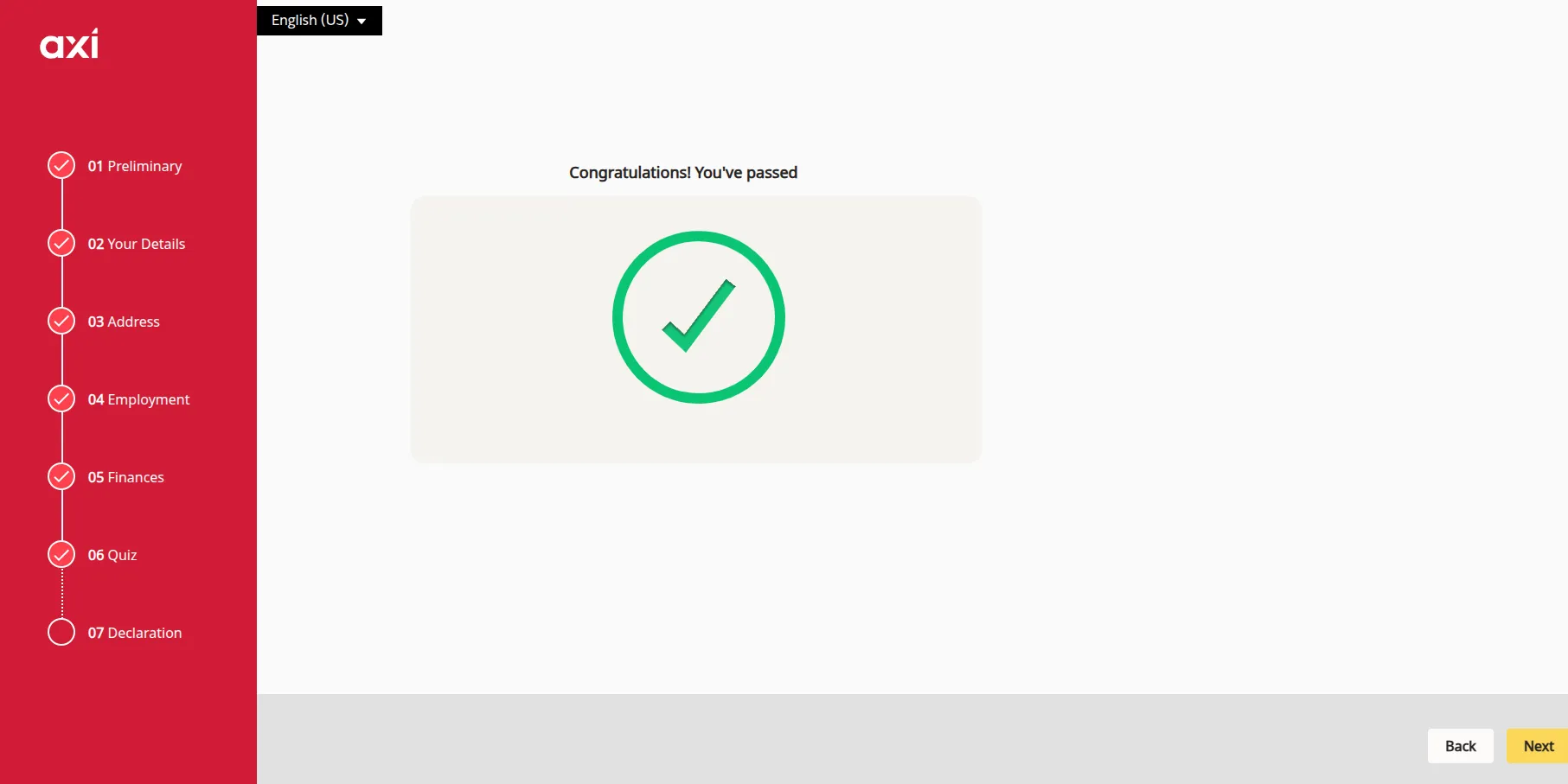

You must provide correct answers to pass the knowledge quiz and proceed to the final stage of the registration process.

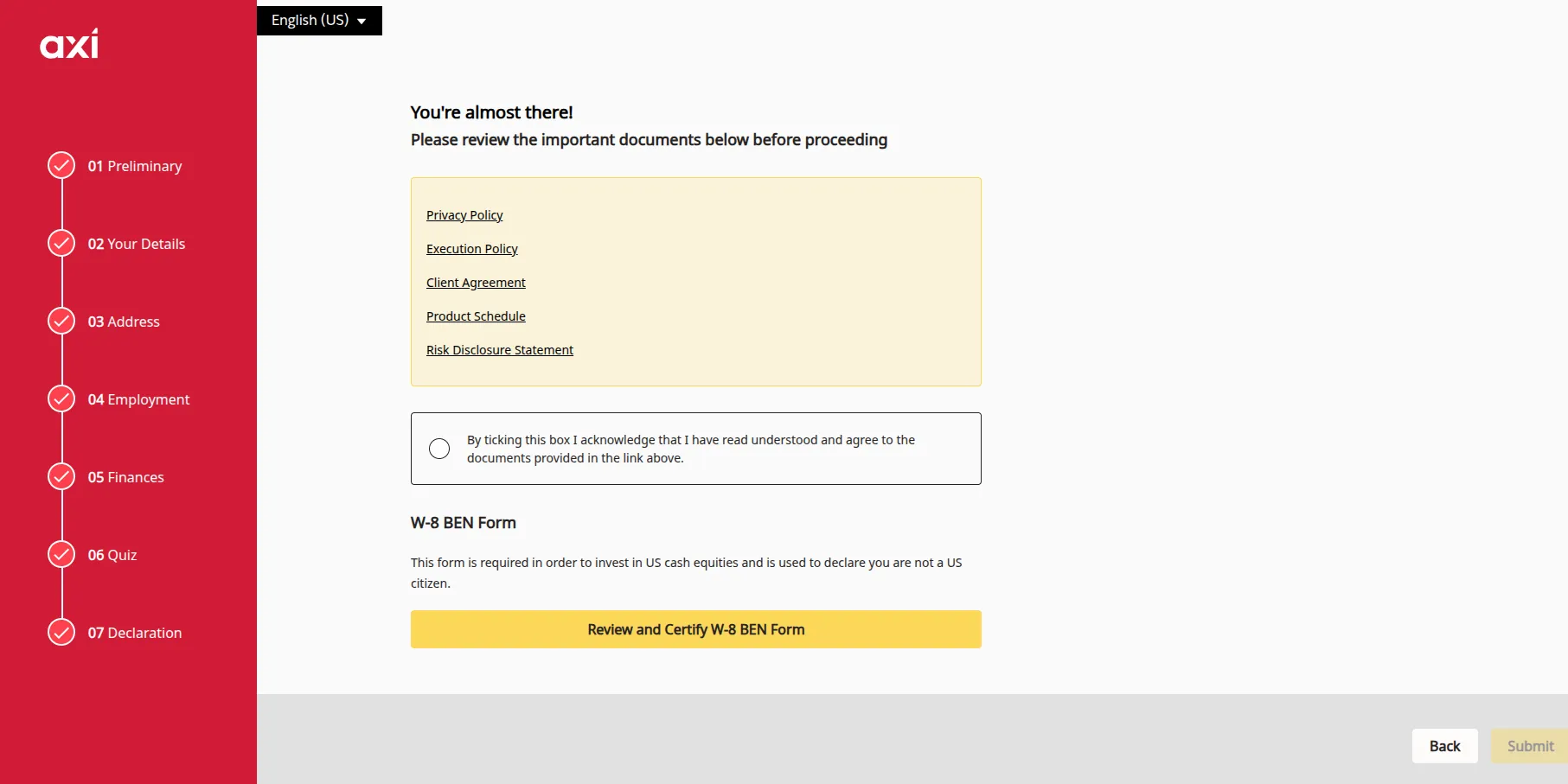

Review the broker’s privacy and execution policies, terms and conditions, risk disclosure, and product specifications. You must also review and fill in the W-8BEN form if you plan to invest in US cash equities.

W-8BEN Form

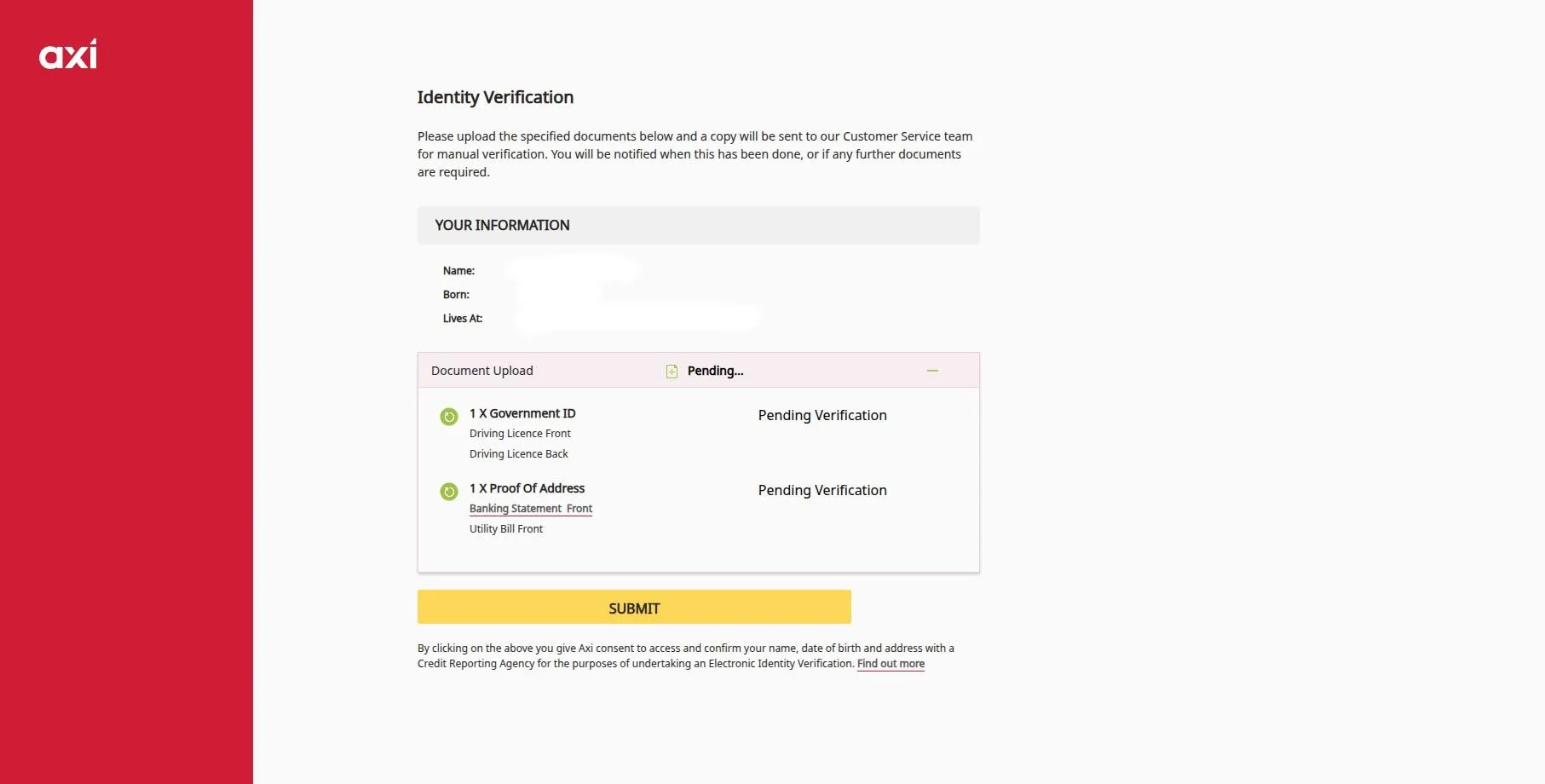

KYC Verification – Requires Approximately 5 to 9 minutes

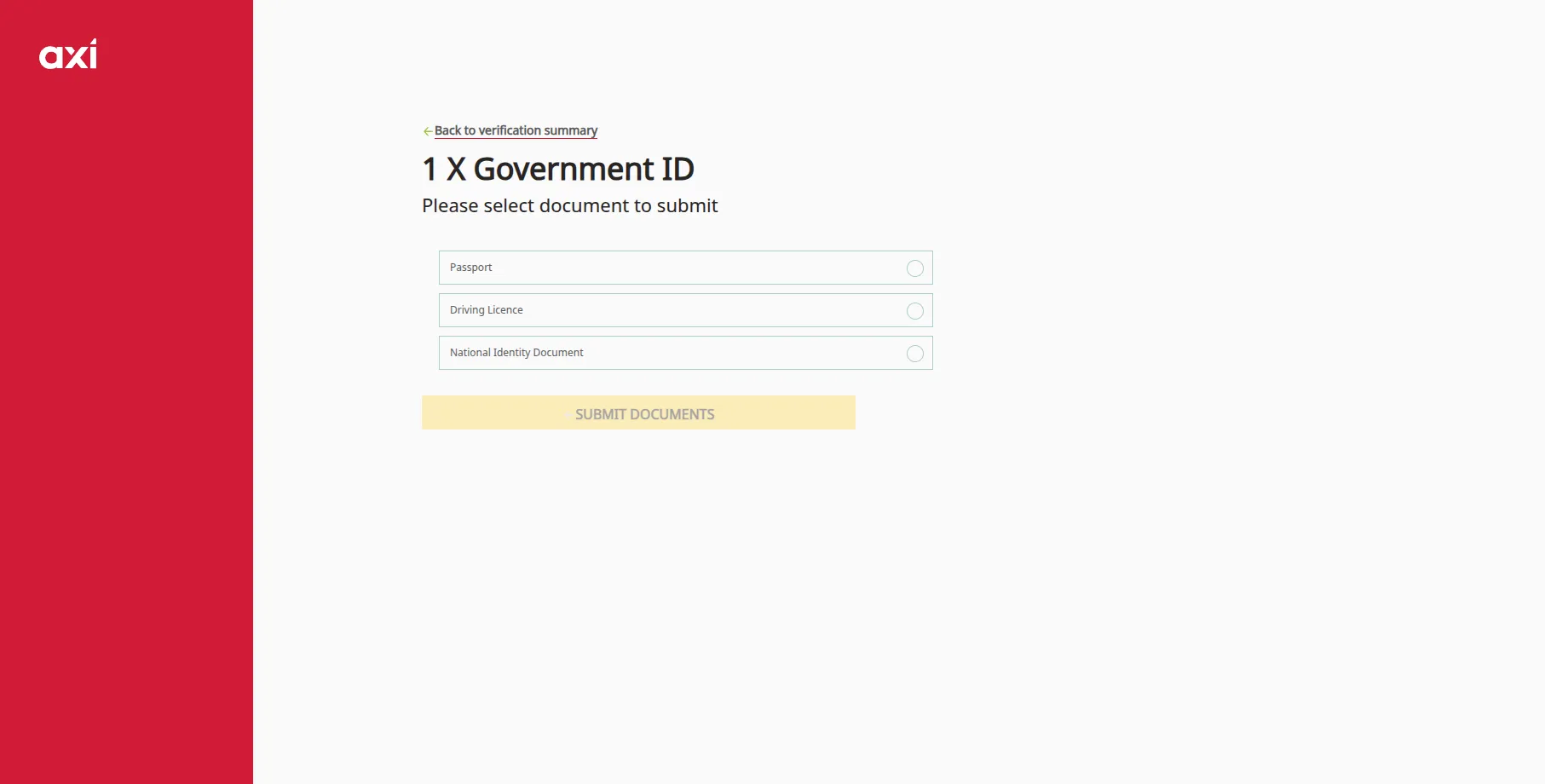

You are nearly at the finish line as all that’s left to do is upload your documents for identity verification. Axi will ask you to provide two sets of documents, starting with photos of your passport, driving permit, or government-issued identification card. You must upload color photos of the front and rear sides of your preferred document. The size should not exceed 10 MB. Three image formats are accepted (jpg, png, jpeg).

Document 1

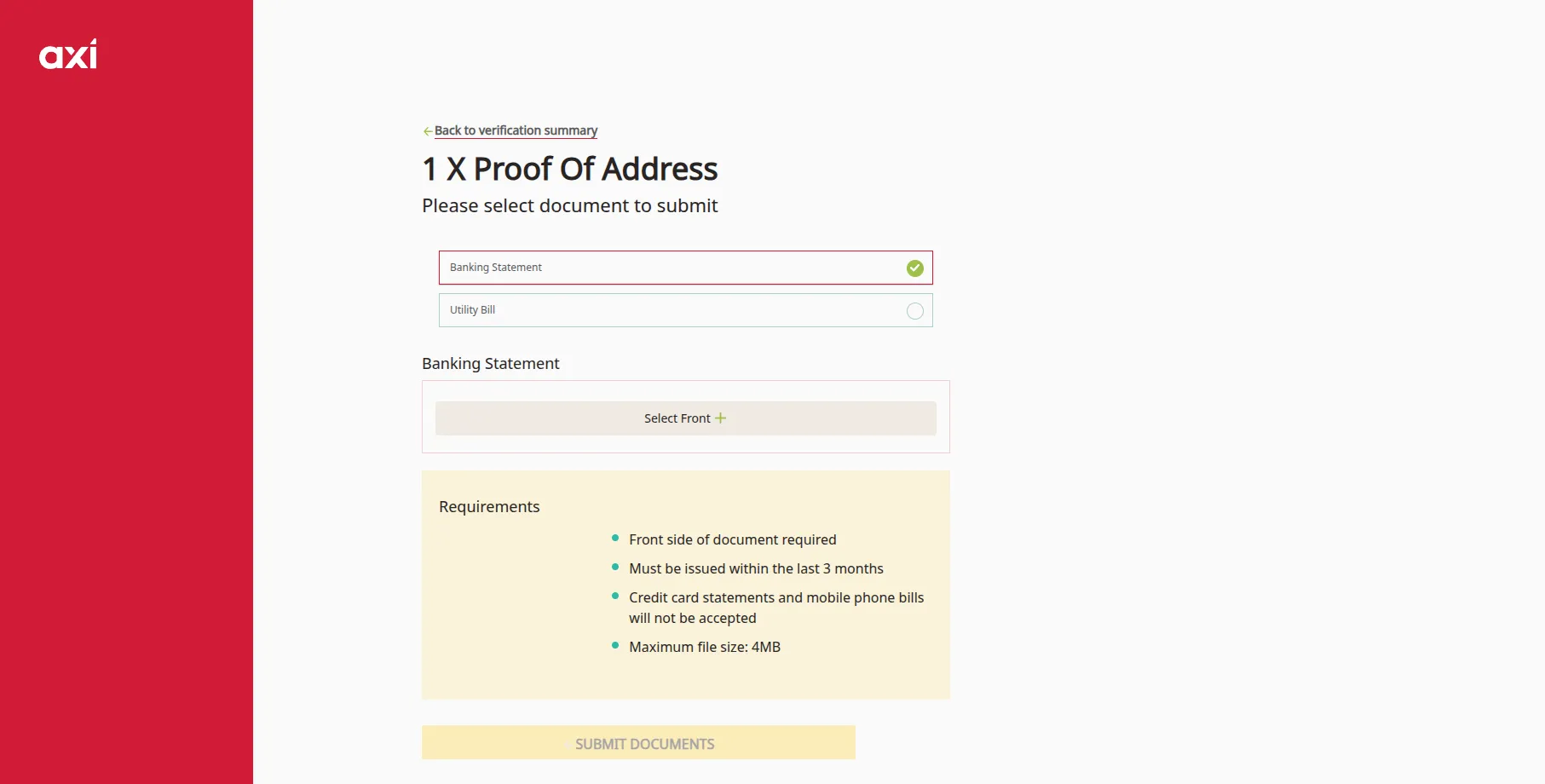

You should also upload a copy of a recent utility bill or bank statement to confirm your current residential address.

Document 2

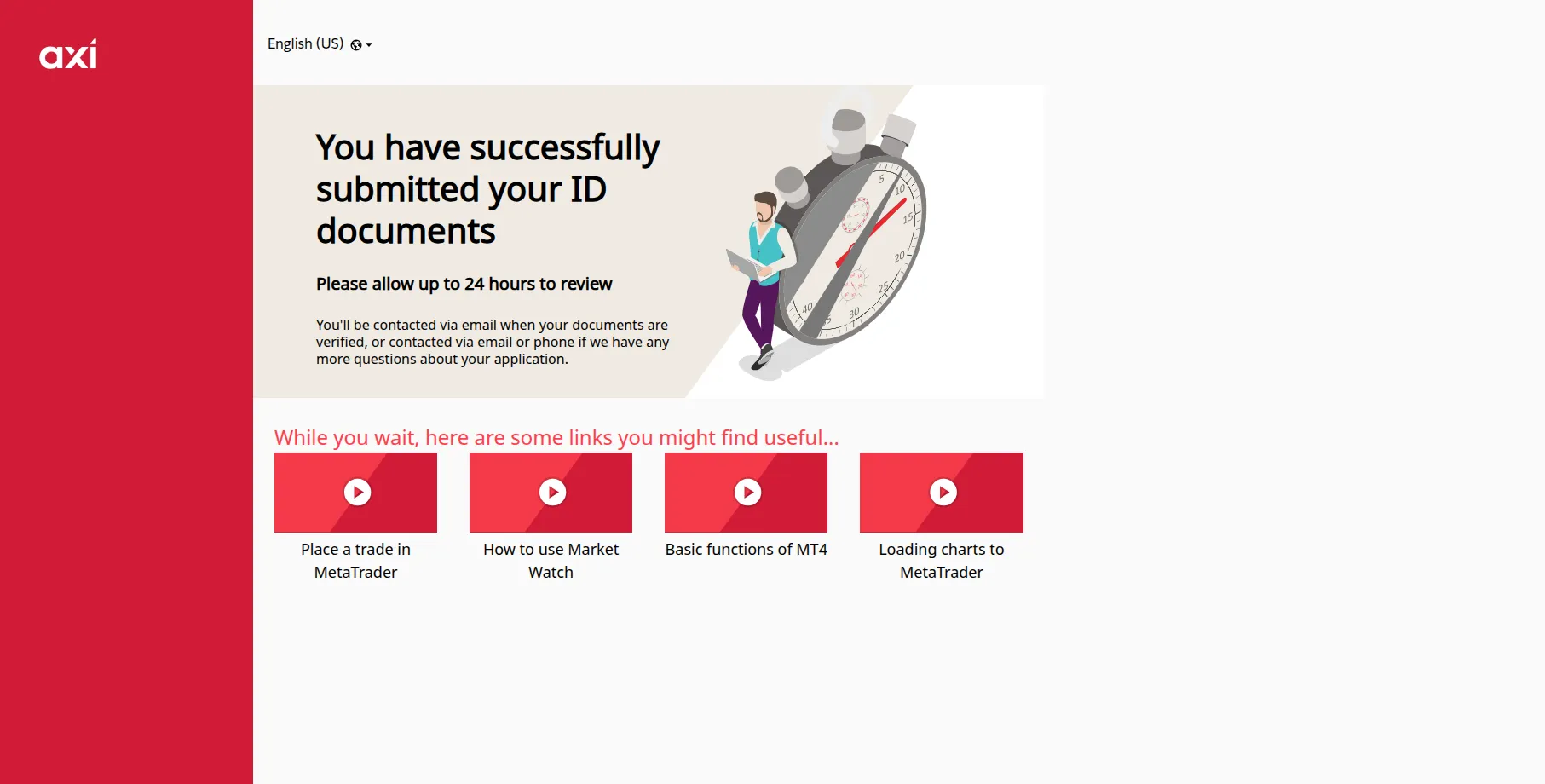

Pending Verification Status

Submit your documents and wait for the customer service department to evaluate your account application. This usually takes up to one business day. Approved onboarding customers are notified via email to confirm their successful registrations.

Final Impressions

All things considered, setting up a live account at Axi is a simple and intuitive process that takes around 15 to 19 minutes if all your documents are in order. You will face no issues passing the suitability test provided that you have a rudimentary knowledge of derivative trading and CFDs at the very least. There are no additional fees for account opening and you can do it from the comfort of your surroundings on your desktop computer or mobile phone. Make sure you use your account occasionally as Axi charges a $10 monthly fee after one year of inactivity.