CMC Markets Account Types in Brief

Onboarding customers at CMC Markets can open a CFD Trading or FX Active account. The former is intended for speculation on the price movements of forex, indices, commodities, and stocks, offering narrow spreads and commission-free trading. FX Active users enjoy tighter spreads from 0.0 pips on six major forex pairs and 25% spread discounts for other pairs but pay fixed commissions of 0.0025%.

Both account types are available in a demo format and allow netting and hedging. Users can also engage in telephone trading. The base account currencies include USD, AUD, GBP, EUR, CAD, and SGD, among others. FX Active accounts facilitate trading via MetaTrader 5 and the proprietary NextGen platform. MetaTrader 4 is supported for standard CFD Trading accounts.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

CMC Markets Minimum Deposit Requirements

There are no minimum deposit requirements for either account type. CMC Markets accepts a broad range of account funding methods, including credit and debit cards, online banking, and standard bank transfers. Card transactions incur a 2% processing fee in certain countries (Singapore, for example) but the other supported methods allow for free deposits.

What Can You Trade at CMC Markets

CMC Markets provides retail traders with an immense choice of over 12,000 financial markets available for speculative trading through CFDs. Currency traders can pick from 300+ forex pairs but stocks, commodities, indices, ETFs, treasuries, share baskets, and cryptocurrencies are also tradable at CMC Markets. Depending on their jurisdiction, retail clients can use leverage of up to 1:200 (BMA) or 1:30 (FCA, ASIC). Negative balance protection is available in most countries. Setting up a spread betting account is an option for customers from the UK.

Step-by-Step Registration at CMC Markets (BMA) – Takes 20 to 25 Minutes in Total

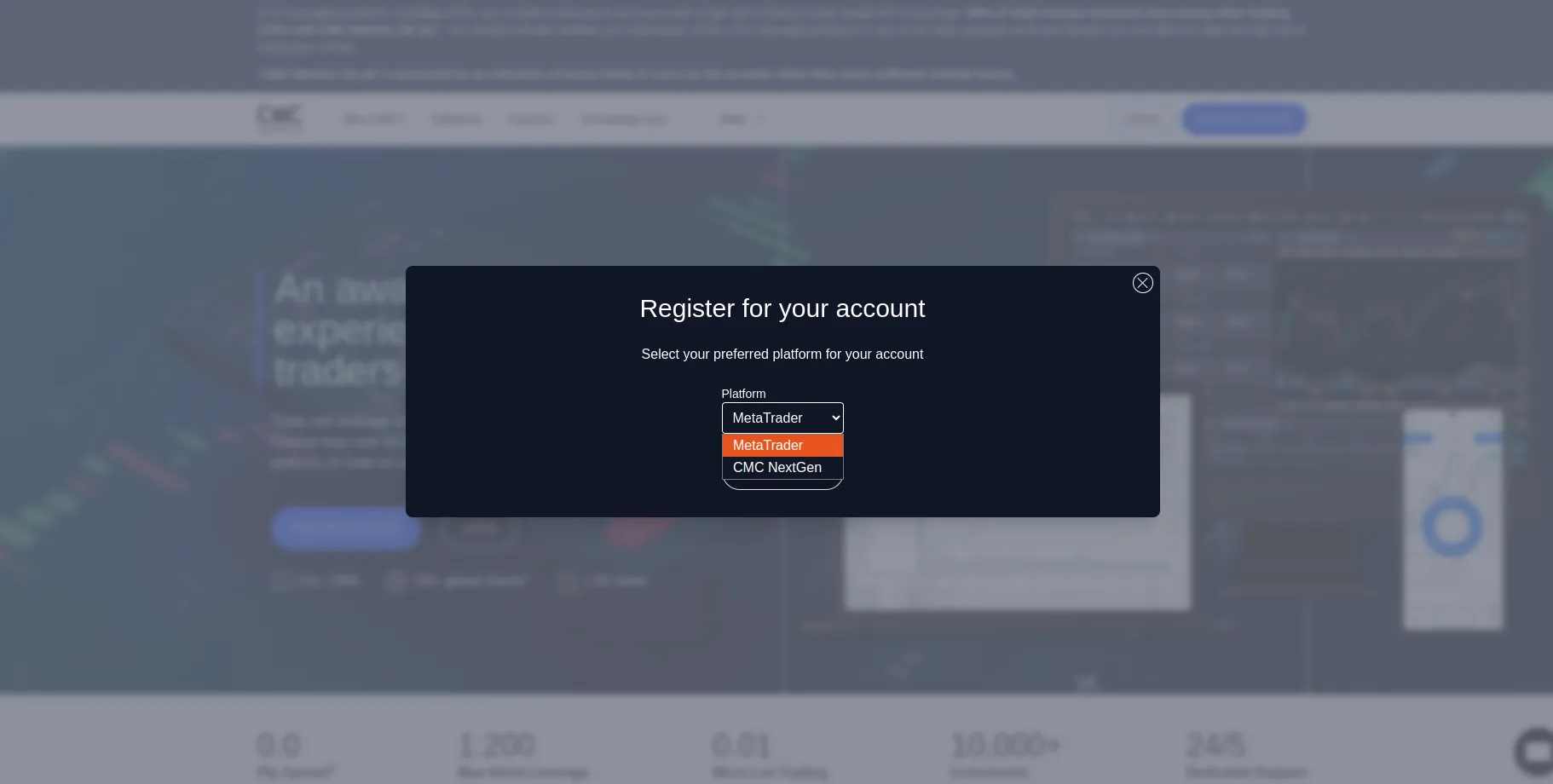

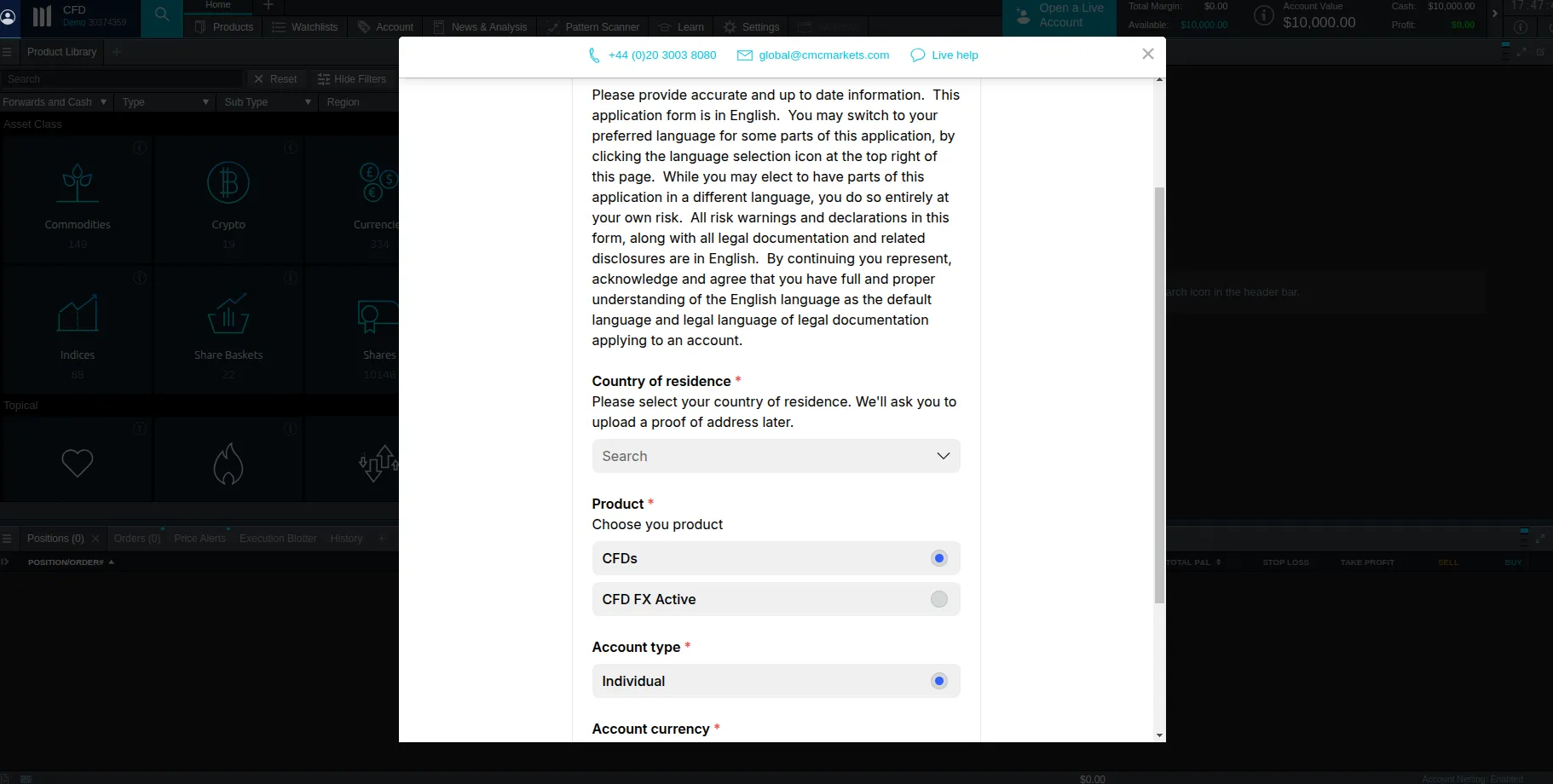

Launch the broker’s website in your mobile or desktop browser and click the blue Open Account button in the upper right corner to launch the registration form. Select your preferred trading platform (MetaTrader or NextGen).

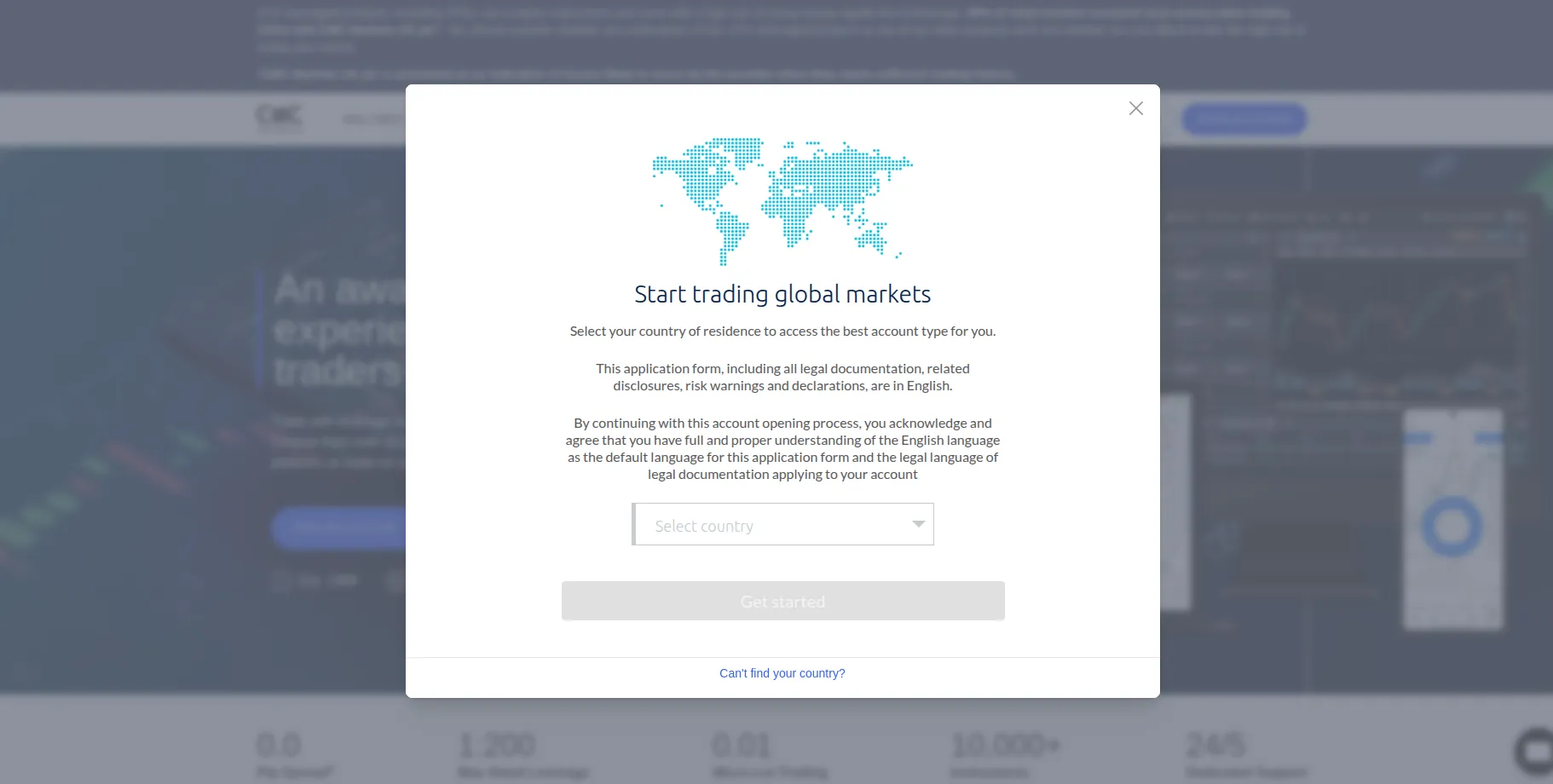

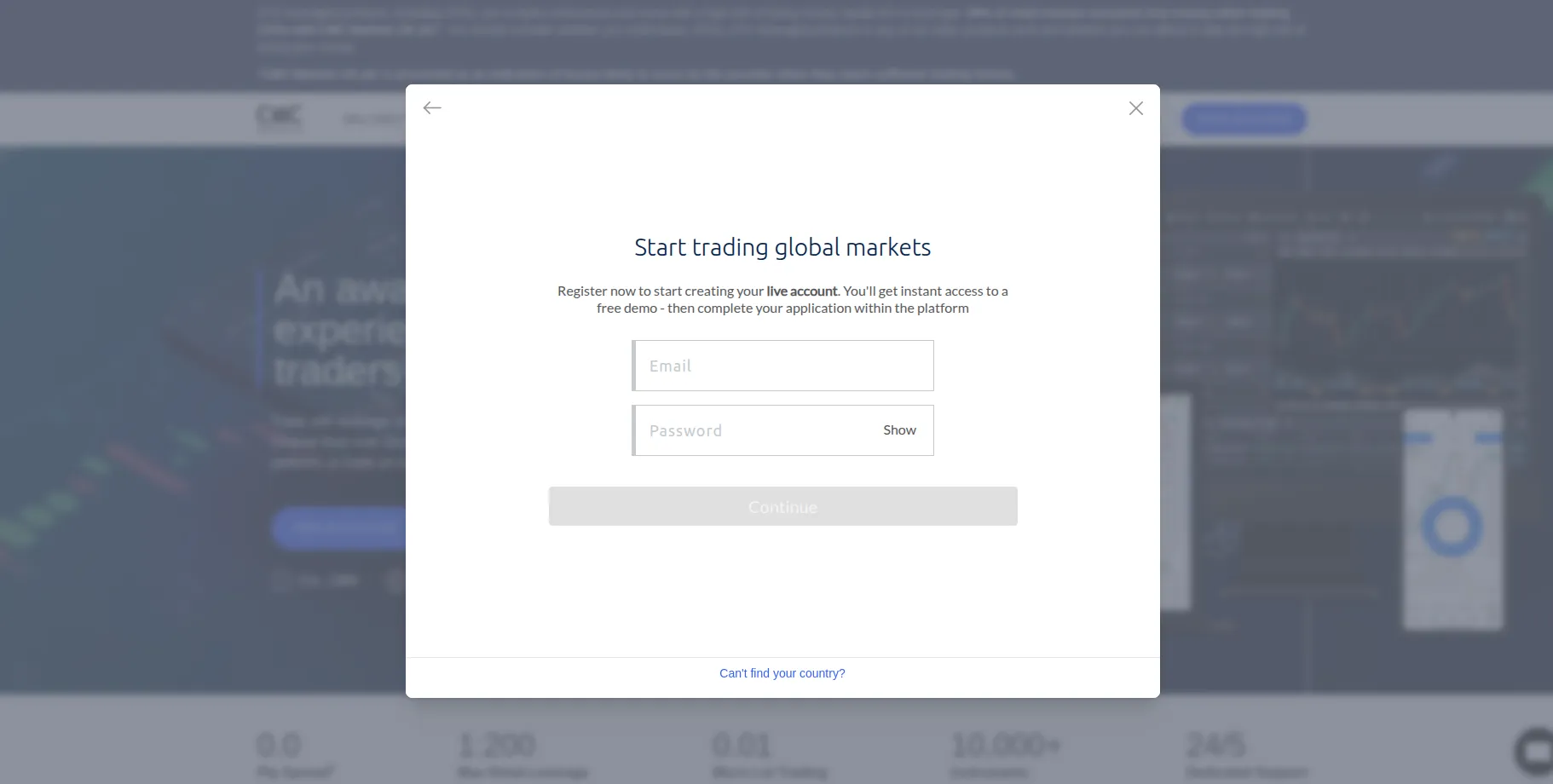

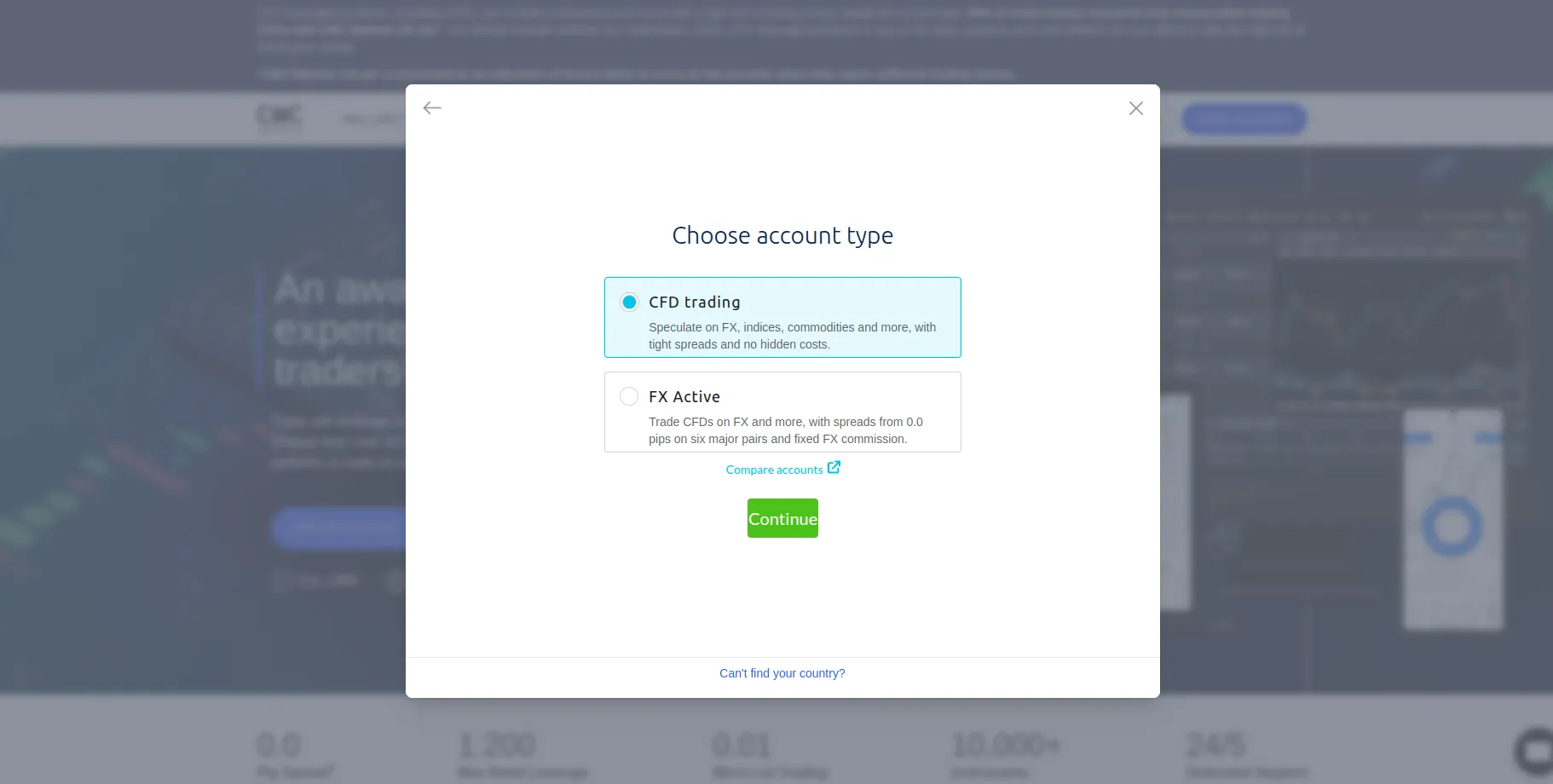

A dropdown menu will open, prompting you to select your jurisdiction to see the account types available there. Provide a valid email address, type in your preferred password, and select your account type (CFD Trading or FX Active).

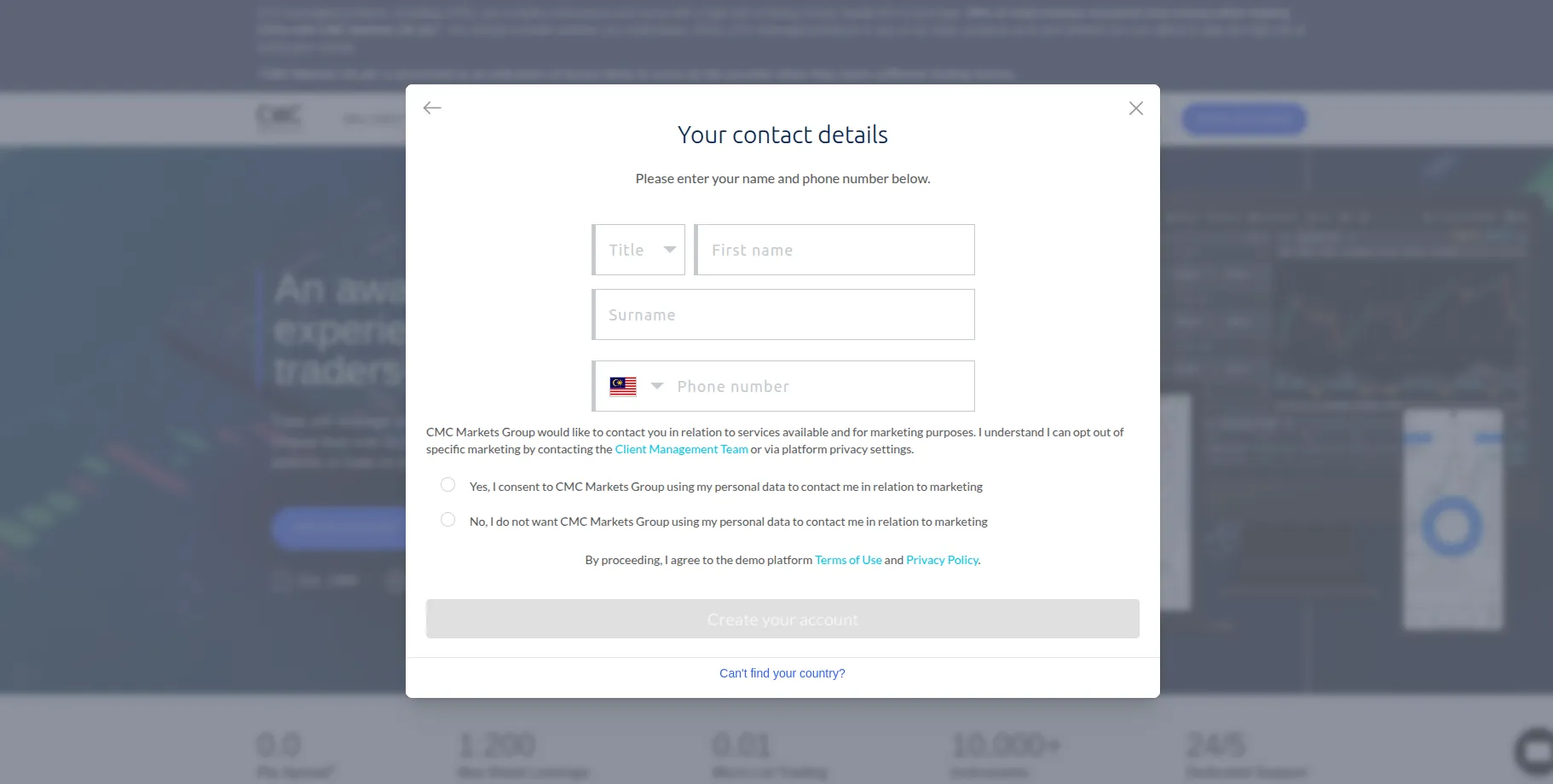

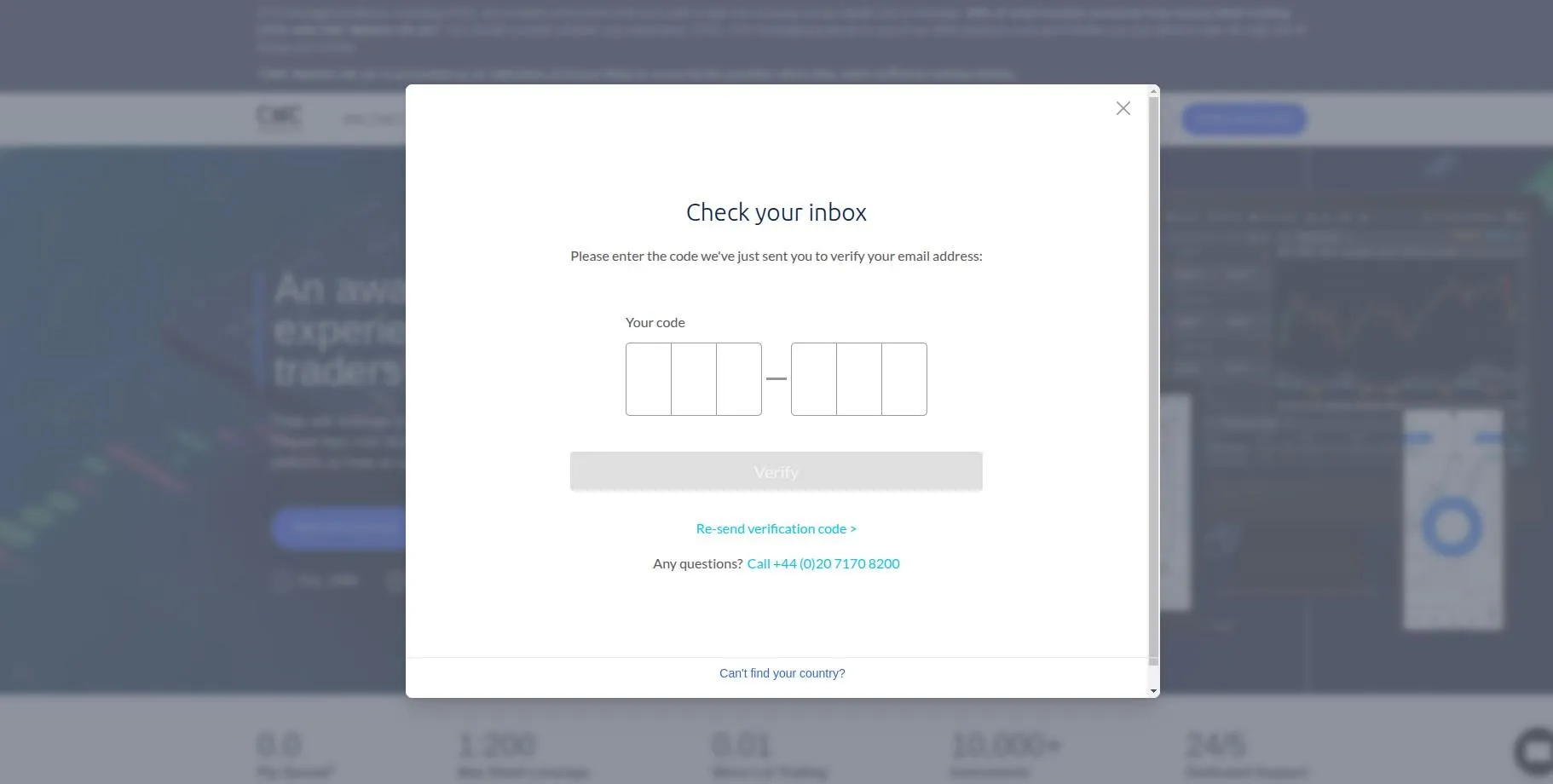

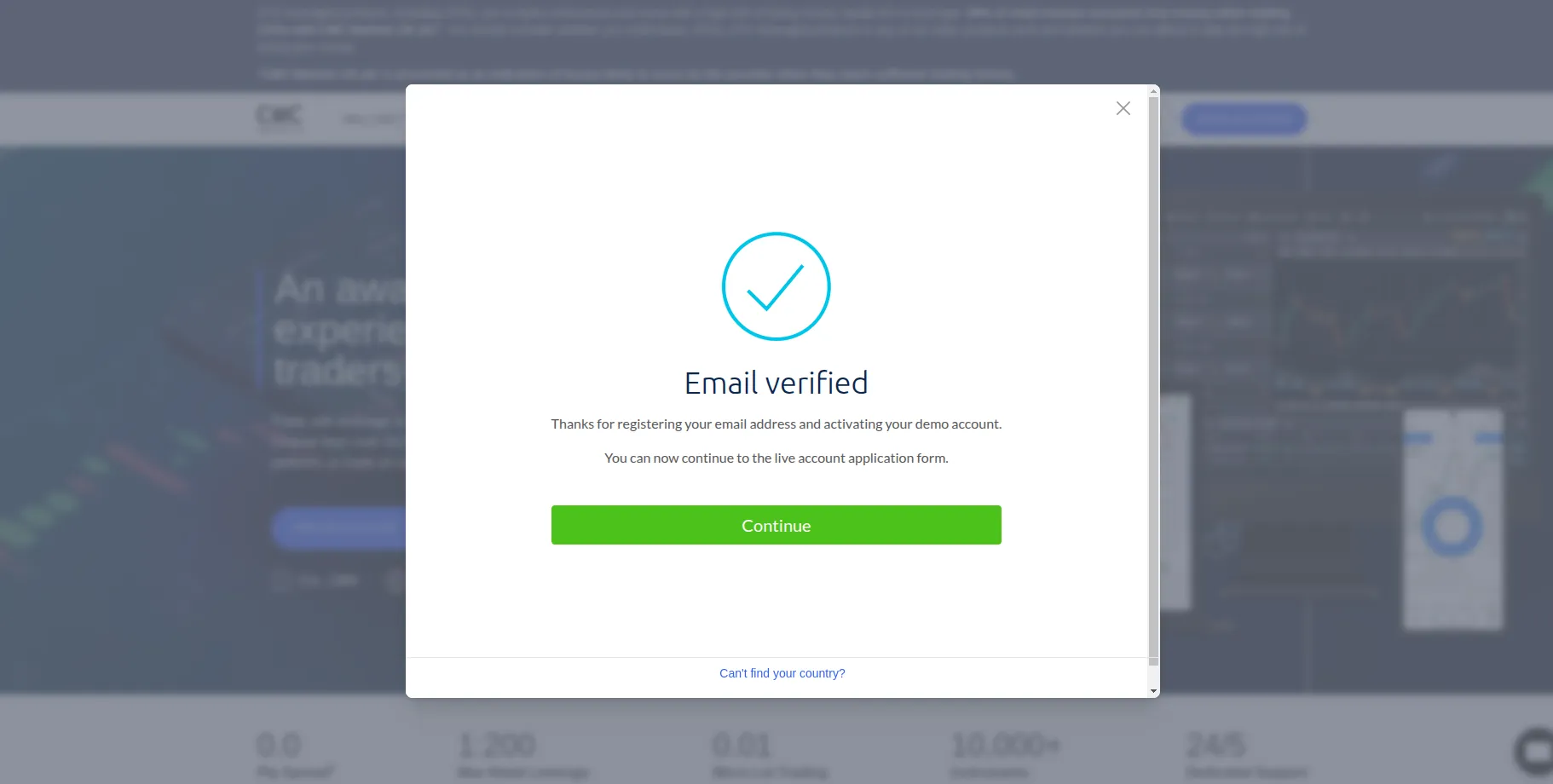

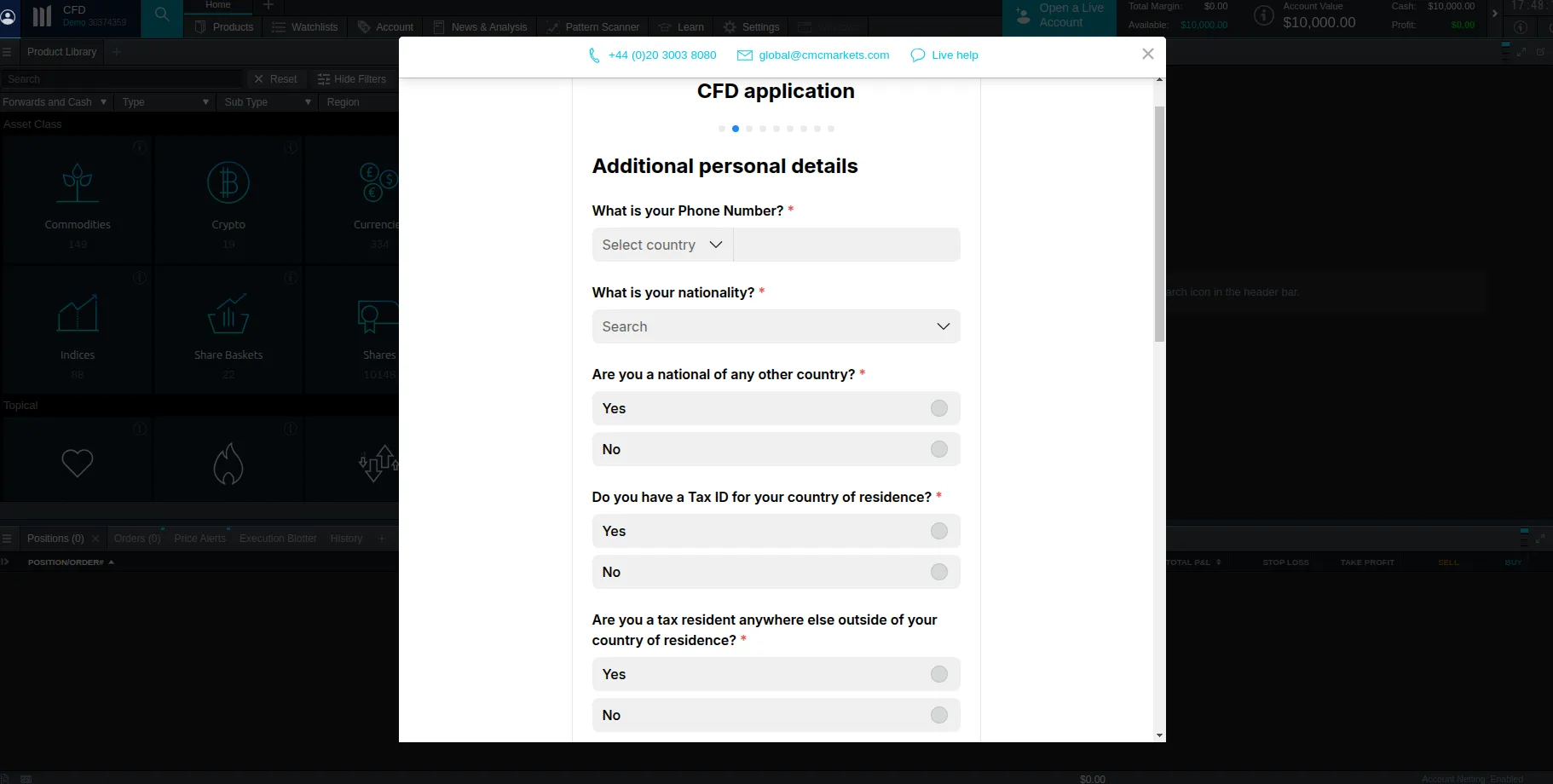

Enter your personal details, starting with your title, telephone number, first name, and surname. CMC Markets will send you a unique six-digit activation code you must enter to verify your email address and continue with your registration.

Start configuring your account by selecting your base currency, tradable products, and account type (individual or corporate).

Provide more personal information, including your nationality and tax residence. You must also specify whether you are a US resident or not.

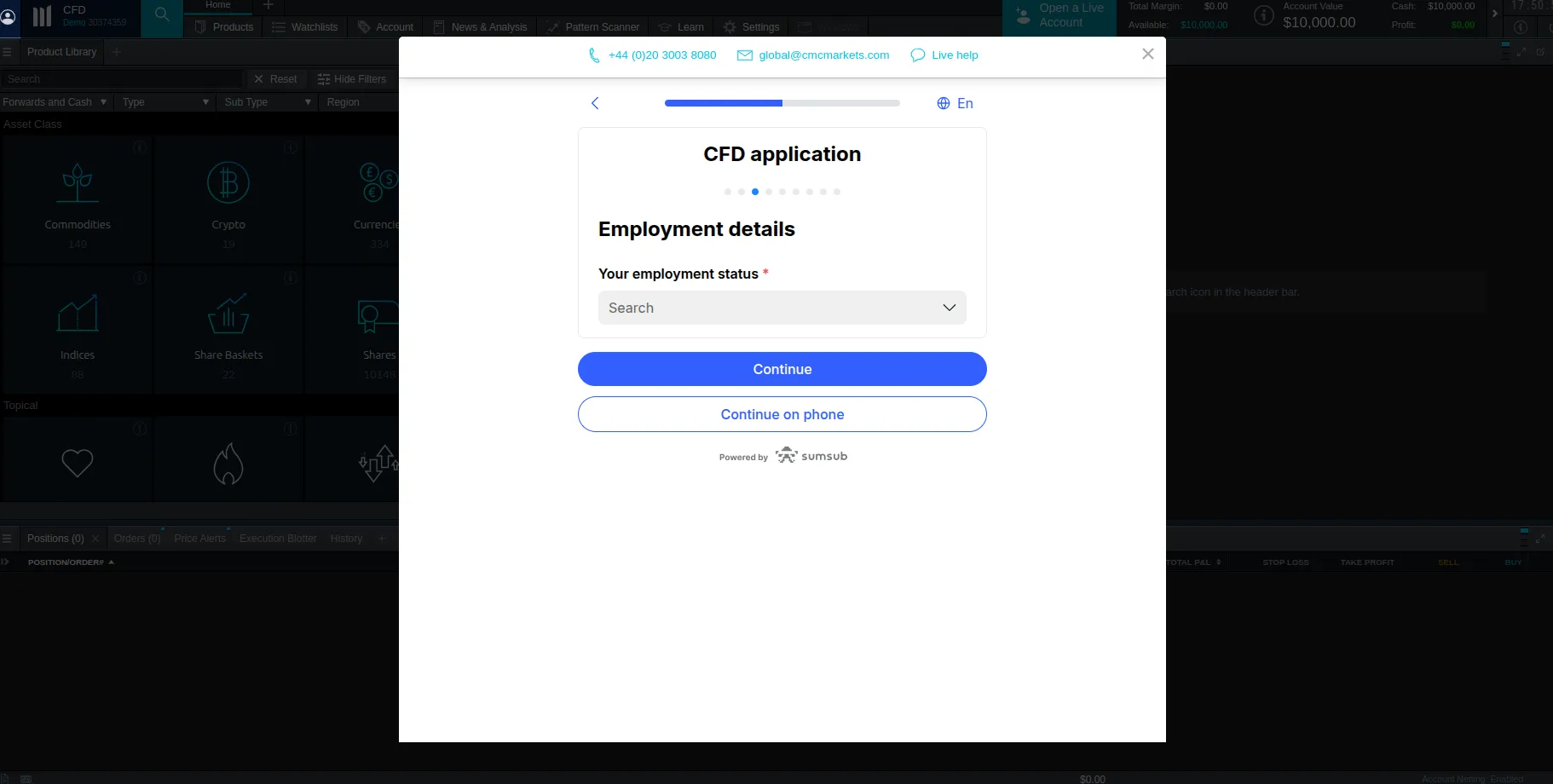

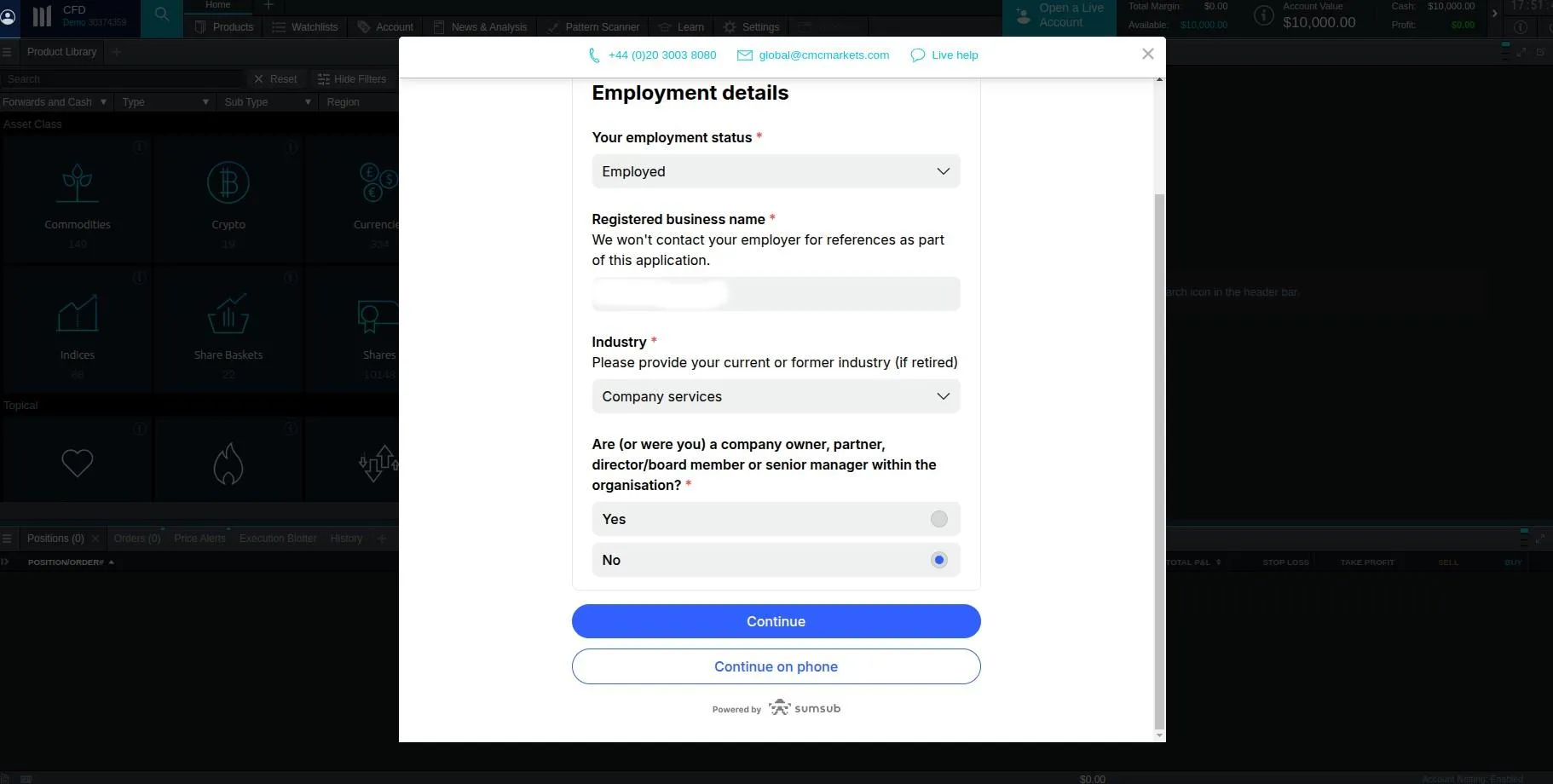

Select your current employment status from the dropdown menu. You must also enter the business name of the company you work for, along with the business sector and whether you are or were an owner, partner, or manager.

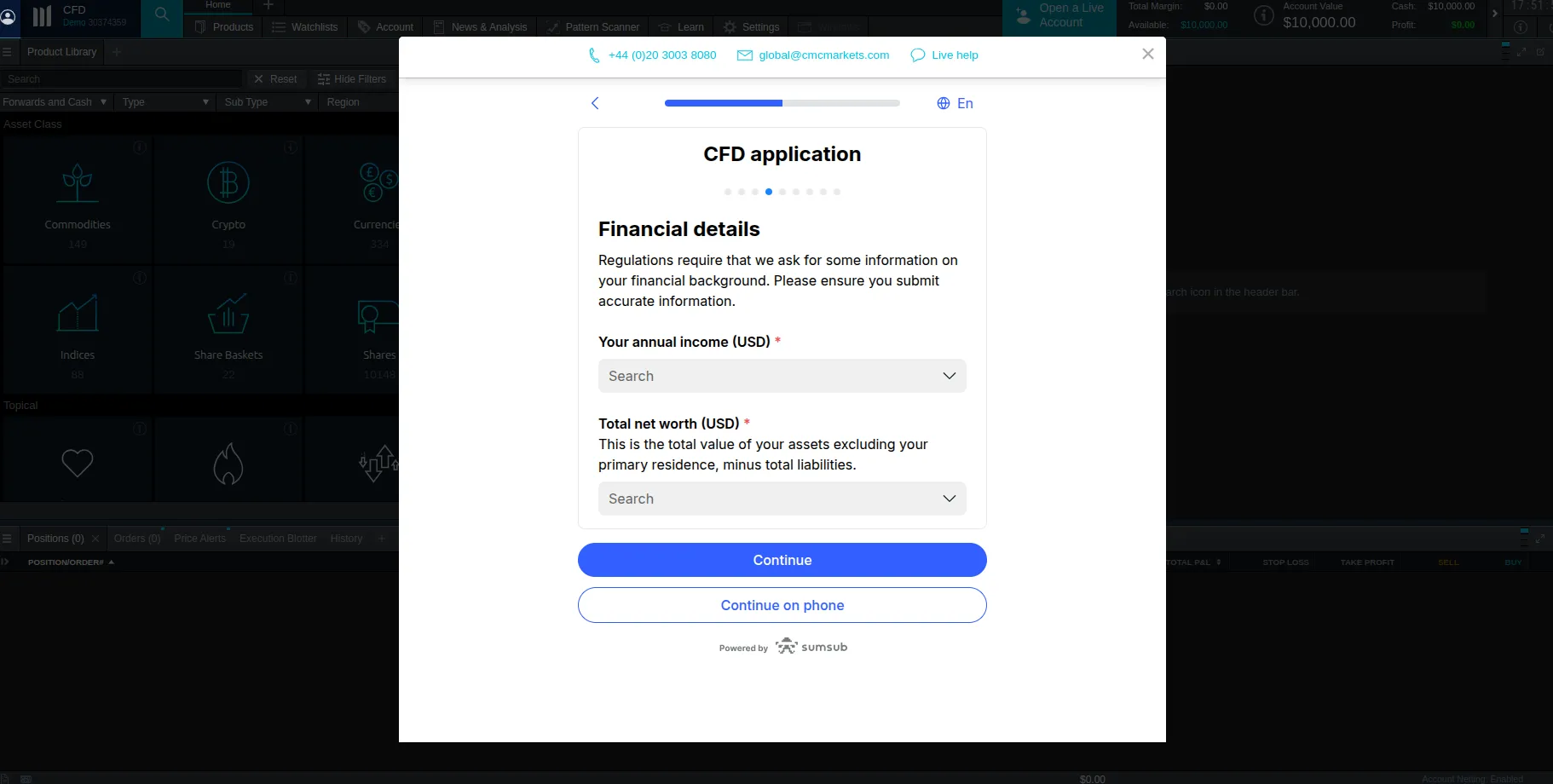

CMC Markets will then prompt you to provide your financial details, including your average annual income and total net worth.

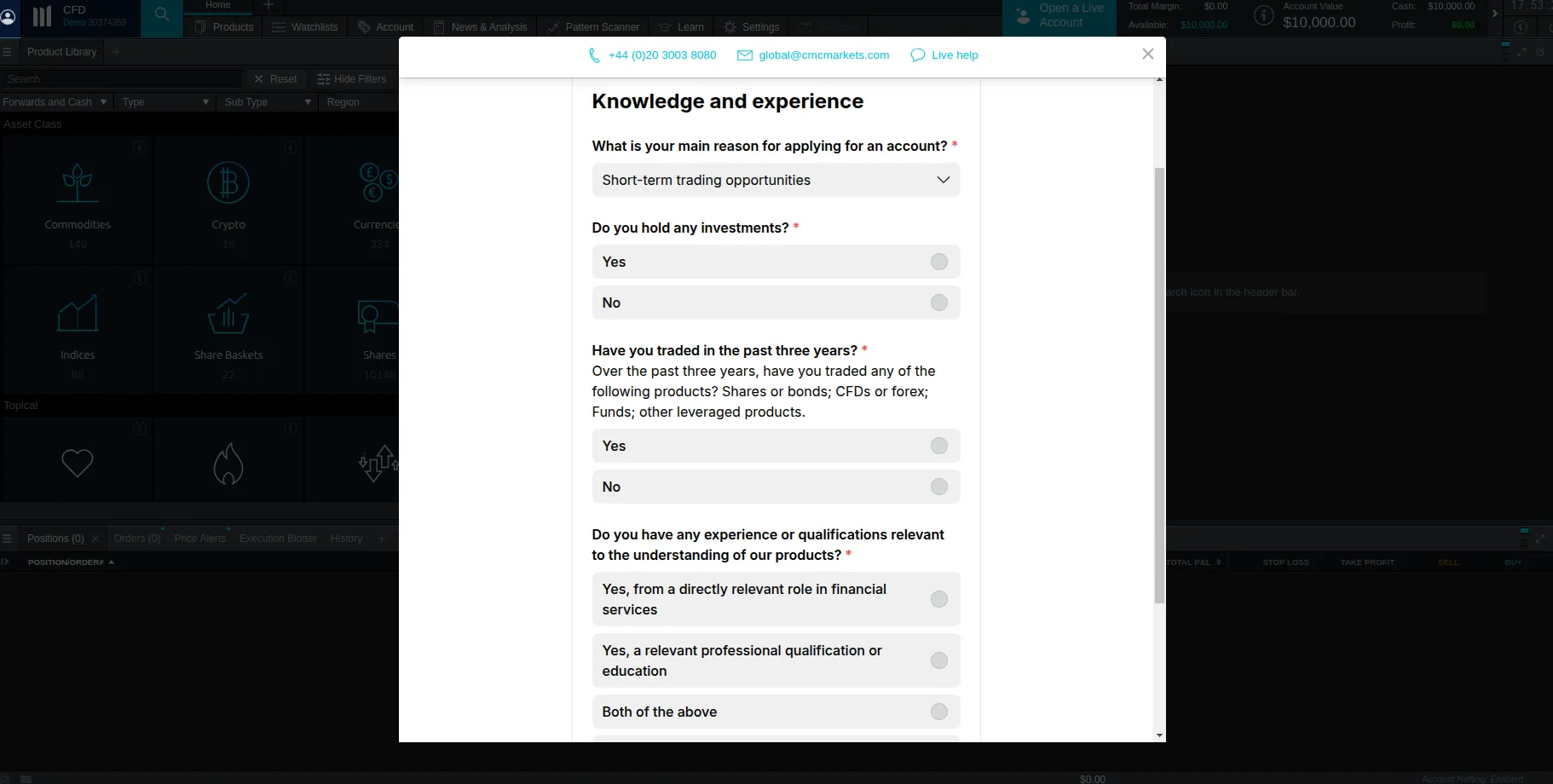

Next, CMC Markets will evaluate your knowledge and experience in derivative trading by asking you to complete a brief questionnaire on your qualifications and what you have traded during the past three years.

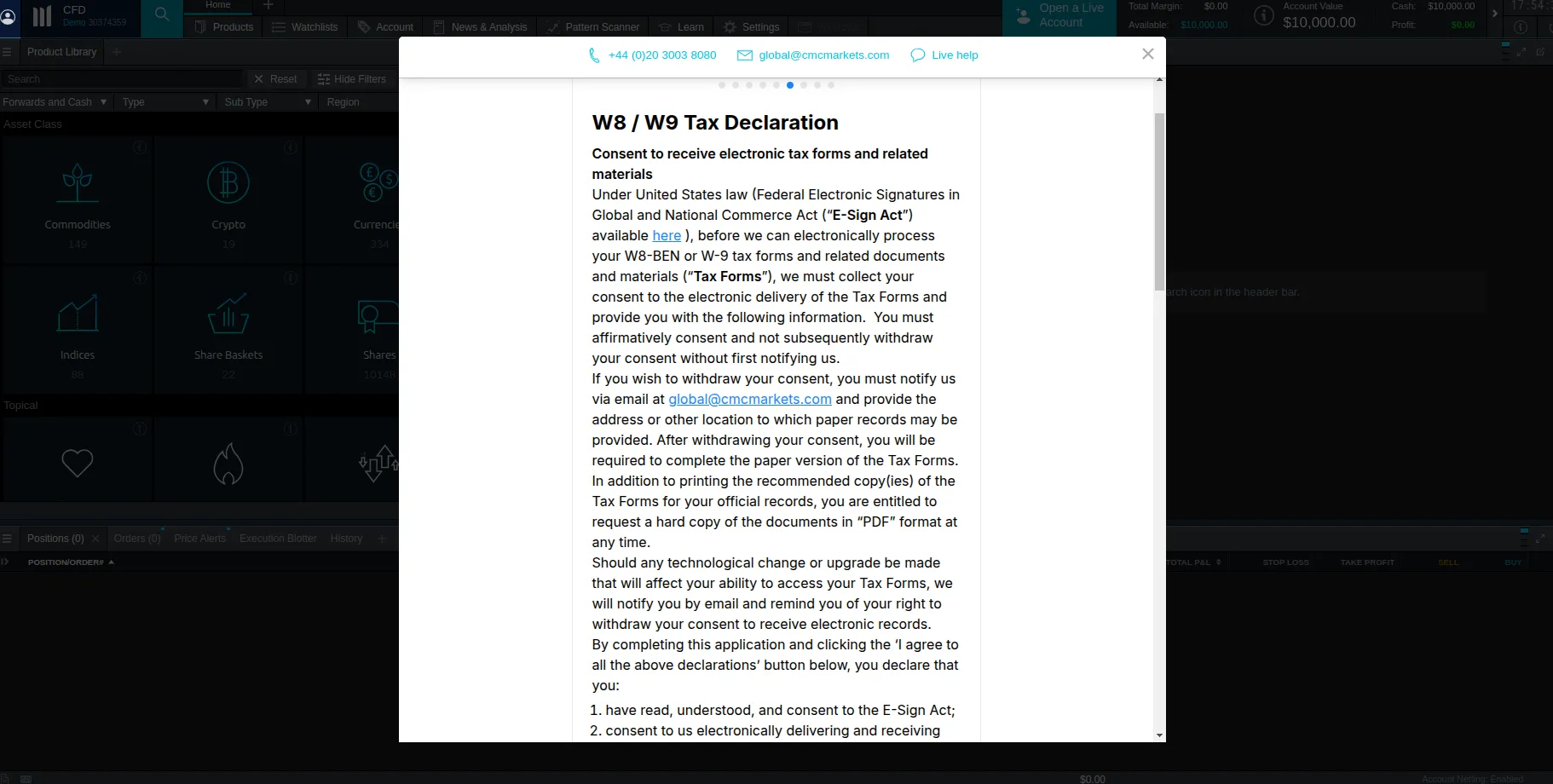

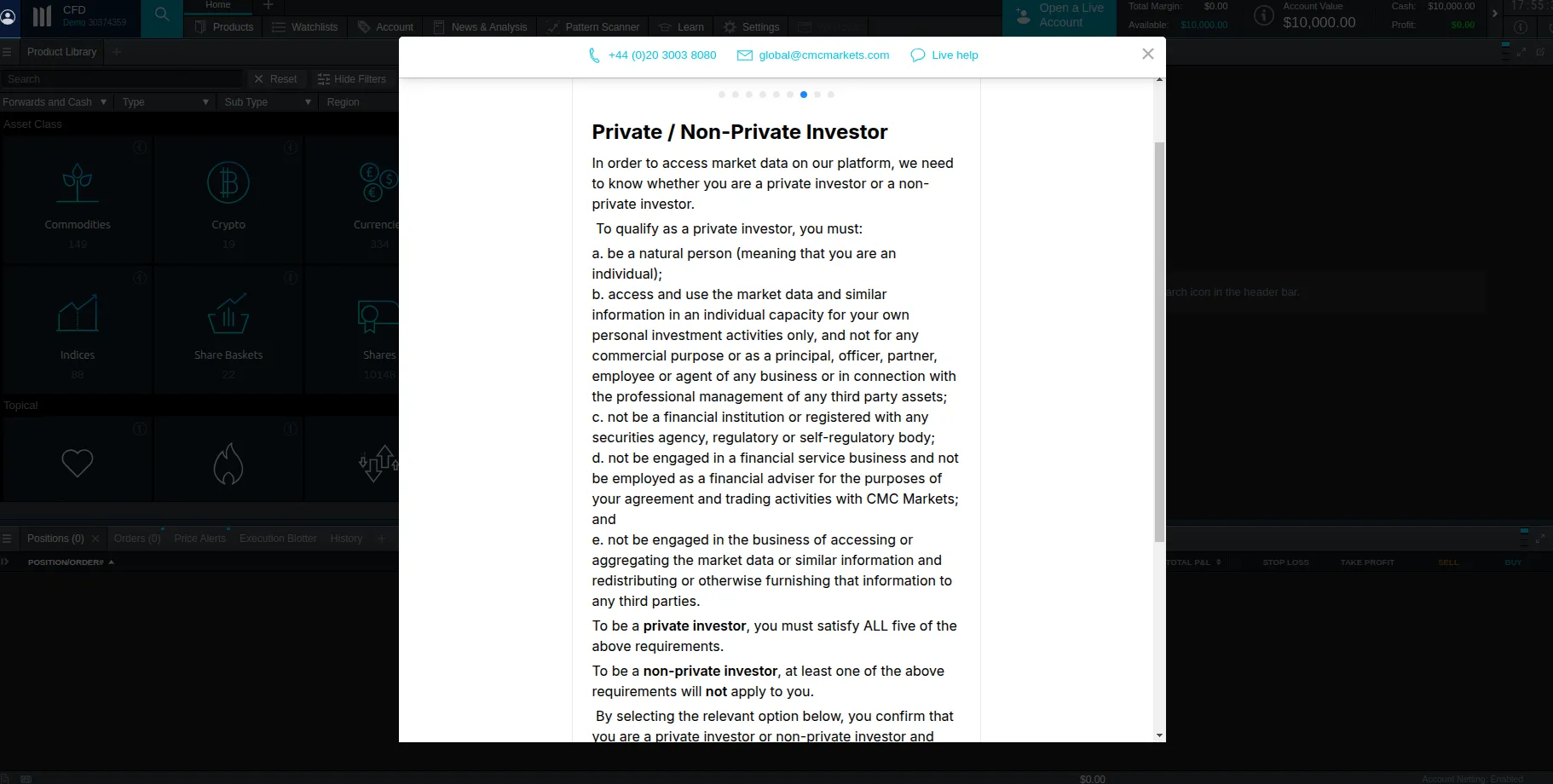

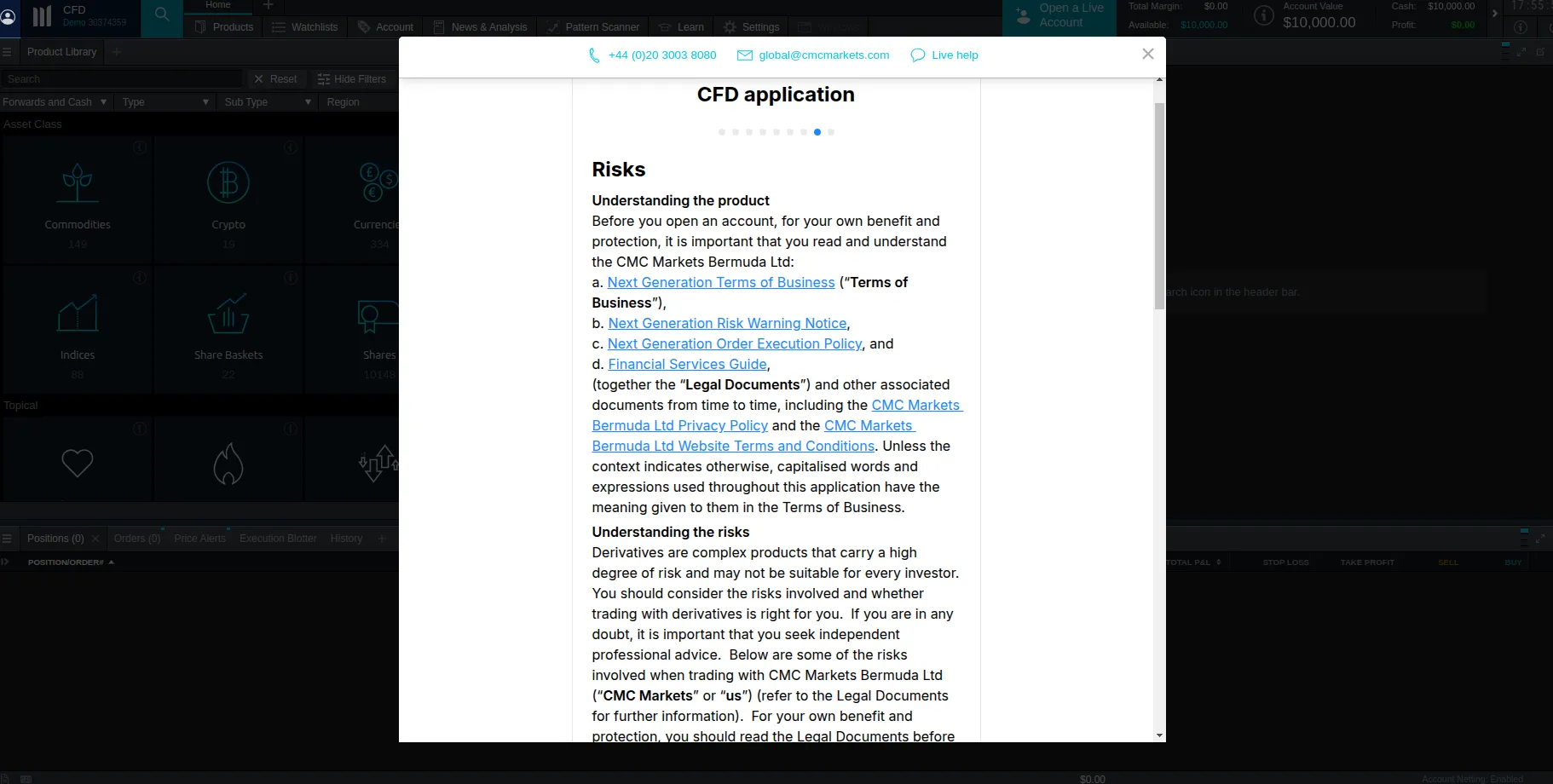

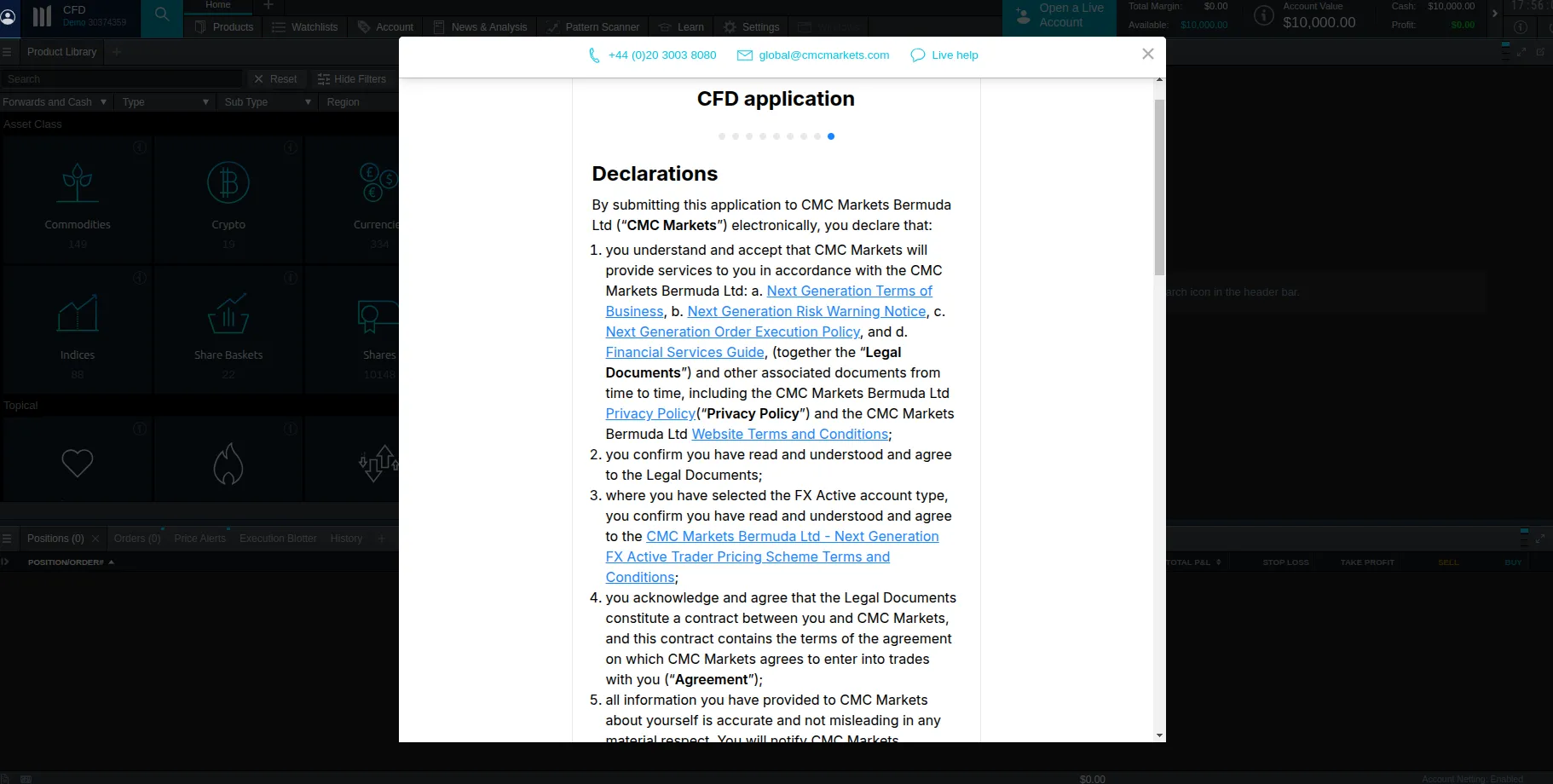

You must also consent to receiving online tax forms (where applicable) and specify whether you are a private or institutional investor. Read the broker’s terms and risk disclosures. Submit your application to proceed to the next step.

Consenting to receiving electronic tax declarations (depends on country).

Specifying whether you are a private investor or not.

Risk disclosures

Submitting the account application.

-

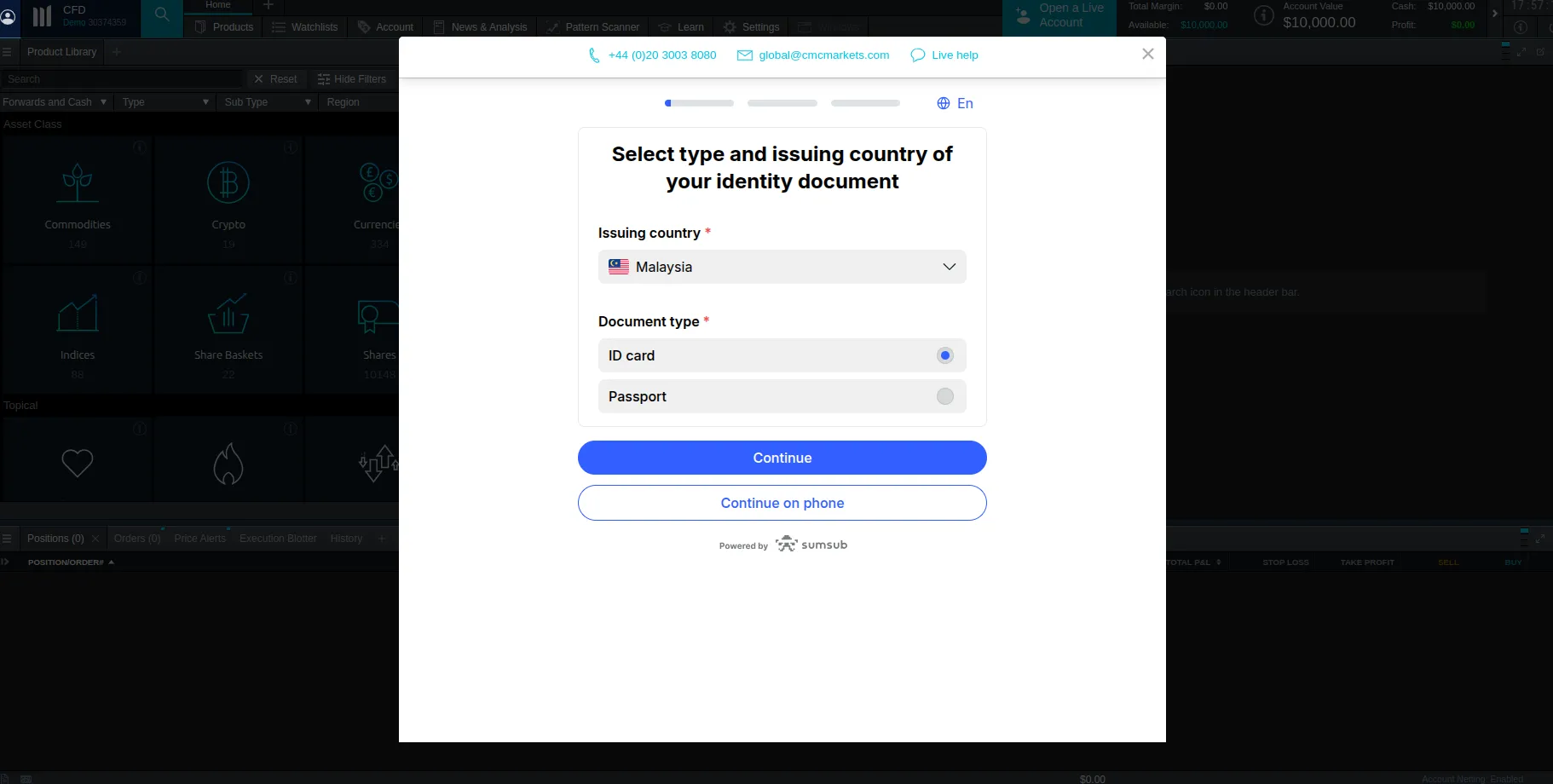

KYC Verification – Takes Approximately 10 minutes

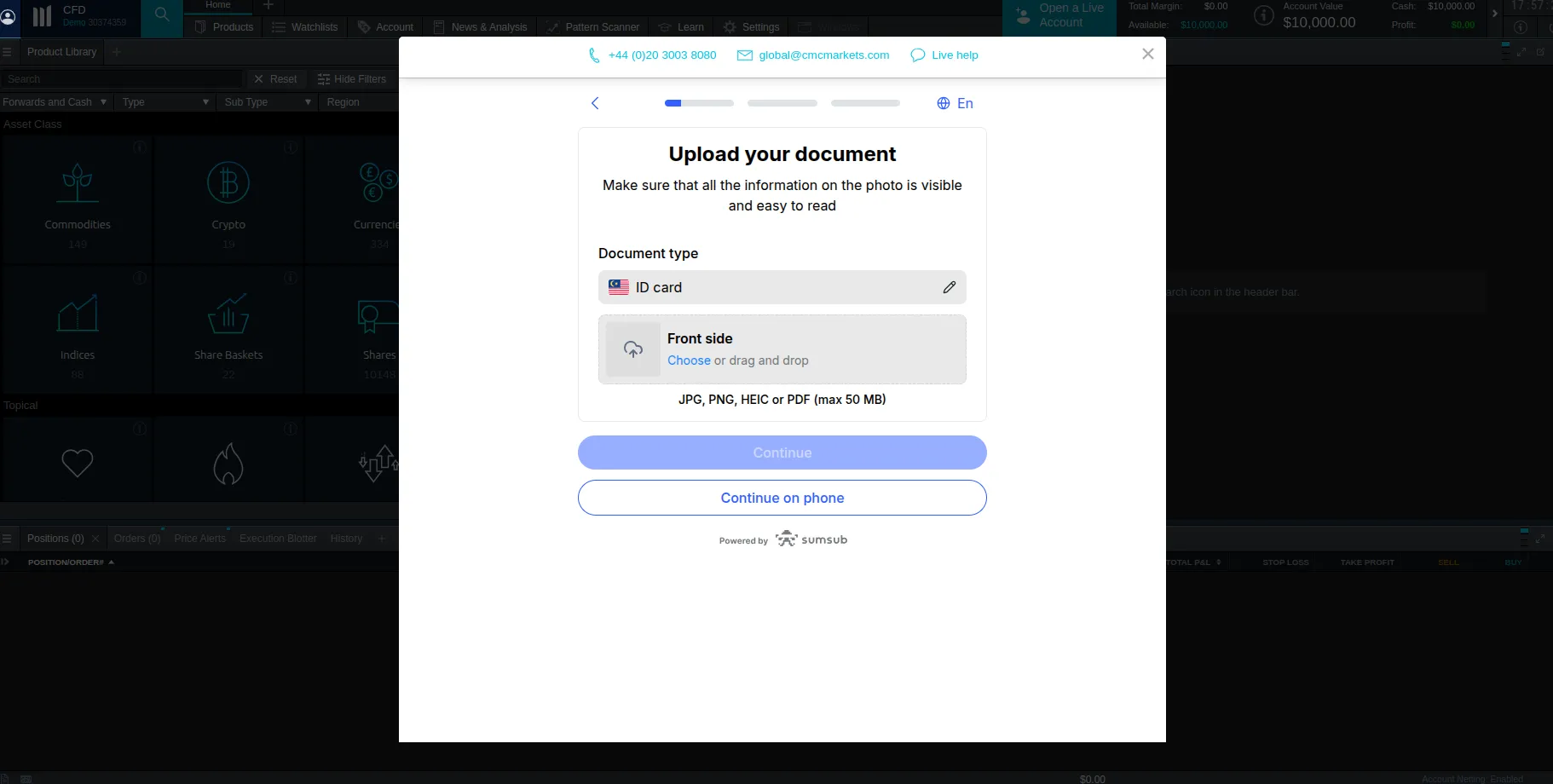

You have now reached the final stage of creating your account at CMC Markets. The broker will prompt you to verify your identity by uploading photos of your identity documents. You must first select your country to see the documents accepted for the respective region.

Select your preferred document and upload photos of the front and back sides. Make sure your photos are clear enough. The system will prompt you to upload again if the information is illegible.

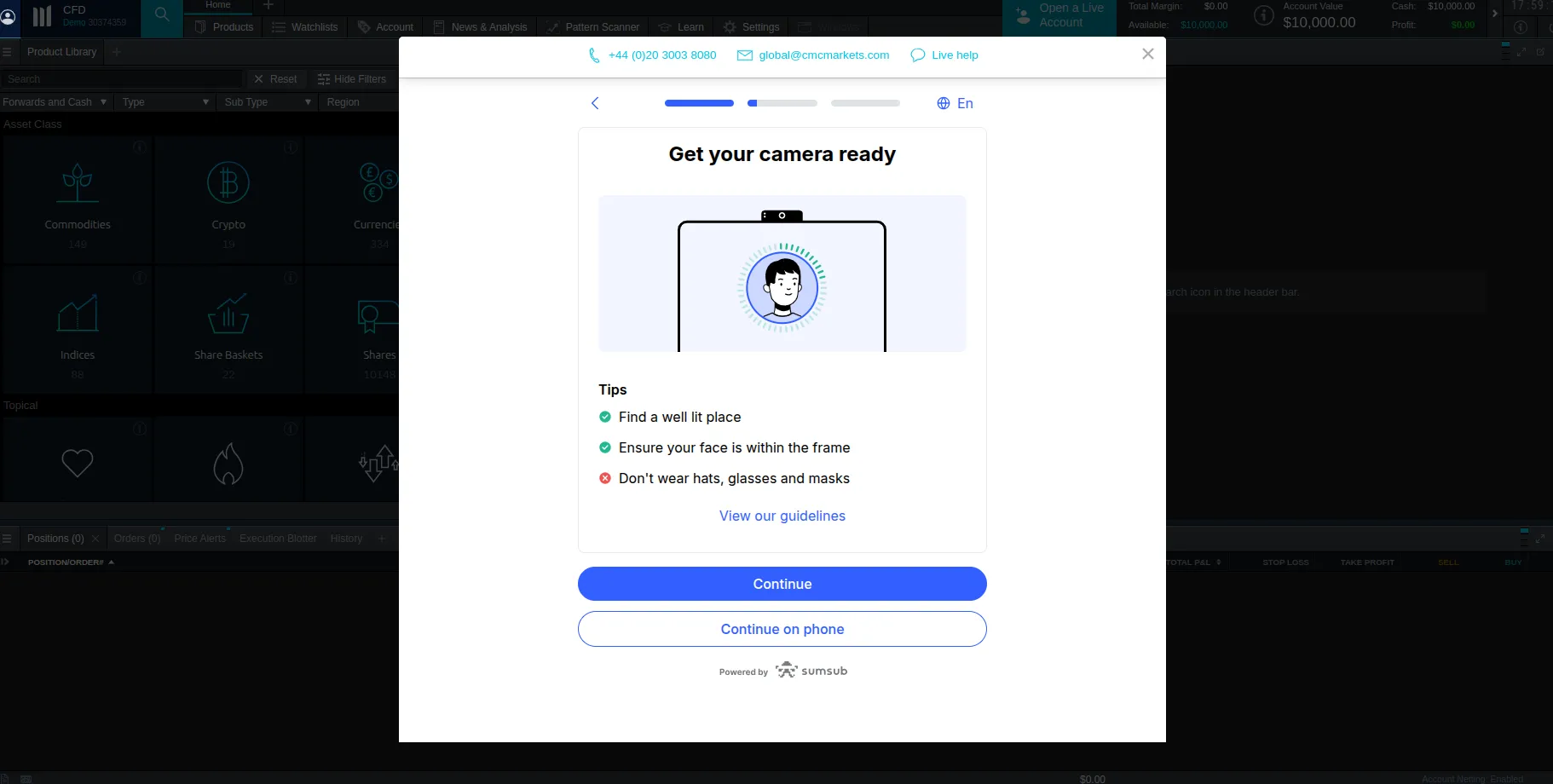

Once you upload your photos, you must proceed on your mobile device. The broker will ask you to record a short video of your face using your smartphone camera to confirm it matches the photos in your identity document.

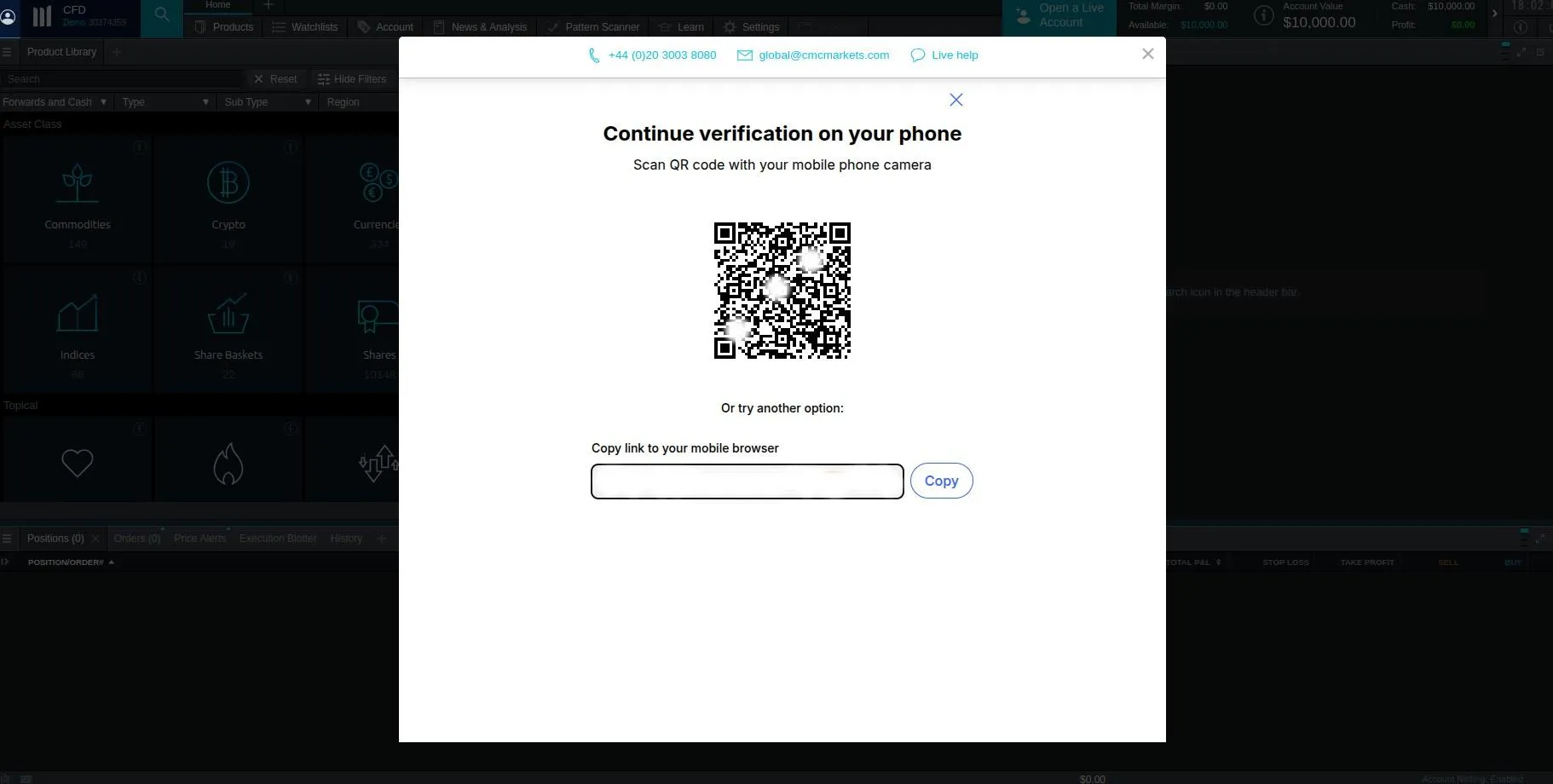

To continue on your phone, you can either scan the QR code CMC Markets generates for you or copy the unique link in your mobile browser. We found it easier to scan the code.

Next, you must upload proof of address such as a recent utility bill or bank statement so that CMC Markets can confirm your current residential address. Once you submit all your KYC documents, you must wait for the relevant department to evaluate your application manually and notify you via email.

Final Impressions

The entire registration at CMC Markets took us around 25 minutes, 10 of which we spent on identity verification. We strongly recommend you prepare all the necessary documents beforehand to prevent further delays in your registration. Signing up through the Bermuda-regulated entity was comparatively easy and intuitive, with little to no setbacks. We suggest you read the broker’s risk disclosures, privacy policies, and terms before initiating your registration.