Account Types at eToro

The broker offers several account types that cater to the preferences of various traders, starting with the Personal account, which is reserved for retail clients. Forex spreads start from 1 pip, and the maximum leverage is capped at 1:30 (CySEC, FCA, etc.) or 1:400 (SFSA). The Professional account, on the other hand, allows one to trade with higher leverage, but opening such an account can only be done if one is eligible.

Additionally, we should highlight eToro’s Islamic account, which is characterized by swap-free trading. The broker also caters to corporate clients with an appropriate account type.

Last but not least, novice traders can switch between virtual and live trading after they register. The demo account grants virtual funds and provides a risk-free environment for traders wishing to practice and hone their skills without the threat of losing money.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

Minimum Account Deposit Requirements

Traders should keep in mind that eToro’s minimum first deposit requirement differs based on where one resides. In most European countries, the minimum first deposit is $50, and the same applies to the UK, Vatican City, Taiwan, and the overseas territories of France. As for the US and the UAE, the required amount is $100. A $1,000 minimum is imposed on those residing in places like New Zealand and Kuwait. In some countries, such as Bulgaria and South Africa, the requirement is $2,000, while Israelis need to adhere to a $10,000 minimum. Finally, traders from eligible countries not included in eToro’s list are subject to a minimum of $200. Subsequent deposits must be at least $50, with the exception of the UK ($10) and the US ($1). Moreover, bank transfers must always involve at least $500 when it comes to deposits.

Tradable Instruments

One of eToro’s major perks is its product catalog. eToro is a major brand when it comes to both social trading and cryptocurrencies, and the platform’s forex trading capabilities have also earned it a good reputation among traders. Major pair spreads typically start from 1 pip, and clients do not need to worry about commissions. Besides forex and crypto, eToro also offers markets like stocks, commodities, indices, and ETFs.

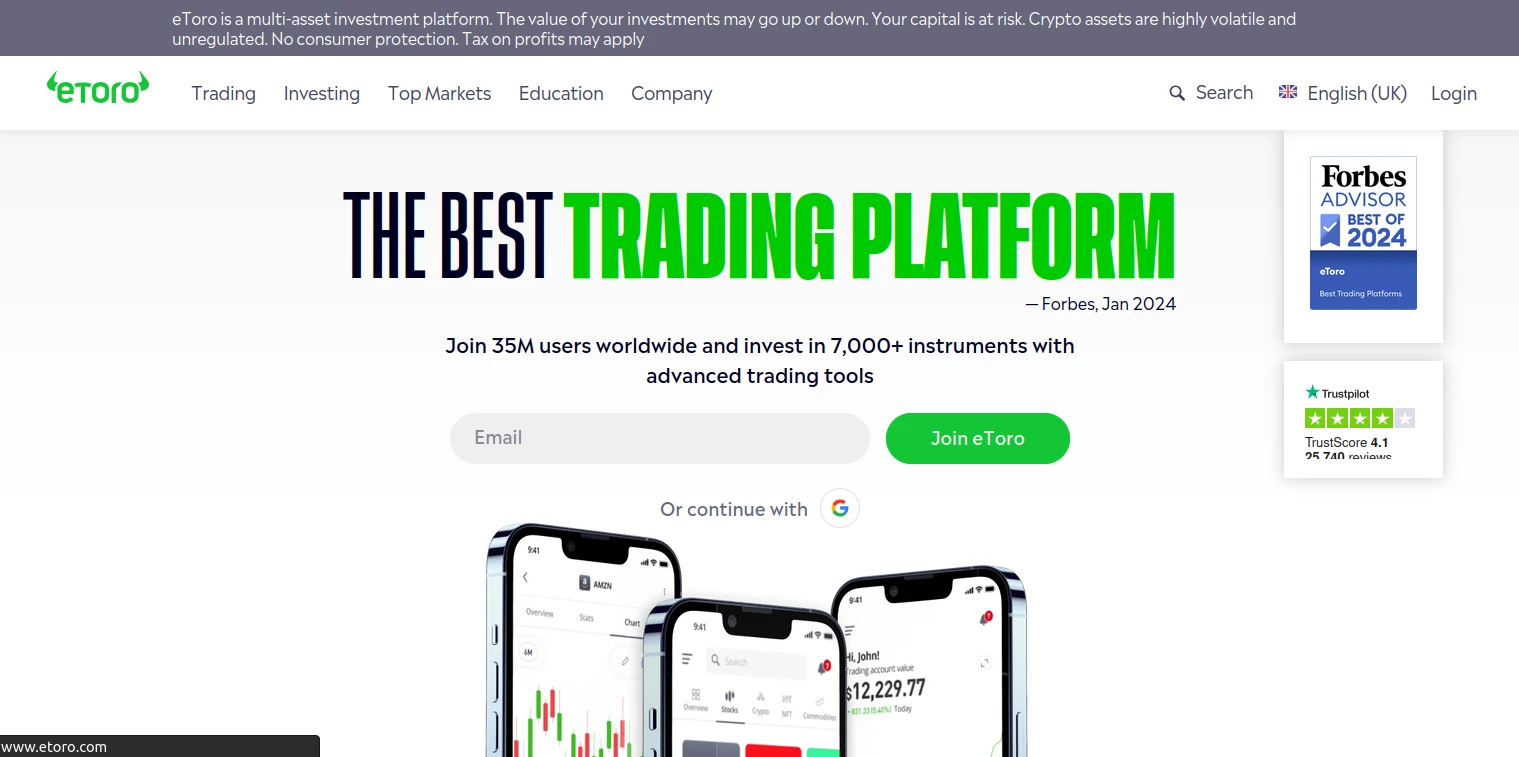

Account Registration at eToro – Takes about 15 minutes (Live account)

eToro’s registration process is among the lengthier ones, but if you follow the steps outlined below, you will be done in no time. We will also cover how you can verify your account.

-

The first step involves clicking the Join eToro button on the broker’s homepage.

-

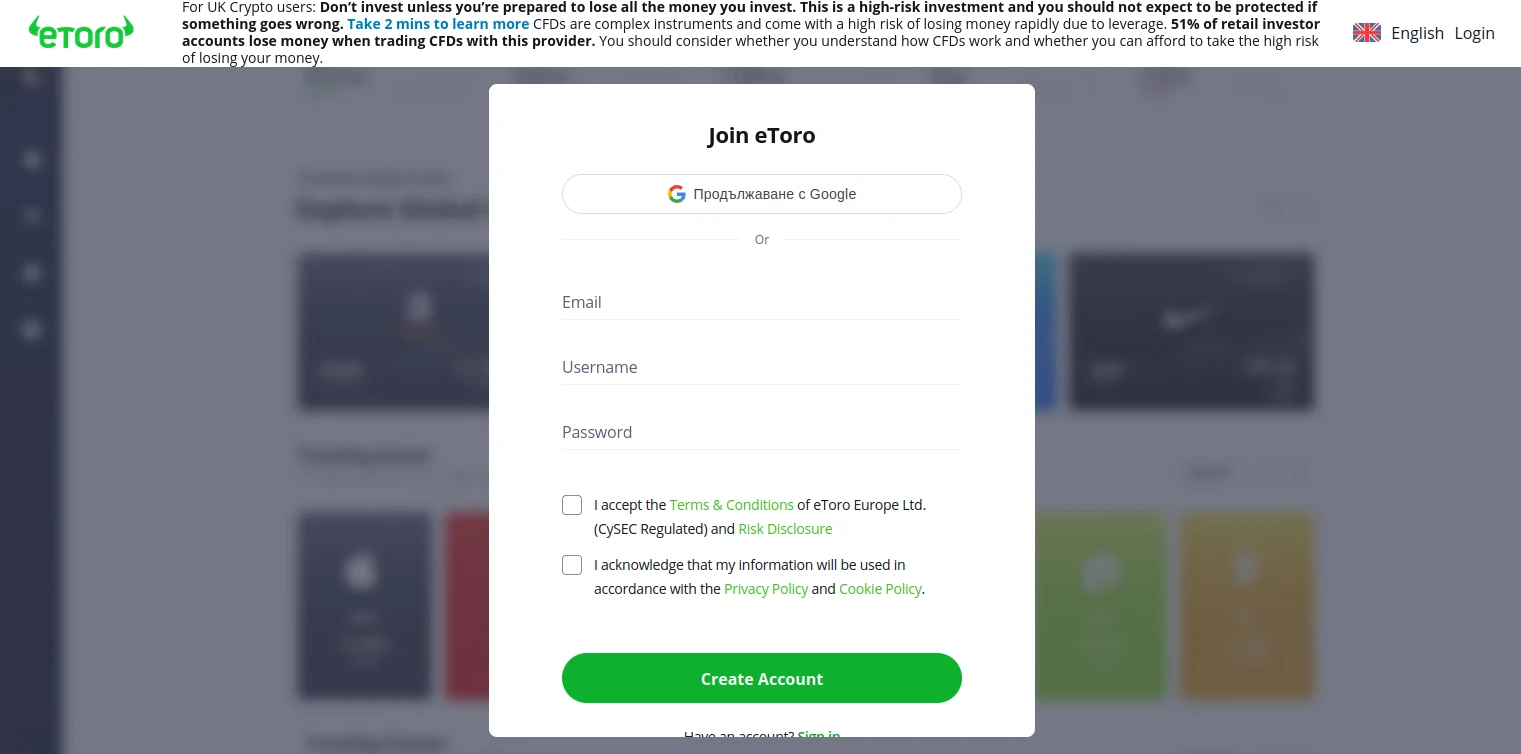

Next, input your email and create a username and password. Accept eToro’s terms and Privacy Policy, and click Create Account.

-

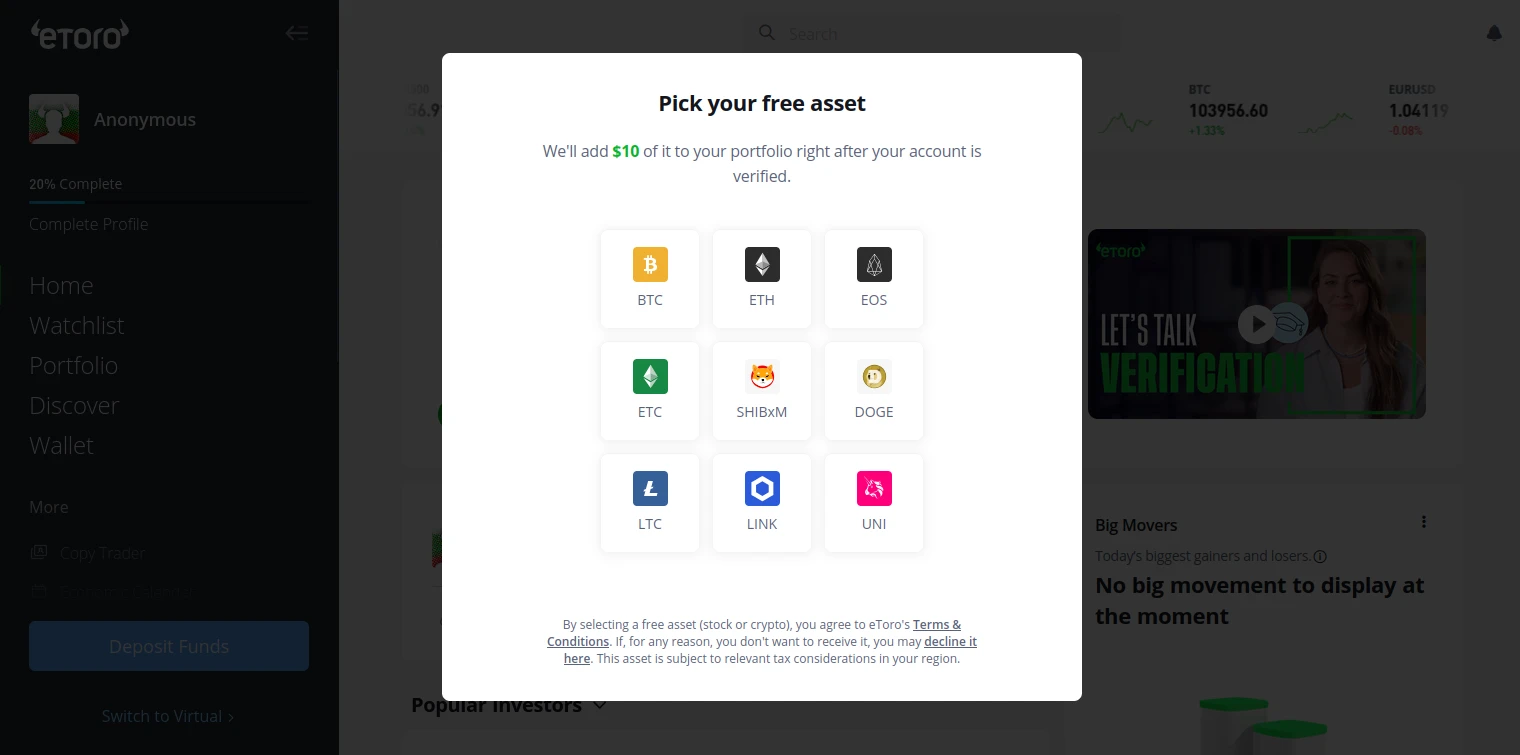

Upon activating your account, you will be granted a $10 crypto position for free. The options are Bitcoin, Ethereum, EOS, Ethereum Classic, Shiba Inu Coin, Dogecoin, Litecoin, Chainlink, and Uniswap. Once you have picked your coin, click Continue.

-

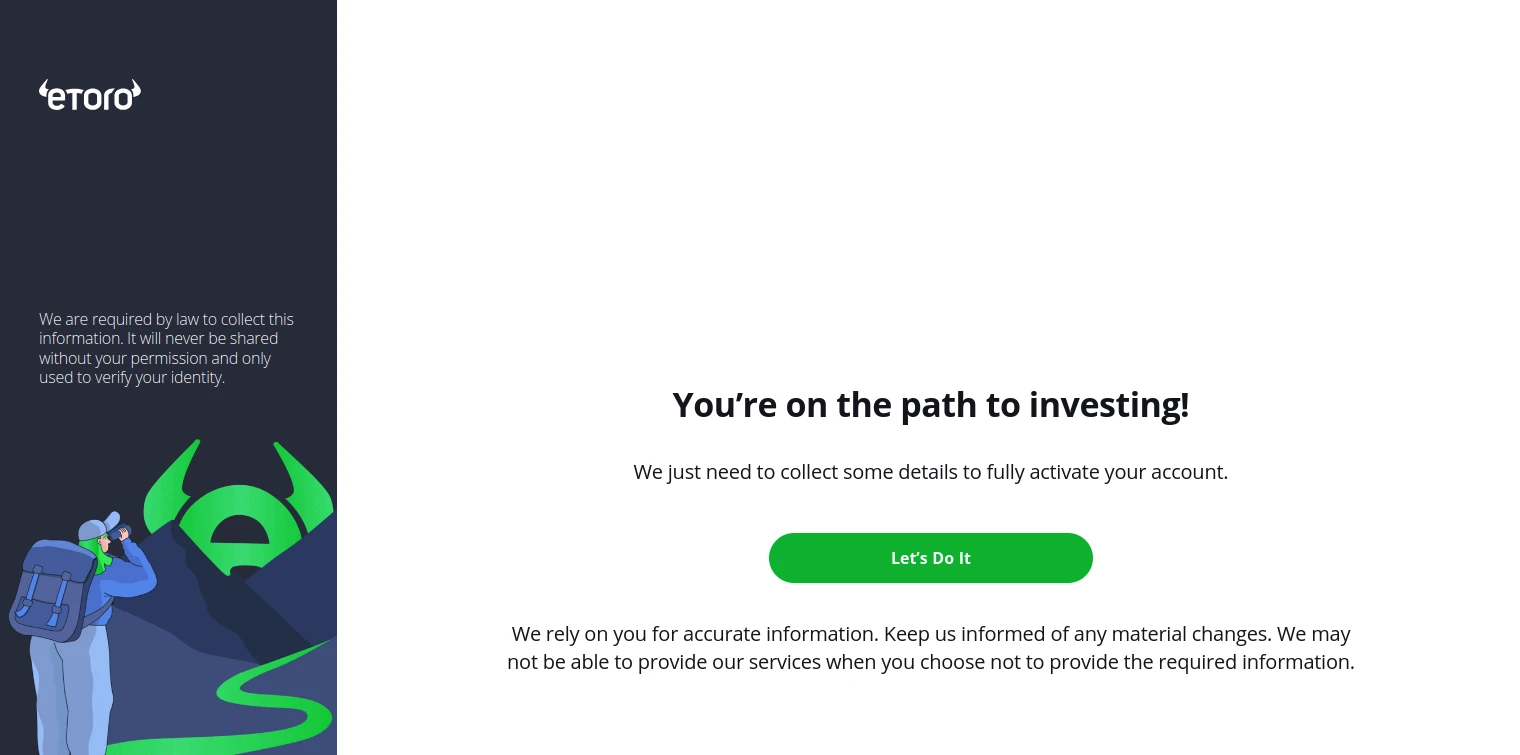

eToro will now require that you begin the verification process.

-

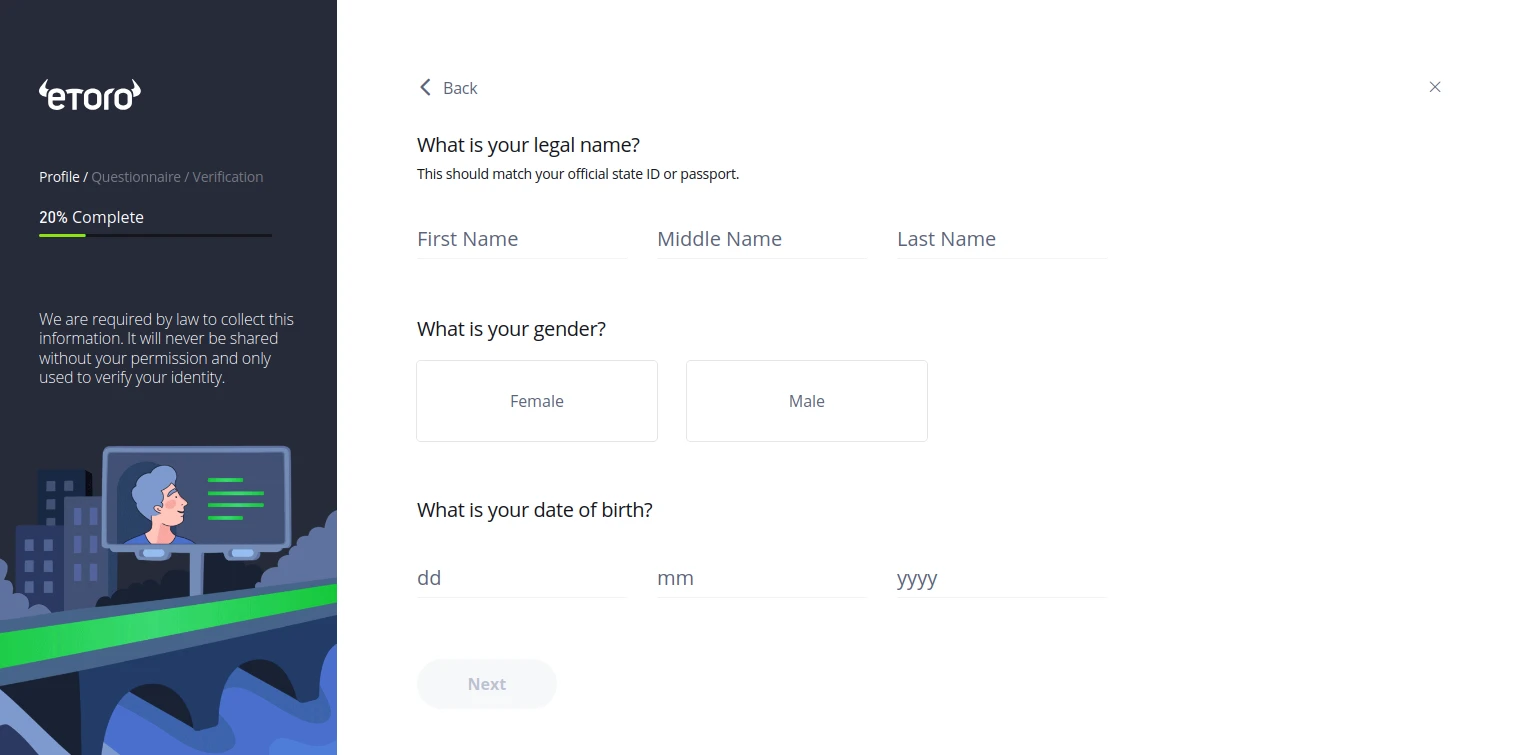

Now, write your legal name, select your gender, and input your date of birth.

-

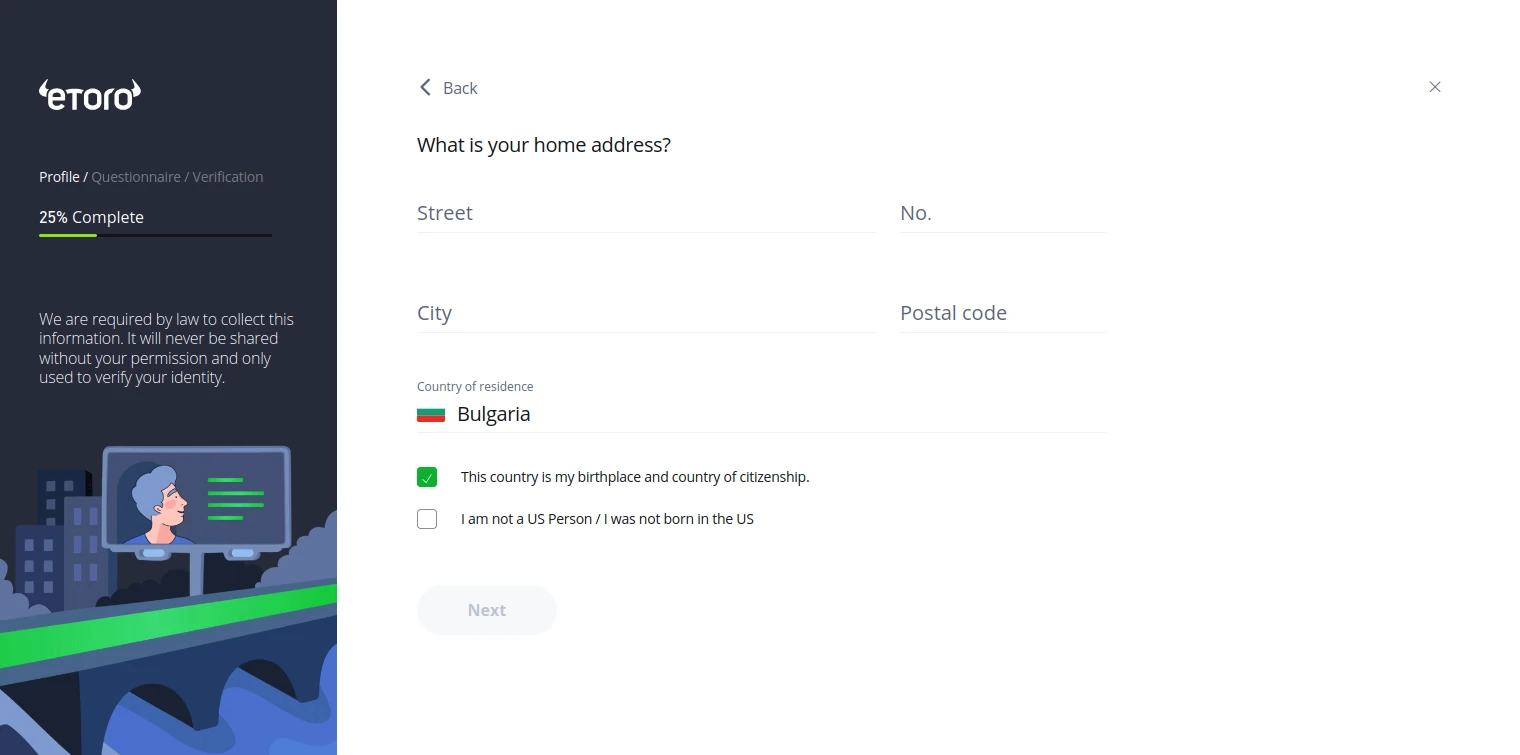

Provide your address, confirm whether the selected country is both your birthplace and country of citizenship, and specify whether you are from the US.

-

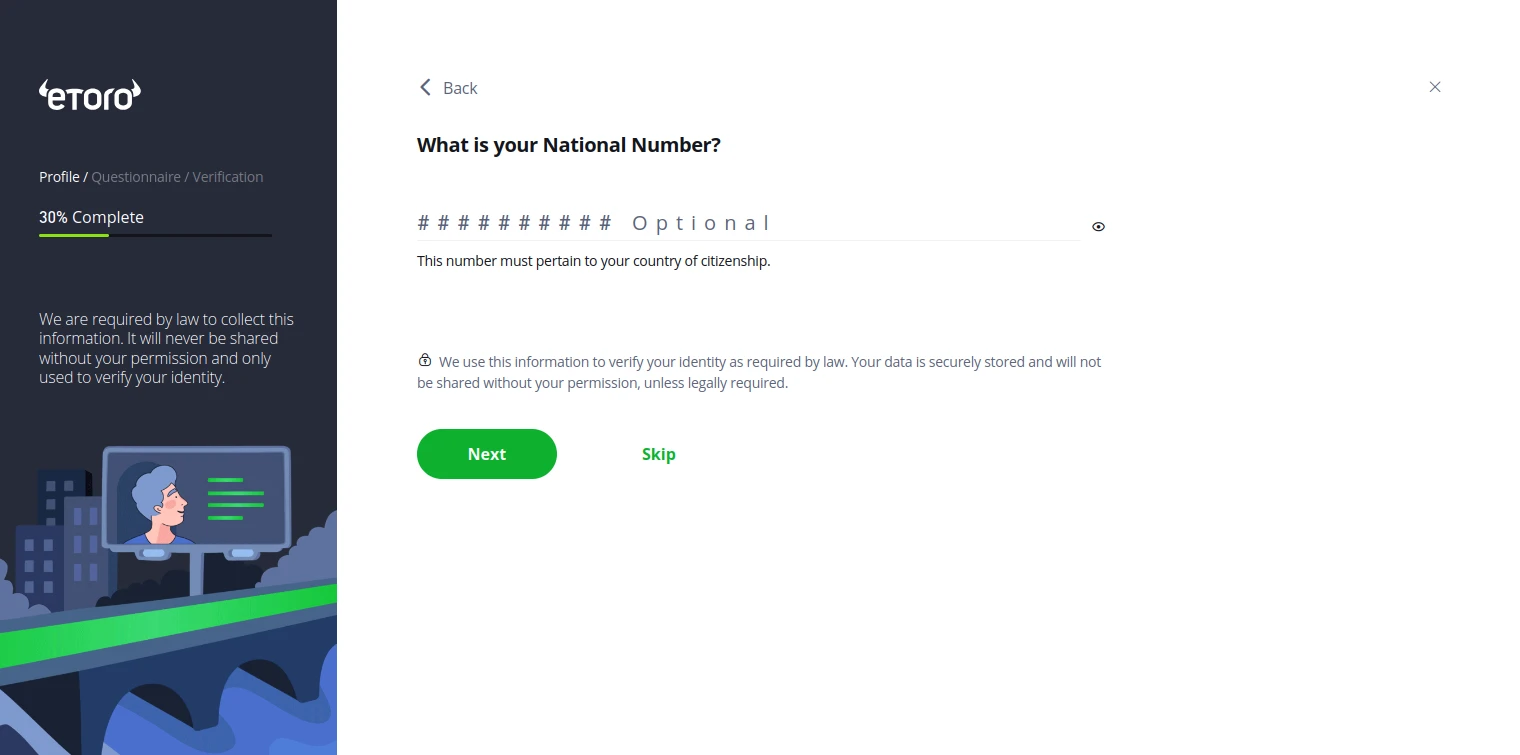

You can now provide your national number. This step is optional.

-

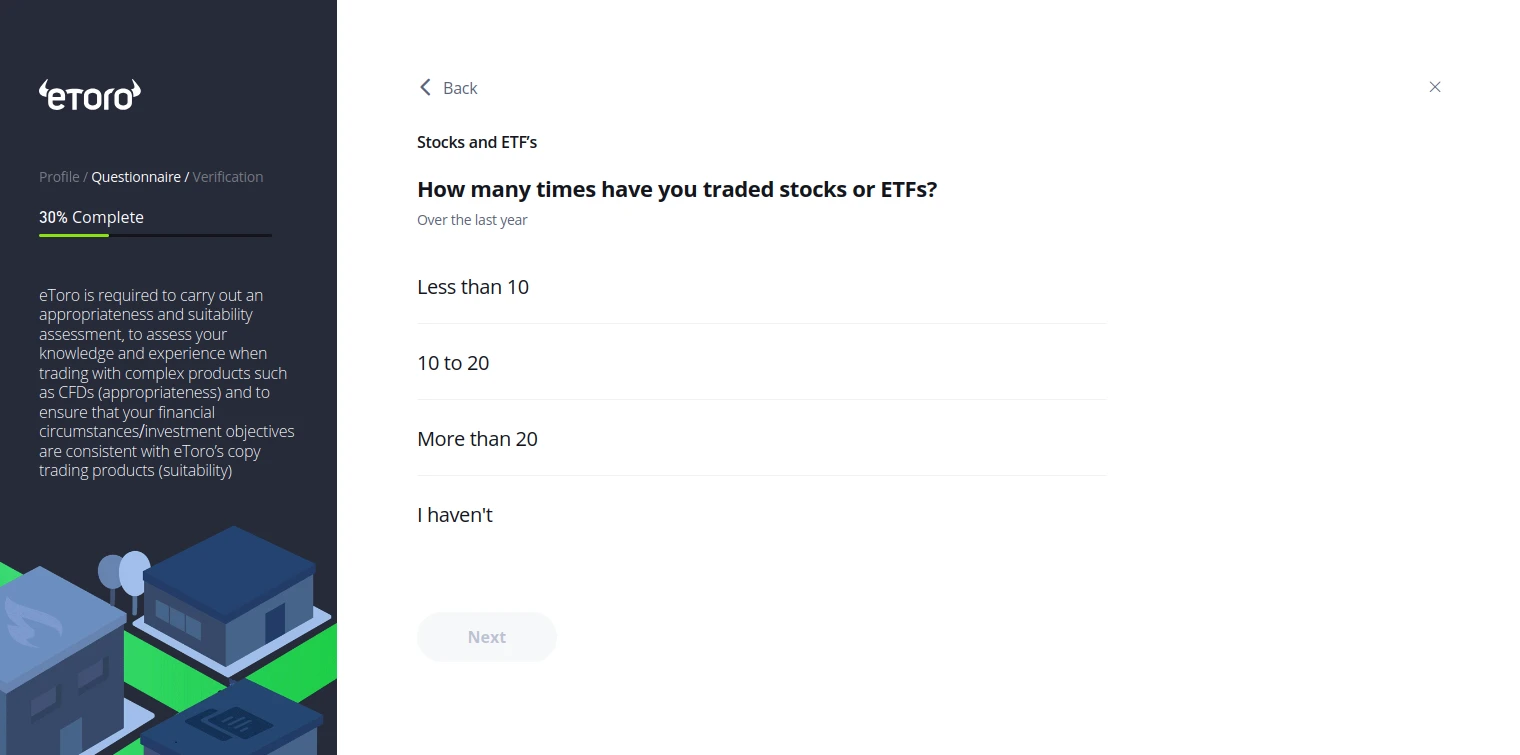

Inform eToro about your experience when it comes to trading stocks and ETFs and the amount of money you have invested in the past twelve months.

-

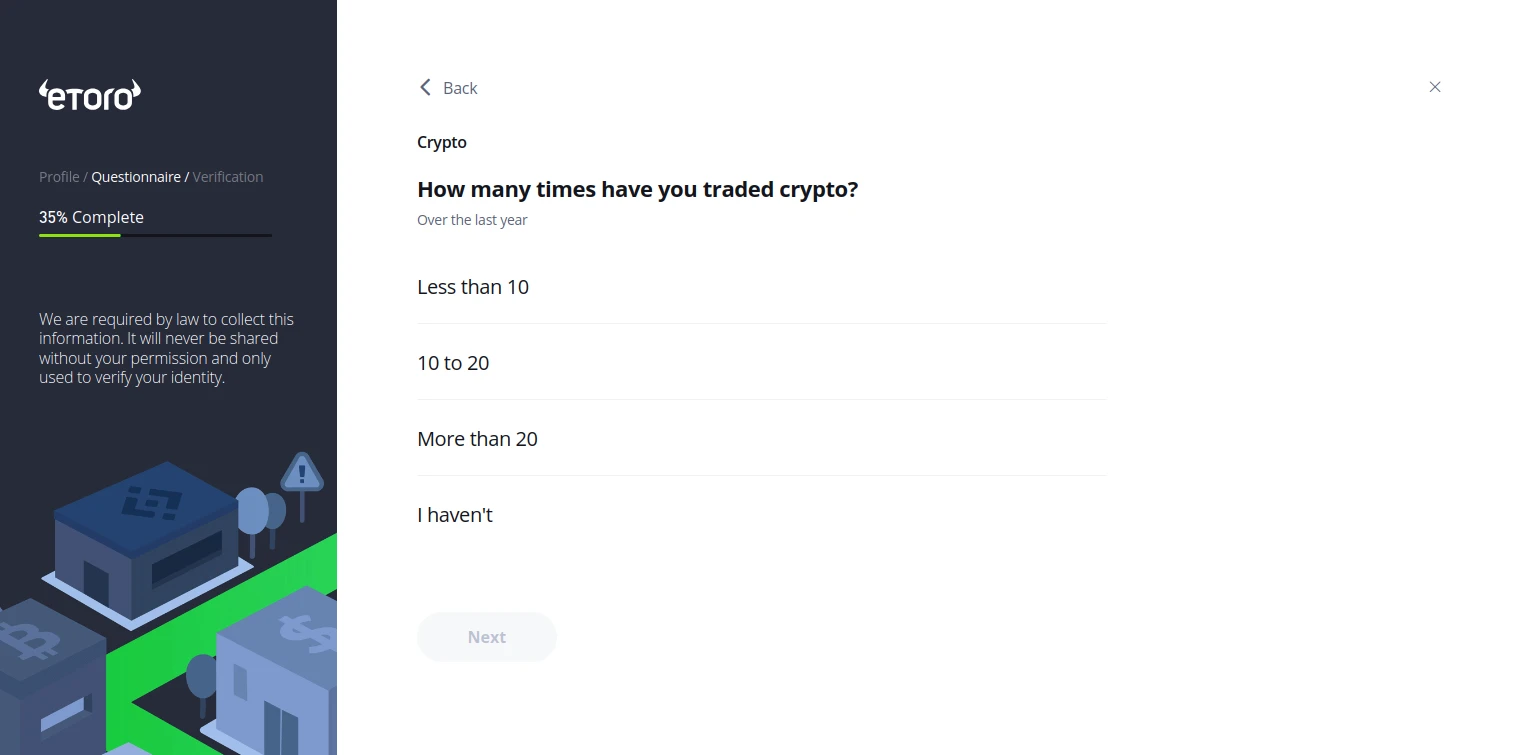

Next, do the same for cryptocurrencies.

-

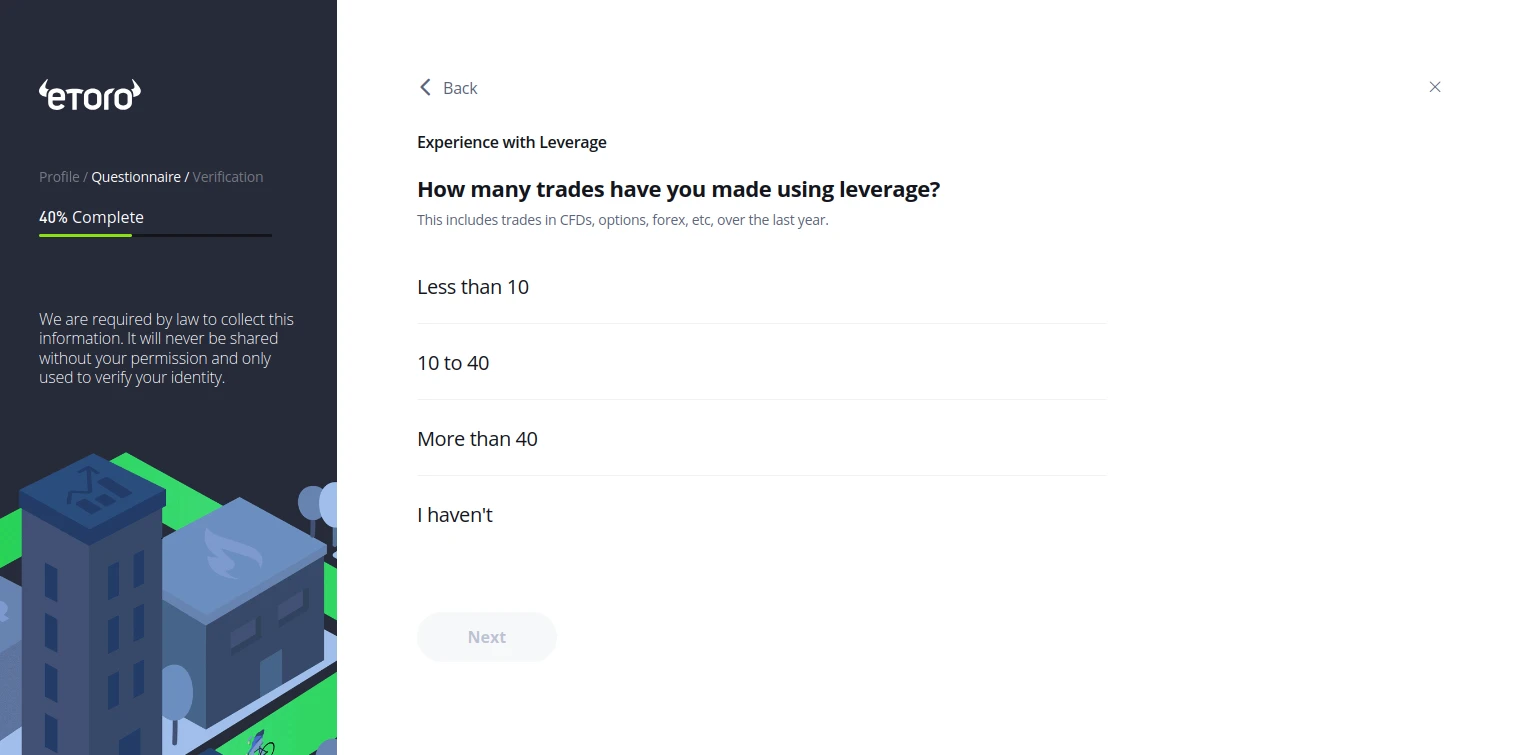

eToro will also inquire about whether you have traded CFDs before

-

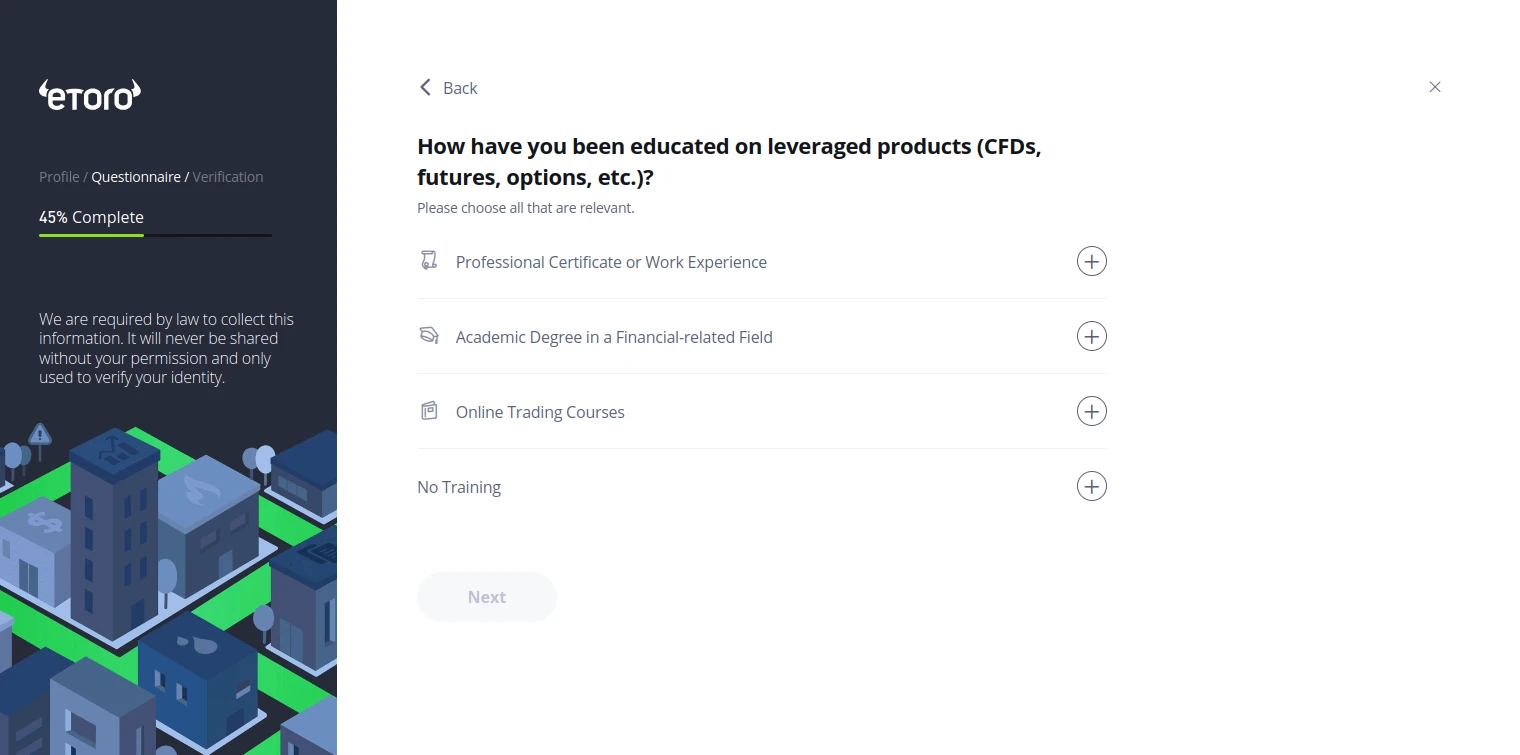

If you have a degree in financing, have taken trading courses centered around leveraged products, or are a certified professional in the financial sphere, you can select the relevant options. Otherwise, pick “No Training” and continue to the next step.

-

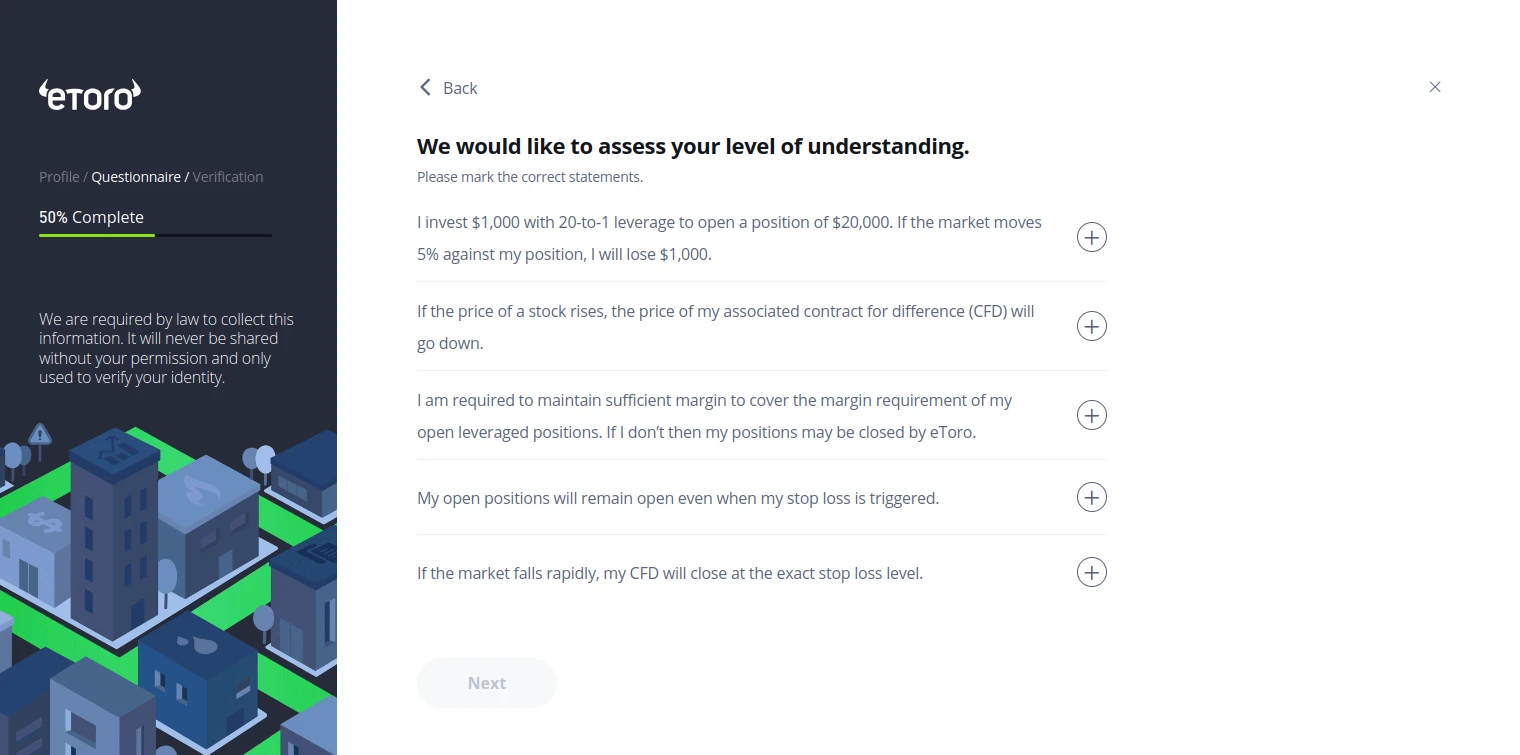

This is the start of the evaluation stage. The first set of statements concerns leverage and other basics, while the next will evaluate your understanding of crypto trading.

-

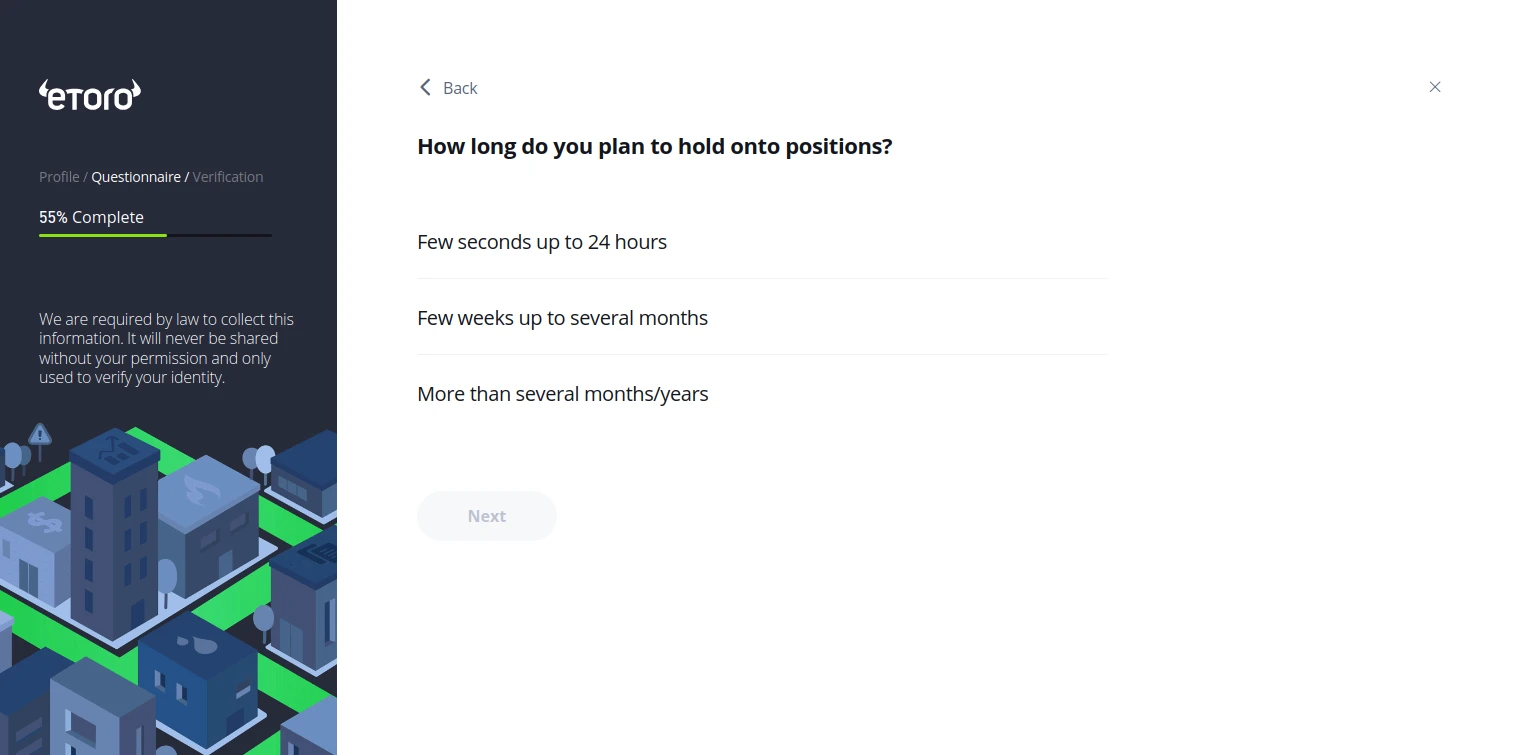

Select for how long your upcoming positions will be held.

-

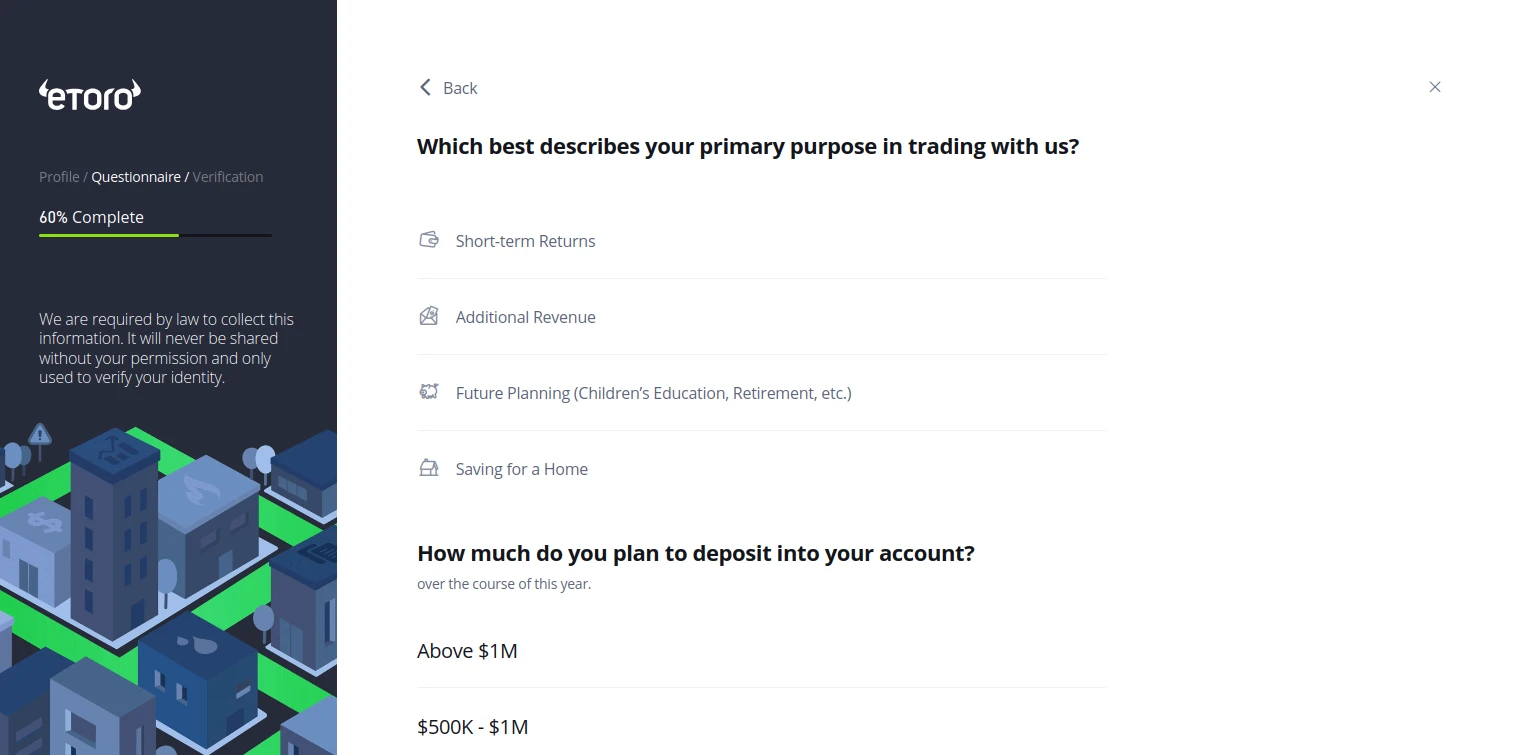

Tell eToro about what you wish to achieve by trading at eToro and the amount of money you plan to deposit. At the very bottom, you will find the minimum initial deposit in your region.

-

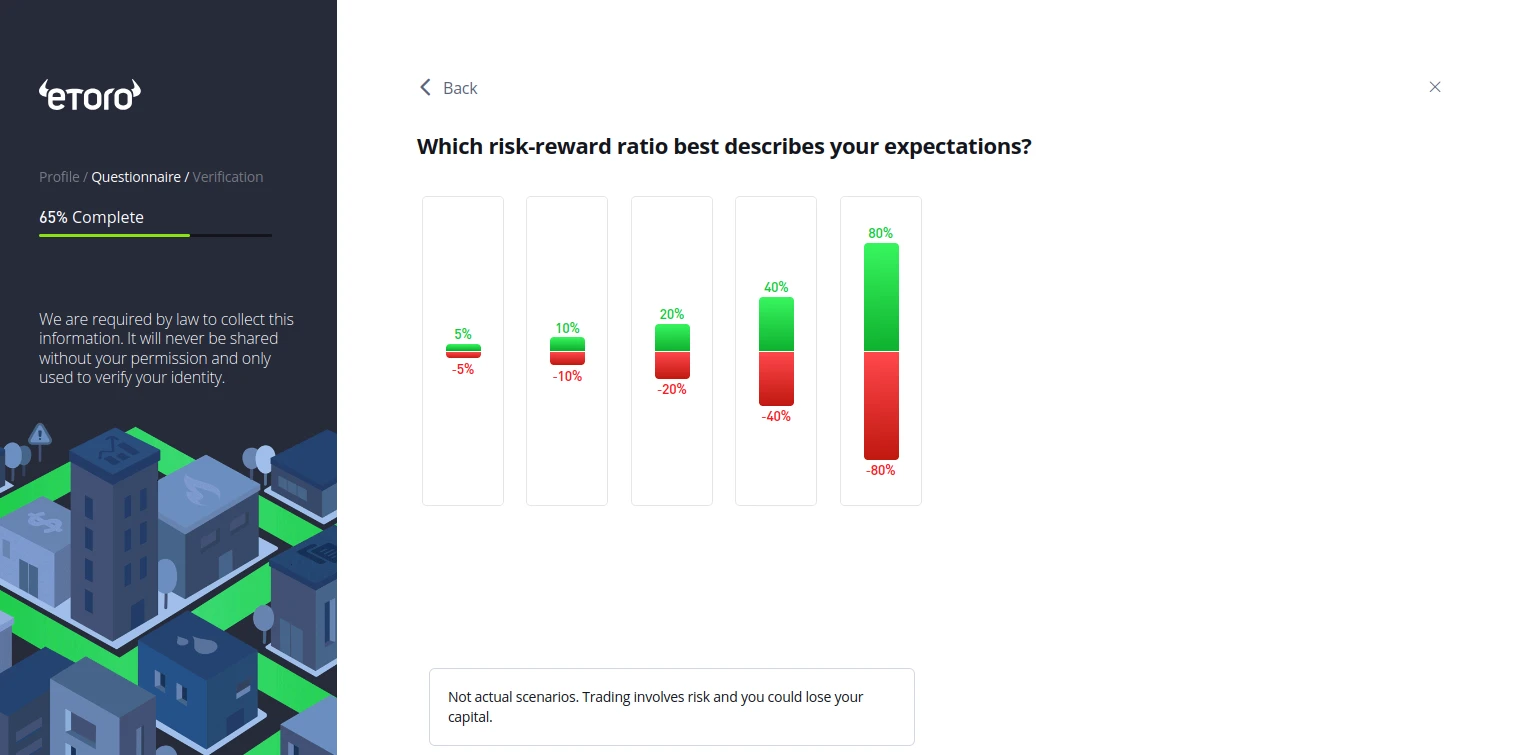

Choose the option that best describes your risk tolerance, specifically how much you expect to gain and lose. For example, picking 20%/-20% means you expect to risk $10,000 to gain $10,000.

-

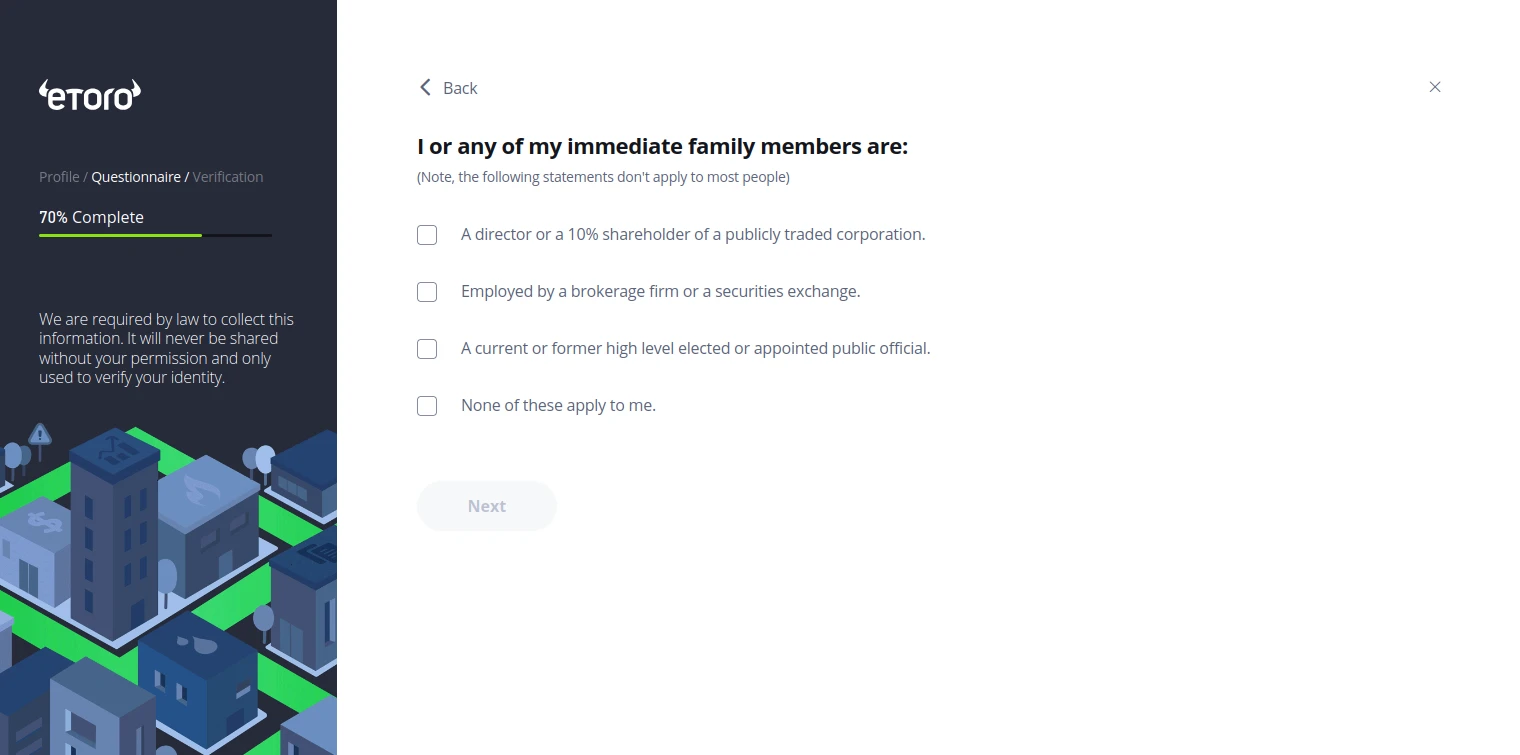

The following page seeks to assess whether you (or an immediate family member) are a politically exposed person.

-

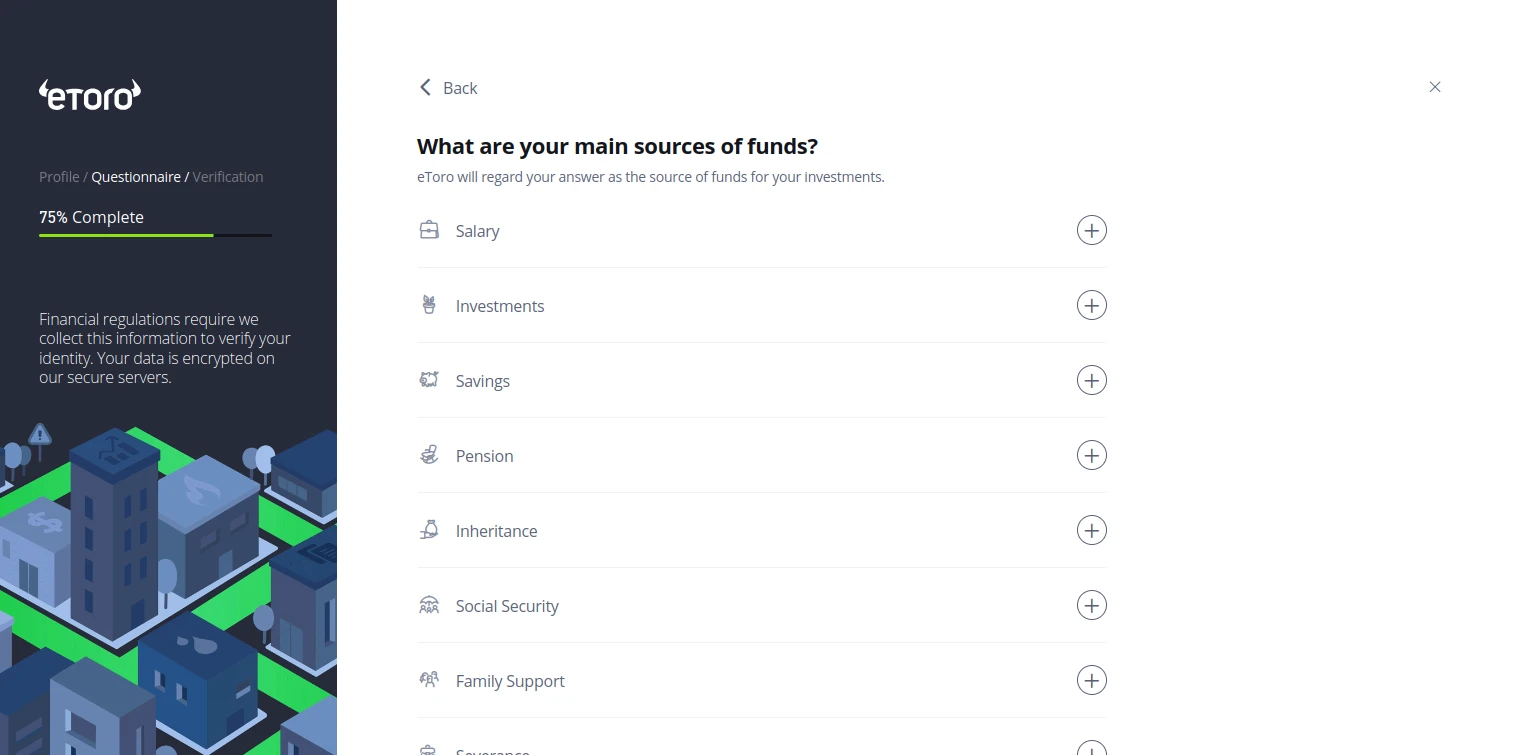

eToro will now inquire about your finances, namely the source of your funds, your occupation, your net annual income, and your savings.

-

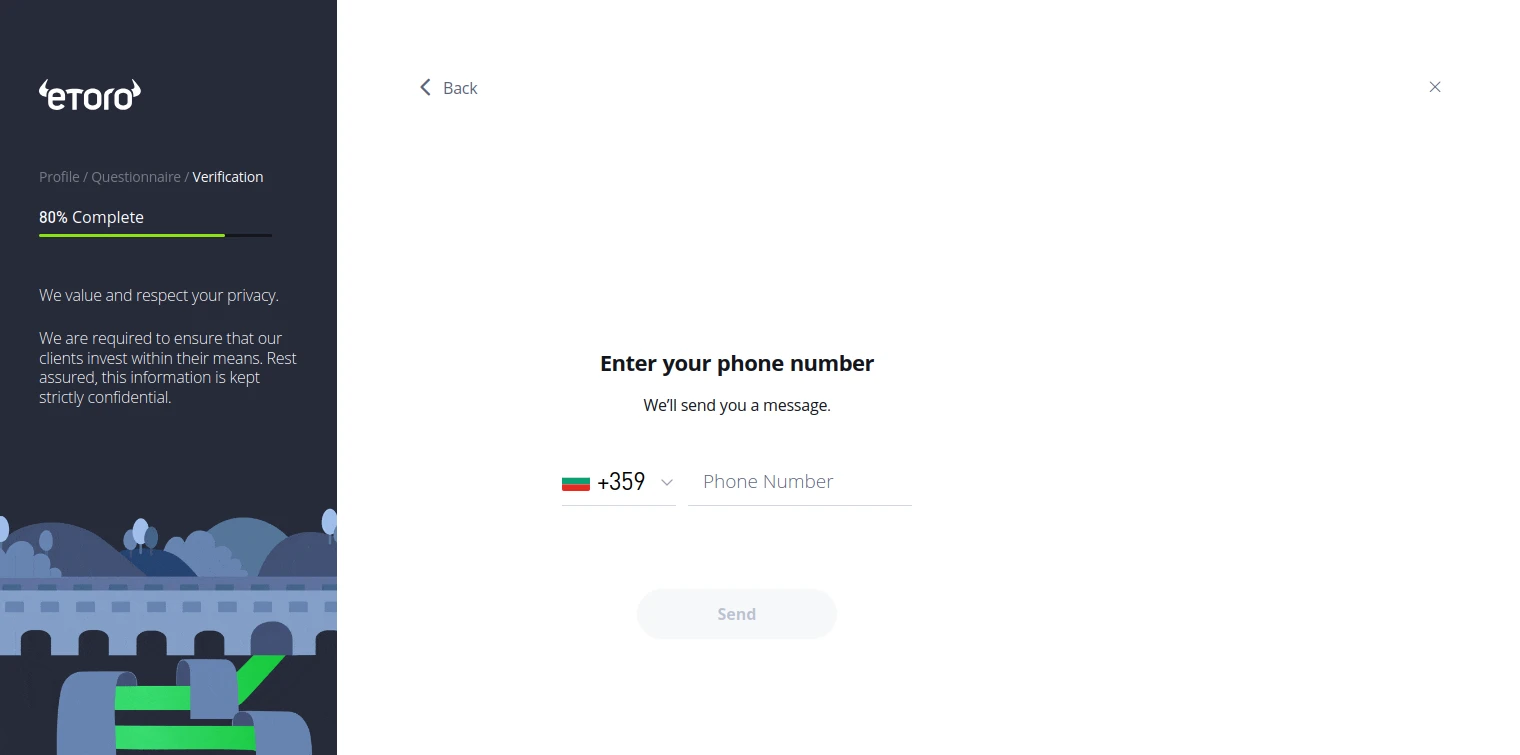

eToro will request that you input your phone number so that it can be verified via a text message.

-

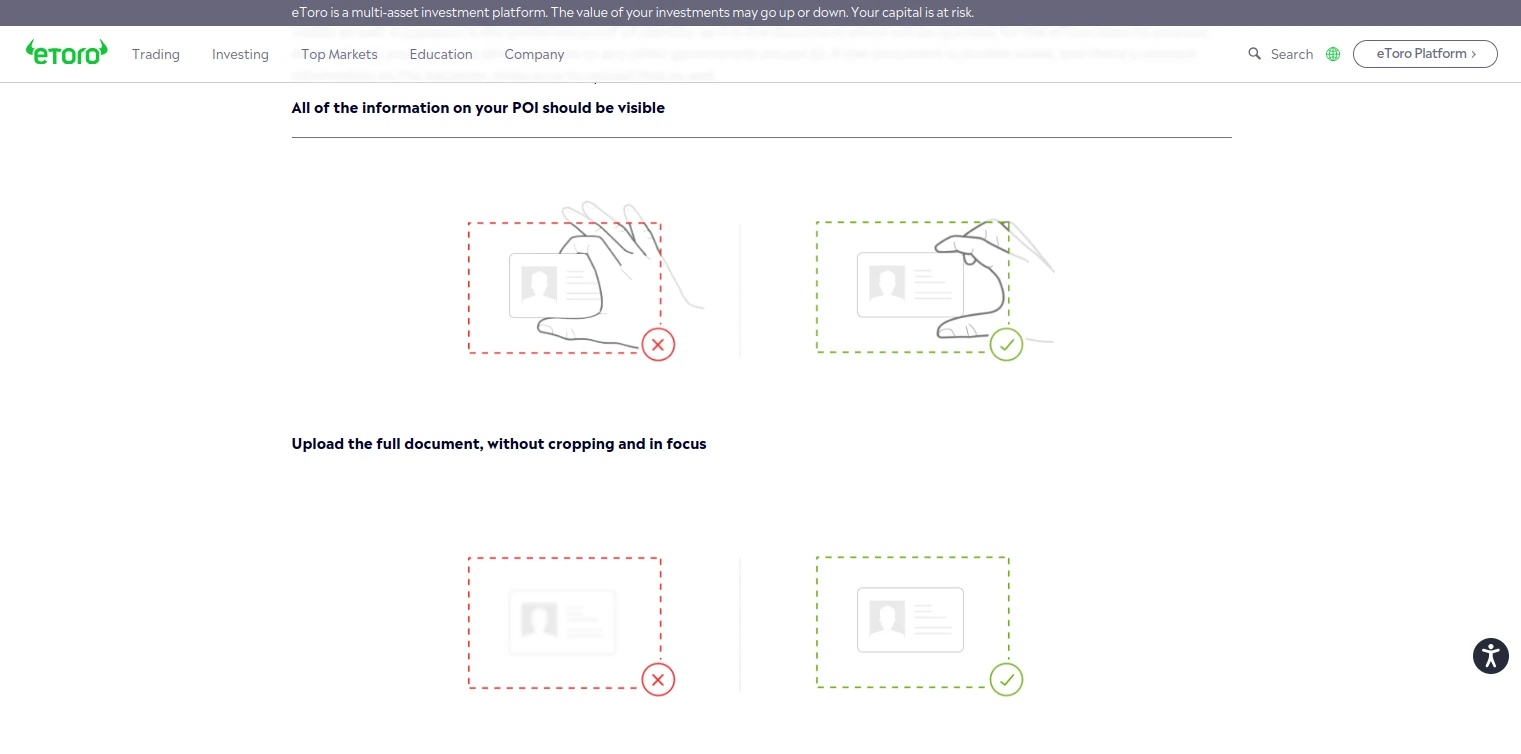

You will also be asked to provide proof of identification (POI) by taking a photo or two of an eligible document. This could be your passport, driver’s license, or ID. Both the front and back of the document should be uploaded.

-

Submitting a proof of address (POA) is also required. Valid POAs include bank statements, credit card statements, utility bills (electricity, water, gas), council tax bills, tax letters, government-issued house rental official agreements, letters from your municipality, phone bills, or internet bills. Note that any POA you choose must have been issued within the past three months.

-

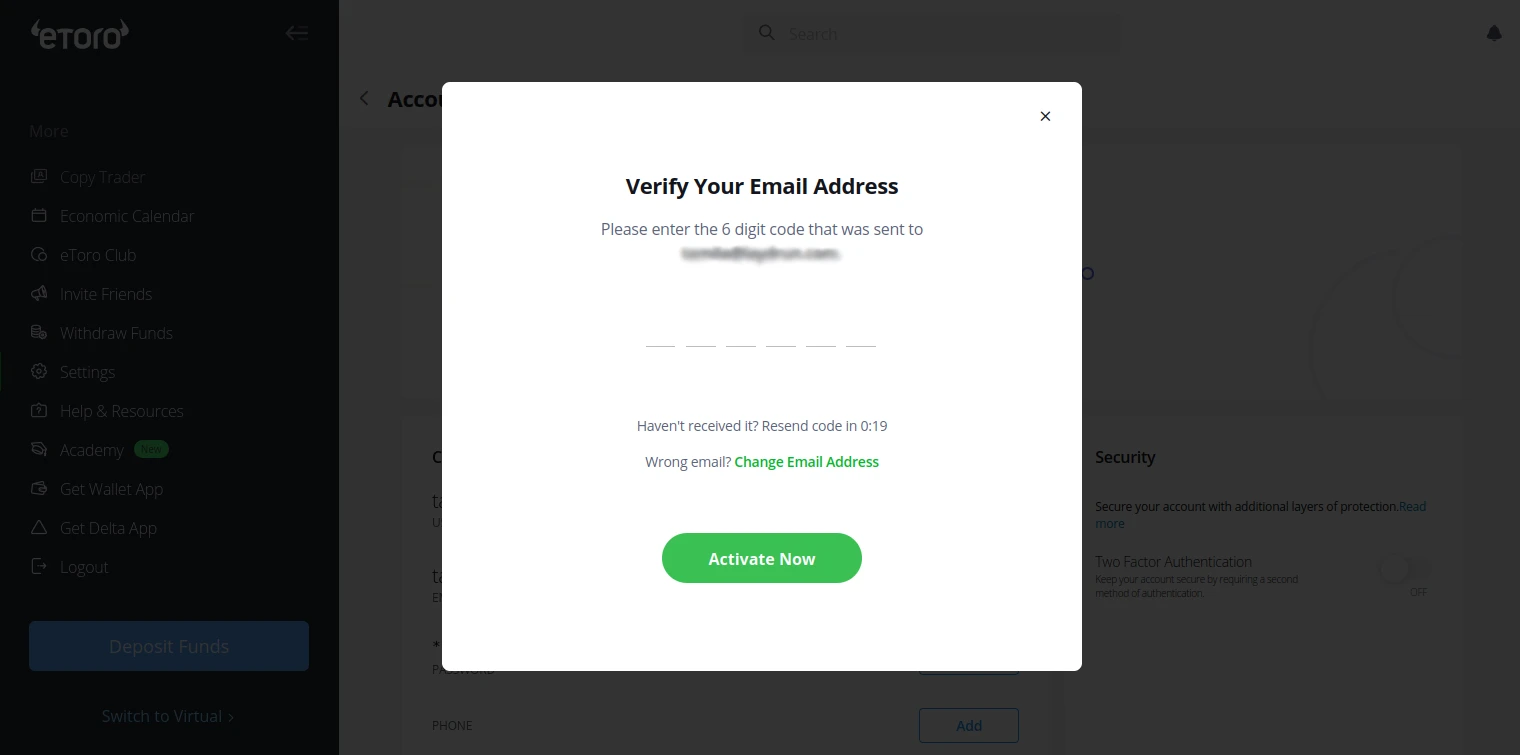

Finally, open your account settings and verify your email by requesting a 6-digit code.

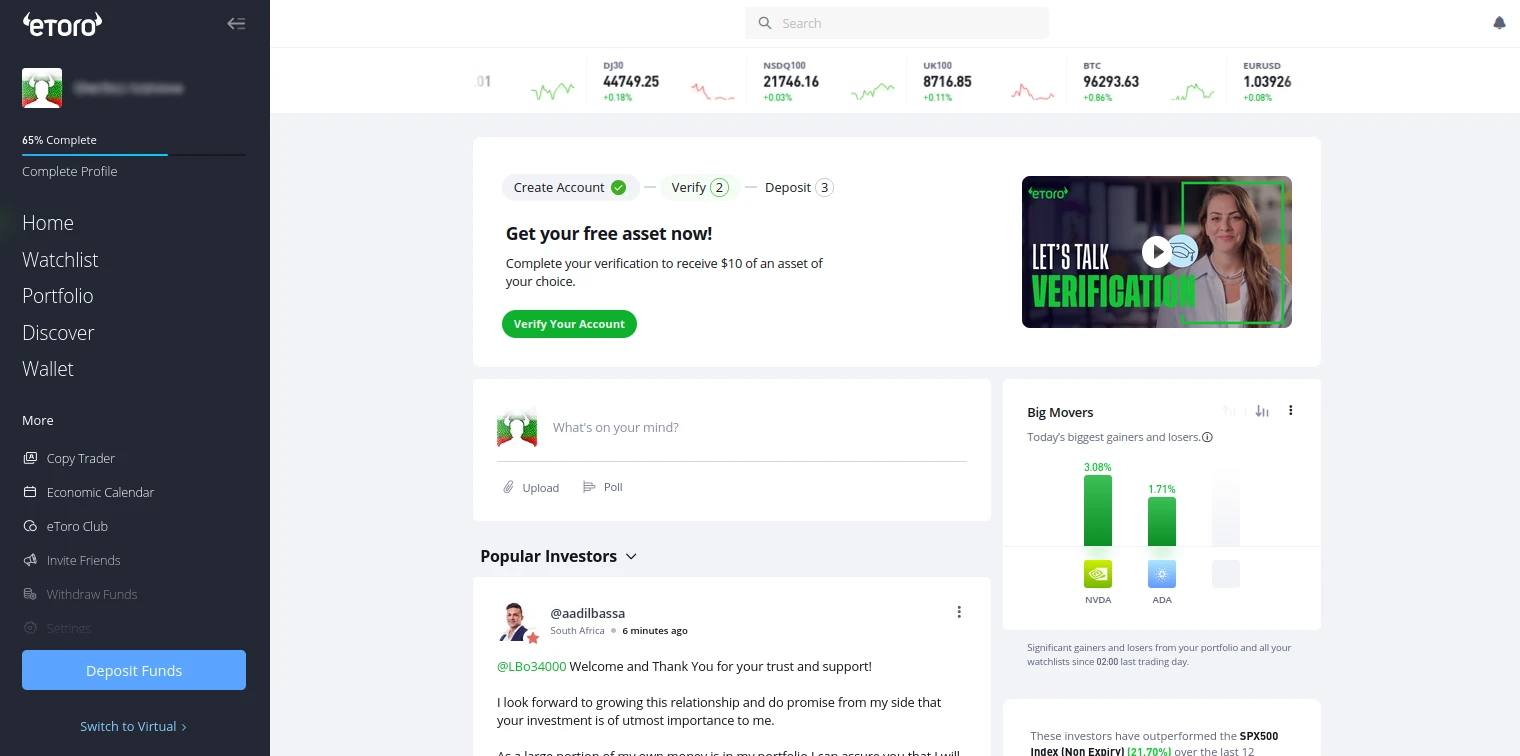

Enabling Virtual Trading – Takes less than a minute

As established, eToro also provides users with the option to try out demo trading with virtual funds before they proceed to trade with real funds.

-

After registering, you can skip the verification process and click the Switch to Virtual button that can be found in the bottom left corner.

-

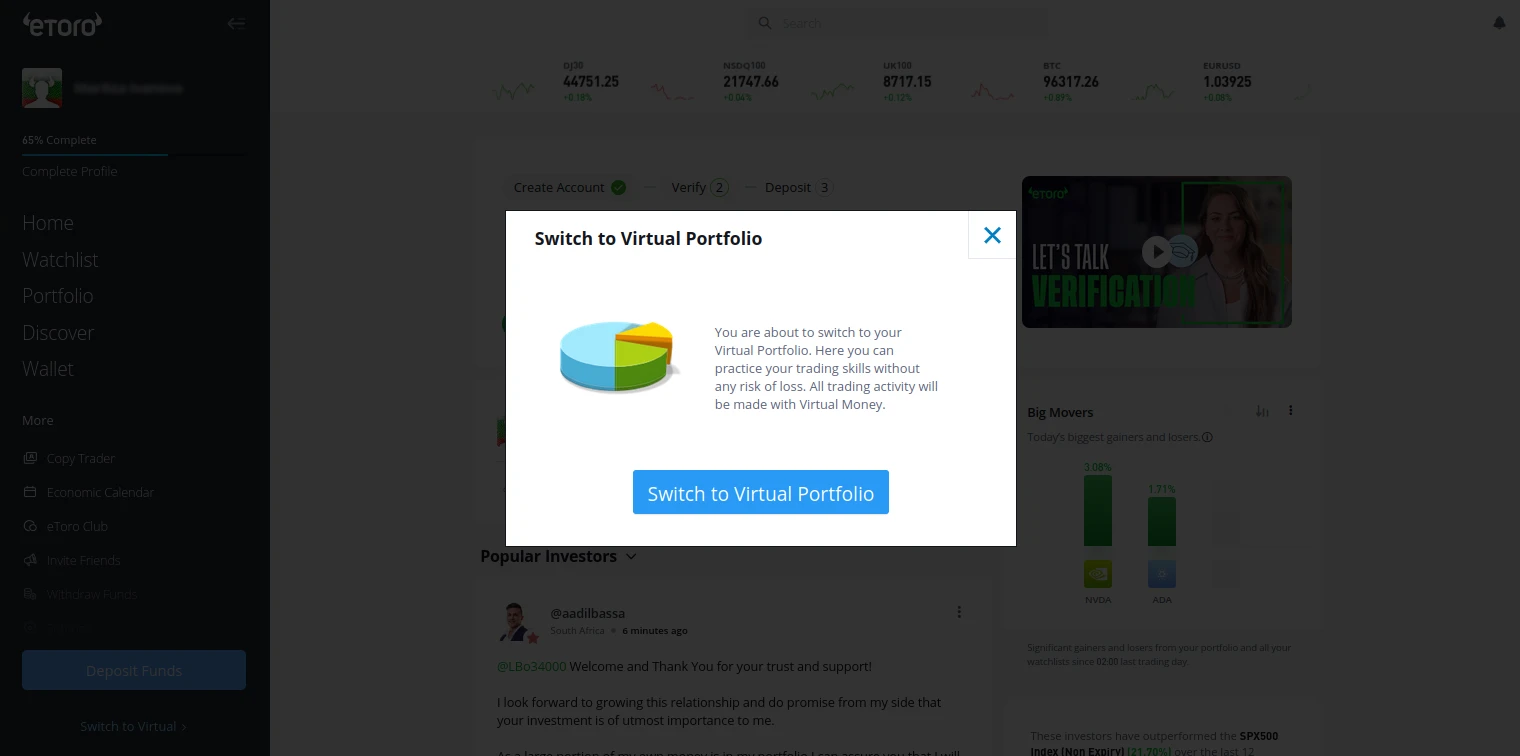

You have now opened the confirmation window, which gives a brief overview of what the virtual mode can be used for. Click the Switch to Virtual Portfolio button.

-

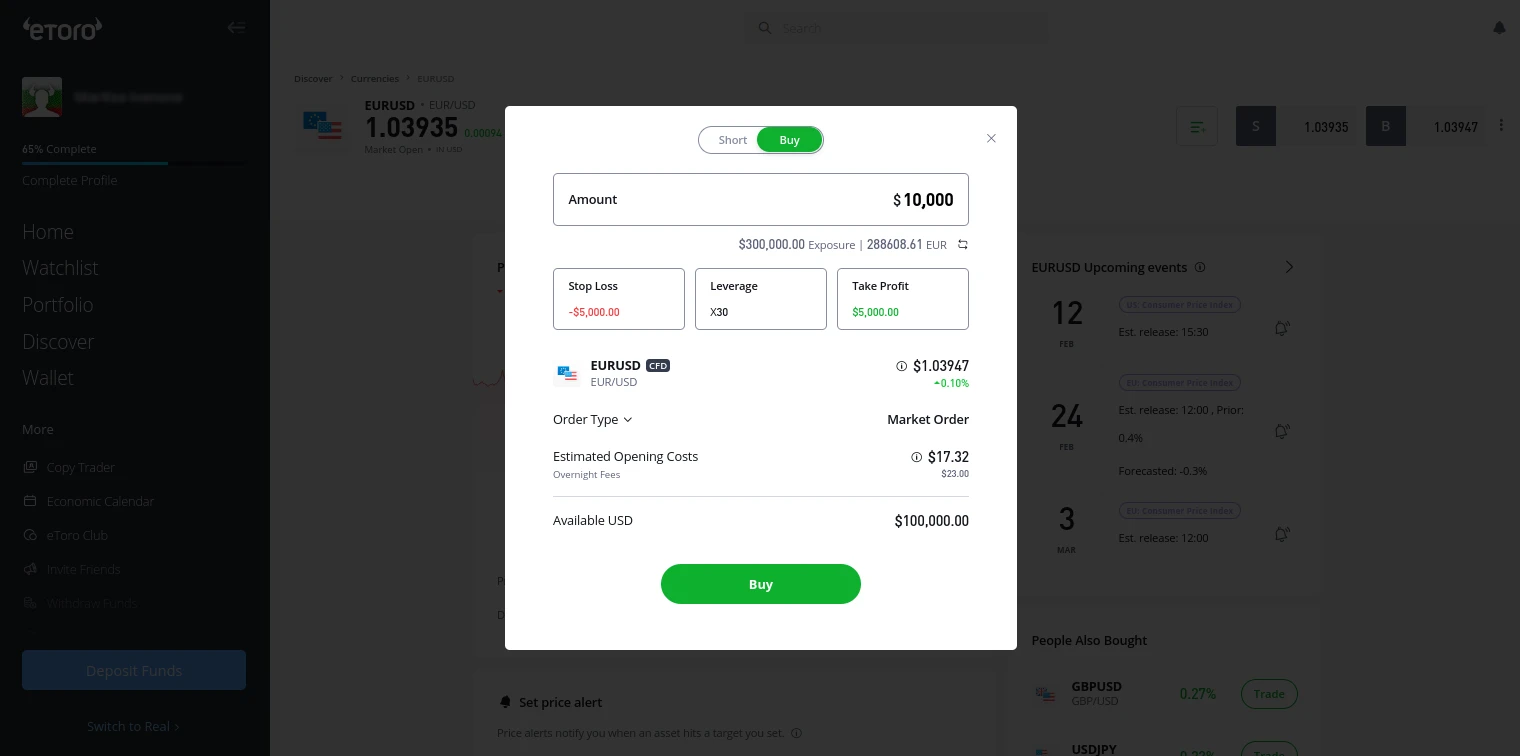

Now, you are ready to explore eToro’s instruments. You will be able to use a total of $100,000 in virtual funds in total.

Overall Thoughts

All in all, registration and verification can take roughly 15 minutes in total. This includes inputting all of the required information and uploading the necessary documents. According to eToro, verification requests are processed automatically, but manual verification (when needed) may take up to three business days. If additional reviews are undertaken, this could further prolong the waiting time.