Licensed in Australia and Vanuatu, Fusion Markets excels at providing low-cost trading in over 250 financial markets, including 90 currency pairs, commodities, indices, cryptocurrencies, and US stocks. The broker delivers ECN order execution with no dealing desk intervention, ensuring the best possible price feeds sourced from a network of reliable liquidity providers.

Fusion Markets ranks among the most affordable brokers in the online trading industry. Onboarding clients can anticipate several types of trading and non-trading costs, including spreads, commissions, administrative fees for swap-free accounts, and overnight funding costs. Stay with us for a detailed breakdown of all expenses arising from forex trading at Fusion Markets.

Fusion Markets Trading Costs

Trading expenses at Fusion Markets largely depend on the type of account clients open. The broker offers both spread-based and commission-based trading. Orders placed through Classic Accounts incur no commissions as all trading costs are built into the spreads. Fusion Markets compensates for the absence of commissions by adding a 0.9-pip markup to all raw spreads.

Classic Accounts Forex Trading Costs

The EUR/USD spread averages 0.93 pips, with zero commissions on trades. We multiply the spread value in pips by the position size to calculate the total costs of a trade. One standard lot of 100,000 base currency units will cost you 0.000093 x 100,000 = $9.30 at Fusion Markets.

For clarification, the pip value for standard lots equals $10, meaning that every price movement of one pip costs $10. When trading micro lots (1,000 currency units) a single-pip price fluctuation amounts to $0.10. Respectively, your spread costs for one micro lot in EUR/USD will average a little over 9 cents with a spread of 0.93 pips (0.000093 x 1,000 units).

| Average Spread Costs* with Classic Accounts | ||||

|---|---|---|---|---|

| Forex Pair | Spread (in pips) | Commission | Cost per Micro Lot | Cost per Standard Lot |

| EUR/USD | 0.93 | $0 | $0.093 | $9.30 |

| USD/JPY | 1.70 | $0 | $0.11 | $11.00 |

| EUR/GBP | 1.09 | $0 | $0.109 | $10.90 |

| GBP/USD | 1.00 | $0 | $0.10 | $10 |

| AUD/USD | 0.91 | $0 | $0.091 | $9.10 |

| USD/CAD | 0.99 | $0 | $0.068 | $6.84 |

| USD/CHF | 1.70 | $0 | $0.187 | $18.67 |

| USD/CNH | 6.04 | $0 | $0.083 | $8.27 |

| NZD/USD | 1.10 | $0 | $0.11 | $11 |

*For simplicity purposes, average costs were calculated for $100,000 and $1,000 trades without leverage. All spread costs are listed in US dollars and reflect your expenses upon opening a position (i.e. a single direction of a trade).

Zero Accounts Forex Trading Costs

Zero Accounts offer raw spreads from 0.00 pips, with an average of 0.03 pips for EUR/USD without the 0.9 markup added to standard spreads. The broker charges $2.25 commissions upon opening and closing positions, totaling $4.50 per standard lot. Commission rates differ across the supported base currencies, as shown in the table below. Customers trading in smaller lot sizes pay $0.45 per mini and $0.045 per micro lot.

| Zero Accounts Commission Rates Based on Account Currency | |||

|---|---|---|---|

| Base Currency | Round-Turn Commission per Standard Lot | Round-Turn Commission per Mini Lot | Round-Turn Commission per Micro Lot |

| USD | $4.50 | $0.45 | $0.045 |

| EUR | €4.05 | €0.41 | €0.041 |

| GBP | £3.55 | £0.36 | £0.036 |

| AUD | $4.50 | $0.45 | $0.045 |

| CHF | ₣4.50 | ₣0.45 | ₣0.045 |

| CAD | $6.00 | $0.60 | $0.06 |

| NZD | $6.90 | $0.69 | $0.069 |

| SEK | kr50.00 | kr5.00 | kr0.50 |

| JPY | ¥495.00 | ¥49.50 | ¥4.95 |

The table below gives you a glimpse at the overall forex trading costs customers with Zero Accounts can anticipate when we factor in spread expenses. This will enable you to determine which Fusion Markets account type offers more favorable trading conditions and better suits your budget.

| Overall Forex Trading Costs with Zero Accounts | ||||

|---|---|---|---|---|

| Forex Pair | Spread (in pips) | Commission Per Side | Cost per Micro Lot | Cost per Standard Lot |

| EUR/USD | 0.03* | $2.25 / $0.0225** | $0.0255 | $2.55 |

| USD/JPY | 0.80 | $2.25 / $0.0225 | $0.0743 | $7.43 |

| EUR/GBP | 0.19 | $2.25 / $0.0225 | $0.0461 | $4.61 |

| GBP/USD | 0.10 | $2.25 / $0.0225 | $0.0325 | $3.25 |

| AUD/USD | 0.01 | $2.25 / $0.0225 | $0.0235 | $2.35 |

| USD/CAD | 0.09 | $2.25 / $0.0225 | $0.0287 | $2,87 |

| USD/CHF | 0.80 | $2.25 / $0.0225 | $0.1104 | $11.04 |

| USD/CNH | 5.14 | $2.25 / $0.0225 | $0.0929 | $9.29 |

| NZD/USD | 0.20 | $2.25 / $0.0225 | $0.0425 | $4.25 |

*The values correspond to the average raw spreads without the 0.9-pip markup. **The second value corresponds to the commission charged per micro lot each way. The cost per lot includes the combined spread and commission expenses.

As you can see from the tables, Zero accounts offer better trading conditions than commission-free accounts at Fusion Markets. One standard lot in EUR/USD will cost you $9.30 per side with Classic Accounts, which is nearly thrice as high compared to Zero accounts where expenses per side are only $2.55 ($0.30 from the spread plus a $2.25 commission).

Fusion Markets Overnight Funding Costs

Leverage positions incur additional rollover fees when held open overnight. These expenses gradually build up if you hold positions over extended periods, comprising a considerable portion of your overall trading costs. The good news is Fusion Markets has relatively low overnight funding rates compared to many rival brokers.

Swap charges vary based on currency, account type, forex pair, trade size, and leverage. Triple (three-day) swaps are due on Wednesdays. Using the swap calculator provided by Fusion Markets is the easiest way to work out your overnight financing expenses. Another way is to use the formula provided by the broker.

F = SR x LN x PV

- F corresponds to daily overnight funding costs (positive or negative).

- SR corresponds to swap rates.

- LN denotes the number of lots.

- PV is short for pip value (eg. 1 pip = $10 with standard lots).

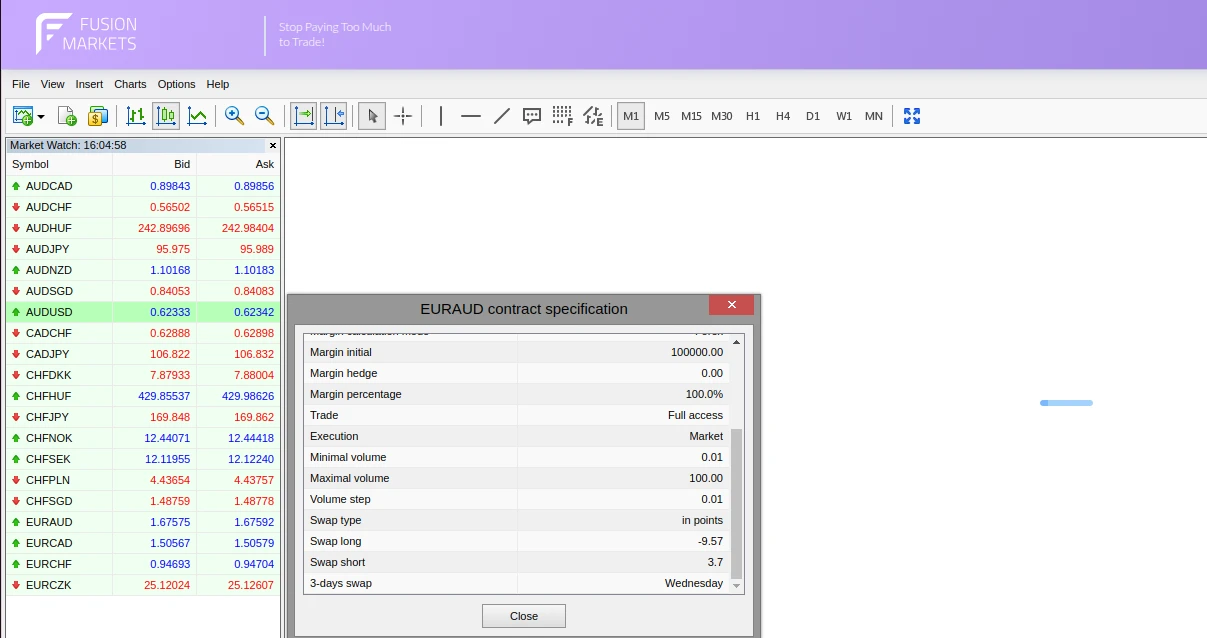

Fusion Markets does not provide information about swap rates directly on its website. To see the current swap rates for long and short overnight positions, customers can access their live MT4 or MT5 accounts on desktop, right-click their preferred currency pair, and select Specifications.

Again, you can conveniently use the free swap calculator provided by Fusion Markets to work out your overnight funding expenses. You must select the asset class (eg. forex), symbol, account base currency, and trading volume in lots. The calculator will display your long and short swaps in the base and converted currencies.

| Fusion Markets Swap Rates* for Major Forex Pairs | ||||

|---|---|---|---|---|

| Forex Pair | Base Currency | Volume in Lots | Long Swaps | Short Swaps |

| EUR/USD | USD | 1 | -6.93 | 1.19 |

| USD/JPY | USD | 1 | 10.17 | -24.96 |

| EUR/GBP | USD | 1 | -6.68 | 1.54 |

| GBP/USD | USD | 1 | -2.16 | -4.79 |

| AUD/USD | USD | 1 | -3.02 | -3.06 |

| USD/CAD | USD | 1 | 2.48 | -8.96 |

| USD/CHF | USD | 1 | 5.09 | -14.47 |

| USD/CNH | USD | 1 | -80.94 | -168.34 |

| NZD/USD | USD | 1 | -1.71 | -1.62 |

*Swap rates are presented in points and are subject to change. The swaps for long and short overnight positions reflect the expenses customers with USD-denominated accounts would incur daily when holding 1 standard lot in the respective currency pair.

Swap-Free Trading Costs at Fusion Markets

Fusion Markets offers swap-free accounts to clients who cannot pay or receive interest for religious reasons. As indicated by the name, this account type enables customers to hold positions after the markets close without incurring overnight funding costs (as case with standard CFD accounts). Swap-free traders are liable for administrative fees instead, which Fusion Markets charges when clients maintain open positions for more than 7 days.

To put things into perspective, the broker will deduct administrative charges from your balance only once if you close your leveraged position 10 days after opening it. We should also highlight that not all forex pairs are available for swap-free trading because some are associated with higher swap-related expenses. This makes it harder for Fusion Markets to manage the trading costs fairly in the swap-free format.

| Administrative Fees for Swap-Free Forex Trading at Fusion Markets | |||

|---|---|---|---|

| Forex Pair | Administrative Fee | Forex Pair | Administrative Fee |

| EUR/USD | $50 | AUD/USD | $30 |

| USD/JPY | $150 | USD/CAD | $30 |

| EUR/GBP | $50 | USD/CHF | $100 |

| GBP/USD | $20 | XAU/USD | $200 |

| USD/HKD | $30 | NZD/USD | $10 |

Fusion Markets enables swap-free trading in all countries it can service legally with its VFSC, FSAS, and ASIC licenses. The service is unavailable in restricted countries and territories like Japan, New Zealand, Ontario, Russia, Ukraine, Syria, Spain, Puerto Rico, Sudan, Iraq, and the United States, among several others.

Fusion Markets Non-Trading Costs

Apart from trading fees, prospective customers should also consider the additional expenses resulting from transactions, account maintenance, copy trading, and subscription-based services like VPS hosting. Fusion Markets does not charge additionally for deposits and withdrawals. Opening a live account comes at no cost. Practicing with a demo account is also complimentary. Clients are not penalized for trading infrequently as the broker has no account inactivity fees.

Copy trading is associated with some additional expenses. Signal providers and their copiers can use the service free of charge on condition their monthly trading volume in forex and metals is 2.5 lots or more. Customers not satisfying this requirement incur a $10 monthly fee to cover the broker’s holding expenses. Depending on their signal providers, copiers may also pay performance fees of up to 30%.

| Fusion Markets Non-Trading Costs at a Glance | |

|---|---|

| Deposit Fees | None |

| Withdrawal Fees | None |

| Account Opening Fee | Free |

| Inactivity Fee | None |

| VPS Hosting Subscription |

|

| Copy Trading |

|

Fusion Markets offers a low-latency VPN hosting service in partnership with leading VPS provider New York City Servers. The service requires a subscription, with clients having the option to choose from three monthly or yearly plans. Subscribing to an annual plan offers better value as you end up paying less per month.

| Fusion Markets VPS Hosting Subscription Plans | |||||

|---|---|---|---|---|---|

| Subscription Plan | Monthly Charges* | Annual Charges* | Server Locations | RAM | Suitable For |

| Basic VPS | $25 | $250 | London, New York, Tokyo | 2 GB | Up to 2 trading accounts |

| Standard VPS | $40 | $400 | London, New York, Tokyo | 4GB | 3 to 6 trading accounts |

| Professional VPS | $60 | $600 | London, New York, Tokyo | 8 GB | Up to 7 trading accounts |

*These are the regular pricing offers without any subscription discounts.

Customers whose monthly trading volume in metals and forex exceeds 20 lots can benefit from complimentary VPS hosting sponsored by Fusion Markets itself. To take advantage of this offer, eligible clients must subscribe to the service from their Fusion Hub. The broker will then send them their VPS credentials and refund their subscription fees.

Closing Thoughts on Fusion Markets Fees

All in All, Fusion Markets provides slightly better trading conditions than its closest competitors. The broker charges the lowest round-turn commissions we have seen thus far, coupled with narrow spreads from zero pips for the most liquid currency pairs. As we established during our research, onboarding customers can further reduce their trading costs by opting for commission-based accounts.

Total trade expenses for most major forex pairs are three times lower than those in spread-based Classic accounts. With little to no account-related fees, Fusion Markets positions itself as a compelling choice for traders wishing to maximize their profits and reduce their expenses. We recommend you read our full review of Fusion Markets if you are interested in learning more about this discount broker.