Account Types at FXTM

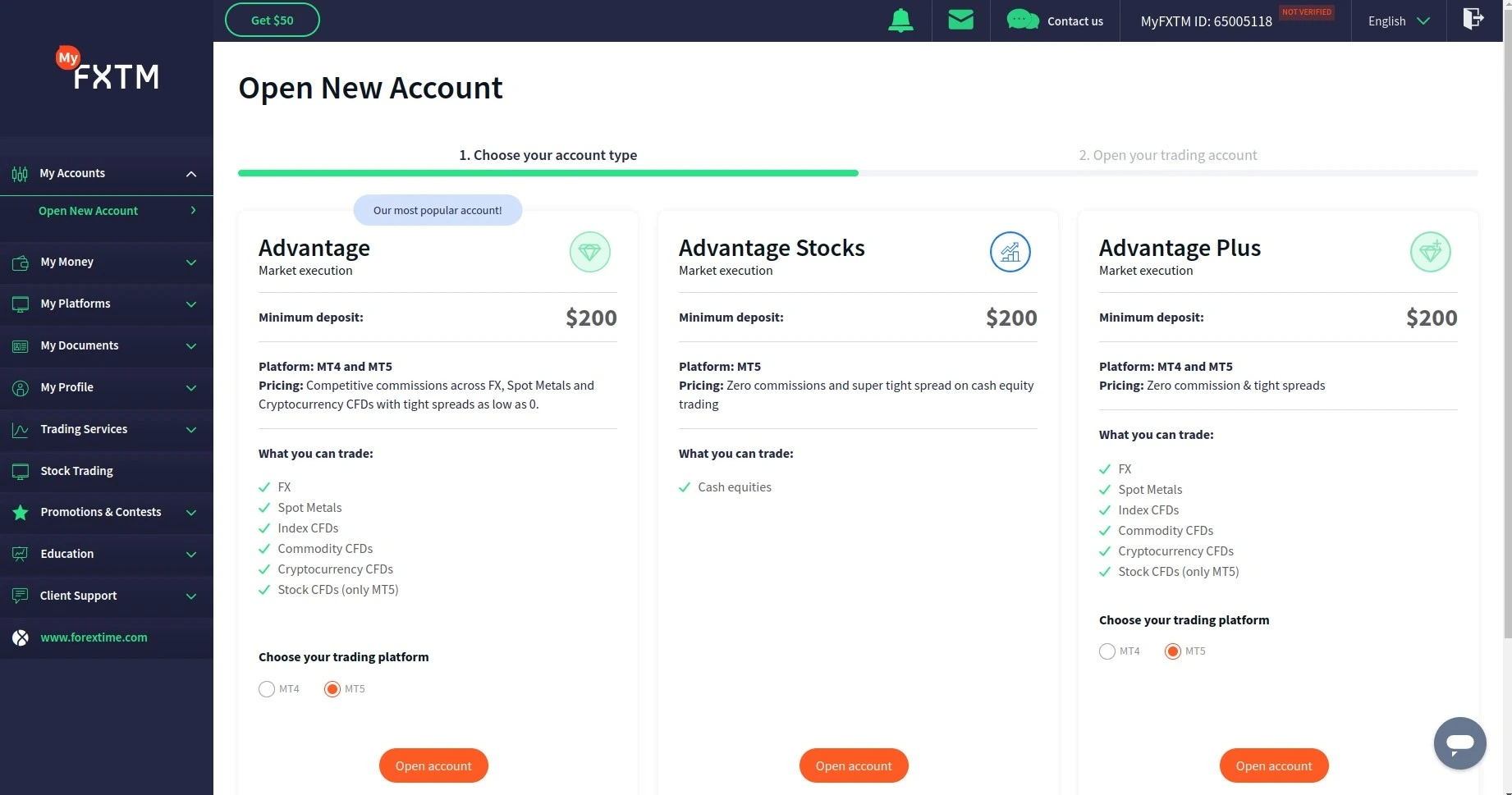

FXTM offers three types of trading accounts, enabling its customers to compare them and pick the one that best suits their trading experience, goals, and budget. The broker’s most popular account, preferred by many customers, is the Advantage trading account, featuring zero spreads on major FX pairs, commission-free trading on Stock CFDs, and lightning-fast execution. The range of trading instruments with this account type includes Forex, Spot Metals, Index CFDs, Crypto CFDs, Stock CFDs, and Stocks. Commissions for products other than Stock CFDs are within the $0.40 – $2.00 range, depending on the trading volume.

The second account type, the Advantage Plus, includes all the great features of the Advantage account, plus the further incentive of trading with zero commissions. However, traders should note that spreads are wider, starting from an average of 1.5 pips. The range of tradable instruments comprises FX, Spot metals, Index CFDs, Crypto CFDs, and Stocks CFDs.

The third account option, Advantage Stocks, features spreads from 6 cents and zero commissions. As its name suggests, stocks are the available trading instruments. The first two account types offer leveraged trading, whereas the third is a non-leveraged type.

FXTM provides a detailed comparison of the three account types and information on minimum deposit requirements, spreads, commissions, tradable instruments, supported currencies, and minimum and maximum trading volume. The Advantage and Advantage Plus accounts offer a swap-free option, making them suitable for Muslim traders. Additionally, the broker supports a Demo account, offering a simulated trading environment and a chance to explore different trading markets without risking real funds.

The process of opening an account with FXTM is streamlined and easy to complete. Customers can rely on responsive and professional support agents, from creating their FXTM profile to choosing an account type, funding the trading account, logging in to the MT platform, and placing their first trade.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

Minimum Account Deposit Requirements

The minimum deposit requirement for FXTM’s three trading account types, Advantage, Advantage Plus, and Advantage Stocks, is $/€/£ 200. While the minimum threshold is the same for the three options, the trading conditions are slightly different.

The Advantage trading account offers spreads starting from 0.0 pips and a $3.5 commission per lot traded on Forex. The Advantage Plus account type offers slightly wider spreads starting from 1.5 pips plus zero commissions on all trading instruments. The Advantage Stocks account type also offers zero commissions on Stocks plus spreads starting from 6 cents. The minimum trading volume in lots per trade for the three account types starts from 0.01.

Forex trading enthusiasts might be interested in the most suitable account type for forex. While forex can be traded on all the above account types, many traders prefer the Advantage account with zero spreads on popular FX pairs. Traders should note that the broker charges a flat $3 transaction fee on all deposits and withdrawals below $30, or currency equivalent.

Tradable Instruments

The trading portfolio of FXTM comprises 1,000+ instruments featuring ultra-low spreads and lightning-fast execution. The main markets supported by the broker include Forex, Metals, Stocks, Stock CFDs, Commodities, Indices, and Cryptocurrencies. Their availability across the jurisdictions may vary based on the local regulatory trading framework.

As for Forex trading, FXTM offers more than 60 currencies, including major, minor, and exotic pairs. Traders can also explore different opportunities for profits from price fluctuations of precious metals, such as gold and silver, traded against currencies like EUR, USD, and GBP. Stocks also provide favorable opportunities for profits from price movements in the shares of popular brands such as Facebook, Apple, and Tesla. Traders can also enter short and long positions on stock prices of different companies from major stock exchanges.

The product offering of FXTM includes trading commodities such as Natural Gas, Brent, and Crude Oil. Stock indices trading is yet another thrilling opportunity, exposing traders to price fluctuations of an entire portfolio of stocks. Last but not least, the cryptocurrency market, featuring unrivaled price swings, has attracted traders willing to speculate on the price movement of Bitcoin, Ripple, Ethereum, and more.

The broker has integrated the industry’s most popular platforms, the MetaTrader 4 and the MetaTrader 5, complete with charts and tools to help traders perform flawlessly and advance their trading skills. The trading tools available for CFD traders include Pip Calculator, Economic Calendar, Risk and Profit Calculators, and Trading Signals, all designed for making the most of the trading opportunities at hand.

Registration Process at FXTM – Takes about 5 Minutes

-

To initiate the registration process at FXTM, traders should click on the ‘Open Account’ button in the upper right-hand side of the website.

-

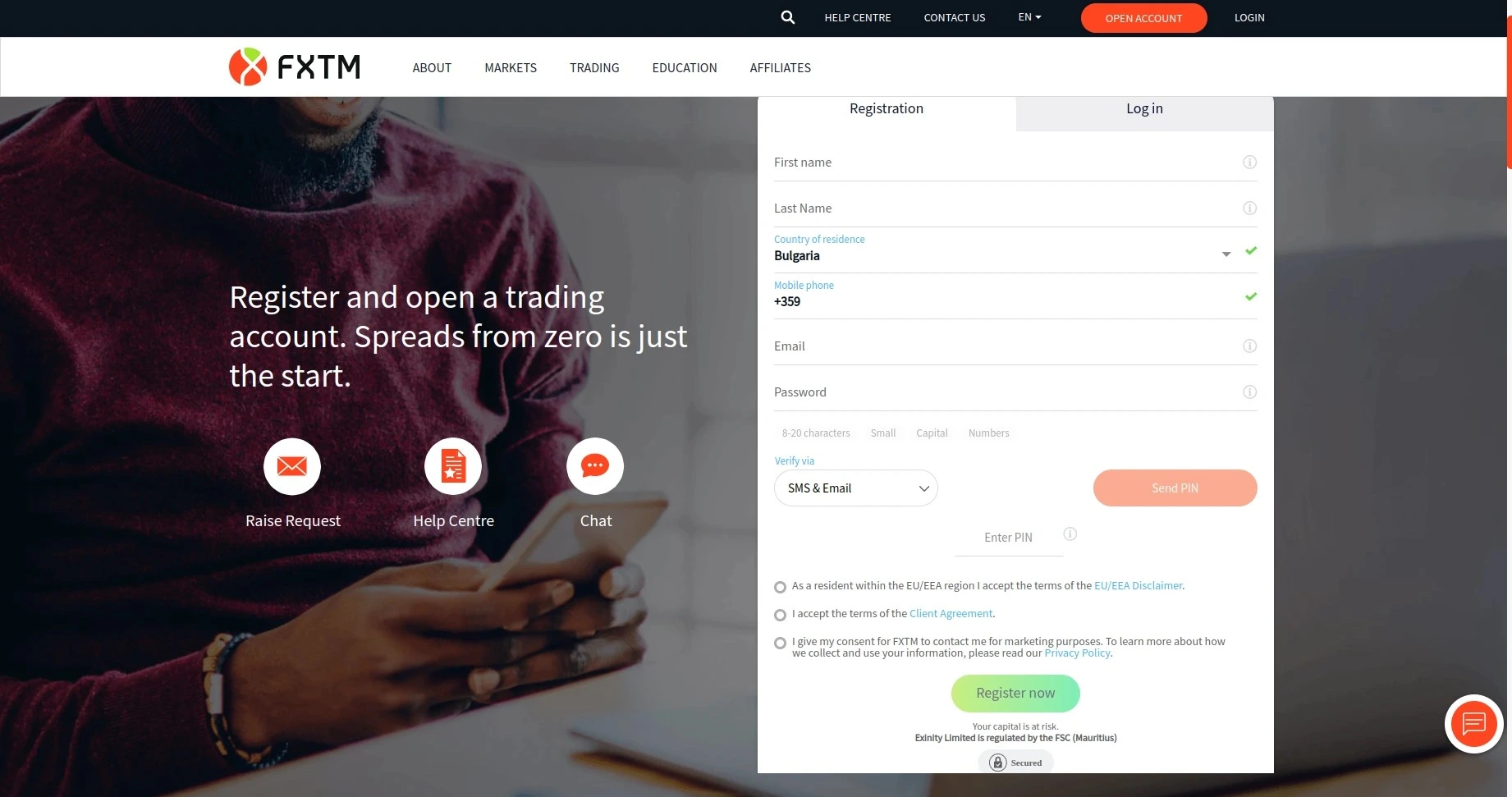

A Registration Form must be filled in, containing information about the trader’s first and last name, country of residence, mobile phone, email, and password. Customers of the broker must indicate the preferred way to have their accounts verified – either by SMS and e-mail or via WhatsApp.

-

The next step of the account opening process involves picking an account type, Advantage, Advantage Stocks, or Advantage Plus, based on the trader’s individual preferences. Traders can opt for a Demo account first, an option that is available for the Advantage and Advantage Plus account types.

-

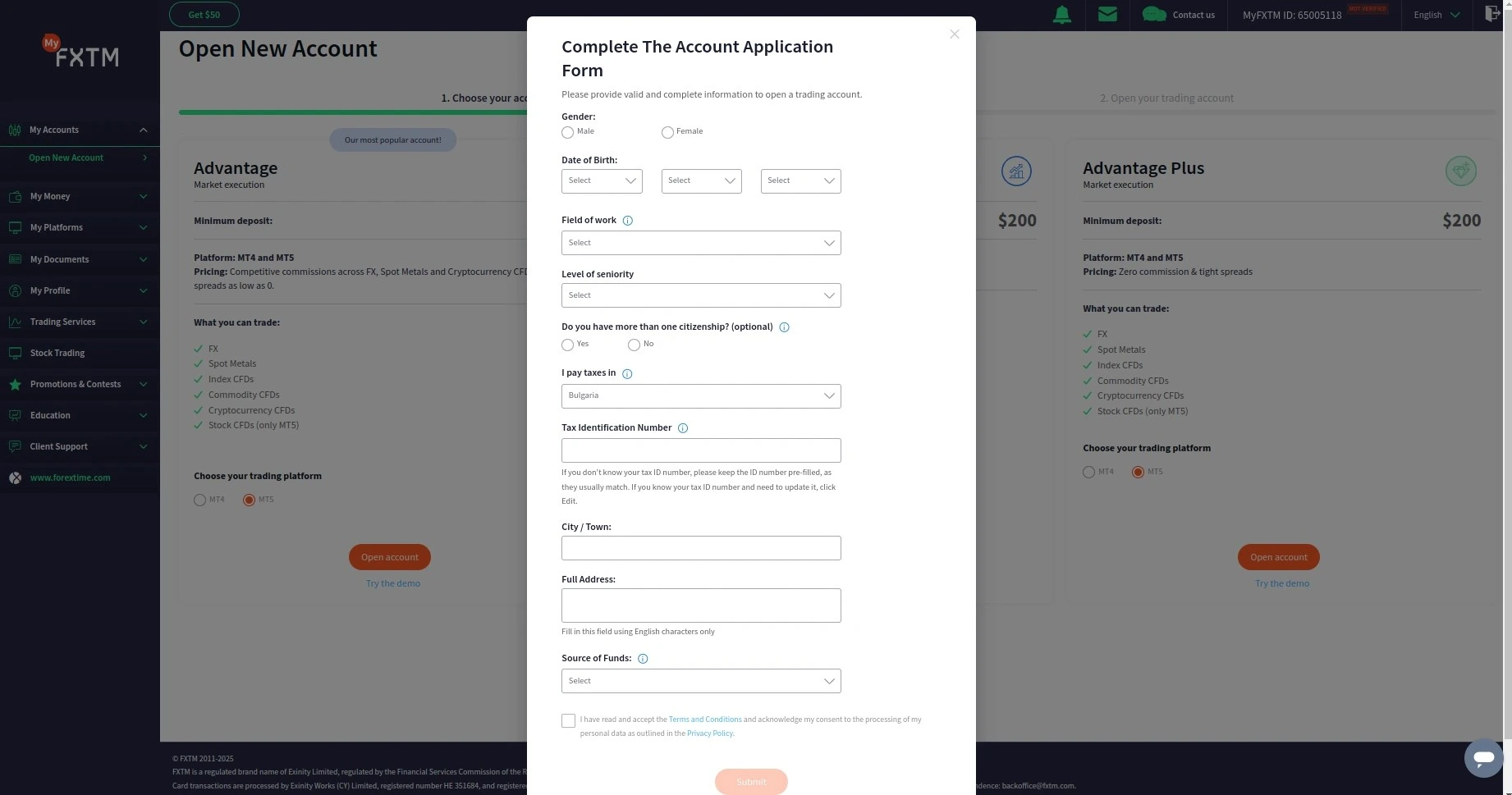

Once they pick a suitable account type, traders must proceed with the next step and complete the Account Application Form. The required information includes gender, date of birth, field of work, level of seniority, citizenship, Tax Identification Number, city, full address, and source of funds.

-

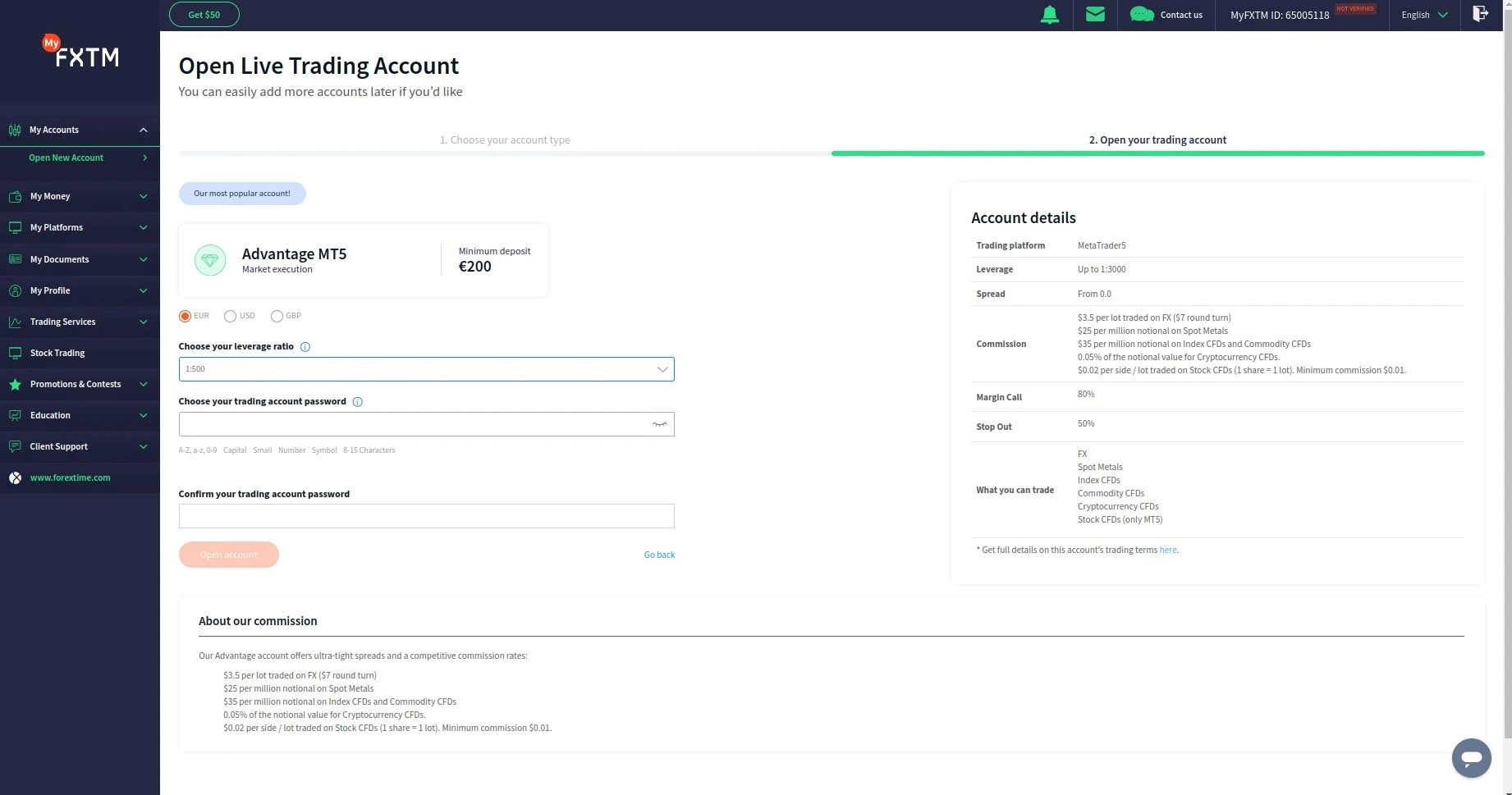

Next, traders must pick an account currency (EUR, USD, or GBP), the preferred leverage ratio, and their trading account password.

-

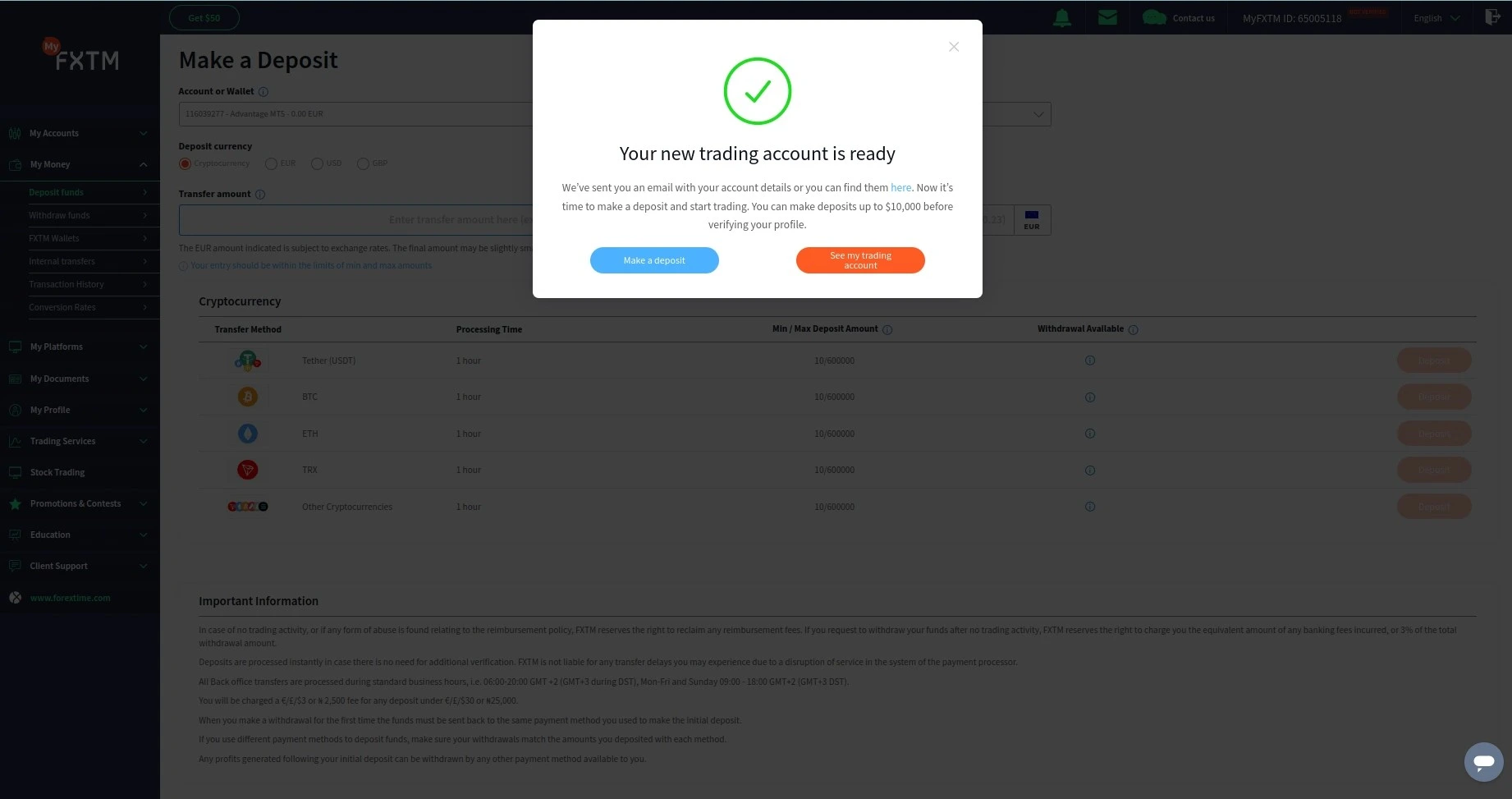

When their new trading account is ready, traders can make deposits of up to $10,000 before the account verification process. The supported deposit methods include e-wallets (Skrill and Neteller) and a range of cryptocurrencies (Tether, BTC, ETH, TRX, and more). The payment methods may vary depending on the traders’ country of residence.

Identity Verification Process – Takes about 5 Minutes

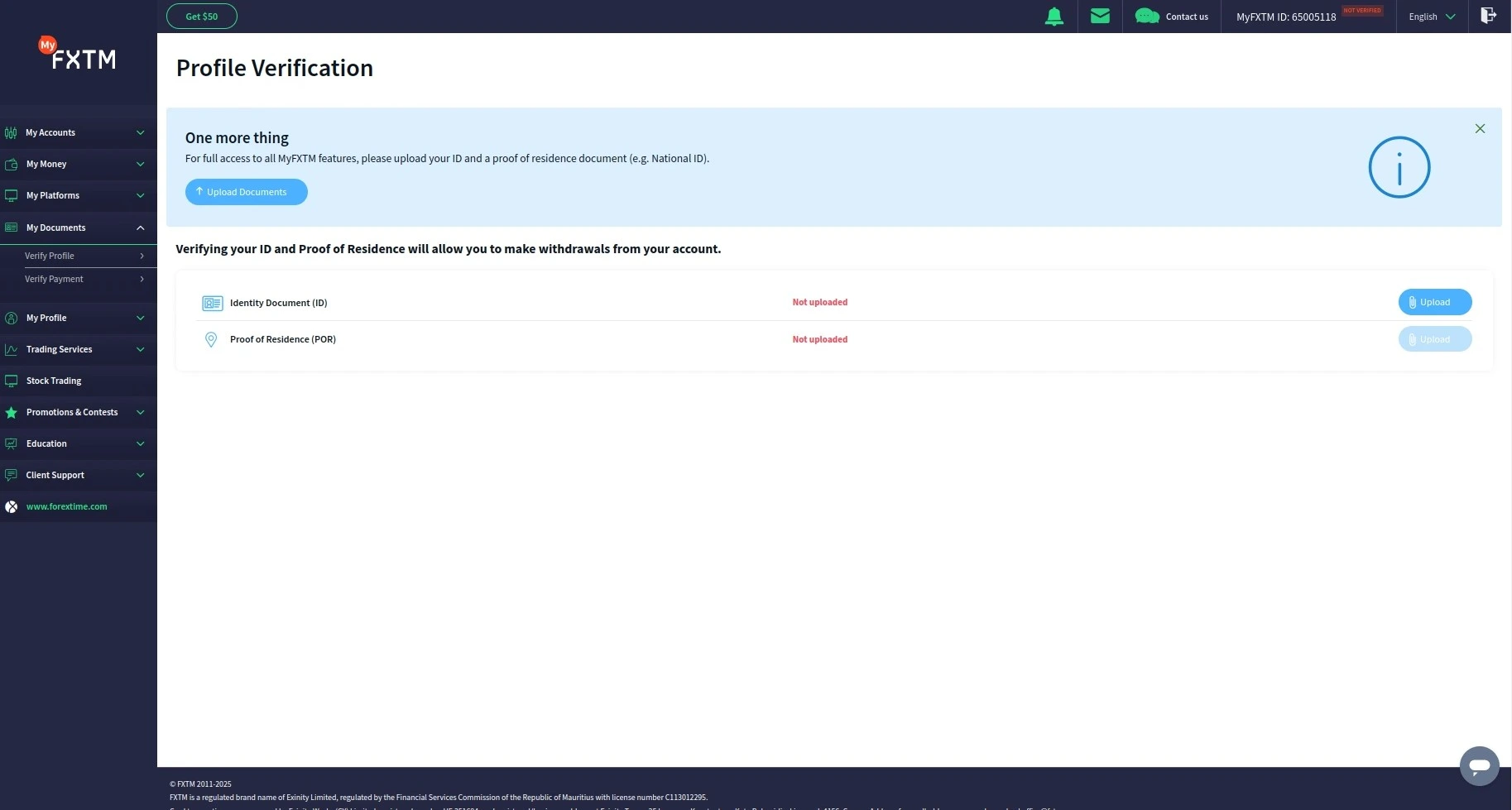

For full access to the features and functionalities of FXTM, and as a standard procedure, traders must verify their profiles and upload ID and Proof of Residence documents.

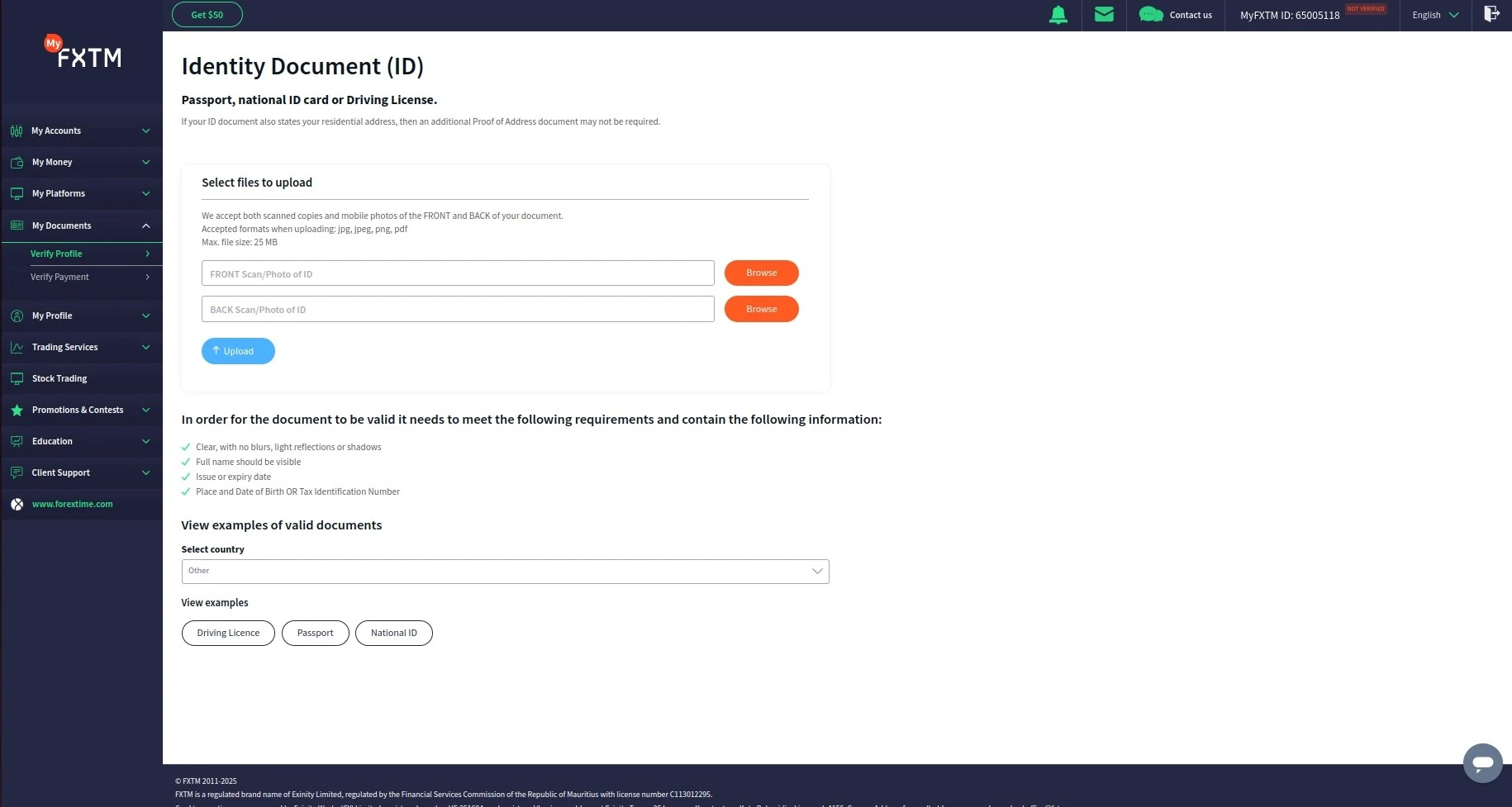

Identity Document (ID)

Documents, eligible for account verification at FXTM include a passport, national ID card, driving license, or residence permit. The broker accepts scanned copies and mobile photos of the front and back of ID documents. The accepted formats of photos and the maximum file size are clearly stated.

To meet the eligibility criteria, the uploaded ID documents must be clear, with no blurs, or shadows. Other mandatory elements that must be clearly visible include full name, issue and expiry date, place and date of birth, or TIN. Traders may have a look at some examples of valid documents.

- The documents accepted as Proof of Residence at FXTM include bank/card statements, utility bills, residency certificates, insurance statements, tenancy agreements, or vehicle registration. These documents must be issued within the last three months. If the ID document, provided in the first step of the account verification process states the trader’s address, a Proof of Address may not be further required.

Overall Thoughts

FXTM is a well-established Forex and CFD broker. The process of account opening and verification is straightforward and can be completed within minutes. The registration form requires personal and contact information. Once provided, traders must go through a verification of their identity and proof of address as a standard AML and KYC procedure. The account verification process may take some time, usually between 1 and 3 business days, depending on the quality of submitted documents and the workload of the FXTM support team.