Account Types at IG

As a well-established online trading broker, IG offers a range of account types to meet customers’ varying needs and goals. When picking an account type, the broker advises clients to consider several important aspects. These include their trading goals and periods of activity, preferred markets, experience, risk tolerance, and available trading budget. Traders can choose between two main categories of trading accounts: leveraged and non-leveraged.

The first category of leveraged account types includes spread betting and CFD accounts. Both offer traders the opportunity to profit from fluctuations in assets’ prices by going long or short with no need to buy the underlying assets. Spread betting is a popular option among UK traders, as it is a tax-free way to trade in the UK.

In contrast to spread betting, which is free from capital gains tax, profits from CFD trades can be offset against losses. As no ownership of the underlying assets is involved, neither of these instruments requires paying stamp duty. The scope of markets customers of IG can trade using a spread betting or a CFD account includes forex, shares, stock indices, metals, energies, cryptocurrencies, and commodities, totaling more than 17,000 instruments.

There are no minimum deposit requirements to open a CFD account with IG. The broker profits from the spread or, alternatively, a small commission charged for shares trades.

As for the second main category of IG accounts, the non-leveraged (investment) accounts, the options include a Share dealing account, Stocks and shares ISA account, IG Smart Portfolio account, and IG Smart ISA Portfolio account. In addition to the above-mentioned account options, IG customers can opt for a Demo account, which would be instrumental in their trading education, as it allows practice trading with $20,000 in virtual funds.

Traders should note that the availability of these accounts may vary, depending on their location and the regulations in their country.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

Minimum Account Deposit Requirements

As mentioned above, there is no minimum account balance requirement for the CFD trading account with IG. Once traders have opened their live trading accounts and started trading, the main charge of the broker is the spread or a small commission applied for shares trades. While the broker does not impose a minimum account balance requirement, traders must note that there is a minimum contract size they must comply with, with several options to pick from.

Customers can choose the price per contract, with different minimum contract sizes for new customers. The contract size at IG varies based on the market and the instrument being traded. In terms of currency trading, one standard lot is typically 100,000 of the base currency.

It is worth noting, however, that IG offers mini and micro contracts for some markets, with smaller contract sizes. A mini contract for forex is 10,000 of the base currency, whereas a micro contract is 1000 of the base currency.

Tradable Instruments

IG unlocks a world of trading opportunities with over 17,000 markets. Depending on their preferences, traders can explore indices, Forex, 13,000+ Shares, Commodities, and Cryptocurrencies. They may be interested in the broker’s specialist markets, such as bonds, rates, and options. Forex traders can benefit from rising and falling prices across 90+ major, minor, and exotic pairs.

The third-party platforms that IG has partnered with include L2 Dealer, ProRealTime, MetaTrader 4, and TradingView. As for the available trading tools, customers of IG have access to a Stock screener, Economic trading calendar, Trade analytics tool, Trading alerts, Trading charts, Trading signals, and Forex Signals.

Traders can explore the said markets and tools with a Demo trading account, enabling them to develop their skills across thousands of markets in a simulated trading environment. Their virtual balance will amount to $20,000, with the added benefit of exclusive educational content on IG Academy. The mobile apps, available for free download, empower traders to test their strategies while on the move.

Registration Process at IG – Takes about 5 Minutes

-

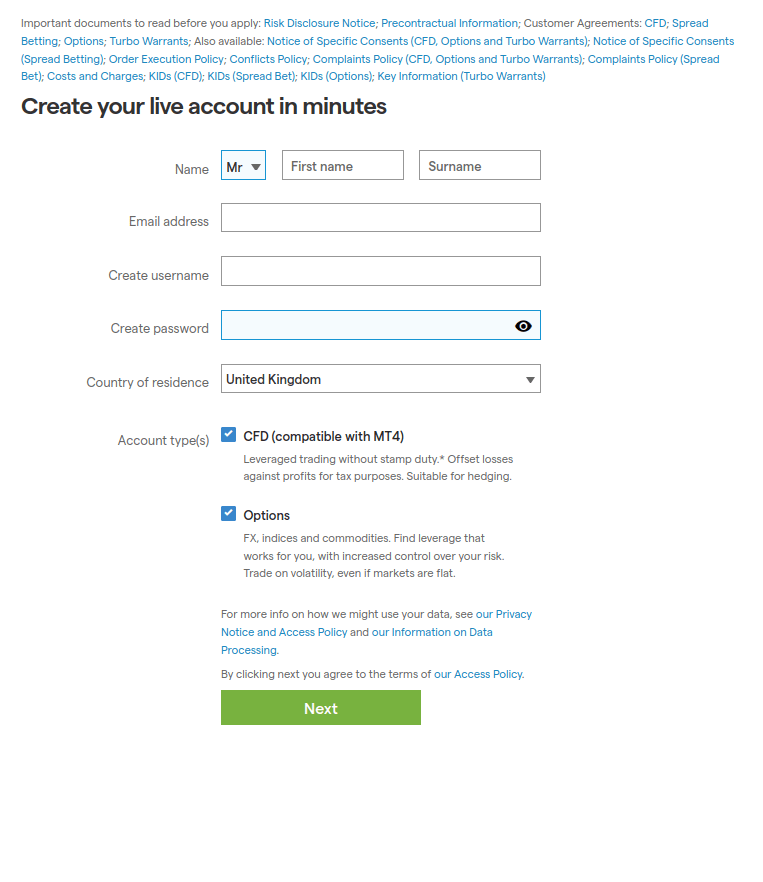

To open an account with IG, navigate to the ‘Create live account’ button, found on the upper right-hand corner of the broker’s home page.

-

Traders will be redirected to an Application Form where they can set up their live accounts in minutes. The information they will be required to provide includes first name, surname, and email address. Traders must create a username and set a password. Next, they must select their country of residence from a dropdown menu and the account type they wish to create.

-

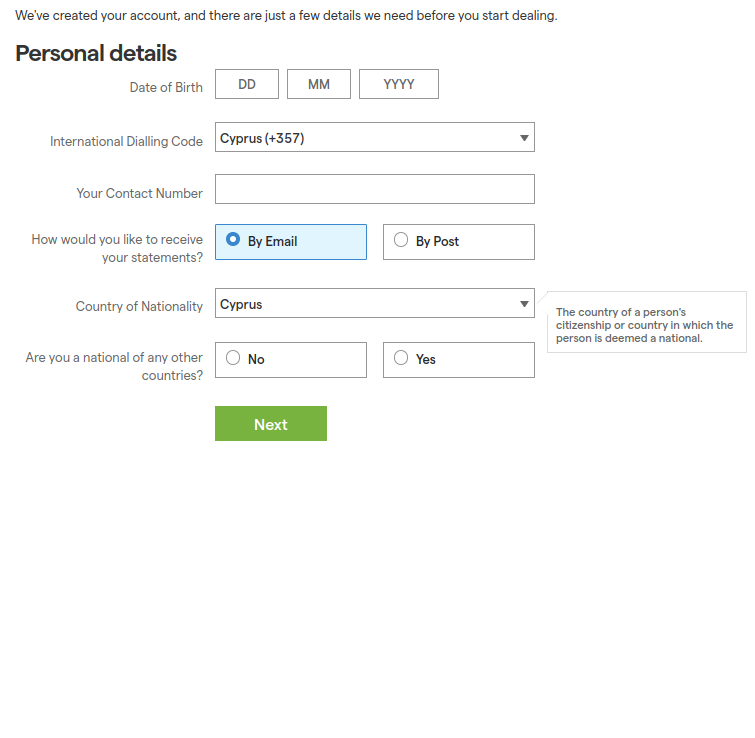

Once traders fill in the Application Form, a few more details will be needed before they can start trading. In the next form, they must provide the following information: date of birth, the international dialing code of their country of residence, their contact number, preferred method of receiving statements, and country of nationality.

-

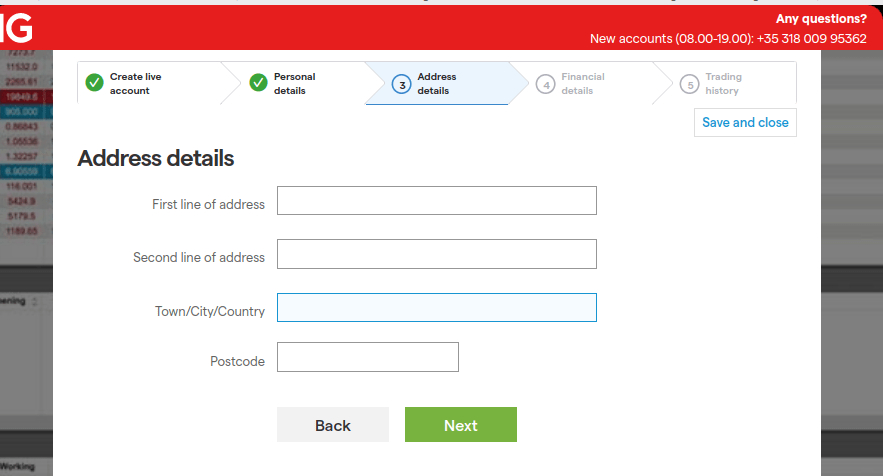

The next step of the account registration process involves providing further information on the trader’s address of residence and postcode.

-

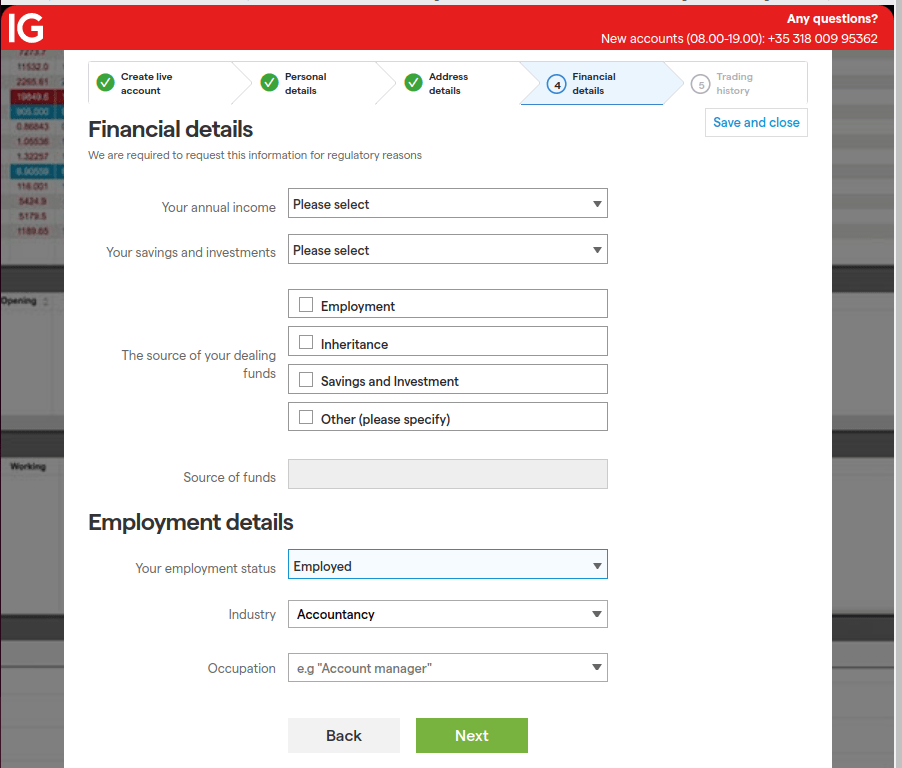

With the next step of the account registration process, traders will be required to provide details about their financial status. These include their annual income, the value of their savings and investments, and the source of their dealing funds. A few employment details will be necessary, too, including employment status, industry, and occupation.

-

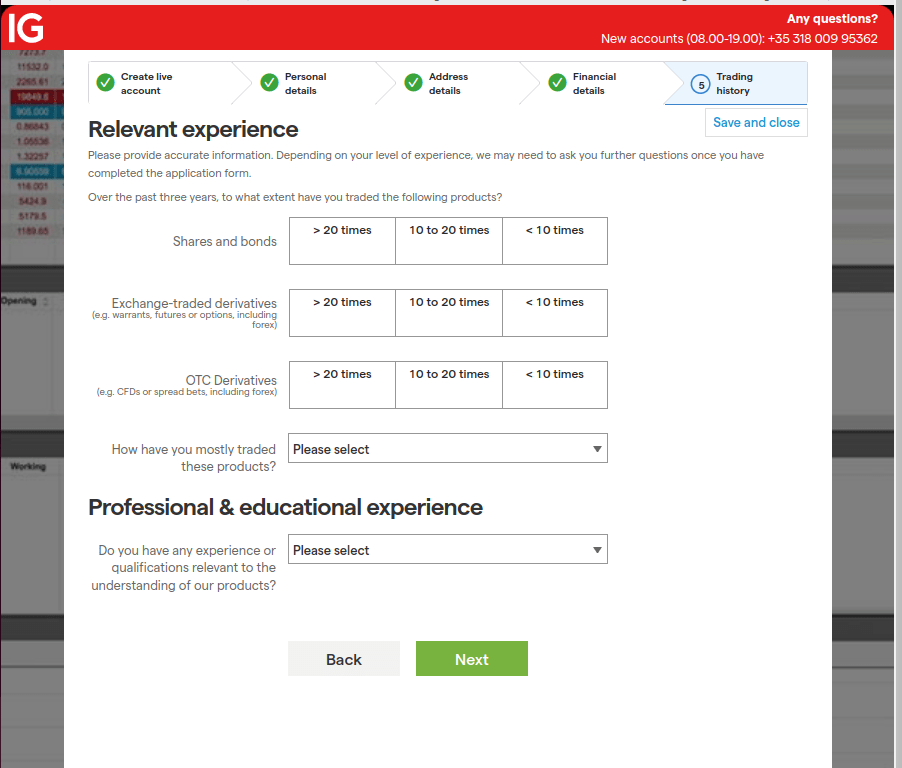

The last, sixth step of the process concerns traders’ relevant experience, based on which the broker may need to require further information. Traders must indicate their trading experience with several products, including shares and bonds, exchange-traded derivatives, and OTC derivatives over the last three years. They must also indicate if they have any experience or qualifications regarding the products offered by the company.

Finally, traders must read and agree to a form declaring they are aware of the risks of CFD trading and Options trading and indicate their marketing preferences.

Identity Verification Process – Takes about 5 Minutes

With the account creation process complete, traders must proceed with the identity verification process. IG typically requires two documents, one verifying traders’ identity and one serving as a proof of address. Alternatively, they can provide two proofs of identity Uploading these documents does not require much time, and once approved, customers can place their first trade with the broker.

When uploading the documents proving their identity and address, traders must make sure that all the information is clearly visible and in focus.

Proof of Identity

As Proof of ID, IG customers can use a passport, ID, or driving license, showing their photo and the document’s expiry date. They can upload multiple files simultaneously. If your ID card is double-sided, do not forget to upload both sides of the document.

Proof of address

As proof of address, traders can use several commonly accepted documents such as utility bills, bank statements, credit card statements, internet bills, rent or tenancy agreements, or a local authority letter, among others. Whatever they pick to use, they must make sure that the name and address on the document match those from the application form. With regard to the document’s validity, it must not be older than three months. Traders should make sure that the name and logo of the issuing institution are clearly visible.

As for bank statements and other documents issued by bank institutions, they must include the account name, number, sort code, and issuing bank. Screenshots from online banking are acceptable as long as they include personal account details and the issuing bank’s details.

Overall Thoughts

Overall, we can rate the account opening and verification process at IG as relatively easy and smooth. The broker’s website and mobile app are well-designed and easy to navigate, making the account creation process hassle-free. The broker provides clear instructions throughout the process, with sections dedicated to personal details, address details, financial details, and trading history. The process of uploading the required documents for identity and address verification is equally streamlined, with 1-2 business days typically needed for most account verifications. Last but not least, traders should note that the broker’s support team is available to help with any queries or issues that may arise during the account registration and verification process.