Swissquote is a prominent online broker with a FINMA banking license that offers all-in spreads with zero commissions for over 80 currency pairs. Customers from certain countries can further reduce their trading expenses by registering commission-based accounts with raw forex spreads from zero pips. The broker supports popular third-party software like MT4 and MT5, although trading on its proprietary CFXD platform is also an option.

Our team carefully researched and tested Swissquote with real money accounts to assess its trading and non-trading fees. We have dissected the broker’s spreads, swap rates, and the overall transaction costs customers will encounter to give you a better idea of the expenses you can anticipate. Let’s start by examining the minimum spreads for the different account types at Swissquote.

Swissquote Trading Costs

Swissquote provides three retail account types under its international entity, with floating spreads adapted to customers’ initial capital. The broker does not impose additional charges or commissions on forex trades as all costs are built into the spreads. The minimum deposit requirements are $1,000 for Standard Accounts, $10,000 for Premium Accounts, and $50,000 for Prime Accounts. We compared the minimum spreads across the three options to determine which account offers the best trading conditions.

Forex Trading Costs for Standard Accounts

Standard Accounts offer minimum spreads from 1.7 pips for EUR/USD. We must admit this is considerably higher than what other top-raking brokers charge for the most liquid currency pair. One standard lot in EUR/USD will cost you $17 (0.00017 x 100,000) at this opening price. Assuming you close your position at the same price, you will incur round-turn expenses of $34. Respectively, one micro lot costs $0.17 (0.00017 x 1,000) per side and $0.34 in both directions of the trade.

We consider these trading conditions somewhat unfavorable, especially when compared to what rival brokers like Fusion Markets and IC Markets charge for the pair. EUR/USD spreads are nearly twice as low and average 0.93 pips for Standard Accounts at Fusion Markets, bringing your trading costs to $9.30 each way. IC Markets offers even lower spreads of 0.86 pips for EUR/USD where one standard lot costs $8.60 per side and $17.20 in total assuming the opening and closing prices are the same.

| Minimum Spread Costs for Standard Accounts at Swissquote | ||||

|---|---|---|---|---|

| Forex Pair | Spread (in pips) | Commission | Cost* per Micro Lot | Cost* per Standard Lot |

| EUR/USD | 1.7 | $0 | $0.17 | $17.00 |

| USD/JPY | 1.6 | $0 | $0.11 | $10.52 |

| EUR/GBP | 1.7 | $0 | $0.21 | $21.07 |

| GBP/USD | 2.0 | $0 | $0.20 | $20.00 |

| AUD/USD | 1.6 | $0 | $0.16 | $16.00 |

| USD/CAD | 2.7 | $0 | $0.19 | $18.83 |

| USD/CHF | 2.0 | $0 | $0.22 | $22.08 |

| USD/CNH | 16.4 | $0 | $0.22 | $22.49 |

| NZD/USD | 2.3 | $0 | $0.23 | $23.00 |

**The minimum spread expenses are rounded to the second number after the decimal point and correspond to the trading costs upon opening a position in the respective forex pair. The same applies to the costs listed for Premium and Prime Accounts at Swissquote.

Forex Trading Costs for Premium Accounts

Premium Accounts offer slightly better value as their minimum spreads for EUR/USD are 0.3 pips lower than those for Standard Accounts. This results in a $3 reduction in the trading costs per side as customers pay $14 (0.00014 x 100,000) per standard lot each way. Trades in mini lots incur spread charges of $1.40 per side, respectively. It is also worth mentioning that Premium accounts require considerably higher initial deposits of $10,000, which renders them unsuitable for beginner traders on a shoestring budget.

Account holders must trade at least 10,000 units in a base currency (one mini lot) to place a forex order. Again, there are no commissions on trades as all expenses are included in the spread. Despite the 0.3-pip reduction, Premium Accounts at Swissquote still have higher spreads than the averages listed by discount brokers like Fusion and IC Markets where minimum deposits start from $0 and $200, respectively.

| Minimum Spread Costs for Premium Accounts at Swissquote | ||||

|---|---|---|---|---|

| Forex Pair | Spread (in pips) | Commission | Cost per Mini Lot | Cost per Standard Lot |

| EUR/USD | 1.4 | $0 | $1.40 | $14.00 |

| USD/JPY | 1.4 | $0 | $0.92 | $9.20 |

| EUR/GBP | 1.5 | $0 | $1.86 | $18.64 |

| GBP/USD | 1.7 | $0 | $1.70 | $17.00 |

| AUD/USD | 1.4 | $0 | $1.40 | $14.00 |

| USD/CAD | 2.4 | $0 | $1.68 | $16.74 |

| USD/CHF | 1.8 | $0 | $1.99 | $19.86 |

| USD/CNH | 14.4 | $0 | $1.98 | $19.75 |

| NZD/USD | 2.2 | $0 | $2.20 | $22.00 |

Forex Trading Costs for Prime Accounts

Now, let’s see how Prime Accounts at Swissquote fare in terms of trading expenses. Minimum EUR/USD spreads for Prime Accounts are 0.60 pips lower meaning that one standard lot will cost you $6 less per side compared to Standard Accounts. Customers end up paying $11 per standard lot as spreads for the popular pair start from 1.1 pips with zero commissions.

While notable, this reduction still does not give Swissquote a competitive edge over rival trading sites like Fusion Markets. The higher barrier to entry for Prime Accounts only adds insult to injury – few retail clients can satisfy the minimum deposit requirement of $50,000. The minimum trade size here is 100,000 currency units, which leads us to the conclusion Prime Accounts are intended primarily for experienced and large-volume traders.

| Minimum Spread Costs for Prime Accounts at Swissquote | |||

|---|---|---|---|

| Forex Pair | Spread (in pips) | Commission | Cost per Standard Lot |

| EUR/USD | 1.1 | $0 | $11.00 |

| USD/JPY | 1.2 | $0 | $7.89 |

| EUR/GBP | 1.2 | $0 | $14.87 |

| GBP/USD | 1.4 | $0 | $14.00 |

| AUD/USD | 1.2 | $0 | $12.00 |

| USD/CAD | 2.2 | $0 | $15.34 |

| USD/CHF | 1.6 | $0 | $17.67 |

| USD/CNH | 10.2 | $0 | $13.99 |

| NZD/USD | 1.8 | $0 | $18.00 |

It is blatantly obvious at this point Prime Accounts are your best bet if you insist on enjoying the lowest possible spreads when trading with Swissquote. Trading conditions are still far from optimal, however, even more so when compared to the spread fees charged by discount brokers like Fusion Markets. The five-digit threshold on minimum deposits is a major setback for most retail traders, leaving them with no option but to register Standard Accounts where minimum spreads are more than half a pip higher.

Forex Trading Costs for Elite Accounts (EU Customers)

Swissquote charges no commissions on forex trades under its global entity but opening a commission-based account is still an option for customers registering through the CySEC-regulated version of the website. Onboarding clients from the EU can register Elite Accounts to enjoy spreads as low as 0.00 pips. The minimum transaction size for this account type is 100,000 base currency units, or one standard lot.

The broker charges a €2.50 commission per side and €5.00 round-turn. Spreads are floating and change all the time according to market volatility. Assuming optimal trading conditions and minimal market volatility, a standard lot in EUR/USD will cost you only €5 in total if the spreads indeed drop to zero pips.

This is still slightly higher than commission-based accounts at Fusion Markets where a single standard lot in the same pair incurs a €4.05 round-turn commission and the spread averages 0.03 pips. Nevertheless, Elite Accounts at Swissquote offer trading conditions that generally align with those of most other brokers providing commission-based accounts.

| Minimum Trading Costs for Elite Accounts at Swissquote (EU Only) | |

|---|---|

| Minimum Spreads | From 0.00 pips (floating) |

| Commission (Buy) | €2.50 |

| Commission (Sell) | €2.50 |

| Minimum Total Costs | €5.00 (in optimal market conditions with a 0.00 spread) |

Swissquote Overnight Funding Costs

Overnight funding costs, also known as swap fees, are another important aspect to consider before opening a live account with an online broker. Swap fees are either debited or deducted from your balance when you hold open positions overnight. These charges account for the differentials between the interest rates of the currencies involved in a forex pair. The swap rates are subject to change and are clearly listed on the Swissquote website.

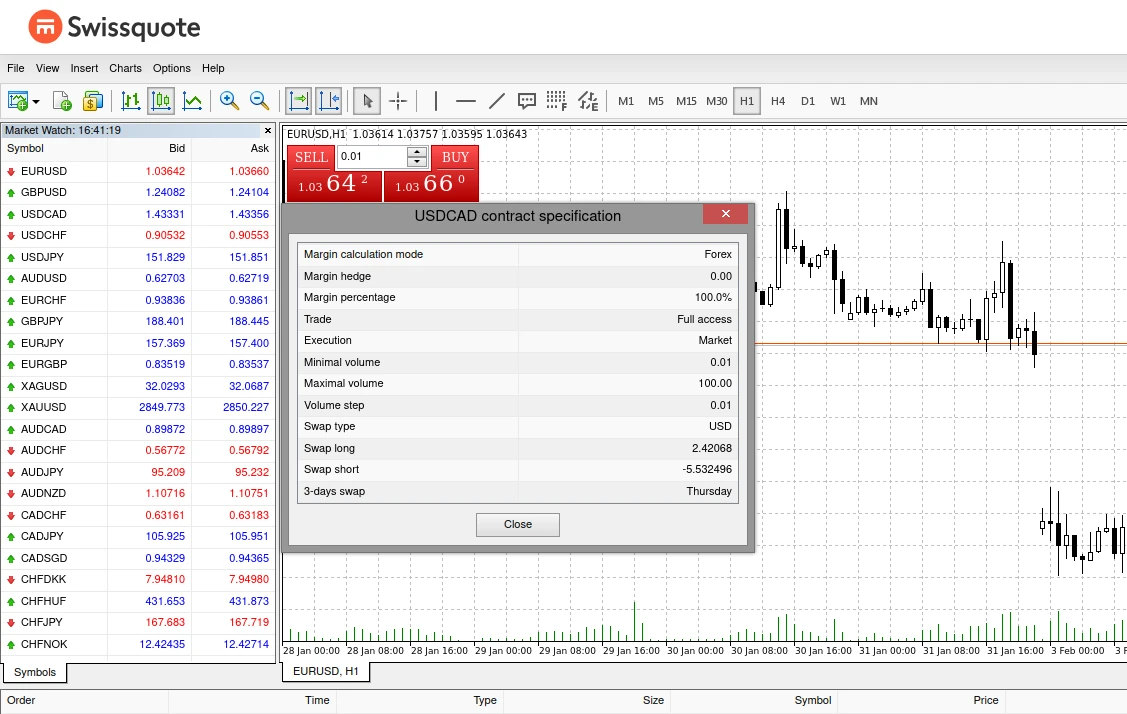

You can also find them in the instrument specifications of the MetaTrader and CFXD platforms supported by the broker, as shown in the screenshot above. The swap rates in the table below were derived from a live trading account linked to MetaTrader 4. Customers can calculate the cost of holding overnight positions using the formula provided by Swissquote. It applies to swap fees on orders placed via the MetaTrader platform.

OFC = PS x SR / ER where:

- OFC is the cost you will incur when holding overnight positions.

- PS is your position size (eg. 100,000 units in the base currency).

- SR is the short or long swap rate listed for your chosen currency pair.

- ER is the current exchange rate for the forex pair.

Let’s put the formula into action with an example where you hold a short position in GBP/USD for one night. Your position size is one standard lot. The current exchange rate is 1.24659, with swap rates of -0.0000225 for short positions in the pair. You will pay overnight funding fees of £1.80 (100,000 x -0.0000225 / 1.24659) in this case. The formula for calculating swaps on positions placed via the proprietary CFXD platform is simpler as you only multiply your position size by the respective swap rate like this: 100,000 x -0.0000225 = -$2.25.

| Swissquote Swap Rates* for Major Forex Pairs | ||||

|---|---|---|---|---|

| Forex Pair | Base Currency | Volume in Lots | Long Swaps per Standard Lot | Short Swaps per Standard Lot |

| EUR/USD | USD | 1 | -6.19 | 3.07 |

| USD/JPY | USD | 1 | 20.81 | -24.14 |

| EUR/GBP | USD | 1 | -6.48 | 3.07 |

| GBP/USD | USD | 1 | -1.33 | -1.81 |

| AUD/USD | USD | 1 | -1.98 | -1.34 |

| USD/CAD | USD | 1 | 2.42 | -5.53 |

| USD/CHF | USD | 1 | 9.51 | -12.85 |

| USD/CNH | USD | 1 | -0.13 | -7.43 |

| NZD/USD | USD | 1 | -2.35 | -1.11 |

*These are the daily swap rates listed for Swissquote customers using the MetaTrader 4 platform. The rates apply to one standard lot in the corresponding currency pair.

The broker charges triple swap rates on Wednesdays at 23:00 CET. This is a standard adjustment accounting for weekend rollovers. Some currency pairs like USD/CAD and OIL/USD incur triple swap charges on Thursdays and Fridays, respectively.

Swissquote Non-Trading Costs

Swissquote does not offer additional services like copy or social trading to retail forex traders. The international entity supports deposits and withdrawals via wire transfers only. Topping up your live balance is free but additional charges on behalf of third-party financial institutions may apply. Opening and maintaining a live account also comes at no cost provided you stay active and trade occasionally.

Customers who fail to log into their accounts and place orders for six successive months incur inactivity fees of $10. The broker will deduct this amount each month from inactive accounts with available balances. From what we gather, retail traders are not liable for any other charges at Swissquote.

| Swissquote Non-Trading Costs at a Glance | |

|---|---|

| Deposit Fees | Free (third-party charges may apply) |

| Withdrawal Fees | Depends on base account currency |

| Account Opening Fee | Free |

| Inactivity Fee | $10 per month |

| VPS Hosting Subscription | N/A |

| Copy Trading | N/A |

Closing Thoughts on Swissquote Fees

Our in-depth look into this broker’s fees revealed Swissquote provides slightly less favorable trading conditions compared to some of the other top-rated retail brokers in the industry. The minimum spreads are higher and so are the minimum capital requirements. If you can afford to deposit a five-digit amount, setting up a Prime Account is perhaps your best option as it offers the lowest spreads.

In conclusion, Swissquote undoubtedly provides high-quality trading services, transparent pricing, and adequate client protections as one would expect from a broker with a FINMA banking license. If you prioritize security, reputation, and quality over tight spreads, you should definitely give Swissquote a try. However, we recommend you look elsewhere if reducing your trading costs is your main priority.