XTB Account Types in Brief

The CySEC entity offers one main retail account that facilitates commission-free trading with contracts for difference. Setting up and maintaining a live account is free for active traders. Customers with dormant accounts incur a €10 monthly fee after one year of inactivity.

The minimum transaction size is 0.01 lots. Live accounts enable trading on desktop, mobile, and tablet devices. Transactions are processed in euros at the CySEC entity but additional base currencies are available to customers from non-EU jurisdictions.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

XTB Minimum Deposit Requirements

Onboarding customers can fund their live accounts with any amount they wish since XTB has no minimum deposit requirements. Deposits are free but withdrawals below €100 incur additional processing fees of €10. The broker segregates client funds from its operating capital in line with the CySEC regulatory requirements. Various instant deposit options are available, including Visa, Mastercard, Maestro, Skrill, PayPal, PayU, and Ecommpay. There are no fees for additional currency conversion.

What Can You Trade with XTB Live Accounts

Opening a live account at XTB enables you to speculate on the price movements of over 1,500 leveraged markets, including 70+ currency pairs with spreads from 0.8 pips. Forex leverage is capped at 1:30 for retail clients. The broker provides negative balance protection to all retail customers, preventing them from running account deficits. Trading indices, commodities, stocks, cryptocurrencies, and ETFs is also possible at XTB. The broker executes orders via the proprietary xStation5 platform. From what we gather, MT4 is supported for demo accounts.

Step-by-Step Registration at XTB – Takes Approximately 20 Minutes in Total

Load www.xtb.com/cy in your mobile or desktop browser and click the green Create Account button in the top right corner of the homepage.

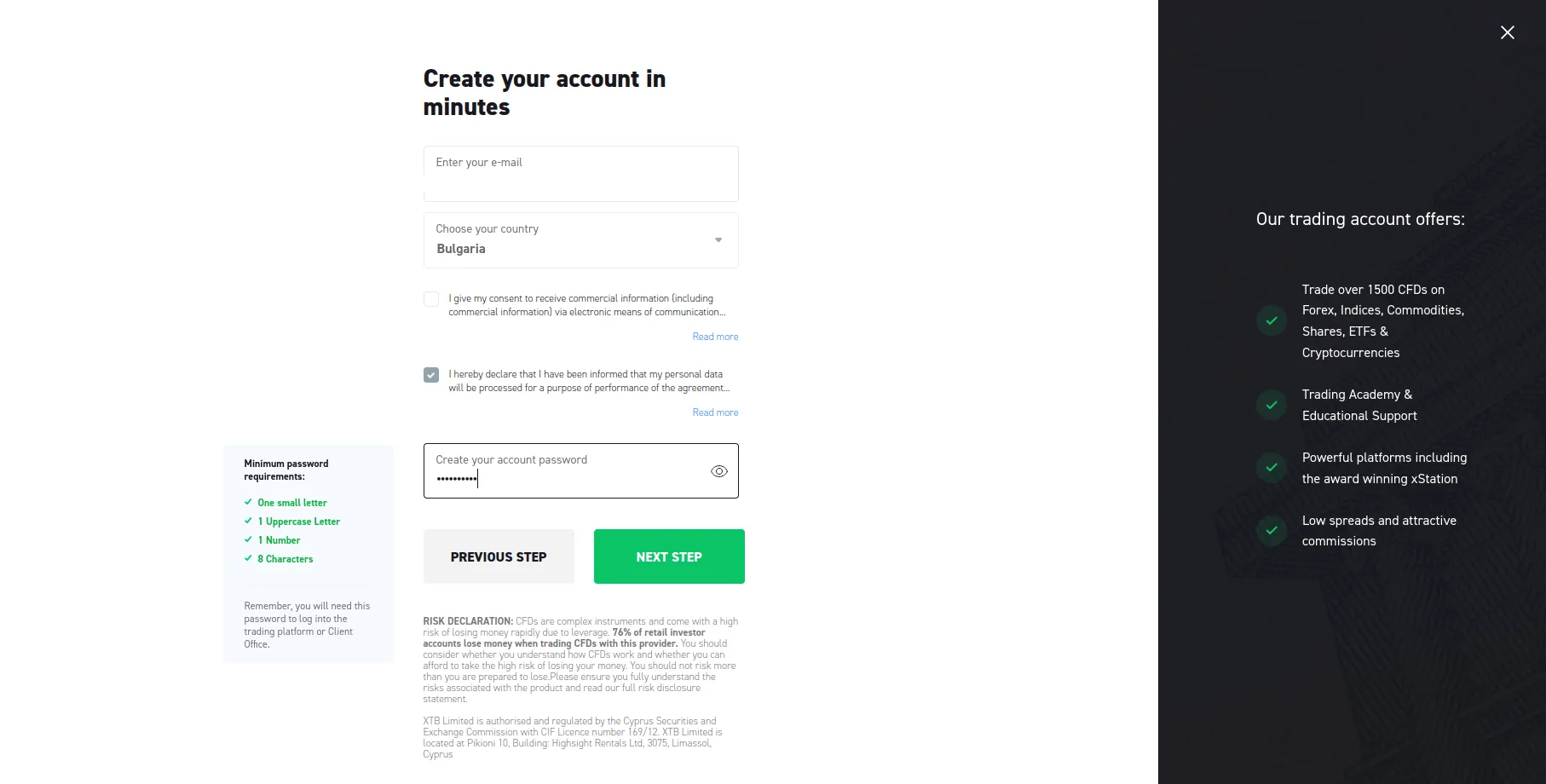

Enter your email address, select your country from the dropdown menu, and tick the boxes below to accept the general terms and conditions. Choose a solid password to access your live account with.

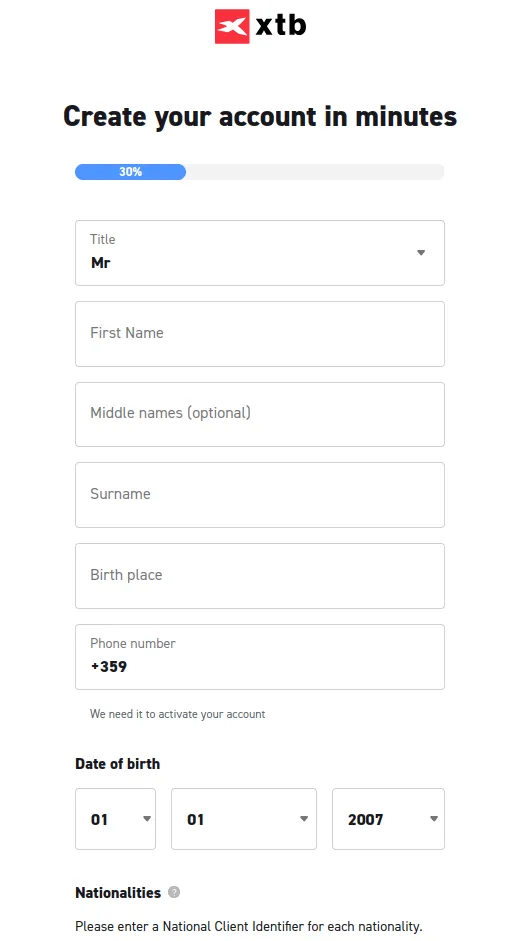

Fill in your personal details in the registration form, including your title, name, place of birth, and birth date.

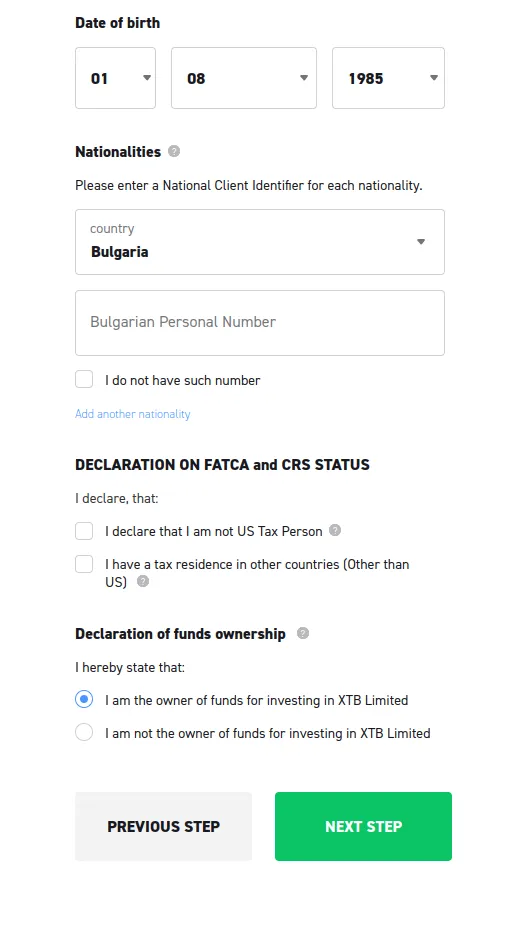

You must also specify your nationality and enter your national identification number. Tick the corresponding boxes below to confirm you are not a US national and are the rightful owner of the funds deposited in your account.

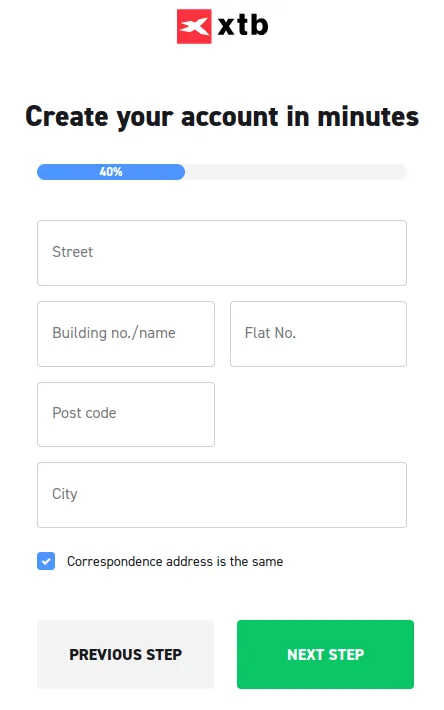

Enter your current residential address, including street name, building and flat number, postcode, and city.

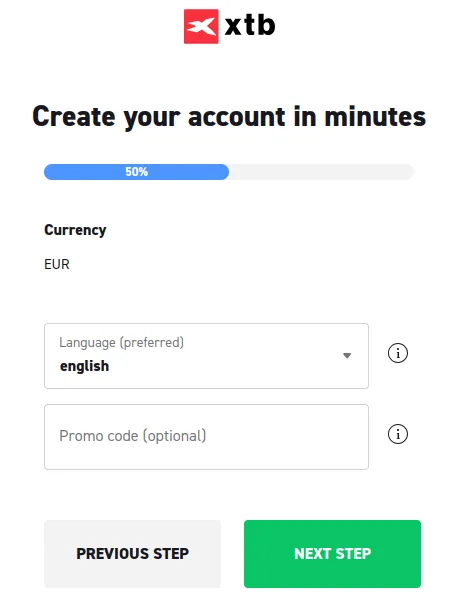

Choose your preferred language and enter a promo code if you plan on using one.

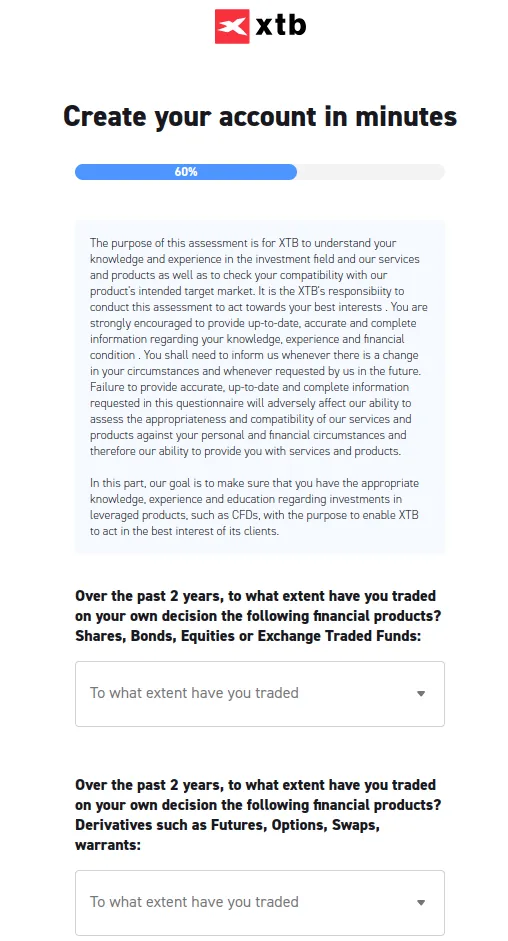

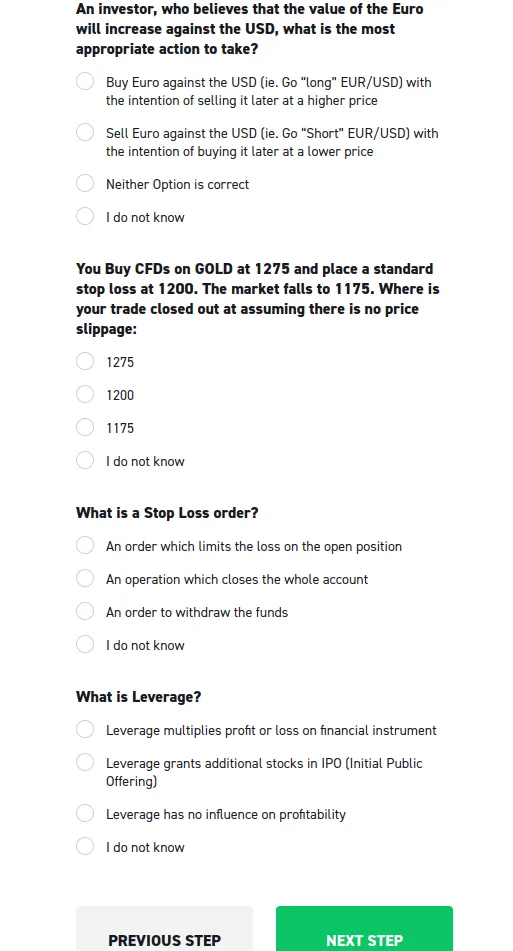

It’s time for the XTB client suitability test to establish whether you are knowledgeable and experienced enough to trade high-risk instruments with leverage. They will ask you how often you have traded shares, bonds, futures, options, swaps, and so on.

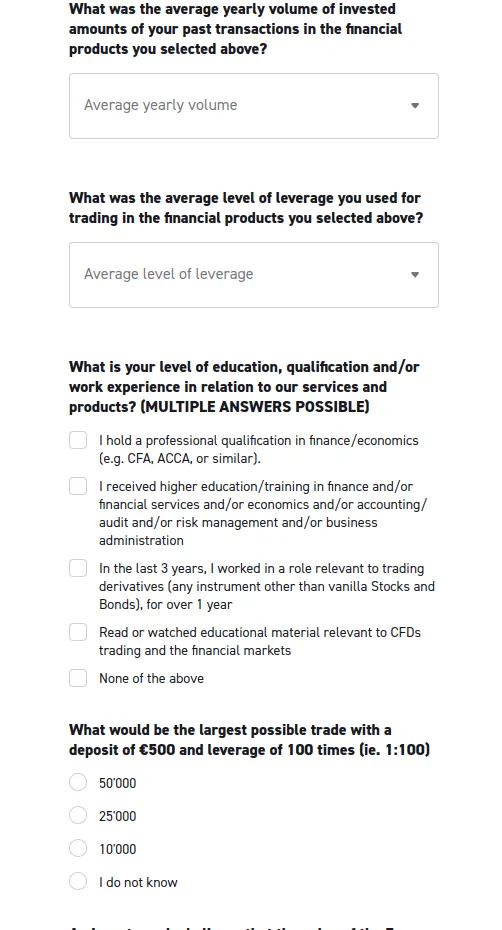

You must also specify your average annual trading volume and the average leverage ratios you have used. Provide information about the average position size you intend to use at XTB and your level of education or qualification in the financial markets.

Next, you must fill out a short questionnaire so that XTB can assess your expertise in dealing with leveraged derivative instruments. Answering these questions should be easy if you have any prior experience in CFD trading.

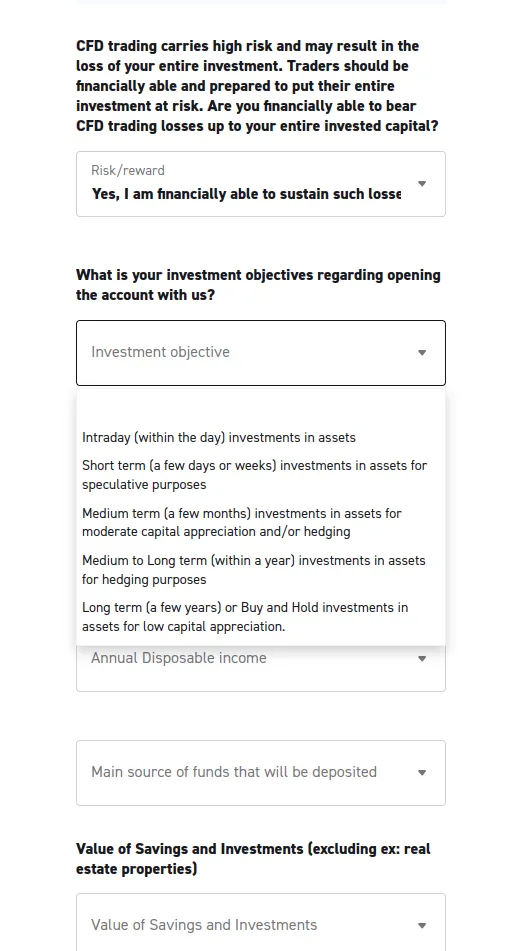

Now it’s time for a financial assessment. XTB will also ask you about your investment objectives, savings, and disposable annual income.

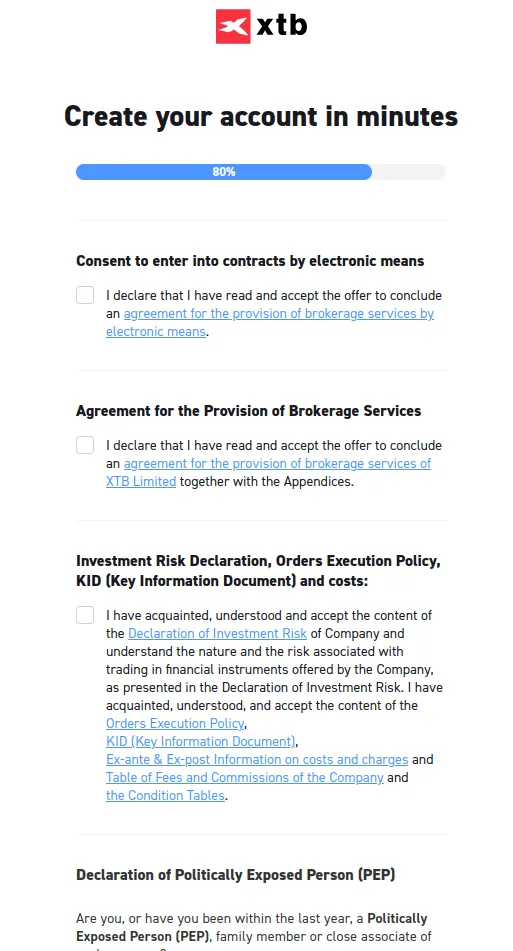

Tick the boxes to consent to the terms of use and confirm you have read the broker’s risk disclosure. You must also provide information on whether you are a politically exposed person (PEP) more likely to become susceptible to corruption or bribery. If so, you must fill out a special PEP declaration form.

You have created your new live account and can continue with KYC verification.

KYC Verification of XTB Account – Takes 5 to 10 Minutes on Average

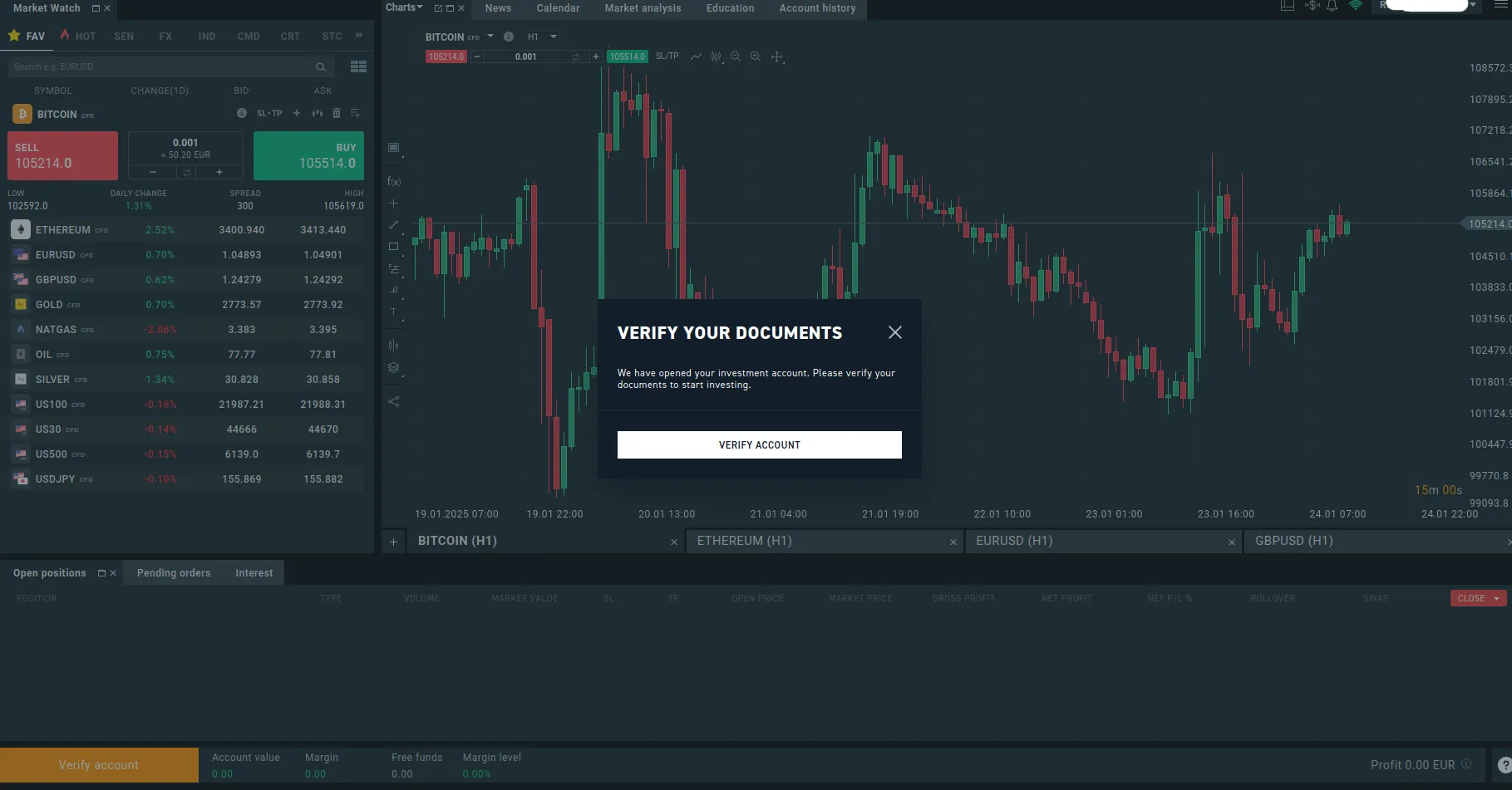

Click the green button to access your new live account and then select Verify Account in the lower left corner of the screen.

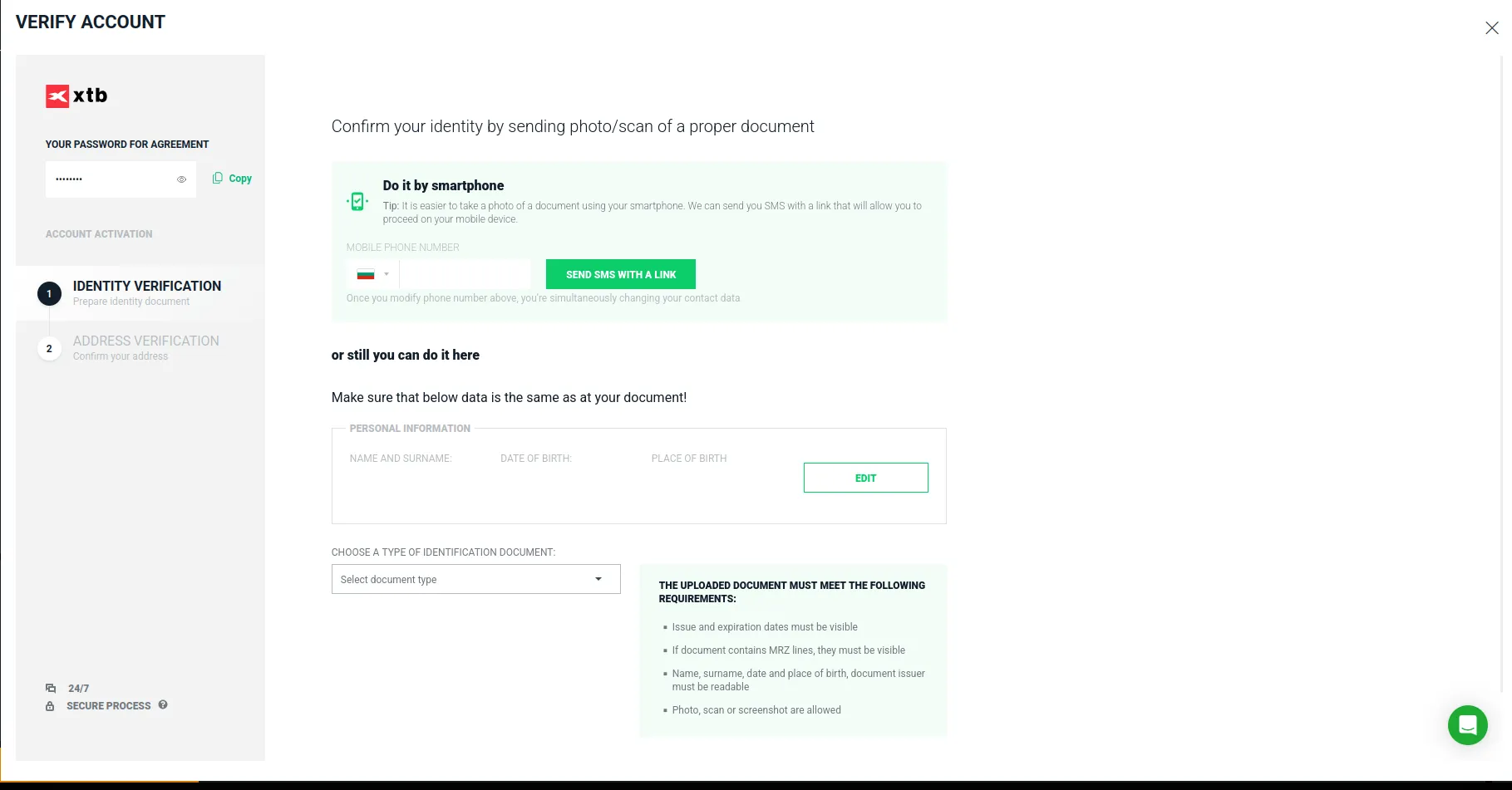

Upload photos of your preferred identity document (passport or ID card) in a supported format (jpg, png, or pdf). The size of your files should not exceed 12 MB. XTB accepts photos, scans, and screenshots as long as all the information is readable. The issue and expiration dates must also be visible.

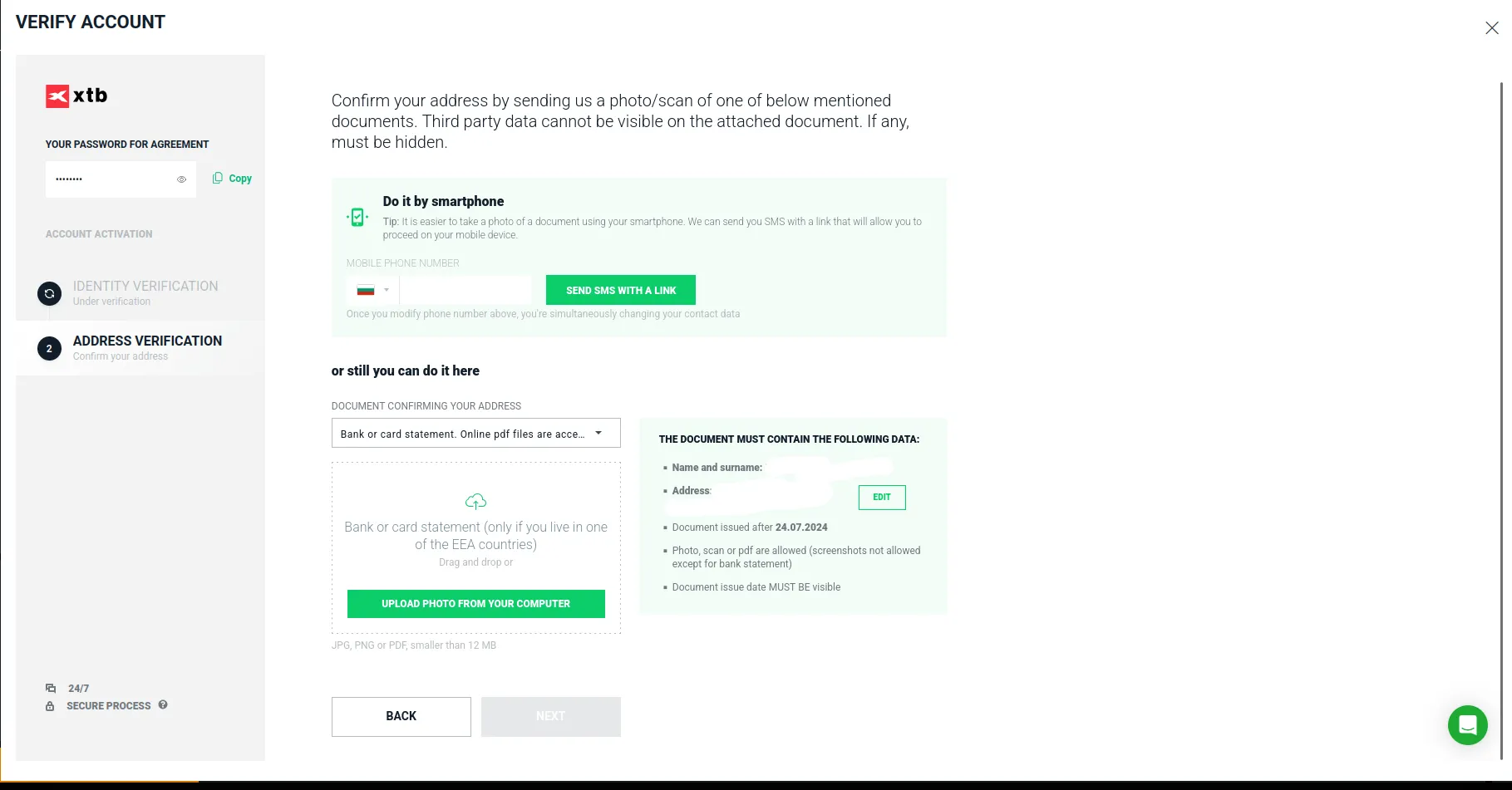

You are almost there as you only have to upload a document to verify your current residential address. XTB accepts a wide range of documents for this purpose, including utility bills, bank statements, bank letters, residence certificates, municipal service fees, tax certificates, and pensioner institution certificates.

Congratulations, you have successfully created your XTB trading account. Now you must wait for the broker to approve your verification documents manually before you can deposit and place orders. The team approved our reviewer’s documents within a couple of hours but it all depends on their current workload. They will inform you about the verification results via email.

Final Impressions

Registering through the CySEC entity is relatively hassle-free, all the more so if you have all the necessary documents close by. You can complete the entire process on your desktop computer or mobile phone in around 20 minutes provided that you are knowledgeable enough to answer the suitability questions quickly. XTB is also quick at assessing verification documents, allowing onboarding customers to start trading within several hours.