Last year, the tech industry faced a brutal wave of layoffs, with 167.6 thousand employees losing their jobs in the first three months alone, exceeding the total number of layoffs for all of 2022. This trend of job cuts has continued into 2024, driven by economic challenges, high interest rates, and rapid advancements in artificial intelligence, showing no signs of slowing down.

To illustrate the scale and distribution of global tech layoffs as of this year so far, the team at BestBrokers analysed over 800 layoff announcements from the technology sector tracked by the IT job portal trueup.io. We organised the layoffs in the database by company and country of headquarters, identifying the companies that have slashed the most jobs since January 2024.

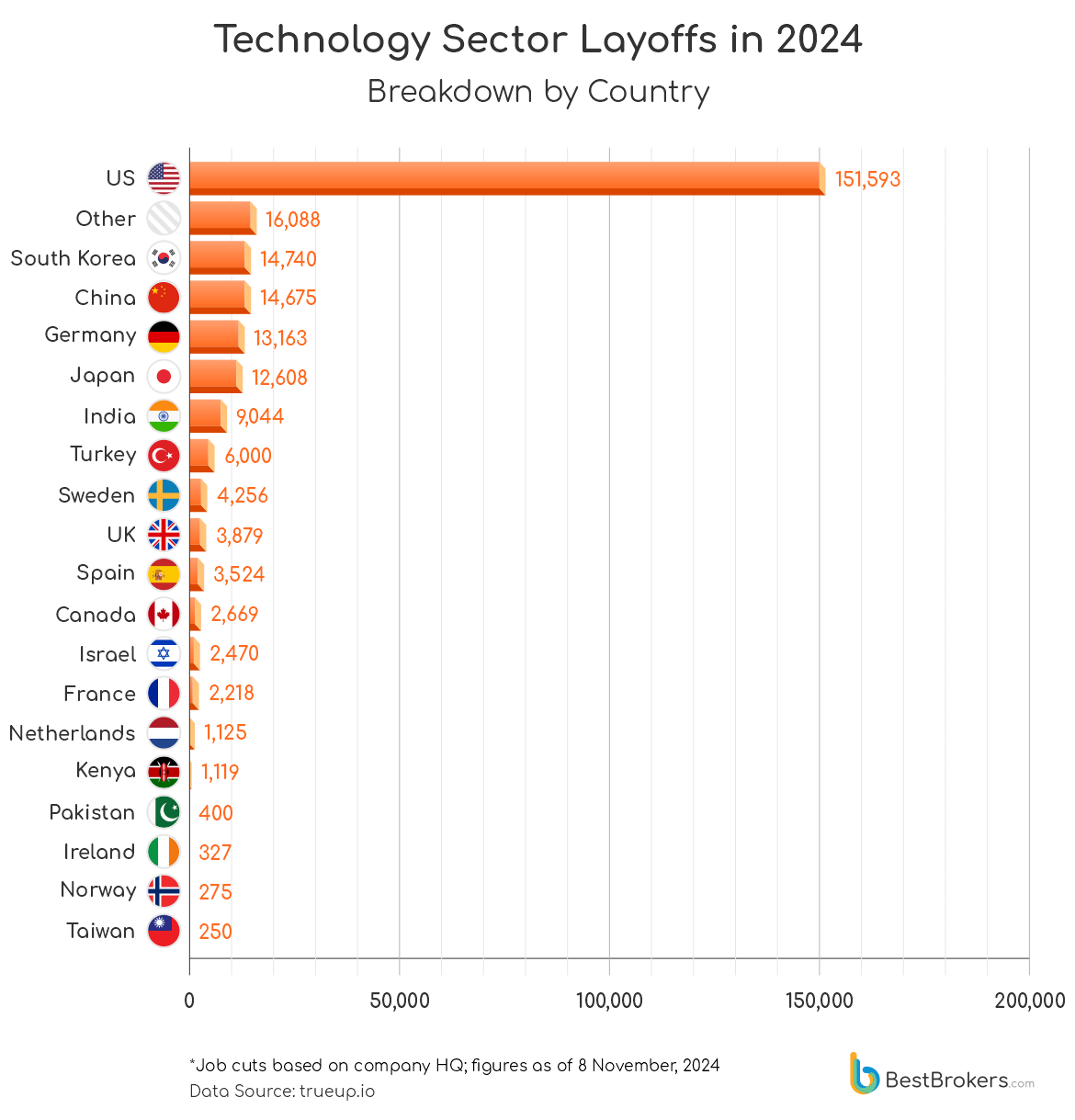

Our findings reveal that a a minimum of 260,423 employees have been laid off across more than 380 tech companies worldwide since the start of 2024, with firms such as Dell, Intel, and Amazon leading the cuts. While major tech players from countries like South Korea (14,740 layoffs) and China (14,675 laid-off employees) have all made significant workforce reductions, U.S.-based corporations top this year’s layoff list with a staggering 151,593 job cuts, accounting for over half of the global total.

What’s driving tech’s massive layoffs?

Layoffs in the technology sector started as a consequence of overhiring during the COVID-19 pandemic. At first, companies rapidly expanded their workforces to meet the soaring demand for digital products and services. However, as the lockdown ended and demand for these products waned, many firms found they had more employees than needed, which led to significant job cuts. Last year alone, over 260,000 tech workers worldwide lost their jobs.

The rise in interest rates, which have made borrowing more expensive, only further exacerbated the situation. Companies have been forced to re-evaluate their strategies and cut costs, often through workforce reductions. Some experts predict that job losses in the U.S. may continue to escalate in the coming months as businesses struggle financially. Preliminary data for September shows 132,000 job openings in the Information sector, up 11% from the 119,000 new jobs announced in August. In October, the whole U.S. economy added just 12,000 jobs compared to 223,000 in September, while the unemployment rate remained unchanged at 4.1%.

Moreover, advancements in automation and AI technologies have led to certain roles becoming redundant, prompting companies to restructure and downsize their teams accordingly. Tech firms, in particular, are heavily investing in AI, frequently at the expense of human jobs. Other factors contributing to the ongoing wave of tech layoffs include economic slowdowns, rising inflation, declining stock prices, slowing sales, and concerns about a potential recession.

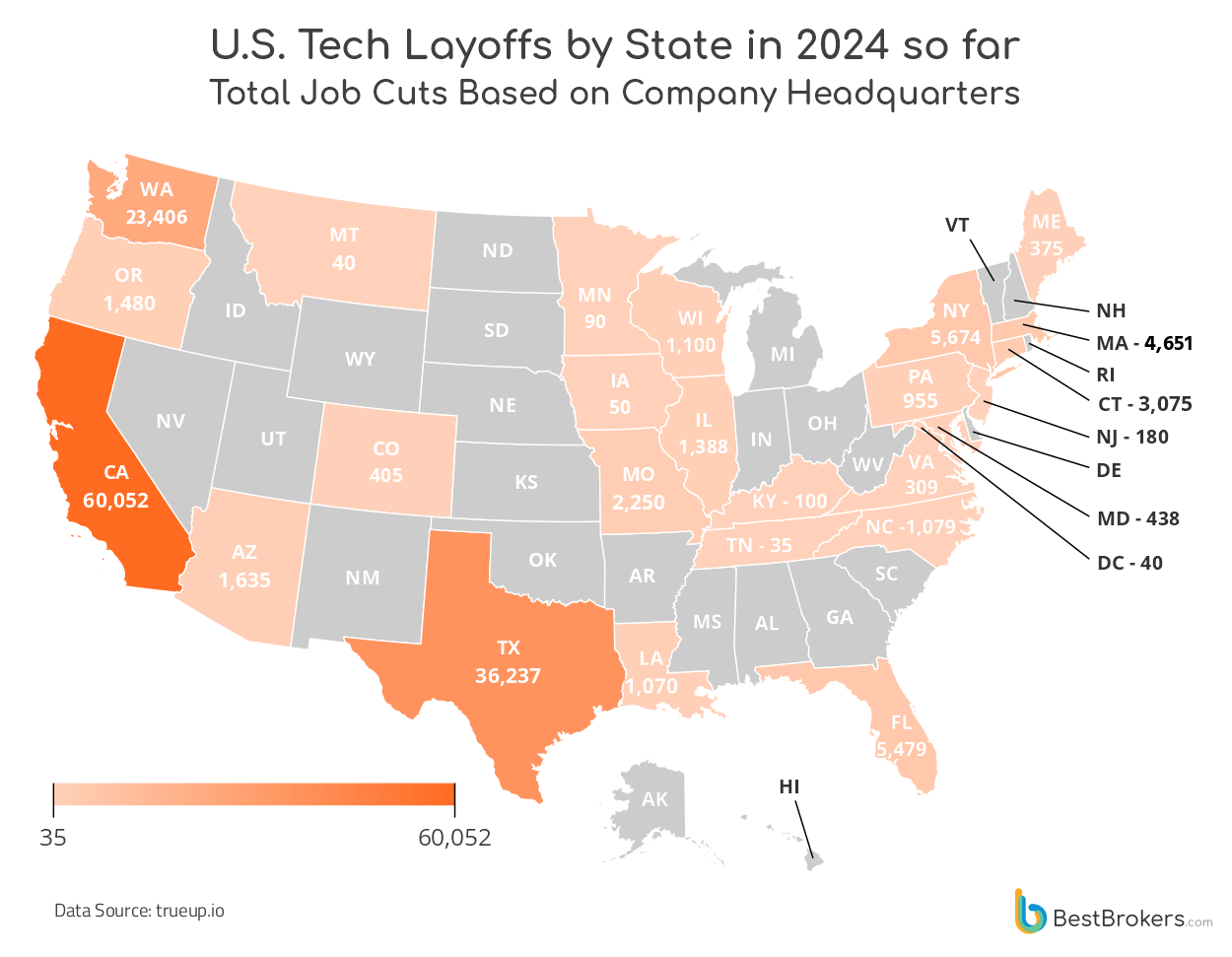

California Firms Lead U.S. Tech Layoffs in 2024

In the U.S., California-based tech companies have taken the lead in layoffs this year, with a total of 60,052 job cuts, representing 39.61% of all job losses nationwide. The state’s high concentration of technology firms, especially in Silicon Valley, likely explains the substantial number of reductions. A big chunk of these cuts comes from chipmaker Intel, which alone has eliminated 15,000 jobs, a quarter of all tech job losses in California. Other significant reductions come from equipment manufacturer Cisco, which has shed 9,600 positions, and digital payment company PayPal, which has reduced its staff by 2,500 people.

Technology companies in Texas and Washington have also made significant workforce reductions, with a total of 36,237 and 23,406 employees affected, respectively. New York State ranks high as well, with 5,674 jobs eliminated across 20 tech firms. [Remarkably, even when combined, the cuts from the companies in these states do not exceed the total number of job losses reported by California-based companies alone.] At the other end of the spectrum, firms in Montana, Iowa and Tennessee have announced the fewest reductions, with a combined total of just 125 job cuts since January 2024.

Companies with the biggest workforce reductions in 2024 so far

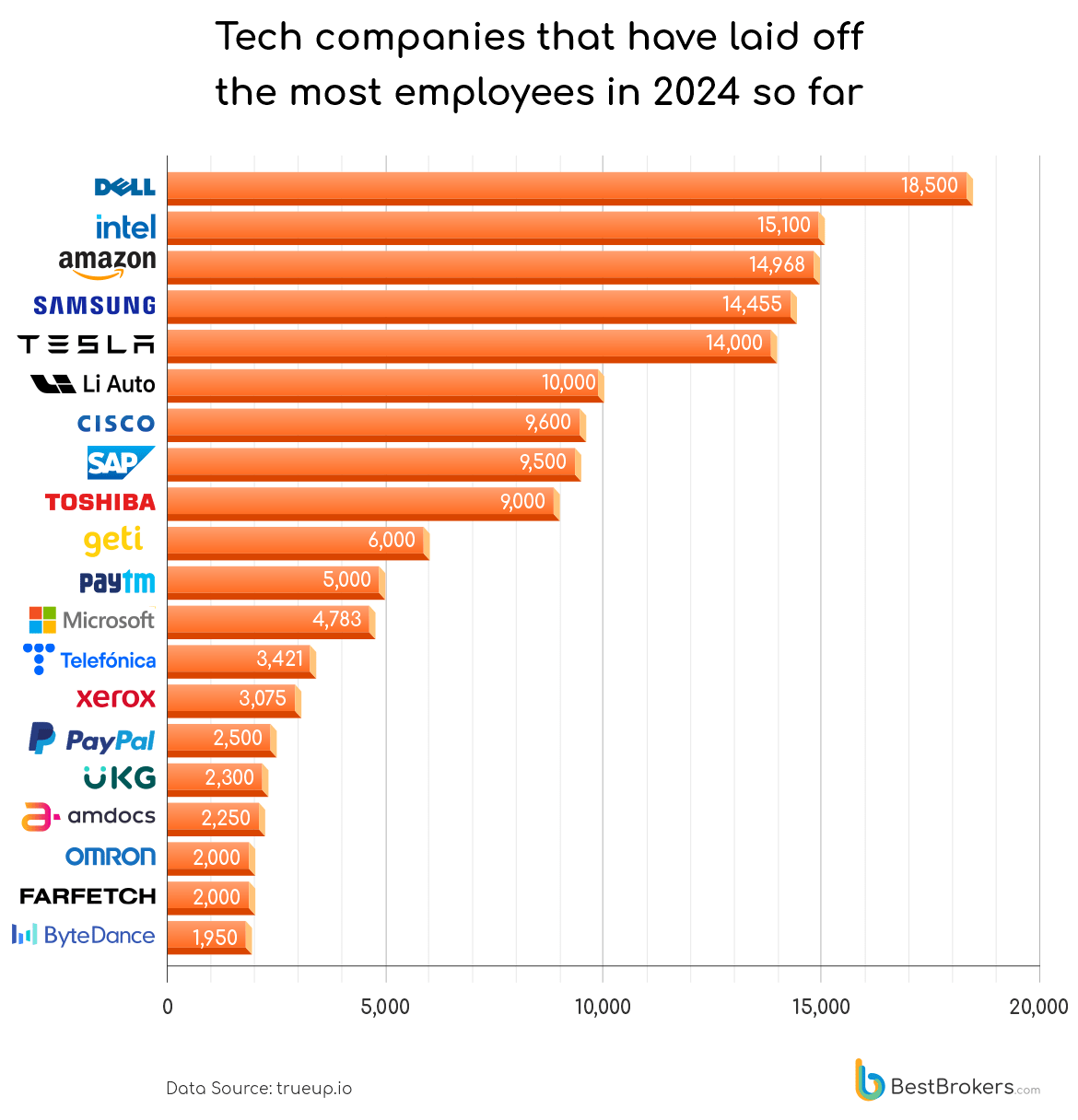

This year so far, major tech giants like Intel, Tesla, Microsoft, and Cisco have each laid off a significant number of employees, often citing restructuring and AI integration as key reasons. It’s Texas-based PC maker Dell, however, that stands out for cutting the most jobs across two rounds of layoffs.

After cutting 6,000 jobs earlier this year, Dell has now announced an additional reduction of approximately 10% of its workforce, or around 12,500 employees. This latest round of layoffs is part of a major reorganisation within the company, which includes establishing a new division focused on AI products and services. These cuts build on the previous fiscal year’s reductions, during which Dell eliminated 13,000 positions due to a slowdown in hardware sales, including personal computers.

Dell’s sweeping layoffs came just days after semiconductor manufacturer Intel announced its own plan to cut over 15,000 jobs – the largest single layoff of 2024 yet, affecting more than 15% of its workforce. These cuts are reportedly part of the company’s effort to reduce costs by over $10 billion in its fiscal 2025. The decision follows a steep 20% drop in Intel’s share price after the company reported a $1.6 billion loss for the April-June period, a sharp contrast to the $1.5 billion profit recorded during the same period the previous year. As CEO Pat Gelsinger noted in a memo, Intel has yet to fully capitalise on the AI boom the same way other semiconductor companies, such as Nvidia, have.

Online retailer Amazon ranks third on the list following October’s announcement by CEO Andy Jassey that by 2025, the company plans to lay off 14,000 employees. Most of the reductions will be managerial positions and aim at boosting efficiency and saving the company around $3 billion annually. Moreover, the move is intended to reduce bureaucracy and increase the ratio of individual contributors to managers to at least 15%. In its latest quarterly report, Amazon announced a 10% increase in net sales to $148 billion from Q2 2023; the gains in operating income and net income were even higher. Operating income in the second quarter jumped to $14.7 billion from the same period in 2023 when it was $7.7 billion. The company reported net income of $13.5 billion compared to $6.75 billion in the second quarter of 2023.

Samsung shares slid by over 25% between January and October as the company struggled to compete in the AI market where rival SK Hynix Inc. managed to ship more memory chips used for artificial intelligence. The South Korean electronics giant now plans to reduce the headcount of its international teams, reportedly slashing more than 14,000 jobs. According to a Bloomberg report, Samsung is now laying off employees mostly from its offices in Southeast Asia, Australia and New Zealand.

EV manufacturer Tesla ranks fifth in layoffs this year so far, cutting approximately 10% of its workforce, or about 14,000 employees. CEO Elon Musk explained that the reductions were necessary due to the company’s rapid expansion, which led to duplication of roles and functions in some areas. This move follows a disappointing quarterly delivery report, where Tesla missed delivery estimates and recorded a rare year-over-year decline in sales.

China’s Li Auto also ranks high on the list, having reduced its workforce by 10,000 employees, which represents over 70% of all job cuts made by Chinese companies since the beginning of the year. German software giant SAP has sacked around 9,500 positions as part of its 2024 restructuring plan, while Japan’s Toshiba has eliminated 9,000 roles. Other companies with significant workforce reductions include Getir, Paytm, Telefónica, Microsoft, and Xerox.

Methodology

For this report, the BestBrokers team analysed more than 1,000 layoff announcements from the technology sector listed on the IT job portal trueup.io between January 1, 2024, and November 8, 2024. Layoffs were first aggregated by company to determine the total number of job cuts per firm. Companies were then categorised by their country of headquarters to illustrate the geographic distribution of these layoffs. Firms were ranked based on the size of their workforce reductions, identifying those with the largest cuts. Similarly, countries were ranked by the total number of layoffs reported by the companies based there.