As of early August 2024, only seven publicly traded companies have market capitalisations of $1 trillion or more. Save for oil giant Saudi Aramco, they are U.S.-based firms operating in the technology sector.

Among them, American chipmaker Nvidia (NVDA), which joined the coveted trillion-dollar club in May 2023, recently made headlines by temporarily surpassing Microsoft (MSFT) and Apple (AAPL) to become the world’s most valuable company, with its market cap soaring to a staggering $3.34 trillion, fuelled by the booming artificial intelligence market. Although its time at the top was brief, Nvidia’s rapid rise is a remarkable turnaround for a firm that was little known outside of tech circles just two years ago.

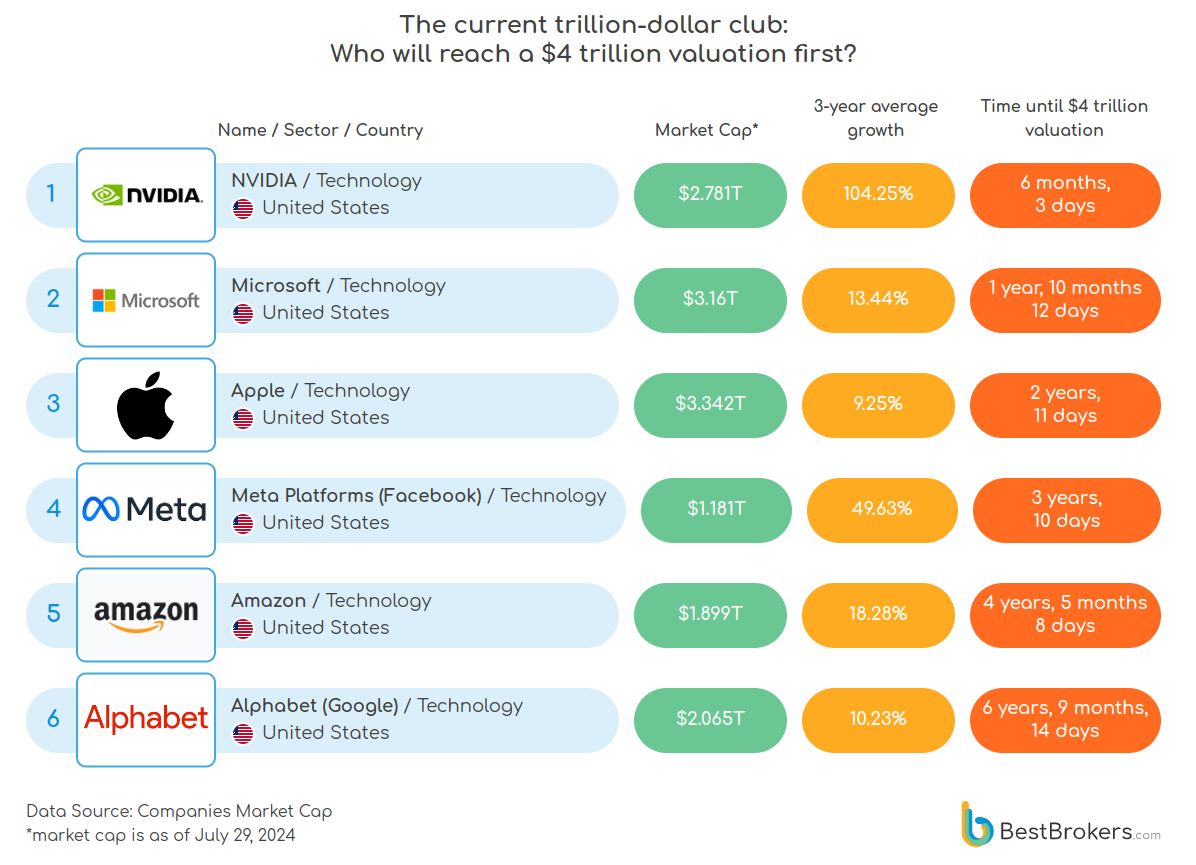

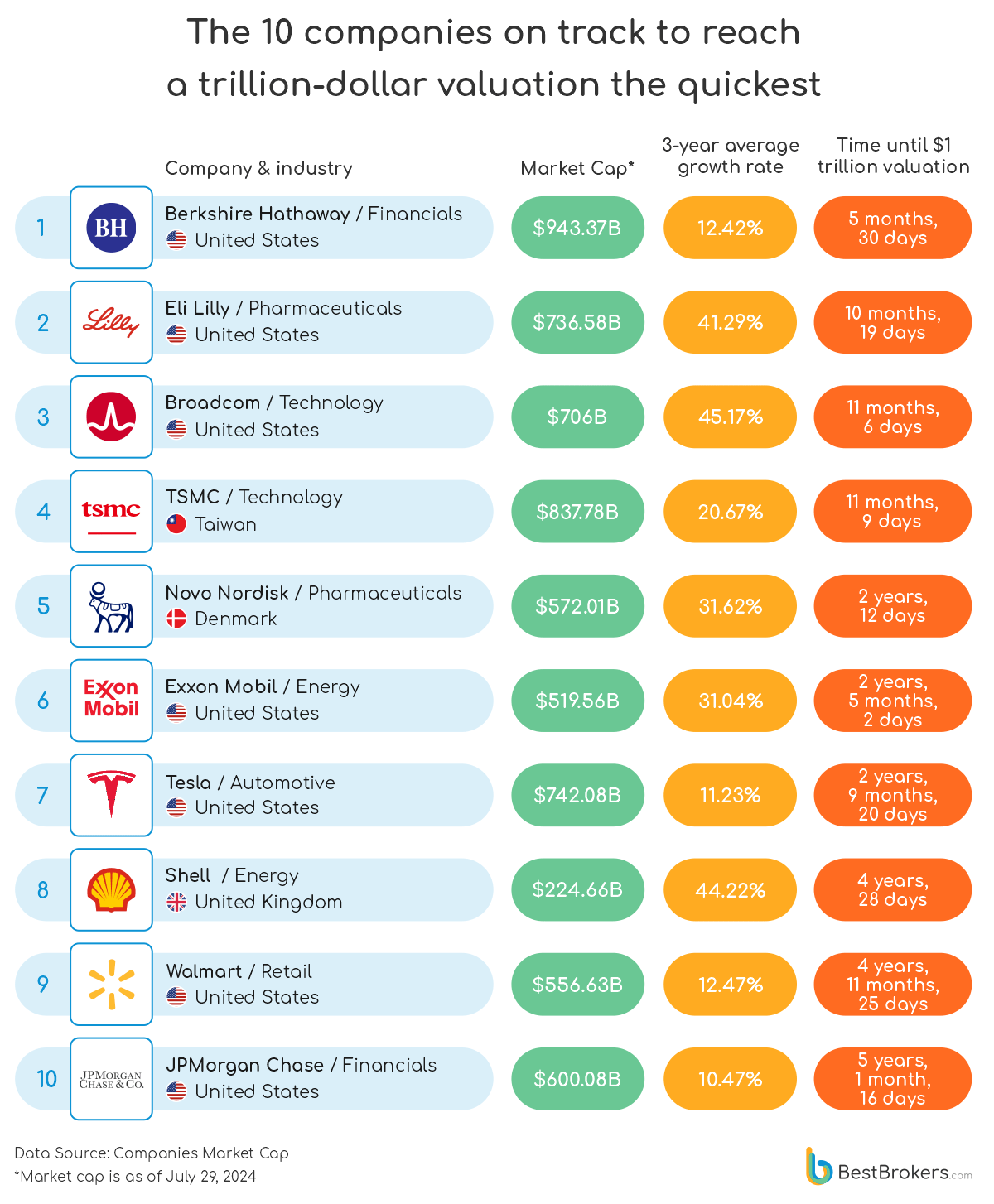

Inspired by the chipmaker’s success, our team at BestBrokers set out to forecast which of the current trillion-dollar giants might be the first to reach the next major milestone of $4 trillion market capitalisation. We also tried to predict which companies with market caps still under $1 trillion are most likely to break into the trillion-dollar club next, using their market capitalisations as of July 29, 2024, and extrapolating based on their historical average growth rates since 2022.

Our calculations reveal that among the current trillion-dollar club members, Nvidia is the only company on track to achieve a $4 trillion market cap within the next year, despite a recent drop in its shares due to recession fears that triggered a global market sell-off. Meanwhile, Microsoft (MSFT) and Apple (AAPL) are both projected to reach this milestone by 2026, well ahead of Google (GOOG), which is not expected to hit this valuation until mid-2031.

Nvidia is set to win the race to the $4 trillion market cap

Earlier this year, Nvidia made history as the first chipmaker to reach $2 trillion in market capitalisation. Soon after, it soared past the $3 trillion mark, joining the ranks of Apple, which achieved this milestone in January 2022, and Microsoft, which reached it in January 2024. For a brief period, Nvidia even held the title of the world’s most valuable public company. However, its stock has since fallen, allowing Apple and Microsoft to reclaim their positions as the top two most valuable firms. So, the question now is: Which tech giant will be the first to reach the next major milestone of a $4 trillion market cap?

According to our projections, if Nvidia’s market cap continues to grow at its recent average rate of 104.25%, its current valuation of $2.781 trillion could hit $4 trillion in roughly six months and three days from now. In a highly optimistic scenario, some tech investors believe Nvidia’s market cap could climb to $6 trillion by the end of 2024. One particularly bullish analyst even forecasts Nvidia reaching nearly $50 trillion within the next decade. To put this in perspective, a $50 trillion valuation would exceed the combined market value of all companies in the S&P 500 index, currently standing at $48.167 trillion, and nearly double the U.S. gross domestic product (GDP) of $28.78 trillion.

Of course, while Nvidia is the frontrunner, it’s possible that a lesser-known company could surprise the market and become the first to reach a $4 trillion valuation. After all, few would have predicted Nvidia’s remarkable surge back in 2022, considering its market cap was only $364.18 billion then.

Our calculations show that Microsoft is likely to be the second company to reach a $4 trillion valuation. With a current market cap of $3.16 trillion – $379 billion more than Nvidia – and an average annual growth rate of 13.44%, Microsoft is expected to achieve this milestone by mid-2026. Apple would probably be the next to follow should its growth continue at a similar pace, while Meta Platforms (META), better known by its former name, Facebook, is projected to hit the $4 trillion milestone by early August 2027.

Google, with a market cap of $2.065 trillion and an average annual growth rate of 10.23%, is anticipated to be the last to reach $4 trillion, likely by early May 2031. Despite being a trillion-dollar club member with a market cap of $1.8 trillion as of July 29, 2024, Saudi Aramco is not included in this projection. Our analysis indicates a negative trend in its average growth over the past three years, suggesting that its market capitalisation is more likely to decrease than grow.

Warren Buffett’s Berkshire Hathaway Is the Next Trillion-Dollar Company

According to our estimates, four of the largest public companies globally with market caps still under $1 trillion are on track to hit this milestone within the next year, with American conglomerate Berkshire Hathaway (BRK-B) likely to be the first. If Berkshire Hathaway’s shares continue to appreciate, the company, currently valued at around $943.37 billion, could reach a market capitalisation of $1 trillion in just five months and thirty days from now. Given its average market cap growth rate of 12.42% since 2022, the holding company is set to achieve this milestone by late January 2025.

Pharmaceutical giant Eli Lilly (LLY), with a market capitalisation of $736.58 billion, and semiconductor manufacturer Broadcom (AVGO), valued at $706 billion, would probably be the next additions to the list of trillion-dollar companies if their market cap growth remains the same at a rate of 41.29% and 45.17%, respectively. Danish pharmaceutical company Novo Nordisk (NVO), with a valuation of $572.01 billion, and oil and gas giant ExxonMobil (XOM), at $519.56 billion, are also showing significant growth and could achieve trillion-dollar status even before Tesla (TSLA), which although currently worth $742.08 billion, won’t be joining the rankings until late May 2027, according to our projections.

On the other hand, UK-based oil and gas company Shell (SHEL), despite its striking distance from the $1 trillion valuation, currently at $224.66 billion, is making significant strides with an average annual growth rate of 44.22%. Shell is forecasted to enter the elite club by late summer 2028, ahead of retail giant Walmart (WMT) and financial behemoth JPMorgan Chase (JPM), which are not expected to reach this milestone until 2029. Looking further ahead, companies like Oracle (ORCL), Advanced Micro Devices (AMD), and Merck (MRK) show strong potential to reach trillion-dollar valuations within the next decade.

Conversely, some firms with higher valuations have struggled with sluggish growth in recent years and may not reach the trillion-dollar mark in the near future unless they improve. For instance, Visa (V), with a current market capitalisation of $506.65 billion and an annual growth rate of just 3.34%, is set to hit this milestone 21 years from now, in 2045.

Methodology

Our team at BestBrokers looked at the 50 most valuable global companies as of July 29, 2024, sourced from CompaniesMarketCap.com. We calculated how much each company’s market capitalisation has increased on а year-over-year basis between 2022 and July 2024 and took the average of these percentages. We then applied this average growth rate to every firm’s market capitalisation as of the time of preparing this report. This allowed us to project the approximate time it will take for each company to reach a market value of $1 trillion or more, starting from the date at the time of writing.