The meteoric rise of companies like Nvidia and Supermicro has turned stock investing into a gold rush with the promise of staggering returns. With online brokerage platforms and commission-free trading, buying and selling shares seems simple and quick, which has opened the markets to millions of new investors, many with little experience or understanding of the risks involved. While some see investing as a straightforward way to build wealth, navigating the stock market without proper knowledge can quickly lead to costly mistakes. As speculative trading surges and social media fuels market hype, the importance of research, strategy, and financial discipline has never been greater.

Seeking answers online now allows taking advantage of AI chatbots like Perplexity, Claude, and ChatGPT, which not only answer simple queries but provide deeper knowledge and financial advice, albeit completely wrong and misleading at times. Still, it seems the popularity of traditional search engines like Google has been so far little impacted by AI competition. People still prefer Googling their questions and doubts when it comes to stock investing and trading, which made the team at BestBrokers curious about what they are actually asking. Moreover, are there national and cultural differences? Are some nations more interested in stock trading and investing than others?

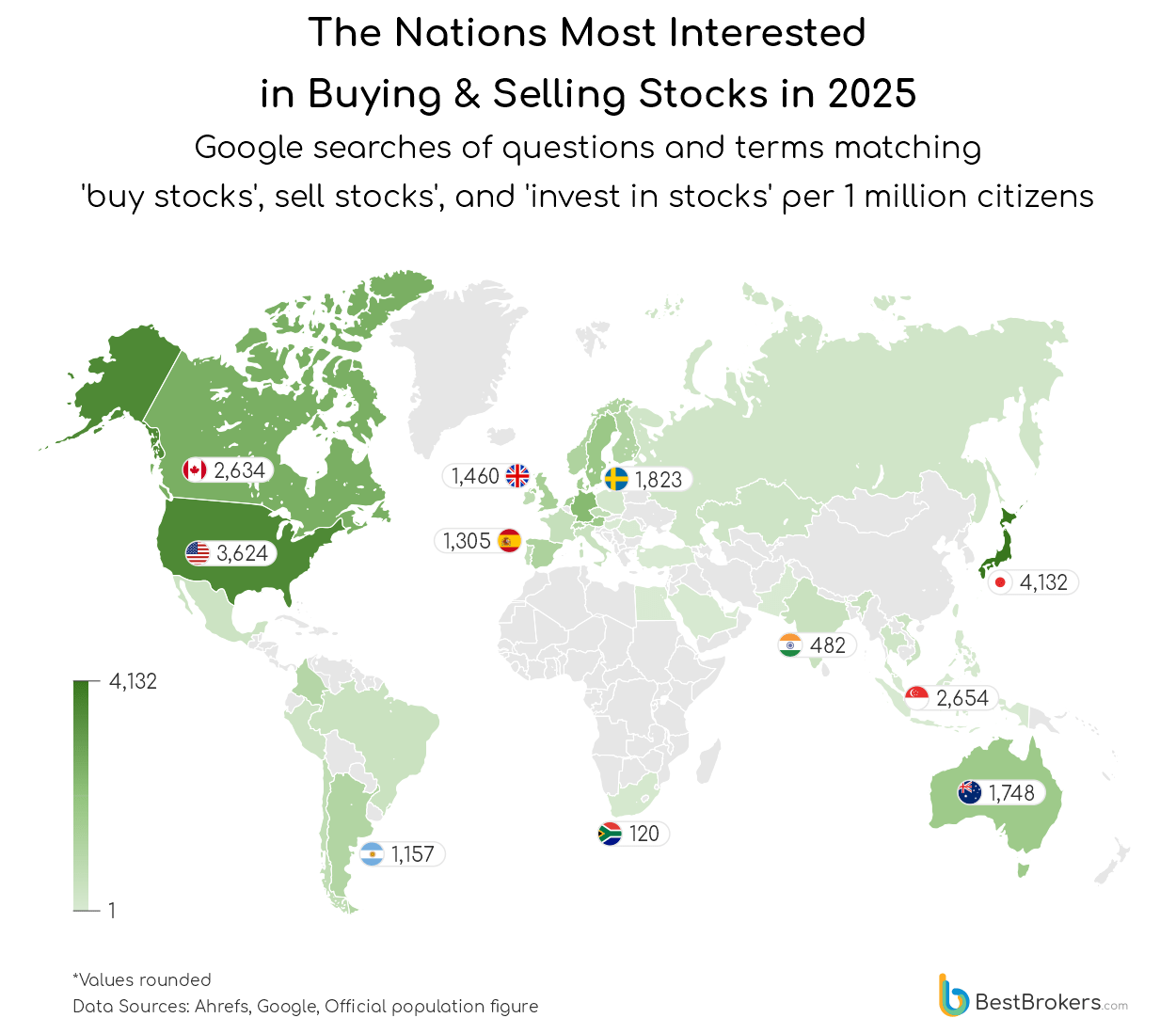

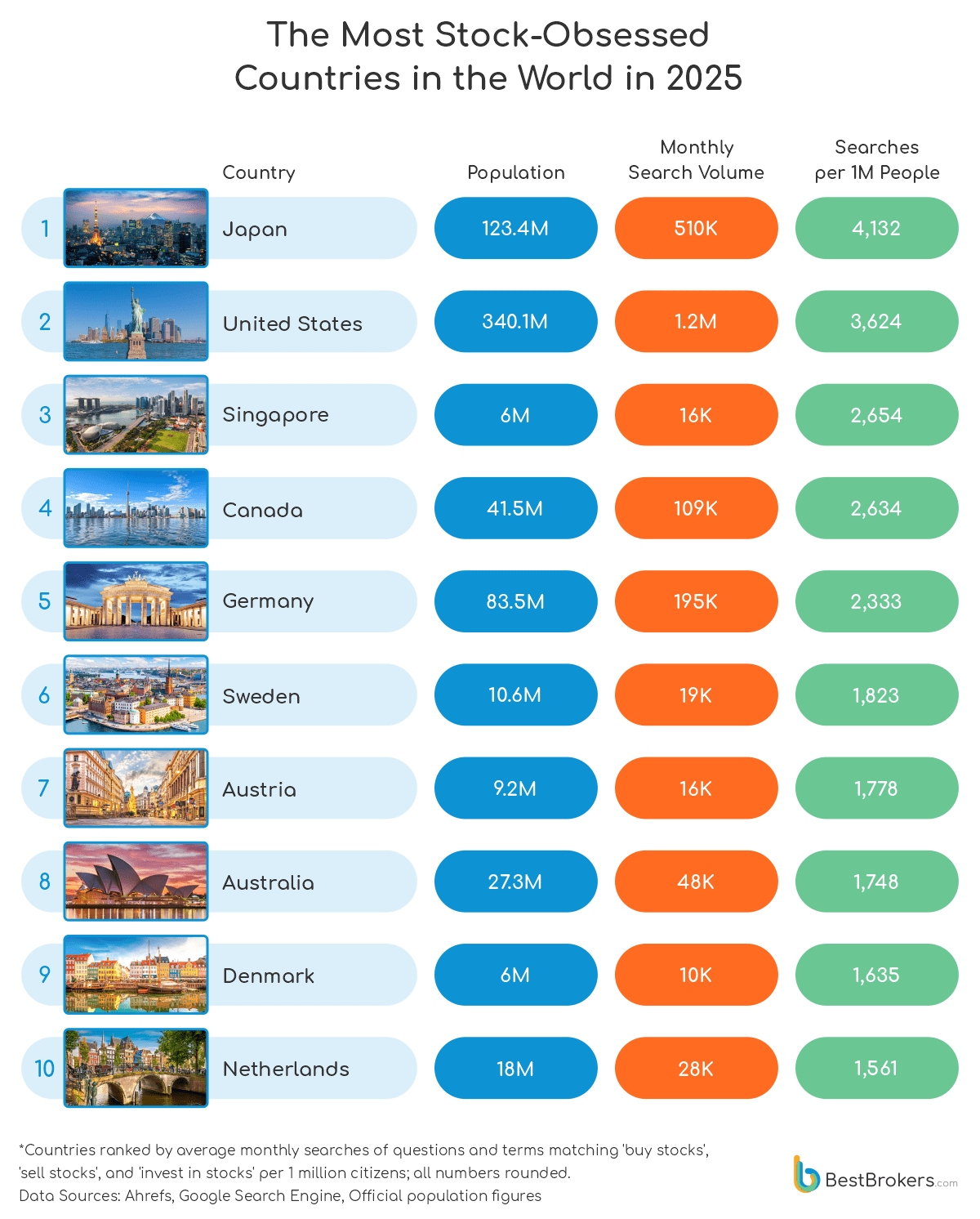

To identify the countries showing the greatest interest in stock trading and to understand the nature of the most common queries, the team at BestBrokers analysed the online stock-related search behaviors across the 50 countries with the highest GDP. Using the marketing platform Ahrefs and its Keywords Explorer, we examined the monthly searches containing the phrases ‘buy stocks’, ‘sell stocks’, and ‘invest in stocks’ in the primary language of 46 countries (no search volume data was available for the other four). To determine the nations most obsessed with stocks, we weighted the findings by the population of each country and discovered that Japanese investors are most interested in buying and selling stocks with 510,110 monthly searches on average or 4,132 per 1 million citizens.

Key Highlights:

- Japan emerges as the country most obsessed with stocks, with 4,132 monthly Google searches per 1 million people for questions and terms that include ‘buy stocks’, ‘sell stocks’ and ‘invest in stocks’.

- When it comes to buying stocks, the most frequently searched questions across countries are ‘How to buy stocks?’ and ‘Which stocks to buy?’, whereas sellers are primarily concerned with ‘When to sell?’.

- NVIDIA, Tesla, and Adobe are the most Googled company stocks globally.

Japan tops our chart with an average of 4,132 stock-related searches per 1 million people every month (510,110 monthly searches in total). The most hotly debated company shares each month include those of Nissan (7,900 searches), NTT (5,000), Oriental Land (2,800), Nintendo (2,500), and McDonald’s (2,400), among others.

While many might expect the United States to have the most stock-related searches per capita since it has the largest stock market and numerous companies are headquartered there (and indeed, it has the highest absolute search volume), its population size prevents it from claiming the top spot on our list. Instead, it ranks second with a total of 1,232,440 stock-related searches entered into Google’s search engine per month, which represents 3,624 queries per million people.

In addition, many Americans seem to be actively considering stock investments, with an average of 16 thousand monthly searches for ‘How to buy stocks?’ – three times more than the 4,700 searches for the second most common query, ‘Where to buy stocks?’. The most frequently searched terms related to stocks in the country are ‘price’ (20 million searches a month), ‘nvidia’ (7.5 million monthly searches), and ‘nvda’ (6.7 million monthly searches). The term ‘tesla’ is also among the most frequently Googled words with all keywords related to it being searched an average of 4.7 million times each month.

Singapore ranks 3rd with 2,645 queries per million people every month, while Canada takes the 4th spot with 2,634 searches per million citizens. Google users from Singapore tend to ask why Nvidia stock is going down today (700 questions per month) and how to buy stocks in Singapore (400 questions per month). Canadians, on the other hand, are interested in what shorting a stock is (3,200 monthly searches), why Nvidia stock is going down (2,100 searches), and how to buy stocks (2,000 searches).

Germans (2,333 monthly searches per million people) and Austrians (1,778 searches per million) seem particularly interested in whether Volkswagen shares are worth buying, as the question is present in their 10 most common monthly queries, whereas Swedish Internet users are pondering if they should purchase Tesla stock, among other things. Another popular company in the country with several different searches related to its stock is Nordea, one of the leading banks in Northern Europe.

Next on the list is Australia with 1,748 stock-related Google searches per million citizens, which is an average of 47,750 searches a month. Denmark follows closely with 1,635 monthly searches per million people. In Denmark, people are particularly interested in buying shares of Tesla, Novo Nordisk, and Danske Bank, whereas in Australia, no specific companies stand out in their most frequently asked questions.

The Netherlands ranks 10th with an average monthly search volume of 1,560 per million people (28,170 searches in total). The companies most frequently mentioned in their online queries are KLM Royal Dutch Airlines, Heineken, the construction-services company BAM, and Tesla. Although the United Kingdom is home to one of the oldest and most influential stock markets in the world, the London Stock Exchange, it ranks 11th in our list with 1,459 questions per million people. China, on the other hand, is not present in our ranking since there is no data on Ahrefs on searches coming from China.

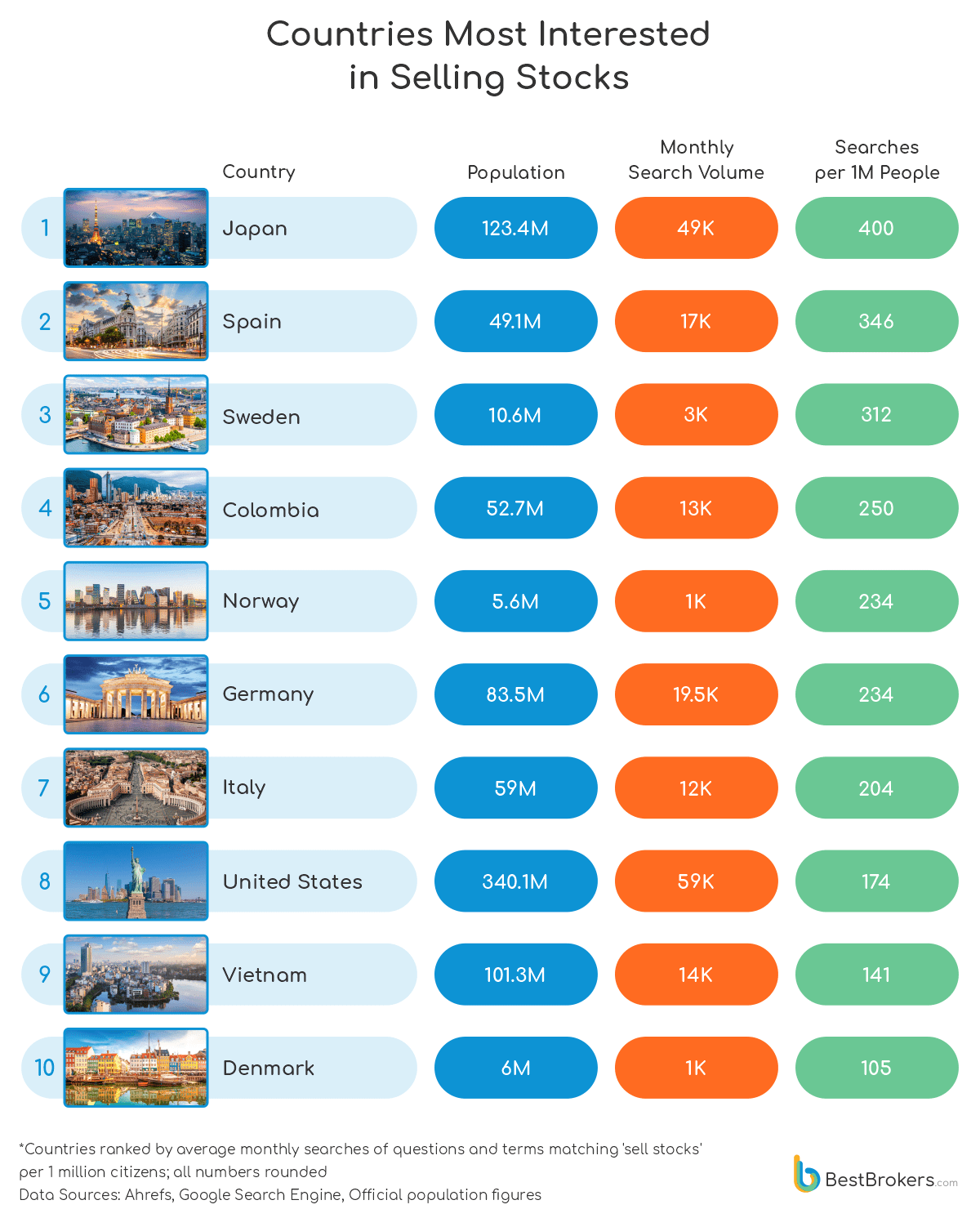

‘Sell Stocks’ Appears Less Frequently Than ‘Buy Stocks’ or ‘Invest in Stocks’

Although the rankings for overall interest in stocks align to a great extent with those of nations most interested in buying them, there are clear distinctions when it comes to countries focused on selling stocks – or at least researching the option more than others. In total, the number of questions regarding buying stocks far exceeds the selling-related ones, a trend observed across all the countries we researched.

When it comes to selling stocks, Japanese Internet users seem to have more questions than anyone else, at least relative to the size of the country. With 49 thousand questions and terms that include the phrase ‘sell stocks’, Japan tops the per-capita list having 400 queries per million citizens a month. Users in the country are showing significant interest in selling shares of Tokyo Electric Power Company and Japan Post Insurance. Notably, Spain ranks second, with an average of 163,980 monthly searches (346 per million) for the phrase “vender acciones” (sell stocks), highlighting its strong interest in stock sales. Spaniards are particularly keen to know when they can sell Santander shares and how to sell them from the app. These queries might be related to the bank’s mobile app for shareholders.

Colombia also stands out when it comes to people’s interest in selling stocks, with an average of 250 related searches per million people (13,180 queries in total). Among these, 100 searches per month focus on how to sell shares of the country’s petroleum giant Ecopetrol. Italy, on the other hand, which ranks 6th on this list, has 203 monthly searches per million people for the phrase ‘vendere azioni’ (12,020 in total). Among those, there are 3,200 searches each month about whether one should sell or hold shares of the energy company Enel. For comparison, Italians’ second most frequently asked question, ‘When to sell stocks at a profit?’ receives only 150 searches per month.

With 173 queries per million citizens about selling stocks, the United States ranks 8th on this list. Of all 59,120 questions related to the phrase, the most common one is ‘When to sell stock?’ which gets asked an average of 2,700 times per month. Another commonly asked question with 1,300 monthly searches is ‘Do I have to pay tax on stocks if I sell and reinvest?’, a testament to the complex tax code in the country.

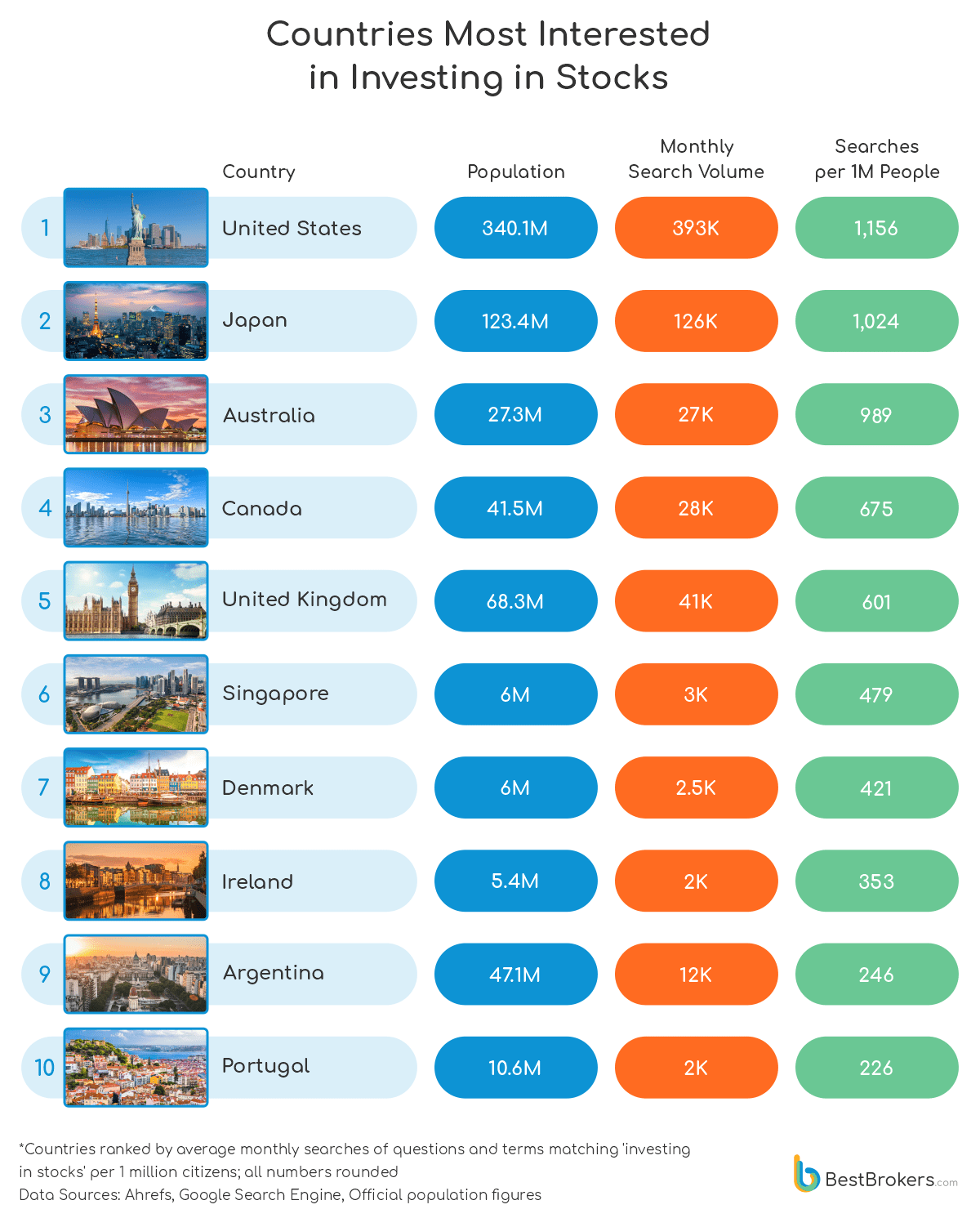

The phrase ‘invest in stocks’ generates a significant volume of searches on Google. For instance, in the United States, the question ‘How to invest in stocks?’ receives 34,000 searches per month, while ‘How to buy stocks?’ receives less than half that number—only 16,000 searches per month. A similar trend is seen in Australia, where the former question garners 8,800 searches per month compared to just 1,000 searches for the latter.

There is also a notable difference between the United States and Japan when it comes to investment-related queries. The top 10 investment questions in the United States receive a total of 55,000 monthly searches, whereas in Japan, the total is just 1,800.

The Most Googled Questions about Stocks

Worldwide, some of the most common questions about stocks include ‘How to invest in stocks’ (64,000 global searches per month), followed by ‘How to buy stocks?’ (26,000 searches), and ‘What are stocks?’ (19,000 searches). This trend suggests that an increasing number of people are considering getting involved in the stock market, with the most frequently asked questions likely coming from beginners eager to learn the basics.

Among the countries we researched more closely, the questions concerning selling stocks turned out to be less diverse (mainly revolving around topics like ‘When to sell?’ and ‘How to sell?’), while those about buying not only outnumber them but also cover a much wider range of topics. An intriguing observation is that some countries, such as Singapore and Canada, ask primarily more general questions, including which stocks to buy, where to buy them, and how to do so. In contrast, some other countries’ most hotly debated stock topics are far more specific. For instance, nearly all of Japan’s top 10 monthly searches (9 out of 10) are related to particular company shares, accounting for a total of 27,200 searches. Perhaps this explains why it takes the top position in all of our rankings.

In Germany and Austria, Volkswagen shares are among the most frequently searched stocks to buy, while in Spain, 4 out of the 10 most searched questions related to selling are associated with Santander shares. Additionally, YPF shares are featured in four of the top 10 most asked stock-related questions online in Argentina (which ranks 8th on the list of the countries most interested in investing in stocks with 11,600 monthly searches in total.

The Most Googled Company Shares in 2025

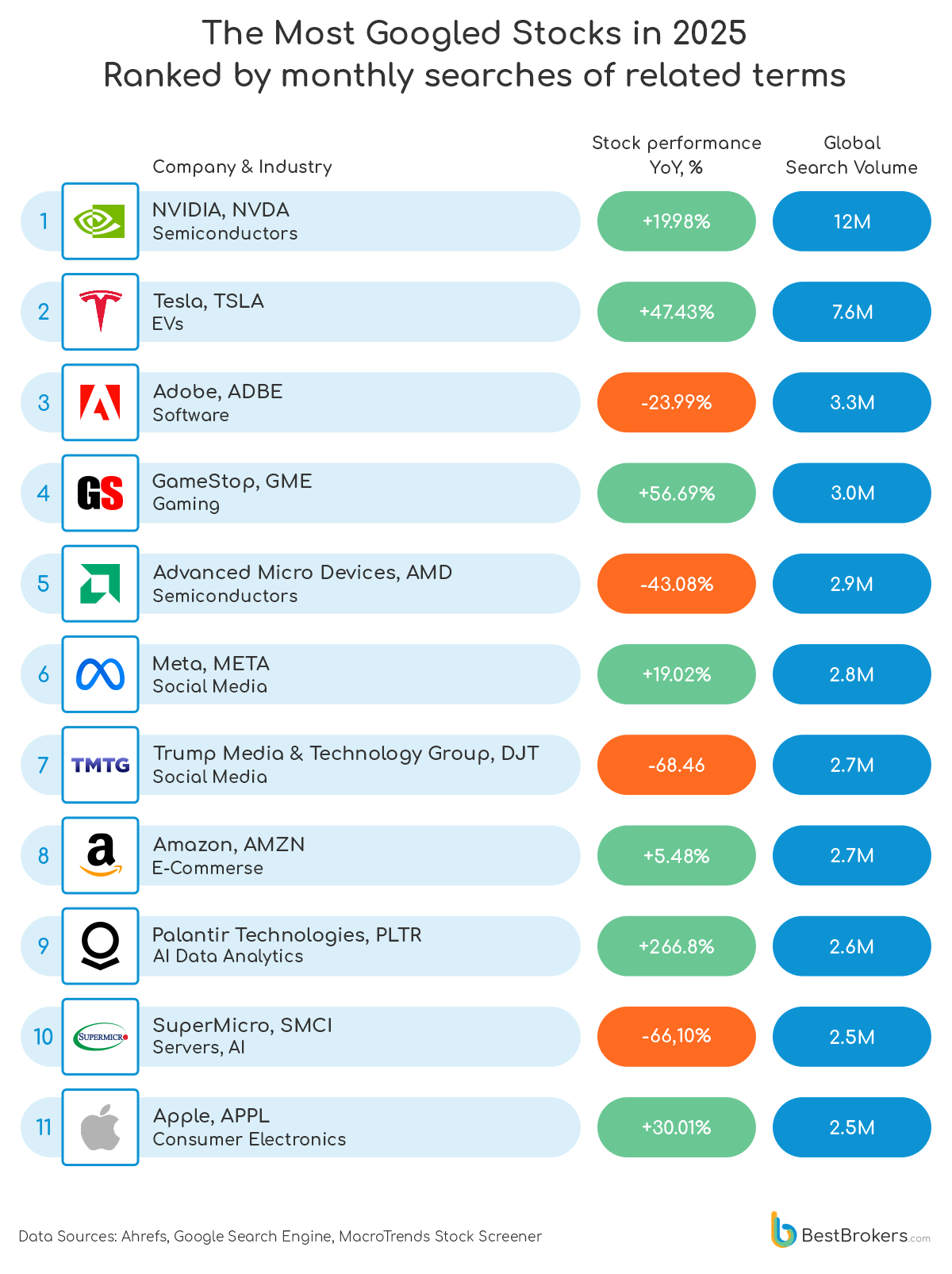

But which are the most googled company stocks globally? We also looked at the companies coming up the most in searches related to the terms ‘stock’ and ‘stocks’. Hardly a surprise, high-growth stocks in the technology and AI sectors spark people’s curiosity the most.

Regarding the companies that appear most frequently in nations’ stock-related Google searches, NVIDIA takes the top spot with a global search volume of 12,000 million per month, followed by Tesla with 7,600 million and Adobe (3,300 million). Note that these are just the searches for the companies’ full names, and searches of ticker symbols are not included. While NVIDIA appears only in Italy’s top 10 most frequently asked questions, Tesla is present in the queries of Japan, Sweden, Denmark, the Netherlands, Norway, Italy, and Portugal.

Other notable companies in which nations show considerable interest are GameStop (3,000 million searches per month), Advanced Micro Devices (2,900 million), and Meta (2,800 million).

Final Thoughts

Research into the stock market is essential for understanding global market trends, economic fluctuations, and identifying emerging markets with growth potential. The decision to use the list of countries with the highest GDP as a starting point was not accidental – while these nations typically have well-established financial markets, it does not necessarily mean their populations are well-versed in and engage in stock trading on a large scale.

As our research demonstrates, not all countries with high GDP rank among the most stock-obsessed nations. Emerging economies, such as India and Brazil, often experience uneven wealth distribution, thus, the buying and selling of stock is limited to a relatively small number of people, which might explain why they do not appear in our rankings. On the other hand, countries like Denmark and Sweden might have lower nominal GDP, but the high standard of living allows amateur traders to actively participate in the stock markets. Cultural factors and financial literacy are also pivotal since they might result in controversial attitudes toward stocks, despite the state of the countries’ GDP.

Making investment decisions without proper research can lead to significant losses. Therefore, knowing what others are engaged in can be useful for observing investor behaviour and spotting emerging trends. High interest in stocks often correlates with higher market liquidity, and tracking changes in this sphere can highlight novel markets with potential or well-established markets that may be losing momentum. Overall, when monitoring stock market interest across countries, individuals and businesses can better navigate the global investment landscape, manage risk, and seize upcoming opportunities.

Methodology

To identify the countries most interested in buying and selling stocks, we took the 50 largest economies, i.e. the countries with the highest nominal gross domestic product (GDP) as per the World Bank, and decided to measure their Google search volume for the phrases ‘buy stocks’, ‘sell stocks’, and ‘invest in stocks’. To calculate the interest in buying, selling, and investing in stocks per capita, we incorporated official population figures.

Then, we translated the phrases ‘buy stocks’, ‘sell stocks’, and ‘invest in stocks’ into each country’s primary language. For countries with more than one official language, we summed up the results for the most widely spoken languages, depending on the percentage of people who use them. Using the Ahrefs Keywords Explorer, we searched for the most frequently asked questions related to stocks globally and listed the top 10 most popular questions.

Regarding the nations we observed more closely, we analysed the total number of monthly local searches for each phrase (‘buy stocks’, ‘sell stocks’, and ‘invest in stocks’) and calculated the overall search volume for the questions asked online. Finally, we combined the results for ‘buy stocks’, ‘sell stocks’, and ‘invest in stocks’, weighting them by each country’s population per 1 million people to get the per capita result.

To rank the most frequently asked questions for each country, we examined the 10 most searched questions and their average monthly search volume. These questions were then translated into English to check for any repetitions. For the most Googled companies worldwide, we used data from Ahrefs for the most searched terms related to the term ‘stock’ and selected those that contained a company’s name, then added the volume of global monthly searches.

Some countries, such as China and Iran, were excluded from our analysis due to a lack of data. Due to insufficient search volume, other countries like South Korea and Bangladesh were also not taken into consideration. This left us with a list of 46 countries out of the initial 50 nations.